Professional Documents

Culture Documents

Manacop vs. Equitable PCI Bank

Uploaded by

Angel MaeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Manacop vs. Equitable PCI Bank

Uploaded by

Angel MaeCopyright:

Available Formats

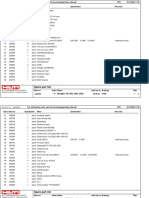

Case flow:

G.R. Nos. 162814-17 August 25, 2005 *Chandru filed TRO that payments be made to Lavine and not to

Equitable Bank. BOD of Lavine intervened.

MANACOP RTC – granted intervention and ruled in favor of petitioners.

vs. *Petitioners filed a Motion for Execution pending appeal.

EQUITABLE PCI BANK *Both parties filed Notice of Appeal

RTC – granted Motion for Execution Pending Appeal & issued a

“Strong and Solemn Juridical Personality (Sec. 2)” Writ of Execution.

*Resps. filed Petition for Certiorari assailing RTC’s order.

CA – Ruled in favor of resps. and lifted the order of levy and

garnishment of their properties

FACTS

Lavine Loungewear Manufacturing (Lavine) insured its building & supplies against fire with PhilFire, Rizal Suret, TICO,

First Lepanto, Equitable Insurance & Reliance Insurance. Except for the policy issued by First Lepanto, all the policies

provide that: “Loss, if any, under this policy is payable to Equitable Banking Corporation-Greenhills Branch, as their

interest may appear subject to the terms, conditions, clauses and warranties under this policy.”

On August 1, 1998, a fire devastated Lavine’s buildings and their contents. Thus, claims were made against the policies

amounted to about P112M. The insurance companies expressed their willingness to pay the insurance proceeds, but

only to the rightful claimant. * Lavine was indebted to Equitable Bank and there was a dispute as to whether the insurance

proceeds should be paid directly to Equitable Bank, or to Lavine first who would then pay Equitable Bank .

Lavine is represented by Chandru Pessumal in negotiating with the insurance companies. Notwithstanding Chandru’s

request that payments be made first to Lavine who shall thereafter pay Equitable Bank, certain insurance companies

released the proceeds directly to Equitable Bank. Thus, Chandru filed a Petition for Issuance of Writ of Preliminary

Injunction with Prayer for Temporary Restraining Order (TRO) before RTC Pasig City against PhilFire, Rizal Surety

Tabacalera Insurance, First Lepanto and Equitable Bank.

The board of directors of Lavine moved to intervene claiming that they were the incumbent directors. The RTC granted

the Motion for Intervention and ruled in favor of petitioners, ordered the insurance companies to pay Lavine, as well as

Equitable Bank to refund Lavine.

The petitioners filed a Motion for Execution pending appeal on the grounds that: (a) Tabacalera Insurance was on the

brink of insolvency (b) Lavine was in imminent danger of extinction (c) any appeal from the trial court’s judgment would

be merely dilatory.

First Lepanto, PhilFire, Rizal Surety, Equitable Bank, and Lavine separately filed a Notice of Appeal. Without filing an MR

from the decision of the RTC, and even before the RTC could rule on the Motion for Execution Pending Appeal, Equitable

Bank filed a Petition for Certiorari. *its Petition for Certiorari assailed the RTC decision and not the order granting the

Motion for Execution Pending Appeal & the Writ of Execution *

Judge Laviña. granted the Motion for Execution Pending Appeal & issued a Writ of Execution. On the other hand, First

Lepanto & Philfire filed a Petition for Certiorari assailing the RTC’s order granting the Motion for Execution Pending

Appeal & the Writ of Execution.

The Court of Appeals rendered judgment lifting the order of levy and garnishment of the properties and deposits of the

insurance companies and denied Equitable Bank’s Motion to Disqualify Judge Laviña.

ISSUES

1. Whether or not the Petition for Certiorari assailing the RTC judgment was proper.

2. Whether or not the Petition for Certiorari assailing the order granting the Motion for Execution Pending Appeal & the

Writ of Execution was proper

3. Whether an execution pending appeal be granted if the prevailing party is a corporation.

RULING

1. NO. Simultaneous filing of a petition for certiorari under Rule 65 and an ordinary appeal under Rule 41 cannot be

allowed since 1 remedy would necessarily cancel out the other. The existence & availability of the right of appeal

proscribes resort to certiorari because one of the requirements for availment of the latter is precisely that there should be

no appeal. It is elementary that for certiorari to prosper, it is not enough that the trial court committed with grave abuse of

discretion amounting to lack or excess of jurisdiction; the requirement that there is no appeal, nor any plain, speedy &

adequate remedy in the ordinary course of law must likewise be satisfied.

It is well-settled that the remedy to obtain reversal or modification of the judgment on the merits is appeal. This is true

even if the error, or one of the errors, ascribed to the trial court rendering the judgment is its lack of jurisdiction over the

subject matter, or the exercise of power in excess thereof, or grave abuse of discretion in the findings of fact or of law set

out in the decision. Thus, while it may be true that a final order or judgment was rendered under circumstances that

would otherwise justify resort to a special civil action under Rule 65, the latter would nonetheless be unavailing if there is

an appeal or any other plain, speedy & adequate remedy in the ordinary course of law.

2. YES. An appeal from a judgment does NOT bar a certiorari petition against the order granting execution pending

appeal & the issuance of the writ of execution. Certiorari lies against an order granting execution pending appeal where

the same is not founded upon good reasons. Since the execution of a judgment pending appeal is an exception to the

general rule, the existence of good reasons is essential .

3. NO. In the case at bar, petitioners insist that execution pending appeal is justified because the insurance companies

admitted their liabilities under the insurance contracts and thus have no reason to withhold payment. We are not

persuaded.

The fact that the insurance companies admit their liabilities is not a compelling or superior circumstance that would

warrant execution pending appeal. On the contrary, admission of their liabilities & willingness to deliver the proceeds to

the proper party militate against execution pending appeal since there is little or no danger that the judgment will become

illusory. There is likewise no merit in petitioners’ contention that the appeals are merely dilatory because, while the

insurance companies admitted their liabilities, the matter of how much is owing from each of them & who is entitled to the

same remain unsettled. Besides, that the appeal is merely dilatory is not a good reason for granting execution pending

appeal.

Lastly, petitioners assert that Lavine’s financial distress is sufficient reason to order execution pending appeal. Citing

Borja v. CA, they claim that execution pending appeal may be granted if the prevailing party is already of advanced age &

in danger of extinction.

Borja is not applicable to the case at bar because its factual milieu is different. In Borja, the prevailing party was a natural

person who, at 76 years of age, “may no longer enjoy the fruit of the judgment before he finally passes away.” Lavine, on

the other hand, is a juridical entity whose existence cannot be likened to a natural person. Its precarious financial

condition is not by itself a compelling circumstance warranting immediate execution & does not outweigh the long

standing general policy of enforcing only final and executory judgments

You might also like

- The ILLUSION of Money - How the USA and Canada Became BankruptDocument0 pagesThe ILLUSION of Money - How the USA and Canada Became BankruptJ.p. Baron100% (1)

- By LawsDocument8 pagesBy LawsChrissy SabellaNo ratings yet

- "SIM Cloning": Submitted To: - Mr. Gurbakash PhonsaDocument6 pages"SIM Cloning": Submitted To: - Mr. Gurbakash PhonsagauravsanadhyaNo ratings yet

- Unpaid Share Subscription Enforced Through Court ActionDocument2 pagesUnpaid Share Subscription Enforced Through Court ActionASGarcia24100% (1)

- Forest Hills V Fil-EstateDocument2 pagesForest Hills V Fil-EstateGlenn Mikko MendiolaNo ratings yet

- Tee Ling Kiat Vs Ayala CorpDocument2 pagesTee Ling Kiat Vs Ayala CorpAisha TejadaNo ratings yet

- Stockholders of F. Guanzon v. RDDocument1 pageStockholders of F. Guanzon v. RDJL A H-Dimaculangan0% (1)

- China Banking Corp. v. Court of Appeals, G.R. No. 117604, March 26, 1997 by Bryce KingDocument4 pagesChina Banking Corp. v. Court of Appeals, G.R. No. 117604, March 26, 1997 by Bryce KingBryce King100% (1)

- Internal Control Affecting Liabilities and EquityDocument21 pagesInternal Control Affecting Liabilities and EquityClark Regin SimbulanNo ratings yet

