Professional Documents

Culture Documents

People V Oriente

People V Oriente

Uploaded by

rod langit0 ratings0% found this document useful (0 votes)

11 views1 pageOriginal Title

People v Oriente.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views1 pagePeople V Oriente

People V Oriente

Uploaded by

rod langitCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

People vs.

Oriente, January 30, 2007

FACTS:

March 18, 1925: El Oriente, Fabrica de Tabacos, Inc. in order to

protect itself against the loss that it might suffer by reason of the death

of its manager, A. Velhagen, who had more than 35 years of experience

in the manufacture of cigars in the Philippine Islands, and whose death

would be a serious loss procured from the Manufacturers Life Insurance

Co., of Toronto, Canada, thru its local agent E.E. Elser, an insurance

policy on the life of A. Velhagen for $50,000

designated itself as the sole beneficiary

Upon the death of A. Velhagen in the year 1929, El Oriente received all

the proceeds of the life insurance policy, together with the interests and

the dividends accruing thereon, aggregating P104,957.88

Collector of Internal Revenue assessed and levied the sum of

P3,148.74 as income tax on the proceeds of the insurance policy which

tax El Oriente paid

ISSUE: W/N proceeds of life insurance policies paid to corporate beneficiaries upon the death of

the insured are also exempted

HELD: YES. reversed and favoring El Oriente

In reality, what the plaintiff received was in the nature of an indemnity

for the loss which it actually suffered because of the death of its

manager and not taxable income

You might also like

- A - Pirovano Vs CIRDocument1 pageA - Pirovano Vs CIRceilo coboNo ratings yet

- El Oriente Vs Posadas DigestDocument2 pagesEl Oriente Vs Posadas DigestMan2x Salomon100% (1)

- Nsurance Case Digest: El Oriente, Fabrica de Tabacos, Inc., V. Posadas (1931)Document1 pageNsurance Case Digest: El Oriente, Fabrica de Tabacos, Inc., V. Posadas (1931)jobelle barcellanoNo ratings yet

- July 01Document23 pagesJuly 01Law StudentNo ratings yet

- El Oriente Vs Posadas and CirDocument2 pagesEl Oriente Vs Posadas and CirNatasha MilitarNo ratings yet

- El Oriente Vs Posadas and CirDocument2 pagesEl Oriente Vs Posadas and CirRea RomeroNo ratings yet

- El Oriente v. Posadas, 56 Phil 147Document2 pagesEl Oriente v. Posadas, 56 Phil 147Homer SimpsonNo ratings yet

- 57 El Oriente vs. PosadasDocument7 pages57 El Oriente vs. PosadasisaaabelrfNo ratings yet

- Lalican V Insular DigestDocument2 pagesLalican V Insular DigestAlexa TinsayNo ratings yet

- Chapter 3 9 Cases TaxDocument15 pagesChapter 3 9 Cases TaxbcarNo ratings yet

- 148 Philippine Reports Annotated: El Oriente, Fabrica de Tabacos, Inc., vs. PosadasDocument4 pages148 Philippine Reports Annotated: El Oriente, Fabrica de Tabacos, Inc., vs. PosadasAlexiss Mace JuradoNo ratings yet

- Insurance CasesDocument209 pagesInsurance CasesAlelie BatinoNo ratings yet

- Digest InsuraDocument35 pagesDigest InsuraMartynov MedinaNo ratings yet

- El Oriente Fabrica v. PosadasDocument2 pagesEl Oriente Fabrica v. PosadasJohn Paul LordanNo ratings yet

- Lalican v. Insular Life G.R. No. 183526 August 25 2009Document3 pagesLalican v. Insular Life G.R. No. 183526 August 25 2009Abilene Joy Dela CruzNo ratings yet

- EL ORIENTE, FABRICA DE TABACOS, INC., Plaintiff-Appellant, vs. JUAN POSADASDocument5 pagesEL ORIENTE, FABRICA DE TABACOS, INC., Plaintiff-Appellant, vs. JUAN POSADASRobert Jayson UyNo ratings yet

