Professional Documents

Culture Documents

Problems EPS

Uploaded by

hukaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problems EPS

Uploaded by

hukaCopyright:

Available Formats

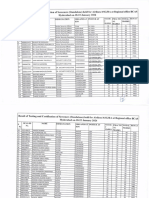

Basic & Diluted EPS

1. ABC has the following preference shares in issue at end of 2016:

• 5% non-cumulative – Rs 100,000: classified as liabilities. During

the year dividend paid was Rs 100,000

• Increasing rate cumulative preference shares issued at discount in

2000, with a cumulative dividend rate of 10% from 2017. Shares

issued at discount to compensate for no dividends in initial years.

Accrual of discount for current year is Rs 18,000. Classified as

equity – Rs 200,000.

• 8% non-cumulative – During the year some shares were

repurchased at a discount of Rs 1,000. (outstanding at end of year

Rs 50,000)

• Profit after taxes for the year is Rs 150,000

Estimate profit attributable to ordinary equity holders for calculating

basic EPS

2. Find number of shares for purpose of calculation of Basic EPS for the

year ended 31st March 2012.

• 01/04/11: 100,000 equity shares outstanding

• 15/06/11: Issued 75,000 equity shares

• 08/11/11: 50,000 equity shares issued on conversion of preference

shares

• 22/02/12: Buyback of 20,000 equity shares

• 31/03/12: 205,000 equity shares outstanding

3. On 1st April 2015 issued capital consisted of equity shares – Rs

100,00,000 (FV – Rs 25/- each) and Rs 50,00,000 in 10% cumulative

preference shares (FV – Rs 1/- each).

On 1st October 2015 the firm issued a 1:4 bonus.

Profits for years ended March ‘15 & ‘16 were Rs 45,00,000 and

55,00,000 respectively.

Calculate Basic EPS for years 2014-15 & 2015-16

4. On 1st January 10,00,000 equity shares were in issue for ABC Ltd.

On 28th February 2,00,000 equity shares were issued for consideration.

A 1:3 bonus was issued on 31st August.

On 30th November 2,50,000 equity shares were issued for consideration.

Calculate the number of shares which would be used for estimating basic

EPS for the year ended on 31st December.

5. PAT for the year ended 31st December 2016 was Rs 63,00,000 and

18,00,000 shares (FV Rs 10/-) were outstanding. On 31st March 2017, a

1:4 rights issue was completed for Rs 30/share. The MPS just prior to the

rights issue was Rs 60/share. PAT for the year ended 31st December 2017

was Rs 87,50,000.

Calculate EPS.

6. PQR has 10,00,000 equity shares (FV - Rs 1) and 1000 10% convertible

debentures (FV – Rs 100). Each debenture is convertible into 20 equity

shares on demand. During the year no debentures were converted.

PAT for the year is Rs 500,000 and tax rate is 21%.

Calculate basic & diluted EPS.

7. MN has 40,00,000 equity shares (FV - Rs 25/-) as on 31 st December 2017

& 2018.

It has granted 630,000 options giving holders the right to acquire shares

at Rs 70/share anytime until 31st December 2019. There was no exercise

of options till date.

PAT for the year ended Dec’17 was Rs 500,000 & Dec’18 was Rs

600,000

The average MPS during these years was Rs 120 & Rs 160 respectively.

8. Earnings for equity shareholders – Rs 60,00,000.

Number of equity shares – 20,00,000. Average MPS – Rs 75

Options – 100,000 with exercise price of Rs 60

8% Convertible Preference Shares – 800,000 shares of FV 100, each

convertible into 2 equity shares

5% Convertible bonds – 100,000 bonds – each convertible in 20 equity

shares

Tax Rate – 40%

Calculate Basic & Diluted EPS

You might also like

- Class Example Companies 2023Document2 pagesClass Example Companies 2023NjabuloNo ratings yet

- Acc05 Far Handout 2Document4 pagesAcc05 Far Handout 2Jullia Belgica0% (1)

