Professional Documents

Culture Documents

Lesson I Inventories PDF

Lesson I Inventories PDF

Uploaded by

Na Dem DolotallasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lesson I Inventories PDF

Lesson I Inventories PDF

Uploaded by

Na Dem DolotallasCopyright:

Available Formats

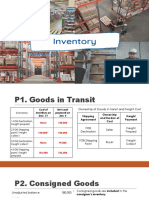

LESSON I.

INVENTORIES – PAS 2 states that Inventories are assets held for sale in the ordinary course

of business, in the process of production for such sale or in the form of materials or supplies to be consumed

in the production process or in the rendering of services.

As a rule, all goods to which the entity has TITLE (ownership) shall be INCLUDED in the INVENTORY,

regardless of location.

Goods to be included as INVENTORY:

a. Goods owned and on hand

b. Goods in transit and sold FOB DESTINATION (FOB Buyer)

c. Goods in transit and purchased FOB SHIPPING PINT (FOB Seller)

d. Goods out on consignment

e. Goods in the hands of salesmen or agents

f. Goods held by customers on approval or on trial

g. Goods PURCHASED on INSTALLMENT.

Freight Terms

1. FOB Destination – Seller should pay the freight. The title of the goods is transferred upon receipt

of the goods by the buyer at the point of destination.

2. FOB Shipping Point – Buyer should pay the freight. The title of the goods is transferred upon

shipment of the goods.

3. Freight Collect – Freight charge is actually paid by the buyer.

4. Freight Prepaid – Freight charge is actually paid by the seller.

5. FAS (Free Alongside) – Seller Dock Carrier

Seller Buyer

6. CIF (Cost, Insurance & Freight) – Title is transferred upon delivery of the goods to the carrier.

7. Ex -Ship – Title is transferred when the goods are unloaded.

Freight Terms Seller’s Point of View Buyer’s Point of View

FOB Destination, Freight Freight out xx

Prepaid Cash xx No entry

FOB Destination, Freight Freight out xx Accounts Payable xx

Collect Accounts Receivable xx Cash xx

FOB Shipping Point, Freight Freight – in xx

Collect No entry Cash xx

FOB Shipping Point, Freight Accounts Receivable xx Freight- in xx

Prepaid Cash xx Accounts Payable xx

Accounting of Inventories:

a. Periodic Inventory System

Beginning Inventory xx

Net Purchases:

Purchases xx

Purchase returns, discounts & Allowances (xx)

Freight – In xx xx

Goods Available for sale xx

Ending Inventory (xx)

Cost of sales xx

b. Perpetual Inventory System – cost of sale can be computed immediately base on the entries

Formulas:

List Price xx

Trade discount (xx)

Invoice Price xx

Cash discount (xx)

Net Amount xx

Cost of Inventory:

*Cost of Purchase xx

Cost of conversion xx

** Other costs incurred that are necessary xx

Cost of Inventory xx

* Cost of purchase:

Purchase price xx

Import duties xx

Irrecoverable taxes xx

Freight xx

Handling xx

Directly attributable cost xx

Trade discount (xx)

Rebates (xx)

Cost of purchase xx

** Other costs – Incurred in bringing the inventories to their present condition. Example is storage of cost

on goods in process.

The following are cost/items that are expensed outright:

a. Abnormal cost c. Administrative overhead

b. Storage cost on Finished goods d. Distribution or selling costs

You might also like

- Bill of Supply: Name: Name: AddressDocument4 pagesBill of Supply: Name: Name: AddressNaveen Rajput100% (1)

- PAS 1 Statement of Comprehensive IncomeDocument21 pagesPAS 1 Statement of Comprehensive Incomepanda 1100% (2)

- MOD 07 Inventory BasicsDocument17 pagesMOD 07 Inventory BasicsKhen HannaNo ratings yet

- Meli Marine - FinalDocument24 pagesMeli Marine - FinalAdvait Bopardikar100% (4)

- Astm A700Document40 pagesAstm A700hegiro2011No ratings yet

- InventoriesDocument7 pagesInventoriesRomlan Akman DuranoNo ratings yet

- Merchandising BusinessDocument9 pagesMerchandising BusinessSean Justin EspinaNo ratings yet

- HO Inventories IntroDocument2 pagesHO Inventories IntroAl Francis GuillermoNo ratings yet

- Who Are We?: Inventory Inclusion and ExclusionDocument12 pagesWho Are We?: Inventory Inclusion and ExclusionShey INFTNo ratings yet

- Inventories ReviewerDocument11 pagesInventories ReviewerHarah LamanilaoNo ratings yet

- InventoriesDocument12 pagesInventoriesRIAN MAE DOROMPILINo ratings yet

- Inventories: Lesson 9Document4 pagesInventories: Lesson 9Mae LotoNo ratings yet

- ABM Fundamentals of ABM 1 Module 12 Accounting Cycle of A Merchandising BusinessDocument16 pagesABM Fundamentals of ABM 1 Module 12 Accounting Cycle of A Merchandising BusinessMariel Santos67% (3)

- Fabm1 Module 12Document13 pagesFabm1 Module 12Mika GerminoNo ratings yet

- EC 1 - Acctg Cycle Part 2 ConceptsDocument3 pagesEC 1 - Acctg Cycle Part 2 ConceptsChelay EscarezNo ratings yet

- Proforma Journal Entries - Merchandising TransactionsDocument4 pagesProforma Journal Entries - Merchandising TransactionsJames Christian AvesNo ratings yet

- Accounting For Merchandising BusinessDocument5 pagesAccounting For Merchandising BusinessArlene AlemaniaNo ratings yet

- Inventory Lecture NotesDocument7 pagesInventory Lecture NotesRena Lyn ManzanoNo ratings yet

- 4.0 COMPLETE INVENTORIES - StudentsDocument14 pages4.0 COMPLETE INVENTORIES - StudentsTyron TayloNo ratings yet

- Chapter 3 InventoryDocument13 pagesChapter 3 Inventorypapajesus papaNo ratings yet

- Inventories: Cost of PurchaseDocument5 pagesInventories: Cost of PurchaseNichola aasNo ratings yet

- 4 InventoryDocument1 page4 InventoryCharisse AbordoNo ratings yet

- Accounting For INVENTORIESDocument4 pagesAccounting For INVENTORIESMeludyNo ratings yet

- Final Inventories PresentationDocument45 pagesFinal Inventories PresentationmysiebongabongNo ratings yet

- Presentation4.2 - Audit of Inventories, Cost of Sales and Other Related AccountsDocument19 pagesPresentation4.2 - Audit of Inventories, Cost of Sales and Other Related AccountsRoseanne Dela CruzNo ratings yet

- Quick NotesDocument7 pagesQuick NotesMelvin BagasinNo ratings yet

- FAR Freight ChargesDocument2 pagesFAR Freight ChargesJaybie John Palco Eralino100% (1)

- Inventories HandoutDocument4 pagesInventories HandoutRoselle Jane LanabanNo ratings yet

- Farap 4503Document12 pagesFarap 4503Marya Nvlz100% (1)

- Accounts ReceivableDocument4 pagesAccounts ReceivableErla PilapilNo ratings yet

- Receivables: For Aging of Accounts Receivables ProblemsDocument4 pagesReceivables: For Aging of Accounts Receivables ProblemsLarpii MonameNo ratings yet

- Week 08 - 01 - Module 18 - Accounting For InventoriesDocument10 pagesWeek 08 - 01 - Module 18 - Accounting For Inventories지마리No ratings yet

- FAR 214 Inventory ConceptsDocument17 pagesFAR 214 Inventory ConceptsJai BacalsoNo ratings yet

- Business Combination and Consolidation On Acquisition Date SummaryDocument6 pagesBusiness Combination and Consolidation On Acquisition Date SummaryWilmar Abriol100% (1)

- FARAP-4403 (Inventories)Document14 pagesFARAP-4403 (Inventories)Dizon Ropalito P.No ratings yet

