Professional Documents

Culture Documents

Value Research Stock Advisor

Uploaded by

tansnvarma0 ratings0% found this document useful (0 votes)

23 views5 pagessmall cap best

Original Title

small-cap-23-Sep-2020--2200

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentsmall cap best

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

23 views5 pagesValue Research Stock Advisor

Uploaded by

tansnvarmasmall cap best

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 5

Value Research Stock Advisor

Generated on: 23-Sep-2020 22:00

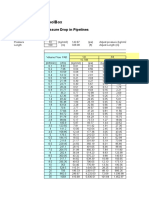

Company Sector Industry Date

Amrutanjan Health Care Healthcare Drugs & Pharma 2020-09-23 15:57:22

Bhansali Engineering Pol Chemicals Thermoplastics 2020-09-23 15:59:28

Cheviot Co. Ltd. Textiles Jute prod. 2020-09-23 00:00:00

Dhanuka Agritech Ltd. Chemicals Pesticides 2020-09-23 15:57:20

Diamines & Chemicals LtChemicals Organic Chemicals 2020-09-23 00:00:00

Elantas Beck India Ltd Chemicals Misc.Chem. 2020-09-23 00:00:00

Esab India Ltd. Engineering Welding machinery 2020-09-23 15:57:21

Excel Industries Ltd. Chemicals Pesticides 2020-09-23 15:57:21

FDC Ltd. Healthcare Drugs & Pharma 2020-09-23 15:59:40

Finolex Industries Ltd. Chemicals Other Plastic Prod. 2020-09-23 15:57:21

Firstsource Solutions Ltd Services Misc.Other Services 2020-09-23 15:58:35

Garware Technical FibresTextiles Misc.Textiles 2020-09-23 15:58:51

Heidelberg Cement IndiaConstruction Cement 2020-09-23 15:59:35

India Nippon Electricals Automobile Auto Ancillaries 2020-09-23 15:57:22

JB Chemicals & PharmaceHealthcare Drugs & Pharma 2020-09-23 15:59:39

Nesco Ltd. Diversified Diversified 2020-09-23 15:57:20

Nucleus Software ExportsTechnology Computer Software 2020-09-23 15:59:42

Orient Refractories Limi Construction Refractories 2020-09-23 15:57:24

Paushak Ltd Chemicals Pesticides 2020-09-23 00:00:00

Polyplex Corporation LtdChemicals Plastic Films 2020-09-23 15:57:20

Procter & Gamble HealthHealthcare Drugs & Pharma 2020-09-23 15:57:20

Rane Brake Linings Ltd. Automobile Auto Ancillaries 2020-09-23 15:57:21

Swaraj Engines Ltd. Automobile Auto Ancillaries 2020-09-23 15:57:21

Ultramarine & Pigments Chemicals Dyes & Pigments 2020-09-23 00:00:00

Vaibhav Global Ltd. Cons Durable Gems & Jewellery 2020-09-23 15:59:33

West Coast Paper Mills LFMCG Paper 2020-09-23 15:57:31

Price Market Cap(Cr) Earning Yield(%) Price earnings to growth

433.85 1,268.32 3.59 3.27

62.90 1,045.21 4.84 0.24

658.70 425.97 17.18 2.84

766.10 3,642.12 6.47 3.45

427.70 418.43 9.94 0.26

2,656.05 2,105.63 2.73 18.03

1,345.30 2,078.06 4.36 1.09

897.95 1,129.79 7.62 1.27

342.60 5,854.12 6.90 2.08

511.40 6,334.45 5.78 0.43

74.95 5,196.30 7.68 2.04

1,869.25 4,086.37 4.15 1.19

179.50 4,063.17 10.51 0.13

348.70 795.14 6.02 1.18

923.10 7,119.61 6.33 0.98

555.80 3,916.87 8.19 0.99

680.20 1,982.90 8.66 1.44

192.40 2,307.87 4.39 2.95

3,905.45 1,203.70 3.79 2.15

664.25 2,099.04 40.68 0.04

4,961.85 8,233.38 3.25 1.59

543.10 427.49 6.30 7.01

1,426.30 1,731.57 4.85 6.31

245.35 716.42 10.68 0.51

1,842.60 5,988.68 4.60 1.56

175.65 1,158.50 23.14 0.04

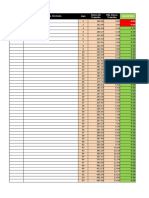

EV / EBITDA Price / Cash Flow Free Cash Flow Per Shar Free Cash Flow (FY)(Cr)