- 162 020Document5 pages162 020Angelli LamiqueNo ratings yet

- SFM CA Final Mutual FundDocument7 pagesSFM CA Final Mutual FundShrey KunjNo ratings yet

- Quiz - Inter 2 UTS - Wo AnsDocument3 pagesQuiz - Inter 2 UTS - Wo AnsNike HannaNo ratings yet

- Gujarat Technological University: InstructionsDocument4 pagesGujarat Technological University: InstructionsMuvin KoshtiNo ratings yet

- Quiz Shareholders Equity TH With Questions PDFDocument4 pagesQuiz Shareholders Equity TH With Questions PDFMichael Angelo FangonNo ratings yet

- Revision Test Paper CAP III June 2020Document233 pagesRevision Test Paper CAP III June 2020Roshan PanditNo ratings yet

- Financial RportingDocument4 pagesFinancial RportingIrfanNo ratings yet

- Quiiz 1Document4 pagesQuiiz 1max pNo ratings yet

- Imt 59 Question 5 Assignmwnet SolDocument26 pagesImt 59 Question 5 Assignmwnet SolamitNo ratings yet

- Retained EarningsDocument9 pagesRetained EarningsCamille GarciaNo ratings yet

- Quiz On Retained EarningsDocument2 pagesQuiz On Retained EarningsCamila AlduezaNo ratings yet

- Latihan Soal Eps: Instruksi: Hitunglah Earnings Per Share PT. XABIRU!Document3 pagesLatihan Soal Eps: Instruksi: Hitunglah Earnings Per Share PT. XABIRU!Ruth AngeliaNo ratings yet

- FR Ias 32, Ifrs 9Document1 pageFR Ias 32, Ifrs 9Prachanda BhandariNo ratings yet

- Shareholer's EquityDocument5 pagesShareholer's EquityRaffy Roi Martagon67% (3)

- Prashant'S Commerce Academy Fundamentals of PartnershipDocument3 pagesPrashant'S Commerce Academy Fundamentals of PartnershipMuskan TilokaniNo ratings yet

- Financial Accounting 2 ReviewerDocument5 pagesFinancial Accounting 2 ReviewerKimberlyVillarinNo ratings yet

- Audit of SheDocument3 pagesAudit of ShegbenjielizonNo ratings yet

- 185f8question BankDocument18 pages185f8question Bank55amonNo ratings yet

- Advanced Financial Reporting Tutorial Questions. (4) DocxDocument3 pagesAdvanced Financial Reporting Tutorial Questions. (4) Docxsmlingwa100% (1)

- Financial Reporting For Financial Institutions MUTUAL FUNDS & NBFC'sDocument77 pagesFinancial Reporting For Financial Institutions MUTUAL FUNDS & NBFC'sParvesh Aghi0% (1)

- EPS SlidesDocument8 pagesEPS SlidesAHSAN IQBALNo ratings yet

- Accounting Test 7 CH 9 Nov 2022 Test Paper 1648898390Document5 pagesAccounting Test 7 CH 9 Nov 2022 Test Paper 1648898390Gaurav JhaNo ratings yet

- ExtrapracticeProblems Chapters15,16,17,18Document16 pagesExtrapracticeProblems Chapters15,16,17,18chloekim03No ratings yet

- Master Budget .. Feb 2020Document9 pagesMaster Budget .. Feb 2020신두No ratings yet

- Test Series: October, 2014 Mock Test Paper - 2 Intermediate (Ipc) : Group - Ii Paper - 5: Advanced AccountingDocument8 pagesTest Series: October, 2014 Mock Test Paper - 2 Intermediate (Ipc) : Group - Ii Paper - 5: Advanced Accountingmanish1318No ratings yet

- E-14 AfrDocument5 pagesE-14 AfrInternational Iqbal ForumNo ratings yet

- Long Answer Type QuestionDocument75 pagesLong Answer Type Questionincome taxNo ratings yet

- 12th AssignmentsDocument134 pages12th AssignmentsRohit Srivastava67% (6)

