Professional Documents

Culture Documents

B. P 9,000 C. P 3,000 D. P 6,000: No. 41 - Continued

Uploaded by

Wawex DavisOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

B. P 9,000 C. P 3,000 D. P 6,000: No. 41 - Continued

Uploaded by

Wawex DavisCopyright:

Available Formats

b.

P 9,000

c. P 3,000

d. P 6,000

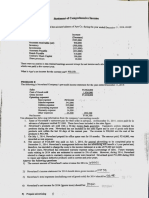

41. PM Company acquired a 70% interest in the SP Company in 2011 at a cost equal

to its book value. For the year ended December 31, 2013, PM Company

Company reported net income from their own operations of P120,000 and P90,000

respectively.

During 2012, SP sold merchandise to PM for P10,000 at a profit of P2,000. The

merchandise was later resold by PM to outsiders for P15,000 during 2013.

No. 41 – Continued

What is the consolidated total comprehensive income attributable to parent on

December 31, 2013? a. P210,000

b. P182,400

c. P183,000

d. P182,000

42. During 2013, PP Corporation sold goods to its 80% owned subsidiary, SS Company.

At December 31, 2013, one-half of these goods were included in SS Company's ending

inventory. Reported 2013 selling expenses were P110,000 and P40,000 for

PP and SS, respectively. PP's selling expenses included P5,000 in freight-out costs

for goods sold to SS.

What amount of selling expenses should be reported in PP's 2013 consolidated

statement of comprehensive income?

a. P150,000

b. P148,000

c. P 147,500

d. P145,000

43. On June 30, 2013, PJ Corporation issued 150,000 shares of its P20 par common

stock for which it received all of SG company's common stock. The fair value of the

common stock issued is equal to the book value of SG company's net assets. Both

companies continued to operate as separate businesses, maintaining accounting

records with years ending December 31. Net income from own operations and

dividends paid were:

PJ Corp. SG Co.

Net income:

Six months ended 6130/013 P750,000 P225,000 Six months ended

12/31/013 825,000 375,000

Dividends paid:

March 25, 2013 950,000 November 15, 2013 - 300,000

You might also like

- Chapter 9Document13 pagesChapter 9Yenelyn Apistar Cambarijan75% (4)

- Audit of Shareholders EquityDocument6 pagesAudit of Shareholders EquityMark Lord Morales Bumagat71% (7)

- Activity 1Document9 pagesActivity 1JESSA ANN A. TALABOC100% (3)

- Intercompany Sales Problem Solving Exercises (Test Bank)Document2 pagesIntercompany Sales Problem Solving Exercises (Test Bank)Kristine Esplana Toralde100% (1)

- p1 ADocument8 pagesp1 Aincubus_yeahNo ratings yet

- PROBLEM 1: P Company Had 90% Ownership Interest Acquired Several Years Ago in S Company. TheDocument4 pagesPROBLEM 1: P Company Had 90% Ownership Interest Acquired Several Years Ago in S Company. TheMargaveth P. Balbin75% (4)

- AuditingDocument4 pagesAuditingMaria Carmela MoraudaNo ratings yet

- FQ 001 Sharehoders - Equity and Retained EarningsDocument4 pagesFQ 001 Sharehoders - Equity and Retained Earningsmarygraceomac83% (6)

- Intercompany Sale of PPE ActivityDocument2 pagesIntercompany Sale of PPE Activitybea kullin0% (1)

- Consolidated FS & Intercompany TransactionsDocument5 pagesConsolidated FS & Intercompany TransactionsJalieha MahmodNo ratings yet

- CPAR - P2 - 7407 - Business Combination Subsequent To Acquisition PDFDocument5 pagesCPAR - P2 - 7407 - Business Combination Subsequent To Acquisition PDFAngelo Villadores100% (3)

- Audit Quizzer ProblemDocument5 pagesAudit Quizzer ProblemJazzy100% (1)

- FQ 002 Book Value and Earnings Per ShareDocument3 pagesFQ 002 Book Value and Earnings Per SharemarygraceomacNo ratings yet

- JADocument4 pagesJACodeSeekerNo ratings yet

- BusCom SubsequentDocument7 pagesBusCom SubsequentDianeL.ChuaNo ratings yet

- 009 Cash Basis Accrual BasisDocument4 pages009 Cash Basis Accrual BasisRosanna Romanca50% (2)

