Professional Documents

Culture Documents

Partnership Act 1895 - 9

Uploaded by

Joshua Daarol0 ratings0% found this document useful (0 votes)

18 views1 pageThis document outlines rules for determining if a partnership exists. It states that joint ownership of property does not automatically create a partnership. Similarly, sharing gross returns alone does not make a partnership. However, receiving a share of business profits is considered prima facie evidence of being a partner. Several exceptions are provided, such as receiving repayment of a debt or loan that is dependent on profits, compensation as an employee or agent via profit sharing, annuities from a deceased partner's estate, loans with interest rates tied to profits, or amounts received for selling the goodwill of a business.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines rules for determining if a partnership exists. It states that joint ownership of property does not automatically create a partnership. Similarly, sharing gross returns alone does not make a partnership. However, receiving a share of business profits is considered prima facie evidence of being a partner. Several exceptions are provided, such as receiving repayment of a debt or loan that is dependent on profits, compensation as an employee or agent via profit sharing, annuities from a deceased partner's estate, loans with interest rates tied to profits, or amounts received for selling the goodwill of a business.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views1 pagePartnership Act 1895 - 9

Uploaded by

Joshua DaarolThis document outlines rules for determining if a partnership exists. It states that joint ownership of property does not automatically create a partnership. Similarly, sharing gross returns alone does not make a partnership. However, receiving a share of business profits is considered prima facie evidence of being a partner. Several exceptions are provided, such as receiving repayment of a debt or loan that is dependent on profits, compensation as an employee or agent via profit sharing, annuities from a deceased partner's estate, loans with interest rates tied to profits, or amounts received for selling the goodwill of a business.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

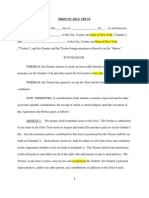

8.

Rules to apply in determining partnership

In determining whether a partnership does or does not exist regard shall be

had to the following rules:

(1) Joint tenancy, tenancy in common, joint property, common property

or part ownership does not of itself create a partnership as to

anything so held or owned, whether the tenants or owners do or do

not share any profits made by the use thereof.

(2) The sharing of gross returns does not of itself create a partnership

whether the persons sharing such returns have or have not a joint or

common right or interest in any property from which, or from the use

of which, the returns are derived.

(3) The receipt by a person of a share of the profits of a business is

prima facie evidence that he is a partner in the business, but the

receipt of such a share, or of a payment contingent upon or varying

with the profits of a business, does not of itself make him a partner in

the business; and in particular:

(a) The receipt by a person of a debt or other liquidated amount

by instalments or otherwise out of the accruing profits of a

business does not of itself make him a partner in the business

or liable as such.

(b) A contract for the remuneration of a servant or agent of any

person engaged in a business by a share of the profits of the

business does not of itself make the servant or agent a partner

in the business, or liable as such, or give him the rights of a

partner.

(c) A person who, immediately before the death of a deceased

partner, was the spouse or de facto partner of the partner, or

who is the child of a deceased partner, and receiving by way

of annuity a portion of the profits made in the business in

which the deceased person was a partner, is not by reason

only of such receipt a partner in the business, or liable as

such.

(d) The advance of money by way of loan to a person engaged, or

about to engage, in any business on a contract with that

person that the lender shall receive a rate of interest varying

with the profits, or shall receive a share of the profits arising

from carrying on the business, does not of itself make the

lender a partner with the person or persons carrying on the

business, or liable as such. Provided that the contract is at the

time of the advance entered into in writing and signed by or

on behalf of all the parties thereto.

(e) A person receiving by way of annuity or otherwise a portion

of the profits of a business in consideration of the sale by him

of the goodwill of the business is not, by reason only of such

receipt, a partner in the business, or liable as such.

[Section 8 amended by No. 28 of 2003 s. 154.]