- Chapter Internal ReconstructionDocument4 pagesChapter Internal ReconstructionAnonymous mTZsMOjNo ratings yet

- 162.materials 1.SHE 001Document2 pages162.materials 1.SHE 001jpbluejnNo ratings yet

- (L1) Financial Reporting PDFDocument25 pages(L1) Financial Reporting PDFCasius MubambaNo ratings yet

- CA IPCC Accounts Mock Test Series 1 - Sept 2015Document8 pagesCA IPCC Accounts Mock Test Series 1 - Sept 2015Ramesh Gupta100% (1)

- Shareholdersx27 Equity Prac 1 PDF FreeDocument10 pagesShareholdersx27 Equity Prac 1 PDF FreeIllion IllionNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Fall (Winter) 2010 ExaminationsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Fall (Winter) 2010 ExaminationsIrfanNo ratings yet

- Illustrative Examples - Earnings Per Share (EPS)Document6 pagesIllustrative Examples - Earnings Per Share (EPS)Ms QuiambaoNo ratings yet

- Ind AS 33 HandoutDocument4 pagesInd AS 33 HandoutSiddhika AgrawalNo ratings yet

- 162 019Document4 pages162 019Angelli LamiqueNo ratings yet

- AP Lecture SW SheDocument23 pagesAP Lecture SW SheMary Dale Joie BocalaNo ratings yet

- CH 16Document3 pagesCH 16vivienNo ratings yet

- Questions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingDocument27 pagesQuestions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingcasarokarNo ratings yet

- Financial ReportingDocument7 pagesFinancial ReportingDivyesh TrivediNo ratings yet

- Chapter 18-Practice ExsercisesDocument18 pagesChapter 18-Practice ExsercisesThiNo ratings yet

- Solutiondone 307Document1 pageSolutiondone 307trilocksp SinghNo ratings yet

- ACC 423 Final Exam GuideDocument11 pagesACC 423 Final Exam Guideapjk510No ratings yet

- ACC 423 Final Exam GuideDocument6 pagesACC 423 Final Exam Guideapjk510No ratings yet

- FAR2 Quiz On CorpDocument16 pagesFAR2 Quiz On CorpYami Sukehiro100% (1)

- QuestionsDocument2 pagesQuestionsApoorv SharmaNo ratings yet

- RTP Dec 2021 Cap II Group IIDocument106 pagesRTP Dec 2021 Cap II Group IIRoshan KhadkaNo ratings yet

- Corporation DividendsDocument2 pagesCorporation DividendsAlcyra SantosNo ratings yet

- Financial Instruments Illustration 1Document10 pagesFinancial Instruments Illustration 1Deep KrishnaNo ratings yet

- Assignment AFA IDocument4 pagesAssignment AFA IAbebeNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Public Financial Management Systems—Indonesia: Key Elements from a Financial Management PerspectiveFrom EverandPublic Financial Management Systems—Indonesia: Key Elements from a Financial Management PerspectiveRating: 5 out of 5 stars5/5 (1)

- Science PortfolioDocument44 pagesScience PortfoliohukaNo ratings yet

- Blockchain and Retail BankingDocument9 pagesBlockchain and Retail BankingMilinbhadeNo ratings yet

- BQ - PayTm Everywhere - But Profitability Not in Sight1Document5 pagesBQ - PayTm Everywhere - But Profitability Not in Sight1hukaNo ratings yet

- Get Out of My Head Meredith Arthur Leah Rosenberg BooktreeDocument98 pagesGet Out of My Head Meredith Arthur Leah Rosenberg Booktreehuka50% (2)

- VitiligoDocument6 pagesVitiligohukaNo ratings yet

- Ratio AnalysisDocument5 pagesRatio AnalysishukaNo ratings yet

- 23732frameworkIndAS PDFDocument36 pages23732frameworkIndAS PDFvbnarwadeNo ratings yet

- Aviation: Sector Reviving, But Valuation Factored inDocument11 pagesAviation: Sector Reviving, But Valuation Factored inhukaNo ratings yet