- Heirs of Augusto L. Salas Jr. vs. Laperal Realty CorporationDocument21 pagesHeirs of Augusto L. Salas Jr. vs. Laperal Realty CorporationChino CubiasNo ratings yet

- Simny Guy V Gilbert Guy DigestDocument2 pagesSimny Guy V Gilbert Guy DigestHannah Rosario100% (1)

- PASAR v. LIMDocument2 pagesPASAR v. LIMBea de Leon100% (1)

- Commercial Law Pre-Week Discussions by Atty. Ella EscalanteDocument28 pagesCommercial Law Pre-Week Discussions by Atty. Ella Escalantejanica246No ratings yet

- DamagesDocument3 pagesDamagesdjenmah0% (1)

- Ra 4200Document34 pagesRa 4200sajdy100% (1)

- Union Bank V Spouses Ong DigestDocument2 pagesUnion Bank V Spouses Ong Digestjilliankad100% (3)

- MDC vs. TanjuatcoDocument2 pagesMDC vs. TanjuatcoAlecsandra Chu100% (2)

- Cojuangco v. SandiganbayanDocument2 pagesCojuangco v. SandiganbayanJay jogs100% (1)

- Ku vs. RCBC Securities DigestDocument3 pagesKu vs. RCBC Securities DigestEmir Mendoza50% (2)

- Harden vs. Benguet Consolidated MiningDocument2 pagesHarden vs. Benguet Consolidated MiningAngel MaeNo ratings yet

- Harden vs. Benguet Consolidated MiningDocument2 pagesHarden vs. Benguet Consolidated MiningAngel MaeNo ratings yet

- Bourns vs. CarmanDocument1 pageBourns vs. CarmanKing BadongNo ratings yet

- Torts and Damages-ReviewerDocument33 pagesTorts and Damages-Reviewerjhoanna mariekar victoriano84% (37)

- Tan Boon Bee & Co., Inc Vs Jarencio-DigestDocument2 pagesTan Boon Bee & Co., Inc Vs Jarencio-DigestRfs SingsonNo ratings yet

- Appeal Against Conviction for MurderDocument24 pagesAppeal Against Conviction for MurderMir Ishrat NabiNo ratings yet

- Tennis Club Expulsion Dispute Falls Under SEC JurisdictionDocument2 pagesTennis Club Expulsion Dispute Falls Under SEC JurisdictionDara RomNo ratings yet

- Bank of Commerce v. RPN DIGESTDocument3 pagesBank of Commerce v. RPN DIGESTkathrynmaydeveza100% (1)

- Magaling vs. Ong SC Ruling on Officer LiabilityDocument1 pageMagaling vs. Ong SC Ruling on Officer LiabilityRaje Paul Artuz100% (1)

- RCBC vs. SerraDocument2 pagesRCBC vs. SerraDiane Dee YaneeNo ratings yet

- Razon vs. IAC DigestDocument2 pagesRazon vs. IAC DigestMae Navarra100% (1)

- Cruz v. DalisayDocument1 pageCruz v. DalisayJL A H-DimaculanganNo ratings yet

- ENGINEERING GEOSCIENCE, INC. v. PHILIPPINE SAVINGS BANKDocument2 pagesENGINEERING GEOSCIENCE, INC. v. PHILIPPINE SAVINGS BANKRizza Angela Mangalleno100% (2)

- Saw v. CADocument2 pagesSaw v. CABananaNo ratings yet

- Legaspi Towers 300 v Amelia MuerDocument2 pagesLegaspi Towers 300 v Amelia MuerHannah RosarioNo ratings yet

- Corpolaw Outline 2 DigestDocument24 pagesCorpolaw Outline 2 DigestAlexPamintuanAbitanNo ratings yet

- Butuan Development Corporation (BDC) V. Court of Appeals (Mindanao Station), Et - Al. - G.R. NO. 197358, APRIL 5, 2017 FactsDocument3 pagesButuan Development Corporation (BDC) V. Court of Appeals (Mindanao Station), Et - Al. - G.R. NO. 197358, APRIL 5, 2017 FactsAngel MaeNo ratings yet

- Grace Christian High School board seat disputeDocument11 pagesGrace Christian High School board seat disputeAlegria IrisNo ratings yet

