Professional Documents

Culture Documents

Intercompany Transactions Had Not Occurred

Uploaded by

Wawex DavisCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Intercompany Transactions Had Not Occurred

Uploaded by

Wawex DavisCopyright:

Available Formats

Attributable to NCI P28,800

51.

Pan's total comprehensive income from P250,000

own operation -- 2013

Sol’s total comprehensive income from own operation 2013 120,000

Realized profit in beginning inventory 12,000

(P20,000 x 60%)

unrealized profit in ending inventory ( 15,000)

(P30,000 x 50%)

Comprehensive income attributable to

NCI:

Sol's total comprehensive income P120,000

Realized profit in beginning inventory 12,000

Unrealized profit in ending inventory ( 15,000)

Net income from outsiders P117,000

NCI % 20% ( 23,400)

P343,600

Consolidated total comprehensive income attributable to parent

December 31,2013

52. Combined financial statements are prepared for companies that are owned by the same

parent company but are not consolidated. To determine the gross profit in Bee and Cee's

combined statement of comprehensive income, the intercompany profit resulting from Bee's

sales to Cee should be eliminated. Thus, the computation is:

Sales to unrelated companies by Cee P 91,000

Cost of sales to combined entity:

(P100,000 x P65,000/P130,000) ( 50,000)

Gross profit P41,000

53. The equipment is retained within the consolidated entity and should have the balance it

would have had if no sale had taken place. The consolidated balances are achieved through

elimination entries to account for the intercompany gain.

The following are the balances the company would have had:

Cost P100,000

Accumulated depreciation:

On date of acquisition P 25,000

For 1 year 5,000 P 30,000

When preparing consolidated financial statements, the objective is to restate the accounts as if

the intercompany transactions had not occurred. Therefore the 2013 gain on sale of machine of

P50,000 [P900,000 -- (P1,100,000 –P250,000)] must be eliminated, since the consolidated

entity has not realized any gain. In, effect, the machine must be reflected on the consolidated

statement of financial position at 1/1/013 at Poe's cost of P1,100,000, and accumulated

depreciation of P250,000, instead of at a new "cost" of P900,000. For

You might also like

- Consolidated Total Comprehensive Income Attributable To Parent P106,000Document2 pagesConsolidated Total Comprehensive Income Attributable To Parent P106,000Wawex DavisNo ratings yet

- Intercompany Sales and PurchasesDocument2 pagesIntercompany Sales and PurchasesWawex DavisNo ratings yet

- Accbusco Chapter 16Document14 pagesAccbusco Chapter 16PaupauNo ratings yet

- Intercompany TransactionsDocument5 pagesIntercompany TransactionsJessica IslaNo ratings yet

- Problem 17-1, ContinuedDocument6 pagesProblem 17-1, ContinuedJohn Carlo D MedallaNo ratings yet

- Computational Multiple Choices Chapter 17Document19 pagesComputational Multiple Choices Chapter 17Christian Blanza LlevaNo ratings yet

- 1.3 Responsibility Accounting Problems AnswersDocument5 pages1.3 Responsibility Accounting Problems AnswersAsnarizah PakinsonNo ratings yet

- Responsibility accounting problems and solutionsDocument5 pagesResponsibility accounting problems and solutionsAsnarizah PakinsonNo ratings yet

- ROI, RI, and EVA AnalysisDocument7 pagesROI, RI, and EVA AnalysisAna Leah DelfinNo ratings yet

- UNDERSTANDING INTERCOMPANY TRANSACTIONSDocument2 pagesUNDERSTANDING INTERCOMPANY TRANSACTIONSMark Lyndon YmataNo ratings yet

- Investment in Subsidiary Problem A - Equity Model and Cost ModelDocument7 pagesInvestment in Subsidiary Problem A - Equity Model and Cost ModelJessica IslaNo ratings yet

- Consolidated Comprehensive Income Attributable To ParentDocument2 pagesConsolidated Comprehensive Income Attributable To ParentWawex DavisNo ratings yet

- Answers To Installment Accounting Previously Uploaded in This ProfileDocument6 pagesAnswers To Installment Accounting Previously Uploaded in This ProfileKate AlvarezNo ratings yet

