Professional Documents

Culture Documents

Strategic Cost Management

Uploaded by

Kim TaehyungOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Strategic Cost Management

Uploaded by

Kim TaehyungCopyright:

Available Formats

STRATEGIC COST MANAGEMENT

MANAGEMENT ACCOUNTING & FINANCIAL ACCOUNTING

Basic Concepts

Management – is the process of planning, organizing, and controlling a certain task to realize the objectives of the organization.

Basic Functions of Management

1. Planning involves setting immediate and long-term objectives and deciding which alternative is best suited to attain the

set objectives.

2. Organizing involves deciding how to utilize available resources as plans are carried out and tackling activities necessary

to achieve objectives such as staffing, subordinating, directing and motivating.

3. Controlling involves comparing actual performance with set plans and standards and deciding what corrective actions to

take should there be any deviation (variance) between actual and planned performance.

NOTE: Decision-making is an inherent function of management; all management functions would require certain amount of decision-

making.

Management by Objectives – is a procedure in which a subordinate and a supervisor agree on goals and the methods of achieving

them and develop a plan in accordance with that agreement. The subordinate is then evaluated with reference to the agreed plan at

the end of the period.

Management by Exception is a technique of highlighting those which vary significantly from plans and standards in line with the

management principle that executive time should be spent on items that are non-routine and are identified as top priority.

Management Accounting refers to reports designed to meet the needs of internal users, particularly the managers. The American

Association of Accountants (AAA) defined it as the application of appropriate techniques and concepts in processing the historical

and projected economic data of an entity to assist management in establishing a plan for reasonable economic objectives and in the

making of rational decisions with a view towards achieving these objectives.

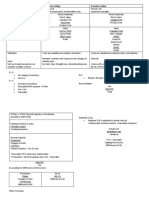

Management Accounting vs. Financial Accounting

FINANCIAL ACCOUNTING MANAGEMENT ACCOUNTING

1. User on information Primarily for external users Exclusively for internal users

2. Guiding principles Generally Accepted Accounting Principles Management wants and needs

3. Optional/Mandatory Mandatory Discretionary or optional

4. Type of information Primarily monetary (financial) in nature Monetary and non-monetary

5. Emphasis of reports Reliability (precision of data) Relevance (timeliness of data)

6. Purpose/End result Financial reporting and compliance Decision-making

7. Source of data From companys (internal) info. system From internal and external users

8. Amount of detail Compressed and simplified Extensive and detailed

9. Focus of information Focus mainly on business as a whole Focus on segments and business as a whole

10. Frequency Periodic (annually, quarterly) As frequent as need arises

11. Time orientation Mainly historical (past) data Future-oriented using current and past data

12. Unifying model Assets = Liabilities + Equity No unifying model or equation

The Controller: Chief Management Accountant

Controllership the practice of the established science of control, which is the process by which management assures itself that the

companys resources are obtained and utilized according to plans that are in line with the company s set objectives.

Controller an officer of an organization who has responsibility for the accounting aspect of management control. He generally

performs two basic roles: (1) accumulation and reporting of accounting information to all levels of management and (2) directing

managements attention to problems and assisting them in solving such problems.

Responsibilities of Controller:

1. Financial accounting 4. Cost & management accounting

2. Accounting systems & procedures 5. Financial analysis & special studies

3. Government & tax reporting

Controller vs. Treasurer

CONTROLLER TREASURER

1. Planning & control 5. Government reporting 1. Provision of capital 5. Credit & collections

2. Reporting & interpreting 6. Protection of assets 2. Investor relations 6. Investments

3. Evaluating & consulting 7. Economic appraisal 3. Short-term financing 7. Insurance

4. Tax administration 4. Banking & custody

Line Function vs. Staff Function

Line Function is the authority to give command or orders to subordinates. It exercises direct downward authority over line

departments (e.g., VP for operations over operations manager).

Staff Function is the authority to advise but not to command others; the function of providing line and staff managers with

specialized service and technical advice for support. It is exercised laterally or upward.

Standards of Ethical Conduct for Management Accountants

1. Competence maintain an appropriate level of professional competence by ongoing development of their knowledge and

skills.

2. Confidentiality refrain from disclosing confidential information acquired in the course of their work, except when

authorized and/or unless legally obligated to do so.

3. Integrity refrain from engaging in any activity that would prejudice their ability to carry out their duties ethically.

4. Objectivity communicate information fairly and objectively and disclose fully all relevant information relative to users

needs.

WRAP-UP EXERCISES (MULTIPLE-CHOICE)

1. The discipline of accounting concerned with providing information to management in making decisions about business

operations.

a. Cost accounting c. Government accounting

b. Financial accounting d. Management accounting

2. The primary purpose of management accounting is to provide information

a. To external users c. To both internal and external users

b. To internal users d. To management and government

3. Which of these information characteristics is deemed most important to management accounting?

a. Verifiability and accuracy c. Relevance, flexibility and timeliness

b. Comparability and full disclosure d. Conservatism and substance over form

4. Managerial accounting

a. Is governed by Generally Accepted Accounting Principles

b. Is concerned only with monetary information

c. Is discretionary rather than mandatory

d. Is focused on business as a whole rather than on segments of the business

5. Managerial accounting is similar to financial accounting in that

a. Both are governed by GAAP c. Both concentrate with historical costs

b. Both classify information in the same way d. Both deal with economic events

6. Which of the following is false?

a. Management accounting is synonymous to managerial accounting

b. Management accounting has no externally imposed standards while financial accounting has to follow the GAAP

c. Financial accounting deals with information that is primarily reported to individuals outside the organization

d. Cost accounting refers to accounting for the annual costs of operating a business.

7. Which of the following statements is true?

a. Financial accounting is a subset of cost accounting

b. Management accounting is a subset of cost accounting

c. Cost accounting is a subset of both management and financial accounting

d. Management accounting is a subset of both cost and financial accounting

8. Cost accounting system is usually utilized for

a. Internal and external reporting that may be used in making non-routine decisions and in developing plans and policies

b. External reporting to government, various outside parties and shareholders

c. Internal reporting for use in management planning and control, and external reporting to the extent its product-costing

function satisfies external reporting requirements

d. Internal reporting for use in planning and controlling routine operations

9. The basic management process does not include

a. Planning b. Controlling c. Subordinating d. Rationalizing

10. The function of management that compares planned results against actual results is known as

a. Planning b. Directing & motivating c. Controlling d. Decision-making

11. The management control process contains the following four sequential steps, including

I. Implementing a program of corrective action.

II. Comparing actual performance with standards.

III. Establishing standards of performance.

IV. Measuring actual performance.

The proper sequence of these activities is:

a. III, IV, I, II b. IV, III, II, I c. IV, II, III, I d. III, IV, II, I

12. A practice in which a subordinate and a supervisor agree on goals and the methods of achieving them.

a. Management by objectives c. Management by exception

b. Management by subjective d. Management by example

13. The controller primarily

a. Occupies a line position c. Occupies a non-supervisory rank-and-file position

b. Occupies a staff position d. Has no or very little influence in the decision-making process

14. Which is a characteristic of a line function rather than a staff function?

a. It is a function that gives support, advice and service to line managers.

b. It is the authority to command action or give orders to subordinates.

c. It is exercised laterally or upward.

d. It is a support function by provision of services to a co-department.

15. Which of the following statements is true?

a. The controller performs primarily a line function

b. The treasurer performs primarily a line function

c. The primary functions of a controller are basically the same as those of a treasurer.

d. The controller, as the title implies, exercises direct control over business operations.

