Professional Documents

Culture Documents

Income Statement (In $1,000) Year 20X1 20X2 20X3 Project Number I II I II II

Uploaded by

charbel khoury0 ratings0% found this document useful (0 votes)

9 views1 pageThis document is an income statement for a construction company with multiple projects over 3 years. It shows revenues, expenses, and profit calculations for each project and in total using both the percentage of completion and completed contract methods. Key line items include total contract amounts, expenses by category, estimated costs to complete, percentages complete based on costs and labor hours, revenues and profits by project and in total.

Original Description:

Original Title

HW 3 template.xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is an income statement for a construction company with multiple projects over 3 years. It shows revenues, expenses, and profit calculations for each project and in total using both the percentage of completion and completed contract methods. Key line items include total contract amounts, expenses by category, estimated costs to complete, percentages complete based on costs and labor hours, revenues and profits by project and in total.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views1 pageIncome Statement (In $1,000) Year 20X1 20X2 20X3 Project Number I II I II II

Uploaded by

charbel khouryThis document is an income statement for a construction company with multiple projects over 3 years. It shows revenues, expenses, and profit calculations for each project and in total using both the percentage of completion and completed contract methods. Key line items include total contract amounts, expenses by category, estimated costs to complete, percentages complete based on costs and labor hours, revenues and profits by project and in total.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

Ref.

Income Statement (in $1,000) Calculations

No. Year 20X1 20X2 20X3

Project Number I II I II II

1 Contract Amount

Expenses

2 Materials used

3 Wages incurred

4 Subs incurred

5 Total year expenses =2+3+4

6 Total expenses to date = exp. prev. year + exp. current year

7 Total est. to complete

8 Total estimated expenses =Total exp. to date +7

9 Total estimated gross profit =1-8

Percentage of completion

10 Labor hours to date

11 Labor hours est. to complete

12 Total est. labor hours =10+11

13 % complete. : Cost to Cost =6/8

14 Labor hours =10/12

Cost of revenue to date

15 Alt. A: Cost to Cost =13*8

16 Labor hours =14*8

17 Alt. B: Cost to Cost =6

18 Labor hours =6

Gross profit to date :

19 Cost to Cost =13*9

20 Labor hours =14*9

Revenue to date

21 Alt. A: Cost to Cost =15+19

22 Labor hours =16+20

23 Alt. B: Cost to Cost =17+19

24 Labor hours =18+20

Gross profit this year

25 Alt. A: Cost to Cost =19-gross profit to date from prev. year

26 Labor hours =20-gross profit to date from prev. year

Company's gross income :

27 Cost to Cost =25:I + 25:II

28 Labor hours =26:I + 26:II

G & A expenses :

29 Supplies

30 Wages

31 Other expenses

32 Total G & A expenses =29+30+31

Net income this year :

33 % complete. Alt. A : Cost to Cost =27-32

34 Labor hours =28-32

35 Completed contract =gross profit-32

Income taxes

36 % complete. Alt. A : Cost to Cost =33*Income Tax

37 Labor hours =34*Income Tax

38 Completed contract =35*Income Tax

Net income after taxes

39 % complete. Alt. A : Cost to Cost =33-36

40 Labor hours =34-37

41 Completed contract =35-38

42 Dividends paid

Adjustment to retained income

43 % complete. Alt. A : Cost to Cost =39-42

44 Labor hours =40-42

45 Completed contract =41-42

You might also like

- My First Persian (Farsi) Money, Finance & Shopping Picture Book with English Translations: Teach & Learn Basic Persian (Farsi) words for Children, #20From EverandMy First Persian (Farsi) Money, Finance & Shopping Picture Book with English Translations: Teach & Learn Basic Persian (Farsi) words for Children, #20No ratings yet

- Mathematical Formulas for Economics and Business: A Simple IntroductionFrom EverandMathematical Formulas for Economics and Business: A Simple IntroductionRating: 4 out of 5 stars4/5 (4)

- Break-Even Point. Producer and Consumer SurplusDocument18 pagesBreak-Even Point. Producer and Consumer SurplusElvira Hernandez BenitoNo ratings yet

- Profit Loss Statement (Accrual Basis Accounting) : Item Formula Target ExampleDocument2 pagesProfit Loss Statement (Accrual Basis Accounting) : Item Formula Target ExampleIan ShengNo ratings yet

- Lec 15. National Income Accounting V3 REVISEDDocument33 pagesLec 15. National Income Accounting V3 REVISEDAbhijeet SinghNo ratings yet

- Problem 2 - Paper Set - 1: Statement of CostDocument3 pagesProblem 2 - Paper Set - 1: Statement of CostBALAJI DASAPPAJINo ratings yet

- Ex1. Input: Num1, Num2 Input: Operator Case +: Output: Num1+num2 Case - : Output Num1-Num2 Case : Output Num1 Num2 Case /: Output Num1/ Num2Document6 pagesEx1. Input: Num1, Num2 Input: Operator Case +: Output: Num1+num2 Case - : Output Num1-Num2 Case : Output Num1 Num2 Case /: Output Num1/ Num2Minh DatNo ratings yet

- Job Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetDocument8 pagesJob Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetTherese Grace PostreroNo ratings yet

- FM16 Ch18 Tool KitDocument7 pagesFM16 Ch18 Tool KitAdamNo ratings yet

- Topic 6Document50 pagesTopic 6刘伟康No ratings yet

- Job Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetDocument8 pagesJob Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetNessa MarasiganNo ratings yet

- Chap 2: 1. CF (A) OCF - Capital Spending - 2. CF (B) Debt Service - Long-Term DebtDocument5 pagesChap 2: 1. CF (A) OCF - Capital Spending - 2. CF (B) Debt Service - Long-Term DebtTRANG NGUYỄN LÊ QUỲNHNo ratings yet

- TD CSC201Document16 pagesTD CSC201ghida2005No ratings yet

- Answers Installment Sales Dayag PDFDocument11 pagesAnswers Installment Sales Dayag PDFAshNor Randy100% (1)

- Target Company: Income Statement Balance Sheet & Multiples Actual Estimated Projected Year 0 RevenueDocument5 pagesTarget Company: Income Statement Balance Sheet & Multiples Actual Estimated Projected Year 0 RevenueDmytro BulakhNo ratings yet

- Sebenta MacroeconomiaDocument27 pagesSebenta MacroeconomiaAAA ANo ratings yet

- Cost SheetDocument11 pagesCost SheetPratiksha GaikwadNo ratings yet

- 3 SolutionsDocument4 pages3 Solutionshoanganhph2004No ratings yet

- Formula SheetDocument7 pagesFormula SheetvermillionmiserNo ratings yet

- Nama: Pinkyvi Tiffany Widajanto NIM: 2201920530 Personal Assignment 2Document4 pagesNama: Pinkyvi Tiffany Widajanto NIM: 2201920530 Personal Assignment 2PinkyNo ratings yet

- Lesson 10b: Aggregate Planning Finding An Optimal Production Plan Using Excel SolverDocument7 pagesLesson 10b: Aggregate Planning Finding An Optimal Production Plan Using Excel SolvervaraduNo ratings yet

- Solution 1sttermDocument3 pagesSolution 1sttermE RDNo ratings yet

- Part 6Document8 pagesPart 6Amr YoussefNo ratings yet

- National Income Accounting PPT MBADocument58 pagesNational Income Accounting PPT MBARhea Mae Caramonte AmitNo ratings yet

- After-Tax Economic Analysis: Engineering EconomyDocument16 pagesAfter-Tax Economic Analysis: Engineering EconomyTUẤN TRẦN MINHNo ratings yet

- CA Inter Economics For Finance Live Revision SJC PDFDocument113 pagesCA Inter Economics For Finance Live Revision SJC PDFsigesh100% (1)

- CH 10 Long Term ContractsDocument6 pagesCH 10 Long Term ContractsMerr Fe PainaganNo ratings yet

- The Keynesian Income & Expenditure AnalysisDocument12 pagesThe Keynesian Income & Expenditure AnalysisrosheelNo ratings yet

- Chapter II-1Document22 pagesChapter II-1ልደቱ ገብረየስNo ratings yet

- Form 4A - GCT Returns PDFDocument2 pagesForm 4A - GCT Returns PDFNicquainCTNo ratings yet

- Assignment 2: Business Value Management: Show Detailed Calculations in The Spaces ProvidedDocument4 pagesAssignment 2: Business Value Management: Show Detailed Calculations in The Spaces Providedelmin mammadovNo ratings yet

- Business Economics Assignment SEM-1Document9 pagesBusiness Economics Assignment SEM-1ankur4scorpioNo ratings yet

- Finance Final222Document7 pagesFinance Final222Mohamed SalamaNo ratings yet

- FINA623 Advanced Capital Budeting Lecture Twelve Stakeholder Impacts OF ProjectsDocument29 pagesFINA623 Advanced Capital Budeting Lecture Twelve Stakeholder Impacts OF ProjectsAdepeju OluokunNo ratings yet

- Manufacturing - Actual Costing - JBJDocument9 pagesManufacturing - Actual Costing - JBJAlexis Jaina TinaanNo ratings yet

- Business Math - X000D - Using Excel: Chapter 14 - Practice 02Document1 pageBusiness Math - X000D - Using Excel: Chapter 14 - Practice 02malvikatanejaNo ratings yet

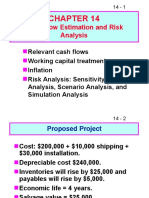

- Cash Flow Estimation and Risk AnalysisDocument55 pagesCash Flow Estimation and Risk AnalysisSurya G.C.No ratings yet

- MT1 Ch29Document12 pagesMT1 Ch29api-3725162No ratings yet

- Ex. Lesson 20-2-2020Document3 pagesEx. Lesson 20-2-2020roberta glionnaNo ratings yet

- 3 - Income Statement-Without Correction of ExercisesDocument58 pages3 - Income Statement-Without Correction of ExercisesClaire YINo ratings yet

- Revenue Recognition: Long Term ConstructionDocument3 pagesRevenue Recognition: Long Term ConstructionLee SuarezNo ratings yet

- Unit 4 - Job, Batch Service Costing (PDF Slides)Document51 pagesUnit 4 - Job, Batch Service Costing (PDF Slides)Ceila FerronNo ratings yet

- BFN 10103Document6 pagesBFN 10103Muhd HafizNo ratings yet

- 41 Job Costing NotesDocument2 pages41 Job Costing Notesgetcultured69No ratings yet

- OF Appraisal Formula A) Compounded Interest Future Value of Single InvestmentDocument21 pagesOF Appraisal Formula A) Compounded Interest Future Value of Single Investmentbhobot riveraNo ratings yet

- Manufacturing Account Worked Example Question 9Document5 pagesManufacturing Account Worked Example Question 9Roshan RamkhalawonNo ratings yet

- Appraisal FormulasDocument21 pagesAppraisal FormulasAlex Cruz100% (2)

- Chap10, MankiwDocument42 pagesChap10, MankiwSaif AliNo ratings yet

- Chap10, MankiwDocument42 pagesChap10, MankiwSaif AliNo ratings yet

- Formulae and Key Data: Number FormulaDocument3 pagesFormulae and Key Data: Number FormulaTrinh LinhNo ratings yet

- Personal Taxation and Behavior: Mcgraw-Hill/IrwinDocument23 pagesPersonal Taxation and Behavior: Mcgraw-Hill/IrwinDaniaNo ratings yet

- Financial Management Equations Korea UniversityDocument2 pagesFinancial Management Equations Korea UniversityTom DNo ratings yet

- Income and SpendingDocument26 pagesIncome and SpendingKylie TarnateNo ratings yet

- ECS1601 Formula SheetDocument1 pageECS1601 Formula Sheetmacedakamogelo16No ratings yet

- Revenue Recognition: Long Term ConstructionDocument3 pagesRevenue Recognition: Long Term ConstructionLee SuarezNo ratings yet

- Chapter 16Document22 pagesChapter 16KENTANG GORENGNo ratings yet

- BFN 10103Document6 pagesBFN 10103Muhd HafizNo ratings yet

- Job, Batch and Service CostingDocument4 pagesJob, Batch and Service CostingAnimashaun Hassan OlamideNo ratings yet

- Chapter 08 DayagDocument25 pagesChapter 08 DayagAljenika Moncada GupiteoNo ratings yet

- My First Gujarati Money, Finance & Shopping Picture Book with English Translations: Teach & Learn Basic Gujarati words for Children, #17From EverandMy First Gujarati Money, Finance & Shopping Picture Book with English Translations: Teach & Learn Basic Gujarati words for Children, #17Rating: 5 out of 5 stars5/5 (1)

- Exam 1 Fall 2016Document15 pagesExam 1 Fall 2016charbel khouryNo ratings yet

- The 1 Crisis: Economic Breakup With Syria: Prepared by Elie Tony EliasDocument4 pagesThe 1 Crisis: Economic Breakup With Syria: Prepared by Elie Tony Eliascharbel khouryNo ratings yet

- Case Study#3 - MEMOIR OF THE SECOND DELEGATION OF LEBANON TO THE PEACE CONFERENCE-ltpelieelias15 PDFDocument4 pagesCase Study#3 - MEMOIR OF THE SECOND DELEGATION OF LEBANON TO THE PEACE CONFERENCE-ltpelieelias15 PDFcharbel khouryNo ratings yet

- Solution Manual For Introduction To Hydrology 5 E 5th Edition 067399337XDocument7 pagesSolution Manual For Introduction To Hydrology 5 E 5th Edition 067399337Xcharbel khouryNo ratings yet

