Professional Documents

Culture Documents

Case Week 6: DCF Valuation of Tottenham Hotspur

Uploaded by

mariliamonfardineOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Week 6: DCF Valuation of Tottenham Hotspur

Uploaded by

mariliamonfardineCopyright:

Available Formats

Case Week 6: Tottenham Hotspur

Prepare a self-contained PowerPoint presentation in groups. You will have to hand in

a hard copy of this presentation at the beginning of the class and send a electronic

version of the excel file with your solutions. The questions are designed in a way that

allows you to refresh the material on which the course builds up on and to check the

material we have covered in class or the lecture notes. Focus in the presentation on

question 1 and 2 below. If times allows also prepare question 3 and 4, but you do not

have to add this in your PowerPoint presentation.

Questions

1. Assume Tottenham Hotspur, plc. continues in their current stadium following their

current player strategy.

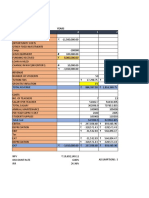

a.) Perform a DCF analysis using the cash flow projections given in the case.

Based on this analysis, what is the value of Tottenham Hotspur, plc.? Also add

a sensitivity analysis regarding the most important assumptions.

b.) Perform a multiples analysis. Based on the multiples analysis, is the value

of Tottenham Hotspurs any different?

c.) At its current stock price of GBP 13.80, is Tottenham fairly priced?

2. Using a DCF approach, evaluate each of the following decisions:

a.) Build the new stadium

b.) Sign a new striker

c.) Build the new stadium and sign a new striker

Note that the past 10 years of Premiership revenue and point total data suggest that for

every 1% increase in a team’s point total, a team could anticipate a 1.52%

improvement in revenues. Do also some sensitivity analysis with respect to this

assumption.

3. What would be the likely stock market reaction to a surprise announcement of each

of the decisions considered in Question 2 (i.e. build stadium, sign new striker, or do

both)?

4. Exhibit 3 provides data on Tottenham’s stock price reaction to outcomes of their

matches in the Premiership. How does this data inform your assessment of how the

stock market might value the addition of a new striker and his expected contribution

to the team?

Good luck!

You might also like

- West Teleservice: Case QuestionsDocument1 pageWest Teleservice: Case QuestionsAlejandro García AcostaNo ratings yet

- Course Syllabus F21Document9 pagesCourse Syllabus F21dhwaniNo ratings yet

- Cafés Monte Bianco - Questions and Additional DataDocument1 pageCafés Monte Bianco - Questions and Additional DataMarco BolzonelloNo ratings yet

- Fonderia di Torino Case PresentationDocument1 pageFonderia di Torino Case Presentationpoo_granger5229No ratings yet

- Tire City IncDocument3 pagesTire City IncAlberto RcNo ratings yet

- Earnings and Financial Ratios StatementDocument10 pagesEarnings and Financial Ratios StatementGiovani R. Pangos RosasNo ratings yet

- Clarkson Lumbar CompanyDocument41 pagesClarkson Lumbar CompanyTheOxyCleanGuyNo ratings yet

- Description of Knoll:: Knoll Furniture: Going PublicDocument3 pagesDescription of Knoll:: Knoll Furniture: Going PublicIni EjideleNo ratings yet

- The Body Shop Plc 2001: Historical Financial AnalysisDocument13 pagesThe Body Shop Plc 2001: Historical Financial AnalysisNaman Nepal100% (1)

- Bearn Sterns and Co.Document10 pagesBearn Sterns and Co.eidel18400% (1)

- Michael McClintock Case1Document2 pagesMichael McClintock Case1Mike MCNo ratings yet

- Tottenham Case SolutionDocument14 pagesTottenham Case SolutionVivek SinghNo ratings yet

- Final Draft - MFIDocument38 pagesFinal Draft - MFIShaquille SmithNo ratings yet

- Precision WorldwideDocument9 pagesPrecision WorldwidePedro José ZapataNo ratings yet

- Willison TowerDocument2 pagesWillison TowerOdiseGrembiNo ratings yet

- Running Head: The Body Shop CaseDocument19 pagesRunning Head: The Body Shop CaseDominique Meagan LeeNo ratings yet

- FM423 Practice Exam IIDocument7 pagesFM423 Practice Exam IIruonanNo ratings yet

- Multinational Management PDFDocument367 pagesMultinational Management PDFtty100% (1)

- Hotspur ModelDocument6 pagesHotspur ModelJuan Carlos Carrion100% (1)

- Hanson Case Turnaround FactorsDocument6 pagesHanson Case Turnaround FactorsAnosh DoodhmalNo ratings yet

- Beams10e Ch07 Intercompany Profit Transactions BondsDocument25 pagesBeams10e Ch07 Intercompany Profit Transactions BondsLeini TanNo ratings yet

- Tottenham Hotspur FCDocument8 pagesTottenham Hotspur FCvgurrola140% (1)

- The Home Depot: QuestionsDocument13 pagesThe Home Depot: Questions凱爾思No ratings yet

- Beta Management QuestionsDocument1 pageBeta Management QuestionsbjhhjNo ratings yet

- Bunker Company Negotiated A Lease With Gilbreth Company That BeginsDocument1 pageBunker Company Negotiated A Lease With Gilbreth Company That Beginstrilocksp SinghNo ratings yet

- Nike Case AnalysisDocument9 pagesNike Case AnalysisFami FamzNo ratings yet

- S2 G9 Hanson CaseDocument2 pagesS2 G9 Hanson CaseShraddha PandyaNo ratings yet

- CORPORATE FINANCE ANALYSISDocument14 pagesCORPORATE FINANCE ANALYSISLof Kyra Nayyara100% (1)

- MscBA 2012 - Advanced Corporate Finance Coursework-2Document78 pagesMscBA 2012 - Advanced Corporate Finance Coursework-2joaopsmt100% (1)

- Acc 255 Final Exam Review Packet (New Material)Document6 pagesAcc 255 Final Exam Review Packet (New Material)Tajalli FatimaNo ratings yet

- PHT and KooistraDocument4 pagesPHT and KooistraNilesh PrajapatiNo ratings yet

- Case 42 West Coast DirectedDocument6 pagesCase 42 West Coast DirectedHaidar IsmailNo ratings yet

- Nonprofit Cost Allocation for Shelter PartnershipDocument33 pagesNonprofit Cost Allocation for Shelter PartnershipFrancisco MarvinNo ratings yet

- Wacc Mini CaseDocument12 pagesWacc Mini CaseKishore NaiduNo ratings yet

- Stryker LTP Final PaperDocument33 pagesStryker LTP Final Paperapi-239845860No ratings yet

- Debt Policy at Ust IncDocument7 pagesDebt Policy at Ust IncIrfan Mohd0% (1)

- ST Clement'S School Case Study: YearsDocument8 pagesST Clement'S School Case Study: YearsTin Bernadette DominicoNo ratings yet

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument17 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The Questionawesome bloggersNo ratings yet

- Tugas FM FuzzyTronicDocument7 pagesTugas FM FuzzyTronicAnggit Tut PinilihNo ratings yet

- This Study Resource Was: Forner CarpetDocument4 pagesThis Study Resource Was: Forner CarpetLi CarinaNo ratings yet

- Dupont AnalysisDocument5 pagesDupont AnalysisNoraminah IsmailNo ratings yet

- Earnings Statement AnalysisDocument8 pagesEarnings Statement AnalysisLinh NguyenNo ratings yet

- Nova Case Course HeroDocument10 pagesNova Case Course HerolibroaklatNo ratings yet

- MIT Sloan School of ManagementDocument3 pagesMIT Sloan School of Managementebrahimnejad64No ratings yet

- Boston Chicken Case AnalysisDocument9 pagesBoston Chicken Case AnalysisamaninjoyNo ratings yet

- This Spreadsheet Supports Analysis of The Case, "American Greetings" (Case 43)Document52 pagesThis Spreadsheet Supports Analysis of The Case, "American Greetings" (Case 43)mehar noorNo ratings yet

- GM588 - Practice Quiz 1Document4 pagesGM588 - Practice Quiz 1Chooy100% (1)

- Maverick Lodging Performance Review SystemDocument3 pagesMaverick Lodging Performance Review Systemfranz_karununganNo ratings yet

- Ma 6Document32 pagesMa 6Tausif Narmawala0% (1)

- T.Hotspur Striker For WednesdayDocument18 pagesT.Hotspur Striker For WednesdayDavide RossettiNo ratings yet

- Chapter Five Decision Making and Relevant Information Information and The Decision ProcessDocument10 pagesChapter Five Decision Making and Relevant Information Information and The Decision ProcesskirosNo ratings yet

- 5 - G2B and G2C Pakistan - Mudasir Rasool - 13879Document4 pages5 - G2B and G2C Pakistan - Mudasir Rasool - 13879saadriazNo ratings yet

- Integrative Case 10 1 Projected Financial Statements For StarbucDocument2 pagesIntegrative Case 10 1 Projected Financial Statements For StarbucAmit PandeyNo ratings yet

- Cvs Health Financial AnalysisDocument12 pagesCvs Health Financial Analysisapi-643481686No ratings yet

- FA - Abercrombie and Fitch Case StudyDocument17 pagesFA - Abercrombie and Fitch Case Studyhaonanzhang100% (2)

- Gainesville Machine Tools Corp financial projections and analysisDocument2 pagesGainesville Machine Tools Corp financial projections and analysisAbhinav Singh100% (1)

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- AF5008 Assessment Brief 20212022 4Document4 pagesAF5008 Assessment Brief 20212022 4lariamalthaniNo ratings yet

- Econ A231 Tma02Document3 pagesEcon A231 Tma02Ho Kwun LamNo ratings yet

- CW1 PaperDocument4 pagesCW1 Paperrevaluate21No ratings yet

- Game ON! Predicting English Premier League Match OutcomesDocument5 pagesGame ON! Predicting English Premier League Match OutcomesManu Díaz VilloutaNo ratings yet

- Interco Takeover Case: Financials and ValuationDocument1 pageInterco Takeover Case: Financials and ValuationqvrlenarasegtNo ratings yet

- Practice Questions Week 4Document3 pagesPractice Questions Week 4mariliamonfardineNo ratings yet

- Midland Energy Resources Inc.: Andrew Picone Will Mcdermott Taylor Appel Liam JoyDocument13 pagesMidland Energy Resources Inc.: Andrew Picone Will Mcdermott Taylor Appel Liam JoymariliamonfardineNo ratings yet

- Uva Logging On To Microsoft 365Document1 pageUva Logging On To Microsoft 365mariliamonfardineNo ratings yet

- MIF Year Calendar 2020-2021Document1 pageMIF Year Calendar 2020-2021mariliamonfardineNo ratings yet

- Installing Two Factor Authentication - Android Phone PDFDocument8 pagesInstalling Two Factor Authentication - Android Phone PDFmariliamonfardineNo ratings yet

- MIF Schedule 2020-2021 Part-Time General TrackDocument1 pageMIF Schedule 2020-2021 Part-Time General TrackmariliamonfardineNo ratings yet

- Learn Dutch at the UvADocument4 pagesLearn Dutch at the UvAmariliamonfardineNo ratings yet

- Learn Dutch at the UvADocument4 pagesLearn Dutch at the UvAmariliamonfardineNo ratings yet

- Learn Dutch at the UvADocument4 pagesLearn Dutch at the UvAmariliamonfardineNo ratings yet

- About Unilever PresentationDocument44 pagesAbout Unilever Presentationmariliamonfardine75% (4)

- Czarnikow Ingredients & PackagingDocument16 pagesCzarnikow Ingredients & PackagingmariliamonfardineNo ratings yet