Professional Documents

Culture Documents

April Dividend Stocks

Uploaded by

hxcd0 ratings0% found this document useful (0 votes)

53 views84 pagesThis document appears to be a list of stock tickers, company names, and current stock prices. It includes over 200 listings of publicly traded companies from a variety of industries such as technology, consumer goods, financial services, real estate investment trusts, and more. The prices range from $0.19 to $222.80 and represent where the stocks were trading on or near the date this list was compiled.

Original Description:

Original Title

april_dividend_stocks (1).xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document appears to be a list of stock tickers, company names, and current stock prices. It includes over 200 listings of publicly traded companies from a variety of industries such as technology, consumer goods, financial services, real estate investment trusts, and more. The prices range from $0.19 to $222.80 and represent where the stocks were trading on or near the date this list was compiled.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

53 views84 pagesApril Dividend Stocks

Uploaded by

hxcdThis document appears to be a list of stock tickers, company names, and current stock prices. It includes over 200 listings of publicly traded companies from a variety of industries such as technology, consumer goods, financial services, real estate investment trusts, and more. The prices range from $0.19 to $222.80 and represent where the stocks were trading on or near the date this list was compiled.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 84

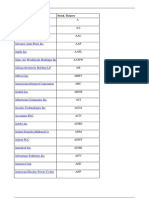

Ticker Name Price

A Agilent Technologies, Inc. $70.42

AAME Atlantic American Corp. $2.10

AAN Aaron's, Inc. $18.62

AAP Advance Auto Parts, Inc. $84.65

ABCB Ameris Bancorp $20.64

ACRE Ares Commercial Real Estate Corp. $4.19

ACU Acme United Corp. $20.00

ADC Agree Realty Corp. $57.08

ADP Automatic Data Processing, Inc. $128.47

AEO American Eagle Outfitters, Inc. $6.75

AFG American Financial Group, Inc. $64.09

AGI Alamos Gold, Inc. $5.64

AGNC AGNC Investment Corp. $9.51

AGR Avangrid, Inc. $39.89

AGX Argan, Inc. $35.28

AHH Armada Hoffler Properties, Inc. $9.23

AHT Ashford Hospitality Trust, Inc. $0.65

AI Arlington Asset Investment Corp. $1.75

AIMC Altra Industrial Motion Corp. $15.63

AIN Albany International Corp. $42.13

AKR Acadia Realty Trust $10.44

AL Air Lease Corp. $18.89

ALB Albemarle Corp. $52.70

ALCO Alico, Inc. $27.97

ALG Alamo Group, Inc. $77.98

ALL The Allstate Corp. $85.96

AMH American Homes 4 Rent $20.64

AMOT Allied Motion Technologies, Inc. $20.71

AMT American Tower Corp. $222.80

ANDE The Andersons, Inc. $17.07

ANH Anworth Mortgage Asset Corp. $0.83

APH Amphenol Corp. $68.42

APLE Apple Hospitality REIT, Inc. $6.91

APTS Preferred Apartment Communities, Inc. $5.50

AQN Algonquin Power & Utilities Corp. $12.61

ARCO Arcos Dorados Holdings, Inc. $3.04

ARE Alexandria Real Estate Equities, Inc. $129.99

ARI Apollo Commercial Real Estate Finance, Inc. $5.31

ARKR Ark Restaurants Corp. $8.31

ARR ARMOUR Residential REIT, Inc. $6.27

ATNI ATN International, Inc. $56.29

AU AngloGold Ashanti Ltd. $17.79

AUY Yamana Gold, Inc. $3.08

AVAL Grupo Aval Acciones y Valores SA $4.42

AVB AvalonBay Communities, Inc. $132.22

AVD American Vanguard Corp. $12.55

AXS AXIS Capital Holdings Ltd. $35.96

BANC Banc of California, Inc. $6.55

BANF BancFirst Corp. (Oklahoma) $31.17

BANR Banner Corp. $28.57

BAX Baxter International, Inc. $81.42

BBBY Bed Bath & Beyond, Inc. $3.94

BBD Banco Bradesco SA $3.55

BBDO Banco Bradesco SA $3.26

BBGI Beasley Broadcast Group, Inc. $1.58

BBVA Banco Bilbao Vizcaya Argentaria SA $2.93

BBY Best Buy Co., Inc. $53.48

BCE BCE, Inc. $40.43

BCRH Blue Capital Reinsurance Holdings Ltd. $6.72

BCS Barclays Plc $3.89

BDC Belden, Inc. $32.21

BDGE Bridge Bancorp, Inc. $17.85

BDN Brandywine Realty Trust $9.17

BEN Franklin Resources, Inc. $15.61

BFS Saul Centers, Inc. $27.74

BGG Briggs & Stratton Corp. $1.62

BGS B&G Foods, Inc. $17.61

BIG Big Lots, Inc. $14.69

BKE The Buckle, Inc. $13.36

BKSC Bank of South Carolina Corp. $14.23

BKTI BK Technologies Corp. $1.59

BKU BankUnited, Inc. $16.62

BNS The Bank of Nova Scotia $38.60

BOCH Bank of Commerce Holdings $6.83

BOOM DMC Global, Inc. $24.18

BPOP Popular, Inc. $31.55

BPT BP Prudhoe Bay Royalty Trust $5.18

BR Broadridge Financial Solutions, Inc. $92.39

BRC Brady Corp. $41.82

BRG Bluerock Residential Growth REIT, Inc. $3.79

BRT BRT Apartments Corp. $9.07

BRX Brixmor Property Group, Inc. $7.87

BUSE First Busey Corp. $15.38

BXMT Blackstone Mortgage Trust, Inc. $15.22

BXP Boston Properties, Inc. $83.04

BXS BancorpSouth Bank $17.94

BYD Boyd Gaming Corp. $11.22

CAC Camden National Corp. (Maine) $27.93

CAH Cardinal Health, Inc. $46.61

CAL Caleres, Inc. $3.37

CARO Carolina Financial Corp. $24.65

CASH Meta Financial Group, Inc. $15.02

CB Chubb Ltd. $102.82

CBL CBL & Associates Properties, Inc. $0.19

CBS ViacomCBS, Inc.

CBU Community Bank System, Inc. $59.59

CCMP Cabot Microelectronics Corp. $99.79

CFFI C&F Financial Corp. $33.00

CHCO City Holding Co. $64.16

CHH Choice Hotels International, Inc. $54.15

CHMG Chemung Financial Corp. $26.69

CHMI Cherry Hill Mortgage Investment Corp. $2.89

CHS Chico's FAS, Inc. $0.96

CI Cigna Corp. $163.84

CIB Bancolombia SA $24.36

CIM Chimera Investment Corp. $7.16

CINF Cincinnati Financial Corp. $70.98

CIO City Office REIT, Inc. $7.07

CKX CKX Lands, Inc. $8.25

CLDT Chatham Lodging Trust $4.79

CLI Mack-Cali Realty Corp. $13.82

CLNY Colony Capital, Inc. $1.42

CM Canadian Imperial Bank of Commerce $54.64

CMA Comerica, Inc. $27.34

CMC Commercial Metals Co. $14.63

CMCSA Comcast Corp. $33.95

CMFN CM Finance, Inc. $7.03

CMO Capstead Mortgage Corp. $3.27

CNMD CONMED Corp. $50.43

CNQ Canadian Natural Resources Ltd. $13.29

CODI Compass Diversified Holdings $12.99

COHU Cohu, Inc. $11.23

CONE CyrusOne, Inc. $61.86

COR CoreSite Realty Corp. $111.58

CP Canadian Pacific Railway Ltd. $212.83

CPB Campbell Soup Co. $49.53

CPG Crescent Point Energy Corp. $1.01

CPHC Canterbury Park Holding Corp. $10.03

CPK Chesapeake Utilities Corp. $78.75

CPT Camden Property Trust $71.95

CRT Cross Timbers Royalty Trust $4.97

CRWS Crown Crafts, Inc. $4.46

CSB VictoryShares US Small Cap High Dividend Volatility Wtd $28.59

CSCO Cisco Systems, Inc. $39.04

CSWC Capital Southwest Corp. $9.08

CTBI Community Trust Bancorp, Inc. (Kentucky) $30.48

CTRE CareTrust REIT, Inc. $13.07

CTS CTS Corp. $21.63

CUBE CubeSmart $24.83

CUZ Cousins Properties, Inc. $27.32

CVA Covanta Holding Corp. $7.09

CVBF CVB Financial Corp. $19.50

CW Curtiss-Wright Corp. $83.66

CWCO Consolidated Water Co. Ltd. $14.10

CXW CoreCivic, Inc. $8.98

CY Cypress Semiconductor Corp. $23.32

DEI Douglas Emmett, Inc. $27.60

DEO Diageo Plc $121.24

DG Dollar General Corp. $162.20

DGX Quest Diagnostics, Inc. $73.34

DHR Danaher Corp. $135.15

DIN Dine Brands Global, Inc. $20.39

DOC Physicians Realty Trust $12.84

DOX Amdocs Ltd. $54.36

DRH DiamondRock Hospitality Co. $4.45

DSW DSW, Inc. $22.51

DTE DTE Energy Co. $87.13

DVCR Diversicare Healthcare Services, Inc. $1.75

DX Dynex Capital, Inc. $9.22

DXC DXC Technology Co. $11.67

EARN Ellington Residential Mortgage REIT $4.03

EBSB Meridian Bancorp, Inc. $9.99

EC Ecopetrol SA $11.16

ECC Eagle Point Credit Co., Inc. $5.05

ECL Ecolab, Inc. $147.26

ECOL US Ecology, Inc. $28.29

EHC Encompass Health Corp. $60.08

EIX Edison International $49.36

ELS Equity LifeStyle Properties, Inc. $52.37

EME EMCOR Group, Inc. $56.07

EMN Eastman Chemical Co. $45.09

ENSG The Ensign Group, Inc. $32.78

EOG EOG Resources, Inc. $39.89

EPR EPR Properties $19.80

EQR Equity Residential $54.26

ERF Enerplus Corp. $1.82

ERIE Erie Indemnity Co. $164.19

ERJ Embraer SA $6.39

ESE ESCO Technologies, Inc. $71.20

ESLT Elbit Systems Ltd. $119.21

ESS Essex Property Trust, Inc. $190.86

ETH Ethan Allen Interiors, Inc. $8.61

EVBN Evans Bancorp, Inc. $24.39

EVRG Evergy, Inc. $51.80

FBNC First Bancorp (North Carolina) $20.84

FCNCA First Citizens BancShares, Inc. (North Carolina) $292.52

FCPT Four Corners Property Trust, Inc. $14.34

FDX FedEx Corp. $109.22

FFIN First Financial Bankshares, Inc. $25.59

FHN First Horizon National Corp. (Tennessee) $7.18

FISI Financial Institutions, Inc. $15.54

FITB Fifth Third Bancorp $13.45

FLIC The First of Long Island Corp. $14.33

FLR Fluor Corp. $5.98

FLS Flowserve Corp. $23.76

FLXS Flexsteel Industries, Inc. $9.60

FMBH First Mid Bancshares, Inc. $21.48

FMBI First Midwest Bancorp, Inc. (Illinois) $12.48

FMC FMC Corp. $70.88

FNLC The First Bancorp, Inc. (Maine) $20.47

FOX Fox Corp. $21.68

FOXA Fox Corp. $22.28

FPI Farmland Partners, Inc. $5.82

FR First Industrial Realty Trust, Inc. $30.73

FRT Federal Realty Investment Trust $65.81

FSV FirstService Corp. $70.43

FTI TechnipFMC Plc $7.17

FULT Fulton Financial Corp. $9.99

GBCI Glacier Bancorp, Inc. $32.75

GE General Electric Co. $6.73

GEF Greif, Inc. $29.14

GES Guess?, Inc. $6.04

GFF Griffon Corp. $12.81

GIL Gildan Activewear, Inc. $12.54

GLNG Golar LNG Ltd. $5.85

GNL Global Net Lease, Inc. $11.00

GNTX Gentex Corp. $20.67

GOOD Gladstone Commercial Corp. $12.31

GORO Gold Resource Corp. $3.08

GPC Genuine Parts Co. $58.26

GPK Graphic Packaging Holding Co. $11.40

GPMT Granite Point Mortgage Trust, Inc. $2.67

GROW U.S. Global Investors, Inc. $0.85

GSBC Great Southern Bancorp, Inc. (Missouri) $36.36

GSK GlaxoSmithKline Plc $37.14

GTY Getty Realty Corp. $19.52

GVA Granite Construction, Inc. $14.10

GWRS Global Water Resources, Inc. $9.81

GZT Gazit-Globe Ltd. $8.05

HASI Hannon Armstrong Sustainable Infrastructure Capital, Inc $17.09

HBAN Huntington Bancshares, Inc. $6.85

HBNC Horizon Bancorp, Inc. (Indiana) $9.04

HCAP Harvest Capital Credit Corp. $3.79

HCC Warrior Met Coal, Inc. $10.56

HCFT Hunt Companies Finance Trust, Inc. $1.44

HIFS Hingham Institution for Savings $131.32

HIG The Hartford Financial Services Group, Inc. $32.15

HIHO Highway Holdings Ltd. $1.98

HPE Hewlett-Packard Enterprise Co. $9.30

HPQ HP, Inc. $14.48

HRB H&R Block, Inc. $11.94

HRTG Heritage Insurance Holdings, Inc. $10.40

HSBC HSBC Holdings Plc $24.33

HST Host Hotels & Resorts, Inc. $9.06

HT Hersha Hospitality Trust $2.84

HTA Healthcare Trust of America, Inc. $21.94

HTLD Heartland Express, Inc. $18.02

HUM Humana, Inc. $291.63

HURC Hurco Cos., Inc. $27.46

HWBK Hawthorn Bancshares, Inc. $17.13

HWKN Hawkins, Inc. $31.02

IBKC IBERIABANK Corp. $32.32

IBOC International Bancshares Corp. $24.72

IFF International Flavors & Fragrances, Inc. $98.90

IGT International Game Technology Plc $4.95

IMKTA Ingles Markets, Inc. $38.12

IMO Imperial Oil Ltd. $12.00

INBK First Internet Bancorp $13.63

INDB Independent Bank Corp. (Massachusetts) $63.09

INGR Ingredion, Inc. $76.21

INT World Fuel Services Corp. $22.58

INTU Intuit, Inc. $218.10

IPAR Inter Parfums, Inc. $41.54

IRET Investors Real Estate Trust $44.36

IRM Iron Mountain, Inc. $22.06

IROQ IF Bancorp, Inc. $15.50

IRT Independence Realty Trust, Inc. $7.04

ISTR Investar Holding Corp. $10.95

ITRN Ituran Location & Control Ltd. $13.10

ITT ITT, Inc. $44.53

ITUB Itaú Unibanco Holding SA $3.90

ITW Illinois Tool Works, Inc. $140.41

IVC Invacare Corp. $5.90

IVR Invesco Mortgage Capital, Inc. $1.95

JCAP Jernigan Capital, Inc. $10.62

JCI Johnson Controls International Plc $25.47

JCS Communications Systems, Inc. $4.06

JJSF J&J Snack Foods Corp. $113.31

JMP JMP Group LLC $2.31

JOUT Johnson Outdoors, Inc. $58.35

JPM JPMorgan Chase & Co. $84.05

KAMN Kaman Corp. $35.33

KAR KAR Auction Services, Inc. $9.50

KBAL Kimball International, Inc. $9.53

KBR KBR, Inc. $19.05

KDP Keurig Dr Pepper, Inc. $23.80

KIM Kimco Realty Corp. $7.77

KMB Kimberly-Clark Corp. $129.92

KO The Coca-Cola Co. $43.83

KRC Kilroy Realty Corp. $58.40

KRG Kite Realty Group Trust $7.24

KSU Kansas City Southern $123.00

KW Kennedy-Wilson Holdings, Inc. $12.57

KWR Quaker Chemical Corp. $114.00

LADR Ladder Capital Corp. $3.39

LAND Gladstone Land Corp. $11.62

LECO Lincoln Electric Holdings, Inc. $66.51

LEG Leggett & Platt, Inc. $22.72

LII Lennox International, Inc. $170.96

LM Legg Mason, Inc. $49.08

LMAT LeMaitre Vascular, Inc. $22.71

LMNR Limoneira Co. $11.68

LOAN Manhattan Bridge Capital, Inc. $3.91

LPT Liberty Property Trust $61.95

LSI Life Storage, Inc. $89.85

LTC LTC Properties, Inc. $27.22

LXP Lexington Realty Trust $9.45

M Macy's, Inc. $4.81

MAA Mid-America Apartment Communities, Inc. $94.31

MAIN Main Street Capital Corp. $17.34

MCK McKesson Corp. $125.49

MDLZ Mondelez International, Inc. $50.84

MDT Medtronic Plc $86.27

MDU MDU Resources Group, Inc. $20.21

MEI Methode Electronics, Inc. $24.98

MERC Mercer International, Inc. $7.02

MFA MFA Financial, Inc. $1.09

MFNC Mackinac Financial Corp. $10.17

MGP MGM Growth Properties LLC $22.12

MGRC McGrath RentCorp $50.53

MHLD Maiden Holdings Ltd. $0.86

MITT AG Mortgage Investment Trust, Inc. $1.63

MKC McCormick & Co., Inc. $146.88

MLHR Herman Miller, Inc. $17.80

MO Altria Group, Inc. $37.41

MORN Morningstar, Inc. $110.48

MOV Movado Group, Inc. $9.96

MPW Medical Properties Trust, Inc. $14.40

MPWR Monolithic Power Systems, Inc. $153.80

MRK Merck & Co., Inc. $76.25

MRVL Marvell Technology Group Ltd. $22.43

MSI Motorola Solutions, Inc. $126.62

MTN Vail Resorts, Inc. $131.73

MTR Mesa Royalty Trust $4.48

MTSC MTS Systems Corp. $18.23

MVC MVC Capital, Inc. $3.97

MVO MV Oil Trust $2.77

MYE Myers Industries, Inc. $9.07

NBR Nabors Industries Ltd. $0.36

NEU NewMarket Corp. $389.24

NFG National Fuel Gas Co. $35.56

NGHC National General Holdings Corp. $14.24

NJR New Jersey Resources Corp. $30.89

NKE NIKE, Inc. $78.86

NLY Annaly Capital Management, Inc. $4.02

NOA North American Construction Group Ltd. $4.63

NRZ New Residential Investment Corp. $3.33

NTAP NetApp, Inc. $37.34

NTP Nam Tai Property, Inc. $5.35

NTRS Northern Trust Corp. $77.14

NVO Novo Nordisk A/S $59.84

NVS Novartis AG $83.64

NWS News Corp. $8.23

NWSA News Corp. $8.19

NYMT New York Mortgage Trust, Inc. $1.08

NYT The New York Times Co. $28.63

O Realty Income Corp. $43.60

OBCI Ocean Bio-Chem, Inc. $4.39

OC Owens Corning $34.98

OFC Corporate Office Properties Trust, Inc. $20.60

OFG OFG Bancorp $9.99

OGE OGE Energy Corp. $26.58

OHAI OHA Investment Corp. $1.31

OLP One Liberty Properties, Inc. $12.77

OMC Omnicom Group, Inc. $49.59

ORC Orchid Island Capital, Inc. $2.36

ORM Owens Realty Mortgage, Inc. $21.75

OXY Occidental Petroleum Corp. $13.00

OZK Bank OZK $15.54

PB Prosperity Bancshares, Inc. $44.83

PBA Pembina Pipeline Corp. $17.41

PBT Permian Basin Royalty Trust $3.02

PDCO Patterson Cos., Inc. $13.45

PEB Pebblebrook Hotel Trust $8.66

PEGA Pegasystems, Inc. $60.87

PEGI Pattern Energy Group, Inc. $26.74

PFBC Preferred Bank (California) $32.15

PFLT PennantPark Floating Rate Capital Ltd. $4.44

PGRE Paramount Group, Inc. $8.05

PHM PulteGroup, Inc. $18.92

PK Park Hotels & Resorts, Inc. $6.04

PKBK Parke Bancorp, Inc. $10.06

PKG Packaging Corporation of America $80.51

PLCE The Children's Place, Inc. $14.05

PLPC Preformed Line Products Co. $41.11

PM Philip Morris International, Inc. $73.46

PMT PennyMac Mortgage Investment Trust $7.00

POL PolyOne Corp. $17.57

POR Portland General Electric Co. $46.31

PPL PPL Corp. $21.77

PRA ProAssurance Corp. $21.30

PRIM Primoris Services Corp. $15.45

PXD Pioneer Natural Resources Co. $74.68

QCRH QCR Holdings, Inc. $23.09

QSR Restaurant Brands International, Inc. $33.27

QTS QTS Realty Trust, Inc. $56.08

RAVN Raven Industries, Inc. $19.62

RBC Regal Beloit Corp. $57.85

RBCAA Republic Bancorp, Inc. (Kentucky) $28.03

RCI Rogers Communications, Inc. $41.24

RCL Royal Caribbean Cruises Ltd. $24.39

RESI Front Yard Residential Corp. $10.84

REXR Rexford Industrial Realty, Inc. $36.12

RF Regions Financial Corp. $8.07

RFIL RF Industries Ltd. $3.77

RGLD Royal Gold, Inc. $93.40

RHP Ryman Hospitality Properties, Inc. $30.60

RILY B. Riley Financial, Inc. $16.12

RIO Rio Tinto Plc $45.04

RJF Raymond James Financial, Inc. $57.53

RL Ralph Lauren Corp. $61.00

RLJ RLJ Lodging Trust $6.76

ROP Roper Technologies, Inc. $299.68

ROYT Pacific Coast Oil Trust $0.21

RPAI Retail Properties of America, Inc. $4.62

RPM RPM International, Inc. $56.94

RPT RPT Realty $4.84

RSG Republic Services, Inc. $72.53

RVSB Riverview Bancorp, Inc. $4.28

SAH Sonic Automotive, Inc. $11.09

SAIC Science Applications International Corp. $71.30

SBR Sabine Royalty Trust $27.92

SCS Steelcase, Inc. $8.22

SCVL Shoe Carnival, Inc. $14.87

SFBS ServisFirst Bancshares, Inc. $27.05

SFNC Simmons First National Corp. $16.72

SHO Sunstone Hotel Investors, Inc. $7.77

SJI South Jersey Industries, Inc. $22.66

SJR Shaw Communications, Inc. $15.62

SJT San Juan Basin Royalty Trust $1.94

SKYW Sky West, Inc. $19.97

SLB Schlumberger NV $14.29

SLCA U.S. Silica Holdings, Inc. $1.56

SLG SL Green Realty Corp. $38.64

SNHY Sun Hydraulics Corp.

SNV Synovus Financial Corp. $14.55

SNX SYNNEX Corp. $67.63

SOHO Sotherly Hotels, Inc. $1.50

SPR Spirit AeroSystems Holdings, Inc. $18.43

SR Spire, Inc. (Missouri) $69.64

SRC Spirit Realty Capital, Inc. $22.25

SRE Sempra Energy $104.28

SRG Seritage Growth Properties $6.68

SSD Simpson Manufacturing Co., Inc. $56.58

SSW Seaspan Corp. $9.91

STAG STAG Industrial, Inc. $21.44

STLD Steel Dynamics, Inc. $20.96

STN Stantec, Inc. $26.10

STOR STORE Capital Corp. $14.58

STT State Street Corp. $52.16

STWD Starwood Property Trust, Inc. $9.28

STX Seagate Technology Plc $45.75

SUI Sun Communities, Inc. $106.75

SUP Superior Industries International, Inc. $1.28

SYBT Stock Yards Bancorp, Inc. $26.54

SYK Stryker Corp. $148.07

SYY Sysco Corp. $39.50

TAC TransAlta Corp. $5.02

TCFC The Community Financial Corp. (Maryland) $19.61

TD The Toronto-Dominion Bank $39.44

TG Tredegar Corp. $14.24

TGNA TEGNA, Inc. $10.12

THO Thor Industries, Inc. $36.16

TIF Tiffany & Co. $128.28

TIPT Tiptree, Inc. $4.89

TMO Thermo Fisher Scientific, Inc. $282.21

TOL Toll Brothers, Inc. $17.85

TOT Total SA $35.67

TOWN TowneBank $16.94

TPR Tapestry, Inc. $11.09

TPVG TriplePoint Venture Growth BDC Corp. $4.69

TRN Trinity Industries, Inc. $14.75

TRNO Terreno Realty Corp. $47.46

TRP TC Energy Corp. $42.86

TRST TrustCo Bank Corp. NY $4.92

TRTX TPG RE Finance Trust, Inc. $2.52

TSE Trinseo SA $17.67

TSLX TPG Specialty Lending, Inc. $12.57

TTC The Toro Co. $62.51

TTEC TTEC Holdings, Inc. $32.99

TU TELUS Corp. $15.78

TUP Tupperware Brands Corp. $1.40

TWI Titan International, Inc. $1.30

TWO Two Harbors Investment Corp. $2.42

TXT Textron, Inc. $24.85

UBA Urstadt Biddle Properties, Inc. $10.29

UBFO United Security Bancshares (California) $5.07

UBP Urstadt Biddle Properties, Inc. $9.27

UBSI United Bankshares, Inc. (West Virginia) $21.90

UCBI United Community Banks, Inc. $17.48

UDR UDR, Inc. $31.62

UFS Domtar Corp. $20.65

UGI UGI Corp. $25.00

UHAL AMERCO $252.80

UHT Universal Health Realty Income Trust $91.57

UMBF UMB Financial Corp. $42.41

UMPQ Umpqua Holdings Corp. $9.91

UNIT Uniti Group, Inc. $5.78

USB U.S. Bancorp $31.19

USPH U.S. Physical Therapy, Inc. $56.57

UTMD Utah Medical Products, Inc. $79.70

UVSP Univest Financial Corp. $14.74

VER VEREIT, Inc. $4.00

VET Vermilion Energy, Inc. $3.48

VLGEA Village Super Market, Inc. $23.20

VLY Valley National Bancorp $6.29

VMI Valmont Industries, Inc. $106.49

VTR Ventas, Inc. $22.52

VVI Viad Corp. $17.22

WASH Washington Trust Bancorp, Inc. $32.67

WDC Western Digital Corp. $38.19

WDFC WD-40 Co. $170.60

WGO Winnebago Industries, Inc. $27.53

WHG Westwood Holdings Group, Inc. $16.56

WIRE Encore Wire Corp. (Delaware) $38.47

WLTW Willis Towers Watson Plc $156.80

WMC Western Asset Mortgage Capital Corp. $1.45

WMT Walmart, Inc. $119.48

WPC W.P. Carey, Inc. $50.26

WPM Wheaton Precious Metals Corp. $27.82

WRB W.R. Berkley Corp. $49.48

WSBC WesBanco, Inc. $21.74

WSBF Waterstone Financial, Inc. $13.43

WSO Watsco, Inc. $147.32

WSR Whitestone REIT $5.28

XAN Exantas Capital Corp. $1.06

XEL Xcel Energy, Inc. $57.90

XHR Xenia Hotels & Resorts, Inc. $8.24

XRAY Dentsply Sirona, Inc. $35.47

XRX Xerox Holdings Corp. $16.90

YORW York Water Co. $40.00

ZBH Zimmer Biomet Holdings, Inc. $92.01

Data Provided by IEX Cloud Certain securities may be excluded due to data limitations

Data updated on 2020-04-03

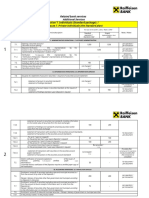

Dividend Yield Market Cap ($M) Forward P/E Ratio Payout Ratio Beta

0.9% $22384.67 28.8 27.4% 0.95

1.0% $42.99 -53.0 -50.5% 0.28

0.8% $1279.50 41.0 31.9% 1.28

0.3% $6121.33 12.3 3.5% 0.94

2.2% $1589.20 7.2 17.5% 1.29

26.3% $167.61 3.2 102.1% 1.40

2.4% $67.91 12.2 29.2% 0.41

3.8% $2848.32 29.1 116.1% 0.92

2.5% $56797.24 22.6 57.6% 1.17

8.1% $1135.31 6.0 48.8% 1.10

2.5% $5993.99 6.4 16.5% 1.43

0.7% $2217.58 22.9 16.2% 0.13

20.4% $5301.24 8.2 172.6% 0.78

4.1% $13111.08 17.6 77.8% 0.81

2.9% $546.22 -14.6 -41.3% 0.83

8.6% $761.31 22.8 207.3% 1.32

46.2% $66.30 -0.4 -19.0% 0.98

48.8% $79.15 5.0 297.3% 1.52

3.9% $1120.66 7.9 34.4% 1.49

1.7% $1343.87 10.3 17.8% 0.99

10.8% $906.66 17.5 189.3% 0.86

2.7% $2305.54 3.7 10.5% 1.58

2.7% $5705.08 10.5 29.2% 1.13

0.9% $215.42 5.4 4.9% 0.85

0.6% $986.11 14.5 8.9% 1.00

2.3% $27188.05 6.0 14.0% 1.03

0.9% $6381.33 72.1 69.9% 0.82

0.6% $203.83 11.4 6.6% 1.25

1.7% $97772.82 52.2 88.6% 0.96

4.0% $567.37 30.7 122.6% 0.86

43.7% $97.26 -1.3 -65.6% 1.07

1.4% $20497.42 17.6 24.7% 1.00

15.5% $1732.70 9.0 156.3% 1.25

17.9% $283.85 -2.0 -38.3% 0.85

4.3% $6628.12 12.1 52.7% 0.97

3.6% $622.41 7.8 28.1% 1.19

3.0% $16120.33 41.9 128.9% 1.01

34.7% $816.42 3.7 128.8% 1.08

11.1% $31.51 6.9 82.0% 0.90

32.3% $394.22 -1.3 -46.3% 1.17

1.2% $880.06 -83.6 -100.7% 1.06

0.5% $7372.28 34.3 18.1% 0.19

1.0% $2899.35 13.0 12.6% 0.30

8.3% $1497.96 53.1 417.6% 1.24

4.5% $19047.07 23.5 107.8% 0.95

0.6% $414.99 27.0 17.2% 1.26

4.4% $3064.39 10.7 47.8% 0.92

4.3% $359.99 138.5 655.4% 1.20

3.9% $1049.54 7.6 30.0% 1.30

5.2% $1108.75 6.8 39.1% 1.30

1.0% $41702.48 40.2 41.9% 0.84

18.8% $451.98 -0.6 -10.7% 1.25

1.2% $15186.61 5.2 6.8% 1.41

1.2% $13842.38 4.8 6.1% 1.09

11.7% $47.84 3.3 41.3% 0.94

10.2% $18967.53 3.7 36.4% 1.23

3.8% $13557.79 9.1 34.1% 1.20

5.9% $36540.94 15.9 93.9% 0.92

4.5% $58.97 -2.5 -11.3% 0.14

10.4% $17355.48 5.2 56.2% 1.24

0.6% $1583.37 -3.7 -2.3% 1.09

4.8% $383.57 7.0 35.5% 1.24

8.1% $1654.40 48.4 401.5% 1.15

6.5% $7980.18 6.2 41.7% 1.07

7.2% $686.73 17.6 134.4% 1.30

25.2% $64.14 -1.1 -26.4% 0.72

10.7% $1135.51 15.0 162.0% 0.53

8.6% $547.55 2.4 19.3% 1.62

7.9% $650.50 6.2 48.9% 0.92

4.7% $76.04 10.7 48.3% 0.38

5.3% $18.95 -7.7 -38.6% 0.40

4.6% $1705.69 5.3 26.7% 1.26

6.9% $47097.00 7.5 51.6% 1.04

2.6% $127.85 8.2 22.9% 1.04

1.2% $340.68 10.6 12.8% 0.77

3.7% $2906.47 4.6 17.4% 1.22

38.4% $124.55 2.3 100.0% 1.01

2.2% $10573.36 25.3 56.1% 0.85

2.0% $2287.63 15.6 32.0% 1.06

14.5% $110.37 -4.2 -72.7% 1.19

7.7% $167.83 -17.0 -150.3% 1.01

14.2% $2354.33 8.6 122.4% 1.13

5.3% $870.19 8.2 44.8% 1.19

14.6% $2302.41 6.5 105.4% 1.05

4.6% $12827.04 25.2 116.0% 1.04

3.7% $1995.34 7.8 30.8% 1.19

2.2% $1350.44 8.1 19.4% 1.76

4.2% $448.87 7.6 33.2% 1.01

4.1% $13544.61 -3.3 -13.5% 0.94

7.8% $143.31 2.2 18.3% 0.87

1.4% $639.02 8.7 12.7% 1.44

1.2% $622.97 5.6 7.5% 1.19

2.8% $47870.61 10.5 30.5% 1.01

N/A $47.71 -0.2 N/A 1.45

1.8% $15277.66 5.3 9.3% 0.99

2.6% $3186.20 18.3 48.4% 1.00

1.6% $3020.61 45.3 75.9% 1.79

4.3% $127.10 6.0 27.3% 1.10

3.4% $1070.46 11.8 40.5% 0.93

1.6% $3098.53 13.6 21.8% 0.85

3.6% $140.56 8.3 32.4% 1.37

43.7% $68.91 -0.9 -57.1% 1.23

34.7% $121.49 -8.7 -315.9% 0.87

0.0% $62783.82 12.1 0.3% 1.27

5.2% $3078.62 5.6 28.9% 1.31

25.8% $1452.87 3.9 109.8% 0.88

3.1% $11830.98 5.8 18.3% 1.17

13.2% $389.78 -49.3 -655.5% 0.99

N/A $16.02 64.1 N/A 0.28

23.8% $260.62 12.2 335.6% 1.43

5.6% $1286.45 14.0 81.3% 1.03

28.2% $843.38 -0.3 -8.1% 1.54

7.7% $24777.27 6.4 50.5% 0.99

9.6% $3900.16 3.4 33.8% 1.42

3.1% $1871.65 5.6 18.2% 1.26

2.4% $156487.79 11.8 29.2% 0.91

14.2% $95.75 -16.6 -236.4% 0.62

13.3% $339.56 -4.8 -69.6% 1.24

1.5% $1483.01 50.0 79.3% 1.24

8.1% $16496.47 3.9 33.1% 1.50

11.1% $779.30 -6.8 -74.8% 0.88

2.1% $475.97 -6.6 -14.2% 1.28

3.1% $7111.19 156.0 484.4% 1.09

4.1% $4351.49 54.1 230.7% 0.77

1.1% $29289.76 16.1 17.8% 1.15

3.0% $14317.80 29.4 83.1% 0.49

3.3% $475.95 -0.7 -2.1% 1.54

2.8% $46.91 17.0 47.4% 0.38

1.9% $1372.61 21.6 43.5% 0.99

4.4% $7204.22 32.4 144.1% 0.98

17.8% $29.58 5.7 100.0% 1.11

7.2% $45.34 7.2 51.1% 0.50

4.9% $69.05 N/A N/A 0.99

3.5% $168787.02 15.1 54.1% 1.07

17.4% $167.65 12.0 207.0% 0.82

4.7% $560.08 8.5 40.6% 1.18

6.8% $1265.92 26.1 179.9% 1.26

0.7% $730.91 19.6 14.5% 1.06

5.1% $4891.82 28.0 145.6% 0.73

4.2% $4081.65 97.0 411.6% 1.15

11.9% $1104.01 92.9 1310.6% 1.18

3.6% $2783.95 13.1 48.5% 1.00

0.8% $3679.43 11.6 9.2% 1.23

2.3% $218.19 24.7 59.8% 1.02

18.0% $1164.76 5.7 110.9% 1.39

1.9% $8709.64 212.5 401.1% 0.67

3.8% $5708.91 13.3 51.1% 1.08

2.8% $72174.04 18.5 53.4% 0.74

0.8% $40234.98 24.3 19.2% 0.58

2.7% $10336.09 11.5 33.4% 0.77

0.5% $95077.38 38.9 19.6% 0.84

13.1% $346.24 3.4 46.4% 2.14

6.9% $2612.74 32.8 234.8% 0.88

2.1% $7356.14 15.0 31.5% 0.85

10.9% $918.80 N/A N/A 1.28

4.4% $1765.53 -86.2 -383.0% N/A

4.3% $17172.54 13.8 60.8% 1.07

N/A $11.68 -0.3 N/A 0.13

20.2% $228.08 -1.4 -29.6% 0.69

6.6% $3168.98 -1.9 -13.1% 1.88

26.0% $56.08 2.3 66.1% 1.20

2.8% $545.65 7.6 22.1% 1.06

9.4% $21051.75 6.2 53.8% 1.49

44.1% $155.76 -277.5 -13186.8% 1.30

1.2% $43999.50 27.2 34.2% 1.12

2.4% $927.21 18.4 46.8% 0.79

1.8% $6111.70 16.5 30.2% 0.95

4.8% $18685.50 13.0 65.0% 0.98

2.0% $9570.88 33.9 69.3% 0.86

0.5% $3302.40 9.7 5.5% 1.05

5.6% $6166.87 8.2 45.7% 1.13

0.6% $1719.42 15.9 9.3% 1.34

2.8% $22292.71 8.4 22.9% 1.28

22.4% $1575.57 8.6 194.7% 1.72

4.2% $20298.84 20.4 85.3% 0.85

5.3% $382.81 -2.0 -9.9% 1.40

2.3% $7455.83 24.1 53.9% 0.77

N/A $1286.30 -3.6 N/A 1.44

0.4% $1912.79 25.0 11.2% 1.14

1.4% $5208.19 23.2 33.7% 0.67

4.0% $12868.47 28.6 116.9% 0.89

9.0% $231.29 8.9 82.5% 0.84

6.4% $120.56 7.0 44.9% 1.17

3.6% $12121.83 18.4 68.6% 1.09

2.5% $633.21 6.8 17.4% 1.01

0.5% $3243.29 7.1 3.9% 0.99

7.5% $1088.57 13.5 110.0% 1.52

2.2% $30472.20 -81.8 -194.7% 1.08

1.8% $3734.75 21.1 38.3% 1.13

7.3% $2400.77 5.2 40.4% 1.47

6.0% $267.09 5.3 33.7% 1.32

6.6% $10154.98 3.9 27.6% 1.54

4.5% $367.13 8.5 41.6% 1.09

13.5% $869.08 -0.6 -9.0% 1.35

3.2% $3154.71 12.3 39.2% 1.16

8.4% $83.91 -2.5 -22.2% 0.65

3.5% $363.20 7.5 26.4% 1.10

4.1% $1511.18 6.9 29.5% 1.04

2.2% $9601.93 19.2 44.4% 1.25

5.6% $233.60 8.6 50.5% 1.18

2.1% $13253.23 7.5 16.0% 0.87

2.0% $13756.90 7.8 16.0% 0.86

3.4% $176.43 132.0 453.5% 0.74

3.0% $3945.77 16.3 48.8% 1.12

6.2% $4862.62 14.3 89.9% 1.02

0.8% $2938.22 -10.4 -8.8% 0.91

6.9% $3364.80 -1.3 -9.6% 1.45

4.8% $1766.16 7.2 37.3% 1.12

3.3% $3242.65 13.8 46.5% 1.30

0.6% $60315.11 88.6 52.6% 1.34

5.6% $1520.47 9.9 60.0% 1.22

9.5% $390.55 4.1 37.8% 1.71

2.3% $607.94 13.4 30.7% 1.61

4.3% $2468.88 9.9 42.4% 0.92

2.4% $605.38 -2.8 -7.2% 1.40

15.0% $1055.62 27.7 446.2% 1.33

2.2% $5279.27 12.5 27.8% 0.94

11.8% $449.66 -104.1 -1266.9% 1.29

0.9% $186.57 33.7 27.4% 0.65

5.0% $8926.45 13.7 71.6% 1.09

2.5% $3541.97 16.2 42.7% 0.87

57.3% $161.59 2.0 126.9% 2.17

3.4% $13.16 -3.8 -12.6% 0.30

3.5% $539.10 7.0 25.5% 1.01

5.4% $93880.73 15.6 85.4% 0.72

6.7% $878.23 16.5 119.7% 1.40

3.4% $724.02 -6.3 -23.1% 0.91

2.8% $227.85 94.2 277.1% 0.99

5.2% $1515.04 33.8 176.6% N/A

7.5% $1247.71 13.7 107.6% 1.11

7.9% $7539.36 5.3 45.1% 1.15

5.0% $416.15 6.0 30.3% 1.31

23.7% $24.47 -18.9 -485.3% 0.86

1.7% $609.84 1.8 3.4% 0.85

19.2% $38.41 12.8 262.2% 0.61

1.2% $284.31 7.4 8.7% 0.62

3.6% $11919.04 5.6 21.0% 1.16

4.0% $7.53 -97.5 -402.0% 0.31

4.9% $12084.63 10.2 50.3% 1.12

4.2% $22146.98 7.1 32.4% 1.12

8.3% $2417.49 6.1 52.9% 1.07

2.3% $301.70 10.6 24.4% 0.92

10.4% $99910.69 16.7 175.0% 0.68

8.4% $6741.17 7.2 63.6% 0.98

37.3% $117.56 -3.8 -149.5% 1.63

5.5% $9945.54 149.7 852.7% 0.84

0.4% $1461.40 20.3 9.0% 0.83

0.7% $39651.73 14.5 10.9% 1.20

1.7% $188.10 18.6 32.9% 0.99

2.5% $112.60 6.9 17.6% 1.26

2.7% $357.91 12.0 35.7% 0.94

5.1% $1818.51 4.7 25.3% 1.87

4.0% $1725.40 7.9 33.5% 1.36

3.0% $10592.62 24.5 73.2% 0.87

16.1% $1018.09 -53.3 -861.1% 1.61

1.9% $505.98 9.8 16.9% 0.45

5.2% $9055.48 5.6 29.7% 1.10

1.6% $149.45 5.5 9.5% 1.45

2.6% $2320.16 12.6 34.9% 1.00

3.3% $5156.60 12.4 40.7% 0.92

1.6% $1468.36 8.3 13.3% 1.19

0.9% $58667.33 34.8 31.9% 1.21

2.6% $1382.00 21.7 60.3% 1.38

5.9% $626.67 7.3 45.8% 0.78

11.4% $6182.70 23.7 263.1% 0.92

1.7% $52.98 13.7 23.0% 0.34

9.2% $720.81 13.8 141.4% 1.14

1.9% $132.61 6.5 13.5% 1.19

7.1% $280.55 41.4 300.4% 0.64

1.3% $3920.27 12.0 15.9% 1.30

6.0% $19621.81 5.5 34.7% 1.22

2.9% $44960.41 18.0 53.2% 1.14

0.8% $213.31 -3.7 -3.1% 1.71

72.0% $423.96 0.8 76.3% 0.84

13.3% $245.52 9.5 124.9% 0.84

4.0% $19897.69 63.7 260.2% 0.90

1.9% $38.41 5.9 11.5% 0.60

1.8% $2151.66 22.6 41.4% 1.00

5.2% $44.73 -6.5 -33.5% 0.22

1.0% $601.21 10.7 11.3% 0.77

3.9% $269003.99 7.8 31.6% 1.32

2.2% $1027.56 11.6 26.1% 1.37

9.9% $1408.48 6.7 75.8% 0.96

3.3% $375.60 8.5 30.2% 1.14

1.6% $2818.91 13.3 22.4% 1.67

2.5% $33570.78 26.7 67.3% 0.67

14.5% $3351.95 9.7 139.6% 1.05

3.2% $44143.95 20.7 65.6% 0.67

3.6% $188694.93 21.0 76.7% 0.76

3.2% $6976.30 31.3 102.4% 1.16

16.6% $641.12 -1227.1 -21525.4% 1.35

1.2% $11634.26 22.7 27.3% 1.25

6.7% $1806.98 7.9 53.1% 1.18

1.3% $2042.13 50.4 67.4% 1.16

29.8% $552.87 2.9 117.6% 1.46

3.8% $250.39 -90.9 -348.6% 0.68

2.9% $3995.03 14.0 40.2% 1.01

6.5% $3199.04 9.2 63.8% 1.38

1.7% $6829.32 16.3 28.1% 0.66

3.1% $4296.10 18.6 58.2% 0.41

1.5% $466.34 25.3 37.6% 1.08

2.5% $214.65 -25.5 -64.1% 0.91

12.4% $37.20 8.4 103.1% 0.93

2.6% $9777.88 21.6 56.9% -0.04

4.3% $4299.67 16.2 72.0% 0.83

8.1% $1108.33 13.4 112.6% 1.21

4.3% $2460.19 8.3 36.1% 0.94

33.9% $1377.92 2.6 82.9% 1.34

4.1% $10770.04 30.7 126.4% 0.96

13.8% $1139.52 8.4 118.4% 1.27

1.2% $22878.87 -25.8 -32.9% 0.97

2.2% $72191.52 19.0 40.7% 0.90

2.5% $115455.65 21.8 53.5% 0.91

3.9% $4170.86 12.0 48.4% 1.08

1.7% $978.09 8.1 14.3% 1.16

7.3% $481.72 -48.9 -373.0% 0.89

72.7% $498.43 1.4 99.7% 0.37

5.2% $107.12 7.7 40.3% 1.57

8.2% $2997.34 22.8 193.2% 1.44

2.9% $1269.47 12.7 37.6% 1.23

N/A $71.35 -0.7 N/A 0.74

104.4% $59.60 0.7 79.1% 1.38

1.6% $19298.99 27.9 44.2% 0.76

4.1% $1191.28 5.0 23.2% 0.85

9.1% $67310.16 -53.3 -466.9% 0.74

1.0% $4820.96 31.1 32.0% 0.71

7.2% $254.51 5.4 43.3% 1.00

6.8% $7829.53 16.7 118.3% 1.24

1.0% $7025.71 60.9 63.5% 1.54

2.9% $194963.07 19.9 58.9% 0.69

1.1% $15019.22 9.4 10.1% 1.20

1.8% $22370.51 24.3 45.1% 0.90

5.1% $5619.13 17.5 93.7% 0.77

20.4% $8.31 4.9 100.0% 0.66

6.2% $372.59 9.3 61.0% 1.28

16.7% $67.89 3.0 47.7% 1.07

35.5% $34.04 2.6 100.0% 0.90

5.5% $347.60 13.2 78.8% 1.18

10.1% $165.39 -0.2 -1.9% 1.93

1.8% $4442.43 17.1 32.1% 0.49

4.9% $3079.84 10.7 51.8% 0.77

1.1% $1839.81 5.1 6.5% 1.06

3.9% $2952.19 16.2 63.4% 1.21

1.2% $124806.83 28.5 33.7% 1.01

23.0% $6522.26 -2.5 -66.0% 0.94

1.9% $134.73 4.2 8.3% 0.87

46.9% $1770.25 2.5 148.3% 1.18

4.7% $8743.13 8.7 42.7% 1.06

N/A $201.58 -15.1 N/A 0.81

3.4% $16096.82 11.6 39.0% 1.30

1.5% $107621.55 24.3 35.8% 0.66

2.4% $189354.31 16.4 39.3% 0.73

2.4% $4806.13 -26.4 -64.0% 0.97

2.4% $4823.78 -26.2 -64.0% 0.96

70.2% $430.31 1.7 122.9% 0.73

0.7% $4799.79 34.0 23.7% 0.81

6.0% $15695.65 31.5 196.1% 1.12

1.2% $41.00 11.7 13.4% -0.13

2.5% $3975.80 9.4 24.3% 1.21

5.5% $2221.47 12.0 64.2% 1.07

2.7% $530.64 10.8 30.4% 1.29

5.2% $5829.15 12.3 69.5% 0.82

6.1% $26.43 -4.2 -25.9% 0.17

14.8% $243.59 14.5 204.8% 1.11

5.0% $11300.99 8.1 42.6% 0.97

36.9% $172.20 5.4 219.0% 1.08

3.5% $184.51 27.6 96.5% N/A

24.6% $11432.02 -14.6 -352.7% 1.62

5.7% $2109.06 4.7 28.5% 1.28

3.6% $4453.92 9.8 37.1% 1.25

9.9% $9878.59 8.7 88.9% 1.53

13.8% $141.23 7.3 100.0% 0.78

7.2% $1375.77 26.5 204.6% 0.85

16.2% $1232.46 13.7 240.2% 1.23

0.2% $5191.25 -53.2 -10.5% 1.13

6.3% $2626.94 -74.5 -470.5% 0.08

3.7% $487.29 6.2 23.3% 1.29

25.4% $174.09 10.6 269.6% 1.07

5.0% $1831.42 -49.1 -244.1% 1.06

2.3% $5333.01 5.2 12.2% 1.16

29.2% $1559.88 4.3 133.8% 1.46

4.8% $135.56 4.0 21.9% 1.19

3.8% $7963.61 11.0 43.0% 0.93

13.9% $233.02 3.0 47.0% 1.21

1.7% $229.73 9.0 17.3% 0.92

6.2% $115755.56 15.9 100.3% 0.98

23.5% $802.72 2.7 72.4% 1.15

4.4% $1670.25 10.4 46.5% 1.39

3.1% $4337.21 19.3 63.4% 1.02

7.2% $17636.69 9.1 68.6% 1.00

5.5% $1206.04 1086.7 6326.5% 0.90

1.5% $761.46 9.5 14.8% 1.27

1.6% $12453.48 16.6 26.7% 1.59

1.0% $377.82 6.3 6.6% 1.24

5.7% $16144.79 13.9 83.4% 0.95

3.2% $3167.28 -542.4 -1702.1% 0.88

2.5% $734.92 20.2 53.1% 1.03

1.9% $2513.23 10.2 20.8% 1.15

3.5% $567.54 6.4 24.0% 1.18

3.6% $20878.69 13.7 50.1% 0.89

11.9% $5187.38 2.7 33.0% 1.50

3.8% $633.35 -5.5 -23.0% 0.67

2.0% $4213.46 76.9 157.5% 0.99

7.0% $8032.53 5.3 39.0% 1.45

2.1% $37.57 12.2 25.8% 0.60

1.2% $6083.86 36.7 42.1% 0.30

11.3% $1753.47 10.8 127.5% 1.68

3.2% $423.01 5.2 16.6% 1.31

8.3% $57723.66 9.1 77.3% 1.11

2.3% $8354.25 7.6 18.5% 1.32

4.1% $4866.07 7.0 30.7% 1.04

18.6% $1198.65 11.4 222.2% 1.67

0.6% $32370.98 17.6 11.2% 1.10

166.6% $7.37 0.6 97.4% 0.85

13.8% $1029.10 30.7 440.8% 0.95

2.4% $7509.62 22.3 55.3% 1.06

18.0% $391.95 4.6 83.4% 1.09

2.1% $24009.88 21.7 46.7% 0.85

4.1% $99.86 5.7 23.9% 1.29

3.3% $511.21 3.3 11.9% 1.31

2.0% $4258.28 18.4 38.2% 1.34

11.2% $392.90 9.2 100.0% 0.82

6.9% $988.02 4.9 34.8% 0.88

2.0% $229.05 5.0 11.3% 1.39

2.2% $1534.07 9.7 22.4% 1.22

3.7% $1963.16 6.9 26.3% 1.23

9.1% $1802.89 14.4 136.7% 1.08

5.0% $2150.34 26.8 137.1% 1.08

5.6% $8173.74 15.2 86.8% 0.93

7.3% $92.29 11.2 82.7% 0.74

2.2% $1081.53 3.0 7.2% 1.63

14.4% $19267.66 -2.0 -27.3% 1.42

15.2% $121.70 -0.4 -5.6% 1.79

8.6% $3155.28 12.6 112.0% 1.26

0.8% $1431.21 27.8 22.3% 1.56

7.6% $2315.49 4.1 34.2% 1.68

2.1% $3685.53 6.5 14.6% 1.16

35.8% $21.35 -3.5 -115.5% 1.89

2.6% $1961.86 3.6 9.4% 1.40

3.4% $3581.40 20.2 69.5% 0.96

10.8% $2372.38 12.0 134.5% 1.32

3.6% $31069.68 14.1 52.3% 0.99

N/A $290.29 -3.8 N/A 1.28

1.4% $2792.40 18.8 30.3% 0.98

5.0% $2138.14 5.7 28.7% 1.22

6.5% $3358.36 N/A N/A 1.18

4.5% $4527.94 6.9 31.5% 1.31

1.7% $2893.03 20.0 33.4% 0.76

8.7% $3799.11 11.8 110.1% 1.16

3.8% $18574.61 9.0 34.0% 1.33

19.7% $2761.79 5.1 106.4% 1.03

5.3% $12416.29 7.3 40.7% 1.01

2.7% $10376.68 59.5 167.1% 0.81

14.2% $31.91 -0.3 -3.5% 1.35

3.7% $635.68 9.1 35.6% 1.14

1.4% $56066.77 26.6 38.3% 1.07

3.9% $20996.34 11.2 45.8% 1.16

2.4% $1388.15 34.9 83.8% 1.02

2.4% $123.80 7.4 18.2% 0.93

5.6% $72743.90 7.9 44.9% 1.06

3.0% $504.48 9.8 31.7% 1.29

2.5% $2471.76 7.7 21.2% 0.56

4.1% $2136.75 9.7 42.6% 1.57

1.8% $15726.96 28.6 51.1% 0.49

3.1% $170.75 9.3 30.4% 1.19

0.3% $114682.99 30.5 8.2% 0.78

2.5% $2198.80 4.8 11.8% 1.31

7.4% $102732.04 8.2 67.7% 1.09

4.0% $1272.83 8.8 36.4% 1.13

12.3% $3039.08 5.4 65.1% 1.75

27.5% $160.42 3.7 112.5% 1.48

4.3% $1930.83 13.7 64.8% 1.04

2.2% $3207.13 55.4 119.0% 0.85

5.4% $39669.13 13.3 70.1% 1.12

5.1% $514.99 8.2 45.6% 1.28

47.1% $278.91 1.5 99.7% 1.06

9.2% $667.93 7.8 70.8% 1.47

12.2% $855.34 5.4 66.7% 0.76

1.5% $6799.59 23.5 34.8% 0.83

1.8% $1577.90 19.9 37.3% 1.06

10.7% $20089.39 7.2 77.6% 0.86

37.5% $70.46 5.4 208.1% 1.11

1.6% $77.87 -1.6 -2.4% 0.70

49.6% $922.12 2.7 186.4% 0.61

0.3% $5577.30 7.1 2.3% 1.43

9.1% $484.74 18.6 199.5% 1.49

7.3% $102.52 5.7 49.2% 1.42

10.3% $429.05 16.7 199.5% 0.99

6.0% $2319.38 8.6 53.6% 1.20

3.6% $1484.55 7.6 29.4% 1.29

4.3% $15290.75 50.3 217.9% 0.87

8.6% $1174.99 16.0 139.8% 1.32

4.6% $5451.44 11.7 56.6% 0.94

0.4% $5162.79 15.4 6.1% 0.93

3.0% $1258.86 66.3 197.0% 1.53

2.8% $2146.96 8.5 24.2% 1.12

7.9% $2338.85 6.2 52.3% 1.26

6.3% $1138.32 107.6 687.7% 1.64

4.8% $49699.56 7.5 38.0% 1.22