- Lalican v. Insular Life DIGESTDocument2 pagesLalican v. Insular Life DIGESTczarina annNo ratings yet

- Lalican Vs Insular LifeDocument1 pageLalican Vs Insular LifeGian Tristan MadridNo ratings yet

- Insurance ReadingsDocument10 pagesInsurance ReadingsLian Amascual Claridad BasogNo ratings yet

- Violeta Lalican VS Insular Life DigestDocument2 pagesVioleta Lalican VS Insular Life DigestAlex Villahermosa100% (2)

- Insurance Digest CaseDocument6 pagesInsurance Digest CaseDelbertBaldescoNo ratings yet

- Insurance Batch 2Document26 pagesInsurance Batch 2Andrea TiuNo ratings yet

- Lalican - Vs.insular LifeDocument2 pagesLalican - Vs.insular LifeAna Rose CincoNo ratings yet

- Violeta Vs Insular LifeDocument2 pagesVioleta Vs Insular LifeajdgafjsdgaNo ratings yet

- 4 El Oriente Fabrica Vs PosadasDocument4 pages4 El Oriente Fabrica Vs PosadasAngelo ParaoNo ratings yet

- Lalican Vs The Insular Life Assurance Company LimitedDocument2 pagesLalican Vs The Insular Life Assurance Company LimitedCharmila SiplonNo ratings yet

- 17 El Oriente v. PosadasDocument2 pages17 El Oriente v. PosadasJericAquipelNo ratings yet

- 23 - Violeta Lalican VsDocument3 pages23 - Violeta Lalican VsWilfredo Guerrero IIINo ratings yet

- W5 Lalican - vs.InsularLifeDocument3 pagesW5 Lalican - vs.InsularLifeAna Rose CincoNo ratings yet

- Lalican VS Insular LifeDocument7 pagesLalican VS Insular LifeKeanu RibsNo ratings yet

- Plaintiff-Appellant Vs Vs Defendant-Appellee Gibbs & Mcdonough Roman Ozaeta, Attorney-General JaranillaDocument4 pagesPlaintiff-Appellant Vs Vs Defendant-Appellee Gibbs & Mcdonough Roman Ozaeta, Attorney-General JaranillaGael MoralesNo ratings yet

- InsurancepremiumDocument2 pagesInsurancepremiumnikol crisangNo ratings yet

- Lalican Vs Insular LifeDocument3 pagesLalican Vs Insular LifeIan LuigieNo ratings yet

- Violeta R. Lalican, Petitioner, vs. The Insular Life Assurance Company Limited, As Represented by The President Vicente R. Avilon, RespondentDocument3 pagesVioleta R. Lalican, Petitioner, vs. The Insular Life Assurance Company Limited, As Represented by The President Vicente R. Avilon, RespondentTiff DizonNo ratings yet

- Insurance Law - Lalican V Insular Life Assurance Company, LTDDocument6 pagesInsurance Law - Lalican V Insular Life Assurance Company, LTDMarioneMaeThiamNo ratings yet

- 20 El Oriente, Fabrica de Tabacos, Inc., vs. Posadas 56 Phil. 147, September 21, 1931Document7 pages20 El Oriente, Fabrica de Tabacos, Inc., vs. Posadas 56 Phil. 147, September 21, 1931joyeduardoNo ratings yet

- Insurance CasesDocument64 pagesInsurance CasesDANICA FLORESNo ratings yet

- Insurance Law DigestDocument3 pagesInsurance Law DigestMorphuesNo ratings yet

- Gibbs and Mcdonough and Roman Ozaeta For Appellant. Attorney-General Jaranilla For AppelleeDocument3 pagesGibbs and Mcdonough and Roman Ozaeta For Appellant. Attorney-General Jaranilla For AppelleeAbegail AtokNo ratings yet

- Third Division Violeta R. Lalican, G.R. No. 183526: Acting ChairpersonDocument15 pagesThird Division Violeta R. Lalican, G.R. No. 183526: Acting ChairpersonMelvin PernezNo ratings yet

- Insurance Case Digest Del Rosario v. Equitable Ins. and Casualty Co., Inc. (1963)Document2 pagesInsurance Case Digest Del Rosario v. Equitable Ins. and Casualty Co., Inc. (1963)Miley LangNo ratings yet

- Insurance CasesDocument63 pagesInsurance CasesDANICA FLORESNo ratings yet

- D. Construction and InterpretationDocument5 pagesD. Construction and InterpretationAngelica AlonzoNo ratings yet

- 54 Lalican V Insular LifeDocument17 pages54 Lalican V Insular LifeRoland ApareceNo ratings yet

- El Oriente v. Posadas - Taxability of Insurance Proceeds 56 PHIL 147 (1931)Document3 pagesEl Oriente v. Posadas - Taxability of Insurance Proceeds 56 PHIL 147 (1931)mcfalcantaraNo ratings yet

- 6 El Oriente Fabrica vs. Posadas PDFDocument4 pages6 El Oriente Fabrica vs. Posadas PDFKrisleen AbrenicaNo ratings yet

- Life Cover Welcome - D5024708Document4 pagesLife Cover Welcome - D5024708mudvayne2008No ratings yet

- Chapter 13 Part 2Document6 pagesChapter 13 Part 2Danielle Angel MalanaNo ratings yet

- Calanoc V CA Digested by ANFGDocument2 pagesCalanoc V CA Digested by ANFGAndrae Nicolo GeronimoNo ratings yet

- Insurance Case DigestDocument12 pagesInsurance Case DigestJoe BuenoNo ratings yet

- VIOLETA R. LALICAN v. INSULAR LIFE ASSURANCE COMPANY LIMITEDDocument15 pagesVIOLETA R. LALICAN v. INSULAR LIFE ASSURANCE COMPANY LIMITEDKhate AlonzoNo ratings yet

- Violeta R. Lalican, Petitioner, vs. The Insular Life Assurance Company Limited, As Represented by The President Vicente R. Avilon, Respondent.Document10 pagesVioleta R. Lalican, Petitioner, vs. The Insular Life Assurance Company Limited, As Represented by The President Vicente R. Avilon, Respondent.rossiniNo ratings yet

- Insurance DigestDocument5 pagesInsurance DigestAndrea Klein LechugaNo ratings yet

- Lalican v. Insular Life Assurance Co. Ltd.Document13 pagesLalican v. Insular Life Assurance Co. Ltd.Cassie GacottNo ratings yet

- Insurancereview Day5Document44 pagesInsurancereview Day5Jenifer PaglinawanNo ratings yet

- Del Rosario Vs The Equitable Insurance and Casualty CoDocument3 pagesDel Rosario Vs The Equitable Insurance and Casualty CoChelle BelenzoNo ratings yet

- Lalican v. Insular Life Assurnace, 2009Document4 pagesLalican v. Insular Life Assurnace, 2009Randy SiosonNo ratings yet

- Pirovano Vs CIRDocument2 pagesPirovano Vs CIRJDR JDRNo ratings yet

- Verendia v. CADocument7 pagesVerendia v. CAMark Catabijan CarriedoNo ratings yet

- People V ManabanDocument2 pagesPeople V Manabanrod langitNo ratings yet

- Ladonga vs. People, February 17, 2005 DigestDocument1 pageLadonga vs. People, February 17, 2005 Digestrod langitNo ratings yet

- 181 Languages: Pinoy KasiDocument2 pages181 Languages: Pinoy Kasirod langitNo ratings yet

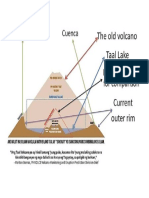

- Taal SupervolcanoDocument1 pageTaal Supervolcanorod langit100% (1)