Professional Documents

Culture Documents

Accounting Assignment

Accounting Assignment

Uploaded by

Tanbir. Nahid.Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Assignment

Accounting Assignment

Uploaded by

Tanbir. Nahid.Copyright:

Available Formats

Accounting Assignment (100)

1. Ms. Anna started her business (“Anna Car Repairing Shop”) on January 1, 2018. During the first

month of its operations, the business engaged in the following transactions:

Date Transactions

Jan 1 Anna invested cash $100,000 as initial capital to start the business.

Jan 2 An amount of $36,000 was paid as advance rent for three months.

Paid $60,000 cash on the purchase of equipment costing $80,000. The remaining amount was

Jan 3

recognized as note payable.

Jan 4 Purchased office supplies costing $17,600 on account.

Jan 13 Provided services to its customers and received $28,500 in cash.

Jan 13 Paid the accounts payable on the office supplies purchased on January 4.

Jan 14 Paid wages to its employees for the month of January, aggregating $19,100.

Provided $54,100 worth of services to its customers. They paid $32,900 and promised to pay the

Jan 18

remaining amount in the next month.

Jan 23 Received $15,300 from customers for the services provided on January 18.

Jan 25 Received $4,000 as an advance payment from customers.

Jan 26 Purchased office supplies costing $5,200 on account.

Jan 28 Paid water bill of $19,000 for January

Jan 31 Paid $5,000 advertising expense.

Jan 31 Received electricity bill of $2,470 for January.

Jan 31 Received telephone bill of $1,494 for January.

Jan 31 Miscellaneous expenses paid during the month totaled $3,470.

Instructions:

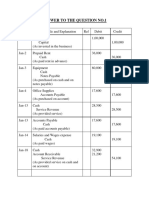

a) Journalize the transactions with explanations (Ignore the reference numbers). (16)

b) Post the transactions in the ledger account. (16)

c) Prepare a Trial Balance for Jan 31, 2018. (10)

d) Prepare an Income Statement and a classified Balance for Jan 31, 2018 based on the information

available in the trial balance. (10)

2. Write short notes on the following accounting principles with proper example: (18)

a) Cost Principle

b) Economic Entity Assumption

c) Monetary Unit Assumption

d) Going Concern

e) Periodicity

f) Revenue Recognition Principle

g) Matching Concept

h) Accrual Basis of Accounting

i) Dual Aspect of Accounting

3. Baker Corporation provided the following Statements for 2014-15 –

Balance Sheet 2015 2014

Assets $ $

Cash 40,000 70,000

Accounts Receivable 320,000 350,000

Inventory 460,000 320,000

Total Current Asset 820,000 740,000

Gross Fixed Assets 560,000 520,000

Accumulated Depreciation 180,000 150,000

Net Fixed Asset 380,000 370,000

Total Asset 1,200,000 1,110,000

Liabilities & Stockholders’ Equity

Current Liabilities

Accounts Payable 390,000 320,000

Notes Payable 110,000 90,000

Accrued Expense 20,000 20,000

Total Current Liabilities 520,000 430,000

Long Term Debt 320,000 350,000

Total Liabilities 840,000 780,000

Stockholders’ Equity

Common Stock at par 100,000 100,000

Share Premium Reserve 150,000 150,000

Retained Earnings 110,000 80,000

Total Liabilities & Stockholders’ Equity 1,200,000 1,110,000

Income Statement 2015

$

Sales 2,200,000

Cogs 1,420,000

Gross Profit 780,000

Operating Expenses 600,000

Operating Income (EBIT) 180,000

Interest 29,000

Earnings before Tax (EBT) 151,000

Tax (30%) 45,000

Earnings after Tax (Net Income) 106,000

Additional Information:

1. Purchased equipments paying $40,000 cash.

2. Annual depreciation expense was $30,000.

3. Paid cash dividend of $76,000.

4. No sale of fixed asset.

Required

A) Prepare a Cash Flow Statement for the year 2015. (12)

B) Calculate the following Ratios for the year 2015 and also indicate the

significance of each ratio – (18)

Current Ratio, Quick Ratio, Accounts Receivable Turnover, Profit Margin, Asset

Turnover, ROA, Return on Common Stockholders’ Equity, Debt to Asset, Times

Interest Earned ratio.