1.9% $761.77 23.1 46.5% 1.36

1.2% $327.52 19.9 27.9% 0.50

5.1% $459.30 6.6 35.7% 1.05

13.3% $4470.92 -10.5 -144.9% 1.26

60.5% $537.64 21.6 1287.9% 1.74

4.4% $325.45 18.7 80.0% 0.54

6.5% $2753.57 7.1 49.5% 1.08

1.4% $2315.34 15.0 21.1% 1.01

13.8% $8579.51 18.9 265.5% 1.29

2.1% $387.89 17.0 39.6% 1.14

5.7% $611.18 8.2 50.2% 1.14

5.2% $11478.99 -9.4 -49.3% 1.51

1.4% $2361.85 43.1 61.7% 0.58

1.6% $948.23 8.9 14.1% 1.42

17.1% $153.23 23.6 409.9% 1.22

0.2% $832.19 13.9 2.9% 0.92

1.6% $20390.69 19.5 32.2% 0.87

75.2% $88.31 1.0 89.3% 0.84

1.8% $336050.02 22.9 40.6% 0.60

7.6% $9399.49 28.2 232.3% 1.06

1.3% $12740.90 144.4 188.1% 0.21

0.8% $9295.83 13.8 12.0% 1.10

5.4% $1554.22 7.7 43.6% 1.03

3.5% $370.01 9.7 34.7% 0.56

4.0% $6055.60 23.1 100.4% 0.55

19.3% $248.50 9.0 194.6% 1.29

59.0% $51.62 1.3 116.6% 0.98

2.7% $31700.50 21.9 61.3% 0.85

12.8% $966.04 16.9 225.9% 1.37

1.0% $8297.32 30.0 31.7% 0.81

4.1% $3932.34 5.3 23.4% 1.19

1.7% $537.86 36.1 63.0% 1.19

1.0% $19161.49 16.7 17.4% 0.86

N/A N/A N/A N/A N/A

N/A N/A N/A N/A N/A

Declaration Date Ex-Dividend Date Record Date Payment Date

2020-03-18 2020-03-30 2020-03-31 2020-04-22

2020-02-25 2020-03-19 2020-03-20 2020-04-07

2020-02-12 2020-03-19 2020-03-20 2020-04-03

2020-03-11 2020-03-30 2020-03-31 2020-04-10

2020-02-20 2020-03-30 2020-03-31 2020-04-15

2020-03-26 2020-04-03 2020-04-06 2020-04-27

2020-02-25 2020-03-26 2020-03-27 2020-04-09

2020-01-15 2020-03-12 2020-03-13 2020-04-01

2020-03-03 2020-03-16 2020-03-17 2020-03-31

2020-03-13 2020-03-30 2020-03-31 2020-04-09

2020-02-19 2020-03-05 2020-03-06 2020-04-01

2020-02-20 2020-03-24 2020-03-25 2020-04-02

2020-02-11 2020-03-17 2020-03-18 2020-04-02

2020-02-21 2020-03-19 2020-03-20 2020-04-08

2020-02-27 2020-03-30 2020-03-31 2020-04-15

2020-02-14 2020-03-19 2020-03-20 2020-04-08

2020-02-28 2020-03-12 2020-03-13 2020-04-01

2020-03-13 2020-03-26 2020-03-27 2020-04-10

2020-02-27 2020-03-12 2020-03-13 2020-03-31

2020-03-11 2020-03-25 2020-03-26 2020-04-08

2020-02-21 2020-03-31 2020-04-01 2020-04-22

2020-01-30 2020-03-16 2020-03-17 2020-04-08

2020-02-21 2020-03-03 2020-03-04 2020-03-16

2020-02-20 2020-03-12 2020-03-13 2020-04-15

2020-02-27 2020-03-30 2020-03-31 2020-04-15

2020-03-02 2020-03-30 2020-03-31 2020-04-15

2020-02-13 2020-03-30 2020-03-31 2020-04-15

2020-03-02 2020-03-13 2020-03-16

2020-02-19 2020-03-13 2020-03-16 2020-03-27

2020-03-17 2020-03-30 2020-03-31 2020-04-10

2020-02-21 2020-03-12 2020-03-13 2020-04-06

2020-02-13 2020-03-30 2020-03-31 2020-04-14

2020-02-05 2020-03-30 2020-03-31 2020-04-15

2020-03-09 2020-03-25 2020-03-26 2020-04-16

2020-02-20 2020-03-30 2020-03-31 2020-04-15

2020-02-10 2020-03-13 2020-03-16 2020-04-01

2020-02-27 2020-03-30 2020-03-31 2020-04-15

2020-01-08 2020-03-12 2020-03-13 2020-04-14

2020-04-02 2020-04-03 2020-05-11

2020-04-02 2020-04-03 2020-05-11

2020-03-04 2020-03-30 2020-03-31 2020-04-07

2020-02-27 2020-03-18 2020-03-19 2020-04-09

2020-02-05 2020-03-13 2020-03-16 2020-04-15

2020-02-12 2020-03-12 2020-03-13 2020-04-07

2020-02-11 2020-03-30 2020-03-31 2020-04-13

2020-02-24 2020-03-30 2020-03-31 2020-04-30

2020-02-27 2020-03-19 2020-03-20 2020-04-03

2020-03-26 2020-04-03 2020-04-06 2020-04-30

2020-03-02 2020-03-30 2020-03-31 2020-04-13

2020-03-18 2020-03-30 2020-03-31 2020-04-09

2020-02-26 2020-03-30 2020-03-31 2020-04-15

2020-02-28 2020-03-18 2020-03-19 2020-04-01

2020-02-04 2020-03-12 2020-03-13 2020-04-03

2020-03-13 2020-03-24 2020-03-25 2020-04-03

2020-03-12 2020-03-23 2020-03-24 2020-04-07

2020-02-10 2020-04-03 2020-04-06 2020-04-15

2020-03-13 2020-03-30 2020-03-31 2020-04-15

2020-03-19 2020-03-30 2020-03-31 2020-04-30

2020-01-22 2020-03-12 2020-03-13 2020-04-01

2020-02-11 2020-03-31 2020-04-01 2020-04-15

2020-03-05 2020-03-17 2020-03-18 2020-04-02

2020-01-30 2020-03-13 2020-03-16 2020-04-06

2020-02-27 2020-03-09 2020-03-10 2020-04-01

2020-02-27 2020-03-19 2020-03-20 2020-04-10

2020-02-20 2020-03-13 2020-03-16 2020-04-09

2020-03-04 2020-03-23 2020-03-24 2020-04-24

2020-02-18 2020-03-12 2020-03-13 2020-04-01

2020-02-28 2020-04-01 2020-04-02 2020-04-16

2020-02-20 2020-03-17 2020-03-18 2020-04-01

2020-03-12 2020-03-30 2020-03-31 2020-04-28

2020-02-27 2020-03-13 2020-03-16 2020-03-30

2020-02-26 2020-03-09 2020-03-10 2020-04-09

2020-03-27 2020-03-30 2020-04-13

2020-02-11 2020-03-30 2020-03-31 2020-04-30

2020-01-31 2020-03-17 2020-03-18 2020-04-15

2020-03-23 2020-04-01 2020-04-02 2020-04-14

2020-02-19 2020-03-30 2020-03-31 2020-04-15

2020-02-26 2020-03-26 2020-03-27 2020-04-28

2020-01-28 2020-03-12 2020-03-13 2020-04-01

2020-03-18 2020-04-03 2020-04-06 2020-04-20

2020-01-18 2020-03-31 2020-04-01 2020-04-22

2020-02-25 2020-03-13 2020-03-16 2020-04-06

2020-03-05 2020-03-19 2020-03-20 2020-04-01

2020-02-19 2020-03-26 2020-03-27 2020-04-10

2020-03-05 2020-03-30 2020-03-31 2020-04-15

2020-01-28 2020-03-26 2020-03-27 2020-04-27

2020-03-05 2020-03-12 2020-03-15 2020-04-01

2020-02-26 2020-03-12 2020-03-13 2020-04-06

2020-01-30 2020-03-30 2020-03-31 2020-04-17

2020-03-20 2020-03-30 2020-03-31 2020-04-14

2020-02-11 2020-03-12 2020-03-13 2020-04-03

2020-03-10 2020-03-11 2020-03-12 2020-03-13

2020-02-12 2020-04-02 2020-04-03 2020-04-22

2020-01-22 2020-03-13 2020-03-16 2020-03-31

2020-01-28 2020-03-12 2020-03-15 2020-04-01

2020-02-06 2020-03-12 2020-03-13 2020-04-17

2020-02-19 2020-03-31 2020-04-01 2020-04-15

2020-03-18 2020-04-02 2020-04-03 2020-04-15

2020-03-11 2020-03-26 2020-03-27 2020-04-03

2020-02-04 2020-03-25 2020-03-26 2020-04-09

2020-02-11 2020-03-31 2020-04-01 2020-04-30

2020-02-20 2020-03-31 2020-04-01 2020-04-15

2020-02-14 2020-03-25 2020-03-26 2020-04-16

2020-03-05 2020-03-30 2020-03-31 2020-04-15

2020-02-20 2020-03-26 2020-03-27 2020-04-24

2020-02-24 2020-03-19 2020-03-20 2020-04-03

2020-03-19 2020-04-01 2020-04-02 2020-04-16

2020-02-04 2020-03-30 2020-03-31 2020-04-24

2020-01-30 2020-03-13 2020-03-16 2020-04-15

2020-03-10 2020-03-20 2020-03-23 2020-04-01

2020-03-10 2020-03-24 2020-03-25 2020-04-14

2020-03-04 2020-03-30 2020-03-31 2020-04-27

2020-02-27 2020-03-18 2020-03-19 2020-04-02

2020-01-02 2020-03-11 2020-03-12 2020-03-31

2020-02-27 2020-03-16 2020-03-17 2020-04-15

2020-02-20 2020-03-31 2020-04-01 2020-04-15

2020-02-27 2020-03-30 2020-03-31 2020-04-30

2020-02-11 2020-03-26 2020-03-27 2020-04-10

2020-02-12 2020-03-13 2020-03-16 2020-04-03

2020-03-23 2020-03-30 2020-03-31 2020-04-30

2020-02-24 2020-03-30 2020-03-31 2020-04-15

2020-03-12 2020-03-20 2020-03-23 2020-04-13

2020-03-30 2020-03-31 2020-04-15

2020-02-20 2020-04-03 2020-04-06 2020-04-21

2020-02-04 2020-04-01 2020-04-02 2020-04-17

2020-04-03 2020-04-06 2020-04-20

2020-02-21 2020-03-30 2020-03-31 2020-04-15

2020-02-12 2020-03-11 2020-03-12 2020-04-02

2020-03-02 2020-03-06 2020-03-09 2020-03-20

2020-02-04 2020-03-30 2020-03-31 2020-04-24

2020-01-28 2020-03-13 2020-03-16 2020-04-06

2020-03-16 2020-03-30 2020-03-31 2020-04-15

2020-02-14 2020-03-06 2020-03-09 2020-04-01

2020-01-28 2020-03-13 2020-03-16 2020-04-01

2020-01-28 2020-03-12 2020-03-13 2020-04-01

2020-02-27 2020-03-18 2020-03-19 2020-04-02

2020-02-24 2020-03-30 2020-03-31 2020-04-14

2020-03-06 2020-03-16 2020-03-17 2020-03-27

2020-02-24 2020-03-26 2020-03-27 2020-04-09

2020-03-09 2020-03-19 2020-03-20 2020-04-06

2020-02-27 2020-03-26 2020-03-27 2020-04-07

2020-02-28 2020-03-30 2020-03-31 2020-04-16

2020-02-03 2020-03-03 2020-03-04 2020-04-01

2020-02-03 2020-03-03 2020-03-04 2020-04-01

2020-03-11 2020-03-31 2020-04-01 2020-04-15

2020-02-12 2020-03-30 2020-03-31 2020-04-20

2020-02-10 2020-03-13 2020-03-16 2020-04-15

2020-02-04 2020-03-30 2020-03-31 2020-04-07

2020-02-25 2020-03-23 2020-03-24 2020-04-08

