Professional Documents

Culture Documents

Financial Markets and Services: Unit 1

Uploaded by

Saumya SinghOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Markets and Services: Unit 1

Uploaded by

Saumya SinghCopyright:

Available Formats

FINANCIAL MARKETS AND SERVICES

UNIT 1

Financial Markets –An Overview Introduction Financial managers and investors

don’t operate in a vacuum; they make decisions within a large and complex

financial environment. This environment includes financial markets and

institutions, tax and regulatory policies, and the state of the economy. The

environment both determines the available financial alternatives and affects the

outcomes of various decisions. Thus, it is crucial that investors and financial

managers have a good understanding of the environment in which they operate.

History shows that a strong financial system is a necessary ingredient for a

growing and prosperous economy. Companies raising capital to finance capital

expenditures as well as investors saving to accumulate funds for future use

require well-functioning financial markets and institutions.

A financial system (within the scope of finance) is a system that allows the

exchange of funds between lenders, investors, and borrowers. Financial systems

operate at national, global, and firm-specific levels. They consist of complex,

closely related services, markets, and institutions intended to provide an

efficient and regular linkage between investors and depositors. Money, credit,

and finance are used as media of exchange in financial systems. They serve as a

medium of known value for which goods and services can be exchanged as an

alternative to bartering. A modern financial system may include banks (operated

by the government or private sector), financial markets, financial instruments,

and financial services. Financial systems allow funds to be allocated, invested,

or moved between economic sectors. They enable individuals and companies to

share the associated risks.

The formal financial system consists of four components:

1. Financial institutions,

SAUMYA SINGH, Assistant Professor Page 1

2. Financial markets,

3. Financial instruments and

4. Financial services.

The financial system acts as a connecting link between savers of money and

users of money and thereby promotes faster economic and industrial growth.

Thus financial system may be defined as “a set of markets and institutions to

facilitate the exchange of assets and risks.” Efficient functioning of the financial

system enables proper flow of funds from investors to productive activities

which in turn facilitates investment.

Financial Markets

Financial markets are the centre that facilitate buying and selling of financial

instruments, claims or services. It caters the credit needs of the individuals,

firms and institutions. It deals with the financial assets of different types such as

currency deposits, cheques, bills, bonds etc. it is defined as a transmission

mechanism between investors and the borrowers through which transfer of

funds is facilitated.

Function Of Financial Markets:

Financial markets serve six basic functions. They are briefly listed below.

1. Borrowing and Lending: Financial markets permit the transfer of funds

from one agent to another for either investment or consumption purposes.

2. Price Determination: It provides means by which prices are set both for

newly issued financial assets and for the existing stock of financial assets.

3. Information Aggregation and Coordination: It acts as collectors and

aggregators of information about financial asset values and the flow of funds

from lenders to borrowers.

4. Risk Sharing: It allows a transfer of risk from those who undertake

investments to those who provide funds for those investments.

SAUMYA SINGH, Assistant Professor Page 2

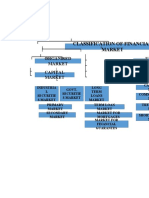

CLASSIFICATION OF FINANCIAL MARKETS

FINANCIAL

MARKETS

CAPITAL

MONEY MARKETS

MARKETS

SECONDARY

PRIMARY MARKET MARKET

1. CALL MONEY

(New issues market) MARKET

(stock exchange) 2. TRESURY BILLS

3.COMMERCIAL

PAPERS

4. CERTIFICATE OF

Public issue: DEPOSITS

IPO, FPO, Rights BSE, NSE, NYSE, 5. govt. securities

Issue, Preferential ISE,

6. commercial bill

issue market

PRIMARY MARKET:

The primary market is where securities are created. It’s in this market that

firms sell (float) new stocks and bonds to the public for the first time. An initial

public offering, or IPO, is an example of a primary market.

SAUMYA SINGH, Assistant Professor Page 3

These trades provide an opportunity for investors to buy securities from the

bank that did the initial underwriting for a particular stock. An IPO occurs when

a private company issues stock to the public for the first time.

FEATURES OF PRIMARY MARKET:

1) This is the market for new long term equity capital. The primary market

is a market where the securities are sold for the first time.

2) In a primary issue, the securities are issued by the company directly to the

investors.

3) The company receives the money and issues new security certificate to

the investors.

4) Primary issues are used by companies for the purpose of setting up new

business or for expanding the existing business.

5) The primary market performs the crucial function of facilitating capital

formation in the economy.

6) The new market issue does not include certain other sources of new long

term external finance, such as loan from financial institutions.

7) The financial assets can only be redeemed by the original holder.

PLAYERS OF PRIMARY MARKET:

1. Merchant Bankers (Managers to the Issue):

SEBI regulations 1992 prescribes that all public issues should be managed by at

least one merchant banker functioning as Lead manager or Managers to the

Issue.

SAUMYA SINGH, Assistant Professor Page 4

“Merchant banker means any person/institution who is engaged in the business

of issue management either by making arrangements regarding selling, buying

or subscribing to securities as manager, consultant, advisor or rendering

corporate advisory services in relation to such issue management.”

2. Underwriters to the Issue:

Underwriters are financial institutions who make a firm commitment that they

will take up the shares up to a certain amount if the public does not subscribe to

it. This is an agreement with one or more institutions and a guarantee of the

marketability of shares. Under writing is mandatory for the Public Issue.

Underwriters are appointed by the company in consultation with the managers

to the issue.

3. Brokers to the Issue:

Brokers are persons authorized to market the issues. Companies can engage any

number of brokers to market the new issue. The brokers may engage sub-

brokers and they send their own circulars, publicity materials and applications

to the clients and follow up the work for canvassing the subscription. Brokers to

the issue are not compulsory for public issues, but their expertise and contacts

with investors could be used for marketing the issue.

4. Registrars to the Issue (Registrar and Share Transfer (R&T) Agents):

R&T agent plays a significant role in a public issue along with the lead

managers. Registrars are persons appointed in consultation with lead managers

to assist the issue management functions. Their work relates to pre-issue

management, management during the currency of issue, pre- allotment Work,

allotment work and post allotment work.

SAUMYA SINGH, Assistant Professor Page 5

5. Syndicate Members:

The Book Running Lead Managers to the issue appoint the Syndicate Members,

who enter the bids of investors in the book building system. Syndicate Members

are commercial or investment banks registered with SEBI who also carry on the

activity of underwriting in IPO.

INSTRUMENTS IN PRIMARY MARKET:

1. Promissory note

2. Certificate of Deposit

3. Bond

4. Common shares

5. Preferred stocks

PROCEDURE FOR ISSUING EQUITY SHARES AND DEBENTURES:

The procedure of issuing debentures by a company is similar to the one

followed while issuing equity stocks. The company starts by releasing a

prospectus declaring the debenture issuance. The interested investors, then,

apply for the same.

1] Issue of Prospectus

Before the issue of shares, comes the issue of the prospectus. The prospectus is

like an invitation to the public to subscribe to shares of the company. A prospectus

contains all the information of the company, its financial structure, previous year

balance sheets and profit and Loss statements etc.

SAUMYA SINGH, Assistant Professor Page 6

2] Receiving Applications

When the prospectus is issued, prospective investors can now apply for shares.

They must fill out an application and deposit the requisite application money in

the schedule bank mentioned in the prospectus. The application process can stay

open a maximum of 120 days. If in these 120 days minimum subscription has not

been reached, then this issue of shares will be cancelled. The application money

must be refunded to the investors within 130 days since issuing of the prospectus.

3] Allotment of Shares

Once the minimum subscription has been reached, the shares can be allotted.

Generally, there is always oversubscription of shares, so the allotment is done on

pro-rata bases. Letters of Allotment are sent to those who have been allotted their

shares. This results in a valid contract between the company and the applicant,

who will now be a part owner of the company.

4) To make call on shares

The remaining amount left after application and allotment money due from

shareholders may be demanded in one or more parts which are termed as “first

call” and “second call” and so on.

SEBI GUIDELINES TOWARDS THE ISSUE OF EQUITY SHARES AND

DEBENTURES –

SEBI GUIDELINES TOWARDS THE ISSUE OF

DEBENTURES –

1. Guidelines will be applicable for the issue of convertible and nonconvertible

debentures by public limited as well as public sector companies.

