Professional Documents

Culture Documents

Intangibles PDF

Intangibles PDF

Uploaded by

Villaruz Shereen MaeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Intangibles PDF

Intangibles PDF

Uploaded by

Villaruz Shereen MaeCopyright:

Available Formats

CHAPTER

BLUE NOTES

22 S

L

An intangible asset is an identifiable nonmonetary asset without physical substance. It must be controlled by the entity

as a result of past event and from which future economic benefits are expected to flow to the entity. (PAS 38, par. 8)

Essential Criteria in Intangible Asset Definition

1. Identifiability

An asset is identifiable when:

a. It is separable.

b. It arises from contractual or other legal rights.

Identifiable Intangible Asset (if acquired through purchase and could be rented or sold separately)

Examples:

a. Patent

b. Copyright

c. Franchise

d. Trademark

e. Lease Rights

f. Computer Software

g. Broadcasting License

h. Airline Right

i. Fishing Right

Unidentifiable Intangible Asset (if can only be identified with the entity as a whole)

Example:

a. Goodwill

2. Control

It is the power of the entity to obtain the future economic benefits flowing from the intangible asset and

restrict the access of others to those benefits.

Example: Control arising from legal rights such as trademark, copyright or patent

3. Future Economic Benefits

It may include revenue from sale, cost savings and other benefits.

Example: Use of legal right to use a new technology to reduce future production costs

Cost of an Intangible Asset

1. Acquired separately

a. The cost comprises the purchase price, import duties, and nonrefundable purchase taxes and any directly

attributable cost of preparing the asset for its intended use.

b. When payment is deferred beyond normal credit terms, its cost is the cash price equivalent.

2. Acquired as part of Business Combination

a. When the FV of identifiable intangible asset can be measured with sufficient reliability, the cost is based

on its FV on acquisition date

b. When there is an active market, the FV is based on quoted market price/current bid price.

c. When there is no active market, the FV is equal to the amount that would be paid by the entity for the

asset in an arm’s length transaction between knowledgeable and willing parties.

Example: Discounted Net Cash Flows

Theory of Accounts Practical Accounting 1

78 USL Blue Notes Chapter 22 – Intangibles

3. Acquired by Government Grant(PAS 20)

Example: Airport land rights, licenses to operate radio or television stations, import licenses

a. Fair Value

b. Nominal amount or zero plus any directly attributable expenditure.

4. Internally generated

a. It comprises all directly attributable costs necessary to create, produce or prepare the asset to be capable

of operating it in the manner intended by the management.

Examples:

Cost of materials and services used or consumed

Cost of employee benefits

Registration fee for a legal right

Amortization of patents or licenses used to generate the asset

Examples of costs excluded in the cost of an intangible asset and expensed when incurred

Cost of introducing a new product or service, advertising and promotional

Relocation costs in a new location or with a new class of customers, reorganization costs

Cost of staff training

Administration and other general overhead costs

Cost incurred while an asset has yet to be brought in the manner intended by the management

Initial operating losses, start up costs

Recognition

1. It is probable that the future economic benefits that are attributable to the asset will flow to the entity.

2. The cost of the intangible asset can be measured reliably.

Initial Measurement

An entity shall measure an intangible asset initially at cost.

Subsequent Measurement

As its accounting policy, an entity shall choose either:

1. Cost model (Cost – Accum. Amortization – Accum. Impairment Losses)

2. Revaluation model (Revalued Amount – Subsequent Accum. Amortization – Subsequent Accum. Impairment

Losses)

Note: An intangible asset can only be carried at revalued amount if there is an active market for the asset.

Treatment of subsequent expenditure

General Rule : A subsequent expenditure on an intangible asset shall be recognized as an expense.

Exception : A subsequent expenditure may be capitalized when:

1. It is probable that future economic benefits that are attributable to the subsequent expenditure

will flow to the entity.

2. The subsequent expenditure can be measured reliably.

Amortization is the systematic allocation of the depreciable amount of an intangible asset over the asset’s useful life.

1. Method

The amortization method shall reflect the pattern in which the economic benefits from the asset are

consumed. If such pattern cannot be determined reliably, the straight line method is used.

2. Residual Value

General Rule : The residual value of an intangible asset shall be presumed to be zero.

Practical Accounting 1 Theory of Accounts

Chapter 22 - Intangibles USL Blue Notes 79

Exception : a. When at the end of its useful life, there is a committed third party buyer.

b. When at the end of its useful life, there is an active market for its residual value.

Impairment

Impairment of intangible assets is recognized in accordance with PAS 36 on impairment of assets.

Useful Life

1. Factors in determining the useful life

a. Technical, technological and other type of obsolescence

b. Expected action by competitors or potential competitors

c. Expected usage of the asset by the entity

d. Typical product life cycle for the asset

e. Stability of the industry in which the asset operates

f. Level of maintenance expenditure required to obtain the expected future economic benefits from the

asset

g. The useful life of the asset may be dependent on the useful life of other assets of the entity

h. Period of control over the asset and legal or similar limits on the use of the asset

2. Assessment whether:

a. Finite or Limited Life (amortized over their useful life)

b. Indefinite Life (tested for impairment at least annually and whenever there is an indication of impairment)

There is no foreseeable limit to the period over which the asset is expected to generate net cash flows.

Note: The useful life of an intangible asset that arises from contractual or other legal rights shall not exceed the period of the

contractual or legal rights.

If the limited term can be renewed, the renewal period shall be included only in cases of renewal by the entity with

insignificant cost.

Derecognition

An intangible asset shall be derecognized from the SFP:

a. On asset disposal

b. When no future economic benefits are expected from its use and disposal

Gain/Loss from derecognition (Net disposal proceeds – CA of asset) shall be recognized as other

income/expense in the income statement.

Disclosures

An entity shall disclose the following for each class of intangible assets, distinguishing between internally generated

intangible assets and other intangible assets.

1. Whether useful lives are indefinite or finite, and if finite, the useful lives or the amortization rate.

2. The amortization method.

3. The gross carrying amount and any accumulated amortization (aggregated with accumulated impairment

losses) at the beginning and end of the period.

4. The line item in the income statement in which any amortization of intangible asset is included.

5. Additions, separately showing those internally generated, those acquired separately and those acquired

through business combination.

6. Intangible assets classified as held for sale in accordance with PFRS 5.

7. Increases and decreases in intangible assets resulting from revaluations.

8. Impairment losses and reversal of impairment losses.

9. Net exchange differences on translation.

10. The carrying amount of intangible asset with indefinite life and the reason supporting the assessment of

Theory of Accounts Practical Accounting 1

80 USL Blue Notes Chapter 22 – Intangibles

indefinite life.

11. The carrying amount and remaining amortization period of intangible assets that are material to the entity’s

financial statements.

12. The carrying amount of intangible assets whose title is restricted or pledged as collateral security.

13. Contractual commitments for the acquisition of intangible assets.

14. Intangible assets acquired by way of government grant and initially recognized at fair value.

15. The amount of research and development expenditure recognized as expense during the period.

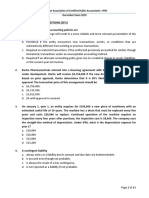

Illustrative Problems

1. Zekoki Company has developed a database of names and addresses of professional people who reach their 25 th

birthdays between the years 2008 and 2014 and intends to exploit this by selling the information to suppliers of

life enhancement products and solutions for junior executives. The company has incurred a total P500,000 to

develop the database.

The company has also incurred a total P800,000 of promoting the databases to vendors of such solutions, such as

adventure holiday companies. The company has also incurred P500,000 losses as there are substantial administrative

costs and no income yet. Zekoki Company intends to capitalize all the costs incurred in relation to the database

promotion and administrative costs.

What amount of intangible asset should Zekoki Company recognize?

Solution: Cost of developing the database 500,000

2. On June 30, 2014, Black Company purchased the net assets of Decker Company. The acquisition resulted in a

purchased goodwill of P1,500,000. During 2014, Black incurred additional costs of developing goodwill: P500,000

for employee training and P250,000 for hiring additional employees.

How much should Black report as goodwill in its December 31, 2014 statement of financial position?

Solution: Purchased goodwill 1,500,000

Practical Accounting 1 Theory of Accounts

You might also like

- ch12 PDFDocument37 pagesch12 PDFerylpaez93% (15)

- ch12 - Problems and SolutionsDocument44 pagesch12 - Problems and SolutionsErica Borres0% (1)

- CH 02Document9 pagesCH 02Omar YounisNo ratings yet

- Golden Book of Accounting Finance Interviews Part I Site Version V 1.0 PDFDocument62 pagesGolden Book of Accounting Finance Interviews Part I Site Version V 1.0 PDFRAJESH M S100% (2)

- Practice Questions: Global Certified Management AccountantDocument23 pagesPractice Questions: Global Certified Management AccountantThiha WinNo ratings yet

- Module 4 - INTACC2 Intangible AssetsDocument20 pagesModule 4 - INTACC2 Intangible AssetsKhan TanNo ratings yet

- Chapter 7 Intangible AssetsDocument70 pagesChapter 7 Intangible AssetsLovely AbadianoNo ratings yet

- Leasing and IADocument39 pagesLeasing and IAshashalalaxiangNo ratings yet

- Accounting Standard 26 - Intangible Assets Issuing Authority: Status: Effective DateDocument6 pagesAccounting Standard 26 - Intangible Assets Issuing Authority: Status: Effective DatePiyush AgarwalNo ratings yet

- INTANGIBLESDocument40 pagesINTANGIBLESPhoebe Dayrit CunananNo ratings yet

- Accounting For Intangible Assets (LKAS 38) 2Document10 pagesAccounting For Intangible Assets (LKAS 38) 29gvsh2w7xyNo ratings yet

- Chapter 12 Intangible Assets ReviewerDocument4 pagesChapter 12 Intangible Assets ReviewerKaname KuranNo ratings yet

- Chapter 21 Intangible AssetsDocument10 pagesChapter 21 Intangible AssetsEllen MaskariñoNo ratings yet

- Intangible Assets Lecture and ExercisesDocument16 pagesIntangible Assets Lecture and ExercisesRNo ratings yet

- PAS 38 - Intangible Asset, R&D CostDocument5 pagesPAS 38 - Intangible Asset, R&D Costd.pagkatoytoyNo ratings yet

- Study Note 1.2, Page 12 32Document21 pagesStudy Note 1.2, Page 12 32s4sahithNo ratings yet

- Intangible AssetsDocument16 pagesIntangible Assets566973801967% (3)

- Australian Financial Accounting 7Th Edition Deegan Test Bank Full Chapter PDFDocument67 pagesAustralian Financial Accounting 7Th Edition Deegan Test Bank Full Chapter PDFsarahpalmerotpdkjcwfq100% (13)

- Intangible AssetsDocument6 pagesIntangible Assetsmark fernandezNo ratings yet

- Intangible Assets1Document22 pagesIntangible Assets1hamarshi2010No ratings yet

- HKAS 38 Intangible Assets: B331 Tutorial 2 (2015)Document17 pagesHKAS 38 Intangible Assets: B331 Tutorial 2 (2015)macmac29No ratings yet

- HKAS 38 Intangible Assets: B331 Tutorial 2 (2015)Document17 pagesHKAS 38 Intangible Assets: B331 Tutorial 2 (2015)macmac29No ratings yet

- CFASDocument15 pagesCFASMary Rose NonesNo ratings yet

- AcctgDocument3 pagesAcctgMa. Alexandra Teddy BuenNo ratings yet

- Module 7 IntangiblesDocument14 pagesModule 7 Intangiblestite ko'y malakeNo ratings yet

- 10.11 AS 26 Intangible AssetsDocument5 pages10.11 AS 26 Intangible AssetsAnakin SkywalkerNo ratings yet

- Financial Reporting Notes SummaryDocument62 pagesFinancial Reporting Notes SummarylucitaevidentNo ratings yet

- Module 7 IntangiblesDocument14 pagesModule 7 IntangiblesEarl ENo ratings yet

- CFAS Notes For FINALS PDFDocument26 pagesCFAS Notes For FINALS PDFMarife PangesbanNo ratings yet

- Intangible AssetsDocument24 pagesIntangible AssetsSummer StarNo ratings yet

- Intangible Assets Under Pfrs ScopeDocument12 pagesIntangible Assets Under Pfrs ScopeYsabella ChenNo ratings yet

- Chapter 11 Intagible AssetsDocument5 pagesChapter 11 Intagible Assetsmaria isabellaNo ratings yet

- Ias 38Document33 pagesIas 38Reever River100% (1)

- Financial Accounting: Theory & Practice Intangible AssetsDocument81 pagesFinancial Accounting: Theory & Practice Intangible AssetsXNo ratings yet

- MFRS 138 Intangible AssetsDocument29 pagesMFRS 138 Intangible AssetsUmairah HusnaNo ratings yet

- Ias 16 & Ias 40Document47 pagesIas 16 & Ias 40Etiel Films / ኢትኤል ፊልሞች100% (1)

- PAS 38 Test BankDocument9 pagesPAS 38 Test BankJake ScotNo ratings yet

- PRACTICE EXERCISES INTANGIBLES Students 2021Document3 pagesPRACTICE EXERCISES INTANGIBLES Students 2021Nicole Anne Santiago SibuloNo ratings yet

- Intangible Assets - Part 1Document29 pagesIntangible Assets - Part 1Avery Paul MateoNo ratings yet

- Audit of Inv Property, NCA HFS and Disc OpDocument32 pagesAudit of Inv Property, NCA HFS and Disc OpPaula BitorNo ratings yet

- Section 18Document27 pagesSection 18Abata BageyuNo ratings yet

- ACC211 Mock Examination1Document11 pagesACC211 Mock Examination1jenayybangNo ratings yet

- ch12 Test Bank For Intermediate Accounting Ifrs Edition 3eDocument42 pagesch12 Test Bank For Intermediate Accounting Ifrs Edition 3eQuỳnh Châu100% (1)

- Intangible Assets NotesDocument6 pagesIntangible Assets NotesRaizel RamirezNo ratings yet

- Ias 38Document7 pagesIas 38Researcher BrianNo ratings yet

- SIM ACC 226ACCE 411 Week 4 To 5 COPY 1Document31 pagesSIM ACC 226ACCE 411 Week 4 To 5 COPY 1Mireya Yue100% (1)

- Intangible Assets and LiabilitiesDocument13 pagesIntangible Assets and LiabilitiesApril ManjaresNo ratings yet

- F7 Summary Dec 2011Document30 pagesF7 Summary Dec 2011artkodis100% (1)

- 4Document3 pages4Carlo ParasNo ratings yet

- TOA ASSET Midterm QuizDocument10 pagesTOA ASSET Midterm QuizEzra Mae SangcoNo ratings yet

- IntangiblesDocument7 pagesIntangiblesWertdie stanNo ratings yet

- Pas 38 - Intangible AssetsDocument21 pagesPas 38 - Intangible AssetsMa. Franceska Loiz T. RiveraNo ratings yet

- Cpa Review School of The Philippines ManilaDocument4 pagesCpa Review School of The Philippines ManilaAljur SalamedaNo ratings yet

- Accounting For Non - Current AssetsDocument10 pagesAccounting For Non - Current AssetsMichael BwireNo ratings yet

- Intangible AssetsmarykellyDocument7 pagesIntangible AssetsmarykellyAshura ShaibNo ratings yet

- Intangible AssetDocument50 pagesIntangible AssetglossvfiedNo ratings yet

- Summary of Ias 36Document4 pagesSummary of Ias 36Dewa WindhuNo ratings yet

- QUIZ - PAS 16 and 40 - CleanDocument6 pagesQUIZ - PAS 16 and 40 - CleanMay Anne MenesesNo ratings yet

- 025499885Document5 pages025499885Abigail PadillaNo ratings yet

- Fundamentals of Accounting Ii: Property, Plant and Equipment Are Tangible Items ThatDocument20 pagesFundamentals of Accounting Ii: Property, Plant and Equipment Are Tangible Items ThatYadeno GirmaNo ratings yet

- Ques. 1. Peterlee (A) - Purpose and Authoritative Status of The FrameworkDocument7 pagesQues. 1. Peterlee (A) - Purpose and Authoritative Status of The FrameworkJulet Harris-TopeyNo ratings yet

- Intangible Assets: Activities That Had Been Issued in July 1978Document3 pagesIntangible Assets: Activities That Had Been Issued in July 1978Latte MacchiatoNo ratings yet

- Ias 38Document6 pagesIas 38nychan99No ratings yet

- Chapter Summaries (Inv, Intangible Asset, Bio Asset)Document4 pagesChapter Summaries (Inv, Intangible Asset, Bio Asset)Kiana FernandezNo ratings yet

- Audit For Intangible AssetDocument30 pagesAudit For Intangible AssetWita AnggarainiNo ratings yet

- Constellation Software IncDocument6 pagesConstellation Software IncSugar RayNo ratings yet

- ĐỀ lần 1 - ĐỀ 4Document13 pagesĐỀ lần 1 - ĐỀ 4buitrantuuyen2003No ratings yet

- Financial Accounting For Managers Author: Sanjay Dhamija Financial Accounting For Managers Author: Sanjay DhamijaDocument42 pagesFinancial Accounting For Managers Author: Sanjay Dhamija Financial Accounting For Managers Author: Sanjay DhamijaShivam Thakur0% (1)

- Bva 3Document7 pagesBva 3najaneNo ratings yet

- Worldwide Accounting Diversity and International Standards: Chapter OutlineDocument19 pagesWorldwide Accounting Diversity and International Standards: Chapter OutlineJordan YoungNo ratings yet

- Chapter 1 Part 1 Investment Speculation GamblingDocument29 pagesChapter 1 Part 1 Investment Speculation GamblingNAVEEN GARG100% (1)

- MGT401 SolvedMCQs PAperForMidTErmDocument42 pagesMGT401 SolvedMCQs PAperForMidTErmMohsin Butt67% (3)

- Dfcamsw Intangibles Applied Auditing Woans 9-21-18Document2 pagesDfcamsw Intangibles Applied Auditing Woans 9-21-18rubert subangNo ratings yet

- Accounting For Business CombinationDocument60 pagesAccounting For Business CombinationFenny MarietzaNo ratings yet

- Financial Accounting Canadian 6th Edition Harrison Solutions Manual DownloadDocument79 pagesFinancial Accounting Canadian 6th Edition Harrison Solutions Manual DownloadDarla Escudero100% (23)

- Introduction To Transfer Taxation: Pamantasan NG Lungsod NG MuntinlupaDocument23 pagesIntroduction To Transfer Taxation: Pamantasan NG Lungsod NG MuntinlupaRizza Omalin100% (1)

- Audit Data Analytics To Traditional Procedures Mapping DocumentDocument553 pagesAudit Data Analytics To Traditional Procedures Mapping DocumentDarma Bonar TampubolonNo ratings yet

- IFRS-In-Practice-IAS-7-2019-2020 BDODocument36 pagesIFRS-In-Practice-IAS-7-2019-2020 BDOLeenin DominguezNo ratings yet

- ACCT 221-Corporate Financial ReportingDocument6 pagesACCT 221-Corporate Financial ReportingZulfeqar HaiderNo ratings yet

- Far-4312: Intangible Assets: - T R S ADocument8 pagesFar-4312: Intangible Assets: - T R S AKate ManalansanNo ratings yet

- Lebanese Association of Certified Public Accountants - IFRS December Exam 2019Document11 pagesLebanese Association of Certified Public Accountants - IFRS December Exam 2019jad NasserNo ratings yet

- ch09 Plant Assets, Natural Resources and Intangible Assets - StudentDocument20 pagesch09 Plant Assets, Natural Resources and Intangible Assets - StudentNhật TâmNo ratings yet

- PPTDocument33 pagesPPTanis solihah0% (1)

- Charlie Munger's Blue Chip Stamps Shareholder Letters - 1978-1982Document51 pagesCharlie Munger's Blue Chip Stamps Shareholder Letters - 1978-1982CanadianValueNo ratings yet

- 78940-SDL Attendance and LearningDocument21 pages78940-SDL Attendance and Learningprc.zamboanga.regulationcpdNo ratings yet

- Deloitte CombinacionDocument236 pagesDeloitte CombinacionEliecer Campos CárdenasNo ratings yet

- SPADE Analysis Globe Telecom Inc PDFDocument29 pagesSPADE Analysis Globe Telecom Inc PDFLara FloresNo ratings yet

- Vouching ControlDocument42 pagesVouching ControlSundayNo ratings yet