- Edward A. Keller & Co., Ltd. V. COB Group Marketing Inc. GR No. L-68907, 16 January 1986 Case DoctrineDocument11 pagesEdward A. Keller & Co., Ltd. V. COB Group Marketing Inc. GR No. L-68907, 16 January 1986 Case DoctrineGrey WolffeNo ratings yet

- Paz v. New International Environmental UniversityDocument2 pagesPaz v. New International Environmental UniversityChic PabalanNo ratings yet

- Manacop VsDocument1 pageManacop VsJana marieNo ratings yet

- Prov Rem ReviewerDocument62 pagesProv Rem ReviewerEmman FernandezNo ratings yet

- Government of Philippine Islands vs. El Hogar FilipinoDocument3 pagesGovernment of Philippine Islands vs. El Hogar FilipinoCharmila SiplonNo ratings yet

- Noli Me Tangere Buod NG Buong KwentoDocument11 pagesNoli Me Tangere Buod NG Buong KwentoLian B. Insigne67% (3)

- Clemente Vs CADocument2 pagesClemente Vs CAAisha Tejada100% (1)

- Mission 2 Contact List Telephone Numbers 20200331Document42 pagesMission 2 Contact List Telephone Numbers 20200331Dawood KhanNo ratings yet

- RTC adoption decree presumptionDocument1 pageRTC adoption decree presumptionTootsie GuzmaNo ratings yet

- Civil Procedure Case Digests (Zepeda vs. China Banking Corp.)Document2 pagesCivil Procedure Case Digests (Zepeda vs. China Banking Corp.)Maestro Lazaro100% (1)

- Cruz vs. MIAA (Digest)Document2 pagesCruz vs. MIAA (Digest)Tini Guanio100% (1)

- Dasmarinas Garments V ReyesDocument9 pagesDasmarinas Garments V ReyescarinokatrinaNo ratings yet

- Tayag v. Benguet ConsolidatedDocument2 pagesTayag v. Benguet ConsolidatedMiguel SanchezNo ratings yet

- G.R. No. L-28120Document2 pagesG.R. No. L-28120Region 6 MTCC Branch 3 Roxas City, CapizNo ratings yet

- DELOS REYES V. PEOPLE - G.R. NO. 138297, January 27, 2006 FactsDocument2 pagesDELOS REYES V. PEOPLE - G.R. NO. 138297, January 27, 2006 FactsAngel MaeNo ratings yet

- Sample Document For Practical Training ReportDocument32 pagesSample Document For Practical Training ReportChai Yung Ken100% (1)

- #12 Secosa Vs Heirs of FranciscoDocument2 pages#12 Secosa Vs Heirs of FranciscoJun RiveraNo ratings yet

- Anita Mangila V CADocument2 pagesAnita Mangila V CAMarion KhoNo ratings yet

- PCGG Vs Office of The Ombudsman - Digest - 032723Document3 pagesPCGG Vs Office of The Ombudsman - Digest - 032723Sam LeynesNo ratings yet

- #13. Prime White Cement Vs IAC. DigestDocument2 pages#13. Prime White Cement Vs IAC. DigestHetty HugsNo ratings yet

- Provisional Remedies and Special Civil ActionsDocument13 pagesProvisional Remedies and Special Civil ActionsEmman FernandezNo ratings yet

- Mortgage Remedies ProperDocument2 pagesMortgage Remedies Propert7uyuytuNo ratings yet

- MANACOP V EquitablePCIBank Case DigestDocument4 pagesMANACOP V EquitablePCIBank Case DigestMaria Cristina MartinezNo ratings yet

- CIVPRO: Asia's Emerging Dragon V DOTC Republic V CADocument3 pagesCIVPRO: Asia's Emerging Dragon V DOTC Republic V CAM50% (2)

- Excellent Quality Apparel V Visayan SuretyDocument3 pagesExcellent Quality Apparel V Visayan SuretyjpegNo ratings yet

- PNB v. IAC and Alcedo G.R. No. 66715. September 18, 1990Document4 pagesPNB v. IAC and Alcedo G.R. No. 66715. September 18, 1990Jeremiah De LeonNo ratings yet

- Juana Complex Vs Fil EstateDocument2 pagesJuana Complex Vs Fil EstateAir Dela CruzNo ratings yet

- Supreme Court Invalidates P6.2B Compromise Deal Between PNCC and CreditorDocument9 pagesSupreme Court Invalidates P6.2B Compromise Deal Between PNCC and CreditorLeighNo ratings yet

- Piercing Corporate Veil in Cardale Financing vs Gutierrez EstateDocument2 pagesPiercing Corporate Veil in Cardale Financing vs Gutierrez EstateAnonymous oDPxEkdNo ratings yet

- Premiere Development Bank V FloresDocument3 pagesPremiere Development Bank V FloresLUNANo ratings yet

- De Guzman v. Ochoa 648 SCRA 677 Facts:: Civil Procedure Case DigestDocument2 pagesDe Guzman v. Ochoa 648 SCRA 677 Facts:: Civil Procedure Case DigestManuel Rodriguez IINo ratings yet

- McCarty cannot escape liability for promissory note used to purchase stockDocument1 pageMcCarty cannot escape liability for promissory note used to purchase stockCindee YuNo ratings yet

- Missionary Sisters of Our Lady of Fatima vs. Alzona (Full Text, Word Version)Document14 pagesMissionary Sisters of Our Lady of Fatima vs. Alzona (Full Text, Word Version)Emir MendozaNo ratings yet

- Tabuada V Hon RuizDocument1 pageTabuada V Hon RuizSuiNo ratings yet

- 1 Provisional Remedies BarredoDocument18 pages1 Provisional Remedies BarredoArdy Falejo Fajutag100% (1)

- Provisional Remedies Case LawsDocument15 pagesProvisional Remedies Case Lawsjim peterick sisonNo ratings yet

- (RemRev1) 12.1 (3, 4), 13.1 (26-28), 14Document9 pages(RemRev1) 12.1 (3, 4), 13.1 (26-28), 14Kristal LeeNo ratings yet

- Rem 1Document2 pagesRem 1Angel MaeNo ratings yet

- BUSTOS V. LUCERO - G.R. NO. L-2086, March 8, 1949Document2 pagesBUSTOS V. LUCERO - G.R. NO. L-2086, March 8, 1949Angel MaeNo ratings yet

- RTC Granted The Motion To Dismiss - The Instant Application For Original Registration IsDocument3 pagesRTC Granted The Motion To Dismiss - The Instant Application For Original Registration IsAngel MaeNo ratings yet

- Rem 5Document2 pagesRem 5Angel MaeNo ratings yet

- Alejandro NG Wee vs. Tankiansee, G.R. NO. 171124 February 13, 2008 FactsDocument3 pagesAlejandro NG Wee vs. Tankiansee, G.R. NO. 171124 February 13, 2008 FactsAngel MaeNo ratings yet

- RTC Granted The Motion To Dismiss - The Instant Application For Original Registration IsDocument3 pagesRTC Granted The Motion To Dismiss - The Instant Application For Original Registration IsAngel MaeNo ratings yet

- Alejandro NG Wee vs. Tankiansee, G.R. NO. 171124 February 13, 2008 FactsDocument3 pagesAlejandro NG Wee vs. Tankiansee, G.R. NO. 171124 February 13, 2008 FactsAngel MaeNo ratings yet

- BUSTOS V. LUCERO - G.R. NO. L-2086, March 8, 1949Document2 pagesBUSTOS V. LUCERO - G.R. NO. L-2086, March 8, 1949Angel MaeNo ratings yet

- Rem 5Document2 pagesRem 5Angel MaeNo ratings yet

- Rem 1Document2 pagesRem 1Angel MaeNo ratings yet

- Specific performance case is an action in personamDocument2 pagesSpecific performance case is an action in personamAngel MaeNo ratings yet

- Asia Brewery Inc. and Charles Go V. Equitable Pci Bank (NOW BDO) - G.R. NO. 190432, APRIL 25, 2017 FactsDocument2 pagesAsia Brewery Inc. and Charles Go V. Equitable Pci Bank (NOW BDO) - G.R. NO. 190432, APRIL 25, 2017 FactsAngel MaeNo ratings yet

- Court upholds dismissal of complaint for failure to state cause of actionDocument2 pagesCourt upholds dismissal of complaint for failure to state cause of actionAngel MaeNo ratings yet