- Chap 9-Homework-KeyDocument22 pagesChap 9-Homework-Keycharbel khouryNo ratings yet

- Investment Proclamation No. 769 of 2012Document33 pagesInvestment Proclamation No. 769 of 2012abdume74No ratings yet

- SWOT Analysis of ItalyDocument22 pagesSWOT Analysis of ItalyTarunendra Pratap SinghNo ratings yet

- Writing Business Proposals, Business Plan and Case ReportsDocument47 pagesWriting Business Proposals, Business Plan and Case ReportsAbhishek Agarwal100% (2)

- Aswath Damodaran - Technology ValuationDocument115 pagesAswath Damodaran - Technology Valuationpappu.subscription100% (1)

- Partner Admin Link Partner-ReadyDocument23 pagesPartner Admin Link Partner-ReadyManuel Pérez100% (1)

- Weele.5th Ed - Chapter 01.2010Document19 pagesWeele.5th Ed - Chapter 01.2010ravin100% (1)

- Financial DerivativesDocument2 pagesFinancial Derivativesviveksharma51No ratings yet

- Shoaib Akhtar Assignment-1 Marketting Research On Mochari Shoes BrandDocument5 pagesShoaib Akhtar Assignment-1 Marketting Research On Mochari Shoes BrandSHOAIB AKHTARNo ratings yet

- A SF Study of Field Marketing Across Europe P IDocument17 pagesA SF Study of Field Marketing Across Europe P IMasud RahmanNo ratings yet

- 10 - Dec 13-20 - GM - Q2 - WEEK5 - Illustrating Stocks and BondsDocument6 pages10 - Dec 13-20 - GM - Q2 - WEEK5 - Illustrating Stocks and Bondsraymond galagNo ratings yet

- KRF ProgramDocument15 pagesKRF ProgramVlado SusacNo ratings yet

- Chap3 Market Opportunity Analysis and Consumer AnalysisDocument53 pagesChap3 Market Opportunity Analysis and Consumer Analysisrachel100% (3)

- Module 1 FINP7Document3 pagesModule 1 FINP7gfdhgfhgfhgfhNo ratings yet

- Business Model - The Case of SkypeDocument4 pagesBusiness Model - The Case of SkypebezzioNo ratings yet

- Personal Finance & Tax Planning For Cost Accountants: Roven PereiraDocument13 pagesPersonal Finance & Tax Planning For Cost Accountants: Roven PereiraK S KamathNo ratings yet

- WEF A Partner in Shaping HistoryDocument190 pagesWEF A Partner in Shaping HistoryAbi SolaresNo ratings yet

- SBI+Life+-+Group+Micro+Shield+-+SP Master+Proposal+Form 09022023Document4 pagesSBI+Life+-+Group+Micro+Shield+-+SP Master+Proposal+Form 09022023arceroxNo ratings yet

- Chairman AppointDocument2 pagesChairman Appointupsc.bengalNo ratings yet

- Risk Management Insurance MbaDocument13 pagesRisk Management Insurance MbaArsheen Waseem100% (1)

- Marketing Offering & Brand ManagementDocument33 pagesMarketing Offering & Brand ManagementTom jerryNo ratings yet

- NIC ASIA BANK Surkhet NepalDocument62 pagesNIC ASIA BANK Surkhet NepalAshish Kumar100% (1)

- Chapter 6 CostDocument144 pagesChapter 6 CostMaria LiNo ratings yet

- Sime DarbyDocument410 pagesSime DarbyzatyNo ratings yet

- LISA Transfer Authority Form PDFDocument2 pagesLISA Transfer Authority Form PDFAnonymous lHIUIweVNo ratings yet

- SalconDocument136 pagesSalconJames WarrenNo ratings yet

- Illinois Tool Works Inc.: FORM 10-KDocument112 pagesIllinois Tool Works Inc.: FORM 10-KMark Francis CosingNo ratings yet

- 165 Stock Statement Msod Book DebtsDocument4 pages165 Stock Statement Msod Book DebtsRamakrishnan NatarajanNo ratings yet

- DerivDocument47 pagesDerivMahesh SabharwalNo ratings yet

- Instructions: Find, Read and Attach An Opinion-Editorial (Op-Ed) Article Instructions: Find, Read and Attach An Opinion-Editorial (Op-Ed) ArticleDocument2 pagesInstructions: Find, Read and Attach An Opinion-Editorial (Op-Ed) Article Instructions: Find, Read and Attach An Opinion-Editorial (Op-Ed) ArticleAriell EmraduraNo ratings yet