Professional Documents

Culture Documents

1 Residential Status: 8 Marks Incidence of Tax: 7 Marks: ST ND

Uploaded by

adhishree bhattacharya0 ratings0% found this document useful (0 votes)

15 views3 pagesOriginal Title

MSE Taxation law QP1 (1)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views3 pages1 Residential Status: 8 Marks Incidence of Tax: 7 Marks: ST ND

Uploaded by

adhishree bhattacharyaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

CHRIST (DEEMED TO BE UNIVERSITY), BANGALORE – 560 029

SCHOOL OF BUSINESS AND MANAGEMENT

MID SEMESTER EXAMINATION – SEPTEMBER 2020

(BBA(H) 5th Sem)

COURSE NAME: Taxation Law I MAX MARKS: 50

COURSE CODE: BBBH532 TIME:2 HRS 30 MINUTES

SECTION A

(Answer ALL questions). Each Question Carries 15 Marks. (2X15=30 Marks)

Q. Questions Rubrics Criteria

N

o

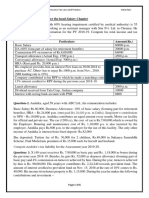

1 Mr Tagore is a citizen of Australia, during the PY 2019-20 he stays in India for Residential Status:

82 days, while during the year 2018-19 he was in India for 120 days, in the 8 marks

year 2017-18, he visited his friend in Chennai and stayed with him for 30

days. During 2016-17, he was in Shimla (Himachal Pradesh) for 200 days , Incidence of tax: 7

prior to this he came to India on 1 st May 2012 and left India on 22 nd Feb marks

2015.

Determine his residential status for AY 2020-21 and accordingly determine his

taxable income, if he had following sources of inflow of money.

Technical fees paid by Government of India for a foreign project( Rs.

Amount is received outside India) 1,90,000

Rental Income from a House property in Canada, this amount Rs

was completely used for education of his daughter at IIM 10,00,000

,Bangalore

Agriculture Income from West Bengal Rs

10,50,000

Income from a Business having its Head office at Kolkata, service Rs

is rendered in India but amount is received in USA 20,00,000

Dividend from a Canadian company Rs 7,65,000

Pension received in Canada for services rendered in India for a Rs 9,10,000

US based company

Interest on Fixed Deposits in Punjab National Bank , Kolkata Rs 2,50,000

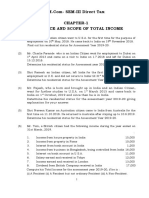

2 Mr Viraj Kapoor is a working with a HR consulting firm at Delhi(population more Basic pay, DA,

than 1 crore according to 2011 census), his salary comprises of following Commission: 3

components. marks

1) His Basic pay was Rs 58000 p.m., according to company policy his DA is

60% of basic pay,50% of which is according to retirement benefits. Salary Allowances and

is due at beginning of next month. Commission on profit Rs 10,000, his Perquisites:10

employer paid his professional tax of Rs 3000. marks

2) His HRA was Rs 12000 p.m., while rent of the house was Rs 15000 p.m.

3) He paid Rs 15,000 towards his Life insurance policy premium Deductions: 2

4) He and his employer contributes Rs 12000 p.m., each towards RPF marks

5) He is also provided with holiday allowance of Rs 6000 p.m.,

6) His employer provided him with a car of 1800 cc with effect from 1-07-

2019, 30% usage of this car is for personal purposes. The cost of the car is

Rs 10,00,000, petrol consumption during the year was Rs 1,00,000, while

on insurance and repair Rs 40,000 was spent. All expenses with respect

to running and maintenance of this car was done by employer of Mr.

Viraj.

7) On 1-4-2019 he took a personal loan from his employer worth Rs

3,00,000 at a rate of 7.5%, however SBI interest rate for personal loan on

1-4-2019 was 11%.

8) Free refreshment is provided during office hours Rs 6000 p.a,

Reimbursement of his resident gas bills Rs 8000 is done by his employer.

9) For 300 days in a year he is provided with free lunch in office premises

worth Rs 150 per meal per day.

