Professional Documents

Culture Documents

20168-2000-Amending Sections of Revenue Regulations No.20180312-6791-1o08lh4 PDF

20168-2000-Amending Sections of Revenue Regulations No.20180312-6791-1o08lh4 PDF

Uploaded by

Aleezah Gertrude Raymundo0 ratings0% found this document useful (0 votes)

27 views4 pagesOriginal Title

20168-2000-Amending_Sections_of_Revenue_Regulations_No.20180312-6791-1o08lh4.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

27 views4 pages20168-2000-Amending Sections of Revenue Regulations No.20180312-6791-1o08lh4 PDF

20168-2000-Amending Sections of Revenue Regulations No.20180312-6791-1o08lh4 PDF

Uploaded by

Aleezah Gertrude RaymundoCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

August 21, 2000

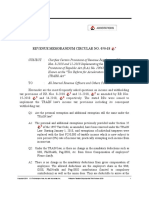

REVENUE REGULATIONS NO. 08-00

Amending Sections 2.78.1(A)(1), (A)(3), (A)(6), (A)(7), and (B)(11)(b) of

SUBJECT: Revenue Regulations No. 2-98, as Amended, and Section 2.33(C) of

Revenue

Regulations No. 3-98, with Respect to "De Minimis" Benefits, Additional

Compensation Allowance (ACA), Representation and Transportation

Allowance (RATA) and Personal Economic Relief Allowance (PERA)

TO : All Internal Revenue Officers and Others Concerned

SECTION 1. Scope. — Pursuant to Section 244 of the 1997 Tax Code, in relation

to Section 78 thereof pertaining to the withholding of income tax on compensation

income, these Regulations are hereby promulgated amending Sections 2.78.1(A)(1), (A)

(3), (A)(6), (A)(7), and (B)(11)(b) of Revenue Regulations No 2-98, as amended, to

further clarify certain bene ts/privileges received by the employees which are not

considered as items of income and therefore not subject to income tax and

consequently, to the withholding tax. Likewise amended is the enumeration of the items

of de-minimis bene ts which are exempt from fringe bene ts tax as appearing under

Sec. 2.33(C) of Revenue Regulations No. 3-98. IHcTDA

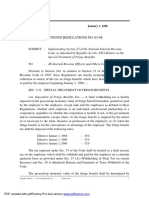

SECTION 2. Amendments. — Sec. 2.78.1(A)(1), (A)(3), (A)(6), (A)(7), n (B)(11)(b)

and(B)(13) are hereby amended to read as follows:

"Sec. 2.78.1. Withholding of Income Tax on Compensation Income. —

"(A) . . .

"(1) Compensation paid in kind. — . . .

''Where compensation is paid in property other than money, the employer

shall make necessary arrangements to ensure that the amount of the tax required

to be withheld is available for payment to the Commissioner.

"(3) Facilities and privileges of relatively small value. — Ordinarily, facilities

and privileges (such as entertainment, medical services, or so-called "courtesy

discounts" on purchases), otherwise known as "de minimis bene ts," furnished or

offered by an employer to his employees, are not considered as compensation

subject to INCOME TAX AND CONSEQUENTLY TO withholding tax, if such

facilities are offered or furnished by the employer merely as means of promoting

the health, goodwill, contentment, or efficiency of his employees.

"THE FOLLOWING SHALL BE CONSIDERED AS "DE MINIMIS" BENEFITS

NOT SUBJECT TO WITHHOLDING TAX ON COMPENSATION INCOME OF BOTH

MANAGERIAL AND RANK AND FILE EMPLOYEES :

(a) MONETIZED UNUSED VACATION LEAVE CREDITS OF EMPLOYEES

NOT EXCEEDING TEN (10) DAYS DURING THE YEAR;

(b) MEDICAL CASH ALLOWANCE TO DEPENDENTS OF EMPLOYEES NOT

EXCEEDING P750.00 PER EMPLOYEE PER SEMESTER OR P125 PER MONTH;

(c) RICE SUBSIDY OF P1,000.00 OR ONE (1) SACK OF 50-KG. RICE PER

CD Technologies Asia, Inc. 2018 cdasiaonline.com

MONTH AMOUNTING TO NOT MORE THAN P1,000.00.

(d) UNIFORMS AND CLOTHING ALLOWANCE NOT EXCEEDING P3,000 PER

ANNUM;

(e) ACTUAL YEARLY MEDICAL BENEFITS NOT EXCEEDING P10,000 PER

ANNUM;

(f) LAUNDRY ALLOWANCE NOT EXCEEDING P300 PER MONTH;

(g) EMPLOYEES ACHIEVEMENT AWARDS, E.G., FOR LENGTH OF SERVICE

OR SAFETY ACHIEVEMENT, WHICH MUST BE IN THE FORM OF A TANGIBLE

PERSONAL PROPERTY OTHER THAN CASH OR GIFT CERTIFICATE, WITH AN

ANNUAL MONETARY VALUE NOT EXCEEDING P10,000.00 RECEIVED BY THE

EMPLOYEE UNDER AN ESTABLISHED WRITTEN PLAN WHICH DOES NOT

DISCRIMINATE IN FAVOR OF HIGHLY PAID EMPLOYEES ;

(h) GIFTS GIVEN DURING CHRISTMAS AND MAJOR ANNIVERSARY

CELEBRATIONS NOT EXCEEDING P5,000 PER EMPLOYEE PER ANNUM;

(i) FLOWERS, FRUITS, BOOKS, OR SIMILAR ITEMS GIVEN TO EMPLOYEES

UNDER SPECIAL CIRCUMSTANCES, E.G., ON ACCOUNT OF ILLNESS, MARRIAGE,

BIRTH OF A BABY, ETC.; AND

(j) DAILY MEAL ALLOWANCE FOR OVERTIME WORK NOT EXCEEDING

TWENTY FIVE PERCENT (25%) OF THE BASIC MINIMUM WAGE."

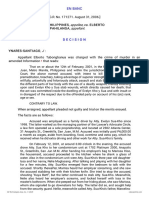

THE AMOUNT OF "DE MINIMIS' BENEFITS CONFORMING TO THE CEILING

HEREIN PRESCRIBED SHALL NOT BE CONSIDERED IN DETERMINING THE

P30,000 CEILING OF "OTHER BENEFITS" PROVIDED UNDER SECTION 32(B)(7)(e)

OF THE CODE. HOWEVER, IF THE EMPLOYER PAYS MORE THAN THE CEILING

PRESCRIBED BY THESE REGULATIONS, THE EXCESS SHALL BE TAXABLE TO

THE EMPLOYEE RECEIVING THE BENEFITS ONLY IF SUCH EXCESS IS BEYOND

THE P30,000.00 CEILING. PROVIDED, FURTHER, THAT ANY AMOUNT GIVEN BY

THE EMPLOYER AS BENEFITS TO ITS EMPLOYEES, WHETHER CLASSIFIED AS

DE MINIMIS BENEFITS OR FRINGE BENEFITS, SHALL CONSTITUTE AS

DEDUCTIBLE EXPENSE UPON SUCH EMPLOYER.

"(4) . . .

(5) . .

"(6) Fixed or variable transportation, representation and other allowances.

—

"(a) IN GENERAL, xed or variable transportation, representation and other

allowances which are received by a public o cer or employee of a private entity,

in addition to the regular compensation xed for his position or o ce, is

compensation subject to withholding. PROVIDED, HOWEVER, THAT

REPRESENTATION AND TRANSPORTATION ALLOWANCE (RATA) GRANTED TO

PUBLIC OFFICERS AND EMPLOYEES UNDER THE GENERAL APPROPRIATIONS

ACT AND THE PERSONNEL ECONOMIC RELIEF ALLOWANCE (PERA) WHICH

ESSENTIALLY CONSTITUTE REIMBURSEMENT FOR EXPENSES INCURRED IN

THE PERFORMANCE OF GOVERNMENT PERSONNEL'S OFFICIAL DUTIES SHALL

NOT BE SUBJECT TO INCOME TAX AND CONSEQUENTLY TO WITHHOLDING

TAX. PROVIDED FURTHER, THAT PURSUANT TO E.O. 219 WHICH TOOK EFFECT

ON JANUARY 1, 2000, ADDITIONAL COMPENSATION ALLOWANCE (ACA) GIVEN

CD Technologies Asia, Inc. 2018 cdasiaonline.com

TO GOVERNMENT PERSONNEL SHALL NOT BE SUBJECT TO WITHHOLDING

TAX PENDING ITS FORMAL INTEGRATION INTO THE BASIC PAY.

CONSEQUENTLY, AND EFFECTIVE FOR THE TAXABLE YEAR 2000, ACA SHALL

BE CLASSIFIED AS PART OF THE "OTHER BENEFITS" UNDER SECTION 32(B)(7)

(e) OF THE CODE WHICH ARE EXCLUDED FROM GROSS COMPENSATION

INCOME PROVIDED THE TOTAL AMOUNT OF SUCH BENEFITS DOES NOT

EXCEED P30,000.00. ADETca

"(b) Any amount paid speci cally, either as advances or reimbursements

for traveling, representation and other bona fide ordinary and necessary expenses

incurred or reasonably expected to be incurred by the employee in the

performance of his duties are not compensation subject to withholding, if the

following conditions are satisfied:

"(i) It is for ordinary and necessary traveling and representation or

entertainment expenses paid or incurred by the employee in the pursuit of the

trade, business or profession; and

"(ii) The employee is required to account/liquidate for the foregoing

expenses in accordance with the speci c requirements of substantiation for each

category of expenses pursuant to Sec. 34 of the Code. The excess of actual

expenses over advances made shall constitute taxable income if such amount is

not returned to the employer. Reasonable amounts of reimbursements/advances

for traveling and entertainment expenses which are pre-computed on a daily basis

and are paid to an employee while he is on an assignment or duty need not be

subject to the requirements of substantiation and to withholding."

"xxx xxx xxx

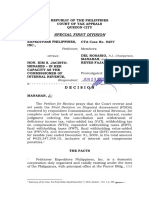

"(B) Exemptions from withholding tax on compensation. The following

income payments are exempted from the requirement of withholding tax on

compensation:

"xxx xxx xxx

"(11) Thirteenth (13th) month pay and other benefits. —

"(a) . . .

"(b) Other bene ts such as Christmas bonus, productivity incentives,

loyalty award, gift in cash or in kind and other bene ts of similar nature actually

received by o cials and employees of both government and private o ces,

INCLUDING THE ADDITIONAL COMPENSATION ALLOWANCE ("ACA") GRANTED

AND PAID TO ALL OFFICIALS AND EMPLOYEES OF THE NATIONAL

GOVERNMENT AGENCIES (NGAs) INCLUDING STATE UNIVERSITIES AND

COLLEGES (SUCs), GOVERNMENT-OWNED AND/OR CONTROLLED

CORPORATIONS (GOCCs), GOVERNMENT FINANCIAL INSTITUTIONS (GFIs) AND

LOCAL GOVERNMENT UNITS (LGUs)

"The above stated exclusions (a) and (b) shall cover bene ts paid or

accrued during the year provided that total amount shall not exceed thirty

thousand pesos (P30,000.00) which may be increased through rules and

regulations issued by the Secretary of Finance, upon recommendation of the

Commissioner, after considering, among others, the effect on the same of the

inflation rate at the end of the taxable year."

"(12) . . .

CD Technologies Asia, Inc. 2018 cdasiaonline.com

"(13) FACILITIES AND PRIVILEGES OF RELATIVELY SMALL VALUE OR 'DE

MINIMIS' BENEFITS AS DEFINED UNDER THESE REGULATIONS ."

SECTION 3. Repealing Clause. — Sections 2.78.1(A)(1), (A)(3), (A)(6), (A)(7), and

(B)(11)(b) of Revenue Regulations No. 2-98, including the enumeration of the items of

de-minimis bene ts which are exempt from fringe bene ts tax as appearing under Sec.

2.33(C) of Revenue Regulations No. 3-98 are hereby modi ed and the inclusion of Sec.

2.78.1(B)(13) in accordance with the amendments under these Regulations. All other

existing rules and regulations or parts thereof which are inconsistent with the

provisions of these Regulations are hereby revoked, modified or amended accordingly.

SECTION 4. Effectivity Clause. — These Regulations shall take effect fteen (15)

days after publication in any newspaper of general circulation.

(SGD.) JOSE T. PARDO

Secretary of Finance

Recommending Approval:

(SGD.) DAKILA B. FONACIER

Commissioner of Internal Revenue

CD Technologies Asia, Inc. 2018 cdasiaonline.com

You might also like

- TAXREV D2019 Reviewer Transcript PDFDocument193 pagesTAXREV D2019 Reviewer Transcript PDFAleezah Gertrude Raymundo100% (1)

- Cir Vs CA and Ymca (Summary)Document4 pagesCir Vs CA and Ymca (Summary)ian clark MarinduqueNo ratings yet

- RMC 27-2011Document0 pagesRMC 27-2011Peggy SalazarNo ratings yet

- Accounting Firm Marketing PlanDocument61 pagesAccounting Firm Marketing Plang24uallNo ratings yet

- Consti - I - Case List - SY 2018-2019 (Fin) Ao16oct2018 - BML (63pp)Document63 pagesConsti - I - Case List - SY 2018-2019 (Fin) Ao16oct2018 - BML (63pp)Aleezah Gertrude RaymundoNo ratings yet

- RR 3-98Document18 pagesRR 3-98TetNo ratings yet

- Contract CostingDocument53 pagesContract Costingrashid69% (16)

- Revenue Regulations 10-2008Document43 pagesRevenue Regulations 10-2008mary lou100% (29)

- Schola Brevis: Date Provisions of Law (And Commentary) CasesDocument6 pagesSchola Brevis: Date Provisions of Law (And Commentary) CasesAleezah Gertrude RaymundoNo ratings yet

- Consulting Math Drills: Short QuestionsDocument74 pagesConsulting Math Drills: Short Questionswind kkun100% (2)

- Deductions From Gross IncomeDocument23 pagesDeductions From Gross IncomeAidyl PerezNo ratings yet

- Allowable Deductions (Sec. 34) DeductionsDocument20 pagesAllowable Deductions (Sec. 34) DeductionsRon Ramos100% (1)

- General Principles of Taxation 2018Document112 pagesGeneral Principles of Taxation 2018Aleezah Gertrude RaymundoNo ratings yet

- RR 10-08Document30 pagesRR 10-08matinikki100% (1)

- Uap Doc 401 402 Architect General ContractorDocument15 pagesUap Doc 401 402 Architect General ContractorJennifer Lachica Soriano100% (2)

- RR 10-00Document3 pagesRR 10-00matinikkiNo ratings yet

- Taxation I - Part Ii Compilation of Cited Bir Issuances, EtcDocument186 pagesTaxation I - Part Ii Compilation of Cited Bir Issuances, Etccmv mendozaNo ratings yet

- Government Accounting - PPEDocument4 pagesGovernment Accounting - PPEEliyah JhonsonNo ratings yet

- Haryana Fire Service Act 2009Document19 pagesHaryana Fire Service Act 2009qubrex1100% (1)

- 2023 Wells Fargo Impact of Women-Owned Businesses, Geography ReportDocument9 pages2023 Wells Fargo Impact of Women-Owned Businesses, Geography Reportcassia.sariNo ratings yet

- Criteria For The Creation of LGUs PDFDocument7 pagesCriteria For The Creation of LGUs PDFAleezah Gertrude RaymundoNo ratings yet

- Nerds Consti 1 PDFDocument670 pagesNerds Consti 1 PDFAleezah Gertrude RaymundoNo ratings yet

- 06 Gross IncomeDocument103 pages06 Gross IncomeJSNo ratings yet

- The Art of Successful Trading - Birger SchafermeierDocument379 pagesThe Art of Successful Trading - Birger SchafermeierMahesh DulaniNo ratings yet

- 2008 BIR - Ruling - DA 128 08 - 20180320 1159 1heemgd PDFDocument2 pages2008 BIR - Ruling - DA 128 08 - 20180320 1159 1heemgd PDFAleezah Gertrude RaymundoNo ratings yet

- 2008 BIR - Ruling - DA 128 08 - 20180320 1159 1heemgd PDFDocument2 pages2008 BIR - Ruling - DA 128 08 - 20180320 1159 1heemgd PDFAleezah Gertrude RaymundoNo ratings yet

- OCAMPO V ENRIQUEZDocument15 pagesOCAMPO V ENRIQUEZAleezah Gertrude Raymundo100% (2)

- RR 8-00Document3 pagesRR 8-00matinikkiNo ratings yet

- RR 08 00Document5 pagesRR 08 00James Peter GarcesNo ratings yet

- RR No. 10-08Document53 pagesRR No. 10-08Deen EnriquezNo ratings yet

- Revenue Regulations (RR) No 10-08Document0 pagesRevenue Regulations (RR) No 10-08sj_adenipNo ratings yet

- RR No. 10-2008Document37 pagesRR No. 10-2008Kristan John ZernaNo ratings yet

- Updated RR 2-98 Sec 2.78.1 (A) CompensationDocument5 pagesUpdated RR 2-98 Sec 2.78.1 (A) CompensationJaymar DetoitoNo ratings yet

- 4.2 BIR Ruling No. 001-07Document5 pages4.2 BIR Ruling No. 001-07IanRaissaPenaNo ratings yet

- Revenue Regulation NoDocument38 pagesRevenue Regulation NolalararafafaNo ratings yet

- RMC No. 50-2018 WTWDocument21 pagesRMC No. 50-2018 WTWAris Basco DuroyNo ratings yet

- Group 1 Assignment - New FormatDocument14 pagesGroup 1 Assignment - New FormatJessaMangadlaoNo ratings yet

- FS2122-INCOMETAX-02: BSA 1202 Atty. F. R. SorianoDocument11 pagesFS2122-INCOMETAX-02: BSA 1202 Atty. F. R. SorianoKatring O.No ratings yet

- Fringe Benefits TaxDocument11 pagesFringe Benefits Taxkenshin sclanimirNo ratings yet

- Fringe Benefits Tax and de Minimis Benefits: ObjectivesDocument11 pagesFringe Benefits Tax and de Minimis Benefits: ObjectivesChristelle JosonNo ratings yet

- Pure Compensation IncomeDocument2 pagesPure Compensation Incomechavezcelvia18No ratings yet

- Withholding of Income Tax On Compensation Income.-: REVENUE REGULATIONS NO. 10-2008 Issued On September 24, 2008Document17 pagesWithholding of Income Tax On Compensation Income.-: REVENUE REGULATIONS NO. 10-2008 Issued On September 24, 2008Kenneth Marvin MateoNo ratings yet

- SB 1944 PDFDocument7 pagesSB 1944 PDFEdu ParungaoNo ratings yet

- De Minimis BenefitsDocument1 pageDe Minimis BenefitsChristineNo ratings yet

- COMPUTATION OF GROSS INCOME As Per Tax Code Sec. 32-33Document5 pagesCOMPUTATION OF GROSS INCOME As Per Tax Code Sec. 32-332022107419No ratings yet

- BIR Ruling DA-499-99 20210505-13Document3 pagesBIR Ruling DA-499-99 20210505-13rian.lee.b.tiangcoNo ratings yet

- Tax Digest 10-27-22Document23 pagesTax Digest 10-27-22angelicaNo ratings yet

- RR No. 03-98Document18 pagesRR No. 03-98fatmaaleahNo ratings yet

- Deductions, Are The Amounts, Which The Law Allows To Be Deducted From Gross Income inDocument22 pagesDeductions, Are The Amounts, Which The Law Allows To Be Deducted From Gross Income inJamilenePandanNo ratings yet

- Sec. 34 IRC-DeductionsDocument8 pagesSec. 34 IRC-DeductionsMav ZamoraNo ratings yet

- Revenue Regulations - CompiledDocument13 pagesRevenue Regulations - Compiledgoannamarie7814No ratings yet

- Topic 1.1 Withholding Tax On CompensationDocument42 pagesTopic 1.1 Withholding Tax On CompensationTeresa AlbertoNo ratings yet

- 20107-1998-Implementing Section 33 of The National20180312-6791-1ui4ur4Document12 pages20107-1998-Implementing Section 33 of The National20180312-6791-1ui4ur4Deanna Clarisse HecetaNo ratings yet