- VbaDocument3 pagesVbahukaNo ratings yet

- Interview 12Document1 pageInterview 12hukaNo ratings yet

- Fin ImpDocument9 pagesFin ImphukaNo ratings yet

- It Project Management NotesDocument2 pagesIt Project Management NoteshukaNo ratings yet

- What Do You Understand by OEMDocument1 pageWhat Do You Understand by OEMhukaNo ratings yet

- SubtitleDocument1 pageSubtitlehukaNo ratings yet

- Cost of Debt Calculations PDFDocument2 pagesCost of Debt Calculations PDFhukaNo ratings yet

- Bloomberg Quint - Will Cheques Soon Check-Out of Indian Payment SystemDocument6 pagesBloomberg Quint - Will Cheques Soon Check-Out of Indian Payment SystemhukaNo ratings yet

- Blockchain Explained What It Is and IsntDocument13 pagesBlockchain Explained What It Is and IsntJulia Magnolia MicaelaNo ratings yet

- NBFC Liquidity Crunch Is Putting The Squeeze On FintechDocument2 pagesNBFC Liquidity Crunch Is Putting The Squeeze On FintechhukaNo ratings yet

- Reserve Bank of India Consultation On Peer To Peer LendingDocument17 pagesReserve Bank of India Consultation On Peer To Peer LendingCrowdfundInsiderNo ratings yet

- The Difference Between Crowdfunding and P2P Lending - FleximizeDocument4 pagesThe Difference Between Crowdfunding and P2P Lending - FleximizehukaNo ratings yet

- Blockchain and Retail BankingDocument9 pagesBlockchain and Retail BankingMilinbhadeNo ratings yet

- Introduction To DCF PDFDocument5 pagesIntroduction To DCF PDFhukaNo ratings yet

- Robo Advisors in India - Investing Made Easy - FintrakkDocument7 pagesRobo Advisors in India - Investing Made Easy - FintrakkhukaNo ratings yet

- Deloitte - Us-Cons-Real-Time-Payments PDFDocument16 pagesDeloitte - Us-Cons-Real-Time-Payments PDFhukaNo ratings yet

- BCG InsideSherpa Task X Past Email ExampleDocument1 pageBCG InsideSherpa Task X Past Email ExampleRISHIN lalNo ratings yet

- Black Scholes Calculator: Strictly ConfidentialDocument4 pagesBlack Scholes Calculator: Strictly ConfidentialTriveni ChopraNo ratings yet

- Paytm E-KYC Rules - India's Payments Banks Trip On E-KYC RulesDocument4 pagesPaytm E-KYC Rules - India's Payments Banks Trip On E-KYC RuleshukaNo ratings yet

- BQ - PayTm Everywhere - But Profitability Not in Sight1Document5 pagesBQ - PayTm Everywhere - But Profitability Not in Sight1hukaNo ratings yet

- Blockchains Occam Problem PDFDocument7 pagesBlockchains Occam Problem PDFAlejandroHerreraGurideChileNo ratings yet

- Valuation Imp QuestionsDocument4 pagesValuation Imp QuestionshukaNo ratings yet

- As 3789.2-1991 Textiles For Health Care Facilities and Institutions Theatre Linen and Pre-PacksDocument9 pagesAs 3789.2-1991 Textiles For Health Care Facilities and Institutions Theatre Linen and Pre-PacksSAI Global - APACNo ratings yet

- B&G 3DX LiteratureDocument2 pagesB&G 3DX LiteratureAnonymous 7xHNgoKE6eNo ratings yet

- Chapter 9 Audit SamplingDocument47 pagesChapter 9 Audit SamplingYenelyn Apistar CambarijanNo ratings yet

- Transport Phenomena 18.4.CDocument3 pagesTransport Phenomena 18.4.CDelyana RatnasariNo ratings yet

- HyderabadDocument3 pagesHyderabadChristoNo ratings yet

- General Electric/ Massachusetts State Records Request Response Part 3Document673 pagesGeneral Electric/ Massachusetts State Records Request Response Part 3Gintautas DumciusNo ratings yet

