Professional Documents

Culture Documents

Section 194M of Income Tax Act

Uploaded by

Prabhath Sharma GantiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Section 194M of Income Tax Act

Uploaded by

Prabhath Sharma GantiCopyright:

Available Formats

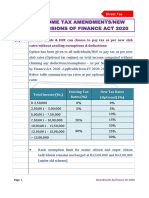

Section 194 M – TDS on Payment of Certain Sum by CERTAIN Individual/HUF

Update :-

Union Budget 2019 –

Which was presented by our Hon’ble Finance Minister Smt. Nirmala Sitharaman Ji.

Which was obtained the Assent of our beloved President of India on 01st August 2019, Sri Ram

Nath Kovind Ji.

Proposes to make it mandatory for Individuals and HUFs to deduct tax at source (TDS) on any

payment exceeding Rs 50 lakh per annum to contractors and professionals.

Example: This would mean that if the total of payments to any single contractor for wedding

functions, house renovation or to a single professional during a financial year exceeds Rs 50

lakh then TDS @ 5% (20% in case of non-submission of PAN) would be deductible by the payer.

Rule of Thumb: At the time of Credit of the sum or payment whichever is earlier.

The provisions of newly inserted section 194M of the Income Tax Act, 1961 shall be effective

from 1st September 2019.

General Doubt :-

Since the above mentioned rule is already prevalent in the existing sections of TDS like 194C

for contractual payments, 194H for commission payments, 194J for professional charges etc.,

where is this section going to make a difference in?

Difference is being made –

The above mentioned sections (194 –C, H, J) (however insurance commission referred in

section 194D is not included) are applicable to all the persons (as defined in the Act) excluding

Individual/HUF who are not liable to get their accounts audited u/s 44AB of the Act.

The Section 194M covers those persons who all are excluded in the aforementioned sections

(i.e. Individual/HUF who are not liable to get their accounts audited u/s 44AB of the Act).

In Brief –

Type of payment Section under which TDS is deductible

Individual/HUF who are liable to Individual/HUF who are not

get their accounts audited liable to get their accounts

audited

Carrying out any work (which Section 194 C Section 194 M

includes supplying of labor for

carrying out any work) in

pursuance of any contract

Commissioner or brokerage Section 194 H Section 194 M

Fees for professional service Section 194 J Section 194 M

Something to be noted/even appreciated :

The individual / HUF requiring to get their account audited are already covered under

respective section 194C, section 194H and section 194J and hence they are not included here.

The threshold limit is Rs. 50 lakhs (too big an amount).

Further section 194M (2) states that the provisions of section 203A of the Income Tax Act, 1961

doesn’t apply to the Deductor. Meaning thereby that the Deductor liable to deduct TDS under

194M is not mandatorily required to obtain TAN (Tax Deduction and Collection Account

Number).

Author’s Analysis :

Govt. – Out of the Box –

May be through this step, govt. may find out some cases of “Tax-Evasion”. Because TDS is not

all about paying the tax and claiming it back, it to establish the authenticity & veracity of the

income of a party through 26AS form.

The threshold limit is Rs. 50 lakhs. So this amendment just doesn’t seem to be like a provision,

it’s a play against the tax evaders. Because for a person, in general (not under presumption

scheme) whose turnover/gross receipts does not exceed Rs. 1 Crore (i.e. not liable to tax audit

u/s 44AB) is neither likely no expected that a payment worth more than Rs. 50 lakhs is made to

a single party in a financial year.

Due to the exemption(for deduction of TDS) provided upto now for those Individual/HUF who

are not liable to get their accounts audited, substantial amount by way of payments made by

individuals or HUFs in respect of contractual work or for professional service is escaping the

levy of TDS, leaving a loophole for possible tax evasion.

To fix this loophole, the above section (194M) has been inserted by the Govt. & these steps are

part of the government's efforts to widen and deepen the income tax base.

However –

There might also be some exceptional cases where it could happen that the whole of the

business of a person depends upon a single party. However the govt. shall consider the

genuineness of the transactions and will arrive at the conclusions. But they are not at all an

exception to this section.

“Rule is rule, rule for all”

You might also like

- Singapore's Participation in Global Value Chains: Perspectives of Trade in Value-AddedDocument63 pagesSingapore's Participation in Global Value Chains: Perspectives of Trade in Value-AddedERIA: Economic Research Institute for ASEAN and East Asia100% (1)

- Tax Deduction at Source on SalariesDocument112 pagesTax Deduction at Source on SalariesArnav MendirattaNo ratings yet

- All about Tax Deducted at Source (TDS)- taxguru.inDocument11 pagesAll about Tax Deducted at Source (TDS)- taxguru.inwaqtkeebaatein12No ratings yet

- BASICS OF TAXATION (Income Tax Ordinance, 1984) Updated Till Finance Act. 2013 by Prof. Mahbubur RahmanDocument14 pagesBASICS OF TAXATION (Income Tax Ordinance, 1984) Updated Till Finance Act. 2013 by Prof. Mahbubur RahmansaadmansheedyNo ratings yet

- TDS ElaboratedDocument80 pagesTDS ElaboratedAncyNo ratings yet

- Overview of TDS: by C.A. Manish JathliyaDocument21 pagesOverview of TDS: by C.A. Manish JathliyaHasan Babu KothaNo ratings yet

- TDS LAW AND PRACTICE UNDER INCOME TAX ACT 1961Document84 pagesTDS LAW AND PRACTICE UNDER INCOME TAX ACT 1961Vaibhav ChauhanNo ratings yet

- TDS On SalariesDocument112 pagesTDS On Salariesbaalaji05No ratings yet

- Finance Act 1991Document6 pagesFinance Act 1991Govardhan VaranasiNo ratings yet

- Tax Deducted at Source ExplainedDocument31 pagesTax Deducted at Source ExplainedShaleenPatniNo ratings yet

- All About New TDS Section 194R and Section 194S - Taxguru - inDocument7 pagesAll About New TDS Section 194R and Section 194S - Taxguru - inParag Jain DugarNo ratings yet

- Chapter 12 Tds & TcsDocument28 pagesChapter 12 Tds & TcsRajNo ratings yet

- Introduction To TDS:-: Tax Deducted at SourceDocument3 pagesIntroduction To TDS:-: Tax Deducted at Sourcepadmanabha14No ratings yet

- TDS Under Sec 194A EtcDocument26 pagesTDS Under Sec 194A EtcDivyaNo ratings yet

- Tax Deduction at SourceDocument4 pagesTax Deduction at SourcevishalsidankarNo ratings yet

- Adjudication - Case (1) .Docx 1Document14 pagesAdjudication - Case (1) .Docx 1aliciag4342No ratings yet

- New Section 194Q Applicable From 1.7.2021Document14 pagesNew Section 194Q Applicable From 1.7.2021ramanmaharishiNo ratings yet

- TDS Provisions SummaryDocument54 pagesTDS Provisions SummaryFalak GoyalNo ratings yet

- TDS Under Sec 194A EtcDocument25 pagesTDS Under Sec 194A EtcGmd NizamNo ratings yet

- 195 Paper With PhotoDocument29 pages195 Paper With Photogrover_deepak18No ratings yet

- Section 192 Relatin Gto TDS On Salary - Section 192 Says That Every Person Who Is Responsible For Paying Any Income Chargeable Under The HeadDocument46 pagesSection 192 Relatin Gto TDS On Salary - Section 192 Says That Every Person Who Is Responsible For Paying Any Income Chargeable Under The HeadAtul SharmaNo ratings yet

- All About TDS Part 2Document9 pagesAll About TDS Part 2Animesh Kumar TilakNo ratings yet

- Delloite CIT (A) PDFDocument7 pagesDelloite CIT (A) PDFshashi vermaNo ratings yet

- TDS Under Section 194C: Press Releases Blog PostsDocument4 pagesTDS Under Section 194C: Press Releases Blog PostsBalu Mahendra SusarlaNo ratings yet

- Tax Deducted at Source IMPORTANT POINTSDocument2 pagesTax Deducted at Source IMPORTANT POINTSnABSAMNNo ratings yet

- Tax-Free Exchanges That Are Not Subject To Income Tax, Capital Gains Tax, Documentary Stamp Tax And/or Value-Added Tax, As The Case May BeDocument7 pagesTax-Free Exchanges That Are Not Subject To Income Tax, Capital Gains Tax, Documentary Stamp Tax And/or Value-Added Tax, As The Case May BeJouhara ObeñitaNo ratings yet

- TDS Presentation - Ca Zalak Parikh - 14.05.2022Document22 pagesTDS Presentation - Ca Zalak Parikh - 14.05.2022zalak jintanwalaNo ratings yet

- Corporate Tax PlanningDocument8 pagesCorporate Tax PlanningTumie Lets0% (1)

- Bar On Direct Demand Against Deductee - Jus in Re Bar On Direct Demand Against Deductee - Jus in ReDocument3 pagesBar On Direct Demand Against Deductee - Jus in Re Bar On Direct Demand Against Deductee - Jus in Reabc defNo ratings yet

