Professional Documents

Culture Documents

Instruction DRC 03 PDF

Uploaded by

Vrajesh PatelOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Instruction DRC 03 PDF

Uploaded by

Vrajesh PatelCopyright:

Available Formats

Instruction No.

3/2/2020- GST

F. No. 354/32/2019-TRU

Government of India

Ministry of Finance

Department of Revenue

(Tax research Unit)

*****

Room No. 146G, North Block,

New Delhi, 24th June, 2020

To

The Principal Chief Commissioners / Chief Commissioners / Principal Commissioners /

Commissioners of Central Tax (All)

The Principal Director Generals / Director Generals (All)

Madam/Sir,

Subject: Payment of GST by real estate promoter/developer supplying construction of

residential apartment etc, on the shortfall value of inward supplies from

registered supplier at the end of the financial year– reg.

A revised GST rate has been prescribed, w.e.f. the 1st April, 2019 on the supply of

service by way of construction of residential apartment. Under this, construction of

affordable residential apartments attract GST at the rate of 1% [without ITC] and other

residential apartments attract GST at the rate of 5% [without ITC]. (These rates have been

prescribed vide Notification no. 11/2017- Central Tax (Rate) dated 28.06.2017 as amended

by Notification no. 3/2019- Central Tax (Rate) dated 29.03.2019).

2. One of the condition prescribed vide said notification is that atleast eighty per cent.

of value of input and input services, [other than services by way of grant of development

rights, long term lease of land or FSI, electricity, high speed diesel, motor spirit, natural

gas], used in supplying the construction service, shall be received by the promoter/developer

from registered supplier only. In case of shortfall from the said threshold of 80 per cent., the

promoter/developer shall pay the tax on the value of input and input services comprising

such shortfall in the manner as has been prescribed vide said notification. This tax shall be

paid through a prescribed form electronically on the common portal by end of the quarter

following the financial year. Accordingly for FY 2019-20, tax on such shortfall is to be paid

by the 30th June, 2020.

3. In the above context, requests have been received seeking details of prescribed form

on which the said tax amount has to be reported.

4. The issue referred by the trade has been examined. It has been decided that FORM

GST DRC-03, as already prescribed, shall be used for making the payment of such tax by

promoter/developer. Accordingly, person required to pay tax in accordance with the said

notification on the shortfall from threshold requirement of procuring input and input

services (below 80%) from registered person shall use the form DRC-03 to pay the tax

electronically on the common portal within the prescribed period.

5. It is requested that suitable instructions may be issued by the States/ field formations

of CBIC to advise the trade accordingly.

Yours Faithfully,

Susanta Kr. Mishra

Technical Officer (TRU)

susanta.mishra87@gov.in

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

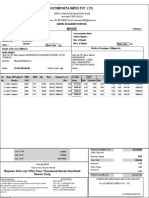

- Ketimporta Impex Pvt. LTD.: InvoiceDocument1 pageKetimporta Impex Pvt. LTD.: Invoicepuneet AroraNo ratings yet

- Economics For ManagersDocument12 pagesEconomics For ManagersArthur DavidNo ratings yet

- Ace Designers Stretch Film QuotationDocument2 pagesAce Designers Stretch Film QuotationChethan PuttaswamyNo ratings yet

- Epda Mv. Tbn. Paria. Bombana Port. Sul-Tra. Sulawesi. 14 April 2020Document1 pageEpda Mv. Tbn. Paria. Bombana Port. Sul-Tra. Sulawesi. 14 April 2020Agus Shofyan TauryNo ratings yet

- Hemanshu Joshi 23Document4 pagesHemanshu Joshi 23HEMANSHU JOSHINo ratings yet

- SAGPL ScoresheetDocument1 pageSAGPL ScoresheetSAGPLNo ratings yet

- Transfer and Business TaxationDocument4 pagesTransfer and Business TaxationKhai Supleo PabelicoNo ratings yet

- Iho1 Robot Spare: QuotationDocument3 pagesIho1 Robot Spare: QuotationChandru ChristurajNo ratings yet

- Vat Indirect Taxes in Africa 2023Document297 pagesVat Indirect Taxes in Africa 2023Olusola OgunyemiNo ratings yet

- Origin of Customs DutyDocument45 pagesOrigin of Customs DutyJayagokul SaravananNo ratings yet

- NoticeDocument4 pagesNoticeAl OkNo ratings yet

- SezDocument34 pagesSezanuragNo ratings yet

- Mrs Kudithipudi Hima Bindu 25-1-1340, NETHAJI NAGAR,, 8TH STREET, Podalakur Road,, Andhrakesari Nagar, Nellore, Andhra Pradesh - 524004 9703512254Document2 pagesMrs Kudithipudi Hima Bindu 25-1-1340, NETHAJI NAGAR,, 8TH STREET, Podalakur Road,, Andhrakesari Nagar, Nellore, Andhra Pradesh - 524004 9703512254Raveendra Babu CherukuriNo ratings yet

- 314 Calculating Taxes, Fees and ChargesDocument49 pages314 Calculating Taxes, Fees and Chargesdawit Terefe67% (3)

- D) Igst: D) Supply of Services Whether The Job Work Is Carried Out With or WithoutDocument20 pagesD) Igst: D) Supply of Services Whether The Job Work Is Carried Out With or Withoutparesh shiralNo ratings yet

- Final Black Book ProjectDocument53 pagesFinal Black Book ProjectHamzah ShaikhNo ratings yet

- Argentina - Textiles and Apparel (AB)Document34 pagesArgentina - Textiles and Apparel (AB)Huyền NamiNo ratings yet

- Paper-8 Indirect Tax Laws 73366bos59159Document44 pagesPaper-8 Indirect Tax Laws 73366bos59159cadivyaguptaNo ratings yet

- Iii. Trade Policies and Practices by Measure (1) I: Mauritius WT/TPR/S/198/Rev.1Document38 pagesIii. Trade Policies and Practices by Measure (1) I: Mauritius WT/TPR/S/198/Rev.1Nanda MunisamyNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruartiNo ratings yet

- Phase-2 MSEDCL-1Document3 pagesPhase-2 MSEDCL-1ninad joshiNo ratings yet

- Integrated Case Study Based MCQ: by CA Mahesh Gour SirDocument6 pagesIntegrated Case Study Based MCQ: by CA Mahesh Gour SirTanyaNo ratings yet

- Telephone BillDocument4 pagesTelephone BillSankar SundaramNo ratings yet

- Advance Tax Law 1 10 219 PDFDocument1,008 pagesAdvance Tax Law 1 10 219 PDFPavlov Kumar HandiqueNo ratings yet

- Unit 2 Public Revenue 2Document19 pagesUnit 2 Public Revenue 2Queenie SpotlightNo ratings yet

- Eastern Telecommunications Philippines v. CIRDocument1 pageEastern Telecommunications Philippines v. CIRMarcella Maria KaraanNo ratings yet

- Chap 7 AnswerDocument89 pagesChap 7 AnswerMai PhươngNo ratings yet

- 5918 SlowbalizationDocument2 pages5918 Slowbalizationkevin hoxhaNo ratings yet

- Eou ManualDocument3 pagesEou ManualastuteNo ratings yet

- Silabus Perpajakan 2 Genap 2021Document7 pagesSilabus Perpajakan 2 Genap 2021Fathiyyah NoviraNo ratings yet