10) His Income Tax penalty paid by employer Rs 1700

Calculate his taxable income.

SECTION B

Case Study

Note: It is MANDATORY to attempt the Case study (1X20=20 Marks)

Q. No Questions Rubrics Criteria

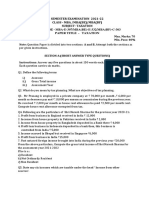

3. Mrs. Rose (58 years), finance manager in a company, at Bangalore. She Basic Pay, DA, Bonus: 3

submits the following information relevant for the PY 2019-20. marks

1) Till her retirement she was provided, basic pay of Rs 80,000

p.m.,( Salary is due at the end of month), entertainment Allowances and

allowance Rs 2000 per month; Bonus Rs 40,000; education perquisites: 5 marks

allowance Rs 400 p.m, for her granddaughter, DA Rs 12,000 per

month Gratuity and leave

2) Mrs. Rose paid her professional tax Rs 2000 for PY 2019-20 encashment: 7 marks

3) She has been provided with House rent allowance (till her

retirement) of Rs 18000 per month, while she stays in a house Deductions and tax

at Bangalore, where rent is Rs 26000 per month. She has spent liability: 5 marks

Rs 2,00,000 on furnishing this house.

4) She was provided with an Apple laptop exclusively for official

purpose worth Rs 1,00,000.

5) She is provided with a car of 1200cc, which is owned by

employer and was used by Mrs. Rose for both personal and

official purpose. Depreciation of the car is of Rs 20,000,

maintenance of car is Rs 38000 and driver’s salary is Rs 10,000

per month (all these expenses are met by employer of Mrs.

Rose) She pays Rs 5000 per month towards personal use of car

provided to her by her employer

6) She retires on 31 Dec 2019 after 20 years of service. She was

drawing a monthly Basic pay of Rs 76,000 during calendar year

2017, Rs 78,000 during calendar year 2018 and Rs 80,000

during calendar year 2019. Till 31 March 2019 her DA was Rs

10,000 p.m., she also received a gratuity of Rs 10,00,000 at the

time of her retirement (according to payment of gratuity act

1972).

7) After her retirement all the above mentioned basic pay,

allowances and perquisites were stopped and she was

provided with leave encashment of Rs 2,80,000, her employer

allowed her 45 days of leave for every one year of service, she

had already availed leave for 18 months during her service

period.

Calculate her taxable income and tax liability for PY 2019-20

You might also like

- Internal AnalysisDocument15 pagesInternal AnalysisTahirAli100% (1)

- WITHHOLDING TAX ON COMPENSATIONDocument58 pagesWITHHOLDING TAX ON COMPENSATIONNikki Estores GonzalesNo ratings yet

- Reliance Industries Ltd. - Head Office PAYSLIPDocument1 pageReliance Industries Ltd. - Head Office PAYSLIPramkohyfab30% (10)

- In Partial Fulfillment of The Requirements in Thesis 1Document32 pagesIn Partial Fulfillment of The Requirements in Thesis 1merii100% (1)

- Jay - Kashyap@vedanta - Co.in F16Document8 pagesJay - Kashyap@vedanta - Co.in F16Jay kashyapNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- SVKM'S Nmims Anil Surendra Modi School of Commerce Sybcom Sem Iii (2019-22) Subject Name: Direct Taxation No. of Hours: 2 Hours InstructionsDocument20 pagesSVKM'S Nmims Anil Surendra Modi School of Commerce Sybcom Sem Iii (2019-22) Subject Name: Direct Taxation No. of Hours: 2 Hours InstructionsMadhuram SharmaNo ratings yet

- Questions On Income From SalaryDocument3 pagesQuestions On Income From SalaryAniket AgrawalNo ratings yet

- IFS QuestionDocument6 pagesIFS QuestionHdkakaksjsbNo ratings yet

- 4.1 Questions On Income From SalaryDocument4 pages4.1 Questions On Income From SalaryAashi GuptaNo ratings yet

- 7401D001 Direct TaxesDocument22 pages7401D001 Direct TaxesMadhuram SharmaNo ratings yet

- Computation of Total Income & TaxDocument3 pagesComputation of Total Income & TaxkhushhalibajajNo ratings yet

- 4.2 Home Assignment Questions - Income From SalaryDocument3 pages4.2 Home Assignment Questions - Income From SalaryAashi Gupta100% (1)

- TAXATION (Preps)Document5 pagesTAXATION (Preps)Navya GulatiNo ratings yet

- Numericals of SalaryDocument7 pagesNumericals of SalaryAnas ShaikhNo ratings yet

- Income From Salary Chapter QuestionsDocument5 pagesIncome From Salary Chapter Questionsanon_595315274100% (1)

- PFTP - Unit II - Income From Salary - Short SumsDocument3 pagesPFTP - Unit II - Income From Salary - Short Sumsgeetagupta2974No ratings yet

- Income From SalaryDocument9 pagesIncome From Salaryvinod nainiwalNo ratings yet

- Assignment Questions: Q1. Raza Is A General Manager in A Pharmaceutical Company in Karachi. His Basic Salary Is RsDocument2 pagesAssignment Questions: Q1. Raza Is A General Manager in A Pharmaceutical Company in Karachi. His Basic Salary Is RsWaasfaNo ratings yet

- 4 (A) Income Tax-1Document4 pages4 (A) Income Tax-1anjanaNo ratings yet

- Mba 3 Sem Tax Planning and Management Jan 2019Document3 pagesMba 3 Sem Tax Planning and Management Jan 2019Er Aftab ShaikhNo ratings yet

- Taxation Cia 3Document27 pagesTaxation Cia 3Soumya KesharwaniNo ratings yet

- Question Test Paper 2 - NOV 2023Document2 pagesQuestion Test Paper 2 - NOV 2023ABCXYZNo ratings yet

- Worksheet Unit1Document8 pagesWorksheet Unit1Kaushal pateriyaNo ratings yet

- Income from salaries and house propertyDocument21 pagesIncome from salaries and house propertyAshish TomsNo ratings yet

- Income Tax Question BankDocument8 pagesIncome Tax Question Banksurya.notes19No ratings yet

- September: (CBCS) (F +R) (2016-17 and Onwards)Document7 pagesSeptember: (CBCS) (F +R) (2016-17 and Onwards)Gracy GeorgeNo ratings yet

- FAC121 - Direct Tax - Assignment 2 - Income From SalaryDocument4 pagesFAC121 - Direct Tax - Assignment 2 - Income From SalaryDeepak DhimanNo ratings yet

- Salary QuestionsDocument3 pagesSalary QuestionsgixNo ratings yet

- Salaries 3Document2 pagesSalaries 3soumyajeetkundu123No ratings yet

- T4Q RCA2 2020 Personal Tax Comp FocusDocument3 pagesT4Q RCA2 2020 Personal Tax Comp FocusHaananth SubramaniamNo ratings yet

- Calculating tax exemptions for HRA, gratuity, and other allowancesDocument1 pageCalculating tax exemptions for HRA, gratuity, and other allowancesSiva SankariNo ratings yet

- Direct Taxes Sem-Iii-20Document22 pagesDirect Taxes Sem-Iii-20Pranita MandlekarNo ratings yet

- Income Tax Test 2020-21Document6 pagesIncome Tax Test 2020-21Arihant DagaNo ratings yet

- PTP SolutionsDocument5 pagesPTP SolutionsSanah SahniNo ratings yet

- Salary Exemption Limits MCQsDocument16 pagesSalary Exemption Limits MCQsGoutam ChakrabortyNo ratings yet

- Taxation Paper EMBA 16042022Document4 pagesTaxation Paper EMBA 16042022Rohit B .S. Prabhu Verlekar100% (1)

- I.TAx 302Document4 pagesI.TAx 302tadepalli patanjaliNo ratings yet

- Assignment MBA III: Business Taxation: TH THDocument4 pagesAssignment MBA III: Business Taxation: TH THShubham NamdevNo ratings yet

