Professional Documents

Culture Documents

Corrigendum to Company Law & IBC Handbook

Uploaded by

Deepa BhatiaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corrigendum to Company Law & IBC Handbook

Uploaded by

Deepa BhatiaCopyright:

Available Formats

Corrigendum & Further Interpretation to

Handwritten Book on Company Law & IBC

Dear Students, Please take a note of the below mentioned Points which are to be

rectified in this book. Before you start reading/studying from this book, it is

advisable to 1st take a note of all these points.

Points/Words which are to be rectified are marked in Bold & Italics

1. IBC, 2016

Page No. 1.7 In point (a) – Application by Financial Creditor,

AA shall communicate in either ways to FC within 14 days of receipt of application

Last Line: (FC should also give name of IRP)

Page No. 1.8 In point (b) – Application by Operational Creditor,

OC may also give a name of IRP

Page No. 1.9 In the 2nd Point of Note,

However it can be withdrawn only before the AA admits it.

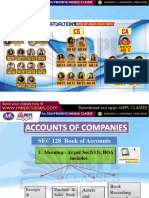

3. Accounts & Audit

Page No. 3.26 Pvt. Ltd. Co. Having T/O < Rs. 50CR & whose borrowing is < Rs. 25CR

4. Appointment & Qualification of Directors

Page No. 4.4 Last Point:

Is not a CEO/Director of any NGO & such NGO receives ≥ 25% of receipts from such

co./group co. or that (person) holds ≥ 2% of voting power of co.

Page No. 4.8 Last Point:

Small SHS director, need not be a small SHS director himself.

Page No. 4.16 Alternate Director (Section 161(2) of CA, 2013):

Point to be added: Powers are given by AOA to Board

Page No. 4.18 1st Point on the page:

-such directors cannot be removed by SHS in GM by OR (i.e. SR is required)

Section 164 (Point (d)):

Lines to be added:

Provided that if a person has been convicted of any offence and sentenced for ≥ 7

years, he shall not be eligible to be appointed as a director in any company (Lifetime

Ban)

Section 164 (Point (e)):

Order of disqualifying him for appointment as director is passed by the court

Page No. 4.20 Section 167 (Point (f)):

Convicted by Court for an offence (minimum imprisonment = 6months) (even if appeal

has been filed)

5. Appointment & Remuneration of Managerial Personnel

Page No. 5.5 After the Table,

In all above cases, remuneration can exceed the limit, after taking approval from SHS in

GM i.e by passing Ordinary Resolution & when the above limit of 11% is exceeded,

additional approval of CG is required.

Page No. 5.6 Replace the entire Section II of Part II of Schedule V:

(A)

Effective Capital Maximum Limit of Yearly Remuneration

(i) Negative or < Rs. 5 Crore Rs. 60,00,000

(ii) ≥ Rs. 5 Cr but < Rs. 100 Cr Rs. 84,00,000

(iii) ≥ Rs. 100 Cr but < Rs. 250 Rs. 120,00,000

Crore

(iv) ≥ Rs. 250 Crore Rs. 120,00,000 (+) 0.01% of capital in

excess of Rs. 250 Crore

If remuneration is paid within above limits, then only OR required.

However the above limit of remuneration can be doubled if SR is passed.

(B) More than double of the above limits may be paid to Managerial Person (without

taking CG approval) if:

Managerial person who is functioning:

-in a professional capacity,

-if such managerial person is not having any interest in capital of such company or

group co. (if holding ≤ 0.5% of PUSC, then not interested) &

- not related to the directors or promoters of the company/ group co. during the last 2

years &

- possesses graduate level qualification with expertise and specialized knowledge in

the field in which the company operates

Above limits specified under items (A) and (B) of this section shall apply, if-

(i) Remuneration has been approved Board’s resolution or by Nomination and

Remuneration Committee (if any);

(ii) the company has not committed any default in repayment of any of its debts & in

case of a default, the company obtains prior approval from secured creditors;

(iii) an OR or SR has been passed etc.

Page No. 5.15 In Summary Table,

In Part II, Section I, II, III, IV is mentioned.

Pls add Section V also (Remuneration payable to a managerial person in 2 companies)

6. Meetings of Board & its Powers

Page No. 6.6 Section 177, Point (i) , In the last limit for Such other class or classes of companies:

All Public companies having total O/s Loans/debentures/deposits of > Rs. 50 crore

Line written in Red just above point (iii),

Committee must be formed within 1 year of incorporation

Page No. 6.8 Last Table of Nomination & Remuneration Committee, for Unlisted Public Companies,

O/s Loans/ deposits/borrowings/debentures of > Rs. 50 crore

Page No. 6.14 Section 185, Point (ii), 1st Arrow:

(due to service conditions or any scheme approved by members by SR

8. Compromises, Arrangements & Amalgamations

Page No. 8.8 Section 234

Add one statement: Here Foreign co. means Company Incorporated Outside India,

whether having Place of Business in India or Not

9. Prevention of Oppression & Mismanagement

Page No. 9.5 Section 246: If fraudulent application is made to Tribunal..

11. Winding Up – Chapter XX

Page No. 11.12 Section 300, Step 1:

CL has made report to Tribunal, that some in his opinion….

Page No. 11.22 Section 348, 5th Point (written in Red)

Spelling of Government

13. Producer Companies

st

Page No. 13.10 Section 581W, 1 Point: Replace BOA by BOD

14. Companies Incorporated Outside India

Page No. 14.1 In definition of Foreign Company,

Insert the words AND between point (a) & (b) ,

Insert the words OR between point (b) & (c)

Page No. 14.6 Section 387, Point (5),

Prospectus should be accompanied….

Section 388:

Prospectus cannot be issued in India if Expert’s statement…

19. Miscellaneous Provisions

Page No. 19.3 Section 403, Point (ii)

Heading – Submission after time specified in relevant provision (but within 270 days

from due date)

Any Further Amendments in Law, may be accessed from our website:

www.commerceeduworld.com

You might also like

- Chapter 1 The Ultimate Solution Summary NotesDocument20 pagesChapter 1 The Ultimate Solution Summary NotesSunny SinghNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Advance AccountsDocument25 pagesAdvance Accountsashish.jhaa756No ratings yet

- (As Per 117 (3) (A) For All SR, MGT-14 Is Required.)Document3 pages(As Per 117 (3) (A) For All SR, MGT-14 Is Required.)Pranzali GuptaNo ratings yet

- Companies Act, 2013: An Insight Into Latest AmendmentsDocument10 pagesCompanies Act, 2013: An Insight Into Latest Amendmentsvipul tutejaNo ratings yet

- CA Final Company Law Amendments SummaryDocument12 pagesCA Final Company Law Amendments SummaryAneek JainNo ratings yet

- Amit Bachhawat: Quesɵ Ons and AnswerDocument22 pagesAmit Bachhawat: Quesɵ Ons and AnswerSwatish GuptaNo ratings yet

- Amendment - CA Final - Nov'22Document6 pagesAmendment - CA Final - Nov'22Vrinda KNo ratings yet

- Corporate and Economic Law MCQ PDFDocument157 pagesCorporate and Economic Law MCQ PDFraj kumarNo ratings yet

- Meetings of Board and Its Powers (Chapter-XII) : A Refresher Course On Companies Act, 2013Document25 pagesMeetings of Board and Its Powers (Chapter-XII) : A Refresher Course On Companies Act, 2013Priyanka BhattacharyyaNo ratings yet

- Audit Papers DecDocument164 pagesAudit Papers DecKeshav SethiNo ratings yet

- P13Document14 pagesP13sogoja2705No ratings yet

- Ease of Doing Business Through Companies (Amendment) Act 2017Document2 pagesEase of Doing Business Through Companies (Amendment) Act 2017Pranzali GuptaNo ratings yet

- Dec 2021 Law New Syllabus MCQ Topic Coverage (Hints) Sebi LodrDocument18 pagesDec 2021 Law New Syllabus MCQ Topic Coverage (Hints) Sebi LodrKhader MohammedNo ratings yet

- RTP Nov 2020Document30 pagesRTP Nov 2020Syamala GadupudiNo ratings yet

- SchedulefileDocument6 pagesSchedulefileShubgamNo ratings yet

- IIBF Monthly ColumnDocument3 pagesIIBF Monthly ColumnNavneet PatelNo ratings yet

- 60829bos49465 PDFDocument11 pages60829bos49465 PDFHari KiranNo ratings yet

- CA Final Law Notes by Gurukripa - AUDITORSDocument56 pagesCA Final Law Notes by Gurukripa - AUDITORSYogesh KumarNo ratings yet

- Sbec Summary NotesDocument107 pagesSbec Summary NotesShobhit ShuklaNo ratings yet

- Rtpfinalnew Nov20 p3Document30 pagesRtpfinalnew Nov20 p3cdNo ratings yet

- Companies Act Amendments 2021Document12 pagesCompanies Act Amendments 2021Archie ShahNo ratings yet

- Exemptions To A Private Limited Company: (Personal & Private Circulation Bearing No Opinion or Advice)Document3 pagesExemptions To A Private Limited Company: (Personal & Private Circulation Bearing No Opinion or Advice)Husnain AhmadNo ratings yet

- Law Old Nov18 Suggested AnsDocument22 pagesLaw Old Nov18 Suggested Ansrshetty066No ratings yet

- Suggested Answer - Syl12 - Jun2014 - Paper - 13 Final Examination: Suggested Answers To QuestionsDocument16 pagesSuggested Answer - Syl12 - Jun2014 - Paper - 13 Final Examination: Suggested Answers To QuestionsMdAnjum1991No ratings yet

- CMA Final Law Super 30 - Dec 2023Document23 pagesCMA Final Law Super 30 - Dec 2023rehanrahman88896No ratings yet

- Companies Act 2013 Raising The Bar On Governance - KPMGDocument49 pagesCompanies Act 2013 Raising The Bar On Governance - KPMGManjunath ShettigarNo ratings yet

- Amendments in Business Law, Ethics and Communication: (For May 2018 Exams (Old Syllabubs) As Per RTP)Document3 pagesAmendments in Business Law, Ethics and Communication: (For May 2018 Exams (Old Syllabubs) As Per RTP)Neha jainNo ratings yet

- Chapter 12 End of Chapter Question AnswersDocument5 pagesChapter 12 End of Chapter Question AnswersnicoleNo ratings yet

- Companies Act 2013Document6 pagesCompanies Act 2013brightlight1989No ratings yet

- UntitledDocument303 pagesUntitledHarismithaNo ratings yet

- Companies Act Amended - Further Advances in The Ease of Doing Business - Corporate - Commercial Law - IndiaDocument3 pagesCompanies Act Amended - Further Advances in The Ease of Doing Business - Corporate - Commercial Law - IndiakaranNo ratings yet

- Schedule XIII-Practical ApproachDocument7 pagesSchedule XIII-Practical Approachmeenu307No ratings yet

- Law Final MCQDocument27 pagesLaw Final MCQJuhi vohraNo ratings yet

- October, 2019 - Company LawDocument10 pagesOctober, 2019 - Company LawHarshvardhan MelantaNo ratings yet

- Pre Reading MaterialDocument24 pagesPre Reading MaterialSaju XavierNo ratings yet

- 2 RTP CompressedDocument416 pages2 RTP CompressedVikash JhaNo ratings yet

- Adv Aud Final May08Document16 pagesAdv Aud Final May08Fazi HaiderNo ratings yet

- NK Academy For Ca: Revision Exam - 2Document5 pagesNK Academy For Ca: Revision Exam - 2S SNo ratings yet

- Ca Final New Case Laws Notification CircularsDocument9 pagesCa Final New Case Laws Notification Circularsbedidanish900No ratings yet

- LimitsDocument9 pagesLimitsNehaNo ratings yet

- Managerial Remuneration Checklist FinalDocument4 pagesManagerial Remuneration Checklist FinaldhuvadpratikNo ratings yet

- CA Final Law SummaryDocument80 pagesCA Final Law SummaryManogna PNo ratings yet

- Paper Set1Document5 pagesPaper Set1AVS InfraNo ratings yet

- Best Part of Ultimate SolutionDocument10 pagesBest Part of Ultimate SolutionDeepika AnandhanNo ratings yet

- 55850bos45243cp2 PDFDocument58 pages55850bos45243cp2 PDFHarshal JainNo ratings yet

- Auditing and Assurance EssentialsDocument14 pagesAuditing and Assurance EssentialsGaihre रातो HULKNo ratings yet

- PROCESS MEMORANDUM-GARIB NAWAZ HOTELS PVT LTDDocument22 pagesPROCESS MEMORANDUM-GARIB NAWAZ HOTELS PVT LTDkapil.mantriNo ratings yet

- AccountsDocument41 pagesAccountskomalc2026No ratings yet

- UntitledDocument84 pagesUntitledkaataveNo ratings yet

- Guideline Answers: Professional ProgrammeDocument57 pagesGuideline Answers: Professional ProgrammeLekshminarayanan KrishnanNo ratings yet

- April, 2019 - Company LawDocument10 pagesApril, 2019 - Company LawHarshvardhan MelantaNo ratings yet

- Amendment To The Companies ActDocument8 pagesAmendment To The Companies Actkripa shresthaNo ratings yet

- Memorandum of AssociationDocument6 pagesMemorandum of AssociationRudra Pratap SinghNo ratings yet

- Company Law - Test IVDocument5 pagesCompany Law - Test IVArundhati PawarNo ratings yet

- Sbec Summary NotesDocument108 pagesSbec Summary NotesRevanthi DNo ratings yet

- FAQ For Company Law 2013Document24 pagesFAQ For Company Law 2013Archanat07100% (1)

- CARO 2016 AuditpediaDocument6 pagesCARO 2016 AuditpediaSri PavanNo ratings yet

- Partnership Deed ThirdDocument48 pagesPartnership Deed ThirdDeepa BhatiaNo ratings yet

- Sample Question Bank Fybms Sem1 Financial Management - Deepa BhatiaDocument14 pagesSample Question Bank Fybms Sem1 Financial Management - Deepa BhatiaDeepa BhatiaNo ratings yet

- 7631 Et 33 ET PDFDocument11 pages7631 Et 33 ET PDFKalpesh RajgorNo ratings yet

- DNA Has Found Many Uses in The Medical and Criminal Investigation FieldsDocument4 pagesDNA Has Found Many Uses in The Medical and Criminal Investigation FieldsDeepa BhatiaNo ratings yet

- Affidavit Flat No 20Document3 pagesAffidavit Flat No 20Deepa BhatiaNo ratings yet

- Basics of ResearchDocument10 pagesBasics of ResearchAnkit JindalNo ratings yet

- Com - Law Test-1 - 13841296Document5 pagesCom - Law Test-1 - 13841296Deepa BhatiaNo ratings yet

- 7630 Et 32 ETDocument15 pages7630 Et 32 ETDeepa BhatiaNo ratings yet

- 1513750093jplaw 04 Q IDocument13 pages1513750093jplaw 04 Q IDeepa BhatiaNo ratings yet

- MootDocument120 pagesMootVaalu MuthuNo ratings yet

- Question 1 Administration of Criminal LawDocument11 pagesQuestion 1 Administration of Criminal LawDeepa BhatiaNo ratings yet

- EVERYTHING YOU NEED TO KNOW ABOUT COMPANY LAWDocument74 pagesEVERYTHING YOU NEED TO KNOW ABOUT COMPANY LAWgaurav.shukla360No ratings yet

- Approaches To Violence in IndiaDocument17 pagesApproaches To Violence in IndiaDeepa BhatiaNo ratings yet

- 8153 Et Et PDFDocument12 pages8153 Et Et PDFshiva karnatiNo ratings yet

- Medicine MCQDocument8 pagesMedicine MCQDeepa BhatiaNo ratings yet

- Question 1 Administration of Criminal LawDocument11 pagesQuestion 1 Administration of Criminal LawDeepa BhatiaNo ratings yet

- 530 Free MCQs by FinAppDocument116 pages530 Free MCQs by FinAppjanardhan CA,CS100% (1)

- Application For Registration of Society: Form - A See Rule No 4 (1) 1Document3 pagesApplication For Registration of Society: Form - A See Rule No 4 (1) 1Deepa BhatiaNo ratings yet

- Multiple Choice Questions: The Indian Contract Act, 187 2Document21 pagesMultiple Choice Questions: The Indian Contract Act, 187 2Deepa BhatiaNo ratings yet

- FormDocument5 pagesFormDeepa BhatiaNo ratings yet

- Performance Prevented byDocument4 pagesPerformance Prevented byDeepa BhatiaNo ratings yet

- Multiple Choice Question (Sample) Corporate and Securities Law Sybbi Sem 4Document17 pagesMultiple Choice Question (Sample) Corporate and Securities Law Sybbi Sem 4Deepa Bhatia80% (5)

- Auditing 75 25Document4 pagesAuditing 75 25Deepa BhatiaNo ratings yet

- Multiple Choice Question (Sample) Corporate and Securities Law Sybbi Sem 4Document17 pagesMultiple Choice Question (Sample) Corporate and Securities Law Sybbi Sem 4Deepa Bhatia80% (5)

- 3 Sem Core Financial Markets and Operations PDFDocument22 pages3 Sem Core Financial Markets and Operations PDFpj04No ratings yet

- Auditing MCQsDocument30 pagesAuditing MCQsZAKA ULLAH81% (16)

- 3 Sem Core Financial Markets and Operations PDFDocument22 pages3 Sem Core Financial Markets and Operations PDFpj04No ratings yet

- Sybms and Fybaf AuditingDocument31 pagesSybms and Fybaf AuditingDeepa BhatiaNo ratings yet

- Question Paper TemplateDocument4 pagesQuestion Paper TemplateDeepa BhatiaNo ratings yet

- Auditing MCQsDocument30 pagesAuditing MCQsZAKA ULLAH81% (16)

- Tales of The Unknown, Volume I, The Bard's Tale #2Document5 pagesTales of The Unknown, Volume I, The Bard's Tale #2adikressNo ratings yet

- Blitzkrieg 2 - WalkthroughDocument4 pagesBlitzkrieg 2 - WalkthroughJuanAndresNavarroSoto0% (1)

- Today's Fallen Heroes Tuesday 8 October 191 (2486)Document50 pagesToday's Fallen Heroes Tuesday 8 October 191 (2486)MickTierneyNo ratings yet

- Singapore River ArtDocument3 pagesSingapore River ArtjsassheadNo ratings yet

- 03-2012 Use Bid Securing DeclarationDocument5 pages03-2012 Use Bid Securing Declarationada bcNo ratings yet

- Hindu HolocaustDocument176 pagesHindu Holocaustramkumaran100% (7)

- Selected Bibliography of Material On The Paakantyi / Paakantji / Barkindji Language and People Held in The AIATSIS LibraryDocument41 pagesSelected Bibliography of Material On The Paakantyi / Paakantji / Barkindji Language and People Held in The AIATSIS LibraryMichael O'DwyerNo ratings yet

- Legal Responsibilities of NursesDocument3 pagesLegal Responsibilities of NursesKat Barretto Boltron25% (4)

- Mr. Smith Goes To Washington: 1. When Senator Sam Foley Dies, How Is His Senate Seat Replaced?Document4 pagesMr. Smith Goes To Washington: 1. When Senator Sam Foley Dies, How Is His Senate Seat Replaced?Viktoriya KuzNo ratings yet

- The Commissioner of Internal Revenue vs. CTA 203054-55Document1 pageThe Commissioner of Internal Revenue vs. CTA 203054-55magenNo ratings yet

- Double Sales - First Possession in Good Faith PrevailsDocument2 pagesDouble Sales - First Possession in Good Faith PrevailsMaribel Nicole LopezNo ratings yet

- Manchester Development Corporation, Et Al v. CA, G.R. No. 75919 May 7, 1987Document3 pagesManchester Development Corporation, Et Al v. CA, G.R. No. 75919 May 7, 1987jessa abellonNo ratings yet

- PensionDocument197 pagesPensionAsma JavedNo ratings yet

- Prop PAST FullDocument14 pagesProp PAST Full유니스No ratings yet

- Gaite Vs Fonacier, 2 SCRA 830Document8 pagesGaite Vs Fonacier, 2 SCRA 830AddAllNo ratings yet

- Leon County Booking Report: Sept. 11, 2021Document4 pagesLeon County Booking Report: Sept. 11, 2021WCTV Digital Team50% (2)

- ĐỀ THI AVDV BỘ 05 - Tổng 7 Đề UTE 2023Document5 pagesĐỀ THI AVDV BỘ 05 - Tổng 7 Đề UTE 202319 Nguyễn Duy KhoaNo ratings yet

- Starkville Dispatch Eedition 9-20-19Document16 pagesStarkville Dispatch Eedition 9-20-19The DispatchNo ratings yet

- KolkataDocument7,629 pagesKolkataprashant kaushikNo ratings yet

- 32 1 Hitler's Lightning WarDocument3 pages32 1 Hitler's Lightning WarjaiurwgghiurhfuigaewNo ratings yet

- Daniel Ptak and Jevin vs. Dobrott AppealDocument15 pagesDaniel Ptak and Jevin vs. Dobrott AppealHeather DobrottNo ratings yet

- The Story of The Smart ParrotDocument3 pagesThe Story of The Smart ParrotBudi RNo ratings yet

- The Stag Book - Issue 50 WebDocument40 pagesThe Stag Book - Issue 50 WebThe StagNo ratings yet

- WT-web Technology AkashDocument54 pagesWT-web Technology Akashshubham moudgilNo ratings yet

- Rhro CLDocument36 pagesRhro CLMirza Nazim BegNo ratings yet

- Crim Pro Class Notes DGDocument34 pagesCrim Pro Class Notes DGFreidrich Anton BasilNo ratings yet

- Combined Results - BUP MT 03 Mentors24Document20 pagesCombined Results - BUP MT 03 Mentors24kumkumbiswas23No ratings yet

- Carole Baskin Victim Statement - Joseph Maldonado Passage Resentencing 1-28-22Document5 pagesCarole Baskin Victim Statement - Joseph Maldonado Passage Resentencing 1-28-22Anonymous EHPq5kNo ratings yet

- Actual Semi Truck Complaint SampleDocument10 pagesActual Semi Truck Complaint SampleShirley WeissNo ratings yet

- No Good Thing Will He WithholdDocument4 pagesNo Good Thing Will He WithholdGrace Church ModestoNo ratings yet