Professional Documents

Culture Documents

Finals - Financial Accounting

Uploaded by

Alyssa QuiambaoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finals - Financial Accounting

Uploaded by

Alyssa QuiambaoCopyright:

Available Formats

Mary the Queen College of Pampanga

Accountancy

Final Examinations

Financial Accounting

Name: Quiambao, Alyssa R. SECTION: BSA 1 Penafrancai Score: _________

Grade in CFAS (Accounting 1 ) 83

Instructions. Answer the questions by writing the letter of your choice on the space provided before each

number. After accomplishing all the numbers, transfer your final answers (without erasures) on the answer

sheet provided on this page. Use ballpens (no friction pens) for your final answers. If you have any concern,

approach the proctor and not your seatmates. (70 points)

Test 1: True or False.

The first twenty number should be answered using the following choices:

A. Only the first statement is true.

B. Only the second statement is true.

C. Both statements are true.

D. Both statements are false.

B1. A partnership has an unlimited life.

A partnership is an unincorporated association of two or more people who agree to carry on a business as co-

owners for the purpose of earning profit.

A2. Mutual agency means each partner can commit/ bind the partnership to any contract within the scope of the

partnership business.

Accounting procedures for all items are the same for both sole proprietorship and partnership forms of

businesses.

A3. In the absence of a partnership agreement, the law says that income of a partnership will be shared equally by

the partners. .

If partners devote their time and services to their partnership, their salaries are expensed on the income

statement.

A4. When a partner leaves a partnership, the present partnership ends

To buy a partner’s interest in an existing partnership, the new partner must contribute cash to the partnership.

A5. The statement of changes in partners' equity shows the beginning balance in the capital and drawing account (if

this was not closed), plus investments, less withdrawals, plus or minus allocated income or loss resulting from

the period’s operation.

The equity section of the partnership’s statement of financial position may not report separately the capital

account balances of each partner

C6. When a partnership is liquidated, its business is ended.

A capital deficiency can arise from liquidation losses, excessive withdrawals before liquidation, or recurring

losses in prior periods.

B7. If at the time of partnership liquidation, a partner has a P5,000 capital deficiency which he pays out of personal

assets, then that partner is entitled to share in the final distribution of cash.

If a partner's investment in a partnership consists of equipment that has accumulated depreciation of P8,000, it

would not be appropriate for the partnership to record the accumulated depreciation.

D8. If a partner's investment in a partnership consists of Accounts Receivable of P25,000 and an Allowance for

Doubtful Accounts of P7,000, it would not be appropriate for the partnership to record the Allowance for

Doubtful Accounts.

If partnership agreement requires a 10% bonus to a managing partner, this should be given whether the business

operation resulted in a profit or a loss.

A9. If a partnership incurs a loss for the period, the closing entry to transfer the loss to the partners will require a credit

to the Income Summary account.

Finals – Financial Accounting Page 1

The income earned by a partnership will always be greater than the income earned by a proprietorship because in

a partnership there is more than one owner contributing to the success of the business.

A10. Total partners' equity of a partnership is equal to the sum of all partners' capital account balances.

The distribution of cash to partners in a partnership liquidation is always made based on the partners' income

sharing ratio.

A11. If a new partner is admitted into a partnership by investment, the total assets and total capital will change.

A bonus to old partners results when the new partner's capital credit on the date of admittance is greater than his

or her investment in the firm.

B12. A corporation is a separate entity for accounting purposes but not for legal purposes.

The financial loss that each shareholder can incur is usually limited to the investment made by the

shareholder.

D13.The number of outstanding shares of stock is equal to the number of shares authorized minus the number of

shares issued.

The amount of capital paid in by the shareholders is called legal capital.

C14. As soon as a corporation is authorized to sell stock, under the journal entry method, an entry should be made

recording the total value of the shares authorized.

When no-par value stock does not have a stated value, the entire proceeds from the issuance of the stock becomes

legal capital.

D15. Each shareholder has a separate capital account in the shareholders' equity section of the Statement of

Financial Position.

The number of ordinary shares outstanding can never be greater than the number of shares issued.

A16.Although preferred shareholders have a greater chance of receiving a regular dividend, ordinary shareholders

have a greater chance of receiving large dividends.

When the Board of Directors declares a cash or stock dividend, this action decreases assets and retained earnings.

. A17.Paid-in capital is the total amount of cash and other assets the corporation receives from its stockholders in

exchange for ordinary stock.

Authorized stock is the total number of shares outstanding.

C18. If a corporation is authorized to issue 1,000 shares of P50 ordinary stock, it is said to have P50,000 of stock

outstanding.

Minimum legal capital requirements are intended to protect creditors by requiring a minimum level of net assets.

D19. The amount of a cash dividend liability is recorded on the date of record because it is on that date that the

persons or entities who will receive the dividend are identified.

A 10% stock dividend will increase the number of shares outstanding but the book value per share will decrease.

A20. Organizational expenses of a corporation often include legal fees and promoter fees.

Ordinary shareholders always share equally with all other shareholders in all dividends.

Test 2: Multiple Choice:

C21. The Metro Manila partnership owned by Mary and Cane is terminated when creditor claims exceed

partnership assets by P40,000. Partner Cane is a millionaire and Mary has no personal assets. Mary’s' partnership

interest is 75% and Cane's is 25%. Creditors

a. must collect their claims equally from Mary and Cane.

b. may collect the entire P40,000 from Cane.

c. must collect their claims 75% from Mary and 25% from Cane.

d. may not require Cane to use his personal assets to satisfy the P40,000 in claims.

B22. Which of the following statements about partnerships is incorrect?

a. Partnership assets are co-owned by partners.

b. If a partnership is terminated, the assets do not legally revert to the original contributor.

c. Right over profits and right over assets represent claims of partners that are allocated based on partners’

capital accounts.

d. The industrial partner does not share in the losses of the partnership.

Finals – Financial Accounting Page 2

B23. In the absence of a partnership agreement, the law says that income (and loss) should beallocated based on:

a. Interest allowances

b. The ratio of capital investments.

c. Salary allowances.

d. Equal shares.

A24. In the liquidation of a partnership, any partner who has a capital deficiency

a. has a personal debt to the partnership for the amount of the deficiency.

b. is automatically terminated as a partner.

c. will receive a cash distribution only on the basis of his or her income-sharing ratio.

d. it may be written off to a “Loss” account

C25. The admission of a new partner to an existing partnership

a. may be accomplished only by investing assets in the partnership.

b. requires purchasing the interest of one or more existing partners.

c. causes a legal dissolution of the existing partnership.

d. is almost always accompanied by the liquidation of the business

B26. Which of the following is correct when admitting a new partner into an existing partnership?

Purchase of an Interest Admission by Investment

a. Total net assetsunchanged unchanged

b. Total capitalincreased unchanged

c. Total net assetsunchanged increased

d. Total capitalunchanged unchanged

C27. When admitting a new partner by investment, a bonus to old partners

a. is usually unjustified because book values clearly reflect partnership net worth.

b. is sometimes justified because goodwill may exist and it is not reflected in the accounts.

c. results if the debit to cash is more than the new partner's capital credit.

d. results if the debit to cash is equal to the new partner's capital credit.

D28. An upward adjustment of partnership assets is implied before a new partner is admitted

a. this is prohibited by GAAP.

b. when the new partner's capital credit is greater than his or her investment of assets in the firm.

c. when recorded book values are greater than market values.

d. when total contributions is lesser than total agreed equity and the new partner's capital credit is the

same as his or her investment of assets in the firm.

D29. An entry is not required in the liquidation of a partnership to record the

a. payment of cash to creditors.

b. distribution of cash to the partners.

c. sale of noncash assets.

d. allocation of a capital deficiency to partners with credit balances when the deficient partner is expected

to pay the deficiency.

C30. Total shareholders' equity represents

a. a claim to specific assets contributed by the owners.

b. the maximum amount that can be borrowed by the enterprise.

c. a claim against a portion of the total assets of an enterprise.

d. only the amount of earnings that have been retained in the business.

