Professional Documents

Culture Documents

(Intermediate Accounting 3) : Lecture Aid

Uploaded by

Frost Garison100%(1)100% found this document useful (1 vote)

82 views28 pagesnotes

Original Title

CHAPTER-3_REVENUE-FROM-CONTRACTS-WITH-CUSTOMERS

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentnotes

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

82 views28 pages(Intermediate Accounting 3) : Lecture Aid

Uploaded by

Frost Garisonnotes

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 28

(Intermediate Accounting 3)

LECTURE AID

2020

ZEUS VERNON B. MILLAN

Chapter 3 Revenue from Contracts

with Customers

Related standard: PFRS 15 Revenue from Contracts

with Customers

Learning Objectives

• State the five steps in the recognition of revenue.

• Describe how performance obligations are identified

in a contract.

• Describe how the transaction price is determined and

how it is allocated to the performance obligations.

• State the timing of revenue recognition and its

measurement.

• State the presentation of contracts with customers in

the statement of financial position.

INTERMEDIATE ACCTG 3 (by: Zeus Vernon B. Millan)

Income vs. Revenue

The Conceptual Framework provides the following definitions:

• Income – increases in economic benefits during the

accounting period in the form of inflows or enhancements of

assets or decreases of liabilities that result in increases in

equity, other than those relating to contributions from equity

participants. Income encompasses both revenue and gains.

• Revenue – income arising in the course of an entity’s

ordinary activities.

INTERMEDIATE ACCTG 3 (by: Zeus Vernon B. Millan)

PFRS 15 supersedes the following standards:

• PAS 18 Revenue;

• PAS 11 Construction Contracts;

• IFRIC 13 Customer Loyalty Programmes;

• IFRIC 15 Agreements for the Construction of Real

Estate;

• IFRIC 18 Transfers of Assets from Customers; and

• SIC-31 Revenue - Barter Transactions Involving

Advertising Services.

INTERMEDIATE ACCTG 3 (by: Zeus Vernon B. Millan)

Applicability of PFRS 15

PFRS 15 shall be applied to contracts wherein the counterparty

is a customer.

• Contract – An agreement between two or more parties that

creates enforceable rights and obligations. A contract can be

written, oral, or implied by an entity’s customary business

practice.

• Customer – A party that has contracted with an entity to

obtain goods or services that are an output of the entity’s

ordinary activities in exchange for consideration.

INTERMEDIATE ACCTG 3 (by: Zeus Vernon B. Millan)

Applicability of PFRS 15 (continuation)

PFRS 15 shall not be applied to the following:

• Lease contracts (PAS 17 Leases);

• Insurance contracts (PFRS 4 Insurance Contracts);

• Financial instruments; and

• Non-monetary exchanges between entities in the same line of

business to facilitate sales to customers. For example, PFRS 15

is not applicable to a contract between two oil companies that

agree to exchange oil to fulfil customer demands in different

locations on a timely basis.

INTERMEDIATE ACCTG 3 (by: Zeus Vernon B. Millan)

Core principle

• An entity recognizes revenue to depict the

transfer of promised goods or services to

customers in an amount that reflects the

consideration to which the entity expects to be

entitled in exchange for those goods or services.

INTERMEDIATE ACCTG 3 (by: Zeus Vernon B. Millan)

Steps in the recognition of revenue

PFRS 15 requires the following steps in recognizing revenue:

• Step 1: Identify the contract with the customer

• Step 2: Identify the performance obligations in the contract

• Step 3: Determine the transaction price

• Step 4: Allocate the transaction price to the performance

obligations in the contract

• Step 5: Recognize revenue when (or as) the entity satisfies a

performance obligation

INTERMEDIATE ACCTG 3 (by: Zeus Vernon B. Millan)

Step 1: Identify the contract with the customer

Requirements before a contract with a customer is accounted for under

PFRS 15:

a. The contract must be approved and the contracting parties are

committed to it;

b. rights and payment terms are identifiable;

c. The contract has commercial substance; and

d. The consideration is probable of collection.

No revenue is recognized if the contract does not meet the criteria

above. Any consideration received is recognized as liability.

INTERMEDIATE ACCTG 3 (by: Zeus Vernon B. Millan)

Step 2: Identify the performance obligations in the contract

Each promise in a contract to transfer a distinct

good or service is treated as a separate

performance obligation.

INTERMEDIATE ACCTG 3 (by: Zeus Vernon B. Millan)

Identifying distinct goods or services

A good or service is distinct if:

(a) the customer can benefit from it, either on its own or together

with other resources that are readily available to the customer

(e.g., the good or service is regularly sold separately); and

(b) the good or service is separately identifiable (i.e., not an input

to a combined output, does not significantly modify the other

promises, or not highly interrelated with the other promises).

A good or service that is not distinct shall be combined with the other

promises in the contract. Combined promises are treated as a single

performance obligation.

INTERMEDIATE ACCTG 3 (by: Zeus Vernon B. Millan)

Step 3: Determine the transaction price

• The entity shall determine the transaction price because this is

the amount at which revenue will be measured.

• Transaction price is “the amount of consideration to which an

entity expects to be entitled in exchange for transferring promised

goods or services to a customer, excluding amounts collected on

behalf of third parties (e.g., some sales taxes).” The consideration

may include fixed amounts, variable amounts, or both.

INTERMEDIATE ACCTG 3 (by: Zeus Vernon B. Millan)

Step 4: Allocate the transaction price to the performance obligations

• The transaction price shall be allocated to each performance

obligation identified in a contract based on the relative stand-

alone prices of the distinct goods or services promised to be

transferred.

• The stand-alone selling price is the price at which a promised good

or service can be sold separately to a customer.

INTERMEDIATE ACCTG 3 (by: Zeus Vernon B. Millan)

Estimating the stand-alone selling price

If the stand-alone selling price is not directly observable, the entity shall

estimate it using one or a combination of the following methods:

• Adjusted market assessment approach – the entity evaluates the

market in which it sells goods or services and estimates the price that a

customer in that market would be willing to pay for those goods or services.

• Expected cost plus a margin approach – the entity forecasts its

expected costs of satisfying a performance obligation and then add an

appropriate margin for that good or service.

• Residual approach – the entity estimates the stand-alone selling price as

the total transaction price less the sum of the observable stand-alone

selling prices of other goods or services promised in the contract.

INTERMEDIATE ACCTG 3 (by: Zeus Vernon B. Millan)

Step 5: Recognize revenue when (or as) the entity satisfies a

performance obligation

• A performance obligation is satisfied when the control over

a promised good or service is transferred to the customer.

• Revenue is measured at the amount of the transaction

price allocated to the satisfied performance obligation.

• Performance obligations are classified into the following:

1. Performance obligation that is satisfied over time

2. Performance obligation that is satisfied at a point in time

INTERMEDIATE ACCTG 3 (by: Zeus Vernon B. Millan)

Performance obligations satisfied over time

For a performance obligation that is satisfied over time, revenue is recognized

over time AS the entity progresses towards the complete satisfaction of the

obligation .

A performance obligation is satisfied over time if one of the following criteria is

met:

a.The customer simultaneously receives and consumes the benefits provided by

the entity’s performance as the entity performs.

b.The entity’s performance creates or enhances an asset that the customer

controls as the asset is created or enhanced.

c.The entity’s performance does not create an asset with an alternative use to the

entity and the entity has an enforceable right to payment for performance

completed to date.

INTERMEDIATE ACCTG 3 (by: Zeus Vernon B. Millan)

Measuring progress towards complete satisfaction of a performance

obligation

• For each performance obligation satisfied over time, an entity shall

recognize revenue over time by measuring the progress towards

complete satisfaction of that performance obligation.

• Examples of acceptable measurement methods:

1. Output methods (e.g., surveys of work performed)

2. Input methods (e.g., relationship between costs incurred to date

and total expected costs)

If efforts or inputs are expended evenly throughout the performance

period, revenue may be recognized on a straight-line basis.

INTERMEDIATE ACCTG 3 (by: Zeus Vernon B. Millan)

Cost-recovery Approach

• If the outcome of a performance obligation cannot be reasonably

measured, revenue shall be recognized only to the extent of

costs incurred that are expected to be recovered.

INTERMEDIATE ACCTG 3 (by: Zeus Vernon B. Millan)

Performance obligations satisfied at a point

in time

• A performance obligation that is not satisfied over time is

presumed to be satisfied at a point in time.

• For a performance obligation that is satisfied at a point

in time, revenue is recognized WHEN the performance

obligation is satisfied.

INTERMEDIATE ACCTG 3 (by: Zeus Vernon B. Millan)

Contract costs

Contract costs include the following:

(a) Incremental costs of obtaining a contract – recognized as asset if

they are recoverable and avoidable. As a practical expedient, the

costs are recognized as expense if their expected amortization

period is 1 year or less.

(b) Costs to fulfill a contract –if within the scope of PFRS 15, they are

recognized as asset if they are: (a) directly related to a contract, (b)

generate or enhance resources, and (c) recoverable.

INTERMEDIATE ACCTG 3 (by: Zeus Vernon B. Millan)

Presentation

A contract where either party has performed is presented in the statement

of financial position as a contract liability, contract asset or receivable.

• Contract liability – is an entity’s obligation to transfer goods or

services to a customer for which the entity has received consideration (or

the amount is due) from the customer.

• Contract asset – is an entity’s right to consideration in exchange for

goods or services that the entity has transferred to a customer when that

right is conditioned on something other than the passage of time.

• Receivable – is an entity’s right to consideration that is unconditional.

INTERMEDIATE ACCTG 3 (by: Zeus Vernon B. Millan)

ADDITIONAL CONCEPTS

Concepts related to Step 2 (Identifying the performance obligations)

• A warranty that provides the customer service in addition to assurance that the

product complies with agreed-upon specifications is a performance obligation. A

warranty required by law is not a performance obligation.

• An option granted to a customer to acquire additional goods or services is a

performance obligation if it gives the customer a material right.

• Non-refundable upfront fee is a performance obligation only if it relates to the

transfer of goods or services. It is not a performance obligation if it relates to

administrative tasks to set up a contract. In the latter case, the non-refundable upfront

fee is treated as a prepayment and recognized as revenue only when the related goods

or services are transferred to the customer.

INTERMEDIATE ACCTG 3 (by: Zeus Vernon B. Millan)

ADDITIONAL CONCEPTS

Concepts related to Step 3 (Determining the transaction

price)

• Discounts are allocated to all of the performance obligations,

unless it is clear that the discount relates only to some, but not all, of

those obligations.

• In a sale with right of return, the entity does not recognize

revenue from goods that are expected to be returned. An asset (and

corresponding adjustment to cost of sales) is recognized for the

entity’s right to recover products from the customer on settling the

refund liability.

INTERMEDIATE ACCTG 3 (by: Zeus Vernon B. Millan)

ADDITIONAL CONCEPTS

Concepts related to Step 3 (Determining the transaction

price) - continuation

• If the timing of agreed payments provides the customer or the entity

with a significant benefit of financing, the revenue recognized

shall reflect the cash selling price of the goods or services. As a

practical expedient, the effect of time value of money may be

disregarded if the consideration is expected to be collected within 1

year from the date of transfer of the goods or services.

INTERMEDIATE ACCTG 3 (by: Zeus

Vernon B. Millan)

ADDITIONAL CONCEPTS

Concepts related to Step 3 (Determining the transaction

price) - continuation

• A non-cash consideration is measured at:

a. fair value; or

b. if fair value is not available, at the selling price of

the good or service promised to be transferred to the

customer.

INTERMEDIATE ACCTG 3 (by: Zeus Vernon B. Millan)

APPLICATION OF CONCEPTS

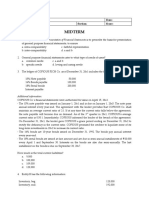

PROBLEM 2: FOR CLASSROOM DISCUSSION

INTERMEDIATE ACCTG 3 (by: Zeus Vernon B. Millan)

OPEN FORUM

QUESTIONS????

REACTIONS!!!!!

INTERMEDIATE ACCTG 3 (by: Zeus Vernon B. Millan)

END

INTERMEDIATE ACCTG 3 (by: Zeus Vernon B. Millan)

You might also like

- IFRS 15 New FridayDocument73 pagesIFRS 15 New Fridaynati67% (3)

- Chapter 6 - Statement of Cash FlowsDocument14 pagesChapter 6 - Statement of Cash Flowsarlynajero.ckc100% (1)

- Chapter 31 - Income TaxesDocument11 pagesChapter 31 - Income TaxesMay Grethel Joy PeranteNo ratings yet

- Chapter 11 - Shareholders' Equity Part 2Document20 pagesChapter 11 - Shareholders' Equity Part 2Camille GarciaNo ratings yet

- CHAPTER 6 PPE Zeus Milan Lecture AidDocument39 pagesCHAPTER 6 PPE Zeus Milan Lecture AidJerome Regalario EspinaNo ratings yet

- B. A Liability of Uncertain Timing or AmountDocument15 pagesB. A Liability of Uncertain Timing or Amountcherry blossomNo ratings yet

- MIDTERM EXAM FDocument14 pagesMIDTERM EXAM FJoyce LunaNo ratings yet

- Pas 7 - Statement of Cash Flows - W RecordingDocument14 pagesPas 7 - Statement of Cash Flows - W Recordingwendy alcoseba100% (1)

- Chapter 2 - Statement of Comprehensive IncomeDocument13 pagesChapter 2 - Statement of Comprehensive IncomeAngel Klein100% (1)

- PAS 12 Accounting For Income TaxDocument17 pagesPAS 12 Accounting For Income TaxReynaldNo ratings yet

- #6 PFRS 8Document2 pages#6 PFRS 8Shara Joy B. ParaynoNo ratings yet

- Financial Forecasting and BudgetingDocument9 pagesFinancial Forecasting and BudgetingPRINCESS HONEYLET SIGESMUNDONo ratings yet

- Financial Reporting Objectives and ConceptsDocument14 pagesFinancial Reporting Objectives and ConceptsDarlyn Dalida San PedroNo ratings yet

- Chapter 5 - Statement of Changes in EquityDocument5 pagesChapter 5 - Statement of Changes in EquityAngel KleinNo ratings yet

- Discontinued Operations ProblemsDocument4 pagesDiscontinued Operations ProblemsJeane Mae BooNo ratings yet

- Pas 10 - Events After The Reporting PeriodDocument11 pagesPas 10 - Events After The Reporting PeriodBritnys Nim100% (1)

- Intermediate Accounting 1B Chapter 19 Borrowing CostsDocument17 pagesIntermediate Accounting 1B Chapter 19 Borrowing CostsjuennaguecoNo ratings yet

- Introduction To Audit Services and Financial Statements AuditDocument35 pagesIntroduction To Audit Services and Financial Statements AuditBryzan Dela CruzNo ratings yet

- Ia2 Prob 1-32 & 33Document1 pageIa2 Prob 1-32 & 33maryaniNo ratings yet

- Chapter 10 - Shareholders' Equity Part 1Document20 pagesChapter 10 - Shareholders' Equity Part 1Camille GarciaNo ratings yet

- Chapter 10 Investments in Debt SecuritiesDocument24 pagesChapter 10 Investments in Debt SecuritiesChristian Jade Lumasag NavaNo ratings yet

- ACTIVITY 5 Interim Reporting PDFDocument2 pagesACTIVITY 5 Interim Reporting PDFEstiloNo ratings yet

- Pas 26 Accounting and Reporting by Retirement Benefit PlansDocument2 pagesPas 26 Accounting and Reporting by Retirement Benefit PlansR.A.No ratings yet

- Notes To FS - Part 1Document24 pagesNotes To FS - Part 1Precious Jireh100% (1)

- PFRS 14 15 16Document3 pagesPFRS 14 15 16kara mNo ratings yet

- Working Capital ManagementDocument5 pagesWorking Capital ManagementellaNo ratings yet

- Level Up - Conceptual Framework ReviewerDocument15 pagesLevel Up - Conceptual Framework Reviewerazithethird100% (1)

- PAS 36 Impairment Asset GuideDocument20 pagesPAS 36 Impairment Asset GuideCyril Grace Alburo BoocNo ratings yet

- CPAR Financial StatementsDocument5 pagesCPAR Financial StatementsAnjo EllisNo ratings yet

- Ia3 - Chapter 1Document8 pagesIa3 - Chapter 1chesca marie penarandaNo ratings yet

- Chapter 4 InventoriesDocument29 pagesChapter 4 InventoriesTzietel Ann FloresNo ratings yet

- Pfrs 5 - Nca Held For Sale & Discontinued OpnsDocument23 pagesPfrs 5 - Nca Held For Sale & Discontinued OpnsAdrianIlagan100% (1)

- 02 Conceptual Framework - RevisedDocument13 pages02 Conceptual Framework - RevisedRazel MhinNo ratings yet

- Conceptual Framework and Accounting Standards: C F A SDocument34 pagesConceptual Framework and Accounting Standards: C F A SG & E ApparelNo ratings yet

- Activity Chapter 4: Ans. 2,320 SolutionDocument2 pagesActivity Chapter 4: Ans. 2,320 SolutionRandelle James FiestaNo ratings yet

- AC78 Chapter 3 Investment in Debt Securities Other Non Current Financial AssetsDocument78 pagesAC78 Chapter 3 Investment in Debt Securities Other Non Current Financial AssetsmerryNo ratings yet

- First Departmental Examination in AccountingDocument3 pagesFirst Departmental Examination in AccountingJao FloresNo ratings yet

- Cost Concept, Terminologies and BehaviorDocument8 pagesCost Concept, Terminologies and BehaviorANDREA NICOLE DE LEONNo ratings yet

- Audit of Current LiabilitiesDocument4 pagesAudit of Current LiabilitiesMark Anthony TibuleNo ratings yet

- Intermediate Accounting 3 ModuleDocument13 pagesIntermediate Accounting 3 ModuleShaina GarciaNo ratings yet

- Chapter 1-Current LiabilitiesDocument15 pagesChapter 1-Current LiabilitiesMonique AlarcaNo ratings yet

- Responsibility Accounting and Transfer PricingDocument13 pagesResponsibility Accounting and Transfer PricingNicole Andrea TuazonNo ratings yet

- Pas 2 Inventories W RecordingDocument13 pagesPas 2 Inventories W Recordingwendy alcoseba100% (1)

- Errors IA3Document24 pagesErrors IA3mddddddNo ratings yet

- Pas 12Document27 pagesPas 12Princess Jullyn ClaudioNo ratings yet

- (Intermediate Accounting 1A) : Lecture AidDocument25 pages(Intermediate Accounting 1A) : Lecture AidShe RC100% (2)

- Chapter 5 Statement of Changes in EquityDocument6 pagesChapter 5 Statement of Changes in EquitylcNo ratings yet

- Intercompany DividendsDocument6 pagesIntercompany DividendsClauie BarsNo ratings yet

- Quiz Printing - Pas 7 - Statement of Cash FlowsDocument1 pageQuiz Printing - Pas 7 - Statement of Cash FlowshasanahNo ratings yet

- Accounting For Governmental / Chapter 4Document9 pagesAccounting For Governmental / Chapter 4Kenneth BunnarkNo ratings yet

- Actg 216 Reviwer Part 2 Without AnswerDocument5 pagesActg 216 Reviwer Part 2 Without Answercute meNo ratings yet

- Shareholder's Equity: ReviewDocument12 pagesShareholder's Equity: ReviewG7 HexagonNo ratings yet

- PAS 10 Events After Reporting PeriodDocument1 pagePAS 10 Events After Reporting PeriodAcissej100% (1)

- Problem 3 Page 41Document8 pagesProblem 3 Page 41MAG MAGNo ratings yet

- Pas 40 Investment PropertyDocument3 pagesPas 40 Investment PropertyR.A.No ratings yet

- AFAR 13 Derivatives and Hedge Accounting Under PFRS 9Document10 pagesAFAR 13 Derivatives and Hedge Accounting Under PFRS 9Louie RobitshekNo ratings yet

- Tax 321 Prelim Quiz 1 Key PDFDocument13 pagesTax 321 Prelim Quiz 1 Key PDFJeda UsonNo ratings yet

- Revenue-from-Contracts-with-CustomersDocument5 pagesRevenue-from-Contracts-with-Customers70fugnayjanetNo ratings yet

- Reviewer Pfrs 15 Revenue From Contracts With CustomersDocument4 pagesReviewer Pfrs 15 Revenue From Contracts With CustomersMaria TheresaNo ratings yet

- Reviewer PFRS 15 Revenue From Contracts With CustomersDocument4 pagesReviewer PFRS 15 Revenue From Contracts With CustomersJezela CastilloNo ratings yet

- Notes (Part 1) : Accounting Policies, Changes in Estimates and ErrorsDocument13 pagesNotes (Part 1) : Accounting Policies, Changes in Estimates and ErrorsPaula Bautista100% (2)

- Cash to Accrual Accounting ConversionDocument9 pagesCash to Accrual Accounting ConversionFrost GarisonNo ratings yet

- Sol. Man. - Chapter 4 - Nca Held For Sale & Discontinued Opns.Document10 pagesSol. Man. - Chapter 4 - Nca Held For Sale & Discontinued Opns.Crown Garcia50% (4)

- San Miguel Corporation's Annual Report Highlights Key Businesses and DevelopmentsDocument355 pagesSan Miguel Corporation's Annual Report Highlights Key Businesses and DevelopmentsFrost GarisonNo ratings yet

- Non-Current Assets Held For Sale and Discontinued OperationsDocument3 pagesNon-Current Assets Held For Sale and Discontinued OperationsFrost GarisonNo ratings yet

- Chapter 2 - Statement of Comprehensive IncomeDocument19 pagesChapter 2 - Statement of Comprehensive IncomeFrost GarisonNo ratings yet

- Disclosure No. 543 2020 Audited Financial Statements As of December 31 2019Document168 pagesDisclosure No. 543 2020 Audited Financial Statements As of December 31 2019Bea ReyNo ratings yet

- Chapter 1 - Statement of Financial Position 1Document22 pagesChapter 1 - Statement of Financial Position 1Frost GarisonNo ratings yet

- Faculty of Law, Jamia Millia Islamia, New Delhi: Land Laws AssignmentDocument19 pagesFaculty of Law, Jamia Millia Islamia, New Delhi: Land Laws AssignmentANAM IQBAL100% (1)

- Commercialization of Space Activities - The Laws and ImplicationsDocument25 pagesCommercialization of Space Activities - The Laws and ImplicationsSHIVANGI BAJPAINo ratings yet

- LAW 1106 - Statutory Construction - JD 14. G.R. No. 186400 - Bolos vs. Bolos - 10.20.2010 - Full TextDocument6 pagesLAW 1106 - Statutory Construction - JD 14. G.R. No. 186400 - Bolos vs. Bolos - 10.20.2010 - Full TextJohn Kenneth ContrerasNo ratings yet

- Rules for Suspensive and Resolutory Conditions in the PhilippinesDocument6 pagesRules for Suspensive and Resolutory Conditions in the PhilippinesmacrosalNo ratings yet

- Civil Service Form GuideDocument3 pagesCivil Service Form GuideStephanie PayumoNo ratings yet

