Professional Documents

Culture Documents

Guide To EBRD Financing - 2018 PDF

Guide To EBRD Financing - 2018 PDF

Uploaded by

Nikola Ivanovic0 ratings0% found this document useful (0 votes)

26 views4 pagesOriginal Title

Guide to EBRD financing - 2018.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

26 views4 pagesGuide To EBRD Financing - 2018 PDF

Guide To EBRD Financing - 2018 PDF

Uploaded by

Nikola IvanovicCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

Guide to EBRD financing

January 2018

Why the EBRD? At a glance

Number of projects (since 1991)

The EBRD invests to build up effective market economies across three

continents and to make a positive impact on people’s lives. 5,035

With a focus on private sector investment and support for policy reform,

we work to ensure that economies in our regions are competitive, inclusive, Cumulative business volume

well-governed, sustainable, resilient and integrated. €119.6 billion

The EBRD is the largest single investor in Strong appetite for risk

the region and also mobilises significant The Bank draws on its government Cumulative disbursements

foreign direct investment into the

economies where it operates.

contacts, special creditor status and

sizeable portfolio to assess and bear risk

€91.5 billion

and to open the options for financing.

Regional expertise

The EBRD has a strong presence in all Adding value

of the economies where it operates, The EBRD complements – rather than

through a network of more than 30 displaces – private sources of finance.

local offices. The Bank invests only where it can

provide added value, by investing in

Innovative financing solutions projects that could not otherwise attract

Where the EBRD invests

For each project it finances, the Bank financing on similar terms.

Albania Lebanon

assigns a dedicated team of specialists Armenia Lithuania

with specific sectoral, regional, legal and Azerbaijan Moldova

Belarus Mongolia

environmental skills. Bosnia and Herzegovina Montenegro

Bulgaria Morocco

Croatia Poland

Cyprus Romania

Egypt Russia

Requirements for EBRD financing Estonia

FYR Macedonia

Serbia

Slovak Republic

Georgia Slovenia

EBRD financing for private sector projects generally ranges from Greece Tajikistan

€5 million to €250 million, in the form of loans or equity. The average Hungary Tunisia

Jordan Turkey

EBRD investment is €25 million. Smaller projects may be financed through Kazakhstan Turkmenistan

financial intermediaries or through special programmes for smaller direct Kyrgyz Republic Ukraine

Kosovo Uzbekistan

investments in the less-developed countries. Latvia West Bank and Gaza

EBRD funding criteria Project structure Sectors supported by the EBRD

To be eligible for EBRD funding, the The EBRD tailors each project to the Agribusiness

project must: needs of the client and to the specific Energy efficiency

Financial institutions

situation of the economy, region and Manufacturing

►► be located in economies where the

sector. The EBRD typically funds up to Municipal and environmental infrastructure

EBRD operates Natural resources

35 per cent of the total project cost for a Power and energy

►► have strong commercial prospects greenfield project or 35 per cent of the Property and tourism

Small and medium-sized enterprises

long-term capitalisation of the project Telecommunications, information technology

►► involve significant equity

company. The Bank requires significant and media

contributions in-cash or in-kind from Transport

equity contributions from the sponsors,

the project sponsor The EBRD does not finance

which must equal or be greater than

Defence-related activities

►► benefit the local economy and help the EBRD’s investment. There must be Tobacco industry

develop the private sector additional funding from the sponsors, Selected alcoholic products

Substances banned by international law

other co-financiers or generated through Stand-alone gambling facilities

►► satisfy banking and environmental

the EBRD’s syndications programme.

standards.

