Professional Documents

Culture Documents

Assignment - Prelim

Assignment - Prelim

Uploaded by

April Mae Intong Tapdasan0 ratings0% found this document useful (0 votes)

5 views2 pagesOriginal Title

Assignment - Prelim.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views2 pagesAssignment - Prelim

Assignment - Prelim

Uploaded by

April Mae Intong TapdasanCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Name:________________________________Date:___________________Time:______________

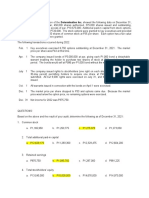

The stockholders equity of Willpower Corporation showed the following data on

December 31, 2018:

12% Preference Share, P30 par, 135,000 shares issued and outstanding P4,050,000

Ordinary Share Capital, P50 par, 180,000 shares issued and outstanding 9,000,000

Share Premium – Preference Share 1,080,000

Share Premium – Ordinary Share 3,240,000

Accumulated Profits (Losses) 1,395,000

The 2019 transactions of the company affecting its stockholders’ equity are summarized

chronologically as follows:

1. Issued 27,000 shares of preference at P40.

2. Issued 94,500 shares of ordinary share at P70.

3. Retired 5,400 shares of preference share at P45.

4. Purchased 13,500 shares of its ordinary share at P80.

5. Split common stock two for one.

6. Reissued 13,500 shares of treasury share – common at P50.

7. Stockholders donated to the company 9,000 shares of ordinary when shares had

a market price of P52. One half of these shares were subsequently issued for P54.

8. Net income for the year was P2,520,000.

Required:

1. Prepare journal entry.

2. Compute the account balance of the following accounts as of December 31, 2018;

1. Preference Share Capital

2. Ordinary Share Capital

3. Total Share Premium

4. Un-appropriated Accumulated Profit (Losses)

5. Totals Stockholders’ Equity

You might also like

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownFrom EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownNo ratings yet

- LSPU - PARCOR Final ExamDocument3 pagesLSPU - PARCOR Final ExamRosejane EM100% (1)

- JJJDocument12 pagesJJJCamille ManalastasNo ratings yet

- Retained EarningsDocument76 pagesRetained EarningsKristine DoydoraNo ratings yet

- She QuizDocument4 pagesShe QuizJomar Villena100% (1)

- ACCO 2026 2nd Sem 2011 Finals SW2016 BlankDocument5 pagesACCO 2026 2nd Sem 2011 Finals SW2016 BlankSarah Quijan BoneoNo ratings yet

- pRACTICE SET INVESTMENTDocument4 pagespRACTICE SET INVESTMENTAlayka A AnuddinNo ratings yet

- Quiz SHEEDocument2 pagesQuiz SHEEJhoana Marie Agawa MallariNo ratings yet

- Exercises SC Transactions Subsequent To Original IssuanceDocument4 pagesExercises SC Transactions Subsequent To Original IssuanceSarah Quijan BoneoNo ratings yet

- Stock Dividend: Date of PaymentDocument6 pagesStock Dividend: Date of PaymentmercyvienhoNo ratings yet

- Post-Test in Corporation (Nov. Batch)Document5 pagesPost-Test in Corporation (Nov. Batch)lady gwaeyngNo ratings yet

- Midterm Exam Intermediate Accounting 2Document10 pagesMidterm Exam Intermediate Accounting 2Juan Dela cruzNo ratings yet

- Midterm SheDocument5 pagesMidterm SheKaye Delos SantosNo ratings yet

- Discussion Questions 8-1:: Unit 8 Audit of Equity Accounts Estimated Time: 4.5 HOURSDocument7 pagesDiscussion Questions 8-1:: Unit 8 Audit of Equity Accounts Estimated Time: 4.5 HOURSmimi96No ratings yet

- Emilio Aguinaldo College - Cavite Campus School of Business AdministrationDocument6 pagesEmilio Aguinaldo College - Cavite Campus School of Business AdministrationKarlayaanNo ratings yet

- Corporation Quiz 2 Up To JournalizingDocument5 pagesCorporation Quiz 2 Up To Journalizingycalinaj.cbaNo ratings yet

- FAR 2 Old Final Exam - 2011 - Problem SolvingDocument5 pagesFAR 2 Old Final Exam - 2011 - Problem SolvingShiela Mae ReyesNo ratings yet

- 62230126Document20 pages62230126ROMULO CUBIDNo ratings yet

- Exam - SHE, RE & Share Based CompensationDocument4 pagesExam - SHE, RE & Share Based CompensationJohnAllenMarilla100% (2)

- Quiz - 3 ABC Problem SolvingDocument6 pagesQuiz - 3 ABC Problem SolvingAngelito Mamersonal0% (1)

- Audit of Shareholders' Equity: Auditing ProblemsDocument4 pagesAudit of Shareholders' Equity: Auditing ProblemsKenneth Adrian AlabadoNo ratings yet

- Audit of Shareholders' Equity: Auditing ProblemsDocument4 pagesAudit of Shareholders' Equity: Auditing ProblemsKenneth Adrian AlabadoNo ratings yet

- Quiz Shareholders Equity TH With Questions PDFDocument4 pagesQuiz Shareholders Equity TH With Questions PDFMichael Angelo FangonNo ratings yet

- The Shareholder's Equity Section BAHRAIN CORPORATION'S Statement of Financial Position As of December 31, 2013, Is As FollowsDocument4 pagesThe Shareholder's Equity Section BAHRAIN CORPORATION'S Statement of Financial Position As of December 31, 2013, Is As FollowsCyril John ReyesNo ratings yet

- Shareholdersx27 Equity Prac 1 PDF FreeDocument10 pagesShareholdersx27 Equity Prac 1 PDF FreeIllion IllionNo ratings yet

- Long Quiz Online Aud ProbDocument2 pagesLong Quiz Online Aud Probsunthatburns00No ratings yet

- Final Reviewer For ACC221Document91 pagesFinal Reviewer For ACC221ZalaR0cksNo ratings yet

- Bcacctg2 - Accounting For Partnership and Corporation: Exercise 4 Shareholders' EquityDocument4 pagesBcacctg2 - Accounting For Partnership and Corporation: Exercise 4 Shareholders' EquityNimfa SantiagoNo ratings yet

- Ap 9401-1 SheDocument4 pagesAp 9401-1 SheLuzviminda SaspaNo ratings yet

- Auditing Problems: RequiredDocument2 pagesAuditing Problems: RequiredvhhhNo ratings yet

- Unit Viii - Audit of Equity Accounts T1 2014-2015 PDFDocument9 pagesUnit Viii - Audit of Equity Accounts T1 2014-2015 PDFSed ReyesNo ratings yet

- Aaca Audit of She CtaDocument7 pagesAaca Audit of She CtaShannel Angelica Claire RiveraNo ratings yet

- Intercompany TransactionsDocument2 pagesIntercompany TransactionsZerjo CantalejoNo ratings yet

- Afar First TakeDocument14 pagesAfar First TakePau CaisipNo ratings yet

- W Final ExamDocument42 pagesW Final ExamAnna TaylorNo ratings yet

- Quiz Audit of Shareholders Equity-2Document10 pagesQuiz Audit of Shareholders Equity-2Moi Escalante100% (1)

- QuestionsDocument3 pagesQuestionslois martinNo ratings yet

- ParCor Corpo EQ Set ADocument3 pagesParCor Corpo EQ Set AMara LacsamanaNo ratings yet

- Basic Accounting For CorporationDocument12 pagesBasic Accounting For CorporationBrian Christian VillaluzNo ratings yet

- University of Luzon College of Accountancy Acc 412 - Equity Part 2Document5 pagesUniversity of Luzon College of Accountancy Acc 412 - Equity Part 2fghhnnnjmlNo ratings yet

- Shareholder's Equity - Practice SetsDocument6 pagesShareholder's Equity - Practice SetsGian GarciaNo ratings yet

- Shareholders' Equity Prac 1Document10 pagesShareholders' Equity Prac 1yaj8cruzada67% (3)

- Name: - Prefinal Examination - Financial Accounting & Reporting Part 3Document3 pagesName: - Prefinal Examination - Financial Accounting & Reporting Part 3acctg2012No ratings yet

- Ap14 - Equity (Quizzer) - Set BDocument4 pagesAp14 - Equity (Quizzer) - Set Bmariesteinsher0No ratings yet

- Earning Per ShareDocument6 pagesEarning Per ShareArianne LlorenteNo ratings yet

- Stockholders' Equity by J. GonzalesDocument7 pagesStockholders' Equity by J. GonzalesGonzales JhayVeeNo ratings yet

- Reviewer - Exam 5 To 6Document30 pagesReviewer - Exam 5 To 6ZalaR0cksNo ratings yet

- Naqdown FinalsDocument6 pagesNaqdown FinalsMJ YaconNo ratings yet

- ASSIGNMENT (3points Each)Document5 pagesASSIGNMENT (3points Each)sammie helsonNo ratings yet

- Title For Something RequiredDocument2 pagesTitle For Something RequiredClesclay FernandezNo ratings yet

- Initiatives May Erode Shareholder Value Because They Fail To Achieve Some SynergiesDocument4 pagesInitiatives May Erode Shareholder Value Because They Fail To Achieve Some SynergiesIde VelascoNo ratings yet

- Multiple Choice: Select The Best Answer From The Given Choices and Write It Down On Your Answer SheetDocument6 pagesMultiple Choice: Select The Best Answer From The Given Choices and Write It Down On Your Answer SheetYaj CruzadaNo ratings yet

- Intacc2 - Assignment 3Document4 pagesIntacc2 - Assignment 3KHAkadsbdhsgNo ratings yet

- Audit of SheDocument3 pagesAudit of ShePrince PierreNo ratings yet

- ACCOUNTING 4 Retained EarningsDocument2 pagesACCOUNTING 4 Retained EarningsJoy ConsigeneNo ratings yet

- Business Combi - SubsequentDocument5 pagesBusiness Combi - Subsequentnaser100% (2)

- 401(k) Day Trading: The Art of Cashing in on a Shaky Market in Minutes a DayFrom Everand401(k) Day Trading: The Art of Cashing in on a Shaky Market in Minutes a DayNo ratings yet

- PEOPLE OF THE PHILIPPINES v. ELIZABETH GANGUSODocument2 pagesPEOPLE OF THE PHILIPPINES v. ELIZABETH GANGUSOJulie CairoNo ratings yet

- Suspension From The Practice of Law in The Territory of Guam of Atty. Leon G. MaqueraDocument1 pageSuspension From The Practice of Law in The Territory of Guam of Atty. Leon G. MaqueraJulie CairoNo ratings yet

- Elisco Tool Manufacturing Corp. vs. Court of Appeals Et. Al.Document3 pagesElisco Tool Manufacturing Corp. vs. Court of Appeals Et. Al.Julie CairoNo ratings yet

- ONAPAL PHILS. COMMODITIES, INC. vs. THE COURT OF APPEALSDocument2 pagesONAPAL PHILS. COMMODITIES, INC. vs. THE COURT OF APPEALSJulie CairoNo ratings yet

- Acctg 1Document1 pageAcctg 1Julie Cairo0% (1)

- A Home Office Accounts Receivable For P10,500 Was Collected by The Branch. Said Collection Was Not Reported To The Home Office by The BranchDocument1 pageA Home Office Accounts Receivable For P10,500 Was Collected by The Branch. Said Collection Was Not Reported To The Home Office by The BranchJulie Cairo0% (1)

- Re Ed Selfhelp 4Document2 pagesRe Ed Selfhelp 4Julie CairoNo ratings yet

- Spokesperson Ent A Role PlayDocument2 pagesSpokesperson Ent A Role PlayJulie CairoNo ratings yet

- January 1, 1873 Badminton Garden PartyDocument2 pagesJanuary 1, 1873 Badminton Garden PartyJulie CairoNo ratings yet

- A 5-Minute Thought To Ponder: What's Your Thought On This?Document20 pagesA 5-Minute Thought To Ponder: What's Your Thought On This?Julie CairoNo ratings yet

- Crossroads!!!: When You're at Crossroads? What Are Your Basis in Decision-Making? How Do You Decide?Document12 pagesCrossroads!!!: When You're at Crossroads? What Are Your Basis in Decision-Making? How Do You Decide?Julie CairoNo ratings yet

- Om 3219 AssignmentDocument3 pagesOm 3219 AssignmentJulie CairoNo ratings yet

- Art. 1475. The Contract of Sale Is Perfected at The Moment There IsDocument8 pagesArt. 1475. The Contract of Sale Is Perfected at The Moment There IsJulie CairoNo ratings yet

- Name: Julie Cairo July 15, 2019 BSA - 1 Block 7 MWF 12:30PM-1:30PM RM# SA 317 "My Reflection For The Movie Facing The Giant"Document1 pageName: Julie Cairo July 15, 2019 BSA - 1 Block 7 MWF 12:30PM-1:30PM RM# SA 317 "My Reflection For The Movie Facing The Giant"Julie CairoNo ratings yet