Professional Documents

Culture Documents

CHAPTER 3 Adjusting The Accounts PDF

Uploaded by

Shahzad AsifOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CHAPTER 3 Adjusting The Accounts PDF

Uploaded by

Shahzad AsifCopyright:

Available Formats

CHAPTER 3 Adjusting the accounts 115

5. Prepare adjusting entries for prepayments. earned and expenses incurred in the current account-

Prepayments are either prepaid expenses or unearned ing period that have not been recognised through daily

revenue. Adjusting entries for prepayments are required at entries.

the reporting date to record the portion of the prepayment 7. Describe the nature and purpose of an adjusted trial

that represents the expense incurred or the revenue earned balance. An adjusted trial balance shows the balances of

in the current accounting period. all accounts, including those that have been adjusted, at

6. Prepare adjusting entries for accruals. Accruals are the end of an accounting period. Its purpose is to show the

either accrued revenue or accrued expenses. Adjusting effects of all financial events that have occurred during the

entries for accruals are required to record revenue accounting period.

KEY TERMS

Accrual-basis accounting (p. 96) Depreciation (p. 101)

Accrued expenses (p. 106) Expense recognition principle (p. 96)

Accrued revenue (p. 105) Financial year (p. 96)

Adjusted trial balance (p. 111) Interim periods (p. 96)

Adjusting entries (p. 97) Prepaid expenses (p. 99)

Calendar year (p. 96) Revenue recognition principle (p. 96)

Carrying amount (p. 102) Time period assumption (p. 95)

Cash-basis accounting (p. 96) Unearned revenue (p. 103)

Contra asset account (p. 102) Useful life (p. 101)

APPENDIX — ALTERNATIVE TREATMENT LEARNING

OBJECTIVE 8

OF PREPAID EXPENSES AND UNEARNED

Prepare adjusting

REVENUE entries for the

In our discussion of adjusting entries for prepaid expenses and unearned revenue, we illustrated alternative treatment

transactions for which the initial entries were made to statement of financial position accounts. of prepayments.

In the case of prepaid expenses, the prepayment was debited to an asset account. In the case

of unearned revenue, the cash received was credited to a liability account. Some businesses

use an alternative treatment: (1) At the time an expense is prepaid, it is debited to an expense

account; (2) At the time of a receipt for future services, it is credited to a revenue account. The

circumstances that justify such entries and the different adjusting entries that may be required

are described below. The alternative treatment of prepaid expenses and unearned revenue has the

same effect on the financial statements as the procedures described earlier in the chapter.

Prepaid expenses

Prepaid expenses become expired costs either through the passage of time (e.g. insurance) or

through consumption (e.g. advertising supplies). If, at the time of purchase, the business expects

to consume the supplies before the next reporting date, it may be more convenient initially to

debit (increase) an expense account rather than an asset account.

Assume that Pioneer Advertising Agency expects that all of the supplies purchased on 5 October

will be used before the end of the month. A debit of $2500 to Advertising Supplies Expense (rather

than to the asset account Advertising Supplies) on 5 October will eliminate the need for an adjusting

entry on 31 October, if all the supplies are used. As at 31 October, the Advertising Supplies Expense

account will show a balance of $2500, which is the cost of supplies used between 5 October and

31 October.

But what if the business does not use all the supplies, and an inventory of $1000 of advertising

supplies remains on 31 October? Obviously, an adjusting entry is needed. Prior to adjustment,

5_60_19243_POA_2E_ch03.indd 115 7/14/09 3:53:13 PM

116 Principles of accounting

the expense account Advertising Supplies Expense is overstated $1000, and the asset account

Advertising Supplies is understated $1000. Thus the following adjusting entry is made.

A = L + E Oct. 31 Advertising Supplies 1 000

+1 000 +1 000 Exp Advertising Supplies Expense 1 000

(To record supplies inventory)

Cash flows

no effect

After posting the adjusting entry, the accounts are as shown in figure 3A.1.

Figure 3A.1 Prepaid

expenses accounts after Advertising Supplies Advertising Supplies Expense

adjustment 31/10 Adj. 1 000 5/10 2 500 31/10 Adj. 1 000

31/10 Bal. 1 500

After adjustment, the asset account Advertising Supplies shows a balance of $1000, which is

equal to the cost of supplies on hand at 31 October. In addition, Advertising Supplies Expense

shows a balance of $1500, which is equal to the cost of supplies used between 5 October and

31 October. If the adjusting entry is not made, expenses will be overstated and profit will be

understated by $1000 in the October income statement. Also, both assets and owner’s equity will

be understated by $1000 on the 31 October statement of financial position.

A comparison of the entries and accounts for advertising supplies is shown in figure 3A.2.

Figure 3A.2 Adjustment

approaches — a comparison Prepayment initially Prepayment initially

debited to asset account debited to expense account

(per chapter) (per appendix)

Oct. 5 Advertising Supplies 2 500 Oct. 5 Advertising Supplies Expense 2 500

Accounts Payable 2 500 Accounts Payable 2 500

Oct. 31 Advertising Supplies Expense 1 500 Oct. 31 Advertising Supplies 1 000

Advertising Supplies 1 500 Advertising Supplies Expense 1 000

After posting the entries, the accounts appear as shown in figure 3A.3.

Figure 3A.3 Comparison of

accounts (per chapter) (per appendix)

Advertising Supplies Advertising Supplies

5/10 2 500 31/10 Adj. 1 500 31/10 Adj. 1 000

31/10 Bal. 1 000

Advertising Supplies Expense Advertising Supplies Expense

31/10 Adj. 1 500 5/10 2 500 31/10 Adj. 1 000

31/10 Bal. 1 500

Note that the account balances under each alternative are the same as at 31 October: Advertising

Supplies $1000, and Advertising Supplies Expense $1500.

Unearned revenue

Unearned revenue becomes earned either through the passage of time (e.g. unearned rent) or

through providing the service (e.g. unearned fees). Similar to the case for prepaid expenses, a

revenue account may be credited (increased) when cash is received for future services.

To illustrate, assume that Pioneer Advertising Agency received $1200 for future services on

2 October. The services were expected to be performed before 31 October.2 In such a case,

2 This example focuses only on the alternative treatment of unearned revenue. In the interest of simplicity,

the entries to Service Revenue pertaining to the immediate earning of revenue ($10 000) and the adjusting

entry for accrued revenue ($200) have been ignored.

5_60_19243_POA_2E_ch03.indd 116 7/14/09 3:53:13 PM

CHAPTER 3 Adjusting the accounts 117

Service Revenue is credited. If revenue is, in fact, earned before 31 October, no adjustment is

needed.

However, if at the reporting date $800 of the services have not been performed, an adjusting

entry is required. The revenue account Service Revenue is overstated $800, and the liability

account Unearned Revenue is understated $800. Thus, the following adjusting entry is made.

Oct. 31 Service Revenue 800 A = L + E

Unearned Revenue 800 +800 −800 Rev

(To record unearned revenue)

Cash flows

no effect

After posting the adjusting entry, the accounts are as shown in figure 3A.4.

Figure 3A.4 Unearned

Unearned Revenue Service Revenue

revenue accounts after

31/10 Adj. 800 31/10 Adj. 800 2/10 1 200 adjustment

31/10 Bal. 400

The liability account Unearned Revenue shows a balance of $800. This is equal to the serv-

ices that will be provided in the future. In addition, the balance in Service Revenue equals the

services provided in October. If the adjusting entry is not made, both revenue and profit will

be overstated by $800 in the October income statement. Also, liabilities will be understated by

$800, and owner’s equity will be overstated by $800 on the 31 October statement of financial

position.

A comparison of the entries and accounts for service revenue earned and unearned is shown in

figure 3A.5.

Figure 3A.5 Adjustment

Unearned revenue Unearned revenue

approaches — a comparison

initially credited to liability account initially credited to revenue account

(per chapter) (per appendix)

Oct. 2 Cash 1 200 Oct. 2 Cash 1 200

Unearned Revenue 1 200 Service Revenue 1 200

Oct. 31 Unearned Revenue 400 Oct. 31 Service Revenue 800

Service Revenue 400 Unearned Revenue 800

After posting the entries, the accounts appear as shown in figure 3A.6.

Figure 3A.6 Comparison of

(per chapter) (per appendix)

accounts

Unearned Revenue Unearned Revenue

31/10 Adj. 400 2/10 1 200 31/10 Adj. 800

31/10 Bal. 800

HELPFUL HINT

Service Revenue Service Revenue

The required adjusted

31/10 Adj. 400 31/10 Adj. 800 2/10 1 200

balances here are

31/10 Bal. 400

Service Revenue $400

and Unearned Revenue

Note that the balances in the accounts are the same under the two alternatives: Unearned Revenue $800.

$800, and Service Revenue $400.

Summary of additional adjustment

relationships

The use of alternative adjusting entries requires additions to the summary of basic relationships

presented earlier in figure 3.18 (page 109). The additions are shown in 1(b) and 2(b) (in bold) in

figure 3A.7 on the next page.

5_60_19243_POA_2E_ch03.indd 117 7/14/09 3:53:13 PM

118 Principles of accounting

Alternative adjusting entries do not apply to accrued revenue and accrued expenses because no

entries occur before these types of adjusting entries are made. Therefore, the entries in figure 3.18

for these two types of adjustments remain unchanged.

Figure 3A.7 Summary

Type of Reason for Account balances Adjusting

of basic relationships for

adjustment adjustment before adjustment entry

prepayments

1. Prepaid expenses (a) Prepaid expenses initially Assets overstated Dr Expenses

recorded in asset accounts have Expenses understated Cr Assets

been used.

(b) Prepaid expenses initially Assets understated Dr Assets

recorded in expense accounts Expenses overstated Cr Expenses

have not been used.

2. Unearned revenue (a) Unearned revenue initially Liabilities overstated Dr Liabilities

recorded in liability accounts has Revenue understated Cr Revenue

been earned.

(b) Unearned revenue initially Liabilities understated Dr Revenue

recorded in revenue accounts Revenue overstated Cr Liabilities

has not been earned.

SUMMARY OF LEARNING OBJECTIVE FOR APPENDIX

8. Prepare adjusting entries for the alternative treatment expenses are a debit to an asset account and a credit to an

of prepayments. Prepayments may be initially debited to expense account. Adjusting entries for unearned revenue

an expense account. Unearned revenue may be credited to are a debit to a revenue account and a credit to a liability

a revenue account. At the end of the period, these accounts account.

may be overstated. The adjusting entries for prepaid

SELF-STUDY QUESTIONS * Note: All asterisked questions, exercises and problems relate to material

in the appendix to the chapter.

Answers are at the end of the chapter. (b) Revenue is only recorded when the cash is

(LO 1) 1. The time period assumption states that: received.

(a) revenue should be recognised in the accounting period in (c) Depreciation is not an expense.

which it is earned. (d) Wages owing at the end of the reporting period are

(b) expenses should be matched with revenue. treated as an expense when they are paid.

(c) the economic life of a business can be divided into time 5. The trial balance may not contain up to date and complete (LO 3)

periods. data because:

(d) the financial year should correspond with the calendar (a) it is inexpedient to journalise all events on a daily

year. basis.

(LO 2) 2. The principle or assumption dictating that revenue is (b) some costs are not journalised during the accounting

recognised when earned is the: period because they expire with the passing of time

(a) matching principle. rather than through recurring daily transactions.

(b) cost assumption. (c) some items may be unrecorded.

(c) periodicity principle. (d) all of the above.

(d) revenue recognition principle. 6. Adjusting entries are made to ensure that: (LO 3)

(LO 2) 3. One of the following statements about the accrual basis of (a) expenses are recognised in the period in which they are

accounting is false. incurred.

(a) Events that change a business’s financial statements are (b) revenue is recorded in the period in which it is earned.

recorded in the periods in which the events occur. (c) statement of financial position and income statement

(b) Revenue is recognised in the period in which it is earned. accounts have correct balances at the end of an

(c) This basis is in accord with generally accepted accounting period.

accounting principles. (d) all of the above.

(d) Revenue is recorded only when cash is received, and 7. Each of the following is a major type (or category) of (LO 4)

expense is recorded only when cash is paid. adjusting entry except:

(LO 2) 4. Which of the following statements is correct concerning (a) prepaid expenses.

accrual accounting versus cash accounting? (b) accrued revenue.

(a) Revenue is recorded irrespective of whether the cash has (c) accrued expenses.

been received. (d) earned revenue.

5_60_19243_POA_2E_ch03.indd 118 7/14/09 3:53:14 PM

CHAPTER 3 Adjusting the accounts 119

(LO 7) 8. An unadjusted trial balance shows sales revenue of $27 000. (a) No entry is required.

The sales department advises that an additional $5000 (b) Salaries Expense 400

of credit sales made on 30 June was not recorded. The Salaries Payable 400

adjustment necessary is: (c) Salaries Expense 400

(a) Cash 5 000 Cash 400

Sales Revenue 5 000 (d) Salaries Payable 400

(b) Sales Revenue 5 000 Cash 400

Accounts Receivable 5 000 13. Which of the following statements is incorrect concerning (LO 7)

(c) Accounts Receivable 5 000 the adjusted trial balance?

Sales Revenue 5 000 (a) An adjusted trial balance proves the equality of the total

(d) Cash 5 000 debit balances and the total credit balances in the ledger

Accounts Payable 5 000 after all adjustments are made.

(LO 5) 9. The trial balance shows Supplies $1350 and Supplies (b) The adjusted trial balance provides the primary basis for

Expense $0. If $500 of supplies are on hand at the end of the preparation of financial statements.

the period, the adjusting entry is: (c) The adjusted trial balance lists the account balances

(a) Supplies 500 segregated by assets and liabilities.

Supplies Expense 500 (d) The adjusted trial balance is prepared after the adjusting

(b) Supplies 850 entries have been journalised and posted.

Supplies Expense 850 *14. The trial balance shows Supplies $0 and Supplies Expense (LO 8)

(c) Supplies Expense 850 $1500. If $900 of supplies are on hand at the end of the

Supplies 850 period, the adjusting entry is:

(d) Supplies Expense 500 (a) Debit Supplies $900 and credit Supplies Expense $900.

Supplies 500 (b) Debit Supplies Expense $900 and credit Supplies $900.

(LO 5)10. Adjustments for unearned revenue now earned are: (c) Debit Supplies $600 and credit Supplies Expense $600.

(a) decrease liabilities and increase revenue. (d) Debit Supplies Expense $600 and credit Supplies $600.

(b) have an assets and revenue account relationship. *15. An annual insurance policy was paid on 31 March at a cost (LO 8)

(c) increase assets and increase revenue. of $3600 and posted to the insurance expense account. As at

(d) decrease revenue and decrease assets. the reporting date, 30 June, the adjusting entry required is:

(LO 6)11. Adjustments for accrued revenue now received are: (a) reduce expenses by $3600 and reduce prepaid insurance

(a) have a liabilities and revenue account relationship. by $3600.

(b) have an assets and revenue account relationship. (b) reduce expenses by $2700 and increase prepaid

(c) increase one asset and reduce another asset. insurance by $2700.

(d) decrease liabilities and increase revenue. (c) increase expenses by $600 and reduce prepaid insurance

by $600.

(LO 6)12. Kathy Siska earned a salary of $400 for the last week of

(d) increase expenses by $600 and increase accrued

September. She will be paid on 1 October. The adjusting

liabilities by $600.

entry for Kathy’s employer as at 30 September is:

QUESTIONS

1. (a) How does the time period assumption affect an 6. ‘Adjusting entries are required by the cost principle of

accountant’s analysis of business transactions? accounting.’ Do you agree? Explain.

(b) Explain the terms financial year, calendar year and 7. Why may a trial balance not contain up-to-date and

interim periods. complete financial information?

2. State two generally accepted accounting principles that

8. Distinguish between the two categories of adjusting entries,

relate to adjusting the accounts.

and identify the types of adjustments applicable to each

3. Joe Thomas, a lawyer, accepts a legal engagement in category.

March, performs the work in April and is paid in May. If

9. What is the debit/credit effect of a prepaid expense adjusting

Thomas’s law firm prepares monthly financial statements,

entry?

when should it recognise revenue from this engagement?

Why? 10. ‘Depreciation is a valuation process that results in the

4. Why do accrual-basis financial statements provide more reporting of the fair value of the asset.’ Do you agree? Explain.

useful information than cash-basis statements? 11. Explain the differences between depreciation expense and

5. In completing the engagement in (3) above, Thomas incurs accumulated depreciation.

$6000 of expenses in March, which are paid in April. How 12. Corts Ltd purchased equipment for $20 000. By the reporting

much expense should be deducted from revenue in the date, $12 000 had been depreciated. Indicate the presentation

month the revenue is recognised? Why? of the data in the statement of financial position.

5_60_19243_POA_2E_ch03.indd 119 7/14/09 3:53:14 PM

120 Principles of accounting

13. What is the debit/credit effect of an unearned revenue (a) Assets are understated.

adjusting entry? (b) Liabilities are overstated.

14. A business fails to recognise revenue earned but not yet (c) Liabilities are understated.

received. Which of the following accounts are involved in (d) Expenses are understated.

the adjusting entry: (a) asset, (b) liability, (c) revenue or (e) Assets are overstated.

(d) expense? For the accounts selected, indicate whether (f) Revenue is understated.

they would be debited or credited in the entry. 19. One-half of the adjusting entry is given below. Indicate the

15. A business fails to recognise an expense incurred but not account title for the other half of the entry.

paid. Indicate which of the following accounts is debited (a) Salaries Expense is debited.

and which is credited in the adjusting entry: (a) asset, (b) Depreciation Expense is debited.

(b) liability, (c) revenue or (d) expense. (c) Interest Payable is credited.

16. A business makes an accrued revenue adjusting entry for (d) Supplies is credited.

$900 and an accrued expense adjusting entry for $600. How (e) Accounts Receivable is debited.

much was profit understated prior to these entries? Explain. (f) Unearned Service Revenue is debited.

17. On 9 January, a business pays $9000 for salaries, of which 20. ‘An adjusting entry may affect more than one statement of

$3000 was reported as Salaries Payable on 31 December. financial position or income statement account.’ Do you

Give the entry to record the payment. agree? Why or why not?

18. For each of the following items before adjustment, indicate 21. Why is it possible to prepare financial statements directly

the type of adjusting entry (prepaid expense, unearned from an adjusted trial balance?

revenue, accrued revenue and accrued expense) that *22. Moon Ltd debits Supplies Expense for all purchases of

is needed to correct the misstatement. If an item could supplies and credits Rent Revenue for all advanced rentals.

result in more than one type of adjusting entry, indicate For each type of adjustment, give the adjusting entry.

each of the types.

BRIEF EXERCISES

Indicate why adjusting entries BE3.1 The ledger of Lim Lam includes the following accounts. Explain why each account may

are needed. require adjustment.

(LO 3) (a) Prepaid Insurance (c) Unearned Revenue

(b) Depreciation Expense (d) Interest Payable

Identify the major types of BE3.2 Grollo Concepts accumulates the following adjustment data as at 31 December. Indicate (a)

adjusting entries. the type of adjustment (prepaid expense, accrued revenue and so on), and (b) the accounts

(LO 4) before adjustment (overstated or understated).

1. Supplies of $250 are on hand.

2. Services provided but not recorded total $1200.

3. Interest of $350 has accumulated on a note payable.

4. Rent collected in advance totalling $1000 has been earned.

Prepare adjusting entry for BE3.3 Profile Advertising’s trial balance as at 31 December shows Advertising Supplies $6700 and

supplies. Advertising Supplies Expense $0. On 31 December, there are $1700 of supplies on hand.

(LO 5) Prepare the adjusting entry as at 31 December and, using T accounts, enter the balances in the

accounts, post the adjusting entry and indicate the adjusted balance in each account.

Prepare adjusting entry for BE3.4 At the end of its first year, the trial balance of Easton Ltd shows Equipment $30 000 and zero

depreciation. balances in Accumulated Depreciation — Equipment and Depreciation Expense. Deprecia-

(LO 5) tion for the year is estimated to be $6000. Prepare the adjusting entry for depreciation as at

31 December, post the adjustments to T accounts and indicate the presentation of the equip-

ment as at 31 December in the statement of financial position.

Prepare adjusting entry for BE3.5 On 1 July 2010, Orlow Ltd pays $12 000 to HNH Insurance Ltd for a 3-year insurance con-

prepaid expense. tract. Both companies have reporting periods ending 31 December. For Orlow Ltd, journalise

(LO 5) and post the entry on 1 July and the adjusting entry on 31 December.

Prepare adjusting entry for BE3.6 Using the data in BE3.5, journalise and post the entry on 1 July and the adjusting entry on

unearned revenue. 31 December for HNH Insurance Ltd. HNH uses the accounts Unearned Insurance Revenue

(LO 5) and Insurance Revenue.

Prepare adjusting entries for BE3.7 The bookeeper for Cofex Ltd asks you to prepare the following accrued adjusting entries as

accruals. at 31 December.

(LO 6) 1. Interest on notes payable of $400 is accrued.

2. Services provided but not recorded total $1250.

3. Salaries earned by employees of $900 have not been recorded.

5_60_19243_POA_2E_ch03.indd 120 7/14/09 3:53:14 PM

CHAPTER 3 Adjusting the accounts 121

Use the following account titles: Service Revenue, Accounts Receivable, Interest Expense,

Interest Payable, Salaries Expense and Salaries Payable.

BE3.8 The trial balance of Wow Designs includes the following statement of financial position Analyse accounts in an

accounts. Identify the accounts that require adjustment. For each account that requires adjust- unadjusted trial balance.

ment, indicate (a) the type of adjusting entry (prepaid expenses, unearned revenue, accrued (LO 4)

revenue and accrued expenses) and (b) the related account in the adjusting entry.

Accounts Receivable Interest Payable

Prepaid Insurance Unearned Service Revenue

Accumulated Depreciation — Equipment

BE3.9 The adjusted trial balance of Hungry Joe’s as at 31 December 2010 includes the following Prepare an income statement

accounts: J. Giaro, Capital $25 000; J. Giaro, Drawings $9000; Service Revenue $65 000; from an adjusted trial balance.

Salaries Expense $32 000; Insurance Expense $1600; Rent Expense $20 000; Supplies (LO 7)

Expense $500; and Depreciation Expense $1500. Prepare an income statement for the year.

BE3.10 Partial adjusted trial balance data for Hungry Joe’s is presented in BE3.9. The balance in Prepare a statement of changes

J. Giaro, Capital is the balance as of 1 January. Prepare a statement of changes in equity for in equity from an adjusted trial

the year assuming profit is $9400 for the year. balance.

(LO 7)

*BE3.11 Basler Gardens records all prepayments in income statement accounts. As at 30 April, the trial Prepare adjusting entries

balance shows Supplies Expense $2800, Service Revenue $9200 and zero balances in related under alternative treatment of

statement of financial position accounts. Prepare the adjusting entries as at 30 April assuming (a) prepayments.

$1000 of supplies on hand and (b) $2000 of service revenue should be reported as unearned. (LO 8)

EXERCISES

E3.1 Many governments have moved from cash to accrual accounting, and even budgeting, over Distinguish between the

the last decade, generating discussion as to how informative and useful accrual-based govern- cash-and accrual basis of

ment financial statements are to the various stakeholders. accounting.

(LO 2)

Instructions

(a) What is the difference between accrual-basis accounting and cash-basis accounting?

(b) Why would politicians prefer the cash basis over the accrual basis?

(c) What advantages would accrual-based government statements provide to users?

E3.2 Shumway accumulates the following adjustment data as at 31 December. Identify types of adjustments

1. Services provided but not recorded total $750. and account relationships.

2. Store supplies of $300 have been used. (LO 4, 5, 6)

3. Utility expenses of $225 are unpaid.

4. Unearned revenue of $260 has been earned.

5. Salaries of $900 are unpaid.

6. Prepaid insurance totalling $350 has expired.

Instructions

For each of the above items indicate the following.

(a) The type of adjustment (prepaid expense, unearned revenue, accrued revenue or accrued

expense).

(b) The accounts before adjustment (overstatement or understatement).

E3.3 The ledger of Hocking Rental Agency on 31 March of the current year includes the following Prepare adjusting entries from

selected accounts before adjusting entries have been prepared. selected account data.

(LO 5, 6, 7)

Debit Credit

Prepaid Insurance $ 3 600

Supplies 2 800

Equipment 25 000

Accumulated

Depreciation — Equipment $ 8 400

Notes Payable 20 000

Unearned Rent 9 900

Rent Revenue 60 000

Interest Expense 0

Wages Expense 14 000

An analysis of the accounts shows the following.

1. The equipment depreciates $300 per month.

2. One-third of the unearned rent was earned during the quarter.

5_60_19243_POA_2E_ch03.indd 121 7/14/09 3:53:14 PM

122 Principles of accounting

3. Interest of $500 is accrued on the notes payable.

4. Supplies on hand total $900.

5. Insurance expires at the rate of $200 per month.

Instructions

Prepare the adjusting entries as at 31 March. Additional accounts are: Depreciation Expense,

Insurance Expense, Interest Payable and Supplies Expense.

Prepare adjusting entries. E3.4 Greg Toohey opened a dental practice on 1 January. During the first month of operations the

(LO 5, 6, 7) following transactions occurred.

1. Performed services for patients. As at 31 January, $1560 of such services was earned but

not yet recorded.

2. Utility expenses incurred but not paid prior to 31 January totalled $800.

3. Purchased dental equipment on 1 January for $80 000, paying $20 000 in cash and

signing a $60 000, 3-year note payable. The equipment depreciates $400 per month.

Interest is $500 per month.

4. Purchased a 1-year professional indemnity insurance policy on 1 January for $24 000.

5. Purchased $1600 of dental supplies. On 31 January, determined that $800 of supplies

were on hand.

