Professional Documents

Culture Documents

PR Corp

Uploaded by

Wawex DavisOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PR Corp

Uploaded by

Wawex DavisCopyright:

Available Formats

a.

P25,300 P4,900

b. P27,000 P5,000

c. P29,000 P7,000

d. P25,000 P7,000

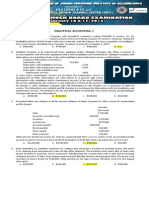

48. PR Corporation holds 80 percent of the stock of SR Company. During 2013 PR

purchased merchandise for P40,000 and resold P30,000 to SR for P48,000. SR

Company reported sales of P67,000 in 2013 and had inventory of P16,000 on

December 31, 2013. The companies had no beginning inventory and had no other

transactions in 2013.

What amount of cost of goods sold and consolidated comprehensive income will

be reported in the 2013 consolidated statement of comprehensive income?

Cost of goods sold Consolidated net

income

a. P20,000 P53,000

b. P30,000 P40,000

c. P 52,00 P47,000

d. P20,000 P47,000

49. PC Corporation purchased 80 percent interest in SD Company for P600,000 on

January 1, 2012, at which time SD's stockholders' equity amounts to P700,000.

The excess cost over book value was assigned to goodwill which is not amortized.

Statements of comprehensive income of the two companies for 2013 are as follows:

SD

PC

Sales P1,000,0® P500,000

Income from subsidiary SD 112,000

Cost of sales ( 400,000) ( 250,000)

Operating expenses ( 220,000)

( 100,000)

Comprehensive income P 492 000 P150,000

No. 50 - Continued

During 2012 SD sold inventory items to PC for P80,000. This merchandise cost SD P50,000 and

one-fourth of it remained in PC's December 31, 2013 inventory. During 2013 SD's sales to PC

amounted to P90,000. This merchandise cost SD P63,000 and one-half of it remained in PC's

December 31, 2013 inventory.

What is the consolidated comprehensive income attributable to parent on Decem-ber 31,

2013?

a. P492,600

b. P492,000

C. P495,200

d. P490,000

51. Below are relevant data for Pan and Sol Companies for 2012 and 2013:

You might also like

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- No 43 - Continued: A. P1,650,000 B. P1,905,000 C. P1,950,000 D. P2,130,000Document2 pagesNo 43 - Continued: A. P1,650,000 B. P1,905,000 C. P1,950,000 D. P2,130,000Wawex DavisNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- BADNEWS!Document4 pagesBADNEWS!Janella CastroNo ratings yet

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Intercompany Sales Problem Solving Exercises (Test Bank)Document2 pagesIntercompany Sales Problem Solving Exercises (Test Bank)Kristine Esplana Toralde100% (1)

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Quizzer 6Document2 pagesQuizzer 6Midas PhiNo ratings yet

- Activity 1Document9 pagesActivity 1JESSA ANN A. TALABOC100% (3)

- BusCom SubsequentDocument7 pagesBusCom SubsequentDianeL.ChuaNo ratings yet

- Quizzer 5Document2 pagesQuizzer 5Midas PhiNo ratings yet

- Intercompany Sale of PPE ActivityDocument2 pagesIntercompany Sale of PPE Activitybea kullin0% (1)

- BFJPIA Cup Level 3 P1Document9 pagesBFJPIA Cup Level 3 P1Blessy Zedlav LacbainNo ratings yet

- Assignment Business CombinationDocument2 pagesAssignment Business CombinationZarah H. LeongNo ratings yet

- Pat CorporationDocument2 pagesPat CorporationWawex DavisNo ratings yet

- Integrated Review Ii: Advanced Financial Accounting and Reporting Module 3: Special Revenue Recognition I. Installment SalesDocument18 pagesIntegrated Review Ii: Advanced Financial Accounting and Reporting Module 3: Special Revenue Recognition I. Installment SalesDarren Joy CoronaNo ratings yet

- Conso FS2Document4 pagesConso FS2Analyn0% (1)

- Problems Audit of InvestmentsDocument15 pagesProblems Audit of InvestmentsKm de Leon75% (4)

- A. P339,600 B. P346,000 C. P343,600 D. P338,600Document2 pagesA. P339,600 B. P346,000 C. P343,600 D. P338,600Wawex DavisNo ratings yet

- Bus Combination 2Document8 pagesBus Combination 2Angelica AllanicNo ratings yet

- Quiz-Intercompany: C. Gain On Sale 70,000 Truck 50,000 Accum. Depreciation 113,636 Depreciation 6,364Document2 pagesQuiz-Intercompany: C. Gain On Sale 70,000 Truck 50,000 Accum. Depreciation 113,636 Depreciation 6,364Richard Rhamil Carganillo Garcia Jr.No ratings yet

- Final Exam Adv Acctg2 - 1st Sem Sy2012-2013Document19 pagesFinal Exam Adv Acctg2 - 1st Sem Sy2012-2013John Paul LappayNo ratings yet

- M36 - Quizzer 4Document5 pagesM36 - Quizzer 4Joshua DaarolNo ratings yet

- M36 - Quizzer 3 PDFDocument4 pagesM36 - Quizzer 3 PDFJoshua DaarolNo ratings yet

- Problems Audit of Investments PDFDocument17 pagesProblems Audit of Investments PDFLove alexchelle ducut0% (1)

- Answer To Practice Set IDocument1 pageAnswer To Practice Set IDin Rose Gonzales100% (1)

- Practice Problems: C. The Consolidated Total Assets After The Combination Is P6,116,250Document5 pagesPractice Problems: C. The Consolidated Total Assets After The Combination Is P6,116,250Will Emmanuel A PinoyNo ratings yet

- Phil IncDocument2 pagesPhil IncWawex DavisNo ratings yet

- Installment Sales - Quiz2Document7 pagesInstallment Sales - Quiz2Cattleya0% (2)

- Acctg630 - ICMA 1st Sem SY2013-14 - With AnswerDocument35 pagesAcctg630 - ICMA 1st Sem SY2013-14 - With AnswerJasper Andrew AdjaraniNo ratings yet

- Auditing Problems February 10, 2016Document3 pagesAuditing Problems February 10, 2016gbenjielizonNo ratings yet

- Problems On Audit of Shareholders EquityDocument26 pagesProblems On Audit of Shareholders EquityNhel AlvaroNo ratings yet

- PRTC Oct 2012 Pract 1 First Preboard W Solutions PDFDocument30 pagesPRTC Oct 2012 Pract 1 First Preboard W Solutions PDFMarked BrassNo ratings yet

- Business Combi - SubsequentDocument5 pagesBusiness Combi - Subsequentnaser100% (2)

- ACTREV 4 Business Combination 2019Document6 pagesACTREV 4 Business Combination 2019Prom GloryNo ratings yet

- Questions Problems Pre BQTAP 2018 2019Document12 pagesQuestions Problems Pre BQTAP 2018 2019GuinevereNo ratings yet

- Business Combination-Intercompany Sale of InventoryDocument1 pageBusiness Combination-Intercompany Sale of InventoryMelodyLongakitBacatanNo ratings yet

- IR 2 - Mod 6 Bus Combi FinalDocument4 pagesIR 2 - Mod 6 Bus Combi FinalLight Desire0% (1)

- Quiz Conso FSDocument3 pagesQuiz Conso FSMark Joshua SalongaNo ratings yet

- SM07 4thExamReview 054702Document4 pagesSM07 4thExamReview 054702Hilarie JeanNo ratings yet

- Removal JulyDocument8 pagesRemoval JulyRosanna RomancaNo ratings yet

- SB Company Is A Wholly Owned Subsidiary of PG Corporation. The Following AreDocument2 pagesSB Company Is A Wholly Owned Subsidiary of PG Corporation. The Following AreWawex DavisNo ratings yet

- Practical Accounting 1 With AnswersDocument10 pagesPractical Accounting 1 With Answerslibraolrack50% (8)

- Partnership Liquidation QuizDocument4 pagesPartnership Liquidation QuizMark Francis Solante100% (1)

- A. P1,300,000 B. P1,284,000 C. P1,532,000 D. P1,540,000Document3 pagesA. P1,300,000 B. P1,284,000 C. P1,532,000 D. P1,540,000Wawex DavisNo ratings yet

- C. P15,000 C. P338,000 B. P353,000Document2 pagesC. P15,000 C. P338,000 B. P353,000Paulo VictoriousNo ratings yet

- B. P 9,000 C. P 3,000 D. P 6,000: No. 41 - ContinuedDocument2 pagesB. P 9,000 C. P 3,000 D. P 6,000: No. 41 - ContinuedWawex DavisNo ratings yet

- 02 - Business Combination Date of AcquisitionDocument5 pages02 - Business Combination Date of AcquisitionMelody Gumba100% (1)

- P2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Document12 pagesP2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Kate Alvarez100% (2)

- p1 ADocument8 pagesp1 Aincubus_yeahNo ratings yet

- Finac3 FinalsDocument6 pagesFinac3 FinalsGloria BeltranNo ratings yet

- Accounting 7 Instructions: Choose The Most Correct Answer For Each of The Following Questions. Write The Letter of Your Choice inDocument5 pagesAccounting 7 Instructions: Choose The Most Correct Answer For Each of The Following Questions. Write The Letter of Your Choice inDiane MagnayeNo ratings yet

- Bfjpia Cup 3 - Practical Accounting 2 Easy: Page 1 of 10Document10 pagesBfjpia Cup 3 - Practical Accounting 2 Easy: Page 1 of 10Arah OpalecNo ratings yet

- Prac 2Document10 pagesPrac 2Fery AnnNo ratings yet

- AFARDocument9 pagesAFARRed Christian PalustreNo ratings yet

- Pre-Quali Examination - Level III - Cluster C, PDF FSUU AccountingDocument13 pagesPre-Quali Examination - Level III - Cluster C, PDF FSUU AccountingRobert CastilloNo ratings yet

- Shareholder's EquityDocument3 pagesShareholder's EquityJyznareth Tapia100% (1)

- Problems Audit of Shareholdersx27 Equitydocx PDFDocument23 pagesProblems Audit of Shareholdersx27 Equitydocx PDFRaisa GeleraNo ratings yet

- AFAR - Final Preboard With AnswersDocument9 pagesAFAR - Final Preboard With AnswersLuiNo ratings yet

- p2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Document12 pagesp2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1AGNES CASTILLONo ratings yet

- 1991 Centesimus Annus - "The One Hundredth Year" - John Paul IIDocument4 pages1991 Centesimus Annus - "The One Hundredth Year" - John Paul IIWawex DavisNo ratings yet

- Leon XIII - Rerum Novarum (1891)Document4 pagesLeon XIII - Rerum Novarum (1891)Wawex DavisNo ratings yet

- 1971 Justicia in Mundo - "Justice in The World" - SynodDocument4 pages1971 Justicia in Mundo - "Justice in The World" - SynodWawex DavisNo ratings yet

- Ang Can We Afford To Give Our Employees A Pay RaiseDocument4 pagesAng Can We Afford To Give Our Employees A Pay RaiseWawex DavisNo ratings yet

- NiFor Us Acme Supply Company Computer PaperDocument4 pagesNiFor Us Acme Supply Company Computer PaperWawex DavisNo ratings yet

- 1963 Pacem in Terris - "Peace On Earth" - John XXIIIDocument4 pages1963 Pacem in Terris - "Peace On Earth" - John XXIIIWawex DavisNo ratings yet

- Big Did The Company Earn A Satisfactory IncomeDocument4 pagesBig Did The Company Earn A Satisfactory IncomeWawex DavisNo ratings yet

- Loss in The Current Period On A Profitable ContractDocument4 pagesLoss in The Current Period On A Profitable ContractWawex DavisNo ratings yet

- Explain What Accounting IsDocument4 pagesExplain What Accounting IsWawex DavisNo ratings yet