Types of funding available

Loans Fees and charges Security

A margin above the base rate is added to The EBRD usually requires the

The EBRD’s loans are structured with a

reflect country risk and project-specific companies it finances to secure the loan

high degree of flexibility to match client

risk. This information is confidential with project assets. These can include:

and project needs. The Bank suggests a

to the client and the EBRD. In addition

suitable loan currency and interest rate. ►► mortgage on fixed assets, such as

to the margin, the Bank charges the

land, plant and other buildings

The basis for a loan is the expected cash following fees and commissions:

flow of the project and the ability of the ►► mortgage on movable assets, such as

►► appraisal fee

client to repay the loan over the agreed equipment and other business assets

period. The credit risk can be taken ►► front-end commission and structuring

►► assignment of the company’s

entirely by the Bank or may be partly fee, paid up-front

hard currency and domestic

syndicated to the market. A loan may

►► syndication fee, where applicable currency earnings

be secured by a borrower’s assets and/

or it may be converted into shares or be ►► commitment fee, payable on ►► pledge of the sponsor’s shares in

equity-linked. Full details are negotiated the committed but undisbursed the company

with the client on a case-by-case basis. loan amount

►► assignment of the company’s

►► loan conversion fee, paid at the insurance policy and other

Loan features

time of interest rate, or currency contractual benefits.

EBRD loans consist of the

conversion on the amount that is to

following features: Covenants

be converted

Typical project finance covenants

►► a minimum amount of €5 million,

►► prepayment, cancellation and late are required as part of the loan

although this can be smaller in

payment fees where applicable. package. Such covenants, limiting

some countries

indebtedness and specifying certain

In line with commercial practice,

►► a fixed or floating rate financial ratios and various other issues,

sponsors are obliged to reimburse

will be negotiated.

►► senior, subordinated, mezzanine or the EBRD for out-of-pocket

convertible debt expenses, such as fees for technical

Loan repayment

consultants, outside legal counsel and

►► denominated in major foreign or Repayment is normally in equal, semi-

travel expenses.

some local currencies annual instalments. Longer maturities

and uneven repayment schedules may

►► short to long-term maturities, from Other lending terms

be considered on an exceptional basis

1 to 15 years Full lending terms are negotiated with

– for example, up to 15 years under

the client for each project.

►► project-specific grace periods mortgage-style authorisation for large

where necessary. infrastructure operations.

Recourse

Interest rates Recourse to a sponsor is not always

Hedging possibilities

EBRD loans are priced competitively, required. However, the EBRD may seek

The EBRD can help manage financial

based on current market rates, such as specific performance and completion

risks associated with a project’s assets

EURIBOR. The EBRD offers both fixed guarantees plus other forms of support

and liabilities. This covers foreign

and floating interest rates (with a cap from sponsors of the kind that are

exchange risk, interest rate risk and

or collar). The EBRD does not subsidise normal practice in limited-recourse

commodity price risk. Risk-hedging

projects, does not offer soft loans financing.

instruments include currency swaps,

and the Bank does not compete with

interest rate swaps, caps, collars and

private banks. Insurance

options and commodity swaps.

The EBRD requires project companies

to obtain insurance against normally

insurable risks. Examples include theft

of assets, outbreak of fire, specific

construction risks. The Bank does not

require insurance against political risk or

non-convertibility of the local currency.

EBRD project cycle Co-financing

The EBRD project cycle consists of the The EBRD tries to mobilise domestic and

Equity

following stages: foreign capital because co‑financing

The EBRD can acquire equity in amounts

increases the resources available for

ranging from €2 million to €100 million Concept Review – The EBRD’s

funding other projects and introduces

in industry, infrastructure and the Operations Committee (OpsCom)

borrowers to the international

financial sector if there is an expected approves the project concept and overall

debt markets.

appropriate return on investment. The structure, including proposed financing

Bank will take only minority positions structure and supporting obligations. Sources of co-financing include

and will have a clear exit strategy. At this stage, the EBRD and the client commercial banks, official co‑financiers

sign a mandate letter, which outlines (such as government agencies and

Equity and quasi-equity instruments the project plan, development expenses bilateral financial institutions providing

The EBRD’s equity and quasi-equity and responsibilities. grants, parallel loans and equity), export

instruments include: credit agencies and other international

Final Review – Once the basic business

financial institutions, such as the

►► ordinary shares, listed or unlisted deal (including a signed term sheet) has

International Finance Corporation and

been negotiated and all investigations

►► subordinated and convertible loans the World Bank. The EBRD aims to

have been substantially completed,

broaden and deepen the co-financing

►► income notes the project receives a Final Review

base by increasing the number of

by OpsCom.

