Professional Documents

Culture Documents

Answer All Questions. 2. All Sub-Parts of A Question Must Be Answered Together Else They Would Not Be Evaluated

Uploaded by

BIBIN VARGHESEOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Answer All Questions. 2. All Sub-Parts of A Question Must Be Answered Together Else They Would Not Be Evaluated

Uploaded by

BIBIN VARGHESECopyright:

Available Formats

Birla Institute of Technology and Science-Pilani, Hyderabad Campus

First Semester: 2014-15

FUNDAMENTALS OF FINANCE & ACCOUNTING ECONF212

Comprehensive examination (Closed book)

Time: Three Hours Date: 12th December, 2014 Max Marks: 40

Weightage: 40%

Instructions:

1. Answer all questions.

2. All sub-parts of a question must be answered together else they would

not be evaluated.

1. Answer the following: (1+1+1+2) Marks

i. What is a balance sheet?

ii. What is a profit and loss statement?

iii. What is a cash flow statement?

iv. What is a loss? Is it an asset or liability, explain.

2. Ward consulting has prepared the following trial balance as on december 31 2005.

(5) Marks

Please prepare the balance sheet as on 31 st December 2005 and the income statement for the

month of December 2005.

Fundamentals of Finance & Accounting Page 1

3. From the following financial statements of M/s Sunny Ltd. calculate. 1) Current Ratio 2) Liquid

Ratio 3) Gross Profit Ratio 4) Net Profit Ratio 5) Net Profit to Capital Employed Ratio 6) Fixed

Assets Turnover Ratio 7) Sales to Capital Ratio 8) Debtors Turnover Ratio. (10) Marks

4. Answer the following questions: (1+1+1+1+1+1+1+3) Marks

i. What is a derivative?

ii. What are the differences between a forward and a future?

iii. What is an option?

iv. What is the difference between a European option and an American option?

v. What are the global indices derivatives traded in India?

vi. What is spot price?

vii. What is strike price?

Fundamentals of Finance & Accounting Page 2

viii. NIFTY spot price is 8573.

a. 8600 strike price December call option is trading at 85. What are the intrinsic value

and time value of this option?

b. 8600 strike price December put option is trading at 78. What are the intrinsic value

and time value of this option?

c. If you buy the above options and do not trade in them, when would they be settled?

5. Read the following news report and answer the given questions: (50 words max. each part)

“India’s central bank chief, pursuing a campaign to strengthen independence, took one of

his biggest steps yet in pushing the nation’s government to rein in a fiscal deficit with a

signal that lower interest rates depend on budget tightening.

Reserve Bank of India Governor Raghuram Rajan held the main rate at 8 percent yesterday

and said he may cut it early in 2015, while not necessarily at the next scheduled policy

review Feb. 3. Rebuffing calls for a cut, the decision had analysts speculating whether he’d

reduce the rate before or after the government’s annual budget, anticipated in late

February.

“Since Rajan became head of the RBI we see the central bank independence increasing, and

he’s certainly done a lot to boost that,” said Per Hammarlund, chief emerging-markets

strategist at Skandinaviska Enskilda Banken AB in Stockholm. Among central bankers, “he’s

one of the few now definitely in a position where he can speak out more forcefully against

the government.”

Rajan’s willingness to reject pressure to lower borrowing costs strengthens his credibility in

a campaign to rein in one of Asia’s fastest inflation rates, as Prime Minister Narendra Modi

pushes to boost growth. Finance Minister Arun Jaitley called for a rate cut last month,

saying it would provide a “good fillip” to the economy as he works to narrow the fiscal

deficit to a seven-year low.

‘Confident in Realization’

The central bank will have more confidence that the government is meeting its fiscal targets

next year, Rajan told analysts yesterday. “We can be confident in expectation, but then we

will be confident in realization when we actually see that happen,” he said.

Policy change depends on “encouraging” fiscal signs and retreating inflationary

expectations. The central bank doesn’t “intend to flip flop,” once it moves, he said.

Consumer prices rose 5.52 percent in October from a year earlier, the slowest pace since

the index was created in January 2012. The benchmark stock index and rupee have been

among the world’s best performers this year.

Deutsche Bank AG, Australia & New Zealand Banking Group Ltd. and Nomura Holdings Inc.

said yesterday they predict a first cut after the budget. Goldman Sachs Group Inc. sees a

Fundamentals of Finance & Accounting Page 3

reduction either in February or March, while BNP Paribas SA says the reduction may occur

before the budget.

Revenue Shortages

A tax revenue shortage makes it difficult to shrink the fiscal gap to 4.1 percent of gross

domestic product in the year through March from 4.5 percent previously, Jaitley said Nov.

21. The government hasn’t begun stake sales accounting for 8 percent of the shortfall and

much of the savings are through short-term spending cuts.

The April-October fiscal deficit was about 90 percent of the full-year target, government

data show. Failure to meet the goal may cause foreign investors to withdraw and a weaker

rupee would fuel inflation, said Christian Maggio, head of emerging markets research at TD

Securities in London. Rajan, 51, vowed to defeat inflation once and for all when he took

office 15 months ago. The former International Monetary Fund chief economist raised the

repo rate three times and has backed a proposal for inflation targeting.

Cut Carrot?

The Finance Ministry is “looking forward” to the central bank supporting growth, it said in a

statement yesterday after the decision. The 1934 Reserve Bank of India Act says the federal

government may direct the central bank on what it considers public interest. The governor

has the authority to veto his advisers on rates. Continued benign price data may prompt

Rajan to cut before Feb. 3, Richard Iley, an analyst at BNP Paribas SA, wrote in a report

yesterday. A quarter-point cut would be a “carrot” for Jaitley to deliver a tight budget, he

said.

Investors are seeking reaffirmation of Jaitley’s pledge to narrow the deficit to 3 percent of

GDP by 2017, as well as progress on a goods-and-services tax and raising foreign investment

caps. While Modi has scrapped some petroleum handouts, they account for a quarter of

India’s subsidy bill.

The more Jaitley succeeds in curbing subsidies, the more room Rajan will have to lower

rates, according to Sonal Varma, an economist at Nomura, who predicts a cut in April.

“In any economy, monetary and fiscal policy have to be aligned,” Varma said by phone in

Mumbai yesterday. “It’s always an implicit thing. This time they explicitly stated this to

anchor the timing of the policy action.”

i. Who is Rajan and what is he trying to achieve?

ii. What is the relation between subsidies and interest rate?

iii. Who may be offered a carrot and for what?

iv. What is the context in which flip flop is used?

v. Based on this report when do you expect interest rates to change? Give reason.

Fundamentals of Finance & Accounting Page 4

You might also like

- Helping You Spot Opportunities: Investment Update - October, 2012Document56 pagesHelping You Spot Opportunities: Investment Update - October, 2012Carla TateNo ratings yet

- Etm 2011 8 22 33Document1 pageEtm 2011 8 22 33Saurabh DardaNo ratings yet

- RBI report shows fall in NPAs, rise in capital for banksDocument17 pagesRBI report shows fall in NPAs, rise in capital for banksAbhinav KumarNo ratings yet

- Niveshak Niveshak: India Vision 2020Document24 pagesNiveshak Niveshak: India Vision 2020Niveshak - The InvestorNo ratings yet

- Niveshak Niveshak: Financial Woes of India'S Rising SunDocument24 pagesNiveshak Niveshak: Financial Woes of India'S Rising SunNiveshak - The InvestorNo ratings yet

- Market Review Future Outlook Feb2012-SbiDocument6 pagesMarket Review Future Outlook Feb2012-SbiSaurav MandhotraNo ratings yet

- Finsight 18march2012Document11 pagesFinsight 18march2012Rahul UnnikrishnanNo ratings yet

- Financial Articles: MembersDocument6 pagesFinancial Articles: MembersSwapnil ChavanNo ratings yet

- BNP Paribas Mid Cap Fund: Young Spark Today. Grandmaster TomorrowDocument2 pagesBNP Paribas Mid Cap Fund: Young Spark Today. Grandmaster TomorrowPrasad Dhondiram Zinjurde PatilNo ratings yet

- A Project Report Stick MarketDocument50 pagesA Project Report Stick MarketVijay HiraniNo ratings yet

- LinkDocument24 pagesLinkDhileepan KumarasamyNo ratings yet

- It Is Very Important For The RBI To Focus On Inflation: Gita GopinathDocument2 pagesIt Is Very Important For The RBI To Focus On Inflation: Gita GopinathRohan PaunikarNo ratings yet

- The World Economy... - 22/04/2010Document2 pagesThe World Economy... - 22/04/2010Rhb InvestNo ratings yet

- Quantitative Easing (QE) Is An UnconventionalDocument16 pagesQuantitative Easing (QE) Is An Unconventionalkanchanagrawal91No ratings yet

- Economics Case StudyDocument2 pagesEconomics Case StudyKUSH SHAH100% (1)

- Strategic Analysis of SBIMFDocument19 pagesStrategic Analysis of SBIMF26amitNo ratings yet

- World Economic Forum: Niveshak NiveshakDocument28 pagesWorld Economic Forum: Niveshak NiveshakNiveshak - The InvestorNo ratings yet

- NEW DELHI, MARCH 11: After 50 Basis Points Cut in The Policy Rates, Banks Are Expected To LowerDocument38 pagesNEW DELHI, MARCH 11: After 50 Basis Points Cut in The Policy Rates, Banks Are Expected To LowerheenaNo ratings yet

- The World Economy... 22/03/2010Document2 pagesThe World Economy... 22/03/2010Rhb InvestNo ratings yet

- Apr-2022-Vol-04 (1) 20220426090456Document10 pagesApr-2022-Vol-04 (1) 20220426090456HMS DeedNo ratings yet

- HDFC Q3 net up 12% on loan growthDocument2 pagesHDFC Q3 net up 12% on loan growthVikash Chander KhatkarNo ratings yet

- Will Rising Inflation Deflate India's Economic RecoveryDocument4 pagesWill Rising Inflation Deflate India's Economic RecoveryTripti GuptaNo ratings yet

- Financial Soundness Indicators for Financial Sector Stability: A Tale of Three Asian CountriesFrom EverandFinancial Soundness Indicators for Financial Sector Stability: A Tale of Three Asian CountriesNo ratings yet

- RBI - Settling For SlowdownDocument3 pagesRBI - Settling For SlowdownSwapnil ShethNo ratings yet

- IndiaEconomicGrowth SDocument16 pagesIndiaEconomicGrowth SAmol SaxenaNo ratings yet

- RBI Springs Surprise, Cuts Repo by 50 Bps by Dinesh Unnikrishnan & Anup RoyDocument5 pagesRBI Springs Surprise, Cuts Repo by 50 Bps by Dinesh Unnikrishnan & Anup RoymahaktripuriNo ratings yet

- Market Outlook 17th February 2012Document4 pagesMarket Outlook 17th February 2012Angel BrokingNo ratings yet

- Empower June 2012Document68 pagesEmpower June 2012pravin963No ratings yet

- Union Budget 2012-13Document24 pagesUnion Budget 2012-13hanuman3No ratings yet

- Niveshak Niveshak: AuditorsDocument26 pagesNiveshak Niveshak: AuditorsNiveshak - The InvestorNo ratings yet

- Debt Mutual Fund Picks: Macro Data Round UpDocument6 pagesDebt Mutual Fund Picks: Macro Data Round Upnaresh_dayani8459No ratings yet

- Performance Analysis Mba ProjectDocument64 pagesPerformance Analysis Mba ProjectShanmukhaSharmaNo ratings yet

- Banking Finance and Insurance: A Report On Financial Analysis of IDBI BankDocument8 pagesBanking Finance and Insurance: A Report On Financial Analysis of IDBI BankRaven FormourneNo ratings yet

- India5trillioneconomy Visionmissionjetir2003408Document10 pagesIndia5trillioneconomy Visionmissionjetir2003408shubham satamNo ratings yet

- FMI Project Report Buddy Group 3Document12 pagesFMI Project Report Buddy Group 3Tanmay MunjalNo ratings yet

- India Opens Stock Market To Foreign InvestorsDocument4 pagesIndia Opens Stock Market To Foreign InvestorsSharad SrivastavaNo ratings yet

- Eco531 Article Review 1Document7 pagesEco531 Article Review 1Muhammad azimNo ratings yet

- Newsletter July 2022 PDFDocument13 pagesNewsletter July 2022 PDFDwaipayan MojumderNo ratings yet

- Opinion Columns C.R.L. Narasimhan: Worrying Numbers Compound ProblemsDocument2 pagesOpinion Columns C.R.L. Narasimhan: Worrying Numbers Compound ProblemsSourabh SharmaNo ratings yet

- The C Unch: Economic IndicatorsDocument9 pagesThe C Unch: Economic IndicatorsAbhishek PramanikNo ratings yet

- Aye Kyu Kyu Khin: Fundamental of EconomicDocument11 pagesAye Kyu Kyu Khin: Fundamental of EconomicHtoo Wai Lin AungNo ratings yet

- Fundamental Analysis of ICICI Bank and Axis BankDocument18 pagesFundamental Analysis of ICICI Bank and Axis BankAnu100% (2)

- Moody's Sets The Mood On Street Will RBI Give It A Boost - The Economic TimesDocument2 pagesMoody's Sets The Mood On Street Will RBI Give It A Boost - The Economic Timesanupbhansali2004No ratings yet

- South Asia ReportDocument9 pagesSouth Asia ReporttoabhishekpalNo ratings yet

- Evolving Bond MarketDocument9 pagesEvolving Bond MarketcoolNo ratings yet

- It's Hard To Do Business in India: Tony: TimesDocument1 pageIt's Hard To Do Business in India: Tony: TimessadiksnmNo ratings yet

- Crisil Yearbook On The Indian Debt Market 2015.unlockedDocument114 pagesCrisil Yearbook On The Indian Debt Market 2015.unlockedPRATIK JAINNo ratings yet

- Finance Questions and AnswersDocument35 pagesFinance Questions and AnswersRohitNo ratings yet

- F F y Y: Ear Uls MmetrDocument4 pagesF F y Y: Ear Uls MmetrChrisBeckerNo ratings yet

- Dnyansagar Institute of Management and Research: Written Home Assignment 50 2 June 2022 Caselet 50 20 June 2022Document6 pagesDnyansagar Institute of Management and Research: Written Home Assignment 50 2 June 2022 Caselet 50 20 June 2022SandeshNo ratings yet

- J Street Volume 281Document10 pagesJ Street Volume 281JhaveritradeNo ratings yet

- Market Insight Q3FY12 RBI Policy Review Jan12Document3 pagesMarket Insight Q3FY12 RBI Policy Review Jan12poojarajeswariNo ratings yet

- LicDocument56 pagesLicvarshaNo ratings yet

- GI Report January 2012Document3 pagesGI Report January 2012Bill HallmanNo ratings yet

- The World Economy... - 06/04/2010Document2 pagesThe World Economy... - 06/04/2010Rhb InvestNo ratings yet

- Niveshak Sept 2012Document24 pagesNiveshak Sept 2012Niveshak - The InvestorNo ratings yet

- How General Elections Impact India's EconomyDocument12 pagesHow General Elections Impact India's Economygaurav vijNo ratings yet

- Kotak Mahindra Bank Q1 FY18 Earnings Call SummaryDocument24 pagesKotak Mahindra Bank Q1 FY18 Earnings Call Summarydivya mNo ratings yet

- Market Highlights December'19Document8 pagesMarket Highlights December'19Pranati BhattacharjeeNo ratings yet

- Equity Research: (Series IV) 10th August 2012Document18 pagesEquity Research: (Series IV) 10th August 2012kgsbppNo ratings yet

- Literature PresentationDocument4 pagesLiterature PresentationBIBIN VARGHESENo ratings yet

- Evolution of LanguageDocument2 pagesEvolution of LanguageBIBIN VARGHESENo ratings yet

- Functionally Graded Al FoamsDocument13 pagesFunctionally Graded Al FoamsBIBIN VARGHESENo ratings yet

- 12 Angry Men Remake Fails to Match Original's CreativityDocument5 pages12 Angry Men Remake Fails to Match Original's CreativityBIBIN VARGHESENo ratings yet

- CAT 2009 solved questionsDocument11 pagesCAT 2009 solved questionsVpn PrasadNo ratings yet

- Reliability-Based Design Optimization of Volume Fraction Distribution in Functionally Graded CompositesDocument8 pagesReliability-Based Design Optimization of Volume Fraction Distribution in Functionally Graded CompositesBIBIN VARGHESENo ratings yet

- Reliability-Based Design Optimization of Volume Fraction Distribution in Functionally Graded CompositesDocument8 pagesReliability-Based Design Optimization of Volume Fraction Distribution in Functionally Graded CompositesBIBIN VARGHESENo ratings yet

- Any Need For Naira Re Denomination NowDocument10 pagesAny Need For Naira Re Denomination NowUtri DianniarNo ratings yet

- EC321 Course Outline 2014Document4 pagesEC321 Course Outline 2014Kun ZhouNo ratings yet

- Macroeconomics Canadian 4th Edition Blanchard Solutions ManualDocument4 pagesMacroeconomics Canadian 4th Edition Blanchard Solutions ManualKaylaHowardxarcs100% (14)

- Cambridge International AS & A Level: Economics 9708/42Document4 pagesCambridge International AS & A Level: Economics 9708/42Melissa ChaiNo ratings yet

- Hamilton - 1988 - The Role of The Gold Standard in Propogating The Great DepressionDocument23 pagesHamilton - 1988 - The Role of The Gold Standard in Propogating The Great DepressionjpkoningNo ratings yet

- Fixed Vs Flexible Exchange RatesDocument63 pagesFixed Vs Flexible Exchange Ratesramya4smilesNo ratings yet

- Introduction To Money Payment System-2Document42 pagesIntroduction To Money Payment System-2lawwrrance chanNo ratings yet

- Evolution of International MonetaryDocument7 pagesEvolution of International MonetaryManish KumarNo ratings yet

- Lecture 6 Money Growth and InflationDocument41 pagesLecture 6 Money Growth and InflationLê Thiên Giang 2KT-19No ratings yet

- Pprinciples of Macroeconomics - Assignment 1Document7 pagesPprinciples of Macroeconomics - Assignment 1rjrNo ratings yet

- Term 2 ECONMAC V24 - Final NotesDocument10 pagesTerm 2 ECONMAC V24 - Final NotesLip SyncersNo ratings yet

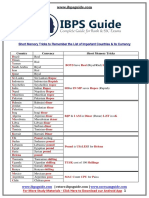

- Short Memory Tricks To Remember The List of Important Countries Its CurrencyDocument2 pagesShort Memory Tricks To Remember The List of Important Countries Its CurrencyRaje VijiNo ratings yet

- 244 PGTRB Economics Study Material 3Document9 pages244 PGTRB Economics Study Material 3shareena ppNo ratings yet

- Agexmark Top1Document6 pagesAgexmark Top1Waren LlorenNo ratings yet

- ECO104.16 AssignmentDocument5 pagesECO104.16 AssignmentRidwan AhmedNo ratings yet

- Investment Risk and Return ChapterDocument10 pagesInvestment Risk and Return ChapterAmbachew MotbaynorNo ratings yet

- Itain (A - Newsweek) 1972 11 27Document2 pagesItain (A - Newsweek) 1972 11 27pedronuno20No ratings yet

- Jackel 2006 - ByImplication PDFDocument6 pagesJackel 2006 - ByImplication PDFpukkapadNo ratings yet

- Investment Guide Market Outlook Year End 2022 enDocument52 pagesInvestment Guide Market Outlook Year End 2022 enAurora Ferreira GonzalezNo ratings yet

- Aggrigate Demand and SupplyDocument7 pagesAggrigate Demand and Supplyarslan shahNo ratings yet

- Faculty of Business and Management Bachelor in Business Administration (Hons.) FinanceDocument9 pagesFaculty of Business and Management Bachelor in Business Administration (Hons.) FinanceNurAuniZayanahNo ratings yet

- PTS 2024 B4 L1 Test 5 QP EngDocument18 pagesPTS 2024 B4 L1 Test 5 QP EngAbhishek KhadseNo ratings yet

- Topic 6: The Phillips Curve: Dudley CookeDocument33 pagesTopic 6: The Phillips Curve: Dudley CookeSubhajyoti DasNo ratings yet

- Monetary PolicyDocument8 pagesMonetary PolicyLyubov KushnirNo ratings yet

- Open Economy - Session 9-10Document8 pagesOpen Economy - Session 9-10Abhyudaya BharadwajNo ratings yet

- Solved SSC CGL 24th August 2021 Shift-1 Paper With SolutionsDocument31 pagesSolved SSC CGL 24th August 2021 Shift-1 Paper With SolutionsabhiNo ratings yet

- 2019 H1 Economics A-Level CSQ 1 PDFDocument5 pages2019 H1 Economics A-Level CSQ 1 PDF19S53 LIAN ZHIJUNNo ratings yet

- AP宏观经济学 2005Document32 pagesAP宏观经济学 2005seoyoon1012No ratings yet

- Capital Account Management in IndiaDocument9 pagesCapital Account Management in IndiaSanjana KrishnakumarNo ratings yet

- RCSI Presentation - China's Threats: Deflation & Slowing GrowthDocument10 pagesRCSI Presentation - China's Threats: Deflation & Slowing GrowthRCS_CFANo ratings yet