- INSURANCE BROKER POLICIES Erna SuryawatiDocument7 pagesINSURANCE BROKER POLICIES Erna SuryawatiKehidupan DuniawiNo ratings yet

- Eastern Bank Limited: Name: ID: American International University of Bangladesh Course Name: Faculty Name: Due DateDocument6 pagesEastern Bank Limited: Name: ID: American International University of Bangladesh Course Name: Faculty Name: Due DateTasheen MahabubNo ratings yet

- Techgig Open Round CompetitionDocument6 pagesTechgig Open Round CompetitionAnil Kumar GodishalaNo ratings yet

- AET Assignment C Kate ThomsonDocument12 pagesAET Assignment C Kate ThomsonaymenmoatazNo ratings yet

- Future Generation Computer SystemsDocument18 pagesFuture Generation Computer SystemsEkoNo ratings yet

- Leadership Style SurveyDocument3 pagesLeadership Style SurveyJanelle BergNo ratings yet

- Course Syllabus: Ecommerce & Internet MarketingDocument23 pagesCourse Syllabus: Ecommerce & Internet MarketingMady RamosNo ratings yet

- User Custom PP Install74Document2 pagesUser Custom PP Install74Zixi FongNo ratings yet

- Evaluating The Policy Outcomes For Urban Resiliency in Informal Settlements Since Independence in Dhaka, Bangladesh: A ReviewDocument14 pagesEvaluating The Policy Outcomes For Urban Resiliency in Informal Settlements Since Independence in Dhaka, Bangladesh: A ReviewJaber AbdullahNo ratings yet

- Audit Process - Performing Substantive TestDocument49 pagesAudit Process - Performing Substantive TestBooks and Stuffs100% (1)

- The Financing Cycle Summary, Case Study, AssignmentsDocument18 pagesThe Financing Cycle Summary, Case Study, AssignmentsbernadetteNo ratings yet

- Cyclical Iterative Design Process, Learning From ExperienceDocument7 pagesCyclical Iterative Design Process, Learning From ExperiencemartinsmitNo ratings yet

- A Study On Impact of Smartphone AddictioDocument4 pagesA Study On Impact of Smartphone AddictiotansuoragotNo ratings yet

- AFAR Problems PrelimDocument11 pagesAFAR Problems PrelimLian Garl100% (8)

- 1610-2311-Executive Summary-EnDocument15 pages1610-2311-Executive Summary-EnKayzha Shafira Ramadhani460 105No ratings yet

- Stryker Endoscopy SDC Pro 2 DVDDocument2 pagesStryker Endoscopy SDC Pro 2 DVDWillemNo ratings yet

- IMO Special Areas Under MARPOLDocument2 pagesIMO Special Areas Under MARPOLRavi Viknesh100% (1)

- HP ELITEBOOK 8740W Inventec Armani 6050A2266501Document61 pagesHP ELITEBOOK 8740W Inventec Armani 6050A2266501Gerardo Mediabilla0% (2)

- Adding Print PDF To Custom ModuleDocument3 pagesAdding Print PDF To Custom ModuleNguyễn Vương AnhNo ratings yet

- Claim Age Pension FormDocument25 pagesClaim Age Pension FormMark LordNo ratings yet

- Lozada V Bracewell DigestDocument3 pagesLozada V Bracewell DigestMickey OrtegaNo ratings yet

- 4 FAR EAST BANK & TRUST COMPANY V DIAZ REALTY INCDocument3 pages4 FAR EAST BANK & TRUST COMPANY V DIAZ REALTY INCDanielleNo ratings yet

- AW-NB037H-SPEC - Pegatron Lucid V1.3 - BT3.0+HS Control Pin Separated - PIN5 - Pin20Document8 pagesAW-NB037H-SPEC - Pegatron Lucid V1.3 - BT3.0+HS Control Pin Separated - PIN5 - Pin20eldi_yeNo ratings yet

- Reterta V MoresDocument13 pagesReterta V MoresRam Migue SaintNo ratings yet