Professional Documents

Culture Documents

Audit Report Amended

Audit Report Amended

Uploaded by

Abbas WazeerCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Audit Report Amended

Audit Report Amended

Uploaded by

Abbas WazeerCopyright:

Available Formats

The Special Auditor Ref : MTCHBS /1028

Cooperative Societies, Punjab Dated: 20-09-2020

Lahore.

SPECIAL AUDIT OF THE MODEL TOWN COOPERATIVE

HOUSE BUILDING SOCIETY LTD-SIALKOT

FOR THE YEARS ENDED 30 JUNE 2005 TO 30 JUNE 2015

In compli anc e to your let ter No. RC S/ Au dit/ All o/447, d at ed 24-02-2020, we hav e comp leted th e Speci al Audit of "

THE MODEL TOWN CO-OPERATIVE HOUSE BUIL DING SOCIETY LIMITED" for t he years en ded 30 Jun e, 2005 to

30 June, 2015 and having obt ained relevan t inform at ion and explanations rep ort as un der:-

1) ABOUT SOCIETY AND ITS OPERATIONS

The Mod el T own Cooperative Hou se Bu ildin g Society lim ited was regist ered with Regist rar Cooperativ es

Societ ies Pu njab, Lahore on 28th May 1951, vide registrat ion no. 81, u nder t he provisi ons of Societ ies Act,

1925. The main objects of t he society are to purch ase land , d evelop it for const ruction of residential houses

an d build ings for onward allot men t / sale to its m embers as approved by t he com mit tee of the s oc iet y. Th e

regist ered office of the societ y i s si tuated at Mu dassar Shaheed road , near Askari colony, Sial kot.

2) SCOPE OF SPECIAL AUDIT

The scope of audit (TORs) as given in your referred letter are given as under:

1) T he com plete audi t of the fun ds an d receipts in clud ing dev elopm ent c harges and its spendin g by th e

soc iety for t he referred p eriod.

2) T o c onduc t au dit as per provisi ons of sec 22 of Coop erative Societies Act , 1925 and Coop erative

Societies Ru les 1927 and in accordance with th e inst ru ction s and t erms of references (TORs) issued by

t he d epartment sp ecifically relat ing to th e ac count s as und er:

i) T o exami ne th e overdu e debts, verify t he cash balanc e, secu ri ties and t o valuate the asset s and

liabilit ies of th e society.

ii) T o c heck all the purchases m ad e by the soc iety and valuate with market rates and t o i nsure

com pliance wit h the proper cod al procedure.

iii) T o c heck t he society has arran ged it s i ntern al audit as requ ired un der Sect ion 22-B of Cooperative

Societies Act, 1925.

iv) To recommend account under Section 50-A in case of any embezzlement are misuse of funds.

v) T o report verification of operat ional p lan , lit igat ion posit ion, l and docum ent s, balance rec overabl e

from mem bers an d detai led rep ort abou t developm ent work.

vi) T o obt ain li st of members showin g t he p rescribed i nformation , th e ban k s tat em ent s verified by the

resp ect ive banks an d schedule of ass ets showin g t he d epreciat ion.

vii) To report compliance with the previous audit observations.

3) Managing Committee & Pattern of Shareholding

The composition of management committee & Pattern of shareholding is given as under:

Designation Deposits

Developm e

Capital Land Cost

nt

3.1 Management Committee members- Elected on 19-09-2017

Muhammad Khalid Waseem President - - -

Akhlaq Hussain Vice President - - -

Hafiz Tasawear Hussain Vice President - - -

Muhammad Boota Executive Member - - -

Iftikhar Ahmed Advocate Executive Member - - -

Muhammad Ali Bajwa Executive Member - - -

Muhammad Hanif Butt Executive Member - - -

Sufi Muhammad Hussain Executive Member - - -

Munawar Iqbal Malik Executive Member - - -

Ghulam Sarwar Executive Member - - -

Muhammad Nawaz Executive Member - - -

Muhammad Amin Executive Member - - -

Prof. Muhammad Javed Akhtar Executive Member - - -

Haji Salamat Ali Executive Member - - -

Munir Qaisar Executive Member - - -

- - -

3.2 Major/top ten shareholders and Depositors

1 - - -

2 - - -

3 - - -

4 - - -

5 - - -

6 - - -

7 - - -

8 - - -

9 - - -

10 - - -

- -

We were not provid ed t he list of share h olders/ depositors showin g t he sum mation of t otal share c ap ital and