Instructions

Prepare the adjusting entries on 31 January. Account titles are Accumulated Depreciation —

Dental Equipment, Depreciation Expense, Service Revenue, Accounts Receivable, Insurance

Expense, Interest Expense, Interest Payable, Prepaid Insurance, Supplies, Supplies Expense,

Utilities Expense and Utilities Payable.

Prepare adjusting entries. E3.5 The trial balance for Pioneer Advertising Agency is shown in figure 3.3, page 99. In lieu of

(LO 5, 6, 7) the adjusting entries shown in the text as at 31 October, assume the following adjustment

data.

1. Advertising supplies on hand as at 31 October total $400.

2. Expired insurance for the month is $200.

3. Depreciation for the month is $100.

4. Unearned revenue earned in October totals $1200.

5. Services provided but not recorded as at 31 October are $650.

6. Interest accrued as at 31 October is $120.

7. Accrued salaries as at 31 October are $1400.

Instructions

Prepare the adjusting entries for the items above.

Prepare correct income E3.6 The income statement of Olympic Ltd for the month of July shows profit of $1400 based

statement. on Service Revenue $5500, Wages Expense $2300, Supplies Expense $1200 and Utilities

(LO 2, 5, 6, 7) Expense $600. In reviewing the statement, you discover the following.

1. Insurance expired during July of $400 was omitted.

2. Supplies expense includes $300 of supplies that are still on hand as at 31 July.

3. Depreciation on equipment of $150 was omitted.

4. Accrued but unpaid wages as at 31 July of $300 were not included.

5. Services provided but unrecorded totalled $1000.

Instructions

Prepare a correct income statement for July.

Analyse adjusted data. E3.7 A partial adjusted trial balance of Rio Ltd as at 31 January shows the following.

(LO 4, 5, 6, 7)

RIO LTD

Adjusted Trial Balance

as at 31 January

Debit Credit

Supplies $ 850

Prepaid Insurance 2 400

Salaries Payable $ 800

Unearned Revenue 750

Supplies Expense 950

Insurance Expense 400

Salaries Expense 1 800

Service Revenue 2 000

5_60_19243_POA_2E_ch03.indd 122 7/14/09 3:53:15 PM

CHAPTER 3 Adjusting the accounts 123

Instructions

Answer the following questions, assuming the year begins 1 January.

(a) If the amount in Supplies Expense is the 31 January adjusting entry, and $650 of

supplies was purchased in January, what was the balance in Supplies on 1 January?

(b) If the amount in Insurance Expense is the 31 January adjusting entry, and the original

insurance premium was for 1 year, what was the total premium and when was the policy

purchased?

(c) If $3000 of salaries was paid in January, what was the balance in Salaries Payable as at

31 December?

(d) If $1600 was received in January for services performed in January, what was the

balance in Unearned Revenue as at 31 December?

E3.8 Selected accounts of Engle Ltd are shown below. Journalise basic transactions

and adjusting entries.

Supplies Expense Salaries Payable (LO 5, 6, 7)

31/7 800 31/7 1 200

Supplies Unearned Revenue

1/7 Bal. 1 100 31/7 800 3/17 900 1/7 Bal. 1500

10/7 200 20/7 750

Accounts Receivable Service Revenue

31/7 500 14/7 2 000

Salaries Expense 31/7 900

31/7 500

15/7 1 200

31/7 1 200

Instructions

After analysing the accounts, journalise (a) the July transactions and (b) the adjusting

entries that were made on 31 July. (Hint: July transactions were for cash.)

E3.9 The trial balances before and after adjustment for Villa Ltd at the end of its financial year are Prepare adjusting entries from

presented below. analysis of trial balances.

(LO 5, 6, 7)

VILLA LTD

Trial Balance

as at 30 June

Before After

adjustment adjustment

Dr Cr Dr Cr

Cash $ 10 400 $ 10 400

Accounts Receivable 8 800 9 400

Office Supplies 2 300 700

Prepaid Insurance 4 000 2 500

Office Equipment 14 000 14 000

Accumulated Depreciation — Office Equipment $ 3 600 $ 4 900

Accounts Payable 5 800 5 800

Salaries Payable 0 1 100

Unearned Rent 1 500 600

Issued Capital and Retained Earnings 15 600 15 600

Service Revenue 34 000 34 600

Rent Revenue 11 000 11 900

Salaries Expense 17 000 18 100

Office Supplies Expense 0 1 600

Rent Expense 15 000 15 000

Insurance Expense 0 1 500

Depreciation Expense 0 1 300

$ 71 500 $ 71 500 $ 74 500 $ 74 500

Instructions

Prepare the adjusting entries that were made.

E3.10 The adjusted trial balance for Villa Ltd is given in E3.9. Prepare financial statements

from adjusted trial balance.

Instructions

(LO 7)

Prepare the income statement and statement of changes in equity for the year and the

statement of financial position as at 30 June.

5_60_19243_POA_2E_ch03.indd 123 7/14/09 3:53:15 PM

124 Principles of accounting

Record transactions on accrual E3.11 The following data are taken from the comparative statements of financial positions of Midland

basis; convert revenue to cash Footy Club, which prepares its financial statements using the accrual basis of accounting.

receipts.

31 December 2010 2009

(LO 5, 6)

Fees receivable from members $12 000 $ 9 000

Unearned fees revenue 17 000 20 000

Fees are billed to members based upon their use of the club’s facilities. Unearned fees

arise from the sale of gift certificates, which members can apply to their future use of club

facilities. The 2010 income statement for the club showed that fees revenue of $153 000 was

earned during the year.

Instructions

(Hint: You will probably find it helpful to use T accounts to analyse these data.)

(a) Prepare journal entries for each of the following events that took place during 2010.

(1) Fees receivable from 2009 were all collected.

(2) Gift certificates outstanding at the end of 2009 were all redeemed.

(3) An additional $35 000 worth of gift certificates were sold during 2010. A portion of

these was used by the recipients during the year; the remainder was still outstanding

at the end of 2010.

(4) Fees for 2010 for services provided to members were billed to members.

(5) Fees receivable for 2010 (i.e. those billed in item [4] above) were partially

collected.

(b) Determine the amount of cash received by the club, with respect to fees, during 2010.

Prepare adjusting entries, post E3.12 Mr Wrong has prepared his income statement for the 12-month period ended 30 June 2010

to ledger accounts and prepare and reports a profit of $250 000. However, Mr Wrong’s statement is prepared on a cash basis

an adjusted trial balance. rather than accrual basis of accounting. The following information is available.

(LO 5, 6, 7) 1. The fortnightly wages and salaries bill of $8500 owing is due to be paid on 1 July

2010.

2. The business has $40 000 of office furniture and equipment with a useful life of 5 years

and zero expected residual value.

3. A client owes $1700 for services provided in May 2010.

4. The utility bills (e.g. water, telephone, electricity) for the quarter ended June 2010 are

unpaid. Based on previous bills, the quarterly expense is expected to be $1500.

5. The business paid a 2-year subscription for $1200 to a trade magazine on 1 January 2010

and recorded it as a Subscription Expense.

6. The business has received $5000 for services yet to be provided.

7. The business is being taken to court over a claimed breach of contract. An unfavourable

ruling could cost the business between $25 000 and $40 000.

Instructions

(a) Prepare journal entries for the above information.

(b) Based on the information, calculate Mr Wrong’s accrual-based profit for the period.

Journalise transactions *E3.13 At Concord Ltd, prepayments are debited to expense when paid, and unearned revenue is

and adjusting entries using credited to revenue when received. During January of the current year, the following transac-

appendix. tions occurred.

(LO 8)

Jan. 2 Paid $2400 for fire insurance protection for the year.

10 Paid $1700 for supplies.

15 Received $6100 for services to be performed in the future.

On 31 January, it is determined that $1500 of the services fees have been earned and that

there are $800 of supplies on hand.

Instructions

(a) Journalise and post the January transactions. (Use T accounts.)

(b) Journalise and post the adjusting entries as at 31 January.

(c) Determine the ending balance in each of the accounts.

Prepare adjusting entries, post PROBLEMS

to ledger accounts and prepare

an adjusted trial balance. P3.1 Marcia Grifin started her own consulting firm, Vektek Consulting, on 1 May 2010. The trial

(LO 5, 6, 7) balance as at 31 May is as follows.

5_60_19243_POA_2E_ch03.indd 124 7/14/09 3:53:15 PM

CHAPTER 3 Adjusting the accounts 125

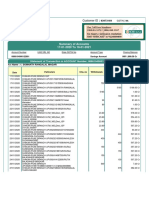

V E K T E K C O N S U LT I N G

Trial Balance

as at 31 May 2010

Account Number Debit Credit

101 Cash $ 15 400

110 Accounts Receivable 8 000

120 Prepaid Insurance 4 800

130 Supplies 3 000

135 Office Furniture 24 000

200 Accounts Payable $ 7 000

230 Unearned Service Revenue 6 000

300 M. Grifin, Capital 38 200

400 Service Revenue 12 000

510 Salaries Expense 6 000

520 Rent Expense 2 000

$63 200 $63 200

In addition to those accounts listed on the trial balance, the chart of accounts for Vektek

Consulting also contains the following accounts and account numbers: No. 136 Accumulated

Depreciation — Office Furniture, No. 210 Travel Payable, No. 220 Salaries Payable, No. 530

Depreciation Expense, No. 540 Insurance Expense, No. 550 Travel Expense and No. 560

Supplies Expense.

Other data:

1. $1000 of supplies have been used during the month.

2. Travel expense incurred but not paid on 31 May 2010, $400.

3. The insurance policy is for 2 years.

4. $2000 of the balance in the unearned service revenue account remains unearned at the

end of the month.

5. 31 May is a Wednesday, and employees are paid on Fridays. Vektek Consulting has two

employees, who are paid $1000 each for a 5-day work week.

6. The office furniture has a 5-year life with no residual value. It is being depreciated at

$400 per month.

7. Invoices representing $2000 of services performed during the month have not been

recorded as at 31 May.

Instructions

(a) Prepare the adjusting entries for the month of May. Use J4 as the page number for your

journal.

(b) Post the adjusting entries to the ledger accounts. Enter the totals from the trial balance

as beginning account balances and place a check mark in the posting reference column.

(c) Prepare an adjusted trial balance as at 31 May 2010. (c) Adj. trial balance $67 200

P3.2 The Mercury Motel opened for business on 1 May 2010. Its trial balance before adjustment Prepare adjusting entries,

on 31 May is as follows. post and prepare adjusted

trial balance and financial

M E R C U RY M OT E L statements.

Trial Balance (LO 5, 6, 7)

as at 31 May 2010

Account Number Debit Credit

101 Cash $ 2 500

126 Supplies 1 900

130 Prepaid Insurance 2 400

140 Land 15 000

141 Buildings 70 000

149 Furniture 16 800

201 Accounts Payable $ 5 300

208 Unearned Rent Revenue 3 600

275 Mortgage Payable 35 000

301 Sue Phillips, Capital 60 000

429 Rent Revenue 9 200

610 Advertising Expense 500

726 Salaries Expense 3 000

732 Utilities Expense 1 000

$113 100 $113 100

5_60_19243_POA_2E_ch03.indd 125 7/14/09 3:53:15 PM

126 Principles of accounting

In addition to those accounts listed on the trial balance, the chart of accounts for Mercury

Motel also contains the following accounts and account numbers: No. 142 Accumulated

Depreciation — Buildings, No. 150 Accumulated Depreciation — Furniture, No. 212 Salaries

Payable, No. 230 Interest Payable, No. 619 Depreciation Expense — Buildings, No. 621

Depreciation Expense — Furniture, No. 631 Supplies Expense, No. 718 Interest Expense and

No. 722 Insurance Expense.

Other data:

1. Insurance expires at the rate of $200 per month.

2. A count of supplies shows $900 of unused supplies on 31 May.

3. Annual depreciation is $2400 on the buildings and $3000 on furniture.

4. The mortgage interest rate is 12%. (The mortgage was taken out on 1 May.)

5. Unearned rent revenue of $2500 has been earned.

6. Salaries of $800 are accrued and unpaid as at 31 May.

Instructions

(a) Journalise the adjusting entries on 31 May.

(b) Prepare a ledger using the three-column form of account. Enter the trial balance amounts

(c) Adj. trial balance $114 700 and post the adjusting entries. (Use J1 as the posting reference.)

(d) Profit $4 400 Ending capital (c) Prepare an adjusted trial balance on 31 May.

balance $64 400 (d) Prepare an income statement and a statement of changes in equity for the month of May

Total assets $106 950 and a statement of financial position as at 31 May.

Prepare adjusting entries and P3.3 Fit Equip was registered on 1 April 2010. Semi-annual financial statements are prepared. The

financial statements. unadjusted and adjusted trial balances as at 30 September are shown below.

(LO 5, 6, 7)

FIT EQUIP

Trial Balance

as at 30 September 2010

Unadjusted Adjusted

Dr Cr Dr Cr

Cash $ 6 700 $ 6 700

Accounts Receivable 400 600

Prepaid Rent 1 500 900

Supplies 1 200 1 000

Equipment 15 000 15 000

Accumulated Depreciation — Equipment $ 850

Notes Payable $ 5 000 5 000

Accounts Payable 1 510 1 510

Salaries Payable 400

Interest Payable 50

Unearned Rent 900 500

P. Fit, Capital 14 000 14 000

P. Fit, Drawings 600 600

Commission Revenue 14 000 14 200

Rent Revenue 400 800

Salaries Expense 9 000 9 400

Rent Expense 900 1 500

Depreciation Expense 850

Supplies Expense 200

Utilities Expense 510 510

Interest Expense 50

$35 810 $35 810 $37 310 $37 310

Instructions

(a) Journalise the adjusting entries that were made.

(b) Profit $2490 (b) Prepare an income statement and a statement of changes in equity for the 6 months

Ending capital $15 890 ending 30 September and a statement of financial position as at 30 September.

Total assets $23 350 (c) If the note bears interest at 12%, how many months has it been on issue?

Prepare adjusting entries. P3.4 A review of the ledger of Khan Ltd as at 31 December 2010 produces the following data

(LO 5, 6) pertaining to the preparation of annual adjusting entries.

1. Insurance expense $4400 1. Prepaid Insurance $9800. The company has separate insurance policies on its buildings

and its motor vehicles. Policy B4564 on the building was purchased on 1 July 2009, for

5_60_19243_POA_2E_ch03.indd 126 7/14/09 3:53:16 PM

CHAPTER 3 Adjusting the accounts 127

$6000. The policy has a term of 3 years. Policy A2958 on the vehicles was purchased on

1 January 2010, for $4800. This policy has a term of 2 years.

2. Unearned Subscriptions $49 000. The company began selling magazine subscriptions 2. Subscription revenue $7000

in 2010 on an annual basis. The magazine is published monthly. The selling price of a

subscription is $50. A review of subscription contracts reveals the following.

Subscription Number of

date subscriptions

1 October 200

1 November 300

1 December 480

980

3. Notes Payable $40 000. This balance consists of a note for 6 months at an annual interest 3. Interest expense $1200

rate of 9%, dated 1 September.

4. Salaries Payable $0. There are eight salaried employees. Salaries are paid every Friday 4. Salaries expense $2940

for the current week. Five employees receive a salary of $500 each per week, and three

employees earn $800 each per week. 31 December is a Wednesday. Employees do not

work weekends. All employees worked the last 3 days of December.

Instructions

Prepare the adjusting entries as at 31 December 2010.

P3.5 On 1 November 2010, the account balances of Digital Equipment Repair were as follows. Journalise transactions and

follow through accounting cycle

No. Debits No. Credits to preparation of financial

statements.

101 Cash $1 395 154 Accumulated Depreciation $ 250

112 Accounts Receivable 1 255 201 Accounts Payable 1 050 (LO 5, 6, 7)

126 Supplies 1 000 209 Unearned Service Revenue 700

153 Store Equipment 5 000 212 Salaries Payable 250

301 P. Samone, Capital 6 400

$ 8 650 $8 650

During November the following summary transactions were completed.

Nov. 8 Paid $550 for salaries due to employees, of which $300 is for November.

10 Received $600 cash from customers on account.

12 Received $700 cash for services performed in November.

15 Purchased store equipment on account $1500.

17 Purchased supplies on account $250.

20 Paid creditors on account $1250.

22 Paid November rent $150.

25 Paid salaries $500.

27 Performed services on account and billed customers for services provided

$350.

29 Received $275 from customers for future service.

Adjustment data consist of:

1. Supplies on hand $500.

2. Accrued salaries payable $250.

3. Depreciation for the month is $60.

4. Unearned service revenue of $575 is earned.

Instructions

(a) Enter the 1 November balances in the ledger accounts.

(b) Journalise the November transactions.

(c) Post to the ledger accounts. Use J1 for the posting reference. Use the following

accounts: No. 407 Service Revenue, No. 615 Depreciation Expense, No. 631 Supplies

Expense, No. 726 Salaries Expense and No. 729 Rent Expense.

(d) Prepare a trial balance as at 30 November. (d) Trial balance $10 225

(e) Journalise and post adjusting entries.

(f) Prepare an adjusted trial balance. (f ) Adj. trial balance $10 535

5_60_19243_POA_2E_ch03.indd 127 7/14/09 3:53:16 PM

128 Principles of accounting

(g) Loss $385 (g) Prepare an income statement and a statement of changes in equity for November and a

Ending capital $6015 statement of financial position as at 30 November.