►► redeemable preference shares commercial lenders, and by introducing

Board Review – The EBRD President new co-financing structures and new

►► underwriting of share issues by public

and operations team present the project countries into the market.

or privately owned enterprises.

to the Board of Directors for approval.

By being flexible and responding to the

Other forms of financing can be

Signing – The EBRD and the client sign market, the Bank seeks to maximise the

discussed with EBRD banking staff. The

the deal and it becomes legally binding. sources of finance available to clients

EBRD usually exits within four to eight

and to structure the most appropriate

years of the initial investment, varying Disbursements – Once repayment

forms of finance.

from project to project. The Bank’s exit conditions are agreed and the

strategy typically involves selling its Bank’s conditions met, the funds are The types of co-financing available

participation to the project sponsors or transferred from the Bank’s account to include A/B loans (where the EBRD

selling the investment via a public offer. the client’s account. finances a portion of the loan and

syndicates the remainder to commercial

The EBRD also participates in equity Repayments – The client repays the

lenders), parallel loans, export credit

funds, which focus on a specific region, loan amount to the EBRD under an

agency guarantees, political risk

country or industry sector, have a local agreed schedule.

insurance, loans and equity from

presence and are run by professional

Sale of equity – The Bank sells international financial institutions

venture capitalists. These funds use the

its equity investments on a and grants.

same investment criteria as the EBRD

non‑recourse basis.

when it considers direct investments. The EBRD works in partnership with

Final maturity – The final loan amount is other institutions to increase the

due for repayment to the Bank. availability of financing and improve the

Guarantees investment climate in the region.

Completion – The loan has been

The EBRD provides various types of

fully repaid and/or the EBRD’s equity

guarantees. These range from all-risk

investment divested.

guarantees, whereby the Bank covers

lenders against default regardless of the Typical capitalisation structure

cause, to partial risk-specific contingent

Syndicated EBRD 35%

guarantees covering default arising from

loan 15%

specified events.

In all cases the maximum exposure Other

must be known and measurable and lenders

the credit risk must be acceptable. 10%

Precise legal definitions of the events

guaranteed and pricing are handled on

a case‑by‑case basis.

Local sponsor Foreign sponsor

equity 15% equity 25%

Information required for financing Contacts

European Bank for Reconstruction and Development

To assess the eligibility of a project, the When the EBRD has all the necessary One Exchange Square

EBRD requires the following information: information, a deal typically takes three London EC2A 2JN

Tel: +44 20 7338 6000

to six months from initial contact to Fax: +44 20 7338 6100

Project information signing. In some cases, however, this

Resident Offices

►► a brief description of the project, can be shorter. The total project cycle, For contact details of the EBRD’s Resident

detailing how the Bank’s financing will from initiation to re-payment, can range Offices, see the Bank’s website:

www.ebrd.com/contacts.html

be used from one year for working capital or trade

New project proposals

financing projects to 15 years for long- (Business Development Support Unit)

►► background information on the

term sovereign infrastructure projects. Tel: +44 20 7338 7168

sponsor, including operating Fax: +44 20 7338 7380

Email: newbusiness@ebrd.com

experience, financial status and how If you are interested in obtaining EBRD

the company will support the project finance, please complete the online form Project enquiries (existing projects)

Tel: +44 20 7338 7168

in terms of equity, management, via the link below to give us a better idea Fax: +44 20 7338 7380

operations, production and marketing of how we could work together. Email: projectenquiries@ebrd.com

Direct Investment Facility

►► details of the product or service that Forms will only be accepted from Tel: +44 20 7338 7750

will be developed and how it will commercial companies or by an Fax: +44 20 7338 6239

Email: vasiliag@ebrd.com

be produced intermediary authorised to act for them.