D31. Shareholders' equity is generally classified into two major categories:

a. contributed capital and appropriated capital.

b. appropriated capital and retained earnings.

c. retained earnings and unappropriated capital.

d. contributed capital and earned capital.

D32. When a corporation issues its capital stock in payment for services, the best appropriate basis for recording

the transaction is the

a. market value of the services received.

b. par value of the shares issued.

c. market value of the shares issued if market value of services received is not known.

d. Any of these provides an appropriate basis for recording the transaction.

C33. When treasury share is purchased for more than the par value of the stock and the cost method is used to

account for treasury share, what account(s) should be debited?

Finals – Financial Accounting Page 3

a. Treasury share for the par value and paid-in capital in excess of par for the excess of the purchase price over

the par value.

b. Paid-in capital in excess of par for the purchase price.

c. Treasury share for the purchase price.

d. Treasury share for the par value and retained earnings for the excess of the purchase price over the par value.

B34. Two financial requirements that the Board of Directors must consider when declaring cash dividends are

a.

sufficient retained earnings and no treasury shares

b.

sufficient cash and sufficient retained earnings

c.

sufficient cash and sufficient additional paid in capital

d.

sufficient retained earnings and sufficient premium on stock

B35. Which dividends do not reduce shareholders' equity?

a.Cash dividends

b.Property dividends

c.Stock dividends

d. Liquidating dividend

D36. The balance in Ordinary Share Dividend Payable should be reported as a(n)

a.reduction from ordinary shares issued.

b.addition to ordinary share capital.

c. current liability.

d. contra current asset.

B37. How should a "gain" from the sale of treasury stock be reflected when using the cost method of recording

treasury stock transactions?

a.As paid-in capital from treasury stock transactions.

b. As ordinary earnings shown on the income statement.

c.As an increase in the amount shown for common stock.

d.As an extraordinary item shown on the income statement.

B38. At the date of the financial statements, ordinary shares issued would exceed outstanding common stock

shares because of the

a.subscription price being higher than the par value

b. declaration of a stock dividend.

c.purchase of treasury shares.

d.payment in full of subscribed stock.

B39. If Victory Corporation issues 2,000 ordinary shares of P5 par value stock for P140,000,

a. Common Stock will be credited for P140,000.

b. Paid-In Capital in Excess of Par Value will be credited for P10,000.

c. Paid-In Capital in Excess of Par Value will be credited for P130,000.

d. Cash will be debited for P130,000

D40. Which of the following represents the largest number of ordinary shares?

a Treasury shares

b.Issued shares

c. Outstanding shares

d.Authorized shares

A41. When preference shares share ratably with the ordinary shareholders in any profit distributions beyond the

prescribed rate this is known as the

a. Cumulative feature.

b. Callable feature

c. Participating feature.

d. Redeemable feature.

C42. Quirk Corporation issued a 100% share dividend of its ordinary shares which had a par value of P10 and a

fair value of P12 on declaration date and P14 on payment date. At what amount should retained earnings be

capitalized for the additional shares issued?

a. No capitalization of retained earnings.

b. Par value

c. Fair value on the declaration date

d. Fair value on the payment date

B43. How would the declaration and subsequent issuance of a 10% share dividend by the issuer affect each of the

following when the fair value of the shares exceeds the par value of the shares?

Share Capital Share Premium

Finals – Financial Accounting Page 4

a. No effect No effect

b. No effect Increase

c. Increase No effect

d. Increase Increase

B44. An ordinary shareholder has the pre-emptive right to

a. share proportionately in company assets upon liquidation.

b. share proportionately in any new issues of shares of the same class.

c. receive cash dividends before they are distributed to preference shareholders.

d. exclude preference shareholders from voting rights.

D45. Dividends are not paid on

a. noncumulative preference shares.

b. nonparticipating preference shares.

c. treasury shares.

d. Dividends are paid on all of these.

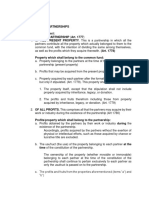

B46. Sun Corporation was organized on January 1, 2013, with an authorization of 400,000 ordinary shares of stock

with a par value of P6 per share. During 2013, the corporation had the following capital transactions:

January 5 - issued 225,000 shares @ P10 per share

July 28 - issued 30,000 shares for land acquired with an appraised value of P250,000

August 15 - issued 10,000 shares for consultancy services rendered by Trias Consultancy

Services for a bill received by Sun Corporation for P120,000.

What is the total amount of additional paid-in capital as of December 31, 2014?

a. P900,000

b. P1,030,000

c. P70,000

d. P60,000

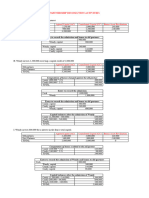

Use the following information for questions 47&48:

Tommy, Inc. has outstanding 200,000 shares of P2 par ordinary shares and 40,000 shares of no-par 8% preferred stock

with a stated value of P5. The preferred stock is cumulative and nonparticipating. Dividends have been paid yearly

except for the past two years and the current year.

B47. Assuming that P100,000 will be distributed as a dividend in the current year, how much will the ordinary

shareholders receive?

a. Zero.

b. P52,000.

c. P68,000.

d. P84,000.

D48. Assuming that P42,000 will be distributed as a dividend in the current year, how much will the preferred

sharehollders receive?

a. P14,000.

b. P16,000.

c. P32,000.

d. P42,000.

D49. On June 30, 2019, when Vida Corporation’s stock was selling at P65 per share, its equity accounts were as

follows:

Share Capital par value P25; 40,000 shares issued P1,000,000

Premium on share capital 600,000

Retained earnings 4,200,000

If a 100% stock dividend were declared and distributed, share capital will become

a. P1,000,000.

b. P2,600,000.

c. P2,000,000.

d. P3,200,000.

B50. The shareholders' equity section of Melrose Corporation as of December 31, 2018, was as follows:

Ordinary share capital, par value P2; authorized 20,000 shares;

issued and outstanding 10,000 shares P 20,000

Paid-in capital in excess of par 30,000

Retained earnings 90,000

P140,000

Finals – Financial Accounting Page 5

On March 1, 2019, the board of directors declared a 10% stock dividend, and accordingly 1,000 additional shares were

issued. On March 1, 2019, the fair market value of the stock was P6 per share. For the two months ended February

28, 2019, Melrose sustained a net loss of P10,000.

What amount should Melrose report as retained earnings as of March 1, 2019?

a. P74,000.

b. P78,000.

c. P84,000.

d. P88,000.

Prepared by: Approved by: Received by:

Dr. Antonieta P. Tungcab, CPA, MBA,AFBE William I. Asenci, CPA, MBA Nikee Guevarra

Faculty Dean Printing

Finals – Financial Accounting Page 6

You might also like

- Adamson University Intermediate Accounting 1 Property, Plant, & Equipment Quiz - Answer KeyDocument4 pagesAdamson University Intermediate Accounting 1 Property, Plant, & Equipment Quiz - Answer KeyKhai Supleo PabelicoNo ratings yet

- (Solved) 1. Mr. Lolong, Supervisory Employee, Received The Following Income... - Course HeroDocument11 pages(Solved) 1. Mr. Lolong, Supervisory Employee, Received The Following Income... - Course HeroBisag AsaNo ratings yet

- PROBLEMS AND EXERCISES ON ACCOUNTING FOR PROPERTY, PLANT AND EQUIPMENTDocument10 pagesPROBLEMS AND EXERCISES ON ACCOUNTING FOR PROPERTY, PLANT AND EQUIPMENTJess SiazonNo ratings yet

- Quiz - Chapter 11 - Investments - Additional Concepts - Ia 1 - 2020 EditionDocument2 pagesQuiz - Chapter 11 - Investments - Additional Concepts - Ia 1 - 2020 EditionJennifer RelosoNo ratings yet

