Professional Documents

Culture Documents

Ramon B. de Los Reyes and Zoilo P. Perlas For Plaintiffs-Appellants. Villamor & Gancayco For Defendants-Appellees

Uploaded by

Wresen Ann Javaluyas0 ratings0% found this document useful (0 votes)

31 views2 pagesPnb vs gancayco

Original Title

PNB-vs-Gancayco

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPnb vs gancayco

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

31 views2 pagesRamon B. de Los Reyes and Zoilo P. Perlas For Plaintiffs-Appellants. Villamor & Gancayco For Defendants-Appellees

Uploaded by

Wresen Ann JavaluyasPnb vs gancayco

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

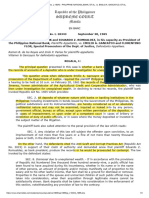

G.R. No. L-18343 September 30, 1965 SEC. 8. Dismissal due to unexplained wealth.

— If in accordance with the

PHILIPPINE NATIONAL BANK and EDUARDO Z. ROMUALDEZ, in his capacity provisions of Republic Act Numbered One thousand three hundred seventy-

as President of the Philippine National Bank, plaintiffs-appellants, nine, a public official has been found to have acquired during his

vs.

incumbency, whether in his name or in the name of other persons, an

EMILIO A. GANCAYCO and FLORENTINO FLOR, Special Prosecutors of the

amount of property and/or money manifestly out of proportion to his salary

Dept. of Justice, defendants-appellees.

Ramon B. de los Reyes and Zoilo P. Perlas for plaintiffs-appellants. and to his other lawful income, that fact shall be a ground for dismissal or

Villamor & Gancayco for defendants-appellees. removal. Properties in the name of the spouse and unmarried children of

such public official may be taken into consideration, when their acquisition

REGALA, J.: through legitimate means cannot be satisfactorily shown. Bank deposits

shall be taken into consideration in the enforcement of this section,

FACTS:

notwithstanding any provision of law to the contrary.

Defendants Emilio A. Gancayco and Florentino Flor, as special prosecutors of

Because of the threat of prosecution, plaintiffs filed an action for

the Department of Justice, required the plaintiff Philippine National Bank

declaratory judgment in the Manila CFI. After trial, during which Senator

(PNB) to produce at a hearing on February 20, 1961 the records of the bank

Arturo M. Tolentino, author of the Anti-Graft and Corrupt Practices Act

deposits of Ernesto T. Jimenez, former administrator of the Agricultural

testified, the court rendered judgment, sustaining the power of the

Credit and Cooperative Administration, who was then under investigation

defendants to compel the disclosure of bank accounts of ACCFA

for unexplained wealth. In declining to reveal its records, PNB invoked RA

Administrator Jimenez. The court said that, by enacting Section 8 of RA

1405 which provides:

3019, Congress clearly intended to provide an additional ground for the

SEC. 2. All deposits of whatever nature with banks or banking institutions in examination of bank deposits. Without such provision, the court added

the Philippines including investments in bonds issued by the Government of prosecutors would be hampered if not altogether frustrated in the

the Philippines, its political subdivisions and its instrumentalities, are hereby prosecution of those charged with having acquired unexplained wealth

considered as of an absolutely confidential nature and may not be while in public office.

examined, inquired or looked into by any person, government official,

From that judgment, plaintiffs appealed to this Court. In brief, plaintiffs’

bureau or office, except upon written permission of the depositor, or in

position is that section 8 of the Anti-Graft Law “simply means that such bank

cases of impeachment, or upon order of a competent court in cases of

deposits may be included or added to the assets of the Government official

bribery or dereliction of duty of public officials, or in cases where the money

or employee for the purpose of computing his unexplained wealth if and

deposited or invested is the subject matter of the litigation.

when the same are discovered or revealed in the manner authorized by

On the other hand, the defendants cited the Anti-Graft and Corrupt Section 2 of RA 1405, which are (1) upon written permission of the

Practices Act (RA 3019) in support of their claim of authority and demanded depositor; (2) in cases of impeachment; (3) upon order of a competent court

anew that plaintiff Eduardo Z. Romualdez, as bank president, produce the in cases of bribery or dereliction of duty of public officials; and (4) in cases

records or he would be prosecuted for contempt. The defendants invoked where the money deposited or invested is the subject matter of the

Sec. 8 of Ra 3019 which states that: litigation.”

Issues: notwithstanding any provision of law to the contrary." The only conclusion possible is that

section 8 of the Anti-Graft Law is intended to amend section 2 of Republic Act No. 1405 by

providing additional exception to the rule against the disclosure of bank deposits.

1. Whether or not RA 3019 which took effect on August 17, 1960 is a

general law which cannot be deemed to have impliedly repealed section 2 Indeed, it is said that if the new law is inconsistent with or repugnant to the old law, the

presumption against the intent to repeal by implication is overthrown because the

of RA 1405 (which took effect on Sept. 9, 1955), because of the rule that inconsistency or repugnancy reveals an intent to repeal the existing law. And whether a

repeals by implication are not favored. statute, either in its entirety or in part, has been repealed by implication is ultimately a

matter of legislative intent. (Crawford, The Construction of Statutes, Secs. 309-310. Cf.

Iloilo Palay and Corn Planters Ass'n v. Feliciano, G.R. No. L-24022, March 3, 1965).

2. Whether or not a bank can be compelled to disclose the records of

accounts of a depositor who is under investigation for unexplained wealth. 2. Yes. With regard to the claim that disclosure would be contrary to the

policy making bank deposits confidential, it is enough to point out that while

section 2 of RA 1405 declares bank deposits to be “absolutely confidential,”

it nevertheless allows such disclosure in the following instances: (1) Upon

Ruling:

written permission of the depositor; (2) In cases of impeachment; (3) Upon

order of a competent court in cases of bribery or dereliction of duty of

1.No. Contrary to their claim that their position effects a reconciliation of the provisions of public officials; (4) In cases where the money deposited is the subject matter

the two laws, plaintiffs are actually making the provisions of Republic Act No. 1405 prevail

over those of the Anti-Graft Law, because even without the latter law the balance standing of the litigation. Cases of unexplained wealth are similar to cases of bribery

to the depositor's credit can be considered provided its disclosure is made in any of the or dereliction of duty and no reason is seen why these two classes of cases

cases provided in Republic Act No. 1405. cannot be excepted from the rule making bank deposits confidential. The

policy as to one cannot be different from the policy as to the other. This

The truth is that these laws are so repugnant to each other than no reconciliation is

possible. Thus, while Republic Act No. 1405 provides that bank deposits are "absolutely policy expresses the motion that a public office is a public trust and any

confidential ... and [therefore] may not be examined, inquired or looked into," except in person who enters upon its discharge does so with the full knowledge that

those cases enumerated therein, the Anti-Graft Law directs in mandatory terms that bank

his life, so far as relevant to his duty, is open to public scrutiny.

deposits "shall be taken into consideration in the enforcement of this section,

You might also like

- Secrecy of Bank DepositsTruth in LendingAMLADocument9 pagesSecrecy of Bank DepositsTruth in LendingAMLAJalod Hadji AmerNo ratings yet

- Simple Guide for Drafting of Civil Suits in IndiaFrom EverandSimple Guide for Drafting of Civil Suits in IndiaRating: 4.5 out of 5 stars4.5/5 (4)

- ANTI MONEY LAUNDERING ACT Case DigestsDocument7 pagesANTI MONEY LAUNDERING ACT Case DigestsRejzl Awit100% (1)

- 31-PNB v. Gancayco 15 SCRA 91Document3 pages31-PNB v. Gancayco 15 SCRA 91Jopan SJNo ratings yet

- Ejercito V SandiganbayanDocument3 pagesEjercito V SandiganbayanMickey RodentNo ratings yet

- Jews, Visigoths and The Musslim Conquest of SpainDocument31 pagesJews, Visigoths and The Musslim Conquest of SpainIsabel Luna0% (1)

- Secrecy of Bank DepositsDocument8 pagesSecrecy of Bank DepositsCyrine CalagosNo ratings yet