deposits t owards land and develop ment cost in view of which we could n ot test chec k t he veracit y of the

total share capital, total deposits. Furt her we coul d not also det ermin e the major/t op ten shares holders/

depositors for determ ing the ri sk fac tors toward s det ailed scrut ny of receipt s and p aym ent s during t he year

from th e major and related parties.

4) Key Audit Matters and Addressal thereof

A) Significant accounting and auditing issues

2.1) Adequate p rovi sion for bad and d oubtful receivables incl udin g advances to contractors, staff l oans and

advances, services ch arges receivable from mem bers, ad vanc e for mosqu e an d school need t o be made

aft er comp lete age analysis and after obt ain ing relev ant i nformation from the respec tive p ersons.

2.2) P rovision for deprecation n eed s to be rest ated as dep reciation has been charged inapp rop riat ely on

d ep reciable and non-dep reciable asset s due t o which th e ac cumu lat ed l os s h as been overst ated. Th e

financial statem ent s and the relevant books of accoun ts an d records d o not give a t rue and fair view of

t he fixed assets of the soci ety as fixed assets inclu de d epreciabl e an d non depreci able assets in single

accou nt head . T he it em wise d et ail of assets the v alu e of which n eed to be adjusted by off setti ng the

wrong d epreciat ion against acc umu lat ed d efic it.

St atu s of level of approprei at e maintenance of accou nt books, d ocum ent s, vou chers, regist ers an d other

2.3)

records could not determ ined in veiw th ere non avai lbilty for our examination.

B) Significant risks including misstatement of fixed assets

2.4 The society is not registered with the federal board of revenue and not filing its income tax

return under the income tax ordinance 2001.

2.5 As per the certificate of litigations status provided to us as Annexure "C-1" to "C-6", the society

has six legal advisors dealing with eighteen(18) legal proceedungs, whether filed by or against

it, which are pending for adjudication in various courts .

2.6 The society is facing investigation from NAB subsequent to the year ended June 30, 2015. We

cannot comment on the allegations if any leveled by NAB due to non supply of relevant record.

2.7 Society purchased a jeep in January, 2015 but the title of ownership has not been transferred in

the name of the society up till the reporting date.

2.8 The map of the society has not been approved from TMA until the date of the report.

5) ACCOUNTING POLICIES

The societ y maintains its accoun ting rec ord on h istorical basis u nder m ercantile acc ou ntin g syst em . T he

ac count ing records comp ris e of vouchers, cash book an d mem bers regist er.

Ou r scop e and nature of work is prim arily based on Internat ional St and ard s on Aud iting and oth er relev ant

pronoun cem ent s in clud ing legisl at ive provision s of the Com panies Act, 2017, Cooperati ve Societ ies Act,

1925 as well as Coop erative Societies Ru les 1927, and our firm's normal prac tices and as requ ired un der ISA

260 "Com muni cat ion of au dit m att ers with t hose ch arged with govern ance".

2015 2005

RS. RS.

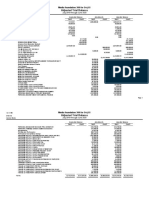

6) SHARE CAPITAL & RSERVES

These comprise of as under

Share Capital 6.1 4,610,250 2,251,000

Suspense Share Capital - 378,864

Accumulated Profit(loss) 6.2 (36,350,116) (9,645,559)

(31,739,866) (7,015,695)

6.1 SHARE CAPITAL

The movement in the account is presented as under

Opening Balance 2,251,000 -

Addition -2005 to 2015 2,359,250 -

Closing Balance 4,610,250 2,251,000

The share money has increased by 104% over the period from 2005 to 2015. The receipts and

payments over the period were test checked with the relevant documents and found in order.