- AccountingDocument119 pagesAccountingJhunnel LangubanNo ratings yet

- Introduction of The Merchandising Business: Subject-Descriptive Title Subject - CodeDocument13 pagesIntroduction of The Merchandising Business: Subject-Descriptive Title Subject - CodeRose LaureanoNo ratings yet

- s2 Aud2 PrelimDocument17 pagess2 Aud2 PrelimDanielNo ratings yet

- Audit of InventoriesDocument57 pagesAudit of Inventoriessethdrea officialNo ratings yet

- Transfer and Business Taxation Accounting Methods and PeriodsDocument5 pagesTransfer and Business Taxation Accounting Methods and PeriodsApril Joy Padua SimonNo ratings yet

- CONSIGNMENT - Focus NotesDocument5 pagesCONSIGNMENT - Focus NotesbrunxNo ratings yet

- FAR3 - InventoryDocument17 pagesFAR3 - InventoryBeing TuluvaNo ratings yet

- Chapter 5: Job Order Costing System: Characteristics of Production ProcessDocument3 pagesChapter 5: Job Order Costing System: Characteristics of Production ProcessANo ratings yet

- Notes On Week 4 - InventoriesDocument15 pagesNotes On Week 4 - InventoriesChristy CaneteNo ratings yet

- ACCT1111 Chapter 6 Lecture (Revised)Document63 pagesACCT1111 Chapter 6 Lecture (Revised)Wky JimNo ratings yet

- Summary PADocument6 pagesSummary PAKhansa RasyaNo ratings yet

- Merchandising BusinessDocument10 pagesMerchandising BusinessMichiiee BatallaNo ratings yet

- Consignment AccountDocument9 pagesConsignment AccountGamers 4 lyfNo ratings yet

- Financial Accounting and Reporting - Inventories (Recognition, Measurement, Estimation and Valuation)Document5 pagesFinancial Accounting and Reporting - Inventories (Recognition, Measurement, Estimation and Valuation)LuisitoNo ratings yet

- Inventories: Iv. (Cost Below P15,000 Capitalization Threshold For PPE)Document4 pagesInventories: Iv. (Cost Below P15,000 Capitalization Threshold For PPE)Alelie Joy dela CruzNo ratings yet

- 2 Assignment For Midterm - Merchandising Business: (Periodic System)Document4 pages2 Assignment For Midterm - Merchandising Business: (Periodic System)Lisa PalermoNo ratings yet

- SS 2 SlidesDocument31 pagesSS 2 SlidesDart BaneNo ratings yet

- INVENTORIESDocument89 pagesINVENTORIESLuisa Janelle BoquirenNo ratings yet

- INVENTORIESDocument64 pagesINVENTORIESLuisa Janelle BoquirenNo ratings yet

- Inventory: Audit ProblemDocument26 pagesInventory: Audit Problemjovelyn labordoNo ratings yet

- Inventory Lecture NotesDocument15 pagesInventory Lecture NotesMinh ThưNo ratings yet

- FSs For CompaniesDocument9 pagesFSs For CompaniesFarid UddinNo ratings yet

- Far 05 InventoriesDocument10 pagesFar 05 InventoriesRefinej WickerNo ratings yet

- Far 6815 - Gross Profit Method Far 6816 - Retail Inventory MethodDocument2 pagesFar 6815 - Gross Profit Method Far 6816 - Retail Inventory MethodKent Raysil PamaongNo ratings yet

- Job Order CostingDocument4 pagesJob Order Costingguliramsam5No ratings yet

- Perpetual Inventory SystemDocument9 pagesPerpetual Inventory SystemAgdum BagdumNo ratings yet

- Intro To Cost Accounting ReviewerDocument2 pagesIntro To Cost Accounting ReviewerDennis LacsonNo ratings yet

- Acrostic Poem About Mother TongueDocument1 pageAcrostic Poem About Mother TongueVincent BuyanNo ratings yet

- Topic: Accounting For Cash and Cash Equivalents: Notes To RememberDocument1 pageTopic: Accounting For Cash and Cash Equivalents: Notes To RememberVincent BuyanNo ratings yet

- Lesson 2. ReceivablesDocument19 pagesLesson 2. ReceivablesVincent BuyanNo ratings yet