Total assets $8215

Prepare adjusting entries, *P3.6 Salzer Graphics was established on 1 January 2010 by Jill Salzer. At the end of the first

adjusted trial balance and 6 months of operations, the trial balance contained the following accounts.

financial statements using

appendix. Debits Credits

(LO 5, 6, 7, 8) Cash $ 9 500 Notes Payable $ 20 000

Accounts Receivable 14 000 Accounts Payable 9 000

Equipment 45 000 Jill Salzer, Capital 22 000

Insurance Expense 1 800 Graphic Revenue 52 100

Salaries Expense 30 000 Consulting Revenue 6 000

Supplies Expense 3 700

Advertising Expense 1 900

Rent Expense 1 500

Utilities Expense 1 700

$ 109 100 $ 109 100

Analysis reveals the following additional data.

1. The $3700 balance in Supplies Expense represents supplies purchased in January. As at

30 June, $1300 of supplies was on hand.

2. The note payable was issued on 1 February. It is a 12%, 6-month note.

3. The balance in Insurance Expense is the premium on a 1-year policy, dated 1 March 2010.

4. Consulting fees are credited to revenue when received. As at 30 June, consulting fees of

$1100 are unearned.

5. Graphic revenue earned but unrecorded as at 30 June totals $2000.

6. Depreciation is $3000 per year.

Instructions

(a) Journalise the adjusting entries as at 30 June. (Assume adjustments are recorded every

(b) Adj. trial balance $113 600

6-months.)

(c) Profit $18 400 (b) Prepare an adjusted trial balance.

Ending capital $40 400 (c) Prepare an income statement and statement of changes in equity for the 6 months ended

Total assets $71 500 30 June and a statement of financial position as at 30 June.

Prepare adjusting entries and P3.7 Paul Owens started Paul Owens Catering in January 2010. The accounting information is

adjusted financial statements. maintained on a cash basis. In its first year, Paul believes that the business has been operating

(LO 5, 6, 7, 8) successfully. The cash-based financial statements are as follows.

P AU L O W E N S C AT E R I N G

Income Statement

for the 12 months ended 31 December 2010

Income

Catering revenue $ 152 000

Expenses

Insurance expense $ 4 200

Catering supplies expense 54 000

Advertising expense 2 500

Salaries expense 33 000

Utilities expense 5 300

Motor vehicle expenses 10 000

Interest expense 600

Total expenses 109 600

Profit $ 42 400

P AU L O W E N S C AT E R I N G

Statement of Changes in Equity

for the year ended 31 December 2010

P. Owens, Capital 1 January $ 0

Investment by owner 60 000

Add: Profit 42 400

P. Owens, Capital 31 December 102 400

5_60_19243_POA_2E_ch03.indd 128 7/14/09 3:53:16 PM

CHAPTER 3 Adjusting the accounts 129

P AU L O W E N S C AT E R I N G

Statement of Financial Position

as at 31 December 2010

Assets

Cash at bank $ 17 900

Catering equipment 80 000

Motor vehicle 40 000

Total Assets 137 900

Liabilities

Notes payable $ 35 500

Total liabilities 35 500

Owner’s equity 102 400

Capital 102 400

Total liabilities and owner’s equity 137 900

In reviewing the financial statements, the accountant informed Paul that he should be

reporting using an accrual basis if he wants to assess the performance and position of the

business. In explaining accrual accounting to Paul, the accountant noted that the financial

statements do not reflect the following.

1. Revenue from the catering jobs completed in December, worth $22 500.

2. The catering supplies on hand at the end of December, worth $8000.

3. Depreciation of the motor vehicle, $4000, and depreciation of the catering equipment,

worth $10 000.

4. The annual insurance policy does not expire until 31 March 2011.

5. Paul has not paid $15 000 owed to casual staff for hours worked in December.

6. The interest owing on the bill is $2000.

7. Paul has not paid the telephone and electricity accounts for the December quarter,

totalling $500.

8. The December petrol account at the garage, totalling $800, has not been paid.

9. Paul has received $10 000 as deposit for a catering job in March 2011.

Instructions

(a) Journalise the adjusting entries as at 31 December.

(b) Prepare an accrual-based income statement, statement of changes in equity and (b) Profit $31 650;

statement of financial position as at 31 December. Ending capital $91 650;

(c) Explain to Paul why the accrual-based financial statements provide a better measure of Total assets $155 450

the performance of the business.

B RO A D E N I N G YO U R P E R S P E C T I V E

Financial reporting and analysis

■ FINANCIAL REPORTING PROBLEM: SINGAPORE AIRLINES

BYP3.1 Locate the most recent financial statements of Singapore Airlines via the website

www.singaporeair.com.

Instructions

(a) Using the consolidated financial statements and related information, identify items that

may result in adjusting entries for prepayments.

(b) Using the consolidated financial statements and related information, identify items that

may result in adjusting entries for accruals.

(c) Using the historical summary of financial data, what has been the trend for profit?

■ COMPARATIVE ANALYSIS PROBLEM: SINGAPORE AIRLINES AND CATHAY

PACIFIC

BYP3.2 Locate the most recent financial statements of Singapore Airlines (via the website

www.singaporeair.com) and Cathay Pacific (via the website www.cathaypacific.com).

5_60_19243_POA_2E_ch03.indd 129 7/14/09 3:53:17 PM

130 Principles of accounting

Instructions

Based on information contained in these statements, determine the following for each

company.

(a) Net increase (decrease) in property, plant and equipment from previous year to current

year.

(b) Net increase (decrease) in depreciation and amortisation expense from previous year to

current year.

(c) Net increase (decrease) in liabilities from previous year to current year.

(d) Net increase (decrease) in profit from previous year to current year.

(e) Net increase (decrease) in cash from previous year to current year.

■ INTERPRETING FINANCIAL STATEMENTS: A GLOBAL FOCUS

BYP3.3 Apple Inc.’s principal activities are to design, manufacture and market personal computers

and related software, peripherals and personal computing and communicating solutions.

Apple Inc. also designs, develops and markets a line of portable digital music players

along with related accessories and services, including the online sale of third-party audio

and video products and iPhone products. The company sells its products through its online

stores, direct sales force, third-party wholesalers and resellers, and its own retail stores. It

has its operations in the United States, Europe, Japan and Asia–Pacific.

Instructions

Answer the following questions.

(a) What profit (net income) is reported in Apple Inc.’s most recent consolidated statement

of operations (income statement)? What cash from operating activities is reported in its

most recent statement of cash flows? What might explain this difference?

(b) The company reports a liability related to warranty costs in its balance sheet (statement

of financial position). What are the possible points in time that warranty costs might be

expensed? At what point do you consider these costs should be expensed in the income

statement?

(c) The company’s net sales consist primarily of revenue from the sale of hardware,

software, music products, digital content, peripherals, and service and support contracts.

In the notes to the financial statements the company notes it ‘recognizes revenue when

persuasive evidence of an arrangement exists, delivery has occurred, the sales price is

fixed or determinable, and collection is probable. Product is considered delivered to the

customer once it has been shipped and title and risk of loss have been transferred’. Is

this consistent with the revenue recognition practices described in this chapter? What

considerations might you want to take into account in determining whether this is the

appropriate approach to recognising revenue?

■ EXPLORING THE WEB

BYP3.4 A wealth of accounting-related information is available via the internet. For example, the

Rutgers Accounting Web offers access to a great variety of sources.

Address: accounting.rutgers.edu

Instructions

Visit the Rutgers website and click on Accounting Resources. List the categories of

information available through the Accounting Resources page. Select any one of these

categories and briefly describe the types of information available.

Critical thinking

■ GROUP DECISION CASE

BYP3.5 Travel Wise was established on 1 January 2010 by Alice Ho. Alice is a good manager but a

poor accountant. From the trial balance prepared by a part-time bookkeeper, Alice prepared

the following income statement for the quarter that ended 31 March 2011.

5_60_19243_POA_2E_ch03.indd 130 7/14/09 3:53:17 PM

CHAPTER 3 Adjusting the accounts 131

T R AV E L W I S E

Income Statement

for the quarter ended 31 March 2011

Income

Booking revenue $ 90 000

Expenses

Advertising $ 5 200

Wages 29 800

Utilities 900

Depreciation 800

Repairs 4 000

Total expenses 40 700

Profit $49 300

Alice knew that something was wrong with the statement because profit had never exceeded

$20 000 in any one quarter. Knowing that you are an experienced accountant, she asks you

to review the income statement and other data.