Trade Facilitation Programme

Tel: +44 20 7338 6813

►► a review of the market, including The EBRD enforces a policy of strict Fax: +44 20 7338 7380

target customers, competition, confidentiality. Details submitted will not Email: TFPOps@ebrd.com

www.ebrd.com/trade

market share and sales volume, be disclosed to any other party without

pricing strategy and distribution. prior consent. Small Business Support

Tel: +44 20 7338 7356

Financial information You will receive a response from an Fax: +44 20 7338 7742

Email: sbs@ebrd.com

►► an accurate breakdown of the project EBRD representative within seven www.ebrd.com/work-with-us/advice-for-small-

costs and how the funds will be used working days of submitting the form. businesses/overview.html

Information Requests

►► a summary of the implementation For information requests and general enquiries,

requirements, including the please use the information request form at

www.ebrd.com/enquiries.html

appointment of contractors, and an

Requests for publications

overview of the procurement process Tel: +44 20 7338 7553

Apply for EBRD financing Fax: +44 20 7338 6102

►► identification of additional sources www.ebrd.com/apply Email: pubsdesk@ebrd.com

www.ebrd.com/publications

of funding

►► an overview of the project’s

anticipated financial performance.

Environmental and

regulatory information

►► a summary of any environmental

issues and copies, where possible,

of environmental audits or

impact assessments

►► details of government licences

or permits required, subsidies

available, import/export restrictions,

border tariffs or quotas and

currency restrictions.

You might also like

- Airbus A350-900 BookletDocument215 pagesAirbus A350-900 Bookletexplorer811193% (15)

- Wrath & Glory - Character Sheet (Fillable)Document4 pagesWrath & Glory - Character Sheet (Fillable)Cyrus Silver67% (3)

- A Competitive Private Private Sector and SME Growth in AlbaniaDocument2 pagesA Competitive Private Private Sector and SME Growth in AlbaniaEkaNo ratings yet

- Ebrd Ukraine 2023Document2 pagesEbrd Ukraine 2023mihiborceastefanNo ratings yet

- Stronger Governance, Institutions and Investment Climate in AlbaniaDocument2 pagesStronger Governance, Institutions and Investment Climate in AlbaniaEkaNo ratings yet

- Raport Startup-Uri CEE 2022Document66 pagesRaport Startup-Uri CEE 2022start-up.roNo ratings yet

- Horizon Europe Funding Opportunities - 2021: Widening Participation and Strengthening The European Research AreaDocument4 pagesHorizon Europe Funding Opportunities - 2021: Widening Participation and Strengthening The European Research AreaLovNo ratings yet

- Montenegro - More Than An Investment 2021 FINAL Hi ResDocument25 pagesMontenegro - More Than An Investment 2021 FINAL Hi Reshs5y7846c6No ratings yet

- SBC Presentation F3Document33 pagesSBC Presentation F3Mile DavidovicNo ratings yet

- Morocco SnapshotDocument9 pagesMorocco SnapshotPranav TrivediNo ratings yet

- A Competitive Private Sector in BulgariaDocument2 pagesA Competitive Private Sector in BulgariaEkaNo ratings yet

- Structured Finance - Conditions For Infrastructure Project Bonds in African MarketsDocument420 pagesStructured Finance - Conditions For Infrastructure Project Bonds in African MarketsSudir ChuckunNo ratings yet

- WBIF 2022 Endorsed Flagship Projects 24.02.22Document17 pagesWBIF 2022 Endorsed Flagship Projects 24.02.22Florian SaliuNo ratings yet

- Power Africa Toolbox-Results-20bb9fDocument112 pagesPower Africa Toolbox-Results-20bb9fEshetu DerssehNo ratings yet

- (Concept Note) Recasting5ptaDocument2 pages(Concept Note) Recasting5ptaHayat Ali ShawNo ratings yet

- Sustainable Balkans Growth Fund Slide Deck January 2023 - Final DraftDocument32 pagesSustainable Balkans Growth Fund Slide Deck January 2023 - Final DraftMile DavidovicNo ratings yet

- Government of Khyber Pakhtunkhwa: Planning & Development DepartmentDocument2 pagesGovernment of Khyber Pakhtunkhwa: Planning & Development DepartmentHayat Ali ShawNo ratings yet

- Efsd Guarantees Feb 2021 enDocument54 pagesEfsd Guarantees Feb 2021 enDonald LawsonNo ratings yet

- Why Invest in MoroccoDocument15 pagesWhy Invest in MoroccoAmina BerjiNo ratings yet

- WHY Morocco ?: OCTOBER 2021Document15 pagesWHY Morocco ?: OCTOBER 2021أمين الدرقاويNo ratings yet

- Femip: Financing Operations in MoroccoDocument4 pagesFemip: Financing Operations in Moroccoaiman882No ratings yet

- WBIF Bilteral Donors - May-2020Document2 pagesWBIF Bilteral Donors - May-2020jrodon63No ratings yet

- Mid-Sized Projects Facility: at A GlanceDocument1 pageMid-Sized Projects Facility: at A GlanceAnonymous ZIMIwJWgANo ratings yet

- Project Information Document (PID) : The World BankDocument8 pagesProject Information Document (PID) : The World Bankፀፀፀፀፀ ከፀፀዘከNo ratings yet

- Ethiopia Small and Medium Enterprises Finance Project Additional FinancingDocument81 pagesEthiopia Small and Medium Enterprises Finance Project Additional Financingveronica legesseNo ratings yet

- Femip Instruments enDocument4 pagesFemip Instruments enValter SilvaNo ratings yet

- Greece en 2019 6 6Document2 pagesGreece en 2019 6 6Minas KonstNo ratings yet

- New 2Document61 pagesNew 2SnakeNo ratings yet

- 2 WBIF Technical Assistance Grant Guidelines FINAL July 2017Document42 pages2 WBIF Technical Assistance Grant Guidelines FINAL July 2017Hizreta Zulić-BijedicNo ratings yet

- CENER21 - Organizational Profile - Draft 03 - PrintDocument20 pagesCENER21 - Organizational Profile - Draft 03 - PrintJasmin GabelaNo ratings yet

- Financing Infrastructure: Breaking The Barriers To Sustainable DevelopmentDocument23 pagesFinancing Infrastructure: Breaking The Barriers To Sustainable DevelopmentM. Junaid AlamNo ratings yet

- Serbia Oct2023Document1 pageSerbia Oct2023natachadelplace19No ratings yet

- Berkeley MBA - Mace Don Ian ICT Project Final ReportDocument44 pagesBerkeley MBA - Mace Don Ian ICT Project Final ReportukamaluddinmbaNo ratings yet

- Mkibn20080421 0019eDocument20 pagesMkibn20080421 0019eberznikNo ratings yet

- ADB Pakistan Facthseet April 2023Document4 pagesADB Pakistan Facthseet April 2023Hassan AshfaqNo ratings yet

- Cps 131107Document106 pagesCps 131107glassoftotallynormalmilkNo ratings yet

- Albania Infrastructure and Tourism-Enabling Project Board Report (Final)Document27 pagesAlbania Infrastructure and Tourism-Enabling Project Board Report (Final)Roxana MariaNo ratings yet

- List of Ongoing Projects NFDocument6 pagesList of Ongoing Projects NFkovacevska.nNo ratings yet

- 2022 Cee Pe Statistics Report - June 2023Document45 pages2022 Cee Pe Statistics Report - June 2023Enrique Castillo SchwankNo ratings yet

- Radionica EBRD DOI 2017Document20 pagesRadionica EBRD DOI 2017Anonymous 9T2RDsNo ratings yet