The society has not so far issued share certificates to the members of the society.

T he name wise list s howing the dep osits for share capital made by each m em ber up to 30 June, 2015

required to be prep ared from member regi ster was n ot provided to us for verification . Accordin gly w e

c ould not t al ly t he sum mation of t otal sh are capit al Rs. 4,610,250 m ad e up 30-06-2015 with t he gen eral

l edger and also prep are l ist of top /major 10 sharehol ders for detail verificat ion. It is su ggested th at

requisit e list be p repared and p rovi ded to the aud itors in fu ture.

6.2 ACCUMULATED SURPLUS/(DEFICIT)

The movement in this account is as under:

Opening Balance (9,645,559) -

Surplus/(Deficit)-2005 to 2015 (26,704,557) -

Closing Balance (36,350,116) (9,645,559)

The accumulated deficit has increased by 276% over the period. The society continued to suffer loss.

up to 2012 as explained in the annexed comparative Income and Expenditure Account. However the

society took turn around after year 2013 to onwards.

The acc umu lat ed d efi cit needs t o be restated after reversing the dep reciation ch arged on non depreciable

ass ets as point ed out in the relevant p aragraph.

2015 2005

RS. RS.

7) RESERVE AND FUNDS

7.1 RESERVE FUND

Opening Balance 899,262 -

Addition -2005 to 2015 6,328,993 -

Closing Balance 7,228,255 899,262

7.2 OTHER RESERVES

Opening Balance 1,499,340 -

Addition -2005 to 2015 - -

Closing Balance 1,499,340 1,499,340

8,727,595 ###2,398,602 263.861741131

7.1 Reserve fund represents 25% of profit of the society transferred over the period to the reserve

fund as per bye law 40 (a). The accumulated balance has increased by 263% over the period from

2005 to 2015.

7.2 Other Reserves comprise of as under:

Common goods fund 153,795 153,795

Share transfer fund 252,731 252,731

Bad and doubtful debts 252,732 252,732

Building fund 840,082 840,082

Balance at June 30, 1,499,340 1,499,340

No movement in these reserve fund account was noticed during the year under our report.

8) MEMBERS DEPOSITS

These comprise of as under

Cost of land 8.1 ### 72,493,273

Development Charges 8.2 32,660,175 -

Electricity & Sui Gas 8.3 71,985,971 -

Un-allocated members Deposit 8.4 5,418,168 -

Other Depoist 160,774 12,374,671

### 84,867,944

8.1 COST OF LAND

The movement in this head of account is as under:

Opening Balance 72,493,273 -

Addition -2005 to 2015 53,858,316 -

Closing Balance ### 72,493,273

The member deposits have increased by 74% over the period from 2005 to 2015. The receipts and 74

payments over the period were test checked with the relevant documents and found in order. Its is

observed that some members have not cleared their dues till the reporting date and have been declare

as defaulters. It also includes amount that is due from members for more than two years. List of

defaulters duly signed by the secretary was not provided for our verification and records.

The nam e wise l ist showing t he deposit s for c os t of land made by each m em ber up to 30 June, 2015 required

to be prepared from m ember register was not provid ed t o u s for verific at ion. Accord ingly we neither cou ld

tally the summ at ion of total cost of l and Rs. 126,351,589 made u p 30-06-2015 wit h the general led ger nor

prep are t he list of top/ major 10 depositors toward cost of l and for det ail verification for report purp oses. It

is suggested that requisi te list be prep ared and provided to the au ditors in futu re.

8.2 DEPSITS FOR DEVELOPMENT CHARGES

The movement in this head of account is as under:

Opening Balance - -

Addition -2005 to 2015 32,660,175 13,515,880

Closing Balance 32,660,175 13,515,880 141.642978481608

The dep osit for develop men t charges has increased by 241% over th e peri od from 2005 t o 2015. T he rec eipt s

an d payments over th e period were test checked with th e relevant docum ent s and found in ord er. The list of

defaulters t oward s over d ue amou nts was not provided for our verification and record s.

The nam e wise l ist showing t he deposit s for d evelopment ch arges m ad e by each member up t o 30 June, 2015

required to be p repared from m em ber register was not provid ed t o u s for verifi cat ion. Accord ingly we

nei ther cou ld tally the summ at ion of total Devel opment charges Rs. 32,660,175 made u p 30-06-2015 wit h the

general ledger nor prep are t he list of top 10 d eposit ors t oward d evelopment charges for d etail verification

for report p urposes . It is sugges ted t hat requisit e list be prepared and p rovided to the aud itors in fu ture.

2015 2005

RS. RS.

8.3 ELECTRICITY & SUI GAS

The movement in this head of account is as under:

Opening Balance -

Addition -2005 to 2015 71,985,971 855,760

Closing Balance 71,985,971 855,760 8311.93453772086

The dep osit for el ectric ity & su i gas has increased by 8411% over the period from 2005 to 2015. Th e receipts

an d payments over th e period were test checked with th e relevant docum ent s and found in ord er. The list of

defaulters t oward s over d ue amou nts was not provided for our verification and record s.

The nam e wise l ist showing t he deposit s for elect ricity & sui gas m ad e by each member up t o 30 June, 2015

required to be p repared from m em ber register was not provid ed t o u s for verifi cat ion. Accord ingly we

nei ther cou ld tally the summ at ion of total Electrici ty & Sui gas Rs.71,985,971 m ad e up 30-06-2015 with t he

general ledger nor prep are t he list of major/ top 10 deposit ors t oward elect ric ity & su i gas for detail

verificat ion for report p urposes. It is suggested that requisi te list be prep ared and provided to the au ditors

in fu ture.

8.4 UN-ALLOCATED MEMBERS DEPOSIT 2015 2005

The movement in this head of account is as under:

Opening Balance - -

Addition -2005 to 2015 5,418,168 -

Closing Balance 5,418,168 -

It represents th e am ount received from m embers bu t not segregated into the cost of land, develop ment

charges and electrici ty an d sui gas c onnec tions. Furth er that the am ount rec eived from m embers represents

the ad vanc es for the plots whereas societ y c urrent ly h as no plot that can be al lotted to suc h persons.

The nam e wise l ist showing t he deposit s for u n-allocated members deposit s m ad e by each member up to 30

Ju ne, 2015 requ ired to be p repared from mem ber register was not p rovi ded to us for verificat ion.

Ac cordingly we n eith er could t all y t he sum mation of t otal un-allocated Rs.5,418,168 m ad e up 30-06-2015

with t he gen eral ledger n or prepare the l ist of major/ top 10 d eposit ors t oward u n-allocated mem bers

deposit for d etail verification for rep ort p urposes. However we not ed d uring our au dit t hat societ y h as

started to refu nd th e am ount t o respec tive m em bers. It is suggested that requi site list be prep ared an d

provided to t he audit ors in futu re.

9 MEMBERS SECURITIES & OTHER DEPOSITS

The movement in this head of account is as under:

Opening Balance 12,374,671 -

Addition -2005 to 2015 27,428,520 -

Deletion -2005 to 2015 (12,213,897) -

Closing Balance 27,589,294 12,374,671 122.949717208643

Thi s represents securities received from mem bers against sewerage and water conn ect ion charges an d

refu ndable t o t he members, if so claim ed by them. The deposits for members securit es & ot her deposits have

increased by 122% over t he period from 2005 t o 2015. The receip ts an d payments over th e period were test

checked wi th the relevant d ocum ent s and found i n ord er. The l ist of default ers toward s over due am ounts

was not provided for our verificat ion an d records.

The nam e wise l ist showing t he deposit s for m embers secu rit ies & other deposit s mad e by each member u p

to 30 Ju ne, 2015 requ ired to be p repared from mem ber regist er was not p rov ided to us for verification.

Ac cordingly we n eith er could t all y t he sum mation of t otal mem bers secu rities & other d eposi ts

Rs.27,589,294 made u p 30-06-2015 wit h the general led ger nor p repare the list of m ajor/top 10 d ep ositors

toward mem bers sec urities & other d ep osit for detail verific at ion for report pu rposes. It is s uggest ed t hat

requis ite list be prep ared and provided to th e au dit ors in futu re.