2. Debentures can be issued for the following purposes:

SAUMYA SINGH, Assistant Professor Page 7

For starting new undertakings

Expansion or diversification

For modernization

Merger/amalgamation which has been approved by financial institutions

Restructuring of capital

For acquiring assets

For increasing resources of long-term finance.

For starting new undertakings

Expansion or diversification

For modernization

Merger/amalgamation which has been approved by financial institutions

Restructuring of capital

For acquiring assets

For increasing resources of long-term finance.

3. Issue of debentures should not exceed more than 20% of gross current assets

and also loans and advances.

4. Debt-equity ratio in issue of debentures should not exceed 2:1. But this

condition will be relaxed for capital intensive projects.

5. Any redemption of debentures will not commence before 7 years since the

commencement of the company.

6. For small investors for value such as Rs. 5,000, payments should be made in

one instalment.

7. With the consent of SEBI, even non-convertible debentures can be converted

into equity.

8. A premium of 5% on the face value is allowed at the time of redemption and

in case of non-convertible debentures only.

SAUMYA SINGH, Assistant Professor Page 8

9. The face value of debenture will be Rs. 100 and it will be listed in one or

more stock exchanges in the country.

10. Secured debentures will be permitted for public subscription.

SEBI GUIDELINES TOWARDS THE ISSUE OF EQUITY

SHARES:

SEBI Guidelines for issue of fresh share capital

1. All applications should be submitted to SEBI in the prescribed form.

2. Applications should be accompanied by true copies of industrial license.

3. Cost of the project should be furnished with scheme of finance.

4. Company should have the shares issued to the public and listed in one or

more recognized stock exchanges.

5. Where the issue of equity share capital involves offer for subscription by the

public for the first time, the value of equity capital, subscribed capital privately

held by promoters, and their friends shall be not less than 15% of the total

issued equity capital.

6. An equity-preference ratio of 3:1 is allowed.

7. Capital cost of the projects should be as per the standard set with a reasonable

debt-equity ratio.

8. New company cannot issue shares at a premium. The dividend on preference

shares should be within the prescribed list.

9. All the details of the underwriting agreement.

SAUMYA SINGH, Assistant Professor Page 9

10. Allotment of shares to NRIs is not allowed without the approval of RBI.

11. Details of any firm allotment in favour of any financial institutions.

12. Declaration by secretary or director of the company.

SEBI Guidelines for first issue by new companies in Primary Market:

1. A new company which has not completed 12 months of commercial

operations will not be allowed to issue shares at a premium.

2. If an existing company with a 5-year track record of consistent

profitability, is promoting a new company, then it is allowed to price its

issue.

3. 3. A draft of the prospectus has to be given to the SEBI before public

issue.

4. 4. The shares of the new companies have to be listed either

with OTCEI or any other stock exchange.

MERITS AND DEMERITS OF PRIMARY MARKET:

Advantages of Primary Market

Companies can raise capital at relatively low cost, and the securities so

issued in the primary market provide high liquidity as the same can be sold

in the secondary market almost immediately.

The primary market is an important source for mobilisation of savings in an

economy. Funds are mobilised from commoners for investing in other

channels. It leads to monetary resources being put into investment options.

Chances of price manipulation in the primary market are considerably less

when compared to the secondary market. Such manipulation usually occurs

SAUMYA SINGH, Assistant Professor Page 10

by deflating or inflating a security price, thereby deliberately interfering

with fair and free operations of the market.

The primary market acts as a potential avenue for diversification to cut

down on risk. It enables an investor to allocate his/her investment across

different categories involving multiple financial instruments and industries.

It is not subject to any market fluctuations. The prices of stocks are

determined before an initial public offering, and investors know the actual

amount they will have to invest.

Disadvantages of Primary Market

There may be limited information for an investor to access before

investment in an IPO since unlisted companies do not fall under the

purview of regulatory and disclosure requirements of the Securities and

Exchange Board of India.

Each stock is exposed to varying degrees of risk, but there is no historical

trading data in a primary market for analysing IPO shares because the

company is offering its shares to the public for the first time through an

initial public offering.

In some cases, it may not be favourable for small investors. If a share is

oversubscribed, small investors may not receive share allocation.

With this information regarding the primary market, individuals can make a

well-thought-out decision regarding investment in the market. It also makes

way for the creation of an investment portfolio with diversified risk.

SAUMYA SINGH, Assistant Professor Page 11

SAUMYA SINGH, Assistant Professor Page 12

You might also like

- Financial Markets Instructional GuideDocument62 pagesFinancial Markets Instructional GuideSky LawrenceNo ratings yet

- Financial Markets Instructional Material 1st Sem SY2020 21 Modules 1 To 8 PDFDocument72 pagesFinancial Markets Instructional Material 1st Sem SY2020 21 Modules 1 To 8 PDFLorielyn Mae SalcedoNo ratings yet

- Financial Institution and Marketing Cha 4Document23 pagesFinancial Institution and Marketing Cha 4Gadisa TarikuNo ratings yet

- What Is Primary MarketDocument10 pagesWhat Is Primary MarketARTI JAISWALNo ratings yet

- Financial MarketsDocument29 pagesFinancial MarketsAthena Fatmah M. AmpuanNo ratings yet

- Capital MarketDocument14 pagesCapital MarketVishaka KarandeNo ratings yet

- Financial Markets and InstitutionsDocument16 pagesFinancial Markets and Institutionszeyad GadNo ratings yet

- Stock-Commodities-Market 6th Sem BbaDocument92 pagesStock-Commodities-Market 6th Sem BbaBhushan Junghare100% (1)

- Unit VII Capital Market in IndiaDocument9 pagesUnit VII Capital Market in IndiaKushal KaushikNo ratings yet

- BU - 5th - semFIM Unit-2Document11 pagesBU - 5th - semFIM Unit-2max90binNo ratings yet

- study material unit 1Document10 pagesstudy material unit 1gsaiesh255No ratings yet

- Capital Market: Submitted By: Namrata Singh Tuba Hasan Shagun Rastogi Raghvendra Kr. YadavDocument11 pagesCapital Market: Submitted By: Namrata Singh Tuba Hasan Shagun Rastogi Raghvendra Kr. YadavSonamNo ratings yet

- Ch-3-Primary MarketDocument17 pagesCh-3-Primary MarketAngelica JacobNo ratings yet

- FinancialDocument19 pagesFinancialramajayamjayam374No ratings yet

- Overview of Indian Securities Market: Chapter-1Document100 pagesOverview of Indian Securities Market: Chapter-1tamangargNo ratings yet

- FM415 Week1Document8 pagesFM415 Week1joahn.rocreo1234No ratings yet

- Unit 2Document23 pagesUnit 2tanushkachauhan71No ratings yet

- Study material FSM(2)Document43 pagesStudy material FSM(2)gsaiesh255No ratings yet

- GR12 Business Finance Module 3-4Document8 pagesGR12 Business Finance Module 3-4Jean Diane JoveloNo ratings yet

- Capital Market PDFDocument12 pagesCapital Market PDFAyush BhadauriaNo ratings yet

- Stock Market and Stock ExchangesDocument9 pagesStock Market and Stock ExchangesMaithreyi JntuNo ratings yet

- Financial Institutions and MarketsDocument10 pagesFinancial Institutions and MarketsVikkuNo ratings yet

- Financial Markets and Services Chapter 1 and 2Document79 pagesFinancial Markets and Services Chapter 1 and 2Poojitha ReddyNo ratings yet

- Introduction to Financial Systems and MarketsDocument33 pagesIntroduction to Financial Systems and MarketsHannah Louise Gutang PortilloNo ratings yet

- IFS-Primary Market - Note Prepared by Dr.R.R.YelikarDocument33 pagesIFS-Primary Market - Note Prepared by Dr.R.R.YelikarBablu JamdarNo ratings yet

- IPO (Initial Public Offer) : Advantages of Going PublicDocument67 pagesIPO (Initial Public Offer) : Advantages of Going PublicIsmath FatimaNo ratings yet

- Chapt Er 1: Investor's Perception Towards "Stock Trading"Document67 pagesChapt Er 1: Investor's Perception Towards "Stock Trading"harpalsinghmaanNo ratings yet

- Investment Management Basic Concepts - Shahid KVDocument149 pagesInvestment Management Basic Concepts - Shahid KVshahid veettil100% (2)