- Principal Agent RelationshipsDocument4 pagesPrincipal Agent RelationshipsWawex DavisNo ratings yet

- Installment Sales MethodDocument4 pagesInstallment Sales MethodWawex DavisNo ratings yet

- Indicate How To Report Cash and Related Items.Document4 pagesIndicate How To Report Cash and Related Items.Wawex DavisNo ratings yet

- Guidelines For Revenue Recognition: The Provides That Companies Should Recognize Revenue When It Is or and When It IsDocument4 pagesGuidelines For Revenue Recognition: The Provides That Companies Should Recognize Revenue When It Is or and When It IsWawex Davis100% (1)

- Trade Loading and Channel StuffingDocument4 pagesTrade Loading and Channel StuffingWawex DavisNo ratings yet

- Revenue Recognition For FranchisesDocument4 pagesRevenue Recognition For FranchisesWawex DavisNo ratings yet

- Summary: $100M Leads: How to Get Strangers to Want to Buy Your Stuff by Alex Hormozi: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary: $100M Leads: How to Get Strangers to Want to Buy Your Stuff by Alex Hormozi: Key Takeaways, Summary & Analysis IncludedRating: 3 out of 5 stars3/5 (6)

- Fascinate: How to Make Your Brand Impossible to ResistFrom EverandFascinate: How to Make Your Brand Impossible to ResistRating: 5 out of 5 stars5/5 (1)

- $100M Offers: How to Make Offers So Good People Feel Stupid Saying NoFrom Everand$100M Offers: How to Make Offers So Good People Feel Stupid Saying NoRating: 5 out of 5 stars5/5 (24)

- Dealers of Lightning: Xerox PARC and the Dawn of the Computer AgeFrom EverandDealers of Lightning: Xerox PARC and the Dawn of the Computer AgeRating: 4 out of 5 stars4/5 (88)

- Yes!: 50 Scientifically Proven Ways to Be PersuasiveFrom EverandYes!: 50 Scientifically Proven Ways to Be PersuasiveRating: 4 out of 5 stars4/5 (154)

- The Catalyst: How to Change Anyone's MindFrom EverandThe Catalyst: How to Change Anyone's MindRating: 4.5 out of 5 stars4.5/5 (275)

- $100M Leads: How to Get Strangers to Want to Buy Your StuffFrom Everand$100M Leads: How to Get Strangers to Want to Buy Your StuffRating: 5 out of 5 stars5/5 (19)

- Ca$hvertising: How to Use More than 100 Secrets of Ad-Agency Psychology to Make Big Money Selling Anything to AnyoneFrom EverandCa$hvertising: How to Use More than 100 Secrets of Ad-Agency Psychology to Make Big Money Selling Anything to AnyoneRating: 5 out of 5 stars5/5 (114)

- Summary: Dotcom Secrets: The Underground Playbook for Growing Your Company Online with Sales Funnels by Russell Brunson: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary: Dotcom Secrets: The Underground Playbook for Growing Your Company Online with Sales Funnels by Russell Brunson: Key Takeaways, Summary & Analysis IncludedRating: 5 out of 5 stars5/5 (2)

- Storytelling: A Guide on How to Tell a Story with Storytelling Techniques and Storytelling SecretsFrom EverandStorytelling: A Guide on How to Tell a Story with Storytelling Techniques and Storytelling SecretsRating: 4.5 out of 5 stars4.5/5 (72)

- Invisible Influence: The Hidden Forces that Shape BehaviorFrom EverandInvisible Influence: The Hidden Forces that Shape BehaviorRating: 4.5 out of 5 stars4.5/5 (131)

- Summary: Traction: Get a Grip on Your Business: by Gino Wickman: Key Takeaways, Summary, and AnalysisFrom EverandSummary: Traction: Get a Grip on Your Business: by Gino Wickman: Key Takeaways, Summary, and AnalysisRating: 5 out of 5 stars5/5 (10)

