Professional Documents

Culture Documents

Total Comprehensive Income From Own Operations - Pedro

Uploaded by

Wawex Davis0 ratings0% found this document useful (0 votes)

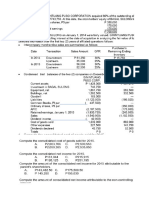

9 views2 pagesPeter's total comprehensive income from own operations was P500,000. Sally's total comprehensive income from own operations was P262,500. The consolidated total comprehensive income attributable to the parent was P676,000.

Original Description:

Total Comprehensive Income From Own Operations – Pedro

Original Title

Total Comprehensive Income From Own Operations – Pedro

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPeter's total comprehensive income from own operations was P500,000. Sally's total comprehensive income from own operations was P262,500. The consolidated total comprehensive income attributable to the parent was P676,000.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views2 pagesTotal Comprehensive Income From Own Operations - Pedro

Uploaded by

Wawex DavisPeter's total comprehensive income from own operations was P500,000. Sally's total comprehensive income from own operations was P262,500. The consolidated total comprehensive income attributable to the parent was P676,000.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Peter total comprehensive income from own P

operations 500,000

Sally total comprehensive income from own operations 262,500

Unrealized gain (40,000)

Realized gain 6,000

Total comp. income attributable to NCI (P262,500 x (52,500)

20%)

Consolidated total comprehensive income attributable P676,000

to parent

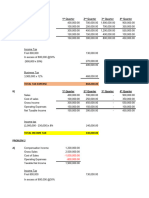

59.

NCI at fair value (P1,000,000/80%) x 20% P250,000

Price paid (parent), 1,000,000

1,250,000

Total 1,000,000

P250,00

Less book value of net assets – Sally, 1/1/08 0

Goodwill 60.

Total comprehensive income from own operations – Pedro P170,000

Unrealized profit in ending inventory [(25%/125%)xP18,000] (3,600)

Realized profit in beginning inventory (20% x 15,000)

Adjusted total comprehensive income

Total comprehensive income from own 103,000

operations - Sally

Unrealized gain on sale of machine (15,000)

Realized gain on sale of machine 3,000 91,000

260,400

Consolidated total comprehensive income 18,200

P242,200

Attributable to NCI (20% c P91,000)

Attributable to controlling interest

You might also like

- Solutions For Problem 1Document4 pagesSolutions For Problem 1spongebob SquarepantsNo ratings yet

- SD's Net Income From Own OperationsDocument2 pagesSD's Net Income From Own OperationsWawex DavisNo ratings yet

- Controlling InterestDocument2 pagesControlling InterestWawex DavisNo ratings yet

- Santos - Solution FinalsDocument3 pagesSantos - Solution FinalsIan SantosNo ratings yet

- Solutions - Intercompany Sale TransactionsDocument16 pagesSolutions - Intercompany Sale TransactionsLuna SanNo ratings yet

- Tax 2Document8 pagesTax 2Genel Christian DeypalubosNo ratings yet

- Quiz On Income TaxationDocument4 pagesQuiz On Income TaxationLenard Josh Ingalla100% (1)

- Accbusco Chapter 16Document14 pagesAccbusco Chapter 16PaupauNo ratings yet

- Advance Accounting 2 by GuerreroDocument13 pagesAdvance Accounting 2 by Guerreromarycayton100% (7)

- Intercompany Transactions Had Not OccurredDocument2 pagesIntercompany Transactions Had Not OccurredWawex DavisNo ratings yet

- 2807-Corporations PPT PDFDocument61 pages2807-Corporations PPT PDFMay Grethel Joy Perante100% (1)

- Installment Sales Consignment Sales Construction ContractsDocument4 pagesInstallment Sales Consