Professional Documents

Culture Documents

Pangakun UAS 2018 - Jawaban

Uploaded by

sepuluh 10Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pangakun UAS 2018 - Jawaban

Uploaded by

sepuluh 10Copyright:

Available Formats

UAS 2017/2018

Pilihan Ganda

1. A

2. C

3. C

4. D

5. D

6. D

7. A

8. D

9. B

10. D

11. B

12. C

13. D

14. D

15. A

16. C

17. C

18. C

19. C

20. B

Problem I Inventory

Oktober 2018

Date Explanation Units Units Cost Total Cost

1/10 Beginning Inventory 50 200.000 10.000.000

15/10 Purchase 110 250.000 27.500.000

25/10 Purchase 160 300.000 48.000.000

Cost Of Goods Available For Sale 320 85.500.000

Sold (260)

Ending Inventory 60 300.000 18.000.000

COGS = Cost Of Goods Available For Sale – Ending Inventory

= 85.500.000 – 18.000.000

= 67.500.000

Gross Profit = Net Sales – COGS

= 84.375.000 – 67.500.000

= 16.875.000

November 2018

Date Explanation Units Units Cost Total Cost

1/11 Beginning Inventory 60 300.000 18.000.000

5/11 Purchase 190 275.000 52.250.000

20/11 Purchase 80 200.000 16.000.000

Total 330 86.250.000

Sold (300)

Ending Inventory 30 200.000 6.000.000

COGS = Cost Of Goods Available For Sale – Ending Inventory

= 86.250.000 – 6.000.000

= 80.250.000

Gross Profit = Net Sales – COGS

= 100.312.500 – 80.250.000

= 20.062.500

Desember 2018

Date Explanation Units Units Cost Total Cost

1/12 Beginning Inventory 300 200.000 6.000.000

10/12 Purchase 250 240.000 60.000.000

16/12 Purchase 200 250.000 50.000.000

Total 480 116.000.000

Gross Profit Rate

Oktober 2018 = 16.875.000 / 84.375.000 x 100%

= 20 %

November 2018 = 20.062.500 / 100.312.500 x 100%

= 20%

Net Sales Desember 132.500.000

Estimated Gross Profit Desember ( 26.500.000)

20% x 132.500.000 _________

Estimated COGS 106.000.000

Cost Of Goods Available For Sale 116.000.000

Estimated COGS (106.000.000)

Estimates Ending Inventory 10.000.000

Unit Ending Inventory = 10.000.000 / 250.000

=4

Ending Inventory 40@250.000 = 10.000.000

Ending Inventory tidak terbakar 10@250.000 = (2.500.000)

Ending Inventory terbakar 30@250.000 = 7.500.000

Problem II Rekonsiliasi Kas

PT. Insan Madani Sejahtera

Bank Reconciliation

December 31, 2017

(Dalam Ribuan Rupiah)

Cash Balance per Bank Statement 215.000

Add : Deposit In transit 125.000

Check Error 16.500 141.500

Less : Outstanding Check

11001 (20.000)

11003 (17.500)

11041 (35.000)

11042 (15.000)

11055 (12.500) (100.000)

Adjusted Cash Balance per Bank Statement 256.500

Cash Balance per Book 237.000

Add : Collected Notes Receivable 45.000

Interest Revenue (N/R) 1.000

Check Error No. 11045 9.000 55.000

Less : NFS Check (27.500)

Check Error No. 11051 ( 7.200)

Bank Service Charge ( 800) (35.500)

Adjusted Cash Balance per Book 256.500

31/12/17 Cash 45.000

Notes Receivable 45.000

31/12/17 Cash 1.000

Interest Revenue 1.000

31/12/17 Cash 9.000

Account Payable 9.000

31/12/17 Account Receivable 27.500

Cash 27.500

31/12/17 Account Payable 7.200

Cash 7.200

31/12/17 Bank Service Charge Expense 800

Cash 800

Problem III Receivables

1/1/17 Account Receivable, Toko Amanah 10.000

Sales 10.000

2/10, n/30

5/1/17 Sales Return and Allowance 500

Account Receivable, Toko Amanah 500

11/1/17 Cash 9.690

Account Receivable, Toko Amanah 9.500

Interest Revenue 190

9.500 x 2%

1/2/17 Allowance for Doubtful Account 1.000

Account Receivable, Toko Mandiri 1.000

15/2/17 Cash 4.875

Bank Service Charge Expense 125

2,5% x 5.000

Sales 5.000

1/3/17 Cash 9.750

Bank Service Charge Expense 250

2,5% x 10.000

Account Receivable 10.000

15/3/17 Notes Receivable, Toko Bihar 4.000

Account Receivable, Toko Bihar 4.000

Jatuh Tempo 3 Bulan, Bunga 10%

1/4/17 Notes Receivable, Toko Pak Dhe 5.000

Account Receivable, Toko Pak Dhe 5.000

Jatuh Tempo 60 Hari, Bunga 9%

31/5/17 Account Receivable, Toko Pak Dhe 5.075

Notes Receivable, Toko Pak Dhe 5.000

Interest Revenue 75

60/360 x 9% x 5.000

15/6/17 Cash 4.100

Notes Receivable 4.000

Interest Revenue 100

3/12 x 10% x 4.000

10/7/17 Cash 1.000

Allowance for Doubtful Account 2.000

Account Receivable, Toko Ulet 3.000

15/8/17 Notes Receivable, Toko Perkasa 20.000

Sales 20.000

Jatuh Tempo 180 Hari, Bunga 12%

26/9/17 Notes Receivable, Toko Salima 10.000

Cash 10.000

Jatuh Tempo 120 Hari, Bunga 12%

10/10/17 Account Receivable, Toko Ulet 2.000

Allowance for Doubtful Account 2.000

Cash 2.000

Account Receivable, Toko Ulet 2.000

1/11/17 Account Receivable, Toko Mandiri 1.000

Allowance for Doubtful Account 1.000

Cash 250

Account Receivable, Toko Mandiri 250

1/12/17 Allowance for Doubtful Account 20.000

Account Receivable 20.000

Allowance for Doubtful Account Account Receivable

1/2/17 1.000 Bal. 15.000 Bal. 300.000 5/1/17 500

10/7/17 2.000 10/10/17 2.000 1/1/17 10.000 11/1/17 9.500

1/12/17 20.000 1/11/17 1.000 31/5/17 5.075 1/2/17 1.000

Bal. 5.000 10/10/17 2.000 1/3/17 10.000

1/11/17 1.000 15/3/17 4.000

1/4/17 5.000

10/7/17 3.000

10/10/17 2.000

1/11/17 250

1/12/17 20.000

Bal. 262.825

Estimasi Piutang Tak Tertagih = 5% x 262.285

= 13.141,25

31/12/17 Bad Debt Expense 18.141,25

Allowance for Doubtful Account 18.141,25

13.141,25 + 5.000

Interest Revenue - Toko Perkasa = 12% x 138/360 x 20.000 = 920

Toko Salima = 12% x 96/360 x 10.000 = 320

1.240

31/12/17 Interest Receivable 1.240

Interest Revenue 1.240

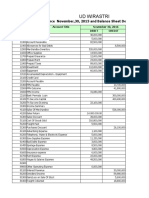

UD Charmaina

Statement of Financial Position

Current Assets :

Account Receivable 262.825

Less : Allowance for Doubtful Account (13.141,25)

Net Account Receivable 249.683,75

Notes Receivable 30.000

Interest Receivable 1.240

Problem IV Aset Tetap

2 Jan 2016

Harga Pembelian 10.000.000

Pajak Pembelian Tanah dan PPN 1.500.000

Biaya Notaris 100.000

Komisi Agen Property 100.000

Sewa Excavator 50.000

Upah Kuli Pembersih Puing 20.000

Hasil Penjualan Puing (50.000)

Total Cost 11.720.000

2/1/16 Land 11.720.000

Misc. Expense 25.000

Land Improvement 55.000

Cash 11.800.000

1/5/16 Service Expense 1.300

Cash 1.300

1/7/16 Building 200.000

Maintenance Building Expense 50.000

Cash 250.000

1/8/16 Depreciation Expense 59.400

Accumulated Depreciation Equipment A 59.400

Tahun Ke- Tarif Book Value Depreciation

1 (2014-2015) 40% 550.000 220.000

2 (2015-2016) 40% 330.000 132.000

3 (2016-2017) 40% 198.000 79.200

Depreciation Tahun 2016 s.d 1/8/16 = 3/12 x 132.000 + 4/12 x 79.200

= 33.000 + 26.400

= 59.400

Book Value = 550.000 – 220.000 – 132.000 – 26.400

= 171.600

Nilai Wajar 375.000

Book Value 171.600

Gain on Disposal of Plant Asset 203.400

1/8/16 Equipment B 600.000

Accumulated Depreciation Equipment A 378.400

Equipment A 550.000

Gain on Disposal of Plant Asset 203.400

Cash 225.000

1/10/16 Depreciation Expense 60.000

Accumulated Depreciation Machine 60.000

9/12 x 400.000 / 5

Depreciation = 400.000/5

= 80.000 / year

Book Value = 440.000 – 6/12 x 80.000 – 2 x 80.000 – 60.000

= 440.000 – 40.000 – 160.000 – 60.000

= 180.000

Book Value 180.000

Harga Jual 100.000

Loss on Disposal of Plant Asset 80.000

1/10/16 Cash 100.000

Accumulated Depreciation Machine 260.000

Loss on Disposal of Plant Asset 80.000

Machine 440.000

31/12/16 Depreciation Expense 132.000

Accumulated Depreciation Vehicle 132.000

Depreciation = 360.000 / 600.000 = 0,6 / KM

Depreciation tahun 2015 = 0,6 x 70.000 = 42.000

Depreciation tahun 2016 = 0,6 x 220.000

= 132.000

Adjustment

31/12/16 Depreciation Expense 54.687,5

Accumulated Depreciation Building 54.687,5

Depreciation = 1.000.000 / 20 = 50.000 / year

Balance Accumulated Depreciation Buillding per 31 Des 2015 = 50.000 x 5 = 250.000

Book Value Building 1 Jan 2016 = 1.000.000 – 250.000 = 750.000

Depreciation Building 2016 s.d 1/7/16 = 50.000 x 6/12 = 25.000

Depreciation Building 1/7/16 s.d. 31/12/16 = 6/12 x 950.000/16 = 29.678,5

Total Depreciation Building 2016 = 25.000 + 29.678,5 = 54.687,5

31/12/16 Depreciation Expense 62.500

Accumulated Depreciation Equipment B 62.500

600.000 /4 x 5/12

31/12/16 Trademarks and Trade Name termasuk dalam indefinite maka tidak ada amortisasi

31/12/16 Depreciation Expense 13.000

Accumulated Depreciation Land Improvement 13.000

52.000/4

UD PKN

Statement of Financial Position

Dec 31, 2016

(Dalam Ribuan Rupiah)

Non-Current Asset

Property, Plant, and Equipment

Land 11.720.000

Land Improvement 55.000

Accumulated Depreciation Land Improvement (13.000) 42.000

Building 1.400.000

Accumulated Depreciation Building (304.687,5) 1.095.312,5

Vehicle 400.000

Accumulated Depreciation Vehicle (174.000) 226.000

Equipment B 600.000

Accumulated Depreciation Equipment B (62.500) 537.500

Total Property, Plant, and Equipment 13.620.812,5

Intangible Asset

Trade Name 250.000__

Total Non Current Asset 13.870.812,5

You might also like

- Tgs Ak-2Document4 pagesTgs Ak-2GhinasaussanNo ratings yet

- Q 1Document5 pagesQ 1blobNo ratings yet

- Tgs Ak-3Document4 pagesTgs Ak-3GhinasaussanNo ratings yet

- Excel - Professional Services Inc.: Management Firm of Professional Review and Training Center (PRTC)Document5 pagesExcel - Professional Services Inc.: Management Firm of Professional Review and Training Center (PRTC)May Grethel Joy Perante100% (1)

- RequiredDocument15 pagesRequiredCheska Anne Mikka RoxasNo ratings yet

- TK03 Aks Liana DamayantiDocument7 pagesTK03 Aks Liana DamayantiLiana DamayantiNo ratings yet

- Pembahasan LabAkun 16-17Document6 pagesPembahasan LabAkun 16-17sepuluh 10No ratings yet

- BAC 211 Assignment 2018Document4 pagesBAC 211 Assignment 2018vincentNo ratings yet

- Date Adjusting Entries Dec.31Document18 pagesDate Adjusting Entries Dec.31Cheska Anne Mikka RoxasNo ratings yet

- The Following Information For CLH Company Is Available On June 30, 2018, The End of A MonthlyDocument5 pagesThe Following Information For CLH Company Is Available On June 30, 2018, The End of A MonthlyJel SanNo ratings yet

- Zabala Auto SupplyDocument7 pagesZabala Auto SupplyEryn GabrielleNo ratings yet

- Accounting Assignment #3 - Jonah KelaryDocument2 pagesAccounting Assignment #3 - Jonah KelaryJerad KotiNo ratings yet

- ACCT103 Supplementary Notes Cash and Cash EquivalentsDocument1 pageACCT103 Supplementary Notes Cash and Cash EquivalentsChrislyn Janna BeljeraNo ratings yet

- Mid Term Review AnswersDocument12 pagesMid Term Review AnswersManasi ChitnisNo ratings yet

- Question Bank 1Document5 pagesQuestion Bank 1lavarocks23100% (1)

- Fab MDocument5 pagesFab Mzacharaya abegailNo ratings yet

- Gabriel T. Soniel COA 2E financial statementsDocument5 pagesGabriel T. Soniel COA 2E financial statementsGabriel Trinidad SonielNo ratings yet

- Additional Practice Exam Solution Updated Nov 19Document7 pagesAdditional Practice Exam Solution Updated Nov 19Shaunny BravoNo ratings yet

- Group Aissignment - AnswerDocument15 pagesGroup Aissignment - AnswerDuyên Lê Ngọc TriềuNo ratings yet

- Corporate Finance II Section: 01 Homework No: 02Document5 pagesCorporate Finance II Section: 01 Homework No: 02Sumaiya TithiNo ratings yet

- Acctg. Equation Puring CompanyDocument8 pagesAcctg. Equation Puring CompanyAngelNo ratings yet

- Accounting Equation ch5Document19 pagesAccounting Equation ch5Ebony Ann delos SantosNo ratings yet

- Business transactions of a men's salonDocument13 pagesBusiness transactions of a men's salonEbony Ann delos SantosNo ratings yet

- Minsupala Trading Corporation (Workbook)Document14 pagesMinsupala Trading Corporation (Workbook)Luis Melquiades P. Garcia100% (3)

- Frias Activity 6Document6 pagesFrias Activity 6Lars FriasNo ratings yet

- Ia MidtermDocument5 pagesIa MidtermCindy CrausNo ratings yet

- Kimberly Veguilla Rodríguez Prof. Ramos Martin Modulo 2. Tarea 1. Los Reportes de ContabilidadDocument4 pagesKimberly Veguilla Rodríguez Prof. Ramos Martin Modulo 2. Tarea 1. Los Reportes de ContabilidadKimberly VeguillaNo ratings yet

- Accounting calculations and journal entriesDocument6 pagesAccounting calculations and journal entriesZatsumono YamamotoNo ratings yet

- Acctg 202Document9 pagesAcctg 202Lore Desa CenizaNo ratings yet

- January transactions and financial recordsDocument8 pagesJanuary transactions and financial recordsRica Ann RoxasNo ratings yet

- Financial Position and Income Statement Analysis of Simple CompanyDocument2 pagesFinancial Position and Income Statement Analysis of Simple CompanyAndrea Monique AlejagaNo ratings yet

- Jawaban Mid Test Praktik Dagang 2022Document14 pagesJawaban Mid Test Praktik Dagang 2022Rahmal SimarangkirNo ratings yet

- Soal UAS 2015.2016 KajianDocument4 pagesSoal UAS 2015.2016 Kajiansyafaatun munajahNo ratings yet

- Activity Review StatementDocument5 pagesActivity Review Statementangel ciiiNo ratings yet

- FAR Final Preboard SolutionsDocument6 pagesFAR Final Preboard SolutionsVillanueva, Mariella De VeraNo ratings yet

- CPAR B94 FAR Final PB Exam - Answers - SolutionsDocument8 pagesCPAR B94 FAR Final PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- 4.2 Answers and Solutions - Assignment On Materials and LaborDocument8 pages4.2 Answers and Solutions - Assignment On Materials and LaborRoselyn LumbaoNo ratings yet

- Modul Pratama - JawabanDocument127 pagesModul Pratama - JawabanDity Rakhma QintariNo ratings yet

- Chapter 8 In-Class Problems SOLUTIONSDocument4 pagesChapter 8 In-Class Problems SOLUTIONSAbdullah alhamaadNo ratings yet

- Review Answer SheetDocument13 pagesReview Answer SheetKeycee Rhaye RivasNo ratings yet

- Homework SolutionsDocument5 pagesHomework SolutionsAnonymous CuUAaRSNNo ratings yet

- Kertas Kerja Modul PratamaDocument59 pagesKertas Kerja Modul Pratamagaming 1stNo ratings yet

- Tutorial #3 - Group 5 - PA1 - MarkedDocument8 pagesTutorial #3 - Group 5 - PA1 - MarkedThanh NguyenNo ratings yet

- Chapter 06 - AdjustmentsDocument26 pagesChapter 06 - AdjustmentsMkhonto Xulu100% (1)

- Questions On Cash Budget-2Document7 pagesQuestions On Cash Budget-2Mpolokeng HlabanaNo ratings yet

- ALEJAGA FM Project Week 4Document5 pagesALEJAGA FM Project Week 4Andrea Monique AlejagaNo ratings yet

- Final Test - AnswersDocument6 pagesFinal Test - Answersnguyễn hiềnNo ratings yet

- P1 Cash FlowDocument2 pagesP1 Cash FlowBeth Diaz LaurenteNo ratings yet

- General Journal Entries for Retail BusinessDocument7 pagesGeneral Journal Entries for Retail BusinessPath_of_windNo ratings yet

- Year 4 Assignment Sept 2022Document2 pagesYear 4 Assignment Sept 2022DANIELNo ratings yet

- Solutions To ProblemsDocument4 pagesSolutions To ProblemslorraineNo ratings yet

- FABM 2 Practice Problems SCIDocument3 pagesFABM 2 Practice Problems SCIMounicha Ambayec100% (4)

- Fabm2 Statement of Comprehensive Income Practice Problems Answer KeyDocument3 pagesFabm2 Statement of Comprehensive Income Practice Problems Answer KeyMounicha Ambayec0% (1)

- Tugas Bab 6 Jawaban P 6-3Document2 pagesTugas Bab 6 Jawaban P 6-3Syahirul AlimNo ratings yet

- Introduction To Accounting An Integrated Approach 6Th Edition Ainsworth Solutions Manual Full Chapter PDFDocument41 pagesIntroduction To Accounting An Integrated Approach 6Th Edition Ainsworth Solutions Manual Full Chapter PDFstevenwhitextsngyadmk100% (12)

- Exercises Module 8 For UploadDocument16 pagesExercises Module 8 For UploadjpNo ratings yet

- Final Exam AnsDocument8 pagesFinal Exam AnsTien NguyenNo ratings yet

- Toaz - Info Adjusting Journal Entries Exercises3xlsx PRDocument22 pagesToaz - Info Adjusting Journal Entries Exercises3xlsx PRpau mejaresNo ratings yet

- 3- Iinvetory & Notes Receivable answeredDocument2 pages3- Iinvetory & Notes Receivable answeredbolaemil20No ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- DIAPHRAGM WALL REPAIR METHOD STATEMENTDocument17 pagesDIAPHRAGM WALL REPAIR METHOD STATEMENTHemaNo ratings yet

- Trading Psychology Framework for BeginnersDocument1 pageTrading Psychology Framework for BeginnersSlavko GligorijevićNo ratings yet

- Assignment RC IDocument2 pagesAssignment RC Iabrhamfikadie676No ratings yet

- Salaar FlourDocument71 pagesSalaar FlourZubair TradersNo ratings yet

- Angeline Tham - AngkasDocument2 pagesAngeline Tham - AngkasDaniella YbutNo ratings yet

- Letter of EngagementDocument3 pagesLetter of EngagementEgay EvangelistaNo ratings yet

- Chapter 10 PPT - Holthausen & Zmijewski 2019Document121 pagesChapter 10 PPT - Holthausen & Zmijewski 2019royNo ratings yet

- Indraprastha GLOBAL SCHOOL Class XI Economics Worksheet Statistics MeanDocument5 pagesIndraprastha GLOBAL SCHOOL Class XI Economics Worksheet Statistics MeanAnnie AroraNo ratings yet

- Investment Update CekoDocument8 pagesInvestment Update CekonitipfileajaNo ratings yet

- Bank Keys Rev 2Document13 pagesBank Keys Rev 2Nitika MinhasNo ratings yet

- Mathematical Economics Week1Document43 pagesMathematical Economics Week1Cholo AquinoNo ratings yet

- Global Competitivement Report 2007-08Document26 pagesGlobal Competitivement Report 2007-08kibria_iba140% (1)

- Isolated Survey IntroDocument15 pagesIsolated Survey IntroAlone in the lonely planetNo ratings yet

- Ditta Shierlly Novierra - Minicase Conch Republic Electronics, Part 2Document36 pagesDitta Shierlly Novierra - Minicase Conch Republic Electronics, Part 2Ummaya MalikNo ratings yet

- International Financial Management 13 Edition: by Jeff MaduraDocument33 pagesInternational Financial Management 13 Edition: by Jeff MaduraJaime SerranoNo ratings yet

- Confirmation 2 PDFDocument2 pagesConfirmation 2 PDFENAD TBISHATNo ratings yet

- Bill of Quantity - Replacement of Roofing & CeilingDocument2 pagesBill of Quantity - Replacement of Roofing & CeilingEdwin FranciscoNo ratings yet

- Plant for Pakistan PT-10 FormDocument2 pagesPlant for Pakistan PT-10 FormAqeel AhmedNo ratings yet

- IFRS Conversion ServicesDocument2 pagesIFRS Conversion ServicesParas MittalNo ratings yet

- Economic Resources and Basic QuestionsDocument2 pagesEconomic Resources and Basic QuestionsGine Bert Fariñas PalabricaNo ratings yet

- Booklet 3er Grado 2023Document24 pagesBooklet 3er Grado 2023impresionespribianNo ratings yet

- Garment Manufacturing Lab Manual Parts GuideDocument67 pagesGarment Manufacturing Lab Manual Parts GuideHammad MustafaNo ratings yet

- Slab Design As Per Is 4562000Document4 pagesSlab Design As Per Is 4562000kyaw kyawNo ratings yet

- StitchDocument10 pagesStitchSherouk Eid100% (1)

- Accounting For Decision Making and Control 9th Edition Zimmerman Solutions ManualDocument25 pagesAccounting For Decision Making and Control 9th Edition Zimmerman Solutions ManualRoseWilliamsqnpt100% (55)

- Gantrex Pad Mk6Document4 pagesGantrex Pad Mk6reza nasiriNo ratings yet

- Nepal Jute Mill Case 2Document3 pagesNepal Jute Mill Case 2Padua CdyNo ratings yet

- Knowlegde Test 1 and 2Document69 pagesKnowlegde Test 1 and 2Đăng TríNo ratings yet

- Maximizing Profits Through Case AnalysisDocument12 pagesMaximizing Profits Through Case AnalysisAjayNo ratings yet

- Multiple Choice Answers and Solutions: Franchise Accounting 177Document11 pagesMultiple Choice Answers and Solutions: Franchise Accounting 177Mazikeen DeckerNo ratings yet