16. Controllers are ordinarily not concerned with

a. Preparation of tax returns c. Protection of assets

b. Reporting to government d. Investor relations

17. The treasurer is usually not concerned with

a. Financial reporting c. Cash custody and banking

b. Short-term financing d. Credit extension and collection of bad debts

18. The professional certification most relevant for managerial accountants is the

a. CPA b. CIA c. CMA d. CFA

19. Which term is not an IMA Standard of Ethical Conduct for Management Accountants?

a. Competence b. Integrity c. Loyalty d. Objectivity

20. Management accounting information is deemed most successful if it

a. Is accurate c. Helps managers improve their decisions

b. Is easily understood by the user d. Helps creditors evaluate the companys ability to pay its debts

You might also like

- AC2102 - Management Accounting Environment - Review Class - Answer KeyDocument9 pagesAC2102 - Management Accounting Environment - Review Class - Answer KeyJona FranciscoNo ratings yet

- MS Multiple Choice Part IIDocument4 pagesMS Multiple Choice Part IIENo ratings yet

- Act 3Document8 pagesAct 3Memey C.No ratings yet

- TAXATION ATsDocument13 pagesTAXATION ATsgazer beamNo ratings yet

- Quiz 001 MANAGEMENT ACCOUNTINGDocument6 pagesQuiz 001 MANAGEMENT ACCOUNTINGGracelle Mae OrallerNo ratings yet

- How management accountants support strategic decisionsDocument2 pagesHow management accountants support strategic decisionsMaricar Dela Cruz VLOGSNo ratings yet

- Relevant CostingDocument6 pagesRelevant CostingJonathan Vidar100% (1)

- Auditing Region 10Document32 pagesAuditing Region 10Jan Christopher CabadingNo ratings yet

- Management 9 Lesson 5 - Operating & Financial Budgeting Review Problems Multiple ChoiceDocument5 pagesManagement 9 Lesson 5 - Operating & Financial Budgeting Review Problems Multiple ChoiceDon CabasiNo ratings yet

- MS 34a-3 PDFDocument1 pageMS 34a-3 PDFSeanNo ratings yet

- 09 X07 C ResponsibilityDocument9 pages09 X07 C ResponsibilityAnjo PadillaNo ratings yet

- (Resa2017) Mas-A (Management Accounting)Document4 pages(Resa2017) Mas-A (Management Accounting)Adam SmithNo ratings yet

- Mas 2Document5 pagesMas 2geminailnaNo ratings yet

- Mas6 7Document46 pagesMas6 7Villena Divina VictoriaNo ratings yet

- Chapter 1 - FS AnalysisDocument40 pagesChapter 1 - FS AnalysisKenneth Bryan Tegerero Tegio100% (2)

- Answer Selected Answer: Correct Answer: Response Feedback:: Second Quarter IsDocument11 pagesAnswer Selected Answer: Correct Answer: Response Feedback:: Second Quarter IsKim FloresNo ratings yet

- SHORT-TERM BUDGETING - Review PDFDocument21 pagesSHORT-TERM BUDGETING - Review PDFAngelica Bautista100% (1)

- This Study Resource Was: Available For Use 10,080,000Document8 pagesThis Study Resource Was: Available For Use 10,080,000Kez MaxNo ratings yet

- BudgetingDocument28 pagesBudgetingJade Gomez50% (2)

- 4 and 5Document3 pages4 and 5Mela carlonNo ratings yet

- Chapter 12-Performance Evaluation and Decentralization: Multiple ChoiceDocument20 pagesChapter 12-Performance Evaluation and Decentralization: Multiple ChoiceRod100% (1)

- Managerial Accounting Midterm Quiz 1Document16 pagesManagerial Accounting Midterm Quiz 1shane0% (1)

- Week 2 Tutorial Questions Chp#1-With AnswersDocument5 pagesWeek 2 Tutorial Questions Chp#1-With AnswersBowen Chen100% (1)

- The Firm's Investing Decisions Capital Budgeting Techniques: Bail-Out PeriodDocument5 pagesThe Firm's Investing Decisions Capital Budgeting Techniques: Bail-Out Periodgem dexter LlamesNo ratings yet

- Polytechnic University of The PhilippinesDocument16 pagesPolytechnic University of The PhilippinesMakoy BixenmanNo ratings yet