2020-03-17 2020-03-31 2020-04-01 2020-04-15

2020-02-14 2020-03-06 2020-03-09 2020-04-27

2020-02-25 2020-03-17 2020-03-18 2020-04-01

2020-02-20 2020-03-11 2020-03-12 2020-04-06

2020-01-14 2020-03-19 2020-03-20 2020-03-31

2020-02-25 2020-03-10 2020-03-11 2020-03-23

2020-02-18 2020-03-05 2020-03-06 2020-04-01

2020-02-20 2020-03-12 2020-03-15 2020-04-05

2019-12-09 2020-03-13 2020-03-16 2020-03-30

2020-03-18 2020-03-27 2020-03-30 2020-04-14

2020-02-26 2020-03-25 2020-03-26 2020-04-09

2020-03-26 2020-03-30 2020-03-31 2020-04-15

2020-02-28 2020-03-16 2020-03-17 2020-03-31

2020-02-20 2020-04-01 2020-04-02 2020-04-10

2020-01-22 2020-03-17 2020-03-18 2020-04-01

2020-03-17 2020-04-02 2020-04-03 2020-04-17

2020-03-05 2020-03-20 2020-03-23 2020-03-30

2020-03-12 2020-03-30 2020-03-31 2020-04-15

2020-03-25 2020-04-03 2020-04-06 2020-04-15

2020-02-15 2020-03-30 2020-03-31 2020-04-06

2020-01-30 2020-03-10 2020-03-11 2020-04-01

2020-01-16 2020-03-10 2020-03-11 2020-04-01

2020-03-03 2020-03-16 2020-03-17 2020-04-01

2020-02-27 2020-03-13 2020-03-16 2020-04-03

2020-02-19 2020-03-30 2020-03-31 2020-04-15

2020-03-05 2020-03-30 2020-03-31 2020-04-15

2020-02-13 2020-04-01 2020-04-02 2020-04-09

2020-02-14 2020-03-19 2020-03-20 2020-04-01

2020-02-20 2020-03-30 2020-03-31 2020-04-24

2020-03-11 2020-03-27 2020-03-30 2020-04-13

2020-01-30 2020-03-12 2020-03-15 2020-04-01

2020-01-28 2020-03-12 2020-03-13 2020-04-01

2020-03-16 2020-03-31 2020-04-01 2020-04-17

2020-03-02 2020-03-25 2020-03-26 2020-04-06

2020-02-26 2020-03-16 2020-03-17 2020-03-31

2020-01-31 2020-03-04 2020-03-05 2020-04-01

2020-03-17 2020-03-30 2020-03-31 2020-04-15

2020-03-19 2020-03-27 2020-03-30 2020-04-09

2020-03-18 2020-03-31 2020-04-01 2020-04-27

2020-03-16 2020-03-26 2020-03-27 2020-04-09

2019-10-11 2020-03-30 2020-03-31 2020-04-15

2020-03-05 2020-03-30 2020-03-31 2020-04-09

2020-02-12 2020-03-13 2020-03-16 2020-04-06

2020-02-11 2020-03-19 2020-03-20 2020-04-10

2020-03-16 2020-04-01 2020-04-02 2020-04-24

2020-03-25 2020-04-03 2020-04-06 2020-04-30

2020-03-04 2020-03-23 2020-03-24 2020-04-07

2020-02-21 2020-03-13 2020-03-16 2020-04-06

2020-03-10 2020-04-01 2020-04-02 2020-05-14

2020-02-14 2020-03-30 2020-03-31 2020-04-15

2020-02-20 2020-04-02 2020-04-03 2020-04-17

2020-03-17 2020-03-27 2020-03-30 2020-04-28

2020-02-21 2020-03-31 2020-04-01 2020-04-15

2020-03-04 2020-03-13 2020-03-16 2020-04-10

2020-02-27 2020-03-13 2020-03-16 2020-04-01

2020-02-11 2020-03-16 2020-03-17 2020-04-08

2020-03-17 2020-04-03 2020-04-06 2020-04-30

2020-02-18 2020-03-16 2020-03-17 2020-04-09

2020-02-18 2020-03-19 2020-03-20 2020-04-03

2020-02-10 2020-03-24 2020-03-25 2020-04-15

2020-02-20 2020-03-13 2020-03-16 2020-04-15

2020-02-13 2020-04-02 2020-04-03 2020-04-17

2020-01-30 2020-04-01 2020-04-02 2020-04-15

2020-01-23 2020-03-05 2020-03-06 2020-04-02

2020-02-20 2020-03-13 2020-03-16 2020-04-01

2020-02-12 2020-03-30 2020-03-31 2020-04-15

2020-02-13 2020-03-26 2020-03-27 2020-04-03

2020-01-30 2020-03-06 2020-03-09 2020-04-08

2020-02-26 2020-03-30 2020-03-31 2020-04-07

2020-02-27 2020-03-09 2020-03-10 2020-04-01

2020-01-14 2020-03-19 2020-03-20 2020-03-31

2020-02-19 2020-03-30 2020-03-31 2020-04-15

2020-02-19 2020-03-12 2020-03-13 2020-04-15

2020-03-20 2020-03-31 2020-04-01 2020-04-15

2020-02-04 2020-03-18 2020-03-19 2020-04-20

2020-03-23 2020-04-03 2020-04-06 2020-04-17

2020-01-02 2020-03-20 2020-03-23 2020-03-31

2020-03-16 2020-03-30 2020-03-31 2020-04-15

2020-02-28 2020-03-12 2020-03-13 2020-04-01

2020-02-06 2020-03-30 2020-03-31 2020-04-14

2020-03-06 2020-03-26 2020-03-27 2020-04-17

2020-02-13 2020-03-11 2020-03-12 2020-04-01

2020-02-13 2020-03-24 2020-03-25 2020-04-01

2020-03-11 2020-03-30 2020-03-31 2020-04-30

2020-03-13 2020-03-30 2020-03-31 2020-04-15

2020-02-27 2020-03-24 2020-03-25 2020-04-30

2020-02-25 2020-04-02 2020-04-03 2020-04-30

2020-02-14 2020-03-11 2020-03-12 2020-04-09

2020-02-05 2020-03-30 2020-03-31 2020-04-15

2020-01-28 2020-03-13 2020-03-16 2020-04-07

2020-03-11 2020-04-02 2020-04-03 2020-04-22

2020-02-13 2020-03-12 2020-03-13 2020-04-15

2020-03-09 2020-03-25 2020-03-26 2020-04-09

2020-03-20 2020-03-30 2020-03-31 2020-04-30

2020-02-10 2020-03-13 2020-03-16 2020-03-30

2020-03-05 2020-03-17 2020-03-18 2020-04-02

2020-02-20 2020-03-11 2020-03-12 2020-04-02

2020-02-27 2020-03-13 2020-03-16 2020-04-01

2020-03-11 2020-03-30 2020-03-31 2020-04-15

2020-02-20 2020-03-31 2020-04-01 2020-04-14

2020-01-21 2020-03-16 2020-03-17 2020-04-01

2020-03-16 2020-03-30 2020-03-31 2020-04-30

2020-02-18 2020-03-04 2020-03-05 2020-04-03

2020-02-12 2020-04-02 2020-04-03 2020-04-22

2020-01-21 2020-03-12 2020-03-13 2020-04-01

2020-02-06 2020-03-27 2020-03-30 2020-04-07

2020-01-31 2020-03-03 2020-03-04 2020-03-12

2020-02-06 2020-03-10 2020-03-11 2020-04-15

2020-02-06 2020-03-10 2020-03-11 2020-04-15

2020-03-17 2020-03-31 2020-04-01 2020-04-15

2020-02-06 2020-03-05 2020-03-06 2020-04-03

2020-02-25 2020-03-30 2020-03-31 2020-04-15

2020-01-27 2020-03-30 2020-03-31 2020-04-15

2020-03-13 2020-03-23 2020-03-24 2020-04-07

2020-02-11 2020-03-09 2020-03-10 2020-04-08

2020-03-18 2020-03-30 2020-03-31 2020-04-28

2020-02-11 2020-03-09 2020-03-10 2020-04-15

2020-01-21 2020-03-13 2020-03-16 2020-04-01

2020-03-04 2020-03-24 2020-03-25 2020-04-15

2020-03-20 2020-03-30 2020-03-31 2020-04-14

2020-03-16 2020-03-30 2020-03-31 2020-04-15

2020-03-16 2020-03-31 2020-04-01 2020-04-15

2020-02-26 2020-03-30 2020-03-31 2020-04-30

2020-03-03 2020-03-17 2020-03-18 2020-04-01

2020-03-13 2020-03-30 2020-03-31 2020-04-15

2020-02-06 2020-03-12 2020-03-13 2020-04-03

2020-02-26 2020-03-30 2020-03-31 2020-04-15

2020-02-25 2020-03-12 2020-03-13 2020-04-15

2020-03-16 2020-03-31 2020-04-01 2020-04-20

2020-03-05 2020-03-20 2020-03-23 2020-04-09

2020-02-10 2020-03-16 2020-03-17 2020-04-08

2020-02-12 2020-03-24 2020-03-25 2020-04-15

2020-02-14 2020-03-09 2020-03-10 2020-04-01

2020-03-04 2020-03-26 2020-03-27 2020-04-15

2020-02-25 2020-03-30 2020-03-31 2020-04-15

2020-02-19 2020-03-30 2020-03-31 2020-04-14

2020-02-12 2020-03-19 2020-03-20 2020-04-08

2020-02-09 2020-03-13 2020-03-16 2020-04-03

2020-02-18 2020-03-19 2020-03-20 2020-04-07

2020-01-25 2020-03-26 2020-03-27 2020-04-09

2020-01-22 2020-03-19 2020-03-20 2020-04-17

2020-01-22 2020-03-09 2020-03-10 2020-04-01

2020-02-20 2020-03-05 2020-03-06 2020-04-06

2020-02-10 2020-03-30 2020-03-31 2020-04-15

2020-02-06 2020-03-05 2020-03-06 2020-04-01

2020-03-05 2020-03-30 2020-03-31 2020-04-15

2020-03-10 2020-04-02 2020-04-03 2020-04-17

2020-02-25 2020-03-30 2020-03-31 2020-04-15

2020-03-03 2020-03-16 2020-03-17 2020-03-31

2020-02-28 2020-03-06 2020-03-09 2020-04-16

2020-02-21 2020-03-31 2020-04-01 2020-04-15

2020-03-16 2020-03-26 2020-03-27 2020-04-10

2020-03-18 2020-03-30 2020-03-31 2020-04-15

2020-03-04 2020-03-13 2020-03-16

2020-02-13 2020-03-25 2020-03-26 2020-04-09

2020-02-13 2020-03-19 2020-03-20 2020-04-01

2020-02-13 2020-03-31 2020-04-01 2020-04-15

2020-02-19 2020-03-12 2020-03-13 2020-04-15

2020-03-06 2020-03-13 2020-03-16 2020-03-30

2020-03-24 2020-04-02 2020-04-03 2020-04-17

2020-03-18 2020-04-03 2020-04-06 2020-04-20

2020-03-16 2020-03-31 2020-04-01 2020-04-10

2020-01-27 2020-03-13 2020-03-16 2020-04-06

2020-02-17 2020-03-30 2020-03-31 2020-04-15

2020-02-18 2020-03-17 2020-03-18 2020-04-02

2020-01-13 2020-03-12 2020-03-13 2020-03-30

2020-03-20 2020-03-30 2020-03-31 2020-04-14

2020-02-04 2020-03-30 2020-03-31 2020-04-06

2020-02-10 2020-03-12 2020-03-13 2020-04-03

2020-03-25 2020-03-30 2020-03-31 2020-04-15

2020-03-03 2020-03-18 2020-03-19 2020-04-01

2020-01-27 2020-03-12 2020-03-13

2020-02-06 2020-03-19 2020-03-20 2020-04-09

2020-02-05 2020-03-10 2020-03-11 2020-04-02

