Professional Documents

Culture Documents

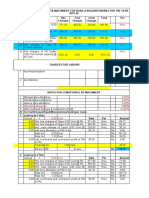

No GST Up 2.50 Lakhs Works

Uploaded by

Sethu Madhav0 ratings0% found this document useful (0 votes)

18 views1 pageGst

Original Title

NO GST UP 2.50 LAKHS WORKS

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGst

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views1 pageNo GST Up 2.50 Lakhs Works

Uploaded by

Sethu MadhavGst

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 1

PRADESH

/ERNMENT OF ANDHRA

cov mor ener

Tax Act, 2017 (Act No.16 of 2017) -

+ TDS by the ODO under GST = Orders =

rradesh Goods and Servi

The And jeauctions and deposk

sued

11) DEPARTMENT

REVENUE (COMMERCIAL TAXES"

bated: 24-09-2018

Read the following:

> ‘No. 65/39/2018-DORF.No.S.3101 1/11/2018-ST-I-DoRyf

of Revenue, Circular

partment

16.oT-1-DOR,New Delhi, Dated the

14th September, 2018.

3) Letter from the CCST in Ref.No.GST/44/2018, dated 19.09.2018.

ORDER:

Pods Sr sccvicFS OF BON, WHETE thE TOtaT value ol

exceeds two lakh Shd TRY WOUsateTUPeEE TNE a

this section shall"be part-t6 the GOVEPHTTTEM: by Ot

{Ye ene oF THETONEI TIT WRTCH-eUCh ded uttron

FORM GSTR:7-GIVINg “TNE detalls of dEductions'

deductor has to issue a certificate to the dedi

contract value, rate of deduction, amount deducted

2. As per the Act, every deductor shall dedu

payment made to the supplier of goods or servic

amount so deducted with the Government acct

cheque to be deposited in one of the authorize

common portal. In addition, the deductors are

filing return in FORM GSTR-7 on the common

deduction has been made based on which the

available to the deductee. The DDOs, who hai

required to register with the common portal

from the bills where the supplies are

to deduct tax from Panchayats, whi

functions under Article 243G of the

neither supply of goods nor supply

notification no 14/2017-Central Tax

No.261, Revenue (CT-II) Dept.,

3, The subject section which

to come into force with eff

introduced. Government of

into force with effect

Central Tax dated 13t

‘Seanne wth CamScanet

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Lob (Left Out of Base Line Ist in Ramachandrapuram Mandal)Document9 pagesLob (Left Out of Base Line Ist in Ramachandrapuram Mandal)Sethu MadhavNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Mini SOR 2022-23 PDFDocument99 pagesMini SOR 2022-23 PDFSethu MadhavNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Weight Chart of Cast Iron FittingsDocument5 pagesWeight Chart of Cast Iron FittingsRajesh BabuNo ratings yet

- Inauguration Board CC DRAINS - 1 PDFDocument1 pageInauguration Board CC DRAINS - 1 PDFSethu MadhavNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Circulr On GS RBKs HC AWB - Optimized Resouer Utilization - Information Req - 2020-09-01Document2 pagesCirculr On GS RBKs HC AWB - Optimized Resouer Utilization - Information Req - 2020-09-01Sethu MadhavNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Nolb List From Ramachandrapuram MandalDocument4 pagesNolb List From Ramachandrapuram MandalSethu MadhavNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Features Deployed On 12th Sep 2020Document2 pagesFeatures Deployed On 12th Sep 2020Sethu MadhavNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- KOTHURUDocument229 pagesKOTHURUSethu MadhavNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Vinayak Nagar - 25.00 (Part-I)Document99 pagesVinayak Nagar - 25.00 (Part-I)Sethu MadhavNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- YV Palem VWSC FormatDocument1 pageYV Palem VWSC FormatSethu MadhavNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- YDU RC Puram FormatDocument44 pagesYDU RC Puram FormatSethu MadhavNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Appsc Group - Ii - Paper - Ii: Model Grand TestDocument7 pagesAppsc Group - Ii - Paper - Ii: Model Grand TestSethu MadhavNo ratings yet

- GS Report DT 07.09.20 - To EeDocument72 pagesGS Report DT 07.09.20 - To EeSethu MadhavNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- GOLLAPALLE MppsDocument178 pagesGOLLAPALLE MppsSethu MadhavNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Ec Redeppa PDFDocument2 pagesEc Redeppa PDFSethu MadhavNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Modified Model Est For VO Building (Rural) 28-12-19.Document147 pagesModified Model Est For VO Building (Rural) 28-12-19.Sethu MadhavNo ratings yet

- List of Prioritized Proposals Rs in Lakhs Status As On 01.04.201 9 Type of Proposal (CMP/H MPR/On GoingDocument6 pagesList of Prioritized Proposals Rs in Lakhs Status As On 01.04.201 9 Type of Proposal (CMP/H MPR/On GoingSethu MadhavNo ratings yet

- 2018PR RT1309Document1 page2018PR RT1309Sethu MadhavNo ratings yet

- Works Proposed in ProjectDocument3 pagesWorks Proposed in ProjectSethu MadhavNo ratings yet

- CPSS Schemes in ChittoorDocument12 pagesCPSS Schemes in ChittoorSethu MadhavNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Memo. 20129 Dated 21-07-2010 Paternity Leave - Avail Either Before 15days or Within 6months From The Date of DeliveryDocument584 pagesMemo. 20129 Dated 21-07-2010 Paternity Leave - Avail Either Before 15days or Within 6months From The Date of DeliverySethu MadhavNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Book 1Document65 pagesBook 1Sethu MadhavNo ratings yet

- 2018fin MS58Document3 pages2018fin MS58Rajesh KarriNo ratings yet

- VAPs InformationDocument1 pageVAPs InformationSethu MadhavNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- GO Underground Drainage SystemDocument2 pagesGO Underground Drainage SystemSethu MadhavNo ratings yet

- 30 CodesDocument2 pages30 CodesSethu MadhavNo ratings yet

- Offtake Sluices Design GuidelinesDocument3 pagesOfftake Sluices Design Guidelinesgurumurthy38No ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- 07 Storage Tank ReqsDocument28 pages07 Storage Tank ReqsMohamed AlkhawagaNo ratings yet

- Valves 2017-18Document59 pagesValves 2017-18Sethu MadhavNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)