25.86 69.78 7.73 22.61

17.06 19.55 1.50 24.92

5.49 10.61 54.76 35.43

14.69 22.47 33.58 159.76

10.15 16.12 25.46 24.91

29.91 44.00 60.37 47.86

20.59 36.34 28.65 44.09

10.32 10.25 47.85 60.15

13.04 23.38 14.00 239.35

14.62 65.27 4.15 51.48

8.83 12.66 4.25 294.73

21.15 37.30 50.86 111.29

7.83 8.89 15.00 339.88

11.78 21.90 14.36 32.48

14.83 25.85 35.59 275.07

11.04 18.72 26.88 189.43

10.25 26.53 28.81 83.65

20.58 23.79 2.72 32.66

25.25 29.14 94.73 29.20

1.85 2.87 55.45 177.37

29.83 -63.15 473.93 786.73

8.12 5.82 45.69 36.14

18.02 17.38 81.41 98.77

8.60 15.06 6.09 17.80

19.05 28.05 48.80 157.51

2.55 2.94 35.58 235.03

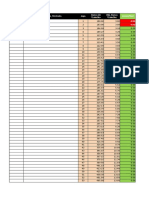

Debt to Equity Return on Equity(%) Return on Equity 5Y Avg5-Year Return(%)

0.00 16.44 17.80 16.41

0.00 16.74 21.39 34.67

0.01 10.33 12.33 12.95

0.01 20.94 21.80 11.96

0.00 42.08 20.67 70.14

0.00 13.71 22.39 16.45

0.00 23.63 13.87 19.31

0.03 13.72 14.79 28.34

0.00 16.10 15.04 10.16

0.14 13.46 14.24 14.42

0.31 12.44 14.14 22.88

0.18 20.23 20.38 42.68

0.31 21.57 13.38 19.76

0.00 16.04 13.57 14.10

0.02 18.69 14.23 28.59

0.00 18.50 20.08 15.27

0.00 16.64 13.04 23.09

0.00 21.65 26.98 18.99

0.00 17.25 20.02 34.21

0.25 17.03 13.41 25.35

0.00 73.79 23.44 45.23

0.07 15.66 19.39 13.97

0.00 30.06 28.72 10.26

0.07 20.50 16.39 26.31

0.09 26.93 20.73 37.45

0.33 30.57 16.67 24.03

Promoter's Stake(%)

50.02

56.45

74.99

75.00

54.74

75.00

73.72

52.80

69.24

52.47

53.89

50.71

69.39

66.39

55.91

68.53

67.59

66.49

66.71

50.66

51.82

66.99

52.18

52.50

58.51

56.17

You might also like

- Chinese FDI in African Countries 1990-2020Document45 pagesChinese FDI in African Countries 1990-2020fdwfwffNo ratings yet

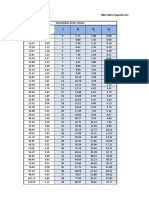

- PRESSURE DROP CALCULATORDocument6 pagesPRESSURE DROP CALCULATORSobhy GendykhelaNo ratings yet

- Aduana: Cuadro #15 - Perú: Importación para El Consumo Trimestral Por Aduanas 2014-2015 (Valores en Millones de US $)Document8 pagesAduana: Cuadro #15 - Perú: Importación para El Consumo Trimestral Por Aduanas 2014-2015 (Valores en Millones de US $)Lindzay Guerrero HuamánNo ratings yet

- FDI-China AfricaDocument39 pagesFDI-China AfricaNadia BustosNo ratings yet

- Production (In MT) Area Harvested (Ha) Wholesale (Urea) Farmgate (Palay)Document5 pagesProduction (In MT) Area Harvested (Ha) Wholesale (Urea) Farmgate (Palay)Merwin Jansen LadringanNo ratings yet

- Calcule BozDocument21 pagesCalcule BozAnca MariaNo ratings yet

- 5 Company FileDocument16 pages5 Company FileRofsana AkterNo ratings yet

- 20 Pip Challenge (Creative Currency Edition) - 3Document3 pages20 Pip Challenge (Creative Currency Edition) - 3Muhammad SufyanNo ratings yet