You first look at the trial balance. In addition to the account balances reported above in

the income statement, the ledger contains the following additional selected balances as at

31 March 2011.

Supplies $ 6 200

Prepaid Insurance 7 200

Notes Payable 12 000

You then make inquiries and discover the following.

1. Booking fees include advanced rentals for summer month occupancy $20 000.

2. There were $1300 of supplies on hand as at 31 March.

3. Prepaid insurance resulted from the payment of a 1-year policy on 1 January 2011.

4. The mail on 1 April 2011 brought the following bills: advertising for week of 24 March,

$110; repairs made 10 March, $260; and utilities, $180.

5. There are four employees, who receive wages totalling $350 per day. As at 31 March,

2 days’ wages have been incurred but not paid.

6. The note payable is a 3-month, 10% note dated 1 January 2011.

Instructions

With the class divided into groups, answer the following.

(a) Prepare a correct income statement for the quarter ended 31 March 2011.

(b) Explain to Alice the generally accepted accounting principles that she did not recognise

in preparing her income statement and their effect on her results.

■ COMMUNICATION ACTIVITY

BYP3.6 In reviewing the accounts of Karibeth Ltd at the end of the year, you discover that adjusting

entries have not been made.

Instructions

Write a memo to Kari Beth Menzies, the owner of Karibeth Ltd, that explains the following:

the nature and purpose of adjusting entries, why adjusting entries are needed and the types

of adjusting entries that may be made.

■ ETHICS CASE

BYP3.7 CPA Australia sponsors a student ethics essay prize: the CPA Australia Ethics Essay

Competition. The winner in 2008 was Jeffrey Dummett for his essay titled ‘Ethics in a

global environment’. Access the article by going to the course management system that

accompanies this text.

5_60_19243_POA_2E_ch03.indd 131 7/14/09 3:53:17 PM

132 Principles of accounting

Instructions

Read the essay and answer the following questions:

(a) Summarise the challenges of a globalised business environment to the practice of

effective accounting ethics.

(b) Discuss possible resolutions to these challenges.

(c) Outline the role of the International Federation of Accountants (IFAC).

■ SUSTAINABILITY CASE

BYP3.8 The Association of Chartered Certified Accountants (ACCA) has conducted annual

ACCA sustainability reporting awards for more than 15 years. The ACCA is involved in

reporting awards in more than 20 countries in Europe, Africa, North America/Canada and

the Asia–Pacific region. For Australia and New Zealand, the best sustainability report for

2007 was awarded to BHP Billiton. Only 35% of Australia’s top 100 companies conduct

sustainability reporting compared with 76% in the United Kingdom.

Instructions

Visit the ACAA sustainability report awards website at www.accaglobal.com under ‘General

public’, ‘Technical activities’, ‘Subject areas’, ‘Sustainability’.

(a) Identify the sources of guidance on sustainability reporting.

(b) Select one of these sources and identify the guidance provided.

Source: Management Update, BRW, 5–11 June 2008, p. 68.

■ FINANCIAL REPORTING QUALITY CASE

BYP3.9 The scene setter for this chapter described inappropriate revenue recognition by an

Australian company. Misstated financial statements have occurred in many countries. For

example, personal computer maker Dell intentionally restated its results from 2003 to 2006

and in the first quarter of 2007 to improve the appearance of its performance. In 2006,

the Malaysian publicly listed company Transmile Group restated its 2005 profit of RM75

million to a loss of RM370 million as a result of fictitious sales. The accounting practices

of Sanyo Electric Co. have been questioned with claims the company misrepresented its

statements by failing to write off ¥200 billion in losses that were subsequently booked in

later years.

Instructions

Why would companies want to misreport their financial results and run the risk of being

detected?

Source: P. Ng, ‘Public-listed firms hit by accounting fraud’, The Business Times Singapore, 3 July

2007; A. Ricadela, ‘Delinquent Dell gets its house in order’, Australian Financial Review, 21 August

2007, p. 32; ‘SESC probes allegations of accounting fraud at Sanyo Elec.’, Nikkei Report, 23 February

2007.

Answers to self-study questions

1. c 2. d 3. d 4. a 5. d 6. d 7. d 8. c 9. c 10. a 11. c 12. b

13. c 14. a 15. b

Solution to Nokia review it question 4, page 104

Nokia’s 2008 annual report shows a total of ¤1617 million depreciation and amortisation.

Please note the 2008 annual report has been used as an example. Students’ answers will vary

depending on the report accessed.

Note: Amortisation is the same concept as depreciation. The term amortisation is used when

referring to specific assets, for example, intangibles and leased assets.

5_60_19243_POA_2E_ch03.indd 132 7/14/09 3:53:17 PM

You might also like

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Fin 4150 Advanced Business Valuation Assignments Overview: Assignment 1: Class Preparation/Professionalism/ParticipationDocument21 pagesFin 4150 Advanced Business Valuation Assignments Overview: Assignment 1: Class Preparation/Professionalism/ParticipationEric McLaughlinNo ratings yet

- 75 No-Code Business IdeasDocument34 pages75 No-Code Business IdeasVipin kumar100% (2)

- Ccounting Principles,: Weygandt, Kieso, & KimmelDocument58 pagesCcounting Principles,: Weygandt, Kieso, & Kimmelpiash246100% (2)

- MBA Dissertation Sample On GlobalizationDocument19 pagesMBA Dissertation Sample On GlobalizationMBA DissertationNo ratings yet

- Adjusting Entry - LectureDocument9 pagesAdjusting Entry - LectureMaDine 19100% (2)

- Chapter 11 Adjusting EntriesDocument91 pagesChapter 11 Adjusting EntriesMelessa Pescador100% (1)

- Accounting Adjustment-Accrued & PrepaidDocument30 pagesAccounting Adjustment-Accrued & PrepaidEida HidayahNo ratings yet

- Business Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Business (Part Ii-A)Document9 pagesBusiness Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Business (Part Ii-A)Tumamudtamud, JenaNo ratings yet

- Mens Salon Business PlanDocument29 pagesMens Salon Business PlanKartik75% (4)

- Inancial CCTG: Adjusting The AccountsDocument28 pagesInancial CCTG: Adjusting The AccountsLj BesaNo ratings yet

- Accounting Cycle of A Service Business-Step 5-Adjusting EntriesDocument18 pagesAccounting Cycle of A Service Business-Step 5-Adjusting EntriesdelgadojudithNo ratings yet

- Legal and Management: GA03 Risk Assessment (Quantitative)Document2 pagesLegal and Management: GA03 Risk Assessment (Quantitative)LucianNo ratings yet

- Adjusting EntriesDocument32 pagesAdjusting EntriesAyniNuyda100% (1)

- Adjusting Account, WORK SHEET-FINALDocument43 pagesAdjusting Account, WORK SHEET-FINALChowdhury Mobarrat Haider Adnan100% (1)

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Chapter 3 Adjusting The Accounts Chloe WuDocument10 pagesChapter 3 Adjusting The Accounts Chloe WuGebeyehu BezabehNo ratings yet

- Accounting: John Wiley & Sons, IncDocument37 pagesAccounting: John Wiley & Sons, Incshafaat_90100% (1)

- Financial Accounting, 4eDocument42 pagesFinancial Accounting, 4eabdirahman mohamed100% (1)

- Chapter 3Document15 pagesChapter 3clara2300181No ratings yet

- Adjustment & Adjusting EntriesDocument32 pagesAdjustment & Adjusting EntriesHumair Ahmed100% (1)

- Chapter 3Document39 pagesChapter 3chanreaksmeytepNo ratings yet

- Topic 4 - Completing The Accounting CycleDocument52 pagesTopic 4 - Completing The Accounting CycleLA Syamsul100% (1)

- Lecture04B-Adjusting AC CycleDocument61 pagesLecture04B-Adjusting AC Cycle錢永健No ratings yet

- Fundamentals of ABM1 - Q4 - LAS1 DRAFTDocument17 pagesFundamentals of ABM1 - Q4 - LAS1 DRAFTSitti Halima Amilbahar AdgesNo ratings yet

- Lecture Slides - Chapter 3 4Document82 pagesLecture Slides - Chapter 3 4Bùi Phan Ý Nhi100% (1)

- Financial Accounting AdjustmentsDocument55 pagesFinancial Accounting AdjustmentsKabeer QureshiNo ratings yet

- CHAPTER 3 Adjusting The Accounts PDFDocument18 pagesCHAPTER 3 Adjusting The Accounts PDFabdul_rehman843467% (3)

- Adjusting Entries FSDocument31 pagesAdjusting Entries FSMylene Salvador100% (1)

- Acctg-Cheat CodeDocument3 pagesAcctg-Cheat CodeLemuel DioquinoNo ratings yet

- Chapter 3 PresentationDocument48 pagesChapter 3 Presentationhosie.oqbeNo ratings yet

