Professional Documents

Culture Documents

Land, Building and Machinery

Land, Building and Machinery

Uploaded by

Artisan0 ratings0% found this document useful (0 votes)

7 views2 pagesCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views2 pagesLand, Building and Machinery

Land, Building and Machinery

Uploaded by

ArtisanCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

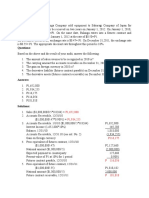

Identify the costs that will be capitalized as Land, Land

Improvement, Building, Machinery, and will be expensed as

incurred.

Edmodo Company Incurred the following costs during the

current year in relation to property plant and equipment:

Cost incurred Land

Cash paid for purchase of land 12,500,000 12,500,000

Mortgage assumed on the land purchased, including interest

accrued 3,000,000 3,000,000

Realtor commission 300,000 300,000

Legal fees, realty taxes and documentation expenses 50,000 50,000

Amount paid to relocate persons squatting on the property 100,000 100,000

Cost of tearing down an old building on the land to make room

for construction of new building 300,000

Salvage value of the old building demolished 150,000

Cost of fencing the property 500,000

Amount paid to the contractor for the building constructed 7,500,000

Building permit fee 100,000

Excavation 100,000

Architect fee 350,000

Interest that would have been earned had the money used

during the period of construction been invested 1,500,000

Invoice cost of machine acquired 3,000,000

Freight, unloading and delivery charges 45,000

Custome duties and other charges 125,000

Allowance and hotel accomodaation, paid to foreign technicians

during installation and test run of machine 346,000

Total 29,966,000 15,950,000

Land Improvement Building Machinery Expensed as incurred

300,000

-150,000

500,000

7,500,000

100,000

100,000

350,000

3,000,000

45,000

125,000

346,000

500,000 8,200,000 3,516,000 0

You might also like

- Strategic-Management-Analysis of "MEGHNA GROUP OF INDUSTRIES"Document10 pagesStrategic-Management-Analysis of "MEGHNA GROUP OF INDUSTRIES"SanaullahSunny100% (1)

- Machinery and Capitl ExpendituresDocument18 pagesMachinery and Capitl ExpendituresAnne Estrella0% (1)

- Ch10 - Soal Dan LatihanDocument29 pagesCh10 - Soal Dan Latihanevelyn aleeza100% (3)

- Garretts Bike Shop Business PlanDocument39 pagesGarretts Bike Shop Business PlanPalo Alto Software92% (122)

- Topic 4 & 5: Land, Building and MachineryDocument11 pagesTopic 4 & 5: Land, Building and MachineryKrissa Mae LongosNo ratings yet

- Exercise 02 INTACC2 Cadiz Jericho E.Document15 pagesExercise 02 INTACC2 Cadiz Jericho E.Kervin Rey JacksonNo ratings yet

- Property, Plant and Equipement: Prior To Expense AfterDocument8 pagesProperty, Plant and Equipement: Prior To Expense AfterAvox EverdeenNo ratings yet

- Week 2 Output-KingDocument4 pagesWeek 2 Output-KingAlexis KingNo ratings yet

- Chap002 Stratgic Marketing CravensDocument30 pagesChap002 Stratgic Marketing CravensHarunRidoNo ratings yet

- Lean Interview QuestionsDocument9 pagesLean Interview QuestionsJasmeet KohliNo ratings yet

- ACTIVITIESDocument13 pagesACTIVITIESJanine TupasiNo ratings yet

- 6905 - Land, Building and MachineryDocument2 pages6905 - Land, Building and MachineryAljur SalamedaNo ratings yet

- Practical Accounting 1 (Ppe)Document9 pagesPractical Accounting 1 (Ppe)Ivan Landaos100% (1)

- 3 HW On PPEDocument3 pages3 HW On PPENikko Bowie PascualNo ratings yet

- Ppe - ModuleDocument7 pagesPpe - ModuleYejin ChoiNo ratings yet

- Ppe Test BankDocument10 pagesPpe Test BankAna Mae HernandezNo ratings yet

- Minglana, Mitch T. BSA - 301 Quiz 2 Problem 1Document5 pagesMinglana, Mitch T. BSA - 301 Quiz 2 Problem 1Mitch MinglanaNo ratings yet

- Far 6673Document4 pagesFar 6673Marinel Felipe0% (1)

- QUIZ - RemovalDocument2 pagesQUIZ - RemovalRazel TercinoNo ratings yet

- Land and Building Exercises - SolutionDocument2 pagesLand and Building Exercises - Solutionjingyuu kimNo ratings yet

- Quiz - Ppe CostDocument2 pagesQuiz - Ppe CostAna Mae HernandezNo ratings yet

- Promlem Solving Problem 1: Property, Plant and Equipment (Answer Key)Document27 pagesPromlem Solving Problem 1: Property, Plant and Equipment (Answer Key)Rica Regoris100% (1)

- Chapter 26Document5 pagesChapter 26Shane Ivory ClaudioNo ratings yet

- Property Plant and Equipment: Problem 1Document13 pagesProperty Plant and Equipment: Problem 1A.B AmpuanNo ratings yet

- Property, Plant and Equipment Chapter 15Document9 pagesProperty, Plant and Equipment Chapter 15Kiminosunoo LelNo ratings yet

- Property, Plant and Equipment Chapter 15Document9 pagesProperty, Plant and Equipment Chapter 15Kiminosunoo Lel100% (3)

- Problem Set PpeDocument11 pagesProblem Set PpeHdhsiaihagatataNo ratings yet

- 5-1 (Uy Company) : Property, Plant and Equipment ProblemsDocument13 pages5-1 (Uy Company) : Property, Plant and Equipment ProblemsExequielCamisaCrusperoNo ratings yet

- Solution - PPE Nad IntangiblesDocument1 pageSolution - PPE Nad IntangiblesROB101512No ratings yet

- AP DLSA 05 PPE For DistributionDocument10 pagesAP DLSA 05 PPE For DistributionStela Marie CarandangNo ratings yet

- Intermediate Accounting Exercise 2 FinalsDocument2 pagesIntermediate Accounting Exercise 2 FinalsJune Maylyn MarzoNo ratings yet

- Exercise 02 INTACC2 Cadiz Jericho E.Document15 pagesExercise 02 INTACC2 Cadiz Jericho E.Kervin Rey JacksonNo ratings yet

- Arlene Joy S. Garcia Practice Test 5.2 BSA-3 ACC 211 7:30-9:30 AM Yu Corporation Land Land Improvements Buildings Machinery and EquipmentDocument1 pageArlene Joy S. Garcia Practice Test 5.2 BSA-3 ACC 211 7:30-9:30 AM Yu Corporation Land Land Improvements Buildings Machinery and EquipmentArlene GarciaNo ratings yet

- Plants, Property and EquipmentDocument21 pagesPlants, Property and EquipmentAna Mae HernandezNo ratings yet

- A.) Land: Problem No.1Document7 pagesA.) Land: Problem No.1MARICEL URBINANo ratings yet

- Problem 1: InvestmentsDocument7 pagesProblem 1: InvestmentsEsse ValdezNo ratings yet

- Audit of Noncurrent Assets UploadDocument4 pagesAudit of Noncurrent Assets Uploadandreamrie0% (2)

- Final Exam Auditing With Answer UcpDocument7 pagesFinal Exam Auditing With Answer UcpJelyn RuazolNo ratings yet

- LEC03B - BSA 2102 - 012021-Problems, Part IDocument3 pagesLEC03B - BSA 2102 - 012021-Problems, Part IKatarame LermanNo ratings yet

- Property, Plant Equipment ExercisesDocument17 pagesProperty, Plant Equipment Exercisescjorillosa2004No ratings yet

- A.) Land: Problem No.1Document7 pagesA.) Land: Problem No.1MARICEL URBINANo ratings yet

- Land Building Machinery ProblemsDocument13 pagesLand Building Machinery ProblemsJomerNo ratings yet

- Accounting PpeDocument7 pagesAccounting PpeJomar Sevilla Rabia100% (1)

- Land Building MachineryDocument11 pagesLand Building MachineryJomerNo ratings yet

- Acccob 2 - 6-1 - 6-10Document27 pagesAcccob 2 - 6-1 - 6-10Ayanna Beyonce CameroNo ratings yet

- Ap Ppe Quizzer Q Accounting ReviewerDocument19 pagesAp Ppe Quizzer Q Accounting Reviewercynthia reyesNo ratings yet

- PPEDocument1 pagePPEExcelsia Grace A. Parreño0% (1)

- Practice Test 5.1 Ppe GarciaDocument3 pagesPractice Test 5.1 Ppe GarciaArlene Garcia100% (1)

- Intermediate Accounting I Ppe AnswersDocument3 pagesIntermediate Accounting I Ppe AnswersChaCha Delos Reyes AguinidNo ratings yet