- Tugas Responsi Ssi - Melly (545140041)Document4 pagesTugas Responsi Ssi - Melly (545140041)Melly DeFlowNo ratings yet

- Work Stock Market Sheet LatestDocument4 pagesWork Stock Market Sheet Latestanand kumar chaubeyNo ratings yet

- Ijerph 18 02798 s001Document7 pagesIjerph 18 02798 s001ابوايمن العمراني ايمنNo ratings yet

- Gerco Export Industrial Supply Co, Inc. Excelente Proveedor de TuberíaDocument1 pageGerco Export Industrial Supply Co, Inc. Excelente Proveedor de TuberíaRoloNo ratings yet

- Captură de Ecran Din 2022-11-03 La 08.38.50Document1 pageCaptură de Ecran Din 2022-11-03 La 08.38.50chioseaalexandruNo ratings yet

- 002 Apicasing PDFDocument1 page002 Apicasing PDFAgus Rizki DarmawanNo ratings yet

- Pile SetlementDocument18 pagesPile SetlementAli_nauman429458No ratings yet

- Api Casing Table Specification: by M.HirschfeldtDocument1 pageApi Casing Table Specification: by M.HirschfeldtJorge MendezNo ratings yet

- Ejercicio Dovelasz ExamenDocument1 pageEjercicio Dovelasz ExamenMaria GuadalupeNo ratings yet

- Converison TorquesDocument2 pagesConverison TorquesSalvador Manuel Rocha CastilloNo ratings yet

- TBP Lavan NewDocument3 pagesTBP Lavan NewRoni SetiawanNo ratings yet

- 25-yr station data rainfall and temperature analysisDocument8 pages25-yr station data rainfall and temperature analysisTalha BhuttoNo ratings yet

- 20 Pip Challenge (Creative Currency Edition)Document2 pages20 Pip Challenge (Creative Currency Edition)PritamNo ratings yet

- Level WW Perhitungan Debit TanggalDocument20 pagesLevel WW Perhitungan Debit TanggalMultindo Barra KaryaNo ratings yet

- M/M/1 Queue AnalysisDocument5 pagesM/M/1 Queue AnalysisEaston GriffinNo ratings yet

- Proyecto Nuevo AlausiDocument16 pagesProyecto Nuevo AlausiSantiago CujiNo ratings yet

- 300zx 1991 FSM SearchableDocument1,248 pages300zx 1991 FSM SearchableMilka Tesla100% (2)

- AWG Specifications TableDocument6 pagesAWG Specifications TableMaralo SinagaNo ratings yet

- r290 Propane PT ChartDocument2 pagesr290 Propane PT ChartAnujKumarMishra100% (3)

- r290 Propane PT ChartDocument2 pagesr290 Propane PT ChartPrashantNo ratings yet

- Head Losses (Tables) : Ater YcleDocument1 pageHead Losses (Tables) : Ater YcleAnilduth BaldanNo ratings yet

- John Neff 22 Sep 2020 1116Document5 pagesJohn Neff 22 Sep 2020 1116Debashish Priyanka SinhaNo ratings yet

- Quantity Between OGL & ETL (0/0 TO 8/0) : Rajdongari-Devnala-Chatva-Pipalpani-Tee Gaon Road KM 0/0 To 16/080Document8 pagesQuantity Between OGL & ETL (0/0 TO 8/0) : Rajdongari-Devnala-Chatva-Pipalpani-Tee Gaon Road KM 0/0 To 16/080popemiNo ratings yet

- 000 Abc 3Document51 pages000 Abc 3nelson jose romero montielNo ratings yet

- SE S&P Mid-Cap Company Financial MetricsDocument80 pagesSE S&P Mid-Cap Company Financial MetricsAnjali BhatiaNo ratings yet

- Data Set 13b: New Feed To Cyclone BM CCT Feed Cyclone Feed Cyclone U/f BM Discharge Cyclone O/fDocument3 pagesData Set 13b: New Feed To Cyclone BM CCT Feed Cyclone Feed Cyclone U/f BM Discharge Cyclone O/fMarko Meneses PlascenciaNo ratings yet

- Table EII Financial Ratios Over TimeDocument7 pagesTable EII Financial Ratios Over TimeAyush KapoorNo ratings yet

- Setiembre - 2018: Yu Li YenDocument54 pagesSetiembre - 2018: Yu Li YenelizabethNo ratings yet

- Propylene PT ChartDocument2 pagesPropylene PT ChartbillNo ratings yet

- Section I: Pipes Flowing Under Pressure Tables For Discharge and Loss of Head and PowerDocument42 pagesSection I: Pipes Flowing Under Pressure Tables For Discharge and Loss of Head and PowerVishakha PatelNo ratings yet

- Compare Common Size Balance Sheet (Dabur & Itc)Document4 pagesCompare Common Size Balance Sheet (Dabur & Itc)gunn RastogiNo ratings yet

- Kalyan JewellersDocument8 pagesKalyan Jewellersaarushikhunger12No ratings yet

- Trading Plan 100 Hari: Hari Modal Profit 10% Modal Akhir Rupiah Kurs 15,000Document3 pagesTrading Plan 100 Hari: Hari Modal Profit 10% Modal Akhir Rupiah Kurs 15,000Dani SetiawanNo ratings yet

- Tabla de Equivalencias de Valores DCP Vrs CBRDocument1 pageTabla de Equivalencias de Valores DCP Vrs CBRJulesNo ratings yet

- Carriage of Materials Data Sheet No 1 For Analysis of Rates: Code Unit Rate Day Day Day Litre LitreDocument14 pagesCarriage of Materials Data Sheet No 1 For Analysis of Rates: Code Unit Rate Day Day Day Litre LitreRatnesh PatelNo ratings yet

- Value Research Online Company Face Value Price at Par Prices 1-Day Return 1-Week Return 515.90 2579.50Document2 pagesValue Research Online Company Face Value Price at Par Prices 1-Day Return 1-Week Return 515.90 2579.50nitmemberNo ratings yet

- Pounds To Kilograms Conversion ChartDocument1 pagePounds To Kilograms Conversion ChartNick MomrikNo ratings yet

- Final HDRT Pte PavónDocument6 pagesFinal HDRT Pte PavónNestor Javier Lanza MejiaNo ratings yet

- Tracking LogDocument99 pagesTracking LoghellocproNo ratings yet

- 3Document81 pages3Suraj DasNo ratings yet

- Report Date 1-Jan-15 Data Date 31-Dec-14: Distribution of Active Companies With Respect To Sub DescriptionDocument6 pagesReport Date 1-Jan-15 Data Date 31-Dec-14: Distribution of Active Companies With Respect To Sub DescriptionShobhit SharmaNo ratings yet

- Approximate Generator Fuel Consumption ChartDocument1 pageApproximate Generator Fuel Consumption Chartankur yadavNo ratings yet

- Sch40Pipe FrictionLossDocument2 pagesSch40Pipe FrictionLossdaud heruNo ratings yet

- General Government Revenues and Expenditures OverviewDocument12 pagesGeneral Government Revenues and Expenditures OverviewBilge SavaşNo ratings yet

- Gestao de BancaDocument25 pagesGestao de BancaSergio JuniorNo ratings yet

- Data Table Bank SimulationDocument25 pagesData Table Bank SimulationRafael SilvaNo ratings yet

- Control de Ingreso: Anexo 01 Expediente Control de Ingreso RCA/SVT/AF/VDF/FP/2023-0056 DE FECHA 22/02/2023Document2 pagesControl de Ingreso: Anexo 01 Expediente Control de Ingreso RCA/SVT/AF/VDF/FP/2023-0056 DE FECHA 22/02/2023SENIAT VALLES DEL TUYNo ratings yet

- 09 NovDocument5 pages09 Novvandy duggalNo ratings yet

- CENTRAL DEPOSITORY SERVICESDocument135 pagesCENTRAL DEPOSITORY SERVICESwafan43277No ratings yet

- Quarterly Sales Meeting ReportDocument11 pagesQuarterly Sales Meeting ReportWhole SolarNo ratings yet

- Nilai Faktor Kapasitas Dukung Terzaghi Keruntuhan Geser Umum α f K N N NDocument12 pagesNilai Faktor Kapasitas Dukung Terzaghi Keruntuhan Geser Umum α f K N N Nkamil sNo ratings yet