- Optimize Working Capital & Cash Flow With Proven TechniquesDocument32 pagesOptimize Working Capital & Cash Flow With Proven TechniquesDaniella Zapata Montemayor100% (1)

- Ca 5107 - Cost Accounting & Control Quizzer - Standard CostingDocument13 pagesCa 5107 - Cost Accounting & Control Quizzer - Standard CostingAlexandra CruzNo ratings yet

- ACC51112 - Responsibility Accounting QuizzerDocument12 pagesACC51112 - Responsibility Accounting QuizzerjasNo ratings yet

- StandardDocument49 pagesStandardGelyn CruzNo ratings yet

- Long QuizDocument4 pagesLong QuizJoshua Rey Sapuras0% (1)

- CH 21Document39 pagesCH 21Leiann Magnaye100% (1)

- Chapter 15 - AnswerDocument18 pagesChapter 15 - AnswerCrisalie BocoboNo ratings yet

- Chapter 10: Standard Costing, Operational Performance Measures, and The Balanced ScorecardDocument41 pagesChapter 10: Standard Costing, Operational Performance Measures, and The Balanced ScorecardSteph GonzagaNo ratings yet

- Assignment 5Document2 pagesAssignment 5Ralph Renz CastilloNo ratings yet

- Management Accounting, Purpose, Definition and ScopeDocument6 pagesManagement Accounting, Purpose, Definition and ScopejaysonNo ratings yet

- Ingo Corporation's cash budget and financial statementsDocument5 pagesIngo Corporation's cash budget and financial statementsLysss EpssssNo ratings yet

- This Study Resource WasDocument3 pagesThis Study Resource Waschiji chzzzmeowNo ratings yet

- X04 Cost Volume Profit RelationshipsDocument39 pagesX04 Cost Volume Profit Relationshipschiji chzzzmeowNo ratings yet

- Strategic Tax Management Quiz No. 2Document15 pagesStrategic Tax Management Quiz No. 2Earl Daniel RemorozaNo ratings yet

- Dia Mae A. Generoso - Learning Activity 3Document10 pagesDia Mae A. Generoso - Learning Activity 3Dia Mae Ablao GenerosoNo ratings yet

- D. Cost To Gather Information Is Increased: Section 2 Theories Chapter 20Document50 pagesD. Cost To Gather Information Is Increased: Section 2 Theories Chapter 20Fernando III PerezNo ratings yet

- CAE 10 Strategic Cost Management: Lyceum-Northwestern UniversityDocument7 pagesCAE 10 Strategic Cost Management: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- Chapter 10Document9 pagesChapter 10Patrick Earl T. PintacNo ratings yet

- WhizKids Questions-UneditedDocument5 pagesWhizKids Questions-UneditedSVTKhsiaNo ratings yet

- Responsibility AccountingDocument6 pagesResponsibility Accountingrodell pabloNo ratings yet

- Quiz 3 Quiz Instructions: Started: Oct 9 at 12:06pmDocument7 pagesQuiz 3 Quiz Instructions: Started: Oct 9 at 12:06pmsalamat lang akin40% (5)

- Financial Statement Analysis Ratios and CalculationsDocument6 pagesFinancial Statement Analysis Ratios and CalculationsHannah Mae VestilNo ratings yet

- I. Multiple Choice. Select The Best Answer Among The Options. Show/Give Your Solution IfDocument3 pagesI. Multiple Choice. Select The Best Answer Among The Options. Show/Give Your Solution IfBabi Dimaano Navarez100% (1)

- 202 Prelim QuizDocument25 pages202 Prelim QuizDonnelly Keith MumarNo ratings yet

- TB ch01Document8 pagesTB ch01Jenny Rose GattuNo ratings yet

- MAS Module Multiple-Choice QuestionsDocument32 pagesMAS Module Multiple-Choice QuestionsClint Abenoja100% (1)

- DocxDocument3 pagesDocxKyla DizonNo ratings yet

- Management Accounting Advisory ServicesDocument6 pagesManagement Accounting Advisory ServicesTin BulaoNo ratings yet

