Professional Documents

Culture Documents

COVID-19 Trade Impact Mitigation Facility: (Cotifa)

COVID-19 Trade Impact Mitigation Facility: (Cotifa)

Uploaded by

Tamenji Banda0 ratings0% found this document useful (0 votes)

6 views2 pagesOriginal Title

(COTIMFA).pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views2 pagesCOVID-19 Trade Impact Mitigation Facility: (Cotifa)

COVID-19 Trade Impact Mitigation Facility: (Cotifa)

Uploaded by

Tamenji BandaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Accelerating Structural Transformation in Malawi

COVID-19 Trade Impact

Mitigation Facility (COTIFA)

1.0 INTRODUCTION caused by Pandemic-induced sharp declines in

The world is presently battling a pandemic, commodity prices, a sudden significant drop in tourism

earnings, disruptions in supply chains, and/or

Coronavirus (COVID-19) which has posed a threat to closure of export manufacturing facilities. Under this

the economy and human life. The effects of the virus facility, EDF is intervening through credit and risk

have an estimated potential of costing the global bearing instruments by providing support to companies

economy about US$1 trillion which would result in a which need direct funding, lines of credit, guarantees

significant decline of 0.4 percent points in global Gross and other similar instruments.

Domestic Product (GDP) growth. A number of sectors

have been affected posing a threat to many African The facility is a rapid financial response that will

countries, Malawi inclusive Export Development enable companies to continue carrying out business

Fund has therefore introduced a “Covid-19 Trade while adjusting to the impacts of the Pandemic, as

Impact Mitigation Facility (COTIMFA)” towards cushion well as manage effects of the Pandemic during and

the effects of the pandemic. after situations normalize specifically by:

• Supporting eligible companies to meet debt pay

2.0 PRODUCT RATIONALE ments falling due and prevent payment defaults;

EDF’s Covid-19 Trade Impact Mitigation Facility • Providing trade finance facilities for exports in view

(COTIFA) aims at assisting companies in Malawi to of distressed working capital;

assist companies in Malawi manage the adverse • Assisting companies whose revenues are tied to

impact of financial economic shocks caused by specific export revenues to manage the sudden

COVID-19 Pandemic. Such an impact may be directly declines of export earnings.

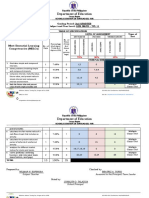

Covid-19 Trade Impact Mitigation Facility (COTIFA)

Existing Loan facility/Supply Assignment of export

facility proceeds/Loan Repayments

Loan 2 COTIFA 4

Provider/Trade EDF

Client

Debt Payments

Refinancing

3 Facility with

retained

exposure

1 Contingent Guarantees

Partnerships

Input Suppliers

Insurance Companies

Development Financial Institutions

Fund & Asset Managers

Commercial Banks

3.0 PRODUCT FEATURES • Companies that are likely to suffer a decline in

With a K20 billion allocation, the facility is available export demand as a repercussion of a shutdown

for a maximum of 18 months as it is largely driven by of export markets, sharp price declines, disruption in

the existence of the Pandemic. The duration shall supply chains, and disruptions in domestic

be reviewed from time to time depending on productions.

developments in the discovery of a drug or vaccine.

5.0 APPLICATION REQUIREMENTS

4.0 ELIGIBLE COMPANIES a. Business/owners profile;

Export manufacturer and tourism projects with the b. Nature of business and funding requirements.

following features: c. Audited financial statements for the past three years;

• Companies experiencing significant drop in tourism d. Financial statement projections;

earnings; and e. A summary of borrowing history and bank

references;

EXPORT DEVELOPMENT FUND

1st Floor - Pamodzi House, Presidential Way Drive • P. O. Box 30063, Lilongwe 3, Malawi

Tel: +265 (0) 882 415 633 Fax: +265 (0) 1 772 219 E-mail: edf@edf.mw

www.edf.mw

You might also like

- Individual Assignment - Fin 360Document7 pagesIndividual Assignment - Fin 360Muhamad syahiir syauqii Mohamad yunus80% (5)