- Thematic Study on Management Integrity and Sharp PracticesDocument56 pagesThematic Study on Management Integrity and Sharp Practicesvijay sharmaNo ratings yet

- About KOUSHALDocument6 pagesAbout KOUSHALtansnvarmaNo ratings yet

- Brief Profile of Speakers2Document1 pageBrief Profile of Speakers2tansnvarmaNo ratings yet

- About KoushalDocument7 pagesAbout KoushaltansnvarmaNo ratings yet

- Brief Profile of SpeakersDocument1 pageBrief Profile of SpeakerstansnvarmaNo ratings yet

- 28 Big Ideas - Safal Niveshak PDFDocument70 pages28 Big Ideas - Safal Niveshak PDFpkkothariNo ratings yet

- Wisdom of Intelligent Investors Safal Niveshak Jan. 2018Document40 pagesWisdom of Intelligent Investors Safal Niveshak Jan. 2018Sagar KondaNo ratings yet

- Quality ScreenDocument43 pagesQuality ScreentansnvarmaNo ratings yet

- Quality ScreenDocument43 pagesQuality ScreentansnvarmaNo ratings yet

- Wealth Builder Funds 23 Dec 2019 0644Document6 pagesWealth Builder Funds 23 Dec 2019 0644Gaurav GuptaNo ratings yet

- 5 Books That Will Make You A Wiser InvestorDocument16 pages5 Books That Will Make You A Wiser InvestorVishal Safal Niveshak Khandelwal100% (2)

- Shivaji, Hindu King in Islamic India - James W. Laine (2003)Document110 pagesShivaji, Hindu King in Islamic India - James W. Laine (2003)Sandrani100% (5)

- M1 CircuitSwitchedNetworksDocument98 pagesM1 CircuitSwitchedNetworksaleksandarpmauNo ratings yet

- HemaDocument1 pageHematansnvarmaNo ratings yet

- Priminary Informati OnDocument4 pagesPriminary Informati OntansnvarmaNo ratings yet

- D Hema-2Document3 pagesD Hema-2tansnvarmaNo ratings yet

- Complete Health Insurance Brochure PDFDocument16 pagesComplete Health Insurance Brochure PDFjohnnokiaNo ratings yet

- Disability Data Needs in IndiaDocument107 pagesDisability Data Needs in IndiaLakshmansaiNo ratings yet

- Gold Petal June 2020 Contract OnwardsDocument8 pagesGold Petal June 2020 Contract OnwardstansnvarmaNo ratings yet

- Quantum ComputersDocument2 pagesQuantum ComputerstansnvarmaNo ratings yet

- Khan Academy Schedules For School ClosuresDocument4 pagesKhan Academy Schedules For School ClosurestansnvarmaNo ratings yet

- Wealth Builder Funds 23 Dec 2019 0644Document6 pagesWealth Builder Funds 23 Dec 2019 0644Gaurav GuptaNo ratings yet

- Technology for All: Assistive Tech Benefits for People with Intellectual DisabilitiesDocument2 pagesTechnology for All: Assistive Tech Benefits for People with Intellectual DisabilitiestansnvarmaNo ratings yet

- Cheat Sheet Tunring Scratch Into Python A3 DIGITALDocument1 pageCheat Sheet Tunring Scratch Into Python A3 DIGITALtansnvarma100% (1)

- INDIADISDocument22 pagesINDIADIStansnvarmaNo ratings yet

- Cheat Sheet Tunring Scratch Into Python A3 DIGITALDocument1 pageCheat Sheet Tunring Scratch Into Python A3 DIGITALtansnvarma100% (1)

- 1.introduction To IoT AppletonDocument55 pages1.introduction To IoT Appletontansnvarma100% (1)

- Img 20180823 141805 76Document1 pageImg 20180823 141805 76tansnvarmaNo ratings yet

- NASI-Young Scientist Platinum Jubilee Awards 2018Document1 pageNASI-Young Scientist Platinum Jubilee Awards 2018tansnvarmaNo ratings yet

- Mushroom Production Technologies PDFDocument5 pagesMushroom Production Technologies PDFPruthwi RajNo ratings yet

- The Effects of Online Learning On Students' Eyes Health: A Case in West JavaDocument40 pagesThe Effects of Online Learning On Students' Eyes Health: A Case in West JavaRagilby IzzaNo ratings yet