2015 2005

RS. RS.

10) CURRENT LIABILITIES

These comprise of as under

Accrued and other Payables 10.1 9,966,415 260,064

Bank Overdraft - 114,798

9,966,415 374,862

10.1 Accrued and other payables include as under:

Payable to Contractors 5,445,210 -

Accrued Liabilities 1,741,909 -

Stamp Duty Payable 2,520,398 -

Loans from Members 194,798 -

Gain Tax Payable 29,000 -

Other Payables 35,100 -

9,966,415 -

Subsequant payments with relevant record were checked and found in order.

11) NON-CURRENT ASSETS

These comprise of as under

Fixed Assets 11.1 ### 32,648,283

Land 11.2 18,359,852 18,359,852

Capital Work in progress 11.3 25,870,999 -

### 51,008,135

11.1 FIXED ASSETS

The movement in this head of account is as under:

Opening Balance 32,648,283

Addition -2005 to 2015 ### -

Closing Balance ### 32,648,283

Item wise detail of fixed assets as 30 June, 2015 is given as under: 30-06-2015

Depreciable Fixed assets

Buildings- Office 24,327,290

Furniture and Fixtures 2,274,161

Computers and Office Equipments 598,175

Tractors and Trollies 524,683

Motor Vehicles 806,306

Arms and Ammunitions 123,255

Other Assets 742,575

Electrification 159,555

Electrical and Equipments 812,310

30,368,310

Non Depreciable Fixed assets

Roads 69,709,483

Tube wells and Water Pumps 16,165,764

Sui Gas Installation 9,508,962

Boundary Wall 14,436,355

Parks and Horticulture 12,000,981

###

###

Society has not maintained fixed assets register. It is observed that society has purchased a jeep Rs.

500,000 in January, 2015 but the title of ownership is not transferred in the name of the society uptill

date the reporting date. Depreciation rates charged on fixed assets are not as per general practice.

Society is charging 2% to 15% depreciation rate on all fixed assets.

Deprec iable and non dep reciable fixed assets h ave been cl ubed wrongl y in t he sin gle head of t he fixed asset s

involu tion of generally acc ept ed accou nting and audi ting princ iple. Accordin gly dep reciation has al so been

charged on t he non deprec iable assets agains t the Internat ional Accou ntin g St and ard s. We suggest that

depreciation s ince in cept ion to date c harged on non deprec iable assets shoul d be as certained an d be added

to the cost of resp ect ive non d epreciabl e ass ets and credited to th e ac cumu lat ed d eficit so th at exact figure of

ac cumu lat ed d eficit may be determ ined.

2015 2005

RS. RS.

11.2 LAND

Opening Balance 18,359,852 18,359,852

Addition -2005 to 2015 - -

Closing Balance 18,359,852 18,359,852

No movement has been noted in the account over the period.

11.3 CAPITAL WORK IN PROGRESS

The movement in this head of account is as under:

Opening Balance 25,870,999

Closing Balance 25,870,999 25,870,999 0

It includes the development expenditure incurred on sewerage, water supply, boundary wall,

and parks and horticulture. It is observed that capital work in progress recorded in prior year

includes development work that was under progress but after the completion of the work this

amount in not transferred to fixed assets and still include in capital work in progress.

The map of the society has not been approved from TMA until the date of this report.

11.4 LONG TERM INVESTMENT

The movement in this head of account is as under:

Opening Balance 10,000,000

Deletion -2005 to 2015 (10,000,000) -

Closing Balance - 10,000,000

The deletion of the investment was checked with the relevant records and found in order.

