Professional Documents

Culture Documents

Weekly Analysis by Uday Week 1 Impact of The Pandemic On India'S International Trade

Uploaded by

VivekOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Weekly Analysis by Uday Week 1 Impact of The Pandemic On India'S International Trade

Uploaded by

VivekCopyright:

Available Formats

WEEKLY ANALYSIS

BY UDAY

ABSTRACT

The COVID-19 pandemic is inflicting high and

rising human costs worldwide, and the

necessary protection measures are severely

impacting economic activity. As a result of the

pandemic, India announced its first nation-

wide lockdown in March, which led to the

economic slowdown. Consequently, India’s

international trade took a huge hit as well.

The objective of this report is to analyze and

compare the trends of India’s imports and

exports in the wake of the current pandemic,

to determine the causes of disparities

WEEKLY

WEEK 1 ANALYSIS BY UDAY

between them as well as to suggest the way

forward.

IMPACT OF THE PANDEMIC ON Uday Arora

INDIA’S INTERNATIONAL TRADE M.A. Economics

(with specialisation in Trade & Finance)

Indian Institute of Foreign Trade

2019 - 2021

WEEKLY ANALYSIS BY UDAY

TABLE OF CONTENTS

NO. CONTENTS PAGE NUMBER

1. Overview 2

2. Trade Trend: Exports 3

3. Trade Trend: Imports 4

4. Exports v/s Imports 5

5. Conclusion & Way Forward 6

1|Page https://www.linkedin.com/in/uday -arora-b5a37a125/

WEEKLY ANALYSIS BY UDAY

OVERVIEW

The world is witnessing the carnage of the novel

coronavirus (COVID-19) pandemic. There has

been a significant loss of human lives and the

global economy has also felt the impact

severely. Global markets are in free fall with

supply-chain disruption and manufacturing

falling to the lowest levels in decades. Reduced

international trade, falling PMIs across the globe

and deep cuts in GDP forecasts for the year

indicate that we have entered the anticipated

recessionary period. With indices fluctuating

wildly and crude oil futures hitting negative

prices on the dollar, this is uncharted territory

for traders and policymakers alike.

The COVID-19 pandemic is inflicting high and

rising human costs worldwide, and the

necessary protection measures are severely

impacting economic activity. As a result of the

pandemic, India announced its first nation-wide

lockdown in March, which led to the economic

slowdown.

Consequently, India’s international trade took a

huge hit as well. This is shown as follows: -

• Between April and July, the goods imports

have fallen by 46.7% to $88.9 billion.

• In comparison, goods exports during the

same period have fallen at a much slower

pace of 30.3% to $74.9 billion.

2|Page https://www.linkedin.com/in/uday -arora-b5a37a125/

WEEKLY ANALYSIS BY UDAY

TRADE TREND: EXPORTS

In June 2020, India’s exports trailed their June 2019 numbers by 12%. In

July 2020, the gap to July 2019 was 10%.

On the face of it, these are not bad numbers for a segment that tumbled

60% in April and is trying to claw back lost ground.

But one caveat is called for: -

➢ India’s exports have had a difficult time in recent years. In 2019-20,

the year against which current performance is being benchmarked,

India’s exports fell 5%, shows data from India’s central bank.

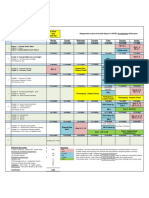

Increase/Decrease in India's Exports in June 2020 (in %)

90

80 77.8

74.7

70

60

50

42.7

40 34.6

30

20

10

-6.3 -11.3

0

-10 China Malaysia Vietnam Singapore Brazil US

-20

➢ India’s exports to China, Singapore, Malaysia, and Vietnam went up

in June as these countries have managed to flatten the covid-19

curve.

➢ Exports to the US and Brazil, however, declined, as they continue to

see a rise in infections.

In July, there’s been positive growth in exports to north-east Asia

(including China and South Korea) and ASEAN countries (including

Malaysia, Singapore and Vietnam). By comparison, exports to North

America, European Union and West Asia have shrunk.

3|Page https://www.linkedin.com/in/uday -arora-b5a37a125/

WEEKLY ANALYSIS BY UDAY

TRADE TREND: IMPORTS

In June 2020, imported commodities such as gold, coal and petroleum

products faced more than 50 percent decline as compared to June 2019.

On the other hand, electronic goods were least affected.

Decrease in India's Imports in June 2020 (in %)

-34.05 Electronic goods

-42.02 Electrical & non-electrical machinery

-55.29 Crude petroleum & its products

-55.72 Coal, coke & briquettes

-77.42 Gold

-100 -80 -60 -40 -20 0

• Why have imports crashed by 46.7%?

A major reason for the overall decline in imports is the drop in oil and

oil products imports, which have plunged by a whopping 55.9% to

$19.6 billion. The lack of mobility due to the spread of the coronavirus

pandemic has led to the consumption of petroleum products coming

down by 22.50% between April and July.

• What else is behind the crash in imports?

Due to the spread of covid-19, incomes have been substantially hit,

causing consumption to fall. And this general lack of demand has

shown up in imports crashing. The non-oil, non-gold, non-silver

imports, —an excellent indicator of consumer demand—have fallen by

38.6% to. $66 billion. Along similar lines, a demand crash in other

countries dealing with COVID, has led to a decline in demand for goods

from India. This has led the exports to crash by 30.3% to $74.9 billion.

4|Page https://www.linkedin.com/in/uday -arora-b5a37a125/

WEEKLY ANALYSIS BY UDAY

EXPORTS V/S IMPORTS

A deceleration in goods imports at a time exports are rising faster

suggests that domestic demand in the country is recovering much more

slowly compared to other countries. A comparison of the resulting import

and export levels due to the pandemic is shown as follows: -

India's exports have done better than imports

in bouncing back to 2019 levels

• Why have imports fallen at a faster pace than exports?

India’s exports have declined at a slower pace simply because some of

India’s trading partners faced the COVID pandemic earlier than India

did, and their economies are gradually getting back on track. As the

rating agency CRISIL pointed out in a recent research note, there has

been a “rise in exports to economies which have been able to control

the pandemic”.

The recovery

in exports is

also more

broad-based

than the one

in imports.

5|Page https://www.linkedin.com/in/uday -arora-b5a37a125/

WEEKLY ANALYSIS BY UDAY

CONCLUSION & WAY FORWARD

India is again pitching to become an alternative investment destination

for big global businesses in the hope that the COVID-19 pandemic would

prompt them to hedge their China-dependent supply chains. But

investment moves are a longer-term play. Meanwhile, Indian exporters

shouldn’t be caught on the back foot as bigger stimulus packages,

announced by other countries, kick in to revive demand and give a minor

fillip to international trade.

India has swung to extremes during the pandemic. Data from the

Organisation for Economic Co-operation and Development (OECD) shows

that India suffered the second-largest monthly drop in exports in April,

the worst month of the pandemic. Subsequently, it was ranked third in

monthly increase in May and seventh in June. In other words, India’s

exports are recovering, but they are doing so on a low base, and

fundamental issues on how to become more competitive globally remain.

Becoming more competitive is a long-term task. In the near term, the

objective would be to at least revert to the old normal, and the recent

trade data suggests reasons for hope.

As CRISIL points out: “Export prospects for this fiscal will pivot on the

trajectory of the pandemic across countries. It will rise for countries that

have controlled their caseload and restarted activity. China is a case in

point. China entered and controlled the pandemic much earlier than other

economies. Its cases peaked in February, post which activities resumed.”

This is precisely how things will play out with other nations when it comes

to exports.

END OF REPORT

6|Page https://www.linkedin.com/in/uday -arora-b5a37a125/

You might also like

- MCOM-presentation-ALI SHER (2018-Ag-3423)Document22 pagesMCOM-presentation-ALI SHER (2018-Ag-3423)ALI SHER HaidriNo ratings yet

- Commerce English 2020 21Document230 pagesCommerce English 2020 21Durai PandianNo ratings yet

- Blah.. BlahhDocument95 pagesBlah.. BlahhBhalaNo ratings yet

- COVID19 Impact Oman - Final 19 April 2020Document27 pagesCOVID19 Impact Oman - Final 19 April 2020Sumant AggNo ratings yet

- Impact of COVID 19 On GJ 20sector2020Document36 pagesImpact of COVID 19 On GJ 20sector2020Yash GuptaNo ratings yet

- Covid-19 and Its Impact On Indian EconomyDocument8 pagesCovid-19 and Its Impact On Indian EconomyDr Shubhi AgarwalNo ratings yet

- Principle of Economics Assignment: RecessionDocument9 pagesPrinciple of Economics Assignment: RecessionSrikanth RevellyNo ratings yet

- COVID-19 and Indian Economy: Impact On Growth, Manufacturing, Trade and MSME SectorDocument25 pagesCOVID-19 and Indian Economy: Impact On Growth, Manufacturing, Trade and MSME SectorVipul ManglaNo ratings yet

- Group Project ReportDocument7 pagesGroup Project ReportRajat KumarNo ratings yet

- Covid-19 Impact On Indian Economy and Supply ChainDocument11 pagesCovid-19 Impact On Indian Economy and Supply ChainShubham JindalNo ratings yet

- Impacts of Covid-19 On International Trade: Evidence From The First Quarter of 2020Document26 pagesImpacts of Covid-19 On International Trade: Evidence From The First Quarter of 2020Muhammad AsrulNo ratings yet

- India Is Among The 15 Most Affected Economies Due To The Coronavirus Epidemic and Slow Down in Production in ChinaDocument11 pagesIndia Is Among The 15 Most Affected Economies Due To The Coronavirus Epidemic and Slow Down in Production in ChinaSaravana BalaNo ratings yet

- University of Agriculture Faisalabad: (Special Problem) Submitted byDocument21 pagesUniversity of Agriculture Faisalabad: (Special Problem) Submitted byALI SHER HaidriNo ratings yet

- COVID-19 and Impact On Export Sector in Sri Lanka: Janaka WijayasiriDocument14 pagesCOVID-19 and Impact On Export Sector in Sri Lanka: Janaka WijayasiriShehan AnuradaNo ratings yet

- The Impact of COVID 19 On China S Trade and Outward FDI and Related CountermeasuresDocument11 pagesThe Impact of COVID 19 On China S Trade and Outward FDI and Related CountermeasuresMatheus F. FröhlichNo ratings yet

- International BusinessDocument23 pagesInternational BusinessMohammed MujahidNo ratings yet

- Covid 19 PrashanthDocument11 pagesCovid 19 Prashanthkochanparambil abdulNo ratings yet

- COVID - 19 and Global Commerce: An Analysis of FMCG, and Retail Industries of TomorrowDocument24 pagesCOVID - 19 and Global Commerce: An Analysis of FMCG, and Retail Industries of TomorrowJasleen kaurNo ratings yet

- The Impact of Covid-19 On The Indian Economy.Document22 pagesThe Impact of Covid-19 On The Indian Economy.Mahira SarafNo ratings yet

- Updated COVID-19 Impact On FDIDocument9 pagesUpdated COVID-19 Impact On FDImaahumNo ratings yet

- 7887 21355 1 PBDocument18 pages7887 21355 1 PBvNo ratings yet

- IBM556 Case Study ReportDocument4 pagesIBM556 Case Study ReportFaiz FahmiNo ratings yet

- AdenomonDocument23 pagesAdenomonsakina razaNo ratings yet

- Admin,+1 +Rossanto+Dwi+Document5 pagesAdmin,+1 +Rossanto+Dwi+Asri DinzNo ratings yet

- Impact of Covid-19 On Economy FinalDocument11 pagesImpact of Covid-19 On Economy FinalIjcams PublicationNo ratings yet

- Presentation IntlEcoDocument17 pagesPresentation IntlEcoوسيم أكرمNo ratings yet

- Synopsis: Impact of COVID-19 On Indian Industry: Challenges and OpportunitiesDocument7 pagesSynopsis: Impact of COVID-19 On Indian Industry: Challenges and OpportunitiesSarita MoreNo ratings yet

- Current Trends in Indian Economy: Presented By: Shaheen Fathima VTP No.1366 To: DR - ManojDocument11 pagesCurrent Trends in Indian Economy: Presented By: Shaheen Fathima VTP No.1366 To: DR - ManojmanojNo ratings yet

- Highlights of Eco Survey 2022-23 14-02Document97 pagesHighlights of Eco Survey 2022-23 14-02CHHAVI GOYALNo ratings yet

- Covid 19 How To Minimize Uncertainties, Increase Confidence and Achieve Economic Stability in IndiaDocument5 pagesCovid 19 How To Minimize Uncertainties, Increase Confidence and Achieve Economic Stability in IndiaEditor IJTSRDNo ratings yet

- Covid EssayDocument6 pagesCovid EssayAlbar RizwanNo ratings yet

- Economics StatsDocument25 pagesEconomics StatsYashasvi SharmaNo ratings yet

- (130-133) Impact of Covid-19 On Indian EconomyDocument4 pages(130-133) Impact of Covid-19 On Indian EconomyDeepa VishwakarmaNo ratings yet

- KPMG Valuation ReportDocument14 pagesKPMG Valuation ReportShrinivas PuliNo ratings yet

- Online Training Program (OTP) 2020 Subject: Current Affairs Assignment #1Document4 pagesOnline Training Program (OTP) 2020 Subject: Current Affairs Assignment #1vishal sinhaNo ratings yet

- Canada EconomicsDocument5 pagesCanada EconomicsSanJana NahataNo ratings yet

- The Impactofthe COVID19 Pandemicon Firm PerformanceDocument20 pagesThe Impactofthe COVID19 Pandemicon Firm PerformanceやたなあはあやたNo ratings yet

- The Impact of Covid-19 On Organized Retailing in India.: September 2020Document5 pagesThe Impact of Covid-19 On Organized Retailing in India.: September 2020Sushmita Boble A - 11No ratings yet

- English Annual Report 2021 22 Department of CommerceDocument240 pagesEnglish Annual Report 2021 22 Department of CommerceRonu CherianNo ratings yet

- English ReportwrittingDocument4 pagesEnglish Reportwrittingsow sowNo ratings yet

- Covid Vaccine Market Demand - EconomicsDocument14 pagesCovid Vaccine Market Demand - EconomicsPooja ShekhawatNo ratings yet

- 1613021865economy Matters December 2020 - Gems & JewelleryDocument33 pages1613021865economy Matters December 2020 - Gems & Jewellerysara eltonyNo ratings yet

- Economic Impact of COVID-19 Lock Down On Small Medium Enterprise (Smes) in Lagos StateDocument7 pagesEconomic Impact of COVID-19 Lock Down On Small Medium Enterprise (Smes) in Lagos StateresearchparksNo ratings yet

- Connecting Macros: Relation Between GDP and Covid 19Document9 pagesConnecting Macros: Relation Between GDP and Covid 19Zea ZakeNo ratings yet

- Impact of Covid-19.Document6 pagesImpact of Covid-19.Pratik WankhedeNo ratings yet

- Covid-19 ResearchDocument8 pagesCovid-19 ResearchShreya RaoNo ratings yet

- Group 5 (FIN 3301)Document10 pagesGroup 5 (FIN 3301)Marilyn MonroeNo ratings yet

- Effect of COVID-19 On The Indian Economy and Supply ChainDocument12 pagesEffect of COVID-19 On The Indian Economy and Supply ChainHrishabhNo ratings yet

- Macroeconomics: Assignment COVID-19: Macroeconomic Implications For IndiaDocument4 pagesMacroeconomics: Assignment COVID-19: Macroeconomic Implications For IndiaRAGHAV MISHRANo ratings yet

- Impact of Corona Virus On Global EconomyDocument10 pagesImpact of Corona Virus On Global EconomyAsif Sadat 1815274060No ratings yet

- Impact-of-COVID-19-on-Indian-Economy-FICCI 2003Document21 pagesImpact-of-COVID-19-on-Indian-Economy-FICCI 2003Uttam Gogoi100% (3)

- Global Impact On Economy During Covid-19Document18 pagesGlobal Impact On Economy During Covid-19Shivam NirwanaNo ratings yet

- 08 Trade and PaymentsDocument26 pages08 Trade and PaymentsMuhammad BilalNo ratings yet

- AkshitaDocument8 pagesAkshitacezam486No ratings yet

- Himanshi Popli (Synopsis)Document12 pagesHimanshi Popli (Synopsis)AmanNo ratings yet

- Impact of Covid 19 On Stock MarektDocument51 pagesImpact of Covid 19 On Stock MarektVinay GangwarNo ratings yet

- Impact of Covid-19: How The World Is Changing For The WorseDocument17 pagesImpact of Covid-19: How The World Is Changing For The Worsenaziba aliNo ratings yet

- Economic Impact of CovidDocument7 pagesEconomic Impact of Covidrishi pereraNo ratings yet

- Last Covid 19Document3 pagesLast Covid 19prince khanNo ratings yet

- AMC Diary 2008Document232 pagesAMC Diary 2008bhaveshbhoiNo ratings yet

- Math Series Course 1 Student Assignments Chapter 6Document14 pagesMath Series Course 1 Student Assignments Chapter 6api-261894355No ratings yet

- Corp SolsDocument90 pagesCorp Solssayray55100% (1)

- Causes of Industrial DisputesDocument2 pagesCauses of Industrial DisputesZÅîb MëýmÖñNo ratings yet

- Jaypee InfraDocument8 pagesJaypee InfraArshit AgarwalNo ratings yet

- Sample PaperDocument5 pagesSample Papervenika.batrviiiNo ratings yet

- MaterialDocument8 pagesMaterialPrasanna SharmaNo ratings yet

- Courtney Guffey Weebly ResumeDocument1 pageCourtney Guffey Weebly Resumeapi-403940799No ratings yet

- Radle To CradleDocument193 pagesRadle To CradleAlessandra Rastelli100% (1)

- CH 08Document43 pagesCH 08Liyana Chua100% (1)

- ValuTeachers Path To GreatnessDocument12 pagesValuTeachers Path To GreatnessScott DauenhauerNo ratings yet

- Inflation. Interest Rates. Balance of Payments. Government Intervention. Other FactorsDocument2 pagesInflation. Interest Rates. Balance of Payments. Government Intervention. Other FactorsEmmanuelle RojasNo ratings yet

- 8-Week Web 2nd Half: Chapter 1 - Personal Finance Basics Chapter 2 - Career Chapter 3-Financial Statements and BudgetsDocument1 page8-Week Web 2nd Half: Chapter 1 - Personal Finance Basics Chapter 2 - Career Chapter 3-Financial Statements and BudgetsArianna KelawalaNo ratings yet

- Boarding PassDocument1 pageBoarding Passക്രിസ്റ്റഫർ ട്രോളൻNo ratings yet

- Kualitas Pelayanan Jasa Penerbangan PT Garuda IndonesiaDocument11 pagesKualitas Pelayanan Jasa Penerbangan PT Garuda Indonesiachindy sulistyNo ratings yet

- Introduction To Geotechnical EngineeringDocument25 pagesIntroduction To Geotechnical EngineeringgeethaNo ratings yet

- Aonla PDFDocument4 pagesAonla PDFRajNo ratings yet

- CHP Clean Energy SolutionDocument24 pagesCHP Clean Energy SolutionFrank MtetwaNo ratings yet

- Financial Markets and ServicesDocument3 pagesFinancial Markets and Serviceshussainmba30No ratings yet

- Banks and Bank DetailsDocument3 pagesBanks and Bank DetailsDeepa KrishnamurthyNo ratings yet

- Answer Key Cbse Sample Papers For Class 8 Social Science FA 2Document3 pagesAnswer Key Cbse Sample Papers For Class 8 Social Science FA 2SoumitraBagNo ratings yet

- EconomicsDocument14 pagesEconomicsravenNo ratings yet

- Great Depression (1) - 1Document26 pagesGreat Depression (1) - 1Tara Holder StewartNo ratings yet

- Multifan Galvanized Box Fan ENDocument4 pagesMultifan Galvanized Box Fan ENNguyễnHồngPhongNo ratings yet

- Calculating Days Sales OutstandingDocument3 pagesCalculating Days Sales Outstandingakak0% (1)

- AWESOME Forex Trading Strategy (Never Lose Again) 2Document6 pagesAWESOME Forex Trading Strategy (Never Lose Again) 2Pekik Bayu Prakoso100% (1)

- Sample Report WritingDocument6 pagesSample Report WritingdeathmoonkillerNo ratings yet

- TrapsDocument11 pagesTrapsAmandeep AroraNo ratings yet

- Lesson Under Cover BossDocument4 pagesLesson Under Cover BossAbhishek PokhrelNo ratings yet

- List of Variables To Be Used in CapstoneDocument2 pagesList of Variables To Be Used in CapstoneErn TNo ratings yet

- Reagan at Reykjavik: Forty-Eight Hours That Ended the Cold WarFrom EverandReagan at Reykjavik: Forty-Eight Hours That Ended the Cold WarRating: 4 out of 5 stars4/5 (4)

- From Cold War To Hot Peace: An American Ambassador in Putin's RussiaFrom EverandFrom Cold War To Hot Peace: An American Ambassador in Putin's RussiaRating: 4 out of 5 stars4/5 (23)

- How Everything Became War and the Military Became Everything: Tales from the PentagonFrom EverandHow Everything Became War and the Military Became Everything: Tales from the PentagonRating: 4 out of 5 stars4/5 (40)

- How States Think: The Rationality of Foreign PolicyFrom EverandHow States Think: The Rationality of Foreign PolicyRating: 5 out of 5 stars5/5 (7)

- Conflict: The Evolution of Warfare from 1945 to UkraineFrom EverandConflict: The Evolution of Warfare from 1945 to UkraineRating: 4.5 out of 5 stars4.5/5 (2)

- No Trade Is Free: Changing Course, Taking on China, and Helping America's WorkersFrom EverandNo Trade Is Free: Changing Course, Taking on China, and Helping America's WorkersRating: 5 out of 5 stars5/5 (2)

- The Israel Lobby and U.S. Foreign PolicyFrom EverandThe Israel Lobby and U.S. Foreign PolicyRating: 4 out of 5 stars4/5 (13)

- Epicenter: Why the Current Rumblings in the Middle East Will Change Your FutureFrom EverandEpicenter: Why the Current Rumblings in the Middle East Will Change Your FutureRating: 4 out of 5 stars4/5 (22)

- The Tragic Mind: Fear, Fate, and the Burden of PowerFrom EverandThe Tragic Mind: Fear, Fate, and the Burden of PowerRating: 4 out of 5 stars4/5 (14)

- Cry from the Deep: The Sinking of the KurskFrom EverandCry from the Deep: The Sinking of the KurskRating: 3.5 out of 5 stars3.5/5 (6)

- New Cold Wars: China’s rise, Russia’s invasion, and America’s struggle to defend the WestFrom EverandNew Cold Wars: China’s rise, Russia’s invasion, and America’s struggle to defend the WestNo ratings yet

- The Bomb: Presidents, Generals, and the Secret History of Nuclear WarFrom EverandThe Bomb: Presidents, Generals, and the Secret History of Nuclear WarRating: 4.5 out of 5 stars4.5/5 (41)

- Catch-67: The Left, the Right, and the Legacy of the Six-Day WarFrom EverandCatch-67: The Left, the Right, and the Legacy of the Six-Day WarRating: 4.5 out of 5 stars4.5/5 (26)

- The Generals Have No Clothes: The Untold Story of Our Endless WarsFrom EverandThe Generals Have No Clothes: The Untold Story of Our Endless WarsRating: 3.5 out of 5 stars3.5/5 (3)

- Palestine Peace Not Apartheid: Peace Not ApartheidFrom EverandPalestine Peace Not Apartheid: Peace Not ApartheidRating: 4 out of 5 stars4/5 (197)

- A World of Enemies: America's Wars at Home and Abroad from Kennedy to BidenFrom EverandA World of Enemies: America's Wars at Home and Abroad from Kennedy to BidenNo ratings yet

- Summary: The End of the World Is Just the Beginning: Mapping the Collapse of Globalization By Peter Zeihan: Key Takeaways, Summary & AnalysisFrom EverandSummary: The End of the World Is Just the Beginning: Mapping the Collapse of Globalization By Peter Zeihan: Key Takeaways, Summary & AnalysisRating: 4.5 out of 5 stars4.5/5 (2)

- The Prize: The Epic Quest for Oil, Money, and PowerFrom EverandThe Prize: The Epic Quest for Oil, Money, and PowerRating: 4 out of 5 stars4/5 (47)

- Human Intelligence Collector OperationsFrom EverandHuman Intelligence Collector OperationsNo ratings yet

- Dereliction of Duty: Johnson, McNamara, the Joint Chiefs of StaffFrom EverandDereliction of Duty: Johnson, McNamara, the Joint Chiefs of StaffRating: 4 out of 5 stars4/5 (61)

- The Revenge of Geography: What the Map Tells Us About Coming Conflicts and the Battle Against FateFrom EverandThe Revenge of Geography: What the Map Tells Us About Coming Conflicts and the Battle Against FateRating: 4.5 out of 5 stars4.5/5 (93)

- Destined For War: Can America and China Escape Thucydides's Trap?From EverandDestined For War: Can America and China Escape Thucydides's Trap?Rating: 4 out of 5 stars4/5 (50)

- Crisis: The Anatomy of Two Major Foreign Policy CrisesFrom EverandCrisis: The Anatomy of Two Major Foreign Policy CrisesRating: 4.5 out of 5 stars4.5/5 (7)

- This Is How They Tell Me the World Ends: The Cyberweapons Arms RaceFrom EverandThis Is How They Tell Me the World Ends: The Cyberweapons Arms RaceRating: 4 out of 5 stars4/5 (75)