- Waste ManagementDocument2 pagesWaste Managementagatha bellNo ratings yet

- Motivation PacketDocument17 pagesMotivation PacketbirlayamahaNo ratings yet

- Notes On Child and Adolescent PsychiatryDocument172 pagesNotes On Child and Adolescent PsychiatryachikNo ratings yet

- AMDM Unit 3-Study Types (DHS 2020-2021)Document3 pagesAMDM Unit 3-Study Types (DHS 2020-2021)Stanice LouisNo ratings yet

- Mental ImageryDocument4 pagesMental ImagerymoB0BNo ratings yet

- Drug Therapy of MalariaDocument41 pagesDrug Therapy of MalariaAbby LiewNo ratings yet

- 1 Swot Analysis of The Priority Training Programs: Its Implication To Policy Formulation Gulf College, Muscat, OmanDocument5 pages1 Swot Analysis of The Priority Training Programs: Its Implication To Policy Formulation Gulf College, Muscat, OmanGajendra AudichyaNo ratings yet

- Wrist Stretching and Posture Guide: @kastor - UyDocument14 pagesWrist Stretching and Posture Guide: @kastor - UyIzzaldinNo ratings yet

- South 24 Parganas Disaster Management ContactsDocument123 pagesSouth 24 Parganas Disaster Management ContactsLibrary My book storeNo ratings yet

- Lagos State Vision 20: 2020 First Implementation Plan 2010-2013 SummaryDocument75 pagesLagos State Vision 20: 2020 First Implementation Plan 2010-2013 SummaryJung Hyun Yun67% (3)

- ZDHCDocument43 pagesZDHCAamir AzizNo ratings yet

- Volume3 Issue8 (4) 2014Document342 pagesVolume3 Issue8 (4) 2014iaetsdiaetsdNo ratings yet

- Guidelines ERASC Part 1 PDFDocument15 pagesGuidelines ERASC Part 1 PDFkintanNo ratings yet

- Important Instructions For The Candidates-5Document23 pagesImportant Instructions For The Candidates-5Engr DanishNo ratings yet

- Original Research Paper: ProsthodonticsDocument3 pagesOriginal Research Paper: ProsthodonticsAbdulghny AlshoaibiNo ratings yet

- Nur1 230 Fundamentals of Canadian NursingDocument1,666 pagesNur1 230 Fundamentals of Canadian NursingSamantha Lau100% (4)

- VRBDADocument2 pagesVRBDAEga DeviNo ratings yet

- Virtual Screening of Pentahydroxyflavone - A Potent COVID-19 Major Protease InhibitorDocument8 pagesVirtual Screening of Pentahydroxyflavone - A Potent COVID-19 Major Protease InhibitorBhavanisha Rithiga Saravanan100% (1)

- Full Download Test Bank For Microbiology Basic and Clinical Principles 1st Edition Lourdes P Norman Mckay PDF Full ChapterDocument36 pagesFull Download Test Bank For Microbiology Basic and Clinical Principles 1st Edition Lourdes P Norman Mckay PDF Full Chaptertwistingafreetukl3o100% (20)

- TCV Campaign-2024Document41 pagesTCV Campaign-2024xtylishshehryarking786No ratings yet

- Meet Our Marketing Team!Document8 pagesMeet Our Marketing Team!Ben LawlessNo ratings yet

- Heavy HandsDocument8 pagesHeavy HandsPicklehead McSpazatronNo ratings yet

- Paracetamol Use Dec 2008Document30 pagesParacetamol Use Dec 2008Nararto PrijogoNo ratings yet

- Avon Fabulous Curls Hair SerumDocument4 pagesAvon Fabulous Curls Hair Serumdenemegaranti78No ratings yet

- Drug Suffixes Cheat Sheet Sorted AlphabeticallyDocument3 pagesDrug Suffixes Cheat Sheet Sorted Alphabeticallystudynote155No ratings yet

- Sterilization Consent Form: LDSS-3134Document1 pageSterilization Consent Form: LDSS-3134Jack TedescoNo ratings yet

- Guide: Hybrid Seed Production in TomatoDocument8 pagesGuide: Hybrid Seed Production in TomatoDaniel Rodriguez MartinezNo ratings yet

- Feeding The Mind - PresentationDocument11 pagesFeeding The Mind - Presentationapi-708898253No ratings yet