- Study Notes For Chapter 1 - MAS 1Document4 pagesStudy Notes For Chapter 1 - MAS 1InserahNo ratings yet

- 01 MAS - Management Acctg.Document8 pages01 MAS - Management Acctg.Karlo D. ReclaNo ratings yet

- CostDocument5 pagesCostKyla Mae OrquijoNo ratings yet

- Strategic Cost Management - Management AccountingDocument5 pagesStrategic Cost Management - Management AccountingVanna AsensiNo ratings yet

- Resa MAS-01: Management Accounting - Financial Management: - T R S ADocument4 pagesResa MAS-01: Management Accounting - Financial Management: - T R S AKenneth Pimentel100% (1)

- UL CPA REVIEW CENTER MAS 1.1 MANAGEMENT ACCOUNTINGDocument8 pagesUL CPA REVIEW CENTER MAS 1.1 MANAGEMENT ACCOUNTINGNhicoleChoiNo ratings yet

- Updates in Managerial AccountingDocument32 pagesUpdates in Managerial Accountingstudentone100% (2)

- Quizlet Econ 303Document29 pagesQuizlet Econ 303Kim TaehyungNo ratings yet

- AsdfDocument2 pagesAsdfKim TaehyungNo ratings yet

- Problem: in The Latest Board Meeting, The Main Topic of Interest Revolves Around Automation WhereinDocument3 pagesProblem: in The Latest Board Meeting, The Main Topic of Interest Revolves Around Automation WhereinKim TaehyungNo ratings yet

- Baye 9e Chapter 01 PDFDocument58 pagesBaye 9e Chapter 01 PDFKim TaehyungNo ratings yet

- Fraud Talk - Episode 100: Behind The Scenes of Wirecard's Billion-Dollar Accounting FraudDocument9 pagesFraud Talk - Episode 100: Behind The Scenes of Wirecard's Billion-Dollar Accounting FraudKim TaehyungNo ratings yet

- AsdDocument5 pagesAsdKim TaehyungNo ratings yet

- Inventory 315,000 Gain 315,000: 10. Net Selling Price 345,000 - 5,500 339,500Document1 pageInventory 315,000 Gain 315,000: 10. Net Selling Price 345,000 - 5,500 339,500Kim TaehyungNo ratings yet

- Problem ADocument5 pagesProblem AKim TaehyungNo ratings yet

- Strategic Cost Management Coordinated Quiz 1Document7 pagesStrategic Cost Management Coordinated Quiz 1Kim TaehyungNo ratings yet

- OR Cost of Inventory: Absorption Costing Variable CostingDocument2 pagesOR Cost of Inventory: Absorption Costing Variable CostingKim TaehyungNo ratings yet

- Microsoft PowerPoint - Stevenson - 13e - Chapter - 6 - Line Balancing - Other Approaches - Designing Process LayoutsDocument23 pagesMicrosoft PowerPoint - Stevenson - 13e - Chapter - 6 - Line Balancing - Other Approaches - Designing Process LayoutsKim TaehyungNo ratings yet

- Strategic Cost Management Coordinated Quiz 2Document8 pagesStrategic Cost Management Coordinated Quiz 2Kim TaehyungNo ratings yet

- Job Order CostingDocument49 pagesJob Order CostingKuroko71% (7)

- Special Production Issues On Lost Units and AccretionDocument47 pagesSpecial Production Issues On Lost Units and AccretionKuroko0% (1)

- Ch.13 TB (Service)Document14 pagesCh.13 TB (Service)Daniel GuevarraNo ratings yet

- The National Bicycle Industrial Compony: Implementing The Strategy of Mass CustomizationDocument34 pagesThe National Bicycle Industrial Compony: Implementing The Strategy of Mass CustomizationAmresh SinghNo ratings yet

- DHL Courier Service Process StudyDocument5 pagesDHL Courier Service Process StudyDipti Sawant50% (6)

- International Journals of Academics & Research: (IJARKE Business & Management Journal)Document15 pagesInternational Journals of Academics & Research: (IJARKE Business & Management Journal)monika sharmaNo ratings yet