- Capital Market - : Difference Between Primary and Secondary MarketDocument7 pagesCapital Market - : Difference Between Primary and Secondary MarketJanellaNo ratings yet

- CH 5 The Capital MarketDocument23 pagesCH 5 The Capital MarketJyoti YadavNo ratings yet

- Indian Securities MarketDocument73 pagesIndian Securities Marketbharti palNo ratings yet

- IFS Unit-1 Notes - 20200717114457Document9 pagesIFS Unit-1 Notes - 20200717114457Vignesh C100% (1)

- Financial MarketDocument64 pagesFinancial MarketPooja Yadav0% (1)

- Overview of Financial MarketsDocument5 pagesOverview of Financial MarketsLovely Joy SantiagoNo ratings yet

- Capital MarketDocument43 pagesCapital MarketAnna Mae NebresNo ratings yet

- Understanding Capital MarketsDocument25 pagesUnderstanding Capital MarketsAnna Mae NebresNo ratings yet

- An Introduction to Capital MarketsDocument31 pagesAn Introduction to Capital MarketsDIPESH BHATTACHARYYANo ratings yet

- FINANCIAL MARKET Can Be Defined As "Any Marketplace Where Buyers andDocument25 pagesFINANCIAL MARKET Can Be Defined As "Any Marketplace Where Buyers andNamita LepchaNo ratings yet

- Chap 10 Short NotesDocument10 pagesChap 10 Short Notesnimisha chaddhaNo ratings yet

- Investment NotesDocument30 pagesInvestment Notesshantanu100% (2)

- Unit - 2 FmeDocument9 pagesUnit - 2 FmeTanyaNo ratings yet

- Reforms of Primary Market-SebiDocument4 pagesReforms of Primary Market-Sebikhaja mohiddienNo ratings yet

- SEBI BookletDocument40 pagesSEBI BookletABHIJEET GAJRENo ratings yet

- Investment Analysis and Portfolio ManagementDocument93 pagesInvestment Analysis and Portfolio ManagementVamsi KrishnaNo ratings yet

- Primary Market Mod 1Document10 pagesPrimary Market Mod 1Ayush JaiswalNo ratings yet

- IFS&S - Ses67Document29 pagesIFS&S - Ses67Shubham kumar BeheraNo ratings yet

- Indian Capital MarketsDocument26 pagesIndian Capital MarketsMANJUNATHA SNo ratings yet

- Indian Financial SystemDocument30 pagesIndian Financial SystemGrow GairolaNo ratings yet

- Portfolio InvestmentDocument129 pagesPortfolio Investmentanchal1987No ratings yet

- Securities Market Foi Sem 6Document11 pagesSecurities Market Foi Sem 6aaradhya pankhuriNo ratings yet

- Financial MarketsDocument83 pagesFinancial MarketsKriz BizNo ratings yet

- Chapter 8Document18 pagesChapter 8Marie Sheaneth BalitangNo ratings yet

- Unit 1 - Capital MarketsDocument9 pagesUnit 1 - Capital MarketsBhumika BapatNo ratings yet

- IFS Chapter 3Document26 pagesIFS Chapter 3riashahNo ratings yet

- Fim NotesDocument13 pagesFim Notesabdul samadNo ratings yet

- Unit 3Document27 pagesUnit 3RAJNo ratings yet

- FM3A Financial Market FunctionsDocument5 pagesFM3A Financial Market FunctionsRoxanne Jhoy Calangi VillaNo ratings yet

- Capital MarketDocument34 pagesCapital MarketVaibhavRanjankarNo ratings yet

- Specialty CorporationDocument171 pagesSpecialty CorporationAdrian Steven Claude CosicoNo ratings yet

- DSM Unit 1 Part 1 NotesDocument9 pagesDSM Unit 1 Part 1 NotesSaumya SinghNo ratings yet

- Capital Structure Debt Equity - ProblemsDocument5 pagesCapital Structure Debt Equity - ProblemsSaumya SinghNo ratings yet

- Financial Markets and Services: Unit 1Document12 pagesFinancial Markets and Services: Unit 1Saumya SinghNo ratings yet

- Financial Markets and Services: Unit 1Document12 pagesFinancial Markets and Services: Unit 1Saumya SinghNo ratings yet

- Financial Markets and Services: Unit 1Document12 pagesFinancial Markets and Services: Unit 1Saumya SinghNo ratings yet

- Unit 3 E-Marketing Management: Product-On InternetDocument10 pagesUnit 3 E-Marketing Management: Product-On InternetSaumya SinghNo ratings yet

- UNIT 1, PART 2 Digital & Social Media MarketingDocument9 pagesUNIT 1, PART 2 Digital & Social Media MarketingSaumya SinghNo ratings yet

- UNIT 4, Digital & Social Media MarketingDocument17 pagesUNIT 4, Digital & Social Media MarketingSaumya SinghNo ratings yet

- DSM Presentation PDFDocument1 pageDSM Presentation PDFSaumya SinghNo ratings yet

- DSM Presentation PDFDocument1 pageDSM Presentation PDFSaumya SinghNo ratings yet

- UNIT 1, PART 2 Digital & Social Media MarketingDocument9 pagesUNIT 1, PART 2 Digital & Social Media MarketingSaumya SinghNo ratings yet

- All You Need to Know About the Primary MarketDocument9 pagesAll You Need to Know About the Primary MarketSaumya SinghNo ratings yet

- Unit 3 E-Marketing Management: Product-On InternetDocument10 pagesUnit 3 E-Marketing Management: Product-On InternetSaumya SinghNo ratings yet

- July-2019 QPDocument2 pagesJuly-2019 QPSaumya SinghNo ratings yet

- Different Sales Promotion Activities On InternetDocument25 pagesDifferent Sales Promotion Activities On InternetSaumya SinghNo ratings yet

- DSM Presentation RamachandraDocument8 pagesDSM Presentation RamachandraSaumya SinghNo ratings yet

- E Marketing NotesDocument65 pagesE Marketing NotesZoheb Ali KNo ratings yet

- MM Unit 4Document11 pagesMM Unit 4Saumya SinghNo ratings yet

- SWOT Analysis of Education Sector in INDIADocument8 pagesSWOT Analysis of Education Sector in INDIASaumya SinghNo ratings yet

- Marketing Management Notes Unit 1Document34 pagesMarketing Management Notes Unit 1Saumya SinghNo ratings yet

- Marketing MIX: Pricing DecisionsDocument5 pagesMarketing MIX: Pricing DecisionsSaumya SinghNo ratings yet

- MM Unit 2Document5 pagesMM Unit 2Saumya SinghNo ratings yet

- DSM Unit 1 Part 1 NotesDocument9 pagesDSM Unit 1 Part 1 NotesSaumya SinghNo ratings yet

- Neelkanth Palace Shop ValuationDocument3 pagesNeelkanth Palace Shop ValuationRaj GohilNo ratings yet

- Unconventional Monetary Policy Measures - A Comparison of The Ecb, FedDocument38 pagesUnconventional Monetary Policy Measures - A Comparison of The Ecb, FedDaniel LiparaNo ratings yet

- Statute of Limitations For Collecting A DebtDocument2 pagesStatute of Limitations For Collecting A DebtmikotanakaNo ratings yet

- 2006-07 - GrasimDocument117 pages2006-07 - GrasimrNo ratings yet

- Reliance Retail Limited Tax Invoice: Original For RecipientDocument1 pageReliance Retail Limited Tax Invoice: Original For RecipientalokNo ratings yet

- Acquiring New Knowledge: Module 26 AgricultureDocument10 pagesAcquiring New Knowledge: Module 26 AgricultureAngelica Sanchez de VeraNo ratings yet

- Chapter Five: Corporation Organization and OperationDocument8 pagesChapter Five: Corporation Organization and OperationSamuel DebebeNo ratings yet

- Tax Avoidance Strategies in ChinaDocument12 pagesTax Avoidance Strategies in Chinakelas cNo ratings yet

- Countingup Statement 2023 07Document1 pageCountingup Statement 2023 07SophiaNo ratings yet

- EMS G7 WorksheetsDocument13 pagesEMS G7 WorksheetsMasieNo ratings yet

- Inv 725939223 26261 202105231059Document1 pageInv 725939223 26261 202105231059Walter MartinezNo ratings yet

- Chapter 21: The Simplest Short-Run Macro Model: Desired Aggregate ExpenditureDocument8 pagesChapter 21: The Simplest Short-Run Macro Model: Desired Aggregate ExpenditureSaaki GaneshNo ratings yet

- Mortgage Loan Case StudiesDocument8 pagesMortgage Loan Case StudiesFurkhan SyedNo ratings yet

- Accounting SummaryDocument39 pagesAccounting SummarySteph WynneNo ratings yet

- Mathematics of Finance: Faculty of Business Studies (FBS) Bangladesh University of Professionals (BUP)Document52 pagesMathematics of Finance: Faculty of Business Studies (FBS) Bangladesh University of Professionals (BUP)Sadia Afrin ArinNo ratings yet

- Retirement Nestegg Calculator: You May Need A Nestegg of $3,287,327 To Retire at Age 67Document4 pagesRetirement Nestegg Calculator: You May Need A Nestegg of $3,287,327 To Retire at Age 67fishtaco96No ratings yet

- Digitalization of Securities MarketDocument8 pagesDigitalization of Securities Marketmrinal kumarNo ratings yet

- Underwriting SOPDocument5 pagesUnderwriting SOPChris JacksonNo ratings yet

- Revenue Recognition Multiple Choice QuestionsDocument9 pagesRevenue Recognition Multiple Choice Questionschowchow123No ratings yet

- New Government Accounting System ManualDocument37 pagesNew Government Accounting System ManualArahbellsNo ratings yet

- Basics of Negotiable InstrumentsDocument46 pagesBasics of Negotiable Instrumentsgox350% (2)

- ExercisesDocument3 pagesExercisesrhumblineNo ratings yet

- Accounting for Partnerships: A Comprehensive GuideDocument74 pagesAccounting for Partnerships: A Comprehensive GuideHussen Abdulkadir100% (2)

- ETF Screener - JustETF A2Document4 pagesETF Screener - JustETF A2fish0123No ratings yet

- Virat Alloys Business Acquisition and Recapitalisation Plan of Sembule Steel Mills 22nd April 2013Document97 pagesVirat Alloys Business Acquisition and Recapitalisation Plan of Sembule Steel Mills 22nd April 2013InfiniteKnowledgeNo ratings yet

- Factors Determining Capital Structure EssayDocument2 pagesFactors Determining Capital Structure Essayrakesh kumarNo ratings yet

- Soal Assignment Financial Audit IiDocument2 pagesSoal Assignment Financial Audit IiEunice ShevlinNo ratings yet

- Easy Online Loans in The Philippines With Fast Approval - AllTheBestLoansDocument21 pagesEasy Online Loans in The Philippines With Fast Approval - AllTheBestLoansEddie C. Resurreccion Jr.No ratings yet

- Final Judgment For Defendants v. Wells Fargo Bank, N.A., in A Residential Mortgage Foreclosure Case After Trial Held in Hernando County, Florida, Before Judge Angel On Feb. 14, 2013.Document11 pagesFinal Judgment For Defendants v. Wells Fargo Bank, N.A., in A Residential Mortgage Foreclosure Case After Trial Held in Hernando County, Florida, Before Judge Angel On Feb. 14, 2013.Chuck Kalogianis100% (1)

- Remote Deposit CaptureDocument60 pagesRemote Deposit Capture4701sandNo ratings yet

- Nine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesFrom EverandNine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesNo ratings yet

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Reasonable Doubts: The O.J. Simpson Case and the Criminal Justice SystemFrom EverandReasonable Doubts: The O.J. Simpson Case and the Criminal Justice SystemRating: 4 out of 5 stars4/5 (25)

- For the Thrill of It: Leopold, Loeb, and the Murder That Shocked Jazz Age ChicagoFrom EverandFor the Thrill of It: Leopold, Loeb, and the Murder That Shocked Jazz Age ChicagoRating: 4 out of 5 stars4/5 (97)