- Accounting Chaprter 3Document49 pagesAccounting Chaprter 3rashmiaakshaNo ratings yet

- Chapter 03 STDocument27 pagesChapter 03 STKim NganNo ratings yet

- Chapter 7 - AdjustmentsDocument70 pagesChapter 7 - AdjustmentsMinetteGabriel100% (1)

- 5.2. Specific ArrangementsDocument51 pages5.2. Specific ArrangementsPranjal pandeyNo ratings yet

- Chapter 4 End of The Period Adjustments Final ModuleDocument75 pagesChapter 4 End of The Period Adjustments Final ModuleRian Hanz AlbercaNo ratings yet

- 03 - Adjusting EntriesDocument3 pages03 - Adjusting EntriesJamie ToriagaNo ratings yet

- Adjustments 20200216101400Document44 pagesAdjustments 20200216101400Chi Cheng100% (1)

- Chapter 03 STDocument27 pagesChapter 03 STHoàng KhôiNo ratings yet

- Adjusting The AccountsDocument36 pagesAdjusting The AccountsTasim Ishraque100% (1)

- Adjusting The AccountsDocument79 pagesAdjusting The AccountsaccpackmlbbNo ratings yet

- FABM1 Q4 M1 Preparing-Adjusting-EntriesDocument14 pagesFABM1 Q4 M1 Preparing-Adjusting-EntriesXedric JuantaNo ratings yet

- CH03Document51 pagesCH03Omar muktarNo ratings yet

- Accounting Chapter 5Document24 pagesAccounting Chapter 5Will TrầnNo ratings yet

- Adjusting Entries IllustrationsDocument3 pagesAdjusting Entries IllustrationsHeeseung LeeNo ratings yet

- Measuring Profitability and Financial Position On The Financial Statements Chapter 4Document66 pagesMeasuring Profitability and Financial Position On The Financial Statements Chapter 4Rupesh Pol100% (1)

- MBA SOP 2021 - Sessions 2 & 3Document86 pagesMBA SOP 2021 - Sessions 2 & 3Bakht Yawer KirmaniNo ratings yet

- Wey AP 8e Ch03 RevisedDocument50 pagesWey AP 8e Ch03 RevisedRahat Morshed NabilNo ratings yet

- Financial Accounting, 3e: Weygandt, Kieso, & KimmelDocument42 pagesFinancial Accounting, 3e: Weygandt, Kieso, & KimmelLili Al ShamisiNo ratings yet

- Session 3+4 - Adjusting The AccountsDocument40 pagesSession 3+4 - Adjusting The Accountshieucaiminh155No ratings yet

- Adjusting Entries NotesDocument5 pagesAdjusting Entries NoteswingNo ratings yet

- Adjusting Entries1Document20 pagesAdjusting Entries1Timothy CaragNo ratings yet

- Accounting 1Document16 pagesAccounting 1Tesfamlak MulatuNo ratings yet

- Financial Acctg Reporting 1 Chapter 5Document20 pagesFinancial Acctg Reporting 1 Chapter 5Charise Jane ZullaNo ratings yet

- The Adjusting Process PDFDocument3 pagesThe Adjusting Process PDFMaria Cristina ArcillaNo ratings yet

- Chapter 3: Preparing Financial StatementsDocument17 pagesChapter 3: Preparing Financial StatementsSittie Haynah Moominah BualanNo ratings yet

- M7C Adjusting Process Prepaid ExpensesDocument8 pagesM7C Adjusting Process Prepaid ExpensesCharles Eli AlejandroNo ratings yet

- Fabm 1 Lesson 7Document44 pagesFabm 1 Lesson 7Dionel RizoNo ratings yet

- LCCI Accounting Concepts-1Document51 pagesLCCI Accounting Concepts-1Khin Lay HtetNo ratings yet

- CH 5 ACT2112Document35 pagesCH 5 ACT2112MUSTAFA KAMAL BIN ABD MUTALIP / BURSAR100% (1)

- Accrual AccountingDocument44 pagesAccrual AccountingSophia LynchNo ratings yet

- Adjusting Journal Entry TugasDocument7 pagesAdjusting Journal Entry TugasLulu IstianahNo ratings yet

- Adjusting EntriesDocument18 pagesAdjusting Entriesfrancismaminta2496No ratings yet

- Group 5 CL Accounting Theory 9th Meeting Chapter 10 ExpenseDocument6 pagesGroup 5 CL Accounting Theory 9th Meeting Chapter 10 ExpenseEggie Auliya HusnaNo ratings yet

- Adjusting The AccountsDocument6 pagesAdjusting The AccountsKena Montes Dela PeñaNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- Accounting Interview QuestionsDocument1 pageAccounting Interview QuestionsShahzad AsifNo ratings yet

- Who Was The First Accountant PDFDocument11 pagesWho Was The First Accountant PDFShahzad AsifNo ratings yet

- What Are The Three Types of Accounts - AccountingCapitalDocument3 pagesWhat Are The Three Types of Accounts - AccountingCapitalShahzad AsifNo ratings yet

- Fundamentals of Accounting PDFDocument9 pagesFundamentals of Accounting PDFShahzad AsifNo ratings yet

- Satyendra DubeyDocument4 pagesSatyendra Dubeysk_firdousNo ratings yet

- Mil-Media and Information LiterateDocument14 pagesMil-Media and Information LiterateNon SyNo ratings yet

- 6480 Midterm ExamDocument26 pages6480 Midterm ExamJuan Dela cruzNo ratings yet

- BRI Sustainability Framework Second Party OpinionDocument24 pagesBRI Sustainability Framework Second Party OpinionJaya IrawanNo ratings yet

- ZestoDocument37 pagesZestoUndebaynNo ratings yet

- Midterm Examination 2Document4 pagesMidterm Examination 2Nhật Anh OfficialNo ratings yet

- Bida-Tech Company Chart of Accounts Account Naccount NameDocument66 pagesBida-Tech Company Chart of Accounts Account Naccount NameTrisha Mae Mendoza MacalinoNo ratings yet

- Pay Order Application-Bangla-englishDocument1 pagePay Order Application-Bangla-englishTasnim RaihanNo ratings yet

- Answer Tutorial 1Document2 pagesAnswer Tutorial 1MUHAMMAD DANIEL BIN MOHD SALIMNo ratings yet

- Project Report On Summer InternshipDocument15 pagesProject Report On Summer InternshipADITYAROOP PATHAKNo ratings yet

- Class Presentation Course: Analysis of Pakistani IndustriesDocument39 pagesClass Presentation Course: Analysis of Pakistani Industrieshuzaifa anwarNo ratings yet

- PD Reissuancetawarruq Dec2018Document34 pagesPD Reissuancetawarruq Dec2018ELISSANUR SURAYA BINTI ARNAZ YUSRYNo ratings yet

- The End of BureaucracyDocument11 pagesThe End of BureaucracyWendel RharaelNo ratings yet

- Vipul Jaiswal. Registration No-19-1017-Institute - Sri Balaji University. (BIMHRD) Subject-Basics of Marketing Management. Specialization-FinanceDocument10 pagesVipul Jaiswal. Registration No-19-1017-Institute - Sri Balaji University. (BIMHRD) Subject-Basics of Marketing Management. Specialization-FinancebeharenbNo ratings yet

- ACC117 Group ProjectDocument15 pagesACC117 Group ProjectEllissya SofeaNo ratings yet

- Entrepreneurship Final Exam (Freshman Program 2021)Document9 pagesEntrepreneurship Final Exam (Freshman Program 2021)Tofik Mohammed100% (5)

- 2022 Trend Report InvisionDocument34 pages2022 Trend Report InvisionrazintntNo ratings yet

- Semiconductor StandoffDocument16 pagesSemiconductor StandoffGary Ryan DonovanNo ratings yet

- I 17012021 886 1 122801 993839-UnlockedDocument13 pagesI 17012021 886 1 122801 993839-UnlockedSomnath MagarNo ratings yet

- Quiz 1 - Part BDocument3 pagesQuiz 1 - Part Bdivya kalyaniNo ratings yet

- Day 3 - ExerciseDocument3 pagesDay 3 - ExerciseDiễm HuỳnhNo ratings yet

- Topic 5 - Product Pricing Profit AnalysisDocument44 pagesTopic 5 - Product Pricing Profit AnalysisJoan LibrandoNo ratings yet

- Annual Financial Report For The Local Government Volume IDocument373 pagesAnnual Financial Report For The Local Government Volume ISean Arvy SamsonNo ratings yet

- Plantacare® 2000 UP: General CharacterisationDocument3 pagesPlantacare® 2000 UP: General CharacterisationDr. Rajesh Kumar SinghNo ratings yet

- Annual KYC Updation Form - IndividualDocument2 pagesAnnual KYC Updation Form - IndividualJoy T100% (1)