- Intermediate Accounting I - Ppe AnswersDocument3 pagesIntermediate Accounting I - Ppe AnswersJoovs Joovho50% (2)

- Let's Check (ULO J)Document8 pagesLet's Check (ULO J)Kirei MinaNo ratings yet

- AP Ppe Quizzer QDocument28 pagesAP Ppe Quizzer Qkimberly bumanlagNo ratings yet

- MIDTERM EXAMINATION INTACC2 With AnswersDocument6 pagesMIDTERM EXAMINATION INTACC2 With AnswersMac b IBANEZNo ratings yet

- Cases PpeDocument19 pagesCases PpeDavid Harrison PascualNo ratings yet

- PpeDocument7 pagesPpeJer Rama100% (1)

- Problem No. 1: QuestionsDocument4 pagesProblem No. 1: QuestionsAnna Mae NebresNo ratings yet

- 5BAP5D03 PPEforprintingDocument8 pages5BAP5D03 PPEforprintingCykee Hanna Quizo LumongsodNo ratings yet

- Exercises 02 INTACC2 Jackson Kervin Rey GDocument12 pagesExercises 02 INTACC2 Jackson Kervin Rey GKervin Rey Jackson100% (1)

- Land Building and MachineryDocument26 pagesLand Building and MachineryNathalie Getino100% (1)

- Increase in Global Competition-Due To An Increase in Global Competition LeadDocument4 pagesIncrease in Global Competition-Due To An Increase in Global Competition LeadAlexis KingNo ratings yet

- Group 3Document12 pagesGroup 3Alexis KingNo ratings yet

- Problem 2.4.1: Name: Jolina C. Pasahol Block: B Time: 03:00 - 04:30 MT A. Cost ModelDocument2 pagesProblem 2.4.1: Name: Jolina C. Pasahol Block: B Time: 03:00 - 04:30 MT A. Cost ModelAlexis KingNo ratings yet

- ERP Core Applications: By: Alexis O. KingDocument7 pagesERP Core Applications: By: Alexis O. KingAlexis KingNo ratings yet

- Problem-2 3 1Document6 pagesProblem-2 3 1Alexis KingNo ratings yet

- Relevant Costing Exercises - KingDocument7 pagesRelevant Costing Exercises - KingAlexis KingNo ratings yet

- Accounting For Shareholders Equity KINGDocument11 pagesAccounting For Shareholders Equity KINGAlexis KingNo ratings yet

- School of Education, Arts and Sciences: LiteratureDocument2 pagesSchool of Education, Arts and Sciences: LiteratureAlexis KingNo ratings yet

- Topic: Economic Policies: I. Learning ObjectivesDocument11 pagesTopic: Economic Policies: I. Learning ObjectivesAlexis KingNo ratings yet

- Problem-2 3 2Document4 pagesProblem-2 3 2Alexis KingNo ratings yet

- Proponents of Archetypal CriticismDocument1 pageProponents of Archetypal CriticismAlexis KingNo ratings yet

- Capital Budgeting Exercises 2 NUNEZ PDFDocument3 pagesCapital Budgeting Exercises 2 NUNEZ PDFAlexis KingNo ratings yet

- Capital BudgetingDocument2 pagesCapital BudgetingAlexis KingNo ratings yet

- Key Ws - Chapter Ix-Assembling Your Opportunity Portfolio: King, Alexis O. Bsa 2CDocument1 pageKey Ws - Chapter Ix-Assembling Your Opportunity Portfolio: King, Alexis O. Bsa 2CAlexis KingNo ratings yet

- Week 1 Output-KingDocument4 pagesWeek 1 Output-KingAlexis KingNo ratings yet

- King, Alexis Orcio: Kawanihan NG Rentas InternasDocument3 pagesKing, Alexis Orcio: Kawanihan NG Rentas InternasAlexis KingNo ratings yet

- Activity 1: Economic Security Refers To A Feeling of Freedom and Safety. The People ofDocument4 pagesActivity 1: Economic Security Refers To A Feeling of Freedom and Safety. The People ofAlexis KingNo ratings yet

- Student: Alexis O. King Course and Year: BSA 2CDocument3 pagesStudent: Alexis O. King Course and Year: BSA 2CAlexis KingNo ratings yet

- Problem 5-1 QuarterDocument6 pagesProblem 5-1 QuarterAlexis KingNo ratings yet

- Name: Alexis O. King Block: CDocument5 pagesName: Alexis O. King Block: CAlexis KingNo ratings yet

- Capital BudgetingDocument2 pagesCapital BudgetingAlexis KingNo ratings yet

- Problem 5-1 1st Month-1Document3 pagesProblem 5-1 1st Month-1Alexis KingNo ratings yet

- Communication in Public Administration PDFDocument2 pagesCommunication in Public Administration PDFMichelle75% (4)

- Office of The Punong Barangay: Executive Order No. 02 Series of 2021Document2 pagesOffice of The Punong Barangay: Executive Order No. 02 Series of 2021Hernand LumawigNo ratings yet

- BP-Make-to-Order Production Wo Variant ConfigurationDocument9 pagesBP-Make-to-Order Production Wo Variant ConfigurationMaxkNo ratings yet

- Sell A Property JamaicaDocument2 pagesSell A Property Jamaicashantelwest48No ratings yet

- 2022 06 23 PEZA Checklist For ExpansionDocument4 pages2022 06 23 PEZA Checklist For ExpansionSarah Jean TaliNo ratings yet

- GE 3 2nd Topic (Consumer Math)Document5 pagesGE 3 2nd Topic (Consumer Math)Ivanne GomezNo ratings yet

- Nep 2.0Document20 pagesNep 2.0Gmail820No ratings yet

- Chapter 9 Marketing (BAR)Document9 pagesChapter 9 Marketing (BAR)Alsudais AkbaresiNo ratings yet

- Greentech Mega Food Park LTDDocument14 pagesGreentech Mega Food Park LTDshniNo ratings yet

- How To Improve Business Development Department ProductivityDocument6 pagesHow To Improve Business Development Department ProductivityHailegeorgis GemedaNo ratings yet

- Submitted by - : Gautam Gulati, Kapil Manwani, Rashmi Sharma, Mohit Motwani, Ankitha SingaviDocument36 pagesSubmitted by - : Gautam Gulati, Kapil Manwani, Rashmi Sharma, Mohit Motwani, Ankitha SingaviDon Iz BackNo ratings yet

- Key Performance Indicators Parmenter en 25210Document6 pagesKey Performance Indicators Parmenter en 25210Keng Eng ChewNo ratings yet

- Sample Questions Shortlisted by Paper Setting CommiteeDocument65 pagesSample Questions Shortlisted by Paper Setting CommiteeDivyeshNo ratings yet

- Syllabus For Business 247Document2 pagesSyllabus For Business 247Antonio FemiaNo ratings yet

- Salary Certificate in ExcelDocument2 pagesSalary Certificate in ExcelAnurag KumarNo ratings yet

- Entrepreneurship Grade 12 2nd Semester PDF Digital Notes/reviewerDocument9 pagesEntrepreneurship Grade 12 2nd Semester PDF Digital Notes/reviewerhendazayaciaNo ratings yet

- High Level+Stakeholder+Analysis+TemplateDocument4 pagesHigh Level+Stakeholder+Analysis+TemplatemkovieshnikovaNo ratings yet

- AEB 212 Introduction To Agricultural Economics: Test 1 (Total Marks 50 Marks)Document5 pagesAEB 212 Introduction To Agricultural Economics: Test 1 (Total Marks 50 Marks)Thabo ChuchuNo ratings yet

- F5 Mock 1 Dec 2012Document7 pagesF5 Mock 1 Dec 2012Rakib Hossain100% (1)

- MMPC 001 SolvedDocument22 pagesMMPC 001 SolvedParneet kaurNo ratings yet

- D G Khan Cement Company LTD Introduction DG Khan Cement IndustryDocument2 pagesD G Khan Cement Company LTD Introduction DG Khan Cement IndustryZeeshan KhalidNo ratings yet

- Pengantar Kewangan - Bab 4Document47 pagesPengantar Kewangan - Bab 4Mardi UmarNo ratings yet

- A Study On Inventory Management of The Titan Industry LTDDocument61 pagesA Study On Inventory Management of The Titan Industry LTDDeepak KumarNo ratings yet

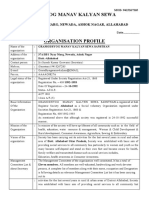

- Gramodhyog Manav Kalyan Seva SansthanDocument2 pagesGramodhyog Manav Kalyan Seva SansthanRohitNo ratings yet

- Paper Presentation - Social Media MarketingDocument10 pagesPaper Presentation - Social Media MarketingBinchu AnnNo ratings yet

- Mock Final F3.2Document3 pagesMock Final F3.2Phạm Việt BáchNo ratings yet