- Father Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #2)Document11 pagesFather Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #2)marygraceomacNo ratings yet

- Installment Sales - Quiz2Document7 pagesInstallment Sales - Quiz2Cattleya0% (2)

- Business Combi - SubsequentDocument5 pagesBusiness Combi - Subsequentnaser100% (2)

- PR CorpDocument2 pagesPR CorpWawex DavisNo ratings yet

- Ap SheDocument8 pagesAp SheMary Dale Joie BocalaNo ratings yet

- SB Company Is A Wholly Owned Subsidiary of PG Corporation. The Following AreDocument2 pagesSB Company Is A Wholly Owned Subsidiary of PG Corporation. The Following AreWawex DavisNo ratings yet

- No 43 - Continued: A. P1,650,000 B. P1,905,000 C. P1,950,000 D. P2,130,000Document2 pagesNo 43 - Continued: A. P1,650,000 B. P1,905,000 C. P1,950,000 D. P2,130,000Wawex DavisNo ratings yet

- Finac3 FinalsDocument6 pagesFinac3 FinalsGloria BeltranNo ratings yet

- Pat CorporationDocument2 pagesPat CorporationWawex DavisNo ratings yet

- A. P339,600 B. P346,000 C. P343,600 D. P338,600Document2 pagesA. P339,600 B. P346,000 C. P343,600 D. P338,600Wawex DavisNo ratings yet

- Ce P1 12-13Document13 pagesCe P1 12-13shudayeNo ratings yet

- Earning Per ShareDocument6 pagesEarning Per ShareArianne LlorenteNo ratings yet

- BADNEWS!Document4 pagesBADNEWS!Janella CastroNo ratings yet

- Acctg630 - ICMA 1st Sem SY2013-14 - With AnswerDocument35 pagesAcctg630 - ICMA 1st Sem SY2013-14 - With AnswerJasper Andrew AdjaraniNo ratings yet

- Quiz Audit of Shareholders Equity-2Document10 pagesQuiz Audit of Shareholders Equity-2Moi Escalante100% (1)

- Partnership and Corporation Comprehensive ProblemDocument2 pagesPartnership and Corporation Comprehensive ProblemJustin Mae BagaNo ratings yet

- Basic Accounting ReviewerDocument11 pagesBasic Accounting ReviewerandreamrieNo ratings yet

- Quizzer 6Document2 pagesQuizzer 6Midas PhiNo ratings yet

- Buscom Quiz: Book Value Fair ValueDocument2 pagesBuscom Quiz: Book Value Fair ValueNairah M. TambieNo ratings yet

- A. P1,300,000 B. P1,284,000 C. P1,532,000 D. P1,540,000Document3 pagesA. P1,300,000 B. P1,284,000 C. P1,532,000 D. P1,540,000Wawex DavisNo ratings yet

- ACFrOgDZ7Mb1kEnd0SWTabZ8VTNHoE2URvhT8DhCJGcSZcROTUArMhbEM93WzGm2kI1BwFxq0 x1Pf-HKvzBDZ5dplRt2Zs - hEPqbAFI0Fc3z2m0dtyYdxz8KJGo8dJYsrypTjAUs2oYzuZ - TDDocument38 pagesACFrOgDZ7Mb1kEnd0SWTabZ8VTNHoE2URvhT8DhCJGcSZcROTUArMhbEM93WzGm2kI1BwFxq0 x1Pf-HKvzBDZ5dplRt2Zs - hEPqbAFI0Fc3z2m0dtyYdxz8KJGo8dJYsrypTjAUs2oYzuZ - TDTwish BarriosNo ratings yet

- Fafa CorpDocument2 pagesFafa CorpWawex DavisNo ratings yet

- Audit of SheDocument3 pagesAudit of ShegbenjielizonNo ratings yet

- 0Document5 pages0Nicco Ortiz50% (2)

- Prac2 ReviewerDocument12 pagesPrac2 ReviewerRay Jhon Ortiz0% (1)

- Acc QuizDocument3 pagesAcc QuizAvox EverdeenNo ratings yet

- MODAUD1 UNIT 6 - Audit of InvestmentsDocument7 pagesMODAUD1 UNIT 6 - Audit of InvestmentsJake BundokNo ratings yet