- A.L. Ang Network, Inc. V. Emma Mondejar, Et Al., - G.R. No. 200804, January 22, 2014 FactsDocument7 pagesA.L. Ang Network, Inc. V. Emma Mondejar, Et Al., - G.R. No. 200804, January 22, 2014 FactsAngel MaeNo ratings yet

- BO Case 1-10Document65 pagesBO Case 1-10Angel MaeNo ratings yet

- UP 2010 Civil Law Credit Transactions .PDocument34 pagesUP 2010 Civil Law Credit Transactions .PAlan GultiaNo ratings yet

- Medina Transportation liable for Bataclan's deathDocument2 pagesMedina Transportation liable for Bataclan's deathAngel MaeNo ratings yet

- In Re: Grand Prix Fixed Lessee LLC, Case No. 10-13825, (Jointly Administered Uder Case No. 10-13800)Document3 pagesIn Re: Grand Prix Fixed Lessee LLC, Case No. 10-13825, (Jointly Administered Uder Case No. 10-13800)Chapter 11 DocketsNo ratings yet

- Certificate of Sale Foreclosure CaseDocument4 pagesCertificate of Sale Foreclosure CaseJuricoAlonzoNo ratings yet

- Mardin Jeovany Moz Giron, A047 300 159 (BIA Jan. 15, 2015)Document4 pagesMardin Jeovany Moz Giron, A047 300 159 (BIA Jan. 15, 2015)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Corpo Cases Finals2Document24 pagesCorpo Cases Finals2Habib SimbanNo ratings yet

- RTC Dismissal Upheld in Corporate Veil Piercing CaseDocument2 pagesRTC Dismissal Upheld in Corporate Veil Piercing CaseRaymond ChengNo ratings yet

- Katherine GyffordDocument55 pagesKatherine GyffordvirendrahariNo ratings yet

- Overview of New Security Controls in ISO 27002 ENDocument15 pagesOverview of New Security Controls in ISO 27002 ENsotomiguelNo ratings yet

- Income Taxation and MCIT RulesDocument4 pagesIncome Taxation and MCIT RulesMJNo ratings yet

- Forensic Analysis Claims On International ConstructionDocument4 pagesForensic Analysis Claims On International Constructionjowimad100% (1)

- The Geography of Religion: Chapter 8 Lecture OutlineDocument25 pagesThe Geography of Religion: Chapter 8 Lecture OutlinedixitbhattaNo ratings yet

- Menka Jha - LinkedInDocument9 pagesMenka Jha - LinkedInVVB MULTI VENTURE FINANCENo ratings yet

- 4 - Is Democracy A FailureDocument8 pages4 - Is Democracy A FailureSaqib Shuhab SNo ratings yet

- Spare Part List: Breaker TE 705 120V USADocument7 pagesSpare Part List: Breaker TE 705 120V USAJoseLuisCarrilloMenaNo ratings yet

- Paper 1Document55 pagesPaper 1Prakash SundaramNo ratings yet

- Lecture Notes On Ethics and Nigerian Legal SystemDocument39 pagesLecture Notes On Ethics and Nigerian Legal Systemolaoluwalawal19No ratings yet

- Accountability and Public Expenditure Management in Decentralised CambodiaDocument86 pagesAccountability and Public Expenditure Management in Decentralised CambodiaSaravorn100% (1)

- AEP Guide to Automated Export ProcessingDocument25 pagesAEP Guide to Automated Export ProcessingNagrani PuttaNo ratings yet

- Philippine National Bank vs. Court of Appeals G.R. NO. 121597 JUNE 29, 2001 FactsDocument2 pagesPhilippine National Bank vs. Court of Appeals G.R. NO. 121597 JUNE 29, 2001 FactsReyzen Paul Unite MendiolaNo ratings yet

- (LLM. Crim.L) Comperative LawDocument11 pages(LLM. Crim.L) Comperative LawAishwarya SudhirNo ratings yet

- Roxanna Mayo LawsuitDocument20 pagesRoxanna Mayo LawsuitNaomi MartinNo ratings yet

- Sonal Project (Transfer of Property Act)Document15 pagesSonal Project (Transfer of Property Act)Handcrafting BeautiesNo ratings yet