Professional Documents

Culture Documents

1at The Current Year

Uploaded by

dagohoy kennethOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1at The Current Year

Uploaded by

dagohoy kennethCopyright:

Available Formats

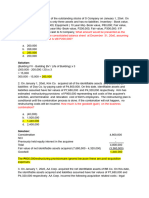

____ 1 At the current year-end, Grey Company issued 4,000 ordinary shares of P100 par

value in connection with a stock dividend. The market value per share on the date of declaration was

P150. The shareholders’ equity accounts immediately before issuance of the stock dividend shares were

as follows:

Ordinary share capital P100 par, 50,000 shares

authorized, 20,000 shares outstanding 2,000,000

Share premium 3,000,000

Retained earnings 1,500,000

What amount should be reported as retained earnings immediately after the stock dividend?

a. 1,100,000 c. 2,100,000

b 1,500,000 d 900,00

. .

____ 2. Ray Company declared a 5% stock dividend on 100,000 issued and outstanding

shares of P20 par value, which had a fair value of P20 per share before the stock dividend was declared.

This stock dividend was distributed 60 days after the declaration date.

What is the increase in current liabilities as a result of the stock dividend declaration?

a. 250,000 c. 150,000

b 100,000 d. 0

.

____ 3. solace Company declared and distributed 10% stock dividend with fair value of

P1,500,000 and par value of P1,000,000, and 25% stock dividend wit fair value o P4,000,000 and par

value of P3,500,000.

What aggregate amount should be debited to retained earnings for the stock diveidends?

a. 4,500,000 c. 5,000,000

b 3,500,000 d 5,500,000

. .

____ 4. At the beginning of the current year, Flash Company had retained earnings of

P4,000,000. During the year, the entity reported net income of P2,000,000, sold treasury shares at a

“gain” of P720,000, declared a cahs dividend of P1,200,000, had declared and issued a small share

dividend of 60,000 shares with P10 par value when the fair value of the share was P20

What is the amount of retained earnings available for dividends at the end of the current year?

a. 3,600,000 c. 4,320,000

b 4,200,000 d 4,920,000

. .

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Self Test No. C3 Earnings Per Share and Book Value Per ShareDocument3 pagesSelf Test No. C3 Earnings Per Share and Book Value Per ShareAlthea CoronadoNo ratings yet

- Feasibility Study of Establishing Siberian Frowyow Parlour Villarosa Trial FcaDocument185 pagesFeasibility Study of Establishing Siberian Frowyow Parlour Villarosa Trial Fcadagohoy kennethNo ratings yet

- Advance Accounting2 FinalsDocument6 pagesAdvance Accounting2 FinalsClarice Kristine SalesNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Corporation ReviewerDocument5 pagesCorporation ReviewerKara GamerNo ratings yet

- SHAREHOLDERS EQUITY - ProblemsDocument3 pagesSHAREHOLDERS EQUITY - ProblemsGlen Javellana0% (2)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Prequalifying Exam Level 2 3 Set B FSUU AccountingDocument9 pagesPrequalifying Exam Level 2 3 Set B FSUU AccountingRobert CastilloNo ratings yet

- ACCTG 002 HandoutDocument5 pagesACCTG 002 HandoutMelana Muli100% (3)

- Multiple Choice - ProblemsDocument2 pagesMultiple Choice - ProblemsAnthony Koko Carlobos0% (1)

- Shareholders Equity With AnswersDocument4 pagesShareholders Equity With AnswersJillian Faye Doria100% (3)

- AFAR - Mastery Class Batch 2Document5 pagesAFAR - Mastery Class Batch 2Antonette Eve CelomineNo ratings yet

- Simulated Qualifying Exam ReviewerDocument10 pagesSimulated Qualifying Exam ReviewerJanina Frances Ruidera100% (1)

- Reviewer - Intangible AssetsDocument7 pagesReviewer - Intangible AssetsKim Nicole Reyes100% (4)

- Business Combination and Consolidated FS 2020 PDFDocument22 pagesBusiness Combination and Consolidated FS 2020 PDFAPO 0005100% (1)

- Seco Company Was Incorporated On January 1Document1 pageSeco Company Was Incorporated On January 1dagohoy kennethNo ratings yet

- FAR-02 Retained EarningsDocument5 pagesFAR-02 Retained EarningsKim Cristian MaañoNo ratings yet

- Reviewer PDFDocument9 pagesReviewer PDFKarysse Arielle Noel Jalao100% (1)

- BSA2BQuiz 3Document19 pagesBSA2BQuiz 3Monica Enrico0% (1)

- PARCOR DiscussionDocument6 pagesPARCOR DiscussionSittiNo ratings yet

- ParCor Corpo EQ Set ADocument3 pagesParCor Corpo EQ Set AMara LacsamanaNo ratings yet

- Chapter 22: Retained Earnings (Dividends)Document12 pagesChapter 22: Retained Earnings (Dividends)Illion IllionNo ratings yet

- Exercises 122BDocument3 pagesExercises 122BAthena Fatmah AmpuanNo ratings yet

- Quiz AppliedDocument12 pagesQuiz AppliedLharissa Ballesteros100% (1)

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaJustine CruzNo ratings yet

- BusCom Seatwork - 05 15 2021Document4 pagesBusCom Seatwork - 05 15 2021Joshua UmaliNo ratings yet

- Quizzer RETAINED EARNINGSDocument5 pagesQuizzer RETAINED EARNINGSPrincess Frean VillegasNo ratings yet

- FAR-01 Contributed CapitalDocument3 pagesFAR-01 Contributed CapitalKim Cristian MaañoNo ratings yet

- ACP Task 3 (20230328164424)Document2 pagesACP Task 3 (20230328164424)Roque LestieNo ratings yet

- Acctg 5Document6 pagesAcctg 5Charmane MatiasNo ratings yet

- Activity With Youtube Video Shareholders Equity Part 1Document2 pagesActivity With Youtube Video Shareholders Equity Part 1Krestyl Ann GabaldaNo ratings yet

- IA2 Finals ReviewerDocument6 pagesIA2 Finals ReviewerJoana MarieNo ratings yet

- Toaz - Info Far Vol 2 Chapter 22 25docx PRDocument22 pagesToaz - Info Far Vol 2 Chapter 22 25docx PRVivialyn PalimpingNo ratings yet

- Midterms SolutionDocument9 pagesMidterms SolutiondmangiginNo ratings yet

- Oria, Maybelyn S. Cfas - Sec 10: What Total Amount Should Be Reported As Shareholders' Equity?Document52 pagesOria, Maybelyn S. Cfas - Sec 10: What Total Amount Should Be Reported As Shareholders' Equity?May OriaNo ratings yet

- Semi Final Exam in CCA33 2022 2023 2Document7 pagesSemi Final Exam in CCA33 2022 2023 2Ladignon IvyNo ratings yet

- Name: - Score: - Year/Course/Section: - ScheduleDocument10 pagesName: - Score: - Year/Course/Section: - ScheduleYukiNo ratings yet

- Shareholders EquityDocument6 pagesShareholders EquityLhea VillanuevaNo ratings yet

- Auditing and Assurance Exam MidtermDocument4 pagesAuditing and Assurance Exam MidtermMica Ella San DiegoNo ratings yet

- Investments AssignmentDocument3 pagesInvestments AssignmentKhai Supleo PabelicoNo ratings yet

- Final Exam Advance IIDocument4 pagesFinal Exam Advance IIRobin RossNo ratings yet

- Bcacctg2 - Accounting For Partnership and Corporation: Exercise 4 Shareholders' EquityDocument4 pagesBcacctg2 - Accounting For Partnership and Corporation: Exercise 4 Shareholders' EquityNimfa SantiagoNo ratings yet

- 6931 - Basic Earnings Per ShareDocument2 pages6931 - Basic Earnings Per ShareJennifer RueloNo ratings yet

- Afar 2 ExamDocument3 pagesAfar 2 ExamNurul-Fawzia Balindong0% (4)

- Exercises 122Document2 pagesExercises 122Athena Fatmah AmpuanNo ratings yet

- Acctg 207B Final ExamDocument5 pagesAcctg 207B Final ExamJERROLD EIRVIN PAYOPAYNo ratings yet

- CFASDocument3 pagesCFASataydeyessaNo ratings yet

- Shareholders Equity Bafacr4x Onlineglimpsenujpia 1Document12 pagesShareholders Equity Bafacr4x Onlineglimpsenujpia 1Aga Mathew MayugaNo ratings yet

- Shareholders Equity Bafacr4x Onlineglimpsenujpia 1 Merged Compressed 1Document98 pagesShareholders Equity Bafacr4x Onlineglimpsenujpia 1 Merged Compressed 1Aga Mathew MayugaNo ratings yet

- Bfjpia Cup 3 - Practical Accounting 2 Easy: Page 1 of 10Document10 pagesBfjpia Cup 3 - Practical Accounting 2 Easy: Page 1 of 10Arah OpalecNo ratings yet

- Prac 2Document10 pagesPrac 2Fery AnnNo ratings yet

- Bus Com 13Document4 pagesBus Com 13Chabelita MijaresNo ratings yet

- Afar Section 402: Business CombinationsDocument3 pagesAfar Section 402: Business CombinationsDianna Tercino IINo ratings yet

- Practical Accounting 2 (P2)Document12 pagesPractical Accounting 2 (P2)Nico evansNo ratings yet

- 6971 - Investment AssociateDocument2 pages6971 - Investment AssociateMarjhon TubillaNo ratings yet

- Quiz Questionsdocx PRDocument7 pagesQuiz Questionsdocx PRJulian CheezeNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErine ContranoNo ratings yet

- Accounting 315 - Quiz Business CombinationDocument3 pagesAccounting 315 - Quiz Business CombinationJoshua HongNo ratings yet

- Aa BcprelimsDocument4 pagesAa BcprelimsJamie RamosNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Graphic OrganizerDocument1 pageGraphic Organizerdagohoy kennethNo ratings yet

- The Advantages of ABM Strands That You Need To KnowDocument2 pagesThe Advantages of ABM Strands That You Need To Knowdagohoy kennethNo ratings yet

- 11123Document2 pages11123dagohoy kennethNo ratings yet

- Chapter 9 Conversion Investigation MethodsDocument21 pagesChapter 9 Conversion Investigation Methodsdagohoy kennethNo ratings yet

- Chapter 2 Why People Commit FraudDocument16 pagesChapter 2 Why People Commit Frauddagohoy kennethNo ratings yet

- Sanderson Company Manufactures CustomDocument1 pageSanderson Company Manufactures Customdagohoy kennethNo ratings yet

- D. Disclosure of P200,000Document2 pagesD. Disclosure of P200,000dagohoy kennethNo ratings yet

- Basic Earnings Per ShareDocument2 pagesBasic Earnings Per Sharedagohoy kennethNo ratings yet

- YryryrDocument2 pagesYryryrdagohoy kennethNo ratings yet

- The Term Relevant Cost Applies To All of The Following Decision Situations Except The ADocument1 pageThe Term Relevant Cost Applies To All of The Following Decision Situations Except The Adagohoy kennethNo ratings yet

- Blah Blah BlahDocument1 pageBlah Blah Blahdagohoy kennethNo ratings yet

- The Balance Sheet For The Partnership of JJ CC and TTDocument1 pageThe Balance Sheet For The Partnership of JJ CC and TTdagohoy kennethNo ratings yet

- Midterm Exam Part 2 Short ProblemsDocument5 pagesMidterm Exam Part 2 Short Problemsdagohoy kennethNo ratings yet

- During The Current YearDocument1 pageDuring The Current Yeardagohoy kennethNo ratings yet

- Aaa 333Document1 pageAaa 333dagohoy kennethNo ratings yet

- M & N Partnership Balance Sheet - July 1, 2021Document1 pageM & N Partnership Balance Sheet - July 1, 2021dagohoy kennethNo ratings yet

- For Item Nos. 20 To 21Document1 pageFor Item Nos. 20 To 21dagohoy kennethNo ratings yet

- Global CompanyDocument1 pageGlobal Companydagohoy kennethNo ratings yet

- What Is The Effect of The Declaration of Scrip Dividends On Total Liabilities and ShareholdersDocument1 pageWhat Is The Effect of The Declaration of Scrip Dividends On Total Liabilities and Shareholdersdagohoy kennethNo ratings yet

- Kiara Company Provided The Following DataDocument1 pageKiara Company Provided The Following Datadagohoy kennethNo ratings yet