12) CURRENT ASSETS

These comprise of as under

Stock - 258,013

Loan to Members - 17,068

Advanes, Deposits & Other Receivables 12.1 34,315,283 -

Advance for Mosque and School 12.2 7,613,208 11,101,449

Security Deposits 11,766,807 378,538

Development Reserve Fund 78,372 78,372

Short Term Investment 12.3 9,000 9,500

Cash and Bank Balances 12.4 755,965 7,684,990

54,538,635 19,527,930

12.1 ADVANCES, DEPOSITS & OTHER RECEIVABLES

The movement in this head of account is as under:

Opening Balance - -

Addition -2005 to 2015 34,315,283 -

Closing Balance 34,315,283 -

The details as per ledger copies of the accounts are given as under: 30-06-2016

Advance to Contractors 12.1.1 7,205,208 4,521,634

Staff Loans & Advances 12.1.2 442,264 557,965

Service Charges Receivable From Members 12.1.3 25,547,879 37,095,478

Rent Receivable 600,000 600,000

Income Tax Receivable 12.1.4 - 1,045,904

Advance to Government for Land 502,864 502,864

Loans to Members 17,068 17,068

34,315,283 44,340,913

12.1.1A representative sample of advance to contractors from the advance portfolio was selected and

performed tests and procedure such as reviewing the agreements for work executed, during the

relevant years, analysis of the changes form last year to current reporting period to gather audit

evidence regarding downgrading of impaired advances and verified the opening balances and found

in order.

12.1.2A representative sample of advance to staff from the advance portfolio was selected and performed

tests and procedure such as reviewing of staff application, repayment history and past due status

during the relevant years, analysis of the changes form last year to current reporting period to gather

audit evidence regarding downgrading of impaired advances and verified the opening balances and

found in order.

12.1.3Name wise list of members from whom service charges are receivable is being maintain by the society.

The recovery from members against service charges is very slow which need to be expedite.

12.1.4Income tax receivable represents the tax deducted by bank on term deposits, telephone and electricity

bill up to 30 June 2015. This balance is not being adjusted against the income tax liability because the

society is not registered with FBR. The society should review its tax status as already advised in

paragraph above so that such deduction / collection of tax at source may be avoided or claimed as

refund.

2015 2005

RS. RS.

12.2 ADVANCE FOR MOSQUE & SCHOOL

The movement in this head of account is as under:

Opening Balance 11,101,449 -

Deletion -2005 to 2015 (3,488,241) -

Closing Balance 7,613,208 11,101,449 (31.42)

These are old balances and represent the advances paid for expenses of mosque and schools of day to

day nature and have been brought forward in the books since previous year. During our audit we

observed that no segregation of these advances has been made by the society in to various expenses.

We recommend that advances paid for the mosque and school should be segregated and maybe

adjusted to proper heads of accounts in the subsequent year. However we were provided the balance

confirmation certificates from school and mosque were provided to us for our verification and found

in order.

12.3 SHORT TERM INVESTMENT

The movement in this head of account is as under:

Opening Balance 9,500

Deletion -2005 to 2015 (500) -

Closing Balance 9,000 9,500

12.4 CASH & BANK BALANCES

The movement in this head of account is as under:

Opening Balance 7,684,990 -

Deletion -2005 to 2015 (6,929,025) -

Closing Balance 755,965 7,684,990

a) We could not physically count the cash in hand as our appointment was made subsequent to years end.

b) Bank balances were checked with bank statements and found in order.

13) INCOME AND EXPENDITURE ACCOUNT

Detail of income and expenditure account over the period is attached. The summary is given as under.

2015 2014

INCOME RS. RS.

Service Charges 17,416,652 13,485,303

Plot Transfer fee 7,095,886 7,165,005

Stamp Duty Charges 4,158,477 3,790,234

Water & Sewerage Fee 3,071,985 3,635,000

Misc Income 1,921,576 3,204,421

33,664,576 31,279,963

Others 6,713,846 7,390,950

Total income = +4% 40,378,422 38,670,913

The hightest increase 29%age has been noticed in the head of services charges whereas decrease

of 40% has been noted in the head of Misc. income. The receipts were checked with relevant

records and found in order.

2015 2014

EXPENSES RS. RS.