2020-03-03 2020-03-30 2020-03-31 2020-04-15

2020-02-25 2020-03-19 2020-03-20 2020-04-15

2020-02-03 2020-04-01 2020-04-02 2020-04-23

2020-01-09 2020-03-30 2020-03-31 2020-04-15

2020-02-26 2020-03-30 2020-03-31 2020-04-10

2020-02-26 2020-03-30 2020-03-31 2020-04-15

2020-03-16 2020-03-30 2020-03-31 2020-04-15

2020-02-20 2020-03-31 2020-04-01 2020-04-15

2020-02-25 2020-03-30 2020-03-31 2020-04-15

2020-01-27 2020-03-24 2020-03-25 2020-04-08

2020-03-06 2020-03-30 2020-03-31 2020-04-15

2020-02-18 2020-03-12 2020-03-13 2020-04-01

2020-02-05 2020-03-30 2020-03-31 2020-04-30

2020-02-27 2020-04-02 2020-04-03 2020-04-24

2020-02-27 2020-03-12 2020-03-13 2020-04-01

2020-02-19 2020-03-05 2020-03-06 2020-04-01

2020-03-19 2020-04-01 2020-04-02 2020-04-16

2020-02-20 2020-03-19 2020-03-20 2020-04-10

2020-03-05 2020-03-20 2020-03-23 2020-03-30

2020-02-25 2020-03-13 2020-03-16 2020-04-16

2019-10-30 2020-03-26 2020-03-27 2020-04-21

2020-02-26 2020-03-27 2020-03-30 2020-04-10

2020-02-20 2020-03-05 2020-03-06 2020-03-30

2020-02-28 2020-03-13 2020-03-16 2020-03-30

2020-02-06 2020-03-26 2020-03-27 2020-04-10

2020-02-13 2020-03-30 2020-03-31 2020-04-30

2020-02-18 2020-03-05 2020-03-06 2020-04-01

2020-03-17 2020-03-26 2020-03-27 2020-04-24

2020-02-19 2020-03-12 2020-03-13 2020-04-15

2020-03-17 2020-03-27 2020-03-30 2020-04-09

2020-02-27 2020-03-31 2020-04-01 2020-04-16

2020-02-13 2020-03-10 2020-03-11 2020-04-01

2020-03-13 2020-03-30 2020-03-31 2020-04-15

2020-02-26 2020-03-12 2020-03-13 2020-04-01

2020-03-19 2020-04-02 2020-04-03 2020-04-17

2020-03-24 2020-04-03 2020-04-06 2020-04-15

2020-03-19 2020-04-02 2020-04-03 2020-04-17

2020-02-24 2020-03-12 2020-03-13 2020-04-01

2020-02-05 2020-03-13 2020-03-16 2020-04-06

2020-02-19 2020-04-01 2020-04-02 2020-04-15

2020-01-22 2020-03-13 2020-03-16 2020-04-01

2020-03-04 2020-03-16 2020-03-17 2020-03-31

2020-01-28 2020-03-09 2020-03-10 2020-04-01

2020-03-13 2020-03-30 2020-03-31 2020-04-15

2020-02-28 2020-03-30 2020-03-31 2020-04-15

2020-03-17 2020-03-30 2020-03-31 2020-04-15

2020-02-27 2020-03-12 2020-03-13 2020-04-17

2020-02-13 2020-03-12 2020-03-13 2020-04-02

2020-02-24 2020-03-09 2020-03-10 2020-04-01

2020-02-25 2020-03-30 2020-03-31 2020-04-15

2020-03-16 2020-03-30 2020-03-31 2020-04-15

2020-03-13 2020-04-01 2020-04-02 2020-04-23

2020-02-26 2020-03-12 2020-03-13 2020-04-01

2020-02-25 2020-03-26 2020-03-27 2020-04-15

2020-03-19 2020-03-31 2020-04-01 2020-04-14

2020-02-27 2020-03-13 2020-03-16 2020-04-01

2020-03-19 2020-03-31 2020-04-01 2020-04-09

2020-02-13 2020-04-02 2020-04-03 2020-04-17

2020-02-05 2020-03-05 2020-03-06 2020-04-01

2020-02-17 2020-04-02 2020-04-03 2020-04-17

2020-02-26 2020-03-30 2020-03-31 2020-04-15

2020-02-18 2020-03-19 2020-03-20 2020-04-06

2020-03-12 2020-03-30 2020-03-31 2020-04-15

2020-03-11 2020-03-25 2020-03-26 2020-04-09

2020-02-20 2020-03-10 2020-03-11 2020-03-25

2020-02-27 2020-03-12 2020-03-13 2020-04-01

2020-02-25 2020-03-10 2020-03-11 2020-04-02

2020-03-11 2020-03-30 2020-03-31 2020-04-28

2020-02-19 2020-03-12 2020-03-13 2020-04-20

2020-02-21 2020-03-30 2020-03-31 2020-04-15

2020-02-26 2020-03-26 2020-03-27 2020-04-10

2020-02-27 2020-03-27 2020-03-30 2020-04-30

2020-03-10 2020-03-26 2020-03-27 2020-04-30

Ticker Name

A Agilent Technologies, Inc.

AAME Atlantic American Corp.

AAN Aaron's, Inc.

AAP Advance Auto Parts, Inc.

ABCB Ameris Bancorp

ACRE Ares Commercial Real Estate Corp.

ACU Acme United Corp.

ADC Agree Realty Corp.

ADP Automatic Data Processing, Inc.

AEO American Eagle Outfitters, Inc.

AFG American Financial Group, Inc.

AGI Alamos Gold, Inc.

AGNC AGNC Investment Corp.

AGR Avangrid, Inc.

AGX Argan, Inc.

AHH Armada Hoffler Properties, Inc.

AHT Ashford Hospitality Trust, Inc.

AI Arlington Asset Investment Corp.

AIMC Altra Industrial Motion Corp.

AIN Albany International Corp.

AKR Acadia Realty Trust

AL Air Lease Corp.

ALB Albemarle Corp.

ALCO Alico, Inc.

ALG Alamo Group, Inc.

ALL The Allstate Corp.

AMH American Homes 4 Rent

AMOT Allied Motion Technologies, Inc.

AMT American Tower Corp.

ANDE The Andersons, Inc.

ANH Anworth Mortgage Asset Corp.

APH Amphenol Corp.

APLE Apple Hospitality REIT, Inc.

APTS Preferred Apartment Communities, Inc.

AQN Algonquin Power & Utilities Corp.

ARCO Arcos Dorados Holdings, Inc.

ARE Alexandria Real Estate Equities, Inc.

ARI Apollo Commercial Real Estate Finance, Inc.

ARKR Ark Restaurants Corp.

ARR ARMOUR Residential REIT, Inc.

ATNI ATN International, Inc.

AU AngloGold Ashanti Ltd.

AUY Yamana Gold, Inc.

AVAL Grupo Aval Acciones y Valores SA

AVB AvalonBay Communities, Inc.

AVD American Vanguard Corp.

AXS AXIS Capital Holdings Ltd.

BANC Banc of California, Inc.

BANF BancFirst Corp. (Oklahoma)

BANR Banner Corp.

BAX Baxter International, Inc.

BBBY Bed Bath & Beyond, Inc.

BBD Banco Bradesco SA

BBDO Banco Bradesco SA

BBGI Beasley Broadcast Group, Inc.

BBVA Banco Bilbao Vizcaya Argentaria SA

BBY Best Buy Co., Inc.

BCE BCE, Inc.

BCRH Blue Capital Reinsurance Holdings Ltd.

BCS Barclays Plc

BDC Belden, Inc.

BDGE Bridge Bancorp, Inc.

BDN Brandywine Realty Trust

BEN Franklin Resources, Inc.

BFS Saul Centers, Inc.

BGG Briggs & Stratton Corp.

BGS B&G Foods, Inc.

BIG Big Lots, Inc.

BKE The Buckle, Inc.

BKSC Bank of South Carolina Corp.

BKTI BK Technologies Corp.

BKU BankUnited, Inc.

BNS The Bank of Nova Scotia

BOCH Bank of Commerce Holdings

BOOM DMC Global, Inc.

BPOP Popular, Inc.

BPT BP Prudhoe Bay Royalty Trust

BR Broadridge Financial Solutions, Inc.

BRC Brady Corp.

BRG Bluerock Residential Growth REIT, Inc.

BRT BRT Apartments Corp.

BRX Brixmor Property Group, Inc.

BUSE First Busey Corp.

BXMT Blackstone Mortgage Trust, Inc.

BXP Boston Properties, Inc.

BXS BancorpSouth Bank

BYD Boyd Gaming Corp.

CAC Camden National Corp. (Maine)

CAH Cardinal Health, Inc.

CAL Caleres, Inc.

CARO Carolina Financial Corp.

CASH Meta Financial Group, Inc.

CB Chubb Ltd.

CBL CBL & Associates Properties, Inc.

CBS ViacomCBS, Inc.

CBU Community Bank System, Inc.

CCMP Cabot Microelectronics Corp.

CFFI C&F Financial Corp.

CHCO City Holding Co.

CHH Choice Hotels International, Inc.

CHMG Chemung Financial Corp.

CHMI Cherry Hill Mortgage Investment Corp.

CHS Chico's FAS, Inc.

CI Cigna Corp.

CIB Bancolombia SA

CIM Chimera Investment Corp.

CINF Cincinnati Financial Corp.

CIO City Office REIT, Inc.

CKX CKX Lands, Inc.

CLDT Chatham Lodging Trust

CLI Mack-Cali Realty Corp.

CLNY Colony Capital, Inc.

CM Canadian Imperial Bank of Commerce

CMA Comerica, Inc.

CMC Commercial Metals Co.

CMCSA Comcast Corp.

CMFN CM Finance, Inc.

CMO Capstead Mortgage Corp.

CNMD CONMED Corp.

CNQ Canadian Natural Resources Ltd.

CODI Compass Diversified Holdings

COHU Cohu, Inc.

CONE CyrusOne, Inc.

COR CoreSite Realty Corp.

CP Canadian Pacific Railway Ltd.

CPB Campbell Soup Co.

CPG Crescent Point Energy Corp.

CPHC Canterbury Park Holding Corp.

CPK Chesapeake Utilities Corp.

CPT Camden Property Trust

CRT Cross Timbers Royalty Trust

CRWS Crown Crafts, Inc.

CSB VictoryShares US Small Cap High Dividend Volatility Wtd

CSCO Cisco Systems, Inc.

CSWC Capital Southwest Corp.

CTBI Community Trust Bancorp, Inc. (Kentucky)

CTRE CareTrust REIT, Inc.

CTS CTS Corp.

CUBE CubeSmart

CUZ Cousins Properties, Inc.

CVA Covanta Holding Corp.

CVBF CVB Financial Corp.

CW Curtiss-Wright Corp.

CWCO Consolidated Water Co. Ltd.

CXW CoreCivic, Inc.

CY Cypress Semiconductor Corp.

DEI Douglas Emmett, Inc.

DEO Diageo Plc

DG Dollar General Corp.

DGX Quest Diagnostics, Inc.

DHR Danaher Corp.

DIN Dine Brands Global, Inc.

DOC Physicians Realty Trust

DOX Amdocs Ltd.

DRH DiamondRock Hospitality Co.

DSW DSW, Inc.

DTE DTE Energy Co.

DVCR Diversicare Healthcare Services, Inc.

DX Dynex Capital, Inc.

DXC DXC Technology Co.

EARN Ellington Residential Mortgage REIT

EBSB Meridian Bancorp, Inc.

EC Ecopetrol SA

ECC Eagle Point Credit Co., Inc.

ECL Ecolab, Inc.

ECOL US Ecology, Inc.

EHC Encompass Health Corp.

EIX Edison International

ELS Equity LifeStyle Properties, Inc.

EME EMCOR Group, Inc.

EMN Eastman Chemical Co.

ENSG The Ensign Group, Inc.

EOG EOG Resources, Inc.

EPR EPR Properties

EQR Equity Residential

ERF Enerplus Corp.

ERIE Erie Indemnity Co.

ERJ Embraer SA

ESE ESCO Technologies, Inc.

ESLT Elbit Systems Ltd.

ESS Essex Property Trust, Inc.

ETH Ethan Allen Interiors, Inc.

EVBN Evans Bancorp, Inc.

EVRG Evergy, Inc.

FBNC First Bancorp (North Carolina)

FCNCA First Citizens BancShares, Inc. (North Carolina)

FCPT Four Corners Property Trust, Inc.

FDX FedEx Corp.

FFIN First Financial Bankshares, Inc.

FHN First Horizon National Corp. (Tennessee)

FISI Financial Institutions, Inc.

FITB Fifth Third Bancorp

FLIC The First of Long Island Corp.

FLR Fluor Corp.

FLS Flowserve Corp.

FLXS Flexsteel Industries, Inc.

FMBH First Mid Bancshares, Inc.

FMBI First Midwest Bancorp, Inc. (Illinois)

FMC FMC Corp.

FNLC The First Bancorp, Inc. (Maine)

FOX Fox Corp.

FOXA Fox Corp.

FPI Farmland Partners, Inc.

FR First Industrial Realty Trust, Inc.

FRT Federal Realty Investment Trust

FSV FirstService Corp.

FTI TechnipFMC Plc

FULT Fulton Financial Corp.

GBCI Glacier Bancorp, Inc.

GE General Electric Co.

GEF Greif, Inc.

GES Guess?, Inc.

GFF Griffon Corp.

GIL Gildan Activewear, Inc.

GLNG Golar LNG Ltd.

GNL Global Net Lease, Inc.

GNTX Gentex Corp.

GOOD Gladstone Commercial Corp.

GORO Gold Resource Corp.

GPC Genuine Parts Co.

GPK Graphic Packaging Holding Co.

GPMT Granite Point Mortgage Trust, Inc.

GROW U.S. Global Investors, Inc.

GSBC Great Southern Bancorp, Inc. (Missouri)

GSK GlaxoSmithKline Plc

GTY Getty Realty Corp.

GVA Granite Construction, Inc.

GWRS Global Water Resources, Inc.

GZT Gazit-Globe Ltd.

HASI Hannon Armstrong Sustainable Infrastructure Capital, Inc

HBAN Huntington Bancshares, Inc.

HBNC Horizon Bancorp, Inc. (Indiana)

HCAP Harvest Capital Credit Corp.

HCC Warrior Met Coal, Inc.

HCFT Hunt Companies Finance Trust, Inc.

HIFS Hingham Institution for Savings

HIG The Hartford Financial Services Group, Inc.

HIHO Highway Holdings Ltd.

HPE Hewlett-Packard Enterprise Co.

HPQ HP, Inc.

HRB H&R Block, Inc.

HRTG Heritage Insurance Holdings, Inc.

HSBC HSBC Holdings Plc

HST Host Hotels & Resorts, Inc.

HT Hersha Hospitality Trust

HTA Healthcare Trust of America, Inc.

HTLD Heartland Express, Inc.

HUM Humana, Inc.

HURC Hurco Cos., Inc.

HWBK Hawthorn Bancshares, Inc.

HWKN Hawkins, Inc.

IBKC IBERIABANK Corp.

IBOC International Bancshares Corp.

IFF International Flavors & Fragrances, Inc.

IGT International Game Technology Plc

IMKTA Ingles Markets, Inc.

IMO Imperial Oil Ltd.

INBK First Internet Bancorp

INDB Independent Bank Corp. (Massachusetts)

INGR Ingredion, Inc.

INT World Fuel Services Corp.

INTU Intuit, Inc.

IPAR Inter Parfums, Inc.

IRET Investors Real Estate Trust

IRM Iron Mountain, Inc.

IROQ IF Bancorp, Inc.

IRT Independence Realty Trust, Inc.

ISTR Investar Holding Corp.

ITRN Ituran Location & Control Ltd.

ITT ITT, Inc.

ITUB Itaú Unibanco Holding SA

ITW Illinois Tool Works, Inc.

IVC Invacare Corp.

IVR Invesco Mortgage Capital, Inc.

JCAP Jernigan Capital, Inc.

JCI Johnson Controls International Plc

JCS Communications Systems, Inc.

JJSF J&J Snack Foods Corp.

JMP JMP Group LLC

JOUT Johnson Outdoors, Inc.

JPM JPMorgan Chase & Co.

KAMN Kaman Corp.

KAR KAR Auction Services, Inc.

KBAL Kimball International, Inc.

KBR KBR, Inc.

KDP Keurig Dr Pepper, Inc.

KIM Kimco Realty Corp.

KMB Kimberly-Clark Corp.

KO The Coca-Cola Co.

KRC Kilroy Realty Corp.

KRG Kite Realty Group Trust

KSU Kansas City Southern

KW Kennedy-Wilson Holdings, Inc.

KWR Quaker Chemical Corp.

LADR Ladder Capital Corp.

LAND Gladstone Land Corp.

LECO Lincoln Electric Holdings, Inc.

LEG Leggett & Platt, Inc.

LII Lennox International, Inc.

LM Legg Mason, Inc.

LMAT LeMaitre Vascular, Inc.

LMNR Limoneira Co.

LOAN Manhattan Bridge Capital, Inc.

LPT Liberty Property Trust

LSI Life Storage, Inc.

LTC LTC Properties, Inc.

LXP Lexington Realty Trust

M Macy's, Inc.

MAA Mid-America Apartment Communities, Inc.

MAIN Main Street Capital Corp.

MCK McKesson Corp.

MDLZ Mondelez International, Inc.

MDT Medtronic Plc

MDU MDU Resources Group, Inc.

MEI Methode Electronics, Inc.

MERC Mercer International, Inc.

MFA MFA Financial, Inc.

MFNC Mackinac Financial Corp.

MGP MGM Growth Properties LLC

MGRC McGrath RentCorp

MHLD Maiden Holdings Ltd.

MITT AG Mortgage Investment Trust, Inc.

MKC McCormick & Co., Inc.

MLHR Herman Miller, Inc.

MO Altria Group, Inc.

MORN Morningstar, Inc.

MOV Movado Group, Inc.

MPW Medical Properties Trust, Inc.

MPWR Monolithic Power Systems, Inc.

MRK Merck & Co., Inc.

MRVL Marvell Technology Group Ltd.

MSI Motorola Solutions, Inc.

MTN Vail Resorts, Inc.

MTR Mesa Royalty Trust

MTSC MTS Systems Corp.

MVC MVC Capital, Inc.

MVO MV Oil Trust

MYE Myers Industries, Inc.

NBR Nabors Industries Ltd.

NEU NewMarket Corp.

NFG National Fuel Gas Co.

NGHC National General Holdings Corp.

NJR New Jersey Resources Corp.

NKE NIKE, Inc.

NLY Annaly Capital Management, Inc.

NOA North American Construction Group Ltd.

NRZ New Residential Investment Corp.

NTAP NetApp, Inc.

NTP Nam Tai Property, Inc.

NTRS Northern Trust Corp.

NVO Novo Nordisk A/S

NVS Novartis AG

NWS News Corp.

NWSA News Corp.

NYMT New York Mortgage Trust, Inc.

NYT The New York Times Co.

O Realty Income Corp.

OBCI Ocean Bio-Chem, Inc.

OC Owens Corning

OFC Corporate Office Properties Trust, Inc.

OFG OFG Bancorp

OGE OGE Energy Corp.

OHAI OHA Investment Corp.

OLP One Liberty Properties, Inc.

OMC Omnicom Group, Inc.

ORC Orchid Island Capital, Inc.

ORM Owens Realty Mortgage, Inc.

OXY Occidental Petroleum Corp.

OZK Bank OZK

PB Prosperity Bancshares, Inc.

PBA Pembina Pipeline Corp.

PBT Permian Basin Royalty Trust

PDCO Patterson Cos., Inc.

PEB Pebblebrook Hotel Trust

PEGA Pegasystems, Inc.

PEGI Pattern Energy Group, Inc.

PFBC Preferred Bank (California)

PFLT PennantPark Floating Rate Capital Ltd.

PGRE Paramount Group, Inc.

PHM PulteGroup, Inc.

PK Park Hotels & Resorts, Inc.

PKBK Parke Bancorp, Inc.

PKG Packaging Corporation of America

PLCE The Children's Place, Inc.

PLPC Preformed Line Products Co.

PM Philip Morris International, Inc.

PMT PennyMac Mortgage Investment Trust

POL PolyOne Corp.

POR Portland General Electric Co.

PPL PPL Corp.

PRA ProAssurance Corp.

PRIM Primoris Services Corp.

PXD Pioneer Natural Resources Co.

QCRH QCR Holdings, Inc.

QSR Restaurant Brands International, Inc.

QTS QTS Realty Trust, Inc.

RAVN Raven Industries, Inc.

RBC Regal Beloit Corp.

RBCAA Republic Bancorp, Inc. (Kentucky)

RCI Rogers Communications, Inc.

RCL Royal Caribbean Cruises Ltd.

RESI Front Yard Residential Corp.

REXR Rexford Industrial Realty, Inc.

RF Regions Financial Corp.

RFIL RF Industries Ltd.

RGLD Royal Gold, Inc.

RHP Ryman Hospitality Properties, Inc.

RILY B. Riley Financial, Inc.

RIO Rio Tinto Plc

RJF Raymond James Financial, Inc.

RL Ralph Lauren Corp.

RLJ RLJ Lodging Trust

ROP Roper Technologies, Inc.

ROYT Pacific Coast Oil Trust

RPAI Retail Properties of America, Inc.

RPM RPM International, Inc.

RPT RPT Realty

RSG Republic Services, Inc.

RVSB Riverview Bancorp, Inc.

SAH Sonic Automotive, Inc.

SAIC Science Applications International Corp.

SBR Sabine Royalty Trust

SCS Steelcase, Inc.

SCVL Shoe Carnival, Inc.

SFBS ServisFirst Bancshares, Inc.

SFNC Simmons First National Corp.

SHO Sunstone Hotel Investors, Inc.

SJI South Jersey Industries, Inc.

SJR Shaw Communications, Inc.

SJT San Juan Basin Royalty Trust

SKYW Sky West, Inc.

SLB Schlumberger NV

SLCA U.S. Silica Holdings, Inc.

SLG SL Green Realty Corp.

SNHY Sun Hydraulics Corp.

SNV Synovus Financial Corp.

SNX SYNNEX Corp.

SOHO Sotherly Hotels, Inc.

SPR Spirit AeroSystems Holdings, Inc.

SR Spire, Inc. (Missouri)

SRC Spirit Realty Capital, Inc.

SRE Sempra Energy

SRG Seritage Growth Properties

SSD Simpson Manufacturing Co., Inc.

SSW Seaspan Corp.

STAG STAG Industrial, Inc.

STLD Steel Dynamics, Inc.

STN Stantec, Inc.

STOR STORE Capital Corp.

STT State Street Corp.

STWD Starwood Property Trust, Inc.

STX Seagate Technology Plc

SUI Sun Communities, Inc.

SUP Superior Industries International, Inc.

SYBT Stock Yards Bancorp, Inc.

SYK Stryker Corp.

SYY Sysco Corp.

TAC TransAlta Corp.

TCFC The Community Financial Corp. (Maryland)

TD The Toronto-Dominion Bank

TG Tredegar Corp.

TGNA TEGNA, Inc.

THO Thor Industries, Inc.

TIF Tiffany & Co.

TIPT Tiptree, Inc.

TMO Thermo Fisher Scientific, Inc.

TOL Toll Brothers, Inc.

TOT Total SA

TOWN TowneBank

TPR Tapestry, Inc.

TPVG TriplePoint Venture Growth BDC Corp.

TRN Trinity Industries, Inc.

TRNO Terreno Realty Corp.

TRP TC Energy Corp.

TRST TrustCo Bank Corp. NY

TRTX TPG RE Finance Trust, Inc.

TSE Trinseo SA

TSLX TPG Specialty Lending, Inc.

TTC The Toro Co.

TTEC TTEC Holdings, Inc.

TU TELUS Corp.

TUP Tupperware Brands Corp.

TWI Titan International, Inc.

TWO Two Harbors Investment Corp.

TXT Textron, Inc.

UBA Urstadt Biddle Properties, Inc.

UBFO United Security Bancshares (California)