- Learn More Salaries - August 2020Document5 pagesLearn More Salaries - August 2020Adarsh PandeyNo ratings yet

- Dac 212 Ass.1Document3 pagesDac 212 Ass.1Nickson AkolaNo ratings yet

- Income Tax S5 Set IDocument5 pagesIncome Tax S5 Set ITitus ClementNo ratings yet

- Semester III 52414304 Income Tax Law and Practice-CORE Set Ii Duration: 3 Hours Attempt Any Four Questions. All Questions Carry Equal MarksDocument3 pagesSemester III 52414304 Income Tax Law and Practice-CORE Set Ii Duration: 3 Hours Attempt Any Four Questions. All Questions Carry Equal MarksAnshu kumarNo ratings yet

- Mba E307 - Mbe E332 - MBF C303Document4 pagesMba E307 - Mbe E332 - MBF C303Shashank TripathiNo ratings yet

- MCQ Taxation 2Document24 pagesMCQ Taxation 2Mahesh VekariyaNo ratings yet

- MBA Sem 1 Indirect Tax PaperDocument4 pagesMBA Sem 1 Indirect Tax PaperVedvati PetkarNo ratings yet

- Income From SalaryDocument10 pagesIncome From SalaryShubham BajajNo ratings yet

- Sum On Salary 27.08.2022Document3 pagesSum On Salary 27.08.2022Nilay ShethNo ratings yet

- Tax Laws Letures (13-07-2021 To 17-07-2021)Document28 pagesTax Laws Letures (13-07-2021 To 17-07-2021)shanmukvardhanNo ratings yet

- Income from Salaries: Calculating Exempted Allowances, Taxable Gratuity & PensionDocument53 pagesIncome from Salaries: Calculating Exempted Allowances, Taxable Gratuity & PensionSiva SankariNo ratings yet

- Calculating Income Tax for Individuals and BusinessesDocument36 pagesCalculating Income Tax for Individuals and BusinessesVelayudham ThiyagarajanNo ratings yet

- Cim 8682 Taxation Question Paper (Ahemadabad)Document3 pagesCim 8682 Taxation Question Paper (Ahemadabad)Pomi ShiyaNo ratings yet

- Calculating Tax LiabilityDocument3 pagesCalculating Tax LiabilityRafia TasnimNo ratings yet

- +++C$C, CCC$ CDocument7 pages+++C$C, CCC$ CKomal Damani ParekhNo ratings yet

- Personal Taxation Final QuestionsDocument5 pagesPersonal Taxation Final QuestionsKarthik RamanathanNo ratings yet

- Aditya Sharma - II Mid Term Paper Shikha Mam 1Document11 pagesAditya Sharma - II Mid Term Paper Shikha Mam 1Aditya SharmaNo ratings yet

- Tax Calculation for Income and BusinessDocument10 pagesTax Calculation for Income and BusinessSichen UpretyNo ratings yet

- Model Question BBS 3rd Taxation in NepalDocument6 pagesModel Question BBS 3rd Taxation in NepalAsmita BhujelNo ratings yet

- Income Tax Law and PracticeDocument5 pagesIncome Tax Law and PracticeHarsh chetiwal50% (2)

- Sa 3 DT NovDocument9 pagesSa 3 DT NovRishabh GargNo ratings yet

- Total Computation QB by CA Pranav ChandakDocument37 pagesTotal Computation QB by CA Pranav ChandakSurajNo ratings yet

- SRI NITHYANANDA SWAMY EDUCATIONAL TRUST DEGREE COLLEGE TAX PROBLEMSDocument2 pagesSRI NITHYANANDA SWAMY EDUCATIONAL TRUST DEGREE COLLEGE TAX PROBLEMSHarish NaikNo ratings yet

- QP 2 PDFDocument7 pagesQP 2 PDFShankar ReddyNo ratings yet

- IT AssignmentDocument5 pagesIT AssignmentAlena AlenaNo ratings yet

- CA Inter Taxation Mock Test - 02.08.2018 - Only QuestionDocument7 pagesCA Inter Taxation Mock Test - 02.08.2018 - Only QuestionKaustubhNo ratings yet

- Adhishree's ResumeDocument1 pageAdhishree's Resumeadhishree bhattacharyaNo ratings yet

- ERP For MBA Colleges - Case Study For Campus Hiring 2021Document1 pageERP For MBA Colleges - Case Study For Campus Hiring 2021adhishree bhattacharyaNo ratings yet

- Correlation and Regression Analysis and Their InterpretationsDocument5 pagesCorrelation and Regression Analysis and Their Interpretationsadhishree bhattacharyaNo ratings yet

- SOP Final EditDocument1 pageSOP Final Editadhishree bhattacharyaNo ratings yet

- Sales Call Deal Closed Jan 19 90 65 Feb 19 60 23 Mar 19 60 66 Apr 19 25 50 May 19 55 78 Jun 19 75 64 July 19 77 66 Aug 19 45 87 Sep 19 70 75 Oct 19 95 67 Dec 19 20 40Document2 pagesSales Call Deal Closed Jan 19 90 65 Feb 19 60 23 Mar 19 60 66 Apr 19 25 50 May 19 55 78 Jun 19 75 64 July 19 77 66 Aug 19 45 87 Sep 19 70 75 Oct 19 95 67 Dec 19 20 40adhishree bhattacharyaNo ratings yet

- Launching BrandDocument97 pagesLaunching BrandMuhammad AhmadNo ratings yet

- BM CIA3 FinalDocument26 pagesBM CIA3 Finaladhishree bhattacharyaNo ratings yet

- Data Analysis and Interpretation (CB CIA 3)Document15 pagesData Analysis and Interpretation (CB CIA 3)adhishree bhattacharyaNo ratings yet

- Submitted By: Adhishree BhattacharyaDocument2 pagesSubmitted By: Adhishree Bhattacharyaadhishree bhattacharyaNo ratings yet

- CB 21.09.20Document2 pagesCB 21.09.20adhishree bhattacharyaNo ratings yet

- Apple's OM Efficiency Through 10 DecisionsDocument1 pageApple's OM Efficiency Through 10 Decisionsadhishree bhattacharyaNo ratings yet

- Employee salary and tax detailsDocument2 pagesEmployee salary and tax detailsadhishree bhattacharyaNo ratings yet

- Taxation Law Cia-3Document38 pagesTaxation Law Cia-3adhishree bhattacharyaNo ratings yet

- Taxation Law Cia-3Document38 pagesTaxation Law Cia-3adhishree bhattacharyaNo ratings yet

- SalerioDocument28 pagesSalerioRizqaFebrilianyNo ratings yet

- Factors Influencing Consumer Buying Behaviour Towards Cosmetic ProductsDocument35 pagesFactors Influencing Consumer Buying Behaviour Towards Cosmetic Productsadhishree bhattacharyaNo ratings yet

- Belle - P&G: Brand Management CIADocument11 pagesBelle - P&G: Brand Management CIAadhishree bhattacharyaNo ratings yet

- Week 3 (7 Modules)Document9 pagesWeek 3 (7 Modules)adhishree bhattacharyaNo ratings yet

- The Resource-Based View and Information Systems Research: Review, Extension, and Suggestions For Future ResearchDocument37 pagesThe Resource-Based View and Information Systems Research: Review, Extension, and Suggestions For Future Researchadhishree bhattacharyaNo ratings yet

- Society 5.0Document14 pagesSociety 5.0adhishree bhattacharyaNo ratings yet

- Week 3 (7 Modules)Document9 pagesWeek 3 (7 Modules)adhishree bhattacharyaNo ratings yet

- 9064 Iceberg Shape PowerpointDocument5 pages9064 Iceberg Shape Powerpointadhishree bhattacharyaNo ratings yet

- Collective BargainingDocument36 pagesCollective Bargainingadhishree bhattacharyaNo ratings yet

- RetailStores PDFDocument11 pagesRetailStores PDFadhishree bhattacharyaNo ratings yet

- Retail Location Analysis ImportanceDocument5 pagesRetail Location Analysis ImportanceLvs KiranNo ratings yet

- Week 3 (7 Modules)Document9 pagesWeek 3 (7 Modules)adhishree bhattacharyaNo ratings yet

- RetailStores PDFDocument11 pagesRetailStores PDFadhishree bhattacharyaNo ratings yet

- RetailStores PDFDocument11 pagesRetailStores PDFadhishree bhattacharyaNo ratings yet

- Day AlanDocument1 pageDay AlanTechnetNo ratings yet

- Exercise 2Document15 pagesExercise 2Riezel PepitoNo ratings yet

- Accounting Voucher DisplayDocument1 pageAccounting Voucher DisplayAntara IndiaNo ratings yet

- Itc - Reversal EntriesDocument3 pagesItc - Reversal Entriessoumav123No ratings yet

- VC Bill No 64Document2 pagesVC Bill No 64Mathewraj Dhanasekaran palanivelNo ratings yet

- CustomInvoice 7670709745Document1 pageCustomInvoice 7670709745budi irawanNo ratings yet

- Pesco Online BilllDocument1 pagePesco Online BilllQaiser Khan Jadoon100% (1)

- Governance Model Could Boost Algerian Zakat FundDocument15 pagesGovernance Model Could Boost Algerian Zakat FundFaizal RaffaliNo ratings yet

- Assessment Date: Income Tax Notice of AssessmentDocument2 pagesAssessment Date: Income Tax Notice of AssessmentBwana KuubwaNo ratings yet

- Section 194M of Income Tax ActDocument2 pagesSection 194M of Income Tax ActPrabhath Sharma GantiNo ratings yet

- Progressive Proportional Tax ExplainedDocument28 pagesProgressive Proportional Tax ExplainedZARANo ratings yet

- Field Training Report 127411Document7 pagesField Training Report 127411deepak mauryaNo ratings yet

- Taxation Assignment 1Document2 pagesTaxation Assignment 1Alviya FatimaNo ratings yet

- Company Budget Summary Earnings Statement Name of Hotel DateDocument1 pageCompany Budget Summary Earnings Statement Name of Hotel DatePermata Inn Hotel SlawiNo ratings yet

- Einvoice 1673085561210Document1 pageEinvoice 1673085561210VINIth UDHAYANo ratings yet

- Form XxiiiDocument2 pagesForm XxiiiJIYA KEJRIWALNo ratings yet

- Chapter 14 - Percentage Taxes2013Document11 pagesChapter 14 - Percentage Taxes2013JB RealizaNo ratings yet

- GST ProjectDocument42 pagesGST Projectharmisha narshanaNo ratings yet

- House No 2, Street No 2, F-7/3, Islamabad Suriya Nauman Rehan & CoDocument4 pagesHouse No 2, Street No 2, F-7/3, Islamabad Suriya Nauman Rehan & Cowaqas aliNo ratings yet

- Relevant BIR Updates on RPT Form and Transfer PricingDocument49 pagesRelevant BIR Updates on RPT Form and Transfer PricingElsha dela penaNo ratings yet

- TabbelDocument2 pagesTabbelLyra EscosioNo ratings yet

- (See Rule 31 (1) (B) ) : Form No. 16ADocument38 pages(See Rule 31 (1) (B) ) : Form No. 16AsamNo ratings yet

- Tax ReportDocument5 pagesTax ReportHanna Lyn BaliscoNo ratings yet

- Economic Crisis in Pakistan and Its Remedial MesauresDocument27 pagesEconomic Crisis in Pakistan and Its Remedial MesauresQarsam IlyasNo ratings yet

- Income From Employment FormatDocument3 pagesIncome From Employment FormatsatyaNo ratings yet

- Answer Key HandoutsDocument5 pagesAnswer Key HandoutsRichard de Leon100% (1)