- SD's Net Income From Own OperationsDocument2 pagesSD's Net Income From Own OperationsWawex DavisNo ratings yet

- Handouts ConsolidationIntercompany Sale of Plant AssetsDocument3 pagesHandouts ConsolidationIntercompany Sale of Plant AssetsCPANo ratings yet

- Consolidated Net Income For 20x5Document13 pagesConsolidated Net Income For 20x5Ryan PatitoNo ratings yet

- Total Comprehensive Income From Own Operations - PedroDocument2 pagesTotal Comprehensive Income From Own Operations - PedroWawex DavisNo ratings yet

- 3 Mas Answer KeyDocument25 pages3 Mas Answer KeyAngelie0% (1)

- Rules in Holding Period in Capital GainsDocument39 pagesRules in Holding Period in Capital GainsTrine De LeonNo ratings yet

- MASDocument7 pagesMASHelen IlaganNo ratings yet

- Picpa-G Company Automates for Higher ProfitsDocument5 pagesPicpa-G Company Automates for Higher ProfitsChabby ChabbyNo ratings yet

- Assignment Business CombinationDocument4 pagesAssignment Business CombinationLeisleiRagoNo ratings yet

- Inter-company Profit Transactions – InventoriesDocument17 pagesInter-company Profit Transactions – InventoriesDrew BanlutaNo ratings yet

- Multiple Choice Answers and Solutions: Realized Gross Profit, 2013 P 675,000Document26 pagesMultiple Choice Answers and Solutions: Realized Gross Profit, 2013 P 675,000ALEXANDRANICOLE OCTAVIANONo ratings yet

- Answer:: The Amount of Sales If The Company Lost P36,000 Last Year Was P976,500Document2 pagesAnswer:: The Amount of Sales If The Company Lost P36,000 Last Year Was P976,500Unknowingly AnonymousNo ratings yet

- Reviewer Strat CostDocument20 pagesReviewer Strat CostMiriam Ubaldo DanielNo ratings yet

- Business Combination and Consolidated FS 2020 PDFDocument22 pagesBusiness Combination and Consolidated FS 2020 PDFAPO 0005100% (1)

- 1007 (RA, SR and TP)Document6 pages1007 (RA, SR and TP)Neil Ryan CatagaNo ratings yet

- TERMINAL OUTPUT FOR THE FINAL TERM (2ND SY 2018-2019Document3 pagesTERMINAL OUTPUT FOR THE FINAL TERM (2ND SY 2018-2019Millen Austria0% (1)

- 91 - Final Preaboard AFAR Solutions (WEEKENDS)Document9 pages91 - Final Preaboard AFAR Solutions (WEEKENDS)Joris YapNo ratings yet

- Consolidated Financial Statements ActivityDocument9 pagesConsolidated Financial Statements ActivityJESSA ANN A. TALABOC100% (3)

- Afar - CVPDocument3 pagesAfar - CVPJoanna Rose Deciar0% (1)

- ReSA AFAR Preweek Lecture 2 CPA ReviewDocument15 pagesReSA AFAR Preweek Lecture 2 CPA ReviewMellaniNo ratings yet

- Handout ManAcc2 PDFDocument16 pagesHandout ManAcc2 PDFmobylay0% (1)

- Afar 10Document8 pagesAfar 10RENZEL MAGBITANGNo ratings yet

- Capital BudgetingDocument23 pagesCapital BudgetingNoelJr. Allanaraiz100% (4)

- Return On InvestmentDocument5 pagesReturn On Investmentela kikay100% (1)

- Intersale AnswerDocument2 pagesIntersale AnswerJJ JaumNo ratings yet

- Tax AssigmentDocument1 pageTax Assigmentasdfg qwertNo ratings yet

- Consolidated Statement of Profit or Loss and Other Comprehensive IncomeDocument40 pagesConsolidated Statement of Profit or Loss and Other Comprehensive IncomeSing YeeNo ratings yet

- Indicate Whether The Statement Is True or FalseDocument11 pagesIndicate Whether The Statement Is True or Falseryan rosalesNo ratings yet

- tax reviewer 3Document4 pagestax reviewer 3tooru oikawaNo ratings yet

- How to calculate consolidated net incomeDocument4 pagesHow to calculate consolidated net incomeMazikeen DeckerNo ratings yet

- Nfjpia Region Xii 8th Annual Regional Convention Mock Board ExaminationDocument49 pagesNfjpia Region Xii 8th Annual Regional Convention Mock Board ExaminationKlomoNo ratings yet

- Questionnaires BSA SubjectsDocument27 pagesQuestionnaires BSA SubjectsJamila Mae FabiaNo ratings yet

- DECENTRALIZATIONDocument5 pagesDECENTRALIZATIONhashinekaymhe tarucNo ratings yet

- 5th Year MidtermDocument11 pages5th Year MidtermJoshua UmaliNo ratings yet

- MGT Adv Serv 09.2019Document11 pagesMGT Adv Serv 09.2019Weddie Mae VillarizaNo ratings yet

- 3 - CREATE Sample Problem Tax On Domestic CorporationsDocument2 pages3 - CREATE Sample Problem Tax On Domestic CorporationsZenNo ratings yet

- Forecasting Product Sales and ProfitsDocument6 pagesForecasting Product Sales and ProfitsSamuel FerolinoNo ratings yet

- Multiple Choices - ComputationalDocument17 pagesMultiple Choices - ComputationalLove FreddyNo ratings yet

- Consolidated Financial Statements Subsequent to AcquisitionDocument5 pagesConsolidated Financial Statements Subsequent to AcquisitionMixx MineNo ratings yet

- Mas TestbanksDocument25 pagesMas TestbanksKristine Esplana ToraldeNo ratings yet

- MANAGEMENT ACCOUNTING SOLUTIONS CHAPTER 14 RESPONSIBILITY ACCOUNTING TRANSFER PRICINGDocument18 pagesMANAGEMENT ACCOUNTING SOLUTIONS CHAPTER 14 RESPONSIBILITY ACCOUNTING TRANSFER PRICINGRenNo ratings yet

- Dumalag Bank financial ratiosDocument1 pageDumalag Bank financial ratiosjuztine dofitasNo ratings yet

- Strategic Cost Management Midterm Examination SY 2021-2022 FIRST SEMESTERDocument4 pagesStrategic Cost Management Midterm Examination SY 2021-2022 FIRST SEMESTERMixx MineNo ratings yet

- Consolidated Net IncomeDocument1 pageConsolidated Net IncomePJ PoliranNo ratings yet

- Government Accounting ProcessDocument3 pagesGovernment Accounting ProcessWawex DavisNo ratings yet

- Every Person Has The RightDocument3 pagesEvery Person Has The RightWawex DavisNo ratings yet

- Knowledge Illuminated by FaithDocument4 pagesKnowledge Illuminated by FaithWawex DavisNo ratings yet

- Faith and Reason Represent The Two Cognitive PathsDocument4 pagesFaith and Reason Represent The Two Cognitive PathsWawex DavisNo ratings yet

- Leon XIII - Rerum Novarum (1891)Document4 pagesLeon XIII - Rerum Novarum (1891)Wawex DavisNo ratings yet

- Evangelization and Social DoctrineDocument4 pagesEvangelization and Social DoctrineWawex DavisNo ratings yet

- Call To Family, Community, and ParticipationDocument3 pagesCall To Family, Community, and ParticipationWawex DavisNo ratings yet

- Branches of Accounting: Ms. Ma. Irene G. Gonzales, LPTDocument3 pagesBranches of Accounting: Ms. Ma. Irene G. Gonzales, LPTWawex DavisNo ratings yet

- Human Dignity Is InnateDocument4 pagesHuman Dignity Is InnateWawex DavisNo ratings yet

- Describe The Mission of The ChurchDocument4 pagesDescribe The Mission of The ChurchWawex DavisNo ratings yet

- Improve The UnderstandabilityDocument3 pagesImprove The UnderstandabilityWawex DavisNo ratings yet

- Marriage and The Family Are The Central Social Institutions That Must Be Supported and Strengthened, Not UnderminedDocument2 pagesMarriage and The Family Are The Central Social Institutions That Must Be Supported and Strengthened, Not UnderminedWawex DavisNo ratings yet

- 1991 Centesimus Annus - "The One Hundredth Year" - John Paul IIDocument4 pages1991 Centesimus Annus - "The One Hundredth Year" - John Paul IIWawex DavisNo ratings yet

- Need Not To Follow Accounting StandardsDocument3 pagesNeed Not To Follow Accounting StandardsWawex DavisNo ratings yet

- 2015 Laudato Si' - "Praised Be To You" - Encyclical Letter On The Care For Our Common Home - Pope FrancisDocument3 pages2015 Laudato Si' - "Praised Be To You" - Encyclical Letter On The Care For Our Common Home - Pope FrancisWawex DavisNo ratings yet

- 1963 Pacem in Terris - "Peace On Earth" - John XXIIIDocument4 pages1963 Pacem in Terris - "Peace On Earth" - John XXIIIWawex DavisNo ratings yet

- KaThe Corporation Pays A DividendDocument4 pagesKaThe Corporation Pays A DividendWawex DavisNo ratings yet

- Deals With The Creation of New KnowledgeDocument3 pagesDeals With The Creation of New KnowledgeWawex DavisNo ratings yet

- Explain What Accounting IsDocument4 pagesExplain What Accounting IsWawex DavisNo ratings yet

- NiFor Us Acme Supply Company Computer PaperDocument4 pagesNiFor Us Acme Supply Company Computer PaperWawex DavisNo ratings yet

- 1971 Justicia in Mundo - "Justice in The World" - SynodDocument4 pages1971 Justicia in Mundo - "Justice in The World" - SynodWawex DavisNo ratings yet

- NgShould Any Product Lines Be EliminatedDocument4 pagesNgShould Any Product Lines Be EliminatedWawex DavisNo ratings yet

- Pag I Daily News For AdvertisingDocument4 pagesPag I Daily News For AdvertisingWawex DavisNo ratings yet

- BiFinancial Statements and You For MeDocument4 pagesBiFinancial Statements and You For MeWawex DavisNo ratings yet

- Ang Can We Afford To Give Our Employees A Pay RaiseDocument4 pagesAng Can We Afford To Give Our Employees A Pay RaiseWawex DavisNo ratings yet

- MayThe Concern Is That The Higher CostsDocument4 pagesMayThe Concern Is That The Higher CostsWawex DavisNo ratings yet

- SaNet Income Will Result During A TimeDocument4 pagesSaNet Income Will Result During A TimeWawex DavisNo ratings yet

- Gay Indicate Whether Each Item Increases or Decreases EquityDocument4 pagesGay Indicate Whether Each Item Increases or Decreases EquityWawex DavisNo ratings yet

- Ikaw Applies To All Economic Entities Regardless of SizeDocument4 pagesIkaw Applies To All Economic Entities Regardless of SizeWawex DavisNo ratings yet

- Big Did The Company Earn A Satisfactory IncomeDocument4 pagesBig Did The Company Earn A Satisfactory IncomeWawex DavisNo ratings yet

- Inventory Management TechniquesDocument13 pagesInventory Management TechniquesBiraj GhimireNo ratings yet

- Principles of Accounting IIDocument175 pagesPrinciples of Accounting IIsamuel debebe95% (22)

- 2nd Quiz Key To CorrectionDocument3 pages2nd Quiz Key To CorrectionJohn Paul MagbitangNo ratings yet

- Backflush Costing Journal EntriesDocument2 pagesBackflush Costing Journal EntriesKellyjean IntalNo ratings yet

- Exam 1z0-1024: Oracle Cost ManagementDocument3 pagesExam 1z0-1024: Oracle Cost Managementdreamsky702243No ratings yet

- Pull List and Stock Determination in Production Part 1Document3 pagesPull List and Stock Determination in Production Part 1Naveen BhaiNo ratings yet

- Supply Chain MCQs guide exam prepDocument5 pagesSupply Chain MCQs guide exam prepZeynep Bülbüllü80% (5)