You might also like

- Angela DeVarso Irrevocable TrustDocument28 pagesAngela DeVarso Irrevocable Trustapple227100% (18)

- Sample Trust Agreement TemplateDocument21 pagesSample Trust Agreement Templatebrillodevarios50% (2)

- Principles of Insurance Law with Case StudiesFrom EverandPrinciples of Insurance Law with Case StudiesRating: 5 out of 5 stars5/5 (1)

- Law On Partnership and Corporation Study GuideDocument109 pagesLaw On Partnership and Corporation Study GuideMaria Angelina Zapanta Jose85% (98)

- PSSA - With Addendum ReferenceDocument8 pagesPSSA - With Addendum ReferenceMark Alvin EspirituNo ratings yet

- Employee Confi AgreementDocument3 pagesEmployee Confi AgreementHoward CohlNo ratings yet

- Law On Partnership and Corporation by Hector de LeonDocument41 pagesLaw On Partnership and Corporation by Hector de LeonMary Claudette Unabia100% (3)

- Credit FINALS ReviewerDocument37 pagesCredit FINALS ReviewerLynielle CrisologoNo ratings yet

- Usc 2019 Civil Law 1 PDFDocument38 pagesUsc 2019 Civil Law 1 PDFAminaamin GuroNo ratings yet

- Lecture Notes On Partnerships Articles 1767-1867, NCC STATUTORY DEFINITION - by A Contract of Partnership, Two or More Persons Bind Themselves ToDocument41 pagesLecture Notes On Partnerships Articles 1767-1867, NCC STATUTORY DEFINITION - by A Contract of Partnership, Two or More Persons Bind Themselves ToMauNo ratings yet

- Success In Franchising: Learn the Secrets of Successful FranchisesFrom EverandSuccess In Franchising: Learn the Secrets of Successful FranchisesRating: 5 out of 5 stars5/5 (1)

- Company Name), A Delaware Corporation (The "Company"), and (Insert Name of Indemnitee)Document17 pagesCompany Name), A Delaware Corporation (The "Company"), and (Insert Name of Indemnitee)Rick SwordsNo ratings yet

- 14 Philippine American Life Insurance Company V AnsaldoDocument3 pages14 Philippine American Life Insurance Company V AnsaldoKeangela Louise100% (1)

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- Law On Partnership and Corporation Study Guide 1Document109 pagesLaw On Partnership and Corporation Study Guide 1Noah OfelNo ratings yet

- Law On Partnership and Corporation by Hector de LeonDocument113 pagesLaw On Partnership and Corporation by Hector de LeonShiela Marie Vics75% (12)

- Partnership Law (Chapter 1 and 2) - ReviewerDocument9 pagesPartnership Law (Chapter 1 and 2) - ReviewerJeanne Marie0% (1)

- Validation SheetDocument1 pageValidation SheetJoshua DaarolNo ratings yet

- Confidentiality, Non-Competition and Non-Solicitation AgreementDocument4 pagesConfidentiality, Non-Competition and Non-Solicitation AgreementLegal Forms100% (2)

- G.R. No. 178044 January 19, 2011 ALAIN M. DIÑO, Petitioner, MA. CARIDAD L. DIÑO, RespondentDocument4 pagesG.R. No. 178044 January 19, 2011 ALAIN M. DIÑO, Petitioner, MA. CARIDAD L. DIÑO, RespondentCharisma AclanNo ratings yet

- UntitledDocument39 pagesUntitledPrincess Dianne CamachoNo ratings yet

- Law On Partnership and Corporation Study GuideDocument109 pagesLaw On Partnership and Corporation Study GuideAlma Landero100% (1)

- How to Build an "Instant" Million-Dollar Direct Marketing Advertising Swipe File!From EverandHow to Build an "Instant" Million-Dollar Direct Marketing Advertising Swipe File!Rating: 3.5 out of 5 stars3.5/5 (7)

- LTI-LHO Form No. TN9: Department of Agrarian Reform Agricultural Leasehold ContractDocument46 pagesLTI-LHO Form No. TN9: Department of Agrarian Reform Agricultural Leasehold ContractSantiago Martin PeregrinoNo ratings yet

- 20 Yu V NLRC, GR No. 97212, June 30, 1993 PDFDocument8 pages20 Yu V NLRC, GR No. 97212, June 30, 1993 PDFMark Emmanuel LazatinNo ratings yet

- Principals of Taxation of Partnerships: Tanzania Revenue Authority Institute of Tax AdministrationDocument62 pagesPrincipals of Taxation of Partnerships: Tanzania Revenue Authority Institute of Tax AdministrationMoud KhalfaniNo ratings yet

- Incentive Compensation Plan Phantom StockDocument4 pagesIncentive Compensation Plan Phantom StockRupesh PandeyNo ratings yet

- Partnership Act - Torts of A PartnerDocument7 pagesPartnership Act - Torts of A Partneranishsani509No ratings yet

- Section 4 in The Indian Partnership ActDocument2 pagesSection 4 in The Indian Partnership ActHitesh HdNo ratings yet

- Draft Collaboration Agree Gla Gnewt 100117 Tfllegal 17.03.17Document26 pagesDraft Collaboration Agree Gla Gnewt 100117 Tfllegal 17.03.17Evelina StoianNo ratings yet

- The Indian Partnership ActDocument14 pagesThe Indian Partnership ActRajeena RahimNo ratings yet

- Law of Partnerships-1-1Document10 pagesLaw of Partnerships-1-1Erick KibeNo ratings yet

- Legal Aspects of BusinessDocument24 pagesLegal Aspects of BusinessArunim MehrotraNo ratings yet

- Partnership Act 1961Document15 pagesPartnership Act 1961Khairul Idzwan100% (8)

- Partnership SY BcomDocument10 pagesPartnership SY BcomSushmita Gupta100% (1)

- Article 1767 Par 2Document2 pagesArticle 1767 Par 2Jeny Princess FrondaNo ratings yet

- InsuranceDocument2 pagesInsurancegetuNo ratings yet

- Somaliland Revenue Act 2016 English v2Document129 pagesSomaliland Revenue Act 2016 English v2Mohamed DaudNo ratings yet

- Rules To Determine Existence of PartnershipDocument7 pagesRules To Determine Existence of Partnershiprbaquino6497valNo ratings yet

- Non-Binding Term SheetDocument2 pagesNon-Binding Term SheetTeresa SilvaNo ratings yet

- HCA Policy Wordings 07092020Document28 pagesHCA Policy Wordings 07092020shamannasriramappa27No ratings yet

- 5Document1 page5gelly studiesNo ratings yet

- HDFC ERGO General Insurance Company Limited: Fidelity Guarantee Insurance PolicyDocument3 pagesHDFC ERGO General Insurance Company Limited: Fidelity Guarantee Insurance PolicyDheepan RajajiNo ratings yet

- Form of Indemnity Agreement For Directors and Executive OfficersDocument8 pagesForm of Indemnity Agreement For Directors and Executive OfficerscsankitkhandalNo ratings yet

- Law of Contract Assinment Sem 2Document8 pagesLaw of Contract Assinment Sem 2Archit SharmaNo ratings yet

- Non CompeteDocument5 pagesNon CompetePriyanshu SinghNo ratings yet

- Legal Practitioners Professional StandardsDocument4 pagesLegal Practitioners Professional StandardsVeronika Shangeelao KaxwekaNo ratings yet

- Emilio What Are The Causes of Dissolution of The PartnershipDocument16 pagesEmilio What Are The Causes of Dissolution of The PartnershipKen AbuanNo ratings yet

- Irish O. AlonzoDocument17 pagesIrish O. AlonzoIrish AlonzoNo ratings yet

- Unit II - DebentureDocument30 pagesUnit II - DebentureKartikey GargNo ratings yet

- Law On Partnerships and CorporationDocument113 pagesLaw On Partnerships and CorporationJessaNo ratings yet

- Parcor Recit ReviewerDocument7 pagesParcor Recit ReviewerNathaly Nicolle CapuchinoNo ratings yet

- Tax SyllabusDocument196 pagesTax SyllabusSaurabh SagarNo ratings yet

- Non - CompeteDocument6 pagesNon - CompeteNirmal ShahNo ratings yet

- Provisions Related To Related PartyDocument3 pagesProvisions Related To Related PartyRina PradhanNo ratings yet

- Agreement 6481a8b31398d66b8aef03e9Document12 pagesAgreement 6481a8b31398d66b8aef03e9Vishal BawaneNo ratings yet

- Master SuretyDocument4 pagesMaster Suretyapi-324291104100% (1)

- The Law of PartnershipDocument11 pagesThe Law of PartnershipKansiime JonanNo ratings yet

- Partnership 2Document1 pagePartnership 2Light StormNo ratings yet

- Partnership and RCCDocument205 pagesPartnership and RCCHendriech Del MundoNo ratings yet

- MODULE-2 ObliConDocument18 pagesMODULE-2 ObliConJudy LarozaNo ratings yet

- Law On Parcor Study GuideDocument16 pagesLaw On Parcor Study GuideMariel DimaculanganNo ratings yet

- VIMA - Model Long Form Term Sheet (22.11.2019)Document24 pagesVIMA - Model Long Form Term Sheet (22.11.2019)Denis LambertNo ratings yet

- Terms of Business UsDocument6 pagesTerms of Business UsMoses ChegeNo ratings yet

- Relation of The PartnersDocument12 pagesRelation of The PartnersRitu AgarwalNo ratings yet

- 2nd SessionDocument7 pages2nd SessionNova MarasiganNo ratings yet

- A Treatise on Indian Transfer Pricing Regulations - Part II: A Treatise on Indian Transfer Pricing Regulations, #2From EverandA Treatise on Indian Transfer Pricing Regulations - Part II: A Treatise on Indian Transfer Pricing Regulations, #2No ratings yet

- ORE Conso AFS 2021-CompressedDocument69 pagesORE Conso AFS 2021-CompressedJoshua DaarolNo ratings yet

- Seth Coleen Divino GoDocument1 pageSeth Coleen Divino GoJoshua DaarolNo ratings yet

- 1071 ArticleText 5113 1 10 20211209Document22 pages1071 ArticleText 5113 1 10 20211209Joshua DaarolNo ratings yet

- Ore Conso Afs 2020Document69 pagesOre Conso Afs 2020Joshua DaarolNo ratings yet

- 2021 SEC Form 17A - Holcim Philippines Inc., and Subsidiaries Part 2 of 2Document218 pages2021 SEC Form 17A - Holcim Philippines Inc., and Subsidiaries Part 2 of 2Joshua DaarolNo ratings yet

- Daarol-Title II - Incorporation and Organization of Private CorporationDocument1 pageDaarol-Title II - Incorporation and Organization of Private CorporationJoshua DaarolNo ratings yet

- Module 36.3 - Consolidated Financial Statements (PFRS 10)Document4 pagesModule 36.3 - Consolidated Financial Statements (PFRS 10)Joshua DaarolNo ratings yet

- ABSENT LETTER John Christian Miñas 09.21.22Document1 pageABSENT LETTER John Christian Miñas 09.21.22Joshua DaarolNo ratings yet

- CHAPTER FOUR-Limited Partnership - Joshua - DaarolDocument2 pagesCHAPTER FOUR-Limited Partnership - Joshua - DaarolJoshua DaarolNo ratings yet

- M36 - Quizzer 4Document5 pagesM36 - Quizzer 4Joshua DaarolNo ratings yet

- Chapter Three: Dissolution and Winding UpDocument2 pagesChapter Three: Dissolution and Winding UpJoshua DaarolNo ratings yet

- M36 - Quizzer 3 PDFDocument4 pagesM36 - Quizzer 3 PDFJoshua DaarolNo ratings yet

- M36 - Quizzer 3 PDFDocument4 pagesM36 - Quizzer 3 PDFJoshua DaarolNo ratings yet

- Module 36.2 - Separate Financial StatementsDocument1 pageModule 36.2 - Separate Financial StatementsJoshua DaarolNo ratings yet

- Module 25.3 - Presentation of Financial StatementsDocument5 pagesModule 25.3 - Presentation of Financial StatementsJoshua DaarolNo ratings yet

- Module 36.1 Quizzer 2 - Subsequent To Date of Acquisition: PendonDocument3 pagesModule 36.1 Quizzer 2 - Subsequent To Date of Acquisition: PendonJoshua Daarol0% (1)

- A Simple Guide To Your Accounting JourneyDocument18 pagesA Simple Guide To Your Accounting JourneyJoshua DaarolNo ratings yet