- FAR 2 Q2 - Sample Problems With Solutions - FOR EMAILDocument11 pagesFAR 2 Q2 - Sample Problems With Solutions - FOR EMAILJoyce Anne GarduqueNo ratings yet

- A Capitalist Partner Can Be A Limited PartnerDocument1 pageA Capitalist Partner Can Be A Limited PartnerJoana TrinidadNo ratings yet

- Intermediate Accounting 1: Module Content - Prefinals Lesson: Module 9-12Document40 pagesIntermediate Accounting 1: Module Content - Prefinals Lesson: Module 9-12Nedelyn PedrenaNo ratings yet

- MILLAN SOL. MAN. Chapter 21 Investment Property IA PART 1BDocument4 pagesMILLAN SOL. MAN. Chapter 21 Investment Property IA PART 1BZhaira Kim CantosNo ratings yet

- TaxDocument4 pagesTaxGia Serilla100% (1)

- Bonus With SolutionDocument8 pagesBonus With SolutionRica RegorisNo ratings yet

- Merger and Consolidation MCQsDocument2 pagesMerger and Consolidation MCQsRSNo ratings yet

- Activity 10Document2 pagesActivity 10Randelle James FiestaNo ratings yet

- Assignment 5-LawDocument4 pagesAssignment 5-LawKath Lea Sanchez AbrilNo ratings yet

- Quiz 1 On Mid Term Period - Notes ReceivableDocument3 pagesQuiz 1 On Mid Term Period - Notes ReceivableErille Julianne (Rielianne)No ratings yet

- Law Quiz PracticeDocument72 pagesLaw Quiz PracticeJyNo ratings yet

- Partnership Dissolution AccountingDocument17 pagesPartnership Dissolution AccountingMaybelle Espenido0% (2)

- Partner Bustos Profit Share ₱74,800Document2 pagesPartner Bustos Profit Share ₱74,800sppNo ratings yet

- Non-Current Assets Held For Sale and Discontinued OperationsDocument4 pagesNon-Current Assets Held For Sale and Discontinued OperationsNicole TeruelNo ratings yet

- Solutions - Problems 1 To 5 (Handout-Manufacturing)Document4 pagesSolutions - Problems 1 To 5 (Handout-Manufacturing)Reniella AllejeNo ratings yet

- Qualifying Exam (Basic & ParCor)Document7 pagesQualifying Exam (Basic & ParCor)Rommel CruzNo ratings yet

- Art. 1776. Kinds of PartnershipsDocument4 pagesArt. 1776. Kinds of PartnershipsJoe P PokaranNo ratings yet

- Chapter 2Document40 pagesChapter 2ellyzamae quiraoNo ratings yet

- False. Article 1468. If The Consideration of The Contract Consists Partly in Money, and Partly inDocument8 pagesFalse. Article 1468. If The Consideration of The Contract Consists Partly in Money, and Partly inIrish AnnNo ratings yet

- CHAPTER 3 Dissolution and Winding Up CODALDocument5 pagesCHAPTER 3 Dissolution and Winding Up CODALfermo ii ramosNo ratings yet

- Article 1811Document6 pagesArticle 1811venus mae b caulinNo ratings yet

- Lim Tong Lim v. Phil Fishing Gear IndustriesDocument10 pagesLim Tong Lim v. Phil Fishing Gear IndustriesPatrick Jorge SibayanNo ratings yet

- Problem6 Ppe-P2Document19 pagesProblem6 Ppe-P2Angela RuedasNo ratings yet

- 5 2Document8 pages5 2Evelyn MorilloNo ratings yet

- Activity 3 Key PDFDocument5 pagesActivity 3 Key PDFKervin Rey JacksonNo ratings yet

- Pledge - Mortgage - Chattel MortgageDocument23 pagesPledge - Mortgage - Chattel MortgageJohn Kayle BorjaNo ratings yet

- STUDY GUIDE Part 3 ProblemsDocument2 pagesSTUDY GUIDE Part 3 ProblemsBaylon RachelNo ratings yet

