Professional Documents

Culture Documents

Activity From Your Answer in Our Activity On Timekeeping, Compute The Taxable Income of Employee A. Use This Format

Uploaded by

Krung Krung0 ratings0% found this document useful (0 votes)

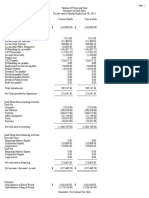

14 views1 pageEmployee A earned a taxable income of 22,211 pesos calculated as follows: gross revenue of 22,921.80 pesos from basic pay of 16,562 pesos, overtime pay of 4,250 pesos, night differential of 100 pesos and holiday pay of 2,009.80 pesos, with total deductions of 711 pesos for SSS, Pag-IBIG and Philhealth dues, resulting in a taxable income of 22,211 pesos.

Original Description:

Original Title

BSA1-1_GROSSREVENUE

Copyright

© © All Rights Reserved

Available Formats

ODT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentEmployee A earned a taxable income of 22,211 pesos calculated as follows: gross revenue of 22,921.80 pesos from basic pay of 16,562 pesos, overtime pay of 4,250 pesos, night differential of 100 pesos and holiday pay of 2,009.80 pesos, with total deductions of 711 pesos for SSS, Pag-IBIG and Philhealth dues, resulting in a taxable income of 22,211 pesos.

Copyright:

© All Rights Reserved

Available Formats

Download as ODT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views1 pageActivity From Your Answer in Our Activity On Timekeeping, Compute The Taxable Income of Employee A. Use This Format

Uploaded by

Krung KrungEmployee A earned a taxable income of 22,211 pesos calculated as follows: gross revenue of 22,921.80 pesos from basic pay of 16,562 pesos, overtime pay of 4,250 pesos, night differential of 100 pesos and holiday pay of 2,009.80 pesos, with total deductions of 711 pesos for SSS, Pag-IBIG and Philhealth dues, resulting in a taxable income of 22,211 pesos.

Copyright:

© All Rights Reserved

Available Formats

Download as ODT, PDF, TXT or read online from Scribd

You are on page 1of 1

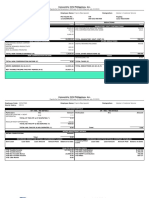

Kassandra Chelsea Casibang

BSA 1-1

ACTIVITY

From your answer in our Activity on Timekeeping,

compute the taxable income of Employee A. Use this

format.

Basic Pay (I go directly to per hour basis) (82.81 x P 200) P 16,562

Add: Overtime (17 hours X P 200 X 1.25) 4,250

Night Differential (4 x P 200X 1.25 X .10) 100

Holiday Pay (7.73 x P200 x 1.30) 2,009.80

GROSS REVENUE 22,921.80

LESS:

Tardiness (These were already taken since

I used

Undertime the net no. of hours per

timekeeping

SSS Dues 400.00

Pagibig Dues 50.00

Philhealth Dues 261.00

Total Deductions 711.00

TAXABLE INCOME 22,211

You might also like

- 01-18-2020 Payslip PDFDocument1 page01-18-2020 Payslip PDFCarla ZanteNo ratings yet

- MR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDDocument1 pageMR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDSharanu HosamaniNo ratings yet

- Assignment No. 2Document22 pagesAssignment No. 2Krung KrungNo ratings yet

- PellaUSOnlinePayslip PDFDocument2 pagesPellaUSOnlinePayslip PDFJoshuaM.ByrneNo ratings yet

- Earnings Taxable Non Taxable Hours Total: OvertimeDocument1 pageEarnings Taxable Non Taxable Hours Total: OvertimeIamRachaelNo ratings yet

- CombinepdfDocument5 pagesCombinepdfKaye ApostolNo ratings yet

- CombinepdfDocument5 pagesCombinepdfKaye ApostolNo ratings yet

- Heads of Income Monthly Actual YTD Projected TotalDocument2 pagesHeads of Income Monthly Actual YTD Projected TotalDsr Santhosh KumarNo ratings yet

- Pay Advice: Results Alaska IncDocument1 pagePay Advice: Results Alaska Incbktsuna0201No ratings yet

- PayslipDocument1 pagePayslipJM GereroNo ratings yet

- Rates ExcelDocument13 pagesRates ExcelAugie LingaNo ratings yet

- PayslipDocument1 pagePayslipjelidom22No ratings yet

- 3rd Floor, JP Techno Park, No.3/1, Millers Road, Bangalore 560001, IndiaDocument1 page3rd Floor, JP Techno Park, No.3/1, Millers Road, Bangalore 560001, IndiaGamer JiNo ratings yet

- Deductions (B) Earnings (A) : Print Date: 03.11.2019, Print Time: 10:35:01Document1 pageDeductions (B) Earnings (A) : Print Date: 03.11.2019, Print Time: 10:35:01Kumar VarunNo ratings yet

- Buy LIT Makeup & Cosmetic Products Online in India - LIT by MyGlammDocument1 pageBuy LIT Makeup & Cosmetic Products Online in India - LIT by MyGlammhariomsingh.karnisenaNo ratings yet

- Adidas 567000 qs601F4RPktIDocument3 pagesAdidas 567000 qs601F4RPktImgmawanayNo ratings yet

- Karan Peshwani-Payslip - Oct-2023Document1 pageKaran Peshwani-Payslip - Oct-2023Karan PeshwaniNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsRICHYBOY SALACNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDj HandsomeNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionspaacostanNo ratings yet

- Asuncion, Maria Myla Reniedo Payslip Nov 16-30-2022Document1 pageAsuncion, Maria Myla Reniedo Payslip Nov 16-30-2022Myla Reniedo AsuncionNo ratings yet

- Taxable Earnings Hours/Day S Amount PHP Deductions Amount PHP Amount PHPDocument1 pageTaxable Earnings Hours/Day S Amount PHP Deductions Amount PHP Amount PHPKent CantoNo ratings yet

- Transcom Worldwide Philippines, Inc.: Taxable Income DetailsDocument1 pageTranscom Worldwide Philippines, Inc.: Taxable Income Detailsbktsuna0201No ratings yet

- My Pay SlipDocument4 pagesMy Pay Slipعلي سعيد سعودNo ratings yet

- 24-7 Intouch PH IncDocument1 page24-7 Intouch PH Incflordeluna100% (1)

- Payslip IndiaApproved On30 Nov 2023 - UnlockedDocument3 pagesPayslip IndiaApproved On30 Nov 2023 - UnlockedrithulblockchainNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsKaye ApostolNo ratings yet

- Cdadc69d Bb7c 4a3d A96a 73cdebed7ab2 4e9a8540 62f6 4bd7 9ad1 Eb878cdb0d28 PayslipDocument1 pageCdadc69d Bb7c 4a3d A96a 73cdebed7ab2 4e9a8540 62f6 4bd7 9ad1 Eb878cdb0d28 PayslipHenry CagaNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt Contributionsxander fordNo ratings yet

- September 15 Payslip PDFDocument1 pageSeptember 15 Payslip PDFjohn lerry loberioNo ratings yet

- Deductions (B) Earnings (A) : Print Date: 03.11.2019, Print Time: 20:51:14Document1 pageDeductions (B) Earnings (A) : Print Date: 03.11.2019, Print Time: 20:51:14Fire SuperstarNo ratings yet

- Encore Receivable Management, Inc. Philippine BranchDocument2 pagesEncore Receivable Management, Inc. Philippine BranchSamantha Joyce Valera TaezaNo ratings yet

- Rate 12 HRSDocument2 pagesRate 12 HRSRichardNo ratings yet

- Catalbas, Joshua Galura 13588176 80031716 11,000.00 07/15/2023 09/08/2023Document4 pagesCatalbas, Joshua Galura 13588176 80031716 11,000.00 07/15/2023 09/08/2023catalbasNo ratings yet

- Bai Tap 3-SolutionDocument3 pagesBai Tap 3-SolutionMạnh hưng LêNo ratings yet

- PayslipDocument1 pagePayslipjohn lerry loberioNo ratings yet

- Mandolado, Ritchell E. BSBA-FM 1-2Document9 pagesMandolado, Ritchell E. BSBA-FM 1-2Moira TayagNo ratings yet

- Your Pay Advice For Pay Ending 30 09 2022Document2 pagesYour Pay Advice For Pay Ending 30 09 2022iqbal.shahid0374No ratings yet

- HendRes Financial First QTR 2010Document5 pagesHendRes Financial First QTR 2010sunshinedavidsonNo ratings yet

- FormDocument1 pageFormPatel NiravNo ratings yet

- Standard - Cash FlowDocument2 pagesStandard - Cash Flowolyad tesfayeNo ratings yet

- Financial Study Computation - JGRCSM Home Designs 2Document8 pagesFinancial Study Computation - JGRCSM Home Designs 2rhoella jhayn marie dizonNo ratings yet

- Profit & Loss Statement: Al Istethaa Elect Cont LLC Year End 2020Document1 pageProfit & Loss Statement: Al Istethaa Elect Cont LLC Year End 2020Asad RehmanNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsEstephen EncenzoNo ratings yet

- Karan Peshwani-Payslip - Sep-2023Document1 pageKaran Peshwani-Payslip - Sep-2023Karan PeshwaniNo ratings yet

- Examples PayrollDocument10 pagesExamples PayrollAlliana Nicole Masalta TorrefrancaNo ratings yet

- Prabhat Shankar Ranjan - 510033 - F&FDocument1 pagePrabhat Shankar Ranjan - 510033 - F&FTechnoCommercial2 OfficeNo ratings yet

- Statement of Salary As of 2019-08-2: Earnings DeductionsDocument1 pageStatement of Salary As of 2019-08-2: Earnings DeductionsHenry CagaNo ratings yet

- Final Na Jud FinancialDocument84 pagesFinal Na Jud FinancialMichael A. BerturanNo ratings yet

- Leido, Ivan Kyle Santiago 13288188 80035411 7,950.00 06/15/2023 06/17/2023Document1 pageLeido, Ivan Kyle Santiago 13288188 80035411 7,950.00 06/15/2023 06/17/2023ybn LdNo ratings yet

- Investment Outlays at Time 0Document3 pagesInvestment Outlays at Time 0jualNo ratings yet

- Conneqt Business Solutions Limited: 286124 Siddhant Murari SharmaDocument1 pageConneqt Business Solutions Limited: 286124 Siddhant Murari SharmaRadha SharmaNo ratings yet

- Debosmita Sarkar - 121328 - Settlement Payslip - RerunDocument3 pagesDebosmita Sarkar - 121328 - Settlement Payslip - RerunMajumdar VijayNo ratings yet

- Cash Outflows (Beginning of The Project) Amount (In Rs. Lakh)Document3 pagesCash Outflows (Beginning of The Project) Amount (In Rs. Lakh)Twinkle ChoudharyNo ratings yet

- Salary Slip Conneqt Business SolutionDocument1 pageSalary Slip Conneqt Business Solutionbittu yoNo ratings yet

- Dec 15 PayslipDocument1 pageDec 15 PayslipMariane Kaye CaseresNo ratings yet

- Sindoor 2Document2 pagesSindoor 2sanju.wageeshaNo ratings yet

- Activity No.3Document2 pagesActivity No.3Krung KrungNo ratings yet

- Casibang OEDocument2 pagesCasibang OEKrung KrungNo ratings yet

- Casibang ch6Document7 pagesCasibang ch6Krung KrungNo ratings yet

- Workforce PlanningDocument2 pagesWorkforce PlanningKrung KrungNo ratings yet

- Casibang ch5Document3 pagesCasibang ch5Krung KrungNo ratings yet

- Central Tendency: Mode, Median, and MeanDocument15 pagesCentral Tendency: Mode, Median, and MeanKrung KrungNo ratings yet

- 4 Numerical Methods For Describing DataDocument50 pages4 Numerical Methods For Describing DataKrung KrungNo ratings yet

- Peace, Justice, and Strong Institutions Amid The COVID-19 Pandemic in The PhilippinesDocument6 pagesPeace, Justice, and Strong Institutions Amid The COVID-19 Pandemic in The PhilippinesKrung KrungNo ratings yet

- Activities Done by The Students Bsa 1-1 Friday # Stud No. Name Workou T REFDocument2 pagesActivities Done by The Students Bsa 1-1 Friday # Stud No. Name Workou T REFKrung KrungNo ratings yet

- Conceptual FrameworkDocument1 pageConceptual FrameworkKrung KrungNo ratings yet

- Marketing PlanDocument37 pagesMarketing PlanKrung KrungNo ratings yet

- To Remind of The Happy Memories He Shared With His Mother, He Continued To WearDocument1 pageTo Remind of The Happy Memories He Shared With His Mother, He Continued To WearKrung KrungNo ratings yet

- Types of Account Titles UsedDocument48 pagesTypes of Account Titles UsedKrung KrungNo ratings yet