Professional Documents

Culture Documents

Example 1: Intra-State (In State)

Example 1: Intra-State (In State)

Uploaded by

pmcmbharat2640 ratings0% found this document useful (0 votes)

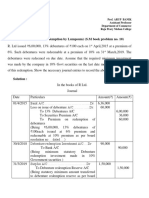

18 views4 pagesThe document shows accounting entries for the purchase of goods worth Rs. 100,000 locally within the same state. It involves debiting the Purchase account for Rs. 100,000, CGST account for Rs. 9,000 (@9% of purchase amount) and SGST account for Rs. 9,000 (@9% of purchase amount). The total amount of Rs. 1,18,000 is credited to the Cash/Bank/Creditors account. This is an example transaction for an intra-state purchase where both CGST and SGST are applicable at 9% each.

Original Description:

EXTRA

Original Title

Example 1

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document shows accounting entries for the purchase of goods worth Rs. 100,000 locally within the same state. It involves debiting the Purchase account for Rs. 100,000, CGST account for Rs. 9,000 (@9% of purchase amount) and SGST account for Rs. 9,000 (@9% of purchase amount). The total amount of Rs. 1,18,000 is credited to the Cash/Bank/Creditors account. This is an example transaction for an intra-state purchase where both CGST and SGST are applicable at 9% each.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views4 pagesExample 1: Intra-State (In State)

Example 1: Intra-State (In State)

Uploaded by

pmcmbharat264The document shows accounting entries for the purchase of goods worth Rs. 100,000 locally within the same state. It involves debiting the Purchase account for Rs. 100,000, CGST account for Rs. 9,000 (@9% of purchase amount) and SGST account for Rs. 9,000 (@9% of purchase amount). The total amount of Rs. 1,18,000 is credited to the Cash/Bank/Creditors account. This is an example transaction for an intra-state purchase where both CGST and SGST are applicable at 9% each.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

Example 1: Intra-state (In state)

Purchased goods Rs. 1,00,000 locally (intra state) CGST @9% and SGST@9%

Purchase A/c ………………Dr. 1,00,000

CGST A/c ………….…………Dr. 9,000

SGST A/c ………………….…Dr. 9,000

To Cash/ Bank/ Creditors A/c ………………….. Cr. 1,18,000

Example 1: Intra-state (In state)

Purchased goods Rs. 1,00,000 locally (intra state) CGST @9% and SGST@9%

Purchase A/c ………………Dr. 1,00,000

CGST A/c ………….…………Dr. 9,000

SGST A/c ………………….…Dr. 9,000

To Cash/ Bank/ Creditors A/c ………………….. Cr. 1,18,000

Example 1: Intra-state (In state)

Purchased goods Rs. 1,00,000 locally (intra state) CGST @9% and SGST@9%

Purchase A/c ………………Dr. 1,00,000

CGST A/c ………….…………Dr. 9,000

SGST A/c ………………….…Dr. 9,000

To Cash/ Bank/ Creditors A/c ………………….. Cr. 1,18,000

Example 1: Intra-state (In state)

Purchased goods Rs. 1,00,000 locally (intra state) CGST @9% and SGST@9%

Purchase A/c ………………Dr. 1,00,000

CGST A/c ………….…………Dr. 9,000

SGST A/c ………………….…Dr. 9,000

To Cash/ Bank/ Creditors A/c ………………….. Cr. 1,18,000

Example 1: Intra-state (In state)

Purchased goods Rs. 1,00,000 locally (intra state) CGST @9% and SGST@9%

Purchase A/c ………………Dr. 1,00,000

CGST A/c ………….…………Dr. 9,000

SGST A/c ………………….…Dr. 9,000

To Cash/ Bank/ Creditors A/c ………………….. Cr. 1,18,000

Example 1: Intra-state (In state)

Purchased goods Rs. 1,00,000 locally (intra state) CGST @9% and SGST@9%

Purchase A/c ………………Dr. 1,00,000

CGST A/c ………….…………Dr. 9,000

SGST A/c ………………….…Dr. 9,000

To Cash/ Bank/ Creditors A/c ………………….. Cr. 1,18,000

Example 1: Intra-state (In state)

Purchased goods Rs. 1,00,000 locally (intra state) CGST @9% and SGST@9%

Purchase A/c ………………Dr. 1,00,000

CGST A/c ………….…………Dr. 9,000

SGST A/c ………………….…Dr. 9,000

To Cash/ Bank/ Creditors A/c ………………….. Cr. 1,18,000

Example 1: Intra-state (In state)

Purchased goods Rs. 1,00,000 locally (intra state) CGST @9% and SGST@9%

Purchase A/c ………………Dr. 1,00,000

CGST A/c ………….…………Dr. 9,000

SGST A/c ………………….…Dr. 9,000

To Cash/ Bank/ Creditors A/c ………………….. Cr. 1,18,000

Example 1: Intra-state (In state)

Purchased goods Rs. 1,00,000 locally (intra state) CGST @9% and SGST@9%

Purchase A/c ………………Dr. 1,00,000

CGST A/c ………….…………Dr. 9,000

SGST A/c ………………….…Dr. 9,000

To Cash/ Bank/ Creditors A/c ………………….. Cr. 1,18,000

Example 1: Intra-state (In state)

Purchased goods Rs. 1,00,000 locally (intra state) CGST @9% and SGST@9%

Purchase A/c ………………Dr. 1,00,000

CGST A/c ………….…………Dr. 9,000

SGST A/c ………………….…Dr. 9,000

To Cash/ Bank/ Creditors A/c ………………….. Cr. 1,18,000

Example 1: Intra-state (In state)

Purchased goods Rs. 1,00,000 locally (intra state) CGST @9% and SGST@9%

Purchase A/c ………………Dr. 1,00,000

CGST A/c ………….…………Dr. 9,000

SGST A/c ………………….…Dr. 9,000

To Cash/ Bank/ Creditors A/c ………………….. Cr. 1,18,000

Example 1: Intra-state (In state)

Purchased goods Rs. 1,00,000 locally (intra state) CGST @9% and SGST@9%

Purchase A/c ………………Dr. 1,00,000

CGST A/c ………….…………Dr. 9,000

SGST A/c ………………….…Dr. 9,000

To Cash/ Bank/ Creditors A/c ………………….. Cr. 1,18,000

Example 1: Intra-state (In state)

Purchased goods Rs. 1,00,000 locally (intra state) CGST @9% and SGST@9%

Purchase A/c ………………Dr. 1,00,000

CGST A/c ………….…………Dr. 9,000

SGST A/c ………………….…Dr. 9,000

To Cash/ Bank/ Creditors A/c ………………….. Cr. 1,18,000

You might also like

- 03 Cash and Cash Equivalents PDFDocument12 pages03 Cash and Cash Equivalents PDFChaesil Kyle CajaNo ratings yet

- Chapter 14 Developing Pricing Strategies and ProgramsDocument40 pagesChapter 14 Developing Pricing Strategies and ProgramsA_Students100% (1)

- Basic Accounting Terms.1Document5 pagesBasic Accounting Terms.1k srinivasNo ratings yet

- Tally Prime Course Account and IntroDocument15 pagesTally Prime Course Account and IntroAnkit Singh100% (1)

- Statement Nov:Dec 2023Document9 pagesStatement Nov:Dec 2023raheemtimo1No ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Basic Accounting Terms.1Document5 pagesBasic Accounting Terms.1k srinivasNo ratings yet

- How To Pass Accounting Entries Under GSTDocument6 pagesHow To Pass Accounting Entries Under GSTSunando Narayan BiswasNo ratings yet

- R12 White Paper On Automatic Creation of Bank Account Transfer Through Sweep Transaction and Cash Leveling ProgramDocument35 pagesR12 White Paper On Automatic Creation of Bank Account Transfer Through Sweep Transaction and Cash Leveling ProgramrpillzNo ratings yet

- Unit-2 Audit of Cash and Marketable SecuritiesDocument6 pagesUnit-2 Audit of Cash and Marketable SecuritiesKiya AbdiNo ratings yet

- Account Statement 2Document6 pagesAccount Statement 2Krishna rajaNo ratings yet

- Project HulDocument70 pagesProject Hulpmcmbharat264No ratings yet

- Bulgaro Angliiski Schet - RechnikDocument131 pagesBulgaro Angliiski Schet - RechnikbabinetiNo ratings yet

- ADCB Cards Limits Website 11 Feb 2024Document2 pagesADCB Cards Limits Website 11 Feb 2024hormonatNo ratings yet

- Example 2: Inter-State (Outside The State)Document3 pagesExample 2: Inter-State (Outside The State)pmcmbharat264No ratings yet

- Accounting Entries Under GSTDocument7 pagesAccounting Entries Under GSTPiousPatialaNo ratings yet

- Accounting Entries Under GSTDocument3 pagesAccounting Entries Under GSTAshish RaiNo ratings yet

- 104c Unit 1 SolutionDocument23 pages104c Unit 1 SolutionDevil 5103No ratings yet

- Fundamental Notes and Conceptual Problem of Journal Ledger Trial Balance and Cash BookDocument7 pagesFundamental Notes and Conceptual Problem of Journal Ledger Trial Balance and Cash BookShekhar TNo ratings yet

- GST Configuration & Jv'sDocument5 pagesGST Configuration & Jv'sKancheti Bhanu PrasadNo ratings yet

- Unit 7 PDFDocument22 pagesUnit 7 PDFSatti NagendrareddyNo ratings yet

- Types of Transaction: Being Name of Person's Cheque Returned ChequeDocument2 pagesTypes of Transaction: Being Name of Person's Cheque Returned ChequeDipendra GiriNo ratings yet

- Trail BlanceDocument9 pagesTrail Blanceujjwalkumar02090No ratings yet

- Calculate The Total Variance Between The Actual Cost and TheDocument1 pageCalculate The Total Variance Between The Actual Cost and TheMiroslav GegoskiNo ratings yet

- Accountancy ProjectDocument25 pagesAccountancy ProjectSumaiya Rahman100% (2)

- Acting For Debs AnsDocument3 pagesActing For Debs AnsbalonNo ratings yet

- N Academy: Class 12 Accountancy CH 9 Company Accounts - Issue of Debentures Que and AnsDocument5 pagesN Academy: Class 12 Accountancy CH 9 Company Accounts - Issue of Debentures Que and AnsYashvi ShahNo ratings yet

- Accounting Mcqs 1Document20 pagesAccounting Mcqs 1Pramod Gowda BNo ratings yet

- Acting For Debs AnsDocument3 pagesActing For Debs AnsbalonNo ratings yet

- 1.cash Basis 2.accrual Basis: Golden Rules of AccountingDocument4 pages1.cash Basis 2.accrual Basis: Golden Rules of AccountingabinashNo ratings yet

- Dipendra Giri B2 (Smile Please) : Cash A/c....... Dr. To Bad Debts Recovered A/cDocument1 pageDipendra Giri B2 (Smile Please) : Cash A/c....... Dr. To Bad Debts Recovered A/cDipendra GiriNo ratings yet

- Total: Balance Sheet Total-' 82,120. The Following EntryDocument2 pagesTotal: Balance Sheet Total-' 82,120. The Following EntryTanishq BindalNo ratings yet

- Accounting and Transaction Processing Assignment ADocument6 pagesAccounting and Transaction Processing Assignment AShubha KoiralaNo ratings yet

- Question and Answer - 54Document31 pagesQuestion and Answer - 54acc-expertNo ratings yet

- BMS (CBCS) Sem 2 BaDocument29 pagesBMS (CBCS) Sem 2 BaTanisha BawneNo ratings yet

- ProblemsDocument12 pagesProblemsShereen FathimaNo ratings yet

- MBA Accounts For ManagerDocument3 pagesMBA Accounts For ManagerGayathri GopiramnathNo ratings yet

- FA Special 2010Document10 pagesFA Special 2010prakash9735No ratings yet

- Transactions Names of A/c Two Effects Type of A/cDocument28 pagesTransactions Names of A/c Two Effects Type of A/cDivyesh NagarkarNo ratings yet

- Accounting Procedure of GST: Date Particulars LF DR AmtDocument6 pagesAccounting Procedure of GST: Date Particulars LF DR AmtSAMRAT SARKERNo ratings yet

- Solved ExercisesDocument9 pagesSolved ExercisesKyle BroflovskiNo ratings yet

- Joint Venture Account HandoutDocument11 pagesJoint Venture Account HandoutMichael AsieduNo ratings yet

- Practical 1Document31 pagesPractical 1Rohit ReddyNo ratings yet

- Assume That DR Aaron Jones Is The Sole Owner ofDocument1 pageAssume That DR Aaron Jones Is The Sole Owner ofMuhammad ShahidNo ratings yet

- Problem - 2 (Redemption by Lumpsum) (S.M Book Problem No. 10)Document5 pagesProblem - 2 (Redemption by Lumpsum) (S.M Book Problem No. 10)Gopal DasNo ratings yet

- Journal EntryDocument7 pagesJournal Entryshreyu14796No ratings yet

- Subsidairy BooksDocument15 pagesSubsidairy BooksAtul Kumar SamalNo ratings yet

- Test Bank For Principles of Cost Accounting 16Th Edition Vanderbeck 1133187862 9781133187868 Full Chapter PDFDocument36 pagesTest Bank For Principles of Cost Accounting 16Th Edition Vanderbeck 1133187862 9781133187868 Full Chapter PDFellen.holt139100% (12)

- Accounts BasicsDocument2 pagesAccounts BasicsRithvik SangilirajNo ratings yet

- Tutorial - Return and RiskDocument3 pagesTutorial - Return and Riskphuongnhitran26No ratings yet

- Accounts Case Study 78Document4 pagesAccounts Case Study 78Vraj AdrojaNo ratings yet

- ACCT 102 Suggested Answers To Practice Questions 2011-2012 S2Document101 pagesACCT 102 Suggested Answers To Practice Questions 2011-2012 S2Dang Ngoc LinhNo ratings yet

- All VouchersDocument23 pagesAll VouchersSunandaNo ratings yet

- Problem - 7: Problem On Redemption by Annual DrawingDocument5 pagesProblem - 7: Problem On Redemption by Annual DrawingGopal DasNo ratings yet

- Joint VentureDocument30 pagesJoint VentureDivyansh TripathiNo ratings yet

- Review Exercise ADocument5 pagesReview Exercise AFitz Gerald BalbaNo ratings yet

- American Laser Inc Reported The Following Account Balances On January PDFDocument1 pageAmerican Laser Inc Reported The Following Account Balances On January PDFHassan JanNo ratings yet

- Calculate The Total Variance For Labor For The Month The StandardDocument1 pageCalculate The Total Variance For Labor For The Month The StandardMiroslav GegoskiNo ratings yet

- Calculate The Rate Variance For Labor For The Month The StandardDocument1 pageCalculate The Rate Variance For Labor For The Month The StandardMiroslav GegoskiNo ratings yet

- AccountsDocument13 pagesAccountspalash khannaNo ratings yet

- Fa 8Document12 pagesFa 8Die PoorNo ratings yet

- Financial Accounting and AnalysisDocument8 pagesFinancial Accounting and AnalysisRajesh BathulaNo ratings yet

- Ans For Decision MakingDocument5 pagesAns For Decision MakingSellKcNo ratings yet

- Journal Entry For Credit Purchase and Cash PurchaseDocument4 pagesJournal Entry For Credit Purchase and Cash PurchaseramakrishnaraoNo ratings yet

- Solutiondone 2-472Document1 pageSolutiondone 2-472trilocksp SinghNo ratings yet

- 29Document4 pages29Carlo ParasNo ratings yet

- Case BasedDocument8 pagesCase BasedRn GuptaNo ratings yet

- Ledger AccountsDocument58 pagesLedger Accountsshrestha.aryxnNo ratings yet

- Purchasing Power Parities and the Real Size of World EconomiesFrom EverandPurchasing Power Parities and the Real Size of World EconomiesNo ratings yet

- Student CertificateDocument7 pagesStudent Certificatepmcmbharat264No ratings yet

- INDEXDocument1 pageINDEXpmcmbharat264No ratings yet

- A Summer Training Project Report On "Market Analysis of Ericsson"Document4 pagesA Summer Training Project Report On "Market Analysis of Ericsson"pmcmbharat264No ratings yet

- "Performance Appraisal": A Summer Training Project Report OnDocument4 pages"Performance Appraisal": A Summer Training Project Report Onpmcmbharat264No ratings yet

- A Summer Training Project Report On "Business Development On Online Food Ordering"Document6 pagesA Summer Training Project Report On "Business Development On Online Food Ordering"pmcmbharat264100% (1)

- A Summer Training Project Report OnDocument4 pagesA Summer Training Project Report Onpmcmbharat264No ratings yet

- Entry For Cash BookDocument10 pagesEntry For Cash Bookpmcmbharat264No ratings yet

- Zomato Front PagesDocument4 pagesZomato Front Pagespmcmbharat264No ratings yet

- Summer Training Report On "Digitalization of HDFC Bank"Document18 pagesSummer Training Report On "Digitalization of HDFC Bank"pmcmbharat264No ratings yet

- Axis Front PagesDocument5 pagesAxis Front Pagespmcmbharat264No ratings yet

- Acknowledgement: Information & Technology, Panipat) - His Expert Opinion and Effort To Direct My Views inDocument14 pagesAcknowledgement: Information & Technology, Panipat) - His Expert Opinion and Effort To Direct My Views inpmcmbharat264No ratings yet

- Index: Chapter No. Particulars PagesDocument9 pagesIndex: Chapter No. Particulars Pagespmcmbharat264No ratings yet

- Declaration and PREFACEDocument2 pagesDeclaration and PREFACEpmcmbharat264No ratings yet

- A Training Report On "A Study of The Consumer Buying Behaviour of Classmate"Document1 pageA Training Report On "A Study of The Consumer Buying Behaviour of Classmate"pmcmbharat264No ratings yet

- Certificate: This Is Certifying That Ms. Neeshu Student of MBA From Geeta EngineeringDocument1 pageCertificate: This Is Certifying That Ms. Neeshu Student of MBA From Geeta Engineeringpmcmbharat264No ratings yet

- Summer Training Report On: "Market Analysis of Ericsson"Document2 pagesSummer Training Report On: "Market Analysis of Ericsson"pmcmbharat264No ratings yet

- A Summer Training Report On "Performance Appraisal of Employees" atDocument5 pagesA Summer Training Report On "Performance Appraisal of Employees" atpmcmbharat264No ratings yet

- ACKNOWLEDGEMENTDocument1 pageACKNOWLEDGEMENTpmcmbharat264No ratings yet

- Declaration and PREFACEDocument2 pagesDeclaration and PREFACEpmcmbharat264No ratings yet

- "Working Capital Management": A Training Report OnDocument1 page"Working Capital Management": A Training Report Onpmcmbharat264No ratings yet

- Chapter-1 (To Industry, Company & Topic)Document69 pagesChapter-1 (To Industry, Company & Topic)pmcmbharat264No ratings yet

- HDFC Front PagesDocument9 pagesHDFC Front Pagespmcmbharat264No ratings yet

- A Summer Training Project Report On "Consumer Perception Towards Icici Prudential Life Insurance With Reference To Panipat City"Document1 pageA Summer Training Project Report On "Consumer Perception Towards Icici Prudential Life Insurance With Reference To Panipat City"pmcmbharat264No ratings yet

- Particulars: Industry Profile Company ProfileDocument65 pagesParticulars: Industry Profile Company Profilepmcmbharat264No ratings yet

- Content Company ProfileDocument60 pagesContent Company Profilepmcmbharat264No ratings yet

- Certificate: Information & Technology, Panipat Has Successfully Completed TrainingDocument1 pageCertificate: Information & Technology, Panipat Has Successfully Completed Trainingpmcmbharat264No ratings yet

- Ss Loom TexDocument1 pageSs Loom Texpmcmbharat264No ratings yet

- "Globalization": "Arya Girls Public School"Document1 page"Globalization": "Arya Girls Public School"pmcmbharat264No ratings yet

- Vouching and VerificationDocument31 pagesVouching and VerificationsamyogforuNo ratings yet

- FICA - Posting in The Cash JournalDocument4 pagesFICA - Posting in The Cash Journalvaishaliak2008No ratings yet

- TRANSACTIONDocument127 pagesTRANSACTIONNikhil DevdharNo ratings yet

- Cash Management ModelDocument23 pagesCash Management Modelkaran kataria100% (1)

- 8 CercularDocument4 pages8 CercularArkan AftabNo ratings yet

- Cash and Cash EquivalentsDocument5 pagesCash and Cash Equivalentsforuse insitesNo ratings yet

- Chapter 02 Overview of Accounting Information SystemDocument42 pagesChapter 02 Overview of Accounting Information Systemfennie lohNo ratings yet

- NAVOne NewDocument19 pagesNAVOne Newamit.kumarNo ratings yet

- Navy Comptroller ManualDocument701 pagesNavy Comptroller ManualThe MajorNo ratings yet

- Life 2e - Elementary - Unit 7 Test - WordDocument6 pagesLife 2e - Elementary - Unit 7 Test - WordGALAGER BATEMANNo ratings yet

- Treasury Management: Transmittal LetterDocument56 pagesTreasury Management: Transmittal Lettermashael abanmiNo ratings yet

- Commodore v. Fruit Supply (Ghana) Ltd.Document37 pagesCommodore v. Fruit Supply (Ghana) Ltd.Gifty BoehyeNo ratings yet

- Financial Accounting in An Economic Context 8th Edition Pratt Test BankDocument38 pagesFinancial Accounting in An Economic Context 8th Edition Pratt Test Bankindocileexothecawtoy100% (14)

- Cash Count and Shortage ComputationDocument4 pagesCash Count and Shortage ComputationCJ alandyNo ratings yet

- FNSACC321 AT1 PE TQM v2Document19 pagesFNSACC321 AT1 PE TQM v2Allison Gibbings-JohnsNo ratings yet

- 2021.06.02 PAGS 1Q21 Earnings ReleaseDocument23 pages2021.06.02 PAGS 1Q21 Earnings ReleaseRenan Dantas SantosNo ratings yet

- Cabigon Problem 1 AuditDocument2 pagesCabigon Problem 1 AuditGianrie Gwyneth CabigonNo ratings yet

- FULLTEXT01Document65 pagesFULLTEXT01Chris aribasNo ratings yet

- Construction AccountDocument21 pagesConstruction AccountSureshkumaryadavNo ratings yet

- CreditCardStatement PDFDocument4 pagesCreditCardStatement PDFuTTkarsh kUMarNo ratings yet

- Mission 200 Economics 100 FINALDocument67 pagesMission 200 Economics 100 FINALHari prakarsh NimiNo ratings yet

- CC Cash Over and ShortDocument3 pagesCC Cash Over and ShortDanica BalinasNo ratings yet