- Obviously Awesome: How to Nail Product Positioning so Customers Get It, Buy It, Love ItFrom EverandObviously Awesome: How to Nail Product Positioning so Customers Get It, Buy It, Love ItRating: 4.5 out of 5 stars4.5/5 (152)

- Jab, Jab, Jab, Right Hook: How to Tell Your Story in a Noisy Social WorldFrom EverandJab, Jab, Jab, Right Hook: How to Tell Your Story in a Noisy Social WorldRating: 4.5 out of 5 stars4.5/5 (18)

- Summary: Influence: The Psychology of Persuasion by Robert B. Cialdini Ph.D.: Key Takeaways, Summary & AnalysisFrom EverandSummary: Influence: The Psychology of Persuasion by Robert B. Cialdini Ph.D.: Key Takeaways, Summary & AnalysisRating: 5 out of 5 stars5/5 (4)

- Brand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleFrom EverandBrand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleRating: 4.5 out of 5 stars4.5/5 (48)

- Understanding Digital Marketing: Marketing Strategies for Engaging the Digital GenerationFrom EverandUnderstanding Digital Marketing: Marketing Strategies for Engaging the Digital GenerationRating: 4 out of 5 stars4/5 (22)

- How to Read People: The Complete Psychology Guide to Analyzing People, Reading Body Language, and Persuading, Manipulating and Understanding How to Influence Human BehaviorFrom EverandHow to Read People: The Complete Psychology Guide to Analyzing People, Reading Body Language, and Persuading, Manipulating and Understanding How to Influence Human BehaviorRating: 4.5 out of 5 stars4.5/5 (33)

- Visibility Marketing: The No-Holds-Barred Truth About What It Takes to Grab Attention, Build Your Brand, and Win New BusinessFrom EverandVisibility Marketing: The No-Holds-Barred Truth About What It Takes to Grab Attention, Build Your Brand, and Win New BusinessRating: 4.5 out of 5 stars4.5/5 (7)

- ChatGPT Millionaire 2024 - Bot-Driven Side Hustles, Prompt Engineering Shortcut Secrets, and Automated Income Streams that Print Money While You Sleep. The Ultimate Beginner’s Guide for AI BusinessFrom EverandChatGPT Millionaire 2024 - Bot-Driven Side Hustles, Prompt Engineering Shortcut Secrets, and Automated Income Streams that Print Money While You Sleep. The Ultimate Beginner’s Guide for AI BusinessNo ratings yet

- Scientific Advertising: "Master of Effective Advertising"From EverandScientific Advertising: "Master of Effective Advertising"Rating: 4.5 out of 5 stars4.5/5 (164)

- Summary: The Intelligent Investor: The Definitive Book on Value Investing by Benjamin Graham: Key Takeaways, Summary & AnalysisFrom EverandSummary: The Intelligent Investor: The Definitive Book on Value Investing by Benjamin Graham: Key Takeaways, Summary & AnalysisRating: 4 out of 5 stars4/5 (4)

- Summary: Range: Why Generalists Triumph in a Specialized World by David Epstein: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary: Range: Why Generalists Triumph in a Specialized World by David Epstein: Key Takeaways, Summary & Analysis IncludedRating: 4.5 out of 5 stars4.5/5 (6)

- Pre-Suasion: Channeling Attention for ChangeFrom EverandPre-Suasion: Channeling Attention for ChangeRating: 4.5 out of 5 stars4.5/5 (278)

- The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetFrom EverandThe Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetNo ratings yet

- 46 Consumer Reporting Agencies Investigating YouFrom Everand46 Consumer Reporting Agencies Investigating YouRating: 4.5 out of 5 stars4.5/5 (6)

- The Power of Why: Breaking Out In a Competitive MarketplaceFrom EverandThe Power of Why: Breaking Out In a Competitive MarketplaceRating: 4 out of 5 stars4/5 (5)

- Create Once, Distribute Forever: How Great Creators Spread Their Ideas and How You Can TooFrom EverandCreate Once, Distribute Forever: How Great Creators Spread Their Ideas and How You Can TooNo ratings yet