- Gross Income: Learning ObjectivesDocument12 pagesGross Income: Learning ObjectivesClaire BarbaNo ratings yet

- RR 10-02Document5 pagesRR 10-02matinikkiNo ratings yet

- 337102-2022-Colegio de San Antonio de Padua Inc.20220929-11-McriyyDocument4 pages337102-2022-Colegio de San Antonio de Padua Inc.20220929-11-McriyyRen Mar CruzNo ratings yet

- Compensation Income - Fringe Benefit TaxDocument41 pagesCompensation Income - Fringe Benefit Taxdelacruzrojohn600No ratings yet

- Income Tax Module 2Document29 pagesIncome Tax Module 2Ramya GowdaNo ratings yet

- 17984-2011-Revocation of BIR Ruling Nos. 002-99 PDFDocument3 pages17984-2011-Revocation of BIR Ruling Nos. 002-99 PDFAleezah Gertrude RaymundoNo ratings yet

- FTP FTP - Bir.gov - PH Webadmin1 PDF 2294rr10 02Document5 pagesFTP FTP - Bir.gov - PH Webadmin1 PDF 2294rr10 02Marj Fulgueras-GoNo ratings yet

- Income Tax - MidtermDocument9 pagesIncome Tax - MidtermThe Second OneNo ratings yet

- Friinge Benifit Tax-18Document9 pagesFriinge Benifit Tax-18s4sahithNo ratings yet

- Gross Income Inc Exc DedDocument9 pagesGross Income Inc Exc DedMelbert BallaraNo ratings yet

- 3-98 and 2-98 PDFDocument103 pages3-98 and 2-98 PDFAna DocallosNo ratings yet

- RR 2-98 and 3-98Document103 pagesRR 2-98 and 3-98Ria Camille de JesusNo ratings yet

- Computation of Income TaxDocument6 pagesComputation of Income TaxshakiraNo ratings yet

- Rev. Regs. 3-98Document17 pagesRev. Regs. 3-98Robynne LopezNo ratings yet

- Answer Key Tax 3rd ExamDocument17 pagesAnswer Key Tax 3rd ExamCharlotte GallegoNo ratings yet

- Bir Ruling No. Ot-0339-2020Document5 pagesBir Ruling No. Ot-0339-2020Ren Mar CruzNo ratings yet

- RR 05-11 (Further Amendments To RR2-98 and RR3-98) de MinimisDocument5 pagesRR 05-11 (Further Amendments To RR2-98 and RR3-98) de MinimisMatthew TiuNo ratings yet

- Accounting V Tax TreatmentDocument3 pagesAccounting V Tax TreatmentReena MaNo ratings yet

- Bir Ruling Da 469 06Document6 pagesBir Ruling Da 469 06juliusNo ratings yet

- TRAIN Briefing - Income TaxDocument48 pagesTRAIN Briefing - Income TaxLovely MagdipigNo ratings yet

- Bam031 Income Taxation P2 NotesDocument8 pagesBam031 Income Taxation P2 NotesRyan Malanum AbrioNo ratings yet

- Gross Income RRsDocument27 pagesGross Income RRsslumbaNo ratings yet

- Income From Other SourcesDocument5 pagesIncome From Other SourcesGovarthanan NarasimhanNo ratings yet

- Income Taxation Module 2Document17 pagesIncome Taxation Module 2Regelene Selda TatadNo ratings yet

- Appellee Vs Vs Appellant: en BancDocument13 pagesAppellee Vs Vs Appellant: en BancAleezah Gertrude RaymundoNo ratings yet

- Plaintiff-Appellee Vs Vs Accused-Appellant Solicitor General Public Attorney's OfficeDocument11 pagesPlaintiff-Appellee Vs Vs Accused-Appellant Solicitor General Public Attorney's OfficeAleezah Gertrude RaymundoNo ratings yet

- 28648-2012-Tax Treatment of Stock Option Plans20190227-5466-1umcn1h PDFDocument2 pages28648-2012-Tax Treatment of Stock Option Plans20190227-5466-1umcn1h PDFAleezah Gertrude RaymundoNo ratings yet

- 17984-2011-Revocation of BIR Ruling Nos. 002-99 PDFDocument3 pages17984-2011-Revocation of BIR Ruling Nos. 002-99 PDFAleezah Gertrude RaymundoNo ratings yet

- III. TAX 1 COMPILATION - Case # 60-78Document54 pagesIII. TAX 1 COMPILATION - Case # 60-78Aleezah Gertrude RaymundoNo ratings yet

- II. Compilation of General Principles - Constitutional LimitationsDocument55 pagesII. Compilation of General Principles - Constitutional LimitationsAleezah Gertrude RaymundoNo ratings yet

- Compilation 1.01 - Articles I and II.v1 PDFDocument60 pagesCompilation 1.01 - Articles I and II.v1 PDFAleezah Gertrude RaymundoNo ratings yet

- Gertrude Consti Notes PDFDocument47 pagesGertrude Consti Notes PDFAleezah Gertrude RaymundoNo ratings yet

- CIVREV Persons Digests (Chan-G)Document371 pagesCIVREV Persons Digests (Chan-G)Aleezah Gertrude RaymundoNo ratings yet

- Contract To Sell Aurora Gardens Tower 2Document4 pagesContract To Sell Aurora Gardens Tower 2Aleezah Gertrude RaymundoNo ratings yet

- Mivumba in Kampala/Used Clothes TradeDocument49 pagesMivumba in Kampala/Used Clothes TradeMegan GarnerNo ratings yet

- Special First Division: Petitioner, - VersusDocument17 pagesSpecial First Division: Petitioner, - VersusEugene SardonNo ratings yet

- Corpo Odd Number Digest NaDocument20 pagesCorpo Odd Number Digest NaYsabelleNo ratings yet

- A Study of Investment Objectives of Individual InvestorsDocument12 pagesA Study of Investment Objectives of Individual InvestorsRishabh SangariNo ratings yet

- Tax H Question 2021Document3 pagesTax H Question 2021Aporupa BarNo ratings yet

- Answers - Partnership OperationsDocument18 pagesAnswers - Partnership OperationsAllondra DapengNo ratings yet

- 317 Units: M/S A K Hasan Bros M/S. M. UsmanDocument2 pages317 Units: M/S A K Hasan Bros M/S. M. UsmanKashif RazaNo ratings yet

- Midterm Exam IntaxDocument20 pagesMidterm Exam IntaxJane TuazonNo ratings yet

- Recruitment NotificationDocument15 pagesRecruitment Notificationavipjadhav.2023No ratings yet

- Barclay & Co. v. Edwards, 267 U.S. 442 (1925)Document5 pagesBarclay & Co. v. Edwards, 267 U.S. 442 (1925)Scribd Government DocsNo ratings yet

- Ken Ofori Atta Finance Statement To Parliament On Domestic Debt ExchangeDocument9 pagesKen Ofori Atta Finance Statement To Parliament On Domestic Debt ExchangeThe Independent GhanaNo ratings yet

- Supplemental-Checklist-COVID-EIDL-intake Form-090821-508Document7 pagesSupplemental-Checklist-COVID-EIDL-intake Form-090821-508Shashank SaxenaNo ratings yet

- (Salary - Judiciary) Perfecto v. MeerDocument2 pages(Salary - Judiciary) Perfecto v. MeerLulu RodriguezNo ratings yet

- Report On Impacts of The Incorporation of St. GeorgeDocument49 pagesReport On Impacts of The Incorporation of St. GeorgedzsamuelsNo ratings yet

- Yes Bank PolicyDocument4 pagesYes Bank PolicyAman AmickNo ratings yet

- Kishore Pay SlipDocument1 pageKishore Pay Slipsuperhit123No ratings yet

- DeclarationPrint (3) - 3Document2 pagesDeclarationPrint (3) - 3Maan JuttNo ratings yet

- NR7413407451445605Document2 pagesNR7413407451445605gajetushanayaNo ratings yet

- Gross Income PDFDocument7 pagesGross Income PDFNikolai Danielovich100% (1)

- Itr4 PreviewDocument11 pagesItr4 PreviewRg RrgNo ratings yet

- Eco - May 2002Document20 pagesEco - May 2002Rafay Mahmood100% (2)