You might also like

- Manufacturing AccountDocument26 pagesManufacturing AccountwilbertNo ratings yet

- Financial Literacy NotesDocument11 pagesFinancial Literacy NotesMaimai Durano100% (1)

- 08-Rectification-Of-Errors Good OneDocument54 pages08-Rectification-Of-Errors Good OneAejaz MohamedNo ratings yet

- Financial Accounting and Reporting: Blank PageDocument28 pagesFinancial Accounting and Reporting: Blank PageMehtab NaqviNo ratings yet

- Accounting Problem Book 2011 PDFDocument103 pagesAccounting Problem Book 2011 PDFViệt Đức Lê67% (3)

- T2&T4Document204 pagesT2&T4សារុន កែវវរលក្ខណ៍No ratings yet

- FA Work BookDocument59 pagesFA Work BookUnais AhmedNo ratings yet

- 2020 Acc 410 Test 1Document8 pages2020 Acc 410 Test 1Kesa Metsi100% (1)

- Addtional Cash Flow Problems and SolutionsDocument7 pagesAddtional Cash Flow Problems and SolutionsHossein ParvardehNo ratings yet

- Functional BudgetsDocument12 pagesFunctional Budgetsarjun sachdev100% (1)

- Journal, Ledger & Trial BalanceDocument14 pagesJournal, Ledger & Trial Balancekaran_madan2000100% (4)

- AccountingDocument26 pagesAccountingMuhammad Jaafar AbinalNo ratings yet

- Allied Bank of PakistanDocument47 pagesAllied Bank of Pakistanmuhammadtaimoorkhan78% (9)

- State Farm California Homeowners Insurance Non-RenewalsDocument19 pagesState Farm California Homeowners Insurance Non-RenewalsCBS News Bay AreaNo ratings yet

- Act201 AssignmentDocument4 pagesAct201 Assignmentmahmud100% (1)

- ACT Assignment FullDocument16 pagesACT Assignment Fullsadif sayeed100% (3)

- Chapter 01Document5 pagesChapter 01AtiqEyashirKanak0% (1)

- Master Budgeting For Bhelpuri - 2019 & 2020: Spring 2021Document12 pagesMaster Budgeting For Bhelpuri - 2019 & 2020: Spring 2021Amira KarimNo ratings yet

- Activity No 1Document2 pagesActivity No 1Makeyc Stis100% (1)

- FA1 Bank ReconciliationDocument4 pagesFA1 Bank Reconciliationamir100% (1)

- Demonstration Problem - Chapter 4 - Internet Consulting ServicesDocument9 pagesDemonstration Problem - Chapter 4 - Internet Consulting ServicesTooba HashmiNo ratings yet

- Subsequent Measurement of Inventory: 2. First in First Out Method (FIFO) : (Interchangeable Inventory)Document6 pagesSubsequent Measurement of Inventory: 2. First in First Out Method (FIFO) : (Interchangeable Inventory)Syed MunibNo ratings yet

- Lecture 2 Part 2 - Emily - QuestionDocument2 pagesLecture 2 Part 2 - Emily - QuestionIsyraf Hatim Mohd TamizamNo ratings yet

- Chap 1 - Inventory Valuation (Questions)Document4 pagesChap 1 - Inventory Valuation (Questions)90 SHAMAZNo ratings yet

- Chapter 12: Corporate Valuation and Financial Planning: Page 1Document33 pagesChapter 12: Corporate Valuation and Financial Planning: Page 1nouraNo ratings yet

- ACCACAT Paper T4 Accounting For Costs INT Topicwise Past PapersDocument40 pagesACCACAT Paper T4 Accounting For Costs INT Topicwise Past PapersGT Boss AvyLara50% (4)

- Nestlé Sla Case SolutionDocument4 pagesNestlé Sla Case SolutionMushfique Ahmed100% (8)

- Cashbook Questions For PractiseDocument21 pagesCashbook Questions For Practisedona100% (1)

- FIA FA1 Course Exam 2 QuestionsDocument16 pagesFIA FA1 Course Exam 2 Questionsmarlynrich3652No ratings yet

- Chapter 21Document4 pagesChapter 21Rahila RafiqNo ratings yet

- Tutorial: Tuesday 8.00-9.00a.m Group: T1G1: CIX1002: Principles of MacroeconomicsDocument22 pagesTutorial: Tuesday 8.00-9.00a.m Group: T1G1: CIX1002: Principles of MacroeconomicsYongAnnNo ratings yet

- Cost Accounting PDFDocument22 pagesCost Accounting PDFLaiba Javed Javed IqbalNo ratings yet

- Accounting Chapter 16 Brief Exercises and ExercisesDocument10 pagesAccounting Chapter 16 Brief Exercises and ExercisesAnonymous jrIMYSz9No ratings yet

- Joint Products AND BY Products: Learning OutcomesDocument28 pagesJoint Products AND BY Products: Learning OutcomesAman PandeyNo ratings yet

- Assignment 4 SolutionDocument5 pagesAssignment 4 SolutionBracu 2023No ratings yet

- Problem Set CompleteDocument18 pagesProblem Set Completevicencio39No ratings yet

- Question No. 1 5 Marks: Not Including The Costs of Plastic Housing (Column B)Document13 pagesQuestion No. 1 5 Marks: Not Including The Costs of Plastic Housing (Column B)Mawaz Khan MirzaNo ratings yet

- Functional BudgetsDocument12 pagesFunctional BudgetsAyush100% (1)

- Journal & LedgerDocument9 pagesJournal & Ledgeranushka100% (1)

- FA Consolidation Test - Questions S20-A21 PDFDocument16 pagesFA Consolidation Test - Questions S20-A21 PDFAlpha MpofuNo ratings yet

- Basics of Accounting - Bridge CourseDocument7 pagesBasics of Accounting - Bridge Coursebikshapati50% (2)

- Skans School of Accoutancy Subject Ma1 Test Teacher Shahab Name Batch Obtained Marks Total Marks 30Document4 pagesSkans School of Accoutancy Subject Ma1 Test Teacher Shahab Name Batch Obtained Marks Total Marks 30shahabNo ratings yet

- CostConExercise - COGM & COGSDocument3 pagesCostConExercise - COGM & COGSLee Tarroza100% (1)

- Self Balancing Ledger Question BankDocument4 pagesSelf Balancing Ledger Question BankQuestionscastle Friend50% (2)

- Cost Sheet QuestionsDocument5 pagesCost Sheet QuestionsDrimit GhosalNo ratings yet

- IUMC-Cost Accounting-Basic Theory and Manufacturing Week 1 - PQs - 2Document9 pagesIUMC-Cost Accounting-Basic Theory and Manufacturing Week 1 - PQs - 2Muhammad ZubairNo ratings yet

- Managerial and Cost Accounting Exercises IVDocument28 pagesManagerial and Cost Accounting Exercises IVAleko tamiruNo ratings yet

- Chapter No. 3 Marketing Cost and Profitability AnalysisDocument12 pagesChapter No. 3 Marketing Cost and Profitability AnalysisBabarNo ratings yet

- COSTINGDocument182 pagesCOSTINGjahazi2100% (1)

- Manufacturing AccountDocument15 pagesManufacturing Accountbalachmalik50% (2)

- AccountingDocument7 pagesAccountingHà PhươngNo ratings yet

- Chap 5 Accounting For Merchandising OperationDocument71 pagesChap 5 Accounting For Merchandising OperationtamimNo ratings yet

- IFIC Bank - HRM340.4-PPT - Philosopher StoneDocument15 pagesIFIC Bank - HRM340.4-PPT - Philosopher StoneNaznin NipaNo ratings yet

- BBA 6thDocument3 pagesBBA 6thFazal Wahab100% (1)

- Budget AnswersDocument6 pagesBudget AnswersSushant MaskeyNo ratings yet

- Assignment No 1 - Cost ClassificationDocument7 pagesAssignment No 1 - Cost ClassificationJitesh Maheshwari100% (1)

- Make-Up AssignmentDocument5 pagesMake-Up AssignmentRileyNo ratings yet

- Chapter 3 Short ProlemsDocument9 pagesChapter 3 Short ProlemsRhedeline LugodNo ratings yet

- Individual AssignmentDocument5 pagesIndividual AssignmentMuhammad Faiyam Shafiq 1911819630No ratings yet

- Accounting Assignment (100) : A. B. C. The Journal EntryDocument2 pagesAccounting Assignment (100) : A. B. C. The Journal EntryFaiaz ShahreearNo ratings yet

- Fall FIN 254.10 Mid QuestionsDocument2 pagesFall FIN 254.10 Mid QuestionsShariar NehalNo ratings yet

- Baker CorporationDocument1 pageBaker CorporationNextdoor CosplayerNo ratings yet

- Use The Following Information To Answer Items 5 - 7Document4 pagesUse The Following Information To Answer Items 5 - 7acctg2012No ratings yet

- ACCT10002 Tutorial 9 ExercisesDocument6 pagesACCT10002 Tutorial 9 ExercisesJING NIENo ratings yet

- Presentation Lecture 4 Functional Level StrategiesDocument14 pagesPresentation Lecture 4 Functional Level Strategiessadif sayeedNo ratings yet

- Presentation Lecture 10 Corporate Level Strategy Related and Unrelated DiversificationDocument6 pagesPresentation Lecture 10 Corporate Level Strategy Related and Unrelated Diversificationsadif sayeedNo ratings yet

- Presentation Lecture 2 External Analysis - Analyzing Opportunities and ThreatsDocument15 pagesPresentation Lecture 2 External Analysis - Analyzing Opportunities and Threatssadif sayeedNo ratings yet

- Presentation Lecture 1Document17 pagesPresentation Lecture 1sadif sayeedNo ratings yet

- Presentation Lecture 7 Strategy and TechnologyDocument13 pagesPresentation Lecture 7 Strategy and Technologysadif sayeedNo ratings yet

- Presentation Lecture 9 Corporate Level Strategy HV Integration OutsourcingDocument13 pagesPresentation Lecture 9 Corporate Level Strategy HV Integration Outsourcingsadif sayeedNo ratings yet

- Instructions (A) Journalize The Transactions. (B) Post To The Ledger Accounts. (C) Prepare A Trial Balance On May 31, 2010Document1 pageInstructions (A) Journalize The Transactions. (B) Post To The Ledger Accounts. (C) Prepare A Trial Balance On May 31, 2010sadif sayeedNo ratings yet

- Statement Cash Flow FormatDocument2 pagesStatement Cash Flow Formatsadif sayeedNo ratings yet

- Chapter-3: Adjusting The AccountsDocument30 pagesChapter-3: Adjusting The Accountssadif sayeedNo ratings yet

- Regulators in Financial System - Rbi - Sebi - IrdaDocument17 pagesRegulators in Financial System - Rbi - Sebi - IrdaAkshay sachanNo ratings yet

- Advanced Finance, Banking and Insurance SamenvattingDocument50 pagesAdvanced Finance, Banking and Insurance SamenvattingLisa TielemanNo ratings yet

- A Study On Comparative Analysis of Non-Performing Assets in Selected Private Sector BankstDocument18 pagesA Study On Comparative Analysis of Non-Performing Assets in Selected Private Sector BankstNavneet NandaNo ratings yet

- OYO AnnualReport FY22 1Document215 pagesOYO AnnualReport FY22 1Harish N. ChaudhariNo ratings yet

- APGLI Operational Guidelines English and TeluguDocument20 pagesAPGLI Operational Guidelines English and Telugunateshnagaraju1568No ratings yet

- Major Opportunities For Prepaid in Mexico - MasterCard®Document4 pagesMajor Opportunities For Prepaid in Mexico - MasterCard®Douglas MarencoNo ratings yet

- Cambridge IGCSE: ACCOUNTING 0452/22Document20 pagesCambridge IGCSE: ACCOUNTING 0452/22Lavanya GoleNo ratings yet

- NO2 Kampung Kuak Hulu 33100 Pengkalan Hulu Perak: Abdul Arif Bin Mahamad HanafiahDocument1 pageNO2 Kampung Kuak Hulu 33100 Pengkalan Hulu Perak: Abdul Arif Bin Mahamad HanafiahMuhammad ikmail KhusaimiNo ratings yet

- Pre Authorized Contribution PAC FormDocument2 pagesPre Authorized Contribution PAC FormAllen Mathew AllenNo ratings yet

- Ic 38 Non Life SyllabusDocument4 pagesIc 38 Non Life SyllabusSKNo ratings yet

- 30 Year Mortgage With Extra Payments - Mortgage CalculatorDocument9 pages30 Year Mortgage With Extra Payments - Mortgage Calculatorapi-351849605No ratings yet

- Chapter 3 Ethics, Fraud, & Internal ControlDocument18 pagesChapter 3 Ethics, Fraud, & Internal Controlkristine mediavilloNo ratings yet

- Rajiv Khadka ReportDocument46 pagesRajiv Khadka ReportPrakash DhunganaNo ratings yet

- Ally Trust Deposits ApplicationDocument5 pagesAlly Trust Deposits ApplicationARTHUR MILLERNo ratings yet

- Define Pledge, Hypothecation and MortgageDocument3 pagesDefine Pledge, Hypothecation and MortgageMuhammadAliNo ratings yet

- Unit-Vii Types of BanksDocument18 pagesUnit-Vii Types of Bankssheetal rajputNo ratings yet

- FBOA Achieves: Landmark Settlement Victory of Our UnityDocument14 pagesFBOA Achieves: Landmark Settlement Victory of Our UnityPar MatyNo ratings yet

- Chapter 9Document34 pagesChapter 9NouraNo ratings yet

- Fin 1 Principles of Money, Banking and CreditDocument6 pagesFin 1 Principles of Money, Banking and CreditvaneknekNo ratings yet

- January Bank StatementDocument8 pagesJanuary Bank StatementYoel CabreraNo ratings yet

- Ty Baf Sem Vi Regular Exam Sample PapersDocument33 pagesTy Baf Sem Vi Regular Exam Sample PapersDurvasNo ratings yet

- Capital and Revenue ExpendituresDocument30 pagesCapital and Revenue ExpendituresBir MallaNo ratings yet

- Policy Paper BD BankDocument28 pagesPolicy Paper BD BankSharifa AminNo ratings yet

- GDP - Credit Debit Card Auto Debit Form (2020 - 04 - 06 10 - 13 - 00 UTC) PDFDocument1 pageGDP - Credit Debit Card Auto Debit Form (2020 - 04 - 06 10 - 13 - 00 UTC) PDFHarith FadhilaNo ratings yet

- ECB ManagersDocument19 pagesECB ManagersLaerte LimaNo ratings yet

- Eddie and Kaye Turner Aged 39 and 37 Respectively QuestionDocument3 pagesEddie and Kaye Turner Aged 39 and 37 Respectively QuestionshauryaNo ratings yet