- Income Tax Amendments/New Provisions of Finance Act 2020Document46 pagesIncome Tax Amendments/New Provisions of Finance Act 2020shubhamworkNo ratings yet

- RECENT AMENDMENTS TO TDS/TCS PROVISIONSDocument12 pagesRECENT AMENDMENTS TO TDS/TCS PROVISIONSABHISHEKNo ratings yet

- Direct Tax Proposals 2019 (No. 2) - 1Document16 pagesDirect Tax Proposals 2019 (No. 2) - 1Namita Agarwal KediaNo ratings yet

- Tax Deducted at Source - I: KPPM & AssociatesDocument63 pagesTax Deducted at Source - I: KPPM & AssociatesSaksham JoshiNo ratings yet

- Module 1 E - Filing of ReturnsDocument8 pagesModule 1 E - Filing of Returnsshivani singhNo ratings yet

- Circular No. 285 Dated 21-10-1980Document1 pageCircular No. 285 Dated 21-10-1980Sayan MajumdarNo ratings yet

- Deduction, Collection & Recovery of TaxesDocument143 pagesDeduction, Collection & Recovery of TaxesjyotiNo ratings yet

- QUESTION: I Own A Commercial Building Giving Me A Rent of Rs. 4 Lakhs A Month. TheDocument3 pagesQUESTION: I Own A Commercial Building Giving Me A Rent of Rs. 4 Lakhs A Month. TheCma Saurabh AroraNo ratings yet

- Section 195 and Form 15CBDocument53 pagesSection 195 and Form 15CBVALTIM09No ratings yet

- Naya' Form 3Cd: 1. Non-Compliance With Provisions of Tax Deduction at Source (Clause 27) : Delays andDocument6 pagesNaya' Form 3Cd: 1. Non-Compliance With Provisions of Tax Deduction at Source (Clause 27) : Delays andrakeshca1No ratings yet

- What Is IncomeDocument6 pagesWhat Is Incomenaman guptaNo ratings yet

- Decoding Indian Union BudgetDocument6 pagesDecoding Indian Union BudgetkumarNo ratings yet

- Non Resident Tax Withholding Section 195: CA Kapil Goel FCA LLB Advocate Delhi High Court 9910272806Document71 pagesNon Resident Tax Withholding Section 195: CA Kapil Goel FCA LLB Advocate Delhi High Court 9910272806HemanthKumarNo ratings yet

- TDS On Real Estate IndustryDocument5 pagesTDS On Real Estate IndustryKirti SanghaviNo ratings yet

- TaxationDocument9 pagesTaxationRohit SoniNo ratings yet

- Section 139Document7 pagesSection 139dhanishta906No ratings yet

- Section 194J: Fees For Professional or Technical ServicesDocument24 pagesSection 194J: Fees For Professional or Technical ServicesSAURABH TIBREWALNo ratings yet

- Recent Amendments in TDS Under Income Tax - TVM BR CPE 03.09.2022Document64 pagesRecent Amendments in TDS Under Income Tax - TVM BR CPE 03.09.2022sushant980No ratings yet

- TAX Types and Classifications Explained in 40 CharactersDocument22 pagesTAX Types and Classifications Explained in 40 CharactersSayanm MittalNo ratings yet

- Deferred Tax-Accounting Standard-22-Accounting For Taxes On IncomeDocument6 pagesDeferred Tax-Accounting Standard-22-Accounting For Taxes On IncomerlpolyfabsmaheshNo ratings yet

- Advance Learning On TDS Under Section 194-I and 194-C: MeaningDocument52 pagesAdvance Learning On TDS Under Section 194-I and 194-C: MeaningTejTejuNo ratings yet

- TDS Under Section 194R – Brief Analysis - Taxguru - inDocument4 pagesTDS Under Section 194R – Brief Analysis - Taxguru - inAbhishek GuptaNo ratings yet

- Latest Circulars, Notifications and Press Releases: 2. This Notification Shall Come Into Force From The 1Document0 pagesLatest Circulars, Notifications and Press Releases: 2. This Notification Shall Come Into Force From The 1Ketan ThakkarNo ratings yet

- TDS AND TCS PROVISIONSDocument55 pagesTDS AND TCS PROVISIONSBeing HumaneNo ratings yet

- TAX 2 Group 1 Handout PDFDocument6 pagesTAX 2 Group 1 Handout PDFMi-young SunNo ratings yet