- Whirlpool Marketing ProjectDocument73 pagesWhirlpool Marketing ProjectAshish Gupta100% (1)

- Sly Landscaping Company RevisedDocument32 pagesSly Landscaping Company Revisedlex tecNo ratings yet

- Topic: Statement of Financial Position (SFP) : Individual Performance Task/ Activity (Week 1 in The Module)Document11 pagesTopic: Statement of Financial Position (SFP) : Individual Performance Task/ Activity (Week 1 in The Module)Joana Jean SuymanNo ratings yet

- Quality PlanDocument53 pagesQuality PlanTariq Khan100% (1)

- Project Manager Role (Job Description)Document3 pagesProject Manager Role (Job Description)Sajjad ahmedNo ratings yet

- #3 Principles, Practices and Techniques of Quality ManagementDocument3 pages#3 Principles, Practices and Techniques of Quality ManagementNeyka YinNo ratings yet

- Improve Press Shop Productivity Through Process EnhancementsDocument1 pageImprove Press Shop Productivity Through Process EnhancementsAmiya KumarNo ratings yet

- OR Subject Review PresentationDocument12 pagesOR Subject Review PresentationJapan KanudoNo ratings yet

- Hitungan Keuntungan AkasiaDocument13 pagesHitungan Keuntungan AkasiaPresa KautsarNo ratings yet

- ISO 9000 VS 9001 ADocument2 pagesISO 9000 VS 9001 AJanieNo ratings yet

- Bcoe 142 PDFDocument4 pagesBcoe 142 PDFShiv KumarNo ratings yet

- ISMS Control of Management ReviewsDocument6 pagesISMS Control of Management ReviewsAmine RachedNo ratings yet

- Feedwater LCA Statement of ComplianceDocument5 pagesFeedwater LCA Statement of ComplianceTarundeep Singh100% (1)

- Auditing Theory Reviewer 4Document3 pagesAuditing Theory Reviewer 4Sheena ClataNo ratings yet

- SM Unit-2#1 by Vivek WankhedeDocument16 pagesSM Unit-2#1 by Vivek WankhedeProf. Vivek Vinayakrao WankhedeNo ratings yet

- Deployment of Spray OperatorsDocument13 pagesDeployment of Spray OperatorsLuo MiyandaNo ratings yet

- 2008 - Boon, K., McKinnon, J., & Ross, P. Audit Service Quality in Compulsory Audit TenderingDocument32 pages2008 - Boon, K., McKinnon, J., & Ross, P. Audit Service Quality in Compulsory Audit TenderingTâm Nguyễn NgọcNo ratings yet

- Cac NotesDocument14 pagesCac Notescoco credo100% (1)

- DQR Sheet 01Document12 pagesDQR Sheet 01nandi_engineerNo ratings yet

- 3rd MEETING (COMPANY STURCTURE ORGANIZATION) - 2Document4 pages3rd MEETING (COMPANY STURCTURE ORGANIZATION) - 2Wardah Siti FauziahNo ratings yet

- Case Study 1Document3 pagesCase Study 1gopika surendranathNo ratings yet

- Analisis Horenso KelompokDocument25 pagesAnalisis Horenso KelompokRajab IndrajietNo ratings yet

- Uda Bin Nordin: Professional Profile Professional ExperienceDocument1 pageUda Bin Nordin: Professional Profile Professional Experienceuda nordinNo ratings yet

- Reflexiones en Torno A La Logística de AprovisionamientoDocument20 pagesReflexiones en Torno A La Logística de AprovisionamientoAnyquinNo ratings yet

- Project Management Template and Tool FreeDocument13 pagesProject Management Template and Tool FreeArt clubNo ratings yet

- Project Manufacturing Integration SetupDocument5 pagesProject Manufacturing Integration SetupAbu SiddiqueNo ratings yet

- CH 3 Test Bank الاسايمنت جا من هناDocument36 pagesCH 3 Test Bank الاسايمنت جا من هناNTNNo ratings yet