- M36 - Quizzer 1 PDFDocument8 pagesM36 - Quizzer 1 PDFJoshua DaarolNo ratings yet

- The Role of Consumer Culture On The Sense of Self and IdentityDocument24 pagesThe Role of Consumer Culture On The Sense of Self and IdentityJoshua Daarol80% (10)

- Failure To Object: ARTICLE 1405Document4 pagesFailure To Object: ARTICLE 1405Joshua DaarolNo ratings yet

- Oblicon Midterm ReviewerDocument20 pagesOblicon Midterm ReviewerJanelle Winli LuceroNo ratings yet

- Subcontract Agreement: I. Scope of Works. Painting WorksDocument1 pageSubcontract Agreement: I. Scope of Works. Painting WorksParallel Civil Engineering ConstructionNo ratings yet

- The Contract Act 1871 RDocument55 pagesThe Contract Act 1871 Rdharmsmart19No ratings yet

- Contract Cre - KaranDocument16 pagesContract Cre - KaranshivamNo ratings yet

- Case: Onglenco vs. Ozaeta (70 Phil. 43)Document13 pagesCase: Onglenco vs. Ozaeta (70 Phil. 43)Eve De Tomas CedulloNo ratings yet

- Instant Download Applied Physics 11th Edition Ewen Test Bank PDF Full ChapterDocument8 pagesInstant Download Applied Physics 11th Edition Ewen Test Bank PDF Full Chaptercynthiahaynesymqgprzace100% (9)

- Sumitomo CorporationDocument12 pagesSumitomo CorporationThanh Lê Thị HoàiNo ratings yet

- 1.2 General Partnership Vs Limited PartnershipDocument2 pages1.2 General Partnership Vs Limited PartnershipXyril MañagoNo ratings yet

- Rice Share Tenancy Act 1933Document7 pagesRice Share Tenancy Act 1933GiboFriasNo ratings yet

- Munasque Vs Court of AppealsDocument12 pagesMunasque Vs Court of AppealsAJ LeoNo ratings yet

- Digests Art 1191-1232Document7 pagesDigests Art 1191-1232Gino LascanoNo ratings yet

- 2022 Victoria Uzoewulu Ijeoma Tenancy - AgreementDocument4 pages2022 Victoria Uzoewulu Ijeoma Tenancy - AgreementDavid AiyedunNo ratings yet

- PDFNet LicenseDocument7 pagesPDFNet LicenseMunnar KeralaNo ratings yet

- V.D Swami & Co Vs Lodge CottrellDocument18 pagesV.D Swami & Co Vs Lodge CottrellThankamKrishnanNo ratings yet

- Contract-Ii (Special Contracts) ObjectivesDocument3 pagesContract-Ii (Special Contracts) ObjectivesMAHANTESH GNo ratings yet

- Student's Copy - Pdf. Seminar 2. AB1301 Lecture Notes - Formation of Contract 1-Intention To Contract & Agreement - Offer & AcceptanceDocument47 pagesStudent's Copy - Pdf. Seminar 2. AB1301 Lecture Notes - Formation of Contract 1-Intention To Contract & Agreement - Offer & AcceptanceJulianne Mari WongNo ratings yet

- MixTorque - VAM TOP ® - VAM TOP ®Document1 pageMixTorque - VAM TOP ® - VAM TOP ®Dowell Josp RalhNo ratings yet

- 03 Prebid Consortium Agreement Con 1Document13 pages03 Prebid Consortium Agreement Con 1Rudrani ChowdhuryNo ratings yet

- Donation LawsDocument2 pagesDonation LawsRonaldo Jr. DIAZ100% (1)

- Volpe 1979 Commercial Law of Zimbabwe Contract Part 4 Termination of Contracts.Document40 pagesVolpe 1979 Commercial Law of Zimbabwe Contract Part 4 Termination of Contracts.miti victorNo ratings yet

- UntitledDocument7 pagesUntitledshweta shurpaliNo ratings yet

- Residential Tenancy AgreementDocument7 pagesResidential Tenancy AgreementMinh TuấnNo ratings yet