- CA-Ashok-Mehta - PPT - Income TaxDocument88 pagesCA-Ashok-Mehta - PPT - Income TaxAbinash DasNo ratings yet

- ASC Group - Budget 2021 HighlightsDocument32 pagesASC Group - Budget 2021 Highlightssaurav royNo ratings yet

- S 206C (1H) – Updated - Taxguru - inDocument11 pagesS 206C (1H) – Updated - Taxguru - inHEMANT PARMARNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Seq 23 0464 0Document5 pagesSeq 23 0464 0AbdEl-Rahman AbdEl-NasserNo ratings yet

- Journal Home GridDocument1 pageJournal Home Grid03217925346No ratings yet

- Ssa 3105Document2 pagesSsa 3105Joshua Sygnal Gutierrez100% (2)

- University of Puthisastra: Economics Development ClassDocument56 pagesUniversity of Puthisastra: Economics Development ClassHeng HengNo ratings yet

- Solar Powered E-bike System DesignDocument7 pagesSolar Powered E-bike System DesignifyNo ratings yet

- Chapter 1: Introduction to the Plastic Waste Problem and Biodegradable AlternativesDocument8 pagesChapter 1: Introduction to the Plastic Waste Problem and Biodegradable Alternatives• 【yunecorn】 •67% (3)

- Demand and Supply Analysis: UNIT - 2Document39 pagesDemand and Supply Analysis: UNIT - 2Deepak SrivastavaNo ratings yet

- Green Technology Compliance in Malaysia For Sustainable BusinessDocument11 pagesGreen Technology Compliance in Malaysia For Sustainable BusinesssajithkumarNo ratings yet

- Deciding The Course of Action: Situation Analysis (Where Are We?)Document32 pagesDeciding The Course of Action: Situation Analysis (Where Are We?)PuttyErwinaNo ratings yet

- Schedule of Premium (Amount in RS.)Document4 pagesSchedule of Premium (Amount in RS.)KiranNo ratings yet

- Exam Practice Questions: 1.11 Price Controls: IB EconomicsDocument3 pagesExam Practice Questions: 1.11 Price Controls: IB EconomicsSOURAV MONDALNo ratings yet

- Ferry Road Conceptual Site PlansDocument12 pagesFerry Road Conceptual Site Planswillhofmann2No ratings yet

- Attachment Summary - Cash Flow Statement PDFDocument5 pagesAttachment Summary - Cash Flow Statement PDFUnmesh MitraNo ratings yet

- CDPDocument115 pagesCDPAr Kunal PatilNo ratings yet

- Consult Vermin SupremeDocument6 pagesConsult Vermin SupremeArchan SenNo ratings yet

- SartikaDocument15 pagesSartikarobbyNo ratings yet

- Payments Collection Methods in Export Import International TradeDocument4 pagesPayments Collection Methods in Export Import International Tradekrissh_87No ratings yet

- Recent Progress in Alkaline Water Electrolysis For Hydrogen Production and Applications.Document20 pagesRecent Progress in Alkaline Water Electrolysis For Hydrogen Production and Applications.Salvador Leon GomezNo ratings yet

- ch06 IMDocument7 pagesch06 IMlokkk333No ratings yet

- Sreedhar's CCE - Institute For Competitive and Entrance ExamsDocument37 pagesSreedhar's CCE - Institute For Competitive and Entrance ExamsSRIVIDYA GANISETTYNo ratings yet

- Notice: Superfund Response and Remedial Actions, Proposed Settlements, Etc.: Greenberg Salvage Yard, ILDocument2 pagesNotice: Superfund Response and Remedial Actions, Proposed Settlements, Etc.: Greenberg Salvage Yard, ILJustia.comNo ratings yet

- MeTC DirectoryDocument3 pagesMeTC Directoryprinsesa0810No ratings yet

- Rise of RobotsDocument9 pagesRise of RobotsPep SS100% (1)

- Presentattion of L & TDocument18 pagesPresentattion of L & TNeha NNo ratings yet

- Jigs and Fixtures For Machine Shops: Instructional ObjectivesDocument21 pagesJigs and Fixtures For Machine Shops: Instructional ObjectivesRinkuNo ratings yet

- Government Intervention in International BusinessDocument8 pagesGovernment Intervention in International Businessਹਰਸ਼ ਵਰਧਨNo ratings yet

- EducationDocument321 pagesEducationManish Kapadiya100% (1)

- Talent Labs Private Limited Gurugram Haryana Pay Slip For The Month of April 2022Document1 pageTalent Labs Private Limited Gurugram Haryana Pay Slip For The Month of April 2022Gamer JiNo ratings yet