- 13833india Exim Bank Success StoriesDocument24 pages13833india Exim Bank Success StoriesPushparaj AlphonseNo ratings yet

- Sustainable Infrastructure and Public Utilities in BulgariaDocument2 pagesSustainable Infrastructure and Public Utilities in BulgariaEkaNo ratings yet

- Bosnia - FactsheetDocument2 pagesBosnia - Factsheetapi-198396065No ratings yet

- Mya 2022Document4 pagesMya 2022Sun HtetNo ratings yet

- EPF - Factsheet - 12-2016 Eng A-ClassDocument1 pageEPF - Factsheet - 12-2016 Eng A-ClassAnonymous 8Mldzk1u11No ratings yet

- OnDA Stabilisation Facility Board Report (Final)Document15 pagesOnDA Stabilisation Facility Board Report (Final)Tarmidi OussamaNo ratings yet

- Turkey CPF 08072017Document83 pagesTurkey CPF 08072017anaNo ratings yet

- Fij 2022Document4 pagesFij 2022Kaushal SharmaNo ratings yet

- AMDIE-Why Morocco GeneralDocument15 pagesAMDIE-Why Morocco Generalinfo.hydrobeautNo ratings yet

- Project Concept Form For New Project - Initiatives (Credit Guarantee Scheme)Document7 pagesProject Concept Form For New Project - Initiatives (Credit Guarantee Scheme)Omer ZiaNo ratings yet

- India Union Budget Analysis 2022 23 1653303448Document18 pagesIndia Union Budget Analysis 2022 23 1653303448thehungrybombaeNo ratings yet

- La Bei Au Maroc enDocument24 pagesLa Bei Au Maroc enAGOUZOULNo ratings yet

- FundingDocument2 pagesFundingSimon BerkovichNo ratings yet

- 51 Million EU Funding For EnterprisesDocument10 pages51 Million EU Funding For EnterprisesGaetano MinardiNo ratings yet

- Bpo 2021Document28 pagesBpo 2021Vlad BuracNo ratings yet

- MCIT Annual Report 2022 en Web CompressedDocument110 pagesMCIT Annual Report 2022 en Web Compressedimranq_3No ratings yet

- Project Bonds Guide enDocument32 pagesProject Bonds Guide ende1970No ratings yet

- Serbia EBRDDocument2 pagesSerbia EBRDluciamg59No ratings yet

- Romania Country Strategy: Approved by The Board of Directors On 23 April 2020Document25 pagesRomania Country Strategy: Approved by The Board of Directors On 23 April 2020Henry DubonNo ratings yet

- Estonia FinalDocument1 pageEstonia FinalZHANG EmilyNo ratings yet

- 01 - WB Financial MarketsDocument47 pages01 - WB Financial MarketsAndrea SkerovicNo ratings yet

- EIB Activity in Africa, the Caribbean, the Pacific and the Overseas Countries and Territories: Annual Report 2018From EverandEIB Activity in Africa, the Caribbean, the Pacific and the Overseas Countries and Territories: Annual Report 2018No ratings yet

- Hole-Drilling Strain-Gage Method of Measuring Residual StressesDocument2 pagesHole-Drilling Strain-Gage Method of Measuring Residual StressesNikola IvanovicNo ratings yet

- The Fifty Nine Story Crisis 15y8x3xDocument15 pagesThe Fifty Nine Story Crisis 15y8x3xNikola Ivanovic100% (1)

- Wind Loads For Permiable Facades With High PorosityDocument12 pagesWind Loads For Permiable Facades With High PorosityNikola IvanovicNo ratings yet

- Practical Design of Stepped Columns PDFDocument12 pagesPractical Design of Stepped Columns PDFNikola IvanovicNo ratings yet

- CA Final Financial Reporting Self Study Notes by Ashwani JMLK3HFFDocument46 pagesCA Final Financial Reporting Self Study Notes by Ashwani JMLK3HFFJashwanthNo ratings yet

- Est Siga-Cr PDFDocument6 pagesEst Siga-Cr PDFjhon bayonaNo ratings yet

- ETech 111 SyllabusDocument4 pagesETech 111 Syllabusferdie marcosNo ratings yet

- Dr. Prajeesh Nath E N PG Dept. of Rasasastra & Bhaishajya Kalpana Amrita School of AyurvedaDocument38 pagesDr. Prajeesh Nath E N PG Dept. of Rasasastra & Bhaishajya Kalpana Amrita School of Ayurvedaj186No ratings yet

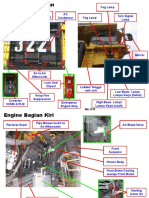

- KOMPONEN - HD785-7 SippDocument23 pagesKOMPONEN - HD785-7 Sippziky dun100% (1)

- Paysliper Template Grid2Document5 pagesPaysliper Template Grid2Jeeva KumarNo ratings yet

- UserGuide PDFDocument311 pagesUserGuide PDFmohdsevenNo ratings yet

- Medical Technologist Career JournalDocument3 pagesMedical Technologist Career Journalapi-262497770No ratings yet

- Modul 4 - EOR 26 Maret 2021Document53 pagesModul 4 - EOR 26 Maret 2021Carolyn R.No ratings yet

- Crude Oil. The Process of Refining Involves The Following StepsDocument4 pagesCrude Oil. The Process of Refining Involves The Following StepsSai Ram MotupalliNo ratings yet

- Combustion and FlameDocument24 pagesCombustion and FlameVikranth PonnalaNo ratings yet

- Authority To Sell (Ats) : TCT No# Lot/Survey Number AREA (SQM) Location Owner/SDocument2 pagesAuthority To Sell (Ats) : TCT No# Lot/Survey Number AREA (SQM) Location Owner/STi NayNo ratings yet

- 3723 Modernizing HR at Microsoft BCSDocument14 pages3723 Modernizing HR at Microsoft BCSYaseen SaleemNo ratings yet

- Networking Newsletter Green VariantDocument38 pagesNetworking Newsletter Green VariantEvlyn PasaribuNo ratings yet

- CloudCore Feature List 20180628Document13 pagesCloudCore Feature List 20180628samir YOUSIFNo ratings yet

- Excavadora KobelcoDocument26 pagesExcavadora KobelcoAnonymous cWO8QvNo ratings yet

- PS TablesDocument9 pagesPS TablesRohit ShirdhankarNo ratings yet

- P7 - Test 3-Est 2023Document20 pagesP7 - Test 3-Est 2023QuíNo ratings yet

- Business Math Module Week 6Document7 pagesBusiness Math Module Week 6Glychalyn Abecia 23No ratings yet

- Lesson3 - Linking The People With The GovernmentDocument5 pagesLesson3 - Linking The People With The GovernmentJoshua Carl MitreNo ratings yet

- Is 1077 Common Burnt Clay Building BricksDocument7 pagesIs 1077 Common Burnt Clay Building BricksKathiravan ManimegalaiNo ratings yet

- 12 Tissue Remedies of Shcussler by Boerick.Document432 pages12 Tissue Remedies of Shcussler by Boerick.scientist786100% (8)

- Service Manual: Tennant A60Document25 pagesService Manual: Tennant A60Павел КорчагинNo ratings yet

- What Was and What Might Have Been: The Threats and Wars in Afghanistan and IraqDocument32 pagesWhat Was and What Might Have Been: The Threats and Wars in Afghanistan and IraqHoover InstitutionNo ratings yet

- 10664-Full TextDocument166 pages10664-Full TextMarlina PalopoNo ratings yet

- DAX Functions For ReferenceDocument8 pagesDAX Functions For ReferenceDeovratNo ratings yet

- Buzila DDocument5 pagesBuzila DDragoi CosminNo ratings yet

- ABC ExercisesDocument2 pagesABC ExercisesGizella AlmedaNo ratings yet