Repair & Maintenance 5,864,291 3,628,156

Salaries 5,597,405 5,415,865

Deprecation 3,374,869 2,811,238

Utilities expenses 3,119,416 3,118,126

School Expense 2,935,790 660,221

Advertisement 1,043,603 1,229,890

Tax deducted 1,027,550 -

22,962,924 16,863,496

5,737,243 9,043,025

Total Expenses = +11% 28,700,167 25,906,521

The hightest increase of 345%age has been noted in the head of school expenses whereas decrease

of 15% has been noted in the head of advertisement. We suggest that the tax deducted should be

treated appropriately as per provision of the relevant Income Tax Law 2001.

14) GENERAL

14.1 We report that

(a) Inc ome T ax was not d ed ucted by the societ y from the paymen t of sal aries, goods and services/ contracts

und er sect ion 149 t o 158 and 232 of the Incom e Tax Ordin anc e 2001.

(b) Mast er plan of the societ y h ave not yet been approved. However, it has been sent to TMA for t he pu rp ose of

ap proval for wh ich copy of t he letter was produ ced t o u s.

The societ y at t he mom ent i s fac ing cert ain in quiries from Nati on al Accoun tability Bu reau (NAB) and all the

(c)

imp ort an t records and fi les incl udin g books of accou nts and al lotment of p lots et c. p rior t o June 30, 2015

were in t he poss ession of NAB. We report that out come of this case is un known to the date of ou r aud it

because case is still pendi ng under t he NAB Court .

(d) As p er the c ertificate of lit igat ion statu s i n year 2015 t he society had six legal ad visors dealing wit h eight een

(18) legal proceedings , whether filed by or ag ainst it, which are pending for adjud icat ion in vari ou s courts.

However, th e evaluation c ertificates are provided to us from the l egal adv isors about t he statu s, t he ul timate

outc ome and th e fin anc ial im pact, if any on the soc iety as regard to these cases is not acert ainable.

14.2 Subject to our foregoing remark and observations we report that:

(a) We have obtained all information and explanation which were necessary for the purpose of our audit.

(b) Proper books of accounts have been maintained and kept by the society even reported by external and

forensic auditors.

(c) Figures have been rounded off to the nearest of rupee.

(d) We are not aware of any other matter of importance that we feel should be reported to you but would

be pleased to give any other information and explanations that you may require.

We appreciate the co-operation extended to us by the Managing Committee during the course of our audit.

M.A. Chaudhri & Co.

Chartered Accountants

C.C.

i) Registrar Co-operative Societies, Punjab Lahore.

ii) Deputy/ Circle Registrar Co-operative Societies, Lahore.

iii) President/Secretary

The Model Town Cooperative House Building Society Ltd-Sialkot

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Questionnaire For Customers On Bank Performance MeasurementDocument3 pagesQuestionnaire For Customers On Bank Performance MeasurementK.t. JoshyNo ratings yet

- Insurance Law Review 2015Document43 pagesInsurance Law Review 2015peanut47No ratings yet

- Answers To End of Chapter Questions: International Financial ManagementDocument6 pagesAnswers To End of Chapter Questions: International Financial ManagementNgan Nguyen100% (1)

- BankWORKS Core BrochureDocument4 pagesBankWORKS Core Brochurepriyak_chariNo ratings yet

- Gazette Inter I Annual 2013 PDFDocument1,381 pagesGazette Inter I Annual 2013 PDFAbbas WazeerNo ratings yet

- Abdul Qadeer Accounts 2020-08-0-9-20Document6 pagesAbdul Qadeer Accounts 2020-08-0-9-20Abbas WazeerNo ratings yet

- 242-Mb Govt. Superior Services Housing Society, Opposite Bahria Town, Canal Bank ROAD, LAHORE., Lahore Iqbal Town Abdul Qadeer KhanDocument4 pages242-Mb Govt. Superior Services Housing Society, Opposite Bahria Town, Canal Bank ROAD, LAHORE., Lahore Iqbal Town Abdul Qadeer KhanAbbas WazeerNo ratings yet

- CamScanner 09-15-2020 15.42.49Document2 pagesCamScanner 09-15-2020 15.42.49Abbas WazeerNo ratings yet

- Adjusted Trial Balance: Media Foundation 360 For Oct, 15Document2 pagesAdjusted Trial Balance: Media Foundation 360 For Oct, 15Abbas WazeerNo ratings yet

- 1ST Ass QuestionsDocument6 pages1ST Ass QuestionsAbbas WazeerNo ratings yet

- Mathematics of Finance: Faculty of Business Studies (FBS) Bangladesh University of Professionals (BUP)Document52 pagesMathematics of Finance: Faculty of Business Studies (FBS) Bangladesh University of Professionals (BUP)Sadia Afrin ArinNo ratings yet

- Savings Bank ManualDocument60 pagesSavings Bank ManualJESTIN JOSEPHNo ratings yet

- Harnischfeger QuestionsDocument1 pageHarnischfeger QuestionsKateryna GerusNo ratings yet

- Bajaj Allianz General Insurance Company LTDDocument8 pagesBajaj Allianz General Insurance Company LTDHarsh PatelNo ratings yet

- Sbi QuestionnaireDocument2 pagesSbi QuestionnaireNivesh GurungNo ratings yet

- Warren SM - Ch.10 - FinalDocument32 pagesWarren SM - Ch.10 - FinalLan Hương Trần ThịNo ratings yet

- Installment Sales Part 2 AND Business CombiDocument33 pagesInstallment Sales Part 2 AND Business CombiBenzon Agojo OndovillaNo ratings yet

- Fe2305-0573 20230903121830Document9 pagesFe2305-0573 20230903121830broken swordNo ratings yet

- Group Assignment Business Law: Prof. M. C. GuptaDocument13 pagesGroup Assignment Business Law: Prof. M. C. GuptaNishit GarwasisNo ratings yet

- CAIIB 2020 Resources EBook by K G KhullarDocument15 pagesCAIIB 2020 Resources EBook by K G KhullarArul ManikandanNo ratings yet

- Allianz Life - Income Enhancer A5 Brochure V2 240613 R3Document6 pagesAllianz Life - Income Enhancer A5 Brochure V2 240613 R3Is EastNo ratings yet

- Khushi Enterprise: Customer Registration FormDocument7 pagesKhushi Enterprise: Customer Registration Formkage laxmiNo ratings yet

- Unit 4Document19 pagesUnit 4Dawit NegashNo ratings yet

- Chapter 5 - RevisionDocument13 pagesChapter 5 - RevisionActOn Business Solutions (Simplifying Business)No ratings yet

- Additional Drill Renz LaundromatDocument3 pagesAdditional Drill Renz LaundromatEngilou Ngaya-anNo ratings yet

- Case Study On Bear StearnsDocument13 pagesCase Study On Bear StearnsBrayanJosueReyesHerreraNo ratings yet

- CH 09Document29 pagesCH 09Huyền NguyễnNo ratings yet

- 13 Reports - Other Assurance and Related ServicesDocument9 pages13 Reports - Other Assurance and Related ServicesDia Mae GenerosoNo ratings yet

- PMPLTY Audit Report 2019 20Document91 pagesPMPLTY Audit Report 2019 20Lalit mohan PradhanNo ratings yet

- Pacing Plans For Illiquid Asset Classes: Rhode Island State Investment CommissionDocument15 pagesPacing Plans For Illiquid Asset Classes: Rhode Island State Investment Commissionnyguy06No ratings yet

- Managing InflationDocument4 pagesManaging Inflationpraveen sagarNo ratings yet

- Indian Financial MarketDocument114 pagesIndian Financial MarketmilindpreetiNo ratings yet

- FY22 SingleAudit WBDocument79 pagesFY22 SingleAudit WBDUSHIME Jean claudeNo ratings yet

- Chapter-1 Introduction To The Financial SystemDocument24 pagesChapter-1 Introduction To The Financial SystemwubeNo ratings yet

- Acces Road To IntakeDocument28 pagesAcces Road To IntakeEng. NKURUNZIZA ApollinaireNo ratings yet

- Settlement LetterDocument1 pageSettlement Letteradvocate572No ratings yet