- ReceivablesDocument1 pageReceivablesVincent BuyanNo ratings yet

- Lesson 1. Cash and Cash EquivalentsDocument5 pagesLesson 1. Cash and Cash EquivalentsVincent BuyanNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument30 pagesFinancial Statements, Cash Flow, and TaxesVincent BuyanNo ratings yet

- Logistic ManagerDocument2 pagesLogistic Managerapi-76843867No ratings yet

- 355 MAY 15 2020 MinDocument14 pages355 MAY 15 2020 MinDeepakNo ratings yet

- Logistics Objectives Chapter 1 - 3Document3 pagesLogistics Objectives Chapter 1 - 3Mia KhalifaNo ratings yet

- Five Yearly Testing of Lifeboat and Rescue Boat Launching AppliancesDocument4 pagesFive Yearly Testing of Lifeboat and Rescue Boat Launching AppliancesPushkar Lamba0% (1)

- Feroform: Hot Cargo Support and Insulation PadsDocument12 pagesFeroform: Hot Cargo Support and Insulation PadsBorza DorinNo ratings yet

- Transpo Law Case DoctrinesDocument5 pagesTranspo Law Case DoctrinesaypodNo ratings yet

- Thierry ClementDocument29 pagesThierry ClementBagus WinarkoNo ratings yet

- Andrew PricelistDocument76 pagesAndrew PricelistJohn Bofarull GuixNo ratings yet

- Benito Macam v. CA, China Ocean Shipping Co. And/or Wallem Phils., Shipping IncDocument1 pageBenito Macam v. CA, China Ocean Shipping Co. And/or Wallem Phils., Shipping IncJOHAYNIENo ratings yet

- AnketaDocument3 pagesAnketaRose AriantiNo ratings yet

- OPEC Annual Statistical Bulletin - 50th Edition - 2015Document120 pagesOPEC Annual Statistical Bulletin - 50th Edition - 2015studyendlessNo ratings yet

- 190802503Document1 page190802503Earl CharlesNo ratings yet

- MS-002, Waldoboro Shipyard Records (Finding Aid)Document18 pagesMS-002, Waldoboro Shipyard Records (Finding Aid)Maine Maritime MuseumNo ratings yet

- Venezuela Maritime Profile UnctadDocument4 pagesVenezuela Maritime Profile UnctadAtlante Global TransportNo ratings yet

- AHM060 1 Load ControlDocument16 pagesAHM060 1 Load ControlhermanNo ratings yet

- Aquan Prime Updated Guide April 2016Document21 pagesAquan Prime Updated Guide April 2016Justin SwanstromNo ratings yet

- Damen Shipyards Galati NEWS 10Document11 pagesDamen Shipyards Galati NEWS 10Andreea RagalieNo ratings yet

- What Future If AnyDocument7 pagesWhat Future If AnyMarko Antic PantaNo ratings yet

- Customs External Policy Refunds and Drawbacks: Effective 30 July 2021Document20 pagesCustoms External Policy Refunds and Drawbacks: Effective 30 July 2021joel enciso enekeNo ratings yet

- Marine Policy in India and TypesDocument16 pagesMarine Policy in India and TypesMiraRaiNo ratings yet

- Maersk Sealand Destination Charges PDFDocument20 pagesMaersk Sealand Destination Charges PDFPIPOL TVNo ratings yet

- Freight Forwarder OperationsDocument96 pagesFreight Forwarder OperationsSelvi veeranNo ratings yet

- Chevron vs. BOCDocument2 pagesChevron vs. BOCjane_rockets100% (3)

- CF1401 - Record of Vessel in Foreign Trade - Clearance - 2Document17 pagesCF1401 - Record of Vessel in Foreign Trade - Clearance - 2Tom RueterNo ratings yet

- Material ManagementDocument27 pagesMaterial ManagementJayananda ElangbamNo ratings yet

- Mail & Shipping Services - USPSDocument1 pageMail & Shipping Services - USPSgs2020No ratings yet

- 2018 LR Offshore Container Certification GuideDocument13 pages2018 LR Offshore Container Certification GuideNicu CojocaruNo ratings yet