- Installmet Sales AssignmentDocument1 pageInstallmet Sales Assignment21-38010No ratings yet

- For 2012, What Is The Consolidated Comprehensive Income Attributable To ControllingDocument2 pagesFor 2012, What Is The Consolidated Comprehensive Income Attributable To ControllingWawex DavisNo ratings yet

- Investment in Equity SecuritiesDocument4 pagesInvestment in Equity Securitieselsana philipNo ratings yet

- P2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Document12 pagesP2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Kate Alvarez100% (2)

- p2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Document12 pagesp2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1AGNES CASTILLONo ratings yet

- Statement of Comprehensive IncomeDocument3 pagesStatement of Comprehensive IncomeMitzi CatemprateNo ratings yet

- Quizzer 5Document2 pagesQuizzer 5Midas PhiNo ratings yet

- Cel 1 Prac 1 Answer KeyDocument12 pagesCel 1 Prac 1 Answer KeyLauren ObrienNo ratings yet

- Ifrs 15 Case Study QuestionsDocument2 pagesIfrs 15 Case Study QuestionsPrudentNo ratings yet

- Chapter 1liabilities2Document12 pagesChapter 1liabilities2Herrika Red Gullon RoseteNo ratings yet

- Quiz Audit of Shareholders Equity 2 PDF FreeDocument10 pagesQuiz Audit of Shareholders Equity 2 PDF FreeRio Cyrel CelleroNo ratings yet

- Practice Problems: C. The Consolidated Total Assets After The Combination Is P6,116,250Document5 pagesPractice Problems: C. The Consolidated Total Assets After The Combination Is P6,116,250Will Emmanuel A PinoyNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryFrom EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Sales Financing Revenues World Summary: Market Values & Financials by CountryFrom EverandSales Financing Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- 1991 Centesimus Annus - "The One Hundredth Year" - John Paul IIDocument4 pages1991 Centesimus Annus - "The One Hundredth Year" - John Paul IIWawex DavisNo ratings yet

- Leon XIII - Rerum Novarum (1891)Document4 pagesLeon XIII - Rerum Novarum (1891)Wawex DavisNo ratings yet

- 1971 Justicia in Mundo - "Justice in The World" - SynodDocument4 pages1971 Justicia in Mundo - "Justice in The World" - SynodWawex DavisNo ratings yet

- Ang Can We Afford To Give Our Employees A Pay RaiseDocument4 pagesAng Can We Afford To Give Our Employees A Pay RaiseWawex DavisNo ratings yet

- NiFor Us Acme Supply Company Computer PaperDocument4 pagesNiFor Us Acme Supply Company Computer PaperWawex DavisNo ratings yet

- 1963 Pacem in Terris - "Peace On Earth" - John XXIIIDocument4 pages1963 Pacem in Terris - "Peace On Earth" - John XXIIIWawex DavisNo ratings yet

- Big Did The Company Earn A Satisfactory IncomeDocument4 pagesBig Did The Company Earn A Satisfactory IncomeWawex DavisNo ratings yet

- Loss in The Current Period On A Profitable ContractDocument4 pagesLoss in The Current Period On A Profitable ContractWawex DavisNo ratings yet

- Explain What Accounting IsDocument4 pagesExplain What Accounting IsWawex DavisNo ratings yet

- Principal Agent RelationshipsDocument4 pagesPrincipal Agent RelationshipsWawex DavisNo ratings yet

- Installment Sales MethodDocument4 pagesInstallment Sales MethodWawex DavisNo ratings yet

- Indicate How To Report Cash and Related Items.Document4 pagesIndicate How To Report Cash and Related Items.Wawex DavisNo ratings yet

- Guidelines For Revenue Recognition: The Provides That Companies Should Recognize Revenue When It Is or and When It IsDocument4 pagesGuidelines For Revenue Recognition: The Provides That Companies Should Recognize Revenue When It Is or and When It IsWawex Davis100% (1)

- Trade Loading and Channel StuffingDocument4 pagesTrade Loading and Channel StuffingWawex DavisNo ratings yet

- Revenue Recognition For FranchisesDocument4 pagesRevenue Recognition For FranchisesWawex DavisNo ratings yet