- Ansi Saia A92 5 2006 R2014 Boom Supported Elevating Work PlatformsDocument62 pagesAnsi Saia A92 5 2006 R2014 Boom Supported Elevating Work PlatformsLuis Carcamo Martinez100% (1)

- Nutrition LabelDocument10 pagesNutrition LabelJoe D.No ratings yet

- Unit 6 Policy Making Theories-ModelsDocument52 pagesUnit 6 Policy Making Theories-ModelsAwetahegn HagosNo ratings yet

- ALPHA INTERNATIONAL INVESTMENTS LTD V NATHAN KIZITO HICIC.S. NO. 131 OF 2001Document6 pagesALPHA INTERNATIONAL INVESTMENTS LTD V NATHAN KIZITO HICIC.S. NO. 131 OF 2001Sam KNo ratings yet

- 0051 001Document4 pages0051 001Raheem KassamNo ratings yet

- Multiple Choice - Theory: Part 2Document4 pagesMultiple Choice - Theory: Part 2Nicolle JungNo ratings yet

- Excellence to Adapt and Grow: Astra Otoparts' 2019 Annual ReportDocument332 pagesExcellence to Adapt and Grow: Astra Otoparts' 2019 Annual ReportFrianta pangaribuanNo ratings yet

- Extinguishing ObligationsDocument60 pagesExtinguishing ObligationsLarry Calata AlicumanNo ratings yet

- Certificate 1Document1 pageCertificate 1dnsent.123No ratings yet

- Republic of The Philippines Office of The City Prosecutor Puerto Princesa CityDocument4 pagesRepublic of The Philippines Office of The City Prosecutor Puerto Princesa CityHezro Inciso CaandoyNo ratings yet

- Marcus Neiman Offers 'More Than The Conventional Approach' in Litigation - Daily Business ReviewDocument5 pagesMarcus Neiman Offers 'More Than The Conventional Approach' in Litigation - Daily Business ReviewMNRNo ratings yet

- US Actions Resurrect Islamic State ThreatDocument21 pagesUS Actions Resurrect Islamic State ThreatMamta MauryaNo ratings yet

- UEP Midterm Exam Covers Contemporary World IssuesDocument6 pagesUEP Midterm Exam Covers Contemporary World IssuesMarienelle MonterNo ratings yet

- Fikir Eske Mekabir Amharic PDFDocument5 pagesFikir Eske Mekabir Amharic PDFFikr Yashenifal25% (4)

- Subscription Agreement Payroll 25 July 2023Document3 pagesSubscription Agreement Payroll 25 July 2023maria claudette lacsonNo ratings yet

- Fifth Semester Commerce Corporate Accounting (CBCS - 2017 Onwards)Document12 pagesFifth Semester Commerce Corporate Accounting (CBCS - 2017 Onwards)VELAVAN ARUNADEVINo ratings yet

- Court Marshal by TISDocument226 pagesCourt Marshal by TISshahidirfanNo ratings yet

- Maths 2 Answer Sheet PDFDocument1 pageMaths 2 Answer Sheet PDFvinitha2675No ratings yet

- L4M4 Mock (7) Ethical and Responsible SourcingDocument40 pagesL4M4 Mock (7) Ethical and Responsible Sourcingrajeev ananth100% (1)

- WWF and WPPF by Syed Hassaan NaeemDocument34 pagesWWF and WPPF by Syed Hassaan Naeemikhan809No ratings yet

- Amercoat® 878: Product Data SheetDocument5 pagesAmercoat® 878: Product Data Sheetabdelkader benabdallahNo ratings yet

- Monopoly PDFDocument13 pagesMonopoly PDFUmer Tariq BashirNo ratings yet

- Form GaransiDocument3 pagesForm GaransiRovita TriyambudiNo ratings yet

- Budget Fy21Document138 pagesBudget Fy21ForkLogNo ratings yet

- Course Manual-Legal PsychologyDocument12 pagesCourse Manual-Legal PsychologyAnanya PillarisettyNo ratings yet