- Original Petition For Bill of ReviewDocument133 pagesOriginal Petition For Bill of ReviewA. Campbell80% (5)

- Construction and Export Manufacturing Guarantee and Re-Financing FacilityDocument2 pagesConstruction and Export Manufacturing Guarantee and Re-Financing FacilityTamenji BandaNo ratings yet

- Karta: Position, Duties and PowersDocument9 pagesKarta: Position, Duties and PowersSamiksha PawarNo ratings yet

- 004 - NRI - Main Application Form - FillableDocument6 pages004 - NRI - Main Application Form - FillableAnkur MishRraNo ratings yet

- Covid Impact On FS-2077-78Document17 pagesCovid Impact On FS-2077-78Rohit ThakuriNo ratings yet

- MERCADO, Erica Kaye M. April 15, 2020 A2B Markfin: Loan CommitmentsDocument3 pagesMERCADO, Erica Kaye M. April 15, 2020 A2B Markfin: Loan CommitmentsMila MercadoNo ratings yet

- Retail Market Conduct Task Force Report Initial Findings and Observations About The Impact of COVID-19 On Retail Market ConductDocument30 pagesRetail Market Conduct Task Force Report Initial Findings and Observations About The Impact of COVID-19 On Retail Market ConductTarbNo ratings yet

- Advisory Note On COVID-19 Impact On Financial Reporting and AuditingDocument24 pagesAdvisory Note On COVID-19 Impact On Financial Reporting and AuditingNarayan PrajapatiNo ratings yet

- Covid-19-Financial-Reporting-And-Disclosures GTDocument12 pagesCovid-19-Financial-Reporting-And-Disclosures GTDhruba AdhikariNo ratings yet

- Zambia Introduces Fiscal Measures To Mitigate Impact of COVID-19Document4 pagesZambia Introduces Fiscal Measures To Mitigate Impact of COVID-19harryNo ratings yet

- 1CIVEA2020001Document43 pages1CIVEA2020001j.assokoNo ratings yet

- Insurance Sector in NigeriaDocument21 pagesInsurance Sector in NigeriaBaba Jide Oniwinde100% (1)

- Supply Chain Finance Market Assessment KenyaDocument18 pagesSupply Chain Finance Market Assessment Kenyaetebark h/michaleNo ratings yet

- COVID-19 Impact Towards Different IndustriesDocument48 pagesCOVID-19 Impact Towards Different IndustriesAnuruddha Rajasuriya100% (1)

- Reporting Alert: COVID-19: MD&A Disclosures in Volatile and Uncertain TimesDocument6 pagesReporting Alert: COVID-19: MD&A Disclosures in Volatile and Uncertain TimesAchmad AndruNo ratings yet

- Appendix 1 ICN - Disclosure - of - COVID-19 - Impacts - Final-Website - CleanDocument4 pagesAppendix 1 ICN - Disclosure - of - COVID-19 - Impacts - Final-Website - CleanDarren LowNo ratings yet

- JPM Q1 2020 PresentaitonDocument16 pagesJPM Q1 2020 PresentaitonZerohedgeNo ratings yet

- BNM - Financial Stability Review PDFDocument20 pagesBNM - Financial Stability Review PDFlowjinkangNo ratings yet

- IFRS in Focus: Accounting Considerations Related To Coronavirus Disease 2019Document6 pagesIFRS in Focus: Accounting Considerations Related To Coronavirus Disease 2019Pramuji HandrajadiNo ratings yet

- The Impact of Covid-19 On Accounting ProfessionDocument9 pagesThe Impact of Covid-19 On Accounting ProfessionShuvo HowladerNo ratings yet

- (EPaC) PDFDocument2 pages(EPaC) PDFTamenji BandaNo ratings yet

- Forex and TM - Soumya Agrawal - 20020942063Document9 pagesForex and TM - Soumya Agrawal - 20020942063Soumya AgrawalNo ratings yet

- Covid-19 Implications On Financial Reporting: Marija Mitevska, Olivera Gjorgieva-Trajkovska, Vesna Georgieva SvrtinovDocument8 pagesCovid-19 Implications On Financial Reporting: Marija Mitevska, Olivera Gjorgieva-Trajkovska, Vesna Georgieva SvrtinovSang PhamNo ratings yet

- R242021127757CR (Standard CR)Document8 pagesR242021127757CR (Standard CR)Lucky MendozaNo ratings yet

- Account AssignDocument3 pagesAccount Assignshan khanNo ratings yet

- COVID-19 Impact: The Due Diligence Perspective: Transaction ServicesDocument13 pagesCOVID-19 Impact: The Due Diligence Perspective: Transaction ServicesSabrinathan NairNo ratings yet

- Re: RIN 3038-AD99: Protection of Cleared Swaps Customers Before and After Commodity Broker Bankruptcies 75 Fed - Reg. 75162 (December 2, 2010)Document9 pagesRe: RIN 3038-AD99: Protection of Cleared Swaps Customers Before and After Commodity Broker Bankruptcies 75 Fed - Reg. 75162 (December 2, 2010)MarketsWikiNo ratings yet

- Bkar3033 A221 Assignment 5Document5 pagesBkar3033 A221 Assignment 5Patricia TangNo ratings yet

- Effect of Covid-19 Pandemic On Corporate Governanace: By-Mananshu Jain V-C 11417703818Document11 pagesEffect of Covid-19 Pandemic On Corporate Governanace: By-Mananshu Jain V-C 11417703818mananshu jainNo ratings yet

- Barq Group: Emergency Response & Mitigation Plan For Covid-19Document6 pagesBarq Group: Emergency Response & Mitigation Plan For Covid-19Yousaf RichuNo ratings yet

- Stephen E. Collins v. Patrick Meyers: Declaration of Michael LandesDocument18 pagesStephen E. Collins v. Patrick Meyers: Declaration of Michael LandesMichael_Roberts2019No ratings yet

- 2020 Third Quarter Results PresentationDocument36 pages2020 Third Quarter Results PresentationVincent ChanNo ratings yet

- Letlhabile - Informal Sector Stimulation ProgrammeDocument8 pagesLetlhabile - Informal Sector Stimulation ProgrammeKano MolapisiNo ratings yet

- Banking and Insurance Laws Project AssigmentDocument7 pagesBanking and Insurance Laws Project AssigmentmandiraNo ratings yet

- Airlines Financial Reporting Implications of Covid 19Document15 pagesAirlines Financial Reporting Implications of Covid 19Rama KediaNo ratings yet

- DBN Sheet Recovery KFW V2023 04Document1 pageDBN Sheet Recovery KFW V2023 04victoria upindiNo ratings yet

- Ey Covid 19 Ifrs Impairment Imperatives For ManagementDocument13 pagesEy Covid 19 Ifrs Impairment Imperatives For ManagementnguyenNo ratings yet

- COVID-19 and Business Integrity: CDC Group Guidance For Fund ManagersDocument4 pagesCOVID-19 and Business Integrity: CDC Group Guidance For Fund ManagersRiza Zausa CuarteroNo ratings yet

- Life Beyond Solvency II A View From The Top of The RegulatorDocument11 pagesLife Beyond Solvency II A View From The Top of The RegulatorHao WangNo ratings yet

- The Role of Trade Finance in Promoting Trade and The Implications of Covid-19Document13 pagesThe Role of Trade Finance in Promoting Trade and The Implications of Covid-19comesa cmiNo ratings yet

- Business Management Assignment 121eDocument16 pagesBusiness Management Assignment 121eZowvuyour Zow Zow MazuluNo ratings yet

- Policies To Supports SMEs - Korea - FinalDocument2 pagesPolicies To Supports SMEs - Korea - FinalYasmin AruniNo ratings yet

- 1607546412443 - final project منهجيةDocument4 pages1607546412443 - final project منهجيةSabreen IssaNo ratings yet

- KPMG Newsletter (Issue 1) - Economic Impact and Pandemic Planning PDFDocument4 pagesKPMG Newsletter (Issue 1) - Economic Impact and Pandemic Planning PDFSNo ratings yet

- IFRS in Focus: Accounting Considerations Related To The Coronavirus 2019 DiseaseDocument25 pagesIFRS in Focus: Accounting Considerations Related To The Coronavirus 2019 DiseaseTaskin Reza KhalidNo ratings yet

- Auditors Responsibility in Assessing Going ConcerDocument17 pagesAuditors Responsibility in Assessing Going ConcerNasrullah DjamilNo ratings yet

- FSI Briefs: Expected Loss Provisioning Under A Global PandemicDocument9 pagesFSI Briefs: Expected Loss Provisioning Under A Global PandemicGeetika KhandelwalNo ratings yet

- Trade Finance Guide2007ch9Document2 pagesTrade Finance Guide2007ch9rjamesbondsNo ratings yet

- 05 Bettina Dorendorf KFW DFBEW OFATEDocument39 pages05 Bettina Dorendorf KFW DFBEW OFATEQuentin PonsNo ratings yet

- Accounting HammadDocument7 pagesAccounting Hammadshan khanNo ratings yet

- Minutes: 1 Quorum and Declarations of InterestDocument7 pagesMinutes: 1 Quorum and Declarations of InterestleseNo ratings yet

- Djibouti: IMF Country Report No. 20/159Document39 pagesDjibouti: IMF Country Report No. 20/159Sobia MurtazaNo ratings yet

- The Impact of COVID 19 On Going Concern Status of Restaurant Industry in The PhilippinesDocument6 pagesThe Impact of COVID 19 On Going Concern Status of Restaurant Industry in The PhilippinesGlyde Vince Isidore DuriaNo ratings yet

- Business Strategy: RequirementDocument14 pagesBusiness Strategy: RequirementTowhidul IslamNo ratings yet

- Credit Risks & ECGCDocument53 pagesCredit Risks & ECGCHARSHIT SAXENA 22IB428No ratings yet

- Icc Document Icc GCD Performance Guarantees StudyDocument10 pagesIcc Document Icc GCD Performance Guarantees StudyAlly Hassan AliNo ratings yet

- Acct Implication Coronavirus Apr2020Document11 pagesAcct Implication Coronavirus Apr2020imranhvcNo ratings yet

- 2010 CFA3 Sample Exam V1 Part1Document10 pages2010 CFA3 Sample Exam V1 Part1Hong ChengNo ratings yet

- Gendered+Impacts+of+COVID 19+on+Small+and+Medium Sized+Enterprises+in+Sri+LankaDocument20 pagesGendered+Impacts+of+COVID 19+on+Small+and+Medium Sized+Enterprises+in+Sri+LankaTharindu PereraNo ratings yet

- M&a PDFDocument6 pagesM&a PDFHarshita SethiyaNo ratings yet

- COVID-19 and Public–Private Partnerships in Asia and the Pacific: Guidance NoteFrom EverandCOVID-19 and Public–Private Partnerships in Asia and the Pacific: Guidance NoteNo ratings yet

- World Development Report 2022: Finance for an Equitable RecoveryFrom EverandWorld Development Report 2022: Finance for an Equitable RecoveryNo ratings yet

- Venture Capital Facility: Accelerating Structural Transformation in MalawiDocument2 pagesVenture Capital Facility: Accelerating Structural Transformation in MalawiTamenji BandaNo ratings yet

- PPS PDFDocument2 pagesPPS PDFTamenji BandaNo ratings yet

- Confarm PDFDocument2 pagesConfarm PDFTamenji BandaNo ratings yet

- (EPaC) PDFDocument2 pages(EPaC) PDFTamenji BandaNo ratings yet

- Hotel Construction Guarantee and Refinancing Facility: 2.0 BenefitsDocument2 pagesHotel Construction Guarantee and Refinancing Facility: 2.0 BenefitsTamenji BandaNo ratings yet

- UTC - Sept2016 - Restat 2d of Trusts - 203Document2 pagesUTC - Sept2016 - Restat 2d of Trusts - 203OneNationNo ratings yet

- Gen. Math - TVL C1&2Document2 pagesGen. Math - TVL C1&2Wilmar EspinosaNo ratings yet

- Makati Leasing and Finance Corporation V Wearever Textile MillsDocument2 pagesMakati Leasing and Finance Corporation V Wearever Textile MillsAbigail Tolabing100% (2)

- Written Statement#18Document8 pagesWritten Statement#18Jitendra Prajapati100% (1)

- SBI Education Loan Disbursement ProcessDocument10 pagesSBI Education Loan Disbursement ProcessGurbani Kaur SuriNo ratings yet

- Mr. Holdings Vs BajarDocument2 pagesMr. Holdings Vs BajarJayNo ratings yet

- Kabboudi: Problem NotesDocument7 pagesKabboudi: Problem NotesamanittaNo ratings yet

- 12-SALAS Vs CADocument2 pages12-SALAS Vs CARobelle RizonNo ratings yet

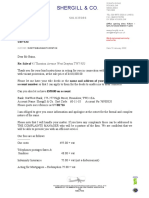

- S00101 Shergill and Co. Client Care Letter 19jul2021 12 38Document4 pagesS00101 Shergill and Co. Client Care Letter 19jul2021 12 38Sanveer BainsNo ratings yet

- Build Realty Class Action ComplaintDocument29 pagesBuild Realty Class Action ComplaintFinney Law Firm, LLC100% (1)

- Bodea BrochureDocument7 pagesBodea BrochureTANVI AGRAWALNo ratings yet

- Sbi Sip Project - Ayush Sinha FinalDocument84 pagesSbi Sip Project - Ayush Sinha FinalFardeen KhanNo ratings yet

- Business Startup CostsDocument5 pagesBusiness Startup CostsAlissa BarnesNo ratings yet

- Torres V Court of Appeals (GR L-63046 June 21 1990)Document2 pagesTorres V Court of Appeals (GR L-63046 June 21 1990)Enma KozatoNo ratings yet

- Division - LTD Rem & CMDocument5 pagesDivision - LTD Rem & CMSk SynzerNo ratings yet

- Tuakaram Narale ReportDocument5 pagesTuakaram Narale Reportprasad kharatNo ratings yet

- Loan Repayment Amortization Schedule For Jeremy KarpelDocument2 pagesLoan Repayment Amortization Schedule For Jeremy KarpelMichael AndersonNo ratings yet

- Rec Fin Natl Contract 11 16 Sample CompletedDocument4 pagesRec Fin Natl Contract 11 16 Sample CompletedBaby BlueNo ratings yet

- Equipment Finance and Leasing Training GuideDocument76 pagesEquipment Finance and Leasing Training GuideHamza FadlaNo ratings yet

- Sale of Immovable PropertyDocument90 pagesSale of Immovable PropertyRAJARAJESHWARI M GNo ratings yet

- Detailed Project Report: Muknogy Micro Finance FoundationDocument23 pagesDetailed Project Report: Muknogy Micro Finance FoundationMadhur DaniNo ratings yet

- 369 Phil. Export and Foreign Loan Guarantee Corp. v. Amalgamated Mgt. & Dev't. Corp.Document3 pages369 Phil. Export and Foreign Loan Guarantee Corp. v. Amalgamated Mgt. & Dev't. Corp.Joshua Ejeil PascualNo ratings yet

- Iibf CCP Exam Recollected Questions 2021 - 2022Document5 pagesIibf CCP Exam Recollected Questions 2021 - 2022Mr VIJAYNo ratings yet

- Preface: Guidelines For PPP ProjectsDocument48 pagesPreface: Guidelines For PPP ProjectsmanugeorgeNo ratings yet

- Bulk Sales Law: Reference: Reviewer of Commercial Law 2014 Ed. by JR Sundiang SR, and TB Aquino Rex BookstoreDocument17 pagesBulk Sales Law: Reference: Reviewer of Commercial Law 2014 Ed. by JR Sundiang SR, and TB Aquino Rex BookstoreJaneth NavalesNo ratings yet

- Social Housing Finance CorporationDocument3 pagesSocial Housing Finance CorporationMajoy Asilo MaraatNo ratings yet