- Accounting for dividends on preference and ordinary sharesDocument5 pagesAccounting for dividends on preference and ordinary sharesBernadette Joyce ManjaresNo ratings yet

- FAR2 CHAPTER 1 (PG 1-13)Document13 pagesFAR2 CHAPTER 1 (PG 1-13)Layla MainNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsHufana, ShelleyNo ratings yet

- pARTcORP. jUNE 17 AND 18Document5 pagespARTcORP. jUNE 17 AND 18ginalynNo ratings yet

- Chapter 16 Test Bank Dissolution and Liquidation of A PartnershipDocument23 pagesChapter 16 Test Bank Dissolution and Liquidation of A Partnershipjosh lunarNo ratings yet

- Partnership Dissolution ActivitiesDocument9 pagesPartnership Dissolution Activitieschrstncstllj100% (1)

- CFAS - Chapter 3: True or FalseDocument1 pageCFAS - Chapter 3: True or Falseagm25No ratings yet

- Far Reviewer For FinalsDocument38 pagesFar Reviewer For Finalsjessamae gundanNo ratings yet

- Cfas ReviewerDocument7 pagesCfas ReviewerDarlene Angela IcasiamNo ratings yet

- Pre FinactDocument6 pagesPre FinactMenardNo ratings yet

- MIDTERMDocument11 pagesMIDTERMHeide PalmaNo ratings yet

- Chapter 9 Investments QuizDocument5 pagesChapter 9 Investments QuizMs Vampire100% (1)

- Exercise 1: Required: Classify The Reports in Part A-E Into One of The Three Major Purposes of Accounting Systems OnDocument2 pagesExercise 1: Required: Classify The Reports in Part A-E Into One of The Three Major Purposes of Accounting Systems OnMyunimintNo ratings yet

- Article 1504Document1 pageArticle 1504Anonymous gG0tLI99S2No ratings yet

- Chapter 10 - AnswerDocument15 pagesChapter 10 - AnswerAgentSkySkyNo ratings yet

- Quiz 1 in Ia3Document6 pagesQuiz 1 in Ia3Dorothy NadelaNo ratings yet

- Corrections: Suggested SolutionDocument5 pagesCorrections: Suggested SolutionZairah FranciscoNo ratings yet

- CASTILLO, Erica Miles C. - LAWS ON OBLIGATION AND CONTRACT ACTIVITY#1Document3 pagesCASTILLO, Erica Miles C. - LAWS ON OBLIGATION AND CONTRACT ACTIVITY#1Miles CastilloNo ratings yet

- Requirement Solution: Employee Benefits (Part 1)Document6 pagesRequirement Solution: Employee Benefits (Part 1)Regina De LunaNo ratings yet

- Article 1828Document27 pagesArticle 1828Mary Elisha PinedaNo ratings yet

- CHAPTER 1 - Partnership Quizzer With AnswersDocument5 pagesCHAPTER 1 - Partnership Quizzer With AnswersJust ForNo ratings yet

- Cfas Theories QuizletDocument4 pagesCfas Theories Quizletagm25No ratings yet

- FAR Reviewer - CPAR Test BankDocument31 pagesFAR Reviewer - CPAR Test BankemmanvillafuerteNo ratings yet

- Partnership Law (Chapter 1 and 2) - ReviewerDocument9 pagesPartnership Law (Chapter 1 and 2) - ReviewerJeanne Marie0% (1)

- Rights and obligations of partners in a partnershipDocument3 pagesRights and obligations of partners in a partnershipenliven morenoNo ratings yet

- PARTNERSHIP ACCOUNTING EXAM REVIEWDocument26 pagesPARTNERSHIP ACCOUNTING EXAM REVIEWIts meh Sushi50% (2)

- COMPREHENSIVE PARTNERSHIP EXAMDocument25 pagesCOMPREHENSIVE PARTNERSHIP EXAMJoemar Santos Torres100% (3)

- Comprehensive Exam For Partnership AcctgDocument30 pagesComprehensive Exam For Partnership AcctgchingNo ratings yet

- Accounting 2 PrelimsDocument3 pagesAccounting 2 PrelimsJohn Alfred Castino100% (1)

- LaunchDocument1 pageLaunchAlyssa QuiambaoNo ratings yet

- PathfinderDocument1 pagePathfinderAlyssa QuiambaoNo ratings yet

- Major AdvanceDocument1 pageMajor AdvanceAlyssa QuiambaoNo ratings yet

- Big PigssDocument1 pageBig PigssAlyssa QuiambaoNo ratings yet

- Perio OddDocument1 pagePerio OddAlyssa QuiambaoNo ratings yet

- LPAaaDocument1 pageLPAaaAlyssa QuiambaoNo ratings yet

- Joint PatrolsDocument1 pageJoint PatrolsAlyssa QuiambaoNo ratings yet

- DevelopDocument1 pageDevelopAlyssa QuiambaoNo ratings yet

- Over CapitalizationDocument1 pageOver CapitalizationAlyssa QuiambaoNo ratings yet

- Profit Maximization CriticismsDocument1 pageProfit Maximization CriticismsAlyssa QuiambaoNo ratings yet

- Objectives of Financial PlanningDocument1 pageObjectives of Financial PlanningAlyssa QuiambaoNo ratings yet

- Payroll, Claims Processing, and AutomationDocument1 pagePayroll, Claims Processing, and AutomationAlyssa QuiambaoNo ratings yet

- Blink enDocument2 pagesBlink enAlyssa QuiambaoNo ratings yet

- AGRISECTTDocument1 pageAGRISECTTAlyssa QuiambaoNo ratings yet

- The Philippine RepublicDocument1 pageThe Philippine RepublicAlyssa QuiambaoNo ratings yet

- When Did Philippine History BeginDocument1 pageWhen Did Philippine History BeginAlyssa QuiambaoNo ratings yet

- WorkkDocument2 pagesWorkkAlyssa QuiambaoNo ratings yet

- Was Spanish Rule Good or BadDocument1 pageWas Spanish Rule Good or BadAlyssa QuiambaoNo ratings yet

- Philippine History During The American EraDocument1 pagePhilippine History During The American EraAlyssa QuiambaoNo ratings yet

- The American Era and IndependenceDocument2 pagesThe American Era and IndependenceAlyssa QuiambaoNo ratings yet

- Discovery of The Philippines by The West and RevolutionDocument1 pageDiscovery of The Philippines by The West and RevolutionAlyssa QuiambaoNo ratings yet

- Philippine History During The Japanese OccupationDocument1 pagePhilippine History During The Japanese OccupationAlyssa QuiambaoNo ratings yet

- Philippine History During The Spanish Colonial TimesDocument1 pagePhilippine History During The Spanish Colonial TimesAlyssa QuiambaoNo ratings yet

- Beginnings of The ArchipelagoDocument1 pageBeginnings of The ArchipelagoAlyssa QuiambaoNo ratings yet

- The Metal AgesDocument2 pagesThe Metal AgesAlyssa QuiambaoNo ratings yet

- Post Martial Law Up To The Present TimeDocument3 pagesPost Martial Law Up To The Present TimeAlyssa QuiambaoNo ratings yet

- Philippine History During The Martial Law RegimeDocument1 pagePhilippine History During The Martial Law RegimeAlyssa QuiambaoNo ratings yet

- Prehistory: Pleistocene Glaciation Pleistocene EpochDocument2 pagesPrehistory: Pleistocene Glaciation Pleistocene EpochAlyssa QuiambaoNo ratings yet

- Neolithic Period: The Adoption of FarmingDocument5 pagesNeolithic Period: The Adoption of FarmingAlyssa QuiambaoNo ratings yet

- History of EuropeDocument1 pageHistory of EuropeAlyssa QuiambaoNo ratings yet

- Cost Benefit AnalysisDocument17 pagesCost Benefit Analysissidmathur2010No ratings yet

- Naan MudhalvanDocument25 pagesNaan Mudhalvanvseerangan401No ratings yet

- TDA066Document15 pagesTDA066Alayas ArtemasNo ratings yet

- Consumer Behaviour Towards Mutual FundDocument119 pagesConsumer Behaviour Towards Mutual FundChandan SrivastavaNo ratings yet

- Statement of Additional InformationDocument136 pagesStatement of Additional InformationArjun KapoorNo ratings yet

- Enf Traders Global Group Complaint 082923Document40 pagesEnf Traders Global Group Complaint 082923Melvin EdwardNo ratings yet

- DLX Earnings Presentation Q2 2018Document25 pagesDLX Earnings Presentation Q2 2018Nikos FatsisNo ratings yet

- UTS 2020-Genap Attempt Reviews1Document10 pagesUTS 2020-Genap Attempt Reviews1HERMAN GEMILANGNo ratings yet

- SAPMDocument11 pagesSAPMVijay DeshpandeNo ratings yet

- Assignment - 5B - Islamic Money MarketDocument19 pagesAssignment - 5B - Islamic Money MarketAlifah IlyanaNo ratings yet

- 4 FinalsDocument59 pages4 FinalsXerez SingsonNo ratings yet

- Round 1 - Finance Accelerator ResearchDocument4 pagesRound 1 - Finance Accelerator ResearchZahin AdibNo ratings yet

- A Guide To The Financial Analysis of Shrimp FarmingDocument22 pagesA Guide To The Financial Analysis of Shrimp FarmingJohn Sebastian Bell-Scott100% (2)

- f7 Mapit-Workbook-Q-A PDFDocument248 pagesf7 Mapit-Workbook-Q-A PDFKevin Ch LiNo ratings yet

- Intrinsic Value Calculator. Book Value and Dividend GrowthDocument4 pagesIntrinsic Value Calculator. Book Value and Dividend Growthvr97No ratings yet

- Forex Trading Advantages & Disadvantages ExplainedDocument2 pagesForex Trading Advantages & Disadvantages ExplainedKhushi SiviaNo ratings yet

- Cyient LTD.: Q1FY20: Weak Quarter, Lack VisibilityDocument7 pagesCyient LTD.: Q1FY20: Weak Quarter, Lack VisibilityADNo ratings yet

- Ilija Murisic - Fairplay - UBS Blue Sea IndexDocument1 pageIlija Murisic - Fairplay - UBS Blue Sea Indexakasaka99No ratings yet

- UTS Aplikasi Manajemen Keuangan Take HomeDocument10 pagesUTS Aplikasi Manajemen Keuangan Take HomeRifan Herwandi FauziNo ratings yet

- OWS Money Market Comment LetterDocument5 pagesOWS Money Market Comment LetterMatt StollerNo ratings yet

- Haskayne Resume Template 1Document1 pageHaskayne Resume Template 1Mako SmithNo ratings yet

- Capital StructureDocument11 pagesCapital StructureSathya Bharathi100% (1)

- Fxtradermagazine 1 EgDocument61 pagesFxtradermagazine 1 EgDoncov EngenyNo ratings yet

- Chapter (14) Corporations: Dividends, Retained Earnings, and Income Reporting DividendsDocument11 pagesChapter (14) Corporations: Dividends, Retained Earnings, and Income Reporting DividendsMondy MondyNo ratings yet

- Sector Report Yes BankDocument53 pagesSector Report Yes BankPriyalNo ratings yet

- Sahand CVDocument1 pageSahand CVSahand LaliNo ratings yet

- Virtual Stock Trading StrategiesDocument10 pagesVirtual Stock Trading StrategiesJan Jovirin GelicameNo ratings yet

- CS FSM Excecutive Revision Series by CA CMA Suraj TatiyaDocument38 pagesCS FSM Excecutive Revision Series by CA CMA Suraj TatiyaAbhay WritesNo ratings yet

- Index Models and Portfolio OptimizationDocument14 pagesIndex Models and Portfolio OptimizationdomazzzNo ratings yet

- Chap021 Text Bank (1) SolutionDocument50 pagesChap021 Text Bank (1) Solutionandlesmason50% (2)