- Economic Batch Quantity (EBQ) : Prepared By: Talha Majeed Khan (M.Phil) Lecturer UCP, Faculty of Management StudiesDocument15 pagesEconomic Batch Quantity (EBQ) : Prepared By: Talha Majeed Khan (M.Phil) Lecturer UCP, Faculty of Management StudieszubairNo ratings yet

- Topic 03 FA3Document5 pagesTopic 03 FA3hellokittysaranghaeNo ratings yet

- Problem 13 - 1 To Problem 13 - 8Document4 pagesProblem 13 - 1 To Problem 13 - 8Jem ColebraNo ratings yet

- Chapter 5: Job Order Costing System: Characteristics of Production ProcessDocument3 pagesChapter 5: Job Order Costing System: Characteristics of Production ProcessANo ratings yet

- Lemonade DFD DiagramDocument7 pagesLemonade DFD Diagram16DBHARADWAJ KNo ratings yet

- Decision Making Assignment QuestionsDocument3 pagesDecision Making Assignment QuestionsMahmoud AhmedNo ratings yet

- Material Management, PROCUREMENT, STORAGE AND DISTRIBUTIONDocument24 pagesMaterial Management, PROCUREMENT, STORAGE AND DISTRIBUTIONMonisha LingamNo ratings yet

- ACFAR 2132 PAA1 InventoriesDocument15 pagesACFAR 2132 PAA1 InventoriesGabrielle Joshebed AbaricoNo ratings yet

- Supply Chain Strategies 2022 - Module 4 Inventory HellriegelDocument54 pagesSupply Chain Strategies 2022 - Module 4 Inventory HellriegelAakarshan MundraNo ratings yet

- Chapter 9 - Input Vat NotesDocument2 pagesChapter 9 - Input Vat NotesGeraldine Mae DamoslogNo ratings yet

- FIN-454 Financial Reporting Analysis (3crDocument5 pagesFIN-454 Financial Reporting Analysis (3crMuhammad EhtishamNo ratings yet

- Chapter 7: Inventories: Inventories of A Government EntityDocument4 pagesChapter 7: Inventories: Inventories of A Government EntityShantalNo ratings yet

- COST ACCOUNTING AND MANAGEMENT II EOQDocument3 pagesCOST ACCOUNTING AND MANAGEMENT II EOQEki OmallaoNo ratings yet

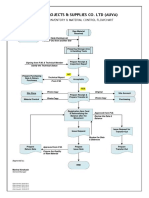

- Projects & Supplies Co. LTD (Auva) : Inventory & Material Control FlowchartDocument1 pageProjects & Supplies Co. LTD (Auva) : Inventory & Material Control FlowchartdtvqatarNo ratings yet

- Quiz No. 4 - InventoriesDocument8 pagesQuiz No. 4 - Inventoriesremalyn rigorNo ratings yet

- Flexit's Failed European ExpansionDocument3 pagesFlexit's Failed European ExpansionAhmed HadadNo ratings yet

- Property & Supply Unit FlowDocument8 pagesProperty & Supply Unit FlowEmmanuel EndrigaNo ratings yet

- Lock Tight Inc Produces Outside Doors For Installation On HomesDocument1 pageLock Tight Inc Produces Outside Doors For Installation On HomesAmit PandeyNo ratings yet

- The Impact of COVID-19 On The Steel IndustryDocument25 pagesThe Impact of COVID-19 On The Steel IndustryAyesha KhalidNo ratings yet

- Provision For Unrealized Profit (Brief Lecture) : FormulaDocument2 pagesProvision For Unrealized Profit (Brief Lecture) : FormulaRizwanuddin Shahad100% (1)

- WIP Meeting MinutesDocument2 pagesWIP Meeting MinutesMohammad KamruzzamanNo ratings yet

- Kinga Doll Company Manufactures Eight Versions of Its Popular GirlDocument1 pageKinga Doll Company Manufactures Eight Versions of Its Popular GirlAmit PandeyNo ratings yet

- EOQ QuestionsDocument3 pagesEOQ QuestionshhaiderNo ratings yet