- Philippine National Bank v. Gancayco GR No. 18343, 30 September 1965Document8 pagesPhilippine National Bank v. Gancayco GR No. 18343, 30 September 1965demosreaNo ratings yet

- Sample Case DigestDocument1 pageSample Case DigestMariz Angeli TrinidadNo ratings yet

- Primer On Secrecy of Bank Deposits and Foreign Currency DepoDocument10 pagesPrimer On Secrecy of Bank Deposits and Foreign Currency DepoNodlesde Awanab ZurcNo ratings yet

- Notes Sa LawDocument11 pagesNotes Sa LawJoana Marie ManaloNo ratings yet

- Case Digests For StatconDocument6 pagesCase Digests For StatconDennis Jay Dencio ParasNo ratings yet

- Innovis Law Partners: Legal Notice by Speed PostDocument2 pagesInnovis Law Partners: Legal Notice by Speed PostNikhilesh MallickNo ratings yet

- Pan v. PenaDocument2 pagesPan v. PenaSophiaFrancescaEspinosaNo ratings yet

- Ejercito V SandiganbayanDocument2 pagesEjercito V SandiganbayanAnonymous 5MiN6I78I0No ratings yet

- CID 20231122201002378796 777900 CIDROC IpayccDocument6 pagesCID 20231122201002378796 777900 CIDROC Ipayccnvm creativeNo ratings yet

- 55 - Banco Filipino Savings and Mortgage Bank v. Purisima, 161 SCRA 576 (1988)Document3 pages55 - Banco Filipino Savings and Mortgage Bank v. Purisima, 161 SCRA 576 (1988)November Lily OpledaNo ratings yet

- Answers Banking Law 2nd Long Exam UpdatedDocument8 pagesAnswers Banking Law 2nd Long Exam UpdatedAldrinNo ratings yet

- Sample Notice of Motion To Set Aside A Default JudgmentDocument4 pagesSample Notice of Motion To Set Aside A Default JudgmentDebbieNo ratings yet

- Marquez VsDocument12 pagesMarquez VsD Del SalNo ratings yet

- Republic V Eugenio Case DigestDocument4 pagesRepublic V Eugenio Case DigestFaye Allen Matas50% (2)

- Eeoc: the Real Deal: (Equal Employment Opportunity Commission)From EverandEeoc: the Real Deal: (Equal Employment Opportunity Commission)No ratings yet

- Far East Agricultural Supply Vs LebatiqueDocument2 pagesFar East Agricultural Supply Vs LebatiqueZoe VelascoNo ratings yet

- Secrecy of Bank DepositsDocument21 pagesSecrecy of Bank DepositsA.T.ComiaNo ratings yet

- Comparative Police SystemDocument172 pagesComparative Police SystemAmy BCNo ratings yet

- Warrantless Search Case Digest PlainviewDocument22 pagesWarrantless Search Case Digest PlainviewD Del SalNo ratings yet

- People v. LiggayuDocument2 pagesPeople v. LiggayuCamille BritanicoNo ratings yet

- Stage 3 - Developed Design ChecklistDocument16 pagesStage 3 - Developed Design ChecklistVirah Sammy ChandraNo ratings yet

- Civil Law: SuccessionDocument47 pagesCivil Law: SuccessionMP ManliclicNo ratings yet

- 1 Republic Vs Eugenio, G.R. No. 174629 February 14, 2008Document3 pages1 Republic Vs Eugenio, G.R. No. 174629 February 14, 2008Perry YapNo ratings yet

- Law On Secrecy of Bank Deposits: R.A. No. 1405, As AmendedDocument33 pagesLaw On Secrecy of Bank Deposits: R.A. No. 1405, As AmendedEricka SantiagoNo ratings yet

- PNB v. GancaycoDocument5 pagesPNB v. Gancaycoeunice demaclidNo ratings yet

- Motion To Quash Subpoena Bank OfficialsDocument7 pagesMotion To Quash Subpoena Bank OfficialsVERA FilesNo ratings yet

- Republic v. Hon. Antonio M. Eugenio, G.R. No. 174629, February 14, 2008Document3 pagesRepublic v. Hon. Antonio M. Eugenio, G.R. No. 174629, February 14, 2008xxxaaxxx80% (5)

- G.R. Nos. 157294-95 DigestDocument2 pagesG.R. Nos. 157294-95 DigestHaze Q.No ratings yet

- Republic of The Philippines vs. Eugenio G.R. No. 174629 February 14, 2008 Tinga, J.: FactsDocument19 pagesRepublic of The Philippines vs. Eugenio G.R. No. 174629 February 14, 2008 Tinga, J.: FactsAdi LimNo ratings yet

- BANCO FILIPINO SAVINGS AND MORTGAGE BANK vs. HON. FIDEL PURISIMA, Etc., and HON. VICENTE ERICTA and JOSE DEL FIERO, Etc.Document2 pagesBANCO FILIPINO SAVINGS AND MORTGAGE BANK vs. HON. FIDEL PURISIMA, Etc., and HON. VICENTE ERICTA and JOSE DEL FIERO, Etc.Dave Lumasag CanumhayNo ratings yet

- Carabeo Vs SandiganbayanDocument2 pagesCarabeo Vs SandiganbayanVane RealizanNo ratings yet

- Secrecy of Bank Deposits Law-NotesDocument5 pagesSecrecy of Bank Deposits Law-Notesjb_uy100% (1)

- Ramon B. de Los Reyes and Zoilo P. Perlas For Plaintiffs-Appellants. Villamor & Gancayco For Defendants-AppelleesDocument3 pagesRamon B. de Los Reyes and Zoilo P. Perlas For Plaintiffs-Appellants. Villamor & Gancayco For Defendants-AppelleesAimie Razul-AparecioNo ratings yet

- 06pnb V GancaycoDocument2 pages06pnb V GancaycofrancisNo ratings yet

- 037 PNB vs. Gancayco, 15 SCRA 91Document3 pages037 PNB vs. Gancayco, 15 SCRA 91Julius Albert SariNo ratings yet

- Ramon B. de Los Reyes and Zoilo P. Perlas For Plaintiffs-Appellants. Villamor & Gancayco For Defendants-AppelleesDocument3 pagesRamon B. de Los Reyes and Zoilo P. Perlas For Plaintiffs-Appellants. Villamor & Gancayco For Defendants-AppelleesIELTSNo ratings yet

- Tecum To The Banco Filipino Savings & Mortgage Bank, Commanding ItsDocument23 pagesTecum To The Banco Filipino Savings & Mortgage Bank, Commanding ItsHiedi SugamotoNo ratings yet

- Secrecy of Bank DepositDocument5 pagesSecrecy of Bank DepositAngelica RoblesNo ratings yet

- PNB v. GancaycoDocument4 pagesPNB v. GancaycoCris LegaspiNo ratings yet

- PNB vs. EMILIO A. GANCAYCODocument1 pagePNB vs. EMILIO A. GANCAYCOKling KingNo ratings yet

- BF V PurisimaDocument17 pagesBF V PurisimaLadybird MngtNo ratings yet

- Republic of The Philippines vs. Eugenio G.R. NO. 174629, FEB. 14, 2008Document1 pageRepublic of The Philippines vs. Eugenio G.R. NO. 174629, FEB. 14, 2008Ramon Khalil Erum IVNo ratings yet

- Bank Secrecy LawDocument6 pagesBank Secrecy LawJillian Mitziko LimquecoNo ratings yet

- 18 Banco Filipino Savings and Mortgage Bank v. PurisimaDocument3 pages18 Banco Filipino Savings and Mortgage Bank v. PurisimaGabriel LedaNo ratings yet

- Bank Secrecy LawsDocument7 pagesBank Secrecy Lawsadulusman501No ratings yet

- Assignnment 3 NotesDocument5 pagesAssignnment 3 NotesAna Marie VirayNo ratings yet

- Philippine National Bank v. Gancayco GR No. 18343, 30 September 1965Document2 pagesPhilippine National Bank v. Gancayco GR No. 18343, 30 September 1965Hendrix GregorioNo ratings yet

- Bank Secrecy Amla Pdic ReviewerDocument21 pagesBank Secrecy Amla Pdic Reviewerchuchu emeNo ratings yet

- RFBT - Chapter 6 - Bank Secrecy LawDocument4 pagesRFBT - Chapter 6 - Bank Secrecy Lawlaythejoylunas21No ratings yet

- Law On Secrecy of Bank DepositsDocument4 pagesLaw On Secrecy of Bank DepositsKerwin Lester MandacNo ratings yet

- Bank Secrecy LawDocument9 pagesBank Secrecy LawnuggsNo ratings yet

- Petitioner vs. vs. Respondents: First DivisionDocument5 pagesPetitioner vs. vs. Respondents: First DivisionjackyNo ratings yet

- PDIC, Secrecy of Bank Deposit and Anti Money LaunderingDocument20 pagesPDIC, Secrecy of Bank Deposit and Anti Money LaunderingCarla LisingNo ratings yet

- Republic V Judge Eugenio G.R. No. 174629, February 14, 2008Document3 pagesRepublic V Judge Eugenio G.R. No. 174629, February 14, 2008Inter_vivosNo ratings yet

- Republic vs. Hon. Antonio EugenioDocument2 pagesRepublic vs. Hon. Antonio Eugeniosabrina hernandezNo ratings yet

- Banking Laws: Ra 1405 - Secrecy of Bank DepositsDocument6 pagesBanking Laws: Ra 1405 - Secrecy of Bank DepositsNica ChanNo ratings yet

- 9 Bank of The Phil. Islands vs. Intermediate Appellate Court PDFDocument7 pages9 Bank of The Phil. Islands vs. Intermediate Appellate Court PDFKristabelleCapaNo ratings yet

- Marquez v. DesiertoDocument5 pagesMarquez v. DesiertoLili MoreNo ratings yet

- CHINA BANK V ORTEGA G.R l-34964Document2 pagesCHINA BANK V ORTEGA G.R l-34964Lemuel AtupNo ratings yet

- State Immunity Cases With Case DigestsDocument37 pagesState Immunity Cases With Case DigestsJM CamposNo ratings yet

- Bank Secrecy ActDocument9 pagesBank Secrecy ActBea GarciaNo ratings yet

- Banco Filipino Vs PurisimaDocument1 pageBanco Filipino Vs PurisimaKrisha FayeNo ratings yet

- Federal Constitution of the United States of MexicoFrom EverandFederal Constitution of the United States of MexicoNo ratings yet

- Succession Digests 2Document13 pagesSuccession Digests 2Wresen Ann JavaluyasNo ratings yet

- Insurance Digest ConcealmentDocument4 pagesInsurance Digest ConcealmentWresen Ann JavaluyasNo ratings yet

- Ramon B. de Los Reyes and Zoilo P. Perlas For Plaintiffs-Appellants. Villamor & Gancayco For Defendants-AppelleesDocument2 pagesRamon B. de Los Reyes and Zoilo P. Perlas For Plaintiffs-Appellants. Villamor & Gancayco For Defendants-AppelleesWresen Ann JavaluyasNo ratings yet

- One Day Someone Will Sweep You Off Your Feet: Angelo CaerlangDocument3 pagesOne Day Someone Will Sweep You Off Your Feet: Angelo CaerlangWresen Ann JavaluyasNo ratings yet

- People Vs LIMDocument17 pagesPeople Vs LIMWresen Ann JavaluyasNo ratings yet

- Semblante Vs CADocument1 pageSemblante Vs CAWresen Ann JavaluyasNo ratings yet

- Republic of The Philippines Manila First DivisionDocument6 pagesRepublic of The Philippines Manila First DivisionWresen Ann JavaluyasNo ratings yet

- Roma Drug Vs Glaxo SmithDocument3 pagesRoma Drug Vs Glaxo SmithChe RylNo ratings yet

- Wellex V SandiganbayanDocument1 pageWellex V SandiganbayanWresen Ann JavaluyasNo ratings yet

- Facts:: Exemption Against GarnishmentDocument6 pagesFacts:: Exemption Against GarnishmentWresen Ann JavaluyasNo ratings yet

- Ejercito V SBDocument2 pagesEjercito V SBWresen Ann JavaluyasNo ratings yet

- Doctrine:: Credit - 6 Producers Bank of The Philippines Vs CA (2003)Document10 pagesDoctrine:: Credit - 6 Producers Bank of The Philippines Vs CA (2003)Wresen Ann JavaluyasNo ratings yet

- Punjab Excise and Property Tax LawDocument4 pagesPunjab Excise and Property Tax LawNishat AhmedNo ratings yet

- Module 3: The Professionals and Practitioners in The Discipline of CommunicationDocument8 pagesModule 3: The Professionals and Practitioners in The Discipline of CommunicationColeen gaboy100% (2)

- Republic v. CA (172S1)Document12 pagesRepublic v. CA (172S1)RMC PropertyLawNo ratings yet

- Contemporary Criminological TheoriesDocument76 pagesContemporary Criminological TheoriesSiu HeiNo ratings yet

- Gujjar ST Tender DocumentsDocument21 pagesGujjar ST Tender DocumentsSYED TANVEERNo ratings yet

- Resolution Legleg SKDocument3 pagesResolution Legleg SKLaurice Morta PaduaNo ratings yet

- Co Kim Cham vs. Tan Keh and DizonDocument2 pagesCo Kim Cham vs. Tan Keh and DizonMARIANNE DILANGALENNo ratings yet

- 01 Jose J. Ferrer JR V City Mayor Herbert Bautista Et Al GR 210551 June 30 2015Document4 pages01 Jose J. Ferrer JR V City Mayor Herbert Bautista Et Al GR 210551 June 30 2015Nojoma PangandamanNo ratings yet

- MR. MOMODU OSENI TKTDocument1 pageMR. MOMODU OSENI TKToseni momoduNo ratings yet

- Memorandum of Agreement SampleDocument3 pagesMemorandum of Agreement SampleFatMan87No ratings yet

- Director of Lands Vs IACDocument5 pagesDirector of Lands Vs IACVikki AmorioNo ratings yet

- Chega de Saudade: No More BluesDocument5 pagesChega de Saudade: No More BluesEslam HosnyNo ratings yet

- Tsu - Trp.nic - in Pcpis Download Appendix-1 47Document1 pageTsu - Trp.nic - in Pcpis Download Appendix-1 47Debashis Df50% (4)

- Policing, Custodial Torture and Human Rights: Designing A Policy Framework For PakistanDocument124 pagesPolicing, Custodial Torture and Human Rights: Designing A Policy Framework For PakistanWasimNo ratings yet

- Simple Discount: SolutionDocument3 pagesSimple Discount: Solutiondreamfever0323100% (1)

- Full Download Test Bank For Criminal Justice A Brief Introduction 12th Edition by Schmalleger PDF Full ChapterDocument36 pagesFull Download Test Bank For Criminal Justice A Brief Introduction 12th Edition by Schmalleger PDF Full Chapterbibberbombycid.p13z100% (18)

- Pulleys and Tension: Engr. Princess Edynette L. PintoDocument16 pagesPulleys and Tension: Engr. Princess Edynette L. PintoJeromeNo ratings yet

- RFBT-07-01a Law On Obligations Notes With MCQs Practice SetDocument110 pagesRFBT-07-01a Law On Obligations Notes With MCQs Practice SetAiza S. Maca-umbosNo ratings yet

- ITB 2021-03 Board Resolution No. 80, 81, 82, 84 & 85 Series of 2021Document2 pagesITB 2021-03 Board Resolution No. 80, 81, 82, 84 & 85 Series of 2021DASURECOWebTeamNo ratings yet

- Kasai Reiko V Annie Lor Lee Fong & Ors (Public Bank BHD, Intervener)Document27 pagesKasai Reiko V Annie Lor Lee Fong & Ors (Public Bank BHD, Intervener)norleena jNo ratings yet