0% found this document useful (0 votes)

959 views4 pagesRevaluation

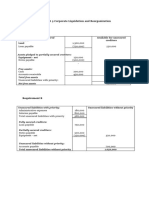

The document provides data on the revaluation of machinery, including original cost, replacement cost, accumulated depreciation, and age. It asks for calculations of appreciation, carrying amount, depreciated replacement cost, revaluation surplus, original useful life, and journal entries to record the revaluation, annual depreciation, and realization of the revaluation surplus. The solution shows the calculations and journal entries to fully address all items required by the document.

Uploaded by

ArtisanCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

959 views4 pagesRevaluation

The document provides data on the revaluation of machinery, including original cost, replacement cost, accumulated depreciation, and age. It asks for calculations of appreciation, carrying amount, depreciated replacement cost, revaluation surplus, original useful life, and journal entries to record the revaluation, annual depreciation, and realization of the revaluation surplus. The solution shows the calculations and journal entries to fully address all items required by the document.

Uploaded by

ArtisanCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd