Professional Documents

Culture Documents

Quiz Corp Finance MMUT 12 OCtYB

Uploaded by

Zero MustafCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quiz Corp Finance MMUT 12 OCtYB

Uploaded by

Zero MustafCopyright:

Available Formats

SWISS GERMAN UNIVE

RSITY

QUIZ Page 1 of 5

Date : 12 Oct Score :

Lecturer : Dr. Ir. Yosman Bustaman M. Buss

Program : Master Degree

Fac./Dept. : FBC/MM-MBA

Semester : 2

Time : 45 minutes

Subject: Corporate Finance Name:

Conditions for the Examination for this subject:

1. Open Book X Yes No

If yes, which books are specified? .........

2. Laptop Allowed without internet Allowed with internet Not allowed

3. Cheat Sheet Yes No Remarks:

Cheat sheet must be attached to the student's work at the end of the examination

4. Calculator Yes No Remarks:

5. Dictionary Yes No Remarks:

6. Pencil Yes No

7. Pen Yes No

File: Final Exam QF 5.17/Rev. 08

Swiss German University Tel. +62 21 2977 9596/9597

The Prominence Tower

Sutera Barat No.15, Alam Sutera Fax. +62 21 2977 9598

Tangerang, Banten 15143, Indonesia info@sgu.ac.id

www.sgu.ac.id

SWISS GERMAN UNIVE

RSITY

QUIZ Page 2 of 5

1. The stock valuation model that determines the current stock price by dividing the next annual dividend

amount by the excess of the discount rate less the dividend growth rate is called the _____ model.

A. zero growth

B. dividend growth

C. capital pricing

D. earnings capitalization

E. differential growth

2. The rate at which a stock's price is expected to appreciate (or depreciate) is called the _____ yield.

A. current

B. total

C. dividend

D. capital gains

E. earnings

3. The constant dividend growth model is:

A. generally used in practice because most stocks have a constant growth rate.

B. generally used in practice because the historical growth rate of most stocks is constant.

C. generally not used in practice because most stocks grow at a non constant rate.

D. generally not used in practice because the constant growth rate is usually higher than the required

rate of return.

E. based on the assumption Dow 30 represents a good estimate of the market index.

4. Assume that you are using the dividend growth model to value stocks. If you expect the market rate of

return to increase across the board on all equity securities, then you should also expect the:

A. market values of all stocks to increase, all else constant.

B. market values of all stocks to remain constant as the dividend growth will offset the increase in the

market rate.

C. market values of all stocks to decrease, all else constant.

D. stocks that do not pay dividends to decrease in price while the dividend-paying stocks maintain a

constant price.

E. dividend growth rates to increase to offset this change

5. Differential growth refers to a firm that increases its dividend by:

A. three or more percent per year.

B. a rate which is most likely not sustainable over an extended period of time.

C. a constant rate of two or more percent per year.

D. $.10 or more per year.

E. an amount in excess of $.10 a year.

File: Final Exam QF 5.17/Rev. 08

Swiss German University Tel. +62 21 2977 9596/9597

The Prominence Tower

Sutera Barat No.15, Alam Sutera Fax. +62 21 2977 9598

Tangerang, Banten 15143, Indonesia info@sgu.ac.id

www.sgu.ac.id

SWISS GERMAN UNIVE

RSITY

QUIZ Page 3 of 5

6. Fred Flintlock wants to earn a total of 10% on his investments. He recently purchased shares of ABC stock

at a price of $20 a share. The stock pays a $1 a year dividend. The price of ABC stock needs to _____ if

Fred is to achieve his 10% rate of return.

A. remain constant

B. decrease by 5%

C. increase by 5%

D. increase by 10%

E. increase by 15%

7. Angelina Inc. made two announcements concerning its common stock today. First, the company

announced that its next annual dividend has been set at $2.16 a share. Secondly, the company

announced that all future dividends will increase by 4% annually. What is the maximum amount you

should pay to purchase a share of Angelina's stock if your goal is to earn a 10% rate of return?

A. $21.60

B. $22.46

C. $27.44

D. $34.62

E. $36.00

8. The common stock of Eddie's Engines Inc. sells for $25.71 a share. The stock is expected to pay $1.80 per

share next month when the annual dividend is distributed. Eddie's has established a pattern of increasing

its dividends by 4% annually and expects to continue doing so. What is the market rate of return on this

stock?

A. 7%

B. 9%

C. 11%

D. 13%

E. 15%

9. The current yield on Alpha Inc. common stock is 4.8%. The company just paid a $2.10 dividend. The

rumor is that the dividend will be $2.205 next year. The dividend growth rate is expected to remain

constant at the current level. What is the required rate of return on Alpha's stock?

A. 10.04%

B. 16.07%

C. 21.88%

D. 43.75%

E. 45.94%

10. Shares of common stock of the Samson Co. offer an expected total return of 12%. The dividend is

increasing at a constant 8% per year. The dividend yield must be:

A. -4%.

B. 4%.

C. 8%.

D. 12%.

E. 20%.

File: Final Exam QF 5.17/Rev. 08

Swiss German University Tel. +62 21 2977 9596/9597

The Prominence Tower

Sutera Barat No.15, Alam Sutera Fax. +62 21 2977 9598

Tangerang, Banten 15143, Indonesia info@sgu.ac.id

www.sgu.ac.id

SWISS GERMAN UNIVE

RSITY

QUIZ Page 4 of 5

11. Turnips and Parsley common stock sells for $39.86 a share at a market rate of return of 9.5%. The

company just paid its annual dividend of $1.20. What is the rate of growth of its dividend?

A. 5.2%

B. 5.5%

C. 5.9%

D. 6.0%

E. 6.3%

12. S&P Enterprises will pay an annual dividend of $2.08 a share on its common stock next year. Last week,

the company paid a dividend of $2.00 a share. The company adheres to a constant rate of growth

dividend policy. What will one share of S&P common stock be worth ten years from now if the applicable

discount rate is 8%?

A. $71.16

B. $74.01

C. $76.97

D. $80.05

E. $83.25

13. The Merriweather Co. just announced that it will pay a dividend next year of $1.60 and is establishing a

policy whereby the dividend will increase by 3.5% annually thereafter. How much will one share be worth

five years from now if the required rate of return is 12%?

A. $21.60

B. $22.36

C. $23.14

D. $23.95

E. $24.79

14. The Bell Weather Co. is a new firm in a rapidly growing industry. The company is planning on increasing

its annual dividend by 20% a year for the next four years and then decreasing the growth rate to 5% per

year. The company just paid its annual dividend in the amount of $1.00 per share. What is the current

value of one share if the required rate of return is 9.25%?

A. $35.63

B. $38.19

C. $41.05

D. $43.19

E. $45.81

File: Final Exam QF 5.17/Rev. 08

Swiss German University Tel. +62 21 2977 9596/9597

The Prominence Tower

Sutera Barat No.15, Alam Sutera Fax. +62 21 2977 9598

Tangerang, Banten 15143, Indonesia info@sgu.ac.id

www.sgu.ac.id

SWISS GERMAN UNIVE

RSITY

QUIZ Page 5 of 5

15. Which of the following amounts is closest to what should be paid for Overland common stock? Overland

has just paid a dividend of $2.25. These dividends are expected to grow at a rate of 5% in the foreseeable

future. The required rate of return is 11%.

A. $20.45

B. $21.48

C. $37.50

D. $39.38

E. $47.70

File: Final Exam QF 5.17/Rev. 08

Swiss German University Tel. +62 21 2977 9596/9597

The Prominence Tower

Sutera Barat No.15, Alam Sutera Fax. +62 21 2977 9598

Tangerang, Banten 15143, Indonesia info@sgu.ac.id

www.sgu.ac.id

You might also like

- Fashion Retailing Group Project Analyzes Product Sales DataDocument6 pagesFashion Retailing Group Project Analyzes Product Sales DataZero MustafNo ratings yet

- Fashion Retailing Group Project Analyzes Product Sales DataDocument6 pagesFashion Retailing Group Project Analyzes Product Sales DataZero MustafNo ratings yet

- Unilever Sample TestDocument9 pagesUnilever Sample TestSherif Eltoukhi75% (4)

- 155 Best Business English Vocabulary TermsFrom Everand155 Best Business English Vocabulary TermsRating: 3 out of 5 stars3/5 (2)

- CFALevel1 Sample QuestionsDocument58 pagesCFALevel1 Sample QuestionsManoj UpretiNo ratings yet

- Midterm - Version A (For Posting)Document21 pagesMidterm - Version A (For Posting)Dennis ChowNo ratings yet

- Series 7 Practice QuestionsDocument5 pagesSeries 7 Practice QuestionsDan MoreiraNo ratings yet

- Group 5th Mini Case The MBA Decision v.05.10.20Document12 pagesGroup 5th Mini Case The MBA Decision v.05.10.20Zero Mustaf100% (2)

- India CIO All Data SalesDocument177 pagesIndia CIO All Data Salesbharat50% (2)

- Important Student Exam InstructionsDocument13 pagesImportant Student Exam InstructionsCarl-Henry FrancoisNo ratings yet

- 33 Comm 308 Final Exam (Summer 1 2018)Document16 pages33 Comm 308 Final Exam (Summer 1 2018)Carl-Henry FrancoisNo ratings yet

- 36 Comm 308 Final Exam (Winter 2019) - SolutionDocument15 pages36 Comm 308 Final Exam (Winter 2019) - SolutionCarl-Henry FrancoisNo ratings yet

- Fa21 Exam 1ADocument14 pagesFa21 Exam 1ABharat KoiralaNo ratings yet

- IEECONO Q1 T1 2022 Set B With Answer Key 1Document9 pagesIEECONO Q1 T1 2022 Set B With Answer Key 1Janry ArezaNo ratings yet

- BFF2341 2015 S1 ExamDocument11 pagesBFF2341 2015 S1 Examasteria0409No ratings yet

- Time Value of Money QuestionsDocument8 pagesTime Value of Money QuestionswanNo ratings yet

- Econ 100 Midterm practice_KEYDocument7 pagesEcon 100 Midterm practice_KEYIzza NaseerNo ratings yet

- AFF2341 Exam 2013 S1Document11 pagesAFF2341 Exam 2013 S1asteria0409No ratings yet

- Final Exam Review QuestionsDocument18 pagesFinal Exam Review QuestionsArchiePatelNo ratings yet

- Blank ExamsDocument9 pagesBlank ExamsAndros MafraugarteNo ratings yet

- FINA Exam1 - PracticeDocument6 pagesFINA Exam1 - Practicealison dreamNo ratings yet

- Mid - Term - Performance Assessment 1 - Time Value of Money: Multiple Choice Questions Problem Solving (100 Points)Document4 pagesMid - Term - Performance Assessment 1 - Time Value of Money: Multiple Choice Questions Problem Solving (100 Points)Nathaniel IricaNo ratings yet

- Tutotial 2 - Time Value of Money FVPVDocument5 pagesTutotial 2 - Time Value of Money FVPVAmy LimnaNo ratings yet

- Final Practice QuestionsDocument32 pagesFinal Practice Questions282487239No ratings yet

- Eng201 Collection of Old PapersDocument29 pagesEng201 Collection of Old Paperscs619finalproject.com100% (2)

- Valuation of Securities 1 - TBPDocument2 pagesValuation of Securities 1 - TBPShaina Monique RangasanNo ratings yet

- Practice QuestionsDocument30 pagesPractice QuestionsmichmagsalinNo ratings yet

- Answer FIN 401 Exam2 Fall15 V1Document7 pagesAnswer FIN 401 Exam2 Fall15 V1mahmudNo ratings yet

- Mid-Term Examination: University of Economics and Law - Vietnam National University - HCMCDocument7 pagesMid-Term Examination: University of Economics and Law - Vietnam National University - HCMCNgân Võ Trần TuyếtNo ratings yet

- Exam 2022 SeptemberDocument11 pagesExam 2022 Septembergio040700No ratings yet

- FINA Final - PracticeDocument9 pagesFINA Final - Practicealison dreamNo ratings yet

- Fin9901 - 02 - Quiz: StudentDocument3 pagesFin9901 - 02 - Quiz: Studentbazookajoe999No ratings yet

- Clase VI - Discount Rates (Equity Risk Premium)Document25 pagesClase VI - Discount Rates (Equity Risk Premium)Miguel Vega OtinianoNo ratings yet

- FSP MBA Midterm (Summer 2021)Document3 pagesFSP MBA Midterm (Summer 2021)KIRAN SARDARNo ratings yet

- Mathematics Final Exam WudnehDocument5 pagesMathematics Final Exam WudnehWudneh AmareNo ratings yet

- ADM 2350 Final Exam Winter 2007 Version 1 Solns Revised For BoothDocument16 pagesADM 2350 Final Exam Winter 2007 Version 1 Solns Revised For BoothIshan VashishtNo ratings yet

- Banking Master Thesis TopicsDocument7 pagesBanking Master Thesis Topicswcldtexff100% (1)

- Edu 2017 04 Cfesdm Exam AmDocument16 pagesEdu 2017 04 Cfesdm Exam AmJRVVNo ratings yet

- Corporate Finance Syllabus and Outline Spring 2011: Aswath DamodaranDocument19 pagesCorporate Finance Syllabus and Outline Spring 2011: Aswath Damodaransondi325No ratings yet

- Engineering Economic Analysis: Equivalence For Repeated Cash FlowsDocument62 pagesEngineering Economic Analysis: Equivalence For Repeated Cash FlowsPhambra FiverNo ratings yet

- 01prelim FIN 103 Answer KeyDocument7 pages01prelim FIN 103 Answer KeyevaNo ratings yet

- ADM 2350P Quiz 1 V1 Solns Winter 2010Document7 pagesADM 2350P Quiz 1 V1 Solns Winter 2010Carolyn LeNo ratings yet

- School of Banking and Finance: Fins1613 Business Finance Practice QuestionsDocument30 pagesSchool of Banking and Finance: Fins1613 Business Finance Practice QuestionsLena ZhengNo ratings yet

- Bus - Math11 Q1mod8of8 Solving Problems On Simple Interest v2 SLMDocument22 pagesBus - Math11 Q1mod8of8 Solving Problems On Simple Interest v2 SLMCaroline LaynoNo ratings yet

- Caselets For Data-InterpretationDocument51 pagesCaselets For Data-InterpretationAbhinay BayyapuNo ratings yet

- FinalDocument5 pagesFinalMotor Racer0% (2)

- Forex SolnsDocument3 pagesForex SolnsMoaaz AhmedNo ratings yet

- BUS 306 Exam 1 - Spring 2011 (B) - Solution by MateevDocument10 pagesBUS 306 Exam 1 - Spring 2011 (B) - Solution by Mateevabhilash5384No ratings yet

- Economics 105 Midterm 2 Fall19 PDFDocument13 pagesEconomics 105 Midterm 2 Fall19 PDFzdgf dfg562465No ratings yet

- Trade Finance Assignment 2Document4 pagesTrade Finance Assignment 2Justin NatanaelNo ratings yet

- Solutions Exam GuideDocument18 pagesSolutions Exam GuideAfafe ElNo ratings yet

- 15 Comm 308 Final Exam (Fall 2012) SolutionsDocument18 pages15 Comm 308 Final Exam (Fall 2012) SolutionsAfafe ElNo ratings yet

- 2022 MayJune Main EQP - 06 June 2022Document9 pages2022 MayJune Main EQP - 06 June 2022Kempton ParksNo ratings yet

- 2019 CFA Exam Prep: Quantitative Methods Level IDocument50 pages2019 CFA Exam Prep: Quantitative Methods Level IHunain Ghulam MohiuddinNo ratings yet

- Korteweg FBE 432: Corporate Financial Strategy Spring 2019Document6 pagesKorteweg FBE 432: Corporate Financial Strategy Spring 2019PeterNo ratings yet

- FACA Midterm 2019Document4 pagesFACA Midterm 2019Iñigo Manrique BautistaNo ratings yet

- 04 Comm 308 Final Exam (Winter 2009) SolutionDocument18 pages04 Comm 308 Final Exam (Winter 2009) SolutionAfafe ElNo ratings yet

- Tutorial 9 PM AnswersDocument6 pagesTutorial 9 PM AnswersKhanh Linh LeNo ratings yet

- Second Examination - Finance 3320 - Spring 2011 (Moore)Document9 pagesSecond Examination - Finance 3320 - Spring 2011 (Moore)Randall McVayNo ratings yet

- HW 2Document2 pagesHW 2chrislmcNo ratings yet

- Manitoba University FIN 2200 Midterm ExamDocument13 pagesManitoba University FIN 2200 Midterm Examupload55No ratings yet

- Quiz 2 Version 2Document6 pagesQuiz 2 Version 2testusername123salds50% (2)

- A Investment Platform for Future: Self Help a Self Operating BankingFrom EverandA Investment Platform for Future: Self Help a Self Operating BankingNo ratings yet

- Opportunity Adoption 05102020Document213 pagesOpportunity Adoption 05102020Zero MustafNo ratings yet

- Sprint Planning 37Document16 pagesSprint Planning 37Zero MustafNo ratings yet

- Group 5 - Big Data in Healthcare - Covid19 Case v.14Document16 pagesGroup 5 - Big Data in Healthcare - Covid19 Case v.14Zero MustafNo ratings yet

- Data Integrity Ecomindo - 2Document14 pagesData Integrity Ecomindo - 2Zero MustafNo ratings yet

- Automated Build, Test & Deploy With: Benjamin DayDocument60 pagesAutomated Build, Test & Deploy With: Benjamin DayZero MustafNo ratings yet

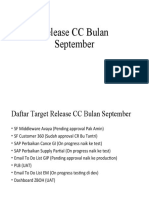

- Release CC Bulan SeptemberDocument2 pagesRelease CC Bulan SeptemberZero MustafNo ratings yet

- Digital Platform Ecosystem: Case StudyDocument16 pagesDigital Platform Ecosystem: Case StudyZero MustafNo ratings yet

- Digital Platform Ecosystem: Case StudyDocument18 pagesDigital Platform Ecosystem: Case StudyZero MustafNo ratings yet

- 5Document20 pages5Saurabh Gupta100% (1)

- Analisa VarianceDocument6 pagesAnalisa VarianceZero MustafNo ratings yet

- Churn Analysis - Group 5 v.30.09.20Document13 pagesChurn Analysis - Group 5 v.30.09.20Zero MustafNo ratings yet

- Book Club Review Reveals Personality Traits Shape BehaviorDocument5 pagesBook Club Review Reveals Personality Traits Shape BehaviorZero MustafNo ratings yet

- Slide Presentasi Final Project Group 5th v10.8.20Document33 pagesSlide Presentasi Final Project Group 5th v10.8.20Zero MustafNo ratings yet

- Project Management For Construction - Fundamental Scheduling ProceduresDocument30 pagesProject Management For Construction - Fundamental Scheduling ProceduresZero MustafNo ratings yet

- Project Management For Construction - Labor, Material and Equipment UtilizationDocument29 pagesProject Management For Construction - Labor, Material and Equipment UtilizationZero MustafNo ratings yet

- Process Model of Work-Flow in Construction Management PDFDocument191 pagesProcess Model of Work-Flow in Construction Management PDFZero MustafNo ratings yet

- Cash Flows at Warf Computers - Group 5 v.28.09Document8 pagesCash Flows at Warf Computers - Group 5 v.28.09Zero MustafNo ratings yet

- Iif 8 Epcm Contracts Feb16 3Document22 pagesIif 8 Epcm Contracts Feb16 3Jorge RammNo ratings yet

- Business Process Re-Engineering of Engineering Procurement Construction (EPC) Project in Oil and Gas Industry in IndonesiaDocument9 pagesBusiness Process Re-Engineering of Engineering Procurement Construction (EPC) Project in Oil and Gas Industry in IndonesiaZero MustafNo ratings yet

- Business Value of BIM For OwnersDocument64 pagesBusiness Value of BIM For Ownerseng qadoumiNo ratings yet

- BIM Implementation Best Practice Part 2Document28 pagesBIM Implementation Best Practice Part 2Zero MustafNo ratings yet

- BIM Implementation Best Practice Part 1 PDFDocument28 pagesBIM Implementation Best Practice Part 1 PDFZero MustafNo ratings yet

- Autodesk Project Transformer WhitepaperDocument12 pagesAutodesk Project Transformer WhitepaperardyankikiNo ratings yet

- EIA1009 Take-Home Exam (30 Marks) (Vetted)Document4 pagesEIA1009 Take-Home Exam (30 Marks) (Vetted)Logan zhengNo ratings yet

- W4 TaxesDocument35 pagesW4 TaxesVanessa LeeNo ratings yet

- Debt Collectors - Georgia Consumer Protection Laws & Consumer ComplaintsDocument11 pagesDebt Collectors - Georgia Consumer Protection Laws & Consumer ComplaintsMooreTrustNo ratings yet

- Stock Investing Mastermind - Zebra Learn-85Document2 pagesStock Investing Mastermind - Zebra Learn-85RGNitinDevaNo ratings yet

- EJS With Portion SaleDocument3 pagesEJS With Portion SaleAidalyn Mendoza100% (1)

- Practice Session - PLDocument9 pagesPractice Session - PLDivyansh PandeyNo ratings yet

- ACC reports 74% rise in Q1 profit, Ambuja Cement to benefitDocument7 pagesACC reports 74% rise in Q1 profit, Ambuja Cement to benefitShivansh RawatNo ratings yet

- - मुख्यमंत्री सीखो कमाओ योजनाDocument81 pages- मुख्यमंत्री सीखो कमाओ योजनाAmitNo ratings yet

- Financial Report: The Coca Cola Company: Ews/2021-10-27 - Coca - Cola - Reports - Continued - Momentum - and - Strong - 1040 PDFDocument3 pagesFinancial Report: The Coca Cola Company: Ews/2021-10-27 - Coca - Cola - Reports - Continued - Momentum - and - Strong - 1040 PDFDominic MuliNo ratings yet

- Statement of Cash FlowsDocument33 pagesStatement of Cash Flowslove_abhi_n_22No ratings yet

- Exercise 1: Supplier Cost Per Valve ($) Percent Large Percent Medium Percent SmallDocument4 pagesExercise 1: Supplier Cost Per Valve ($) Percent Large Percent Medium Percent SmallShital GuptaNo ratings yet

- Pilgrim Bank FinalDocument23 pagesPilgrim Bank FinalAbhiGokhs100% (2)

- On Boundary Spanners and Interfirm Embeddedness - 2021 - Journal of PurchasingDocument11 pagesOn Boundary Spanners and Interfirm Embeddedness - 2021 - Journal of PurchasingRoshanNo ratings yet

- Important Aspects of Rolling of Hot Rolled Coil in Hot Strip Mill - IspatGuruDocument7 pagesImportant Aspects of Rolling of Hot Rolled Coil in Hot Strip Mill - IspatGuruBoban RajkovicNo ratings yet

- Zenith Steel BrochureDocument4 pagesZenith Steel BrochurefebousNo ratings yet

- Inventory ControlDocument26 pagesInventory ControlShweta Dixit100% (1)

- Genentech Account StatementDocument1 pageGenentech Account StatementThanh ĐứcNo ratings yet

- The History of Accounting: From Ancient Record Keeping to Modern StandardsDocument5 pagesThe History of Accounting: From Ancient Record Keeping to Modern StandardsFahrull Hidayatt100% (4)

- Te U/ Home Loan: Subsequent InstalmentsDocument1 pageTe U/ Home Loan: Subsequent InstalmentsShatvik MishraNo ratings yet

- Wood Chipper Machinery Proforma InvoiceDocument2 pagesWood Chipper Machinery Proforma InvoiceAlvaro Espino RodriguezNo ratings yet

- Minutes of The Meeting Chaired by Secretary MoP On 18th Aug 2015Document65 pagesMinutes of The Meeting Chaired by Secretary MoP On 18th Aug 2015Anshu SinghNo ratings yet

- City of Cleveland Shaker Square Housing ComplaintDocument99 pagesCity of Cleveland Shaker Square Housing ComplaintWKYC.comNo ratings yet

- Chapter 22 Homework R. CochranDocument3 pagesChapter 22 Homework R. Cochrancochran123No ratings yet

- RBI Circular RBI2015 PDFDocument4 pagesRBI Circular RBI2015 PDFMurali RangarajanNo ratings yet

- Goods & Services Tax (G.S.T.)Document15 pagesGoods & Services Tax (G.S.T.)EshanMishra100% (1)

- 2023-03-20 Godin, Karen 310072 - Installment Schedule PDFDocument3 pages2023-03-20 Godin, Karen 310072 - Installment Schedule PDFKarenNo ratings yet

- Residency Final / On Account WHT Tax Code Rate %Document3 pagesResidency Final / On Account WHT Tax Code Rate %wilberforceNo ratings yet

- LangfieldSmith7e PPT Ch13Document33 pagesLangfieldSmith7e PPT Ch13Bành Đức HảiNo ratings yet

- Villanueva v. CA, G.R. No. 114870Document2 pagesVillanueva v. CA, G.R. No. 114870xxxaaxxx100% (5)