- Summary: Surrounded by Idiots: The Four Types of Human Behavior and How to Effectively Communicate with Each in Business (and in Life) by Thomas Erikson: Key Takeaways, Summary & AnalysisFrom EverandSummary: Surrounded by Idiots: The Four Types of Human Behavior and How to Effectively Communicate with Each in Business (and in Life) by Thomas Erikson: Key Takeaways, Summary & AnalysisRating: 4 out of 5 stars4/5 (2)

- O.J. Is Innocent and I Can Prove It: The Shocking Truth about the Murders of Nicole Brown Simpson and Ron GoldmanFrom EverandO.J. Is Innocent and I Can Prove It: The Shocking Truth about the Murders of Nicole Brown Simpson and Ron GoldmanRating: 4 out of 5 stars4/5 (2)

- Reading the Constitution: Why I Chose Pragmatism, not TextualismFrom EverandReading the Constitution: Why I Chose Pragmatism, not TextualismNo ratings yet

- Perversion of Justice: The Jeffrey Epstein StoryFrom EverandPerversion of Justice: The Jeffrey Epstein StoryRating: 4.5 out of 5 stars4.5/5 (10)

- Hunting Whitey: The Inside Story of the Capture & Killing of America's Most Wanted Crime BossFrom EverandHunting Whitey: The Inside Story of the Capture & Killing of America's Most Wanted Crime BossRating: 3.5 out of 5 stars3.5/5 (6)

- Conviction: The Untold Story of Putting Jodi Arias Behind BarsFrom EverandConviction: The Untold Story of Putting Jodi Arias Behind BarsRating: 4.5 out of 5 stars4.5/5 (16)

- The Law Says What?: Stuff You Didn't Know About the Law (but Really Should!)From EverandThe Law Says What?: Stuff You Didn't Know About the Law (but Really Should!)Rating: 4.5 out of 5 stars4.5/5 (10)

- Beyond the Body Farm: A Legendary Bone Detective Explores Murders, Mysteries, and the Revolution in Forensic ScienceFrom EverandBeyond the Body Farm: A Legendary Bone Detective Explores Murders, Mysteries, and the Revolution in Forensic ScienceRating: 4 out of 5 stars4/5 (107)

- A Contractor's Guide to the FIDIC Conditions of ContractFrom EverandA Contractor's Guide to the FIDIC Conditions of ContractNo ratings yet

- The Internet Con: How to Seize the Means of ComputationFrom EverandThe Internet Con: How to Seize the Means of ComputationRating: 5 out of 5 stars5/5 (6)

- How To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionFrom EverandHow To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionNo ratings yet

- The Edge of Doubt: The Trial of Nancy Smith and Joseph AllenFrom EverandThe Edge of Doubt: The Trial of Nancy Smith and Joseph AllenRating: 4.5 out of 5 stars4.5/5 (10)

- The Death of Punishment: Searching for Justice among the Worst of the WorstFrom EverandThe Death of Punishment: Searching for Justice among the Worst of the WorstNo ratings yet

- I GIVE YOU CREDIT: A DO IT YOURSELF GUIDE TO CREDIT REPAIRFrom EverandI GIVE YOU CREDIT: A DO IT YOURSELF GUIDE TO CREDIT REPAIRNo ratings yet

- The Killer Across the Table: Unlocking the Secrets of Serial Killers and Predators with the FBI's Original MindhunterFrom EverandThe Killer Across the Table: Unlocking the Secrets of Serial Killers and Predators with the FBI's Original MindhunterRating: 4.5 out of 5 stars4.5/5 (456)

- Splitting, Second Edition: Protecting Yourself While Divorcing Someone with Borderline or Narcissistic Personality DisorderFrom EverandSplitting, Second Edition: Protecting Yourself While Divorcing Someone with Borderline or Narcissistic Personality DisorderRating: 4 out of 5 stars4/5 (17)

- All You Need to Know About the Music Business: 11th EditionFrom EverandAll You Need to Know About the Music Business: 11th EditionNo ratings yet

- The Law of the Land: The Evolution of Our Legal SystemFrom EverandThe Law of the Land: The Evolution of Our Legal SystemRating: 4.5 out of 5 stars4.5/5 (11)

- Never Suck a Dead Man's Hand: Curious Adventures of a CSIFrom EverandNever Suck a Dead Man's Hand: Curious Adventures of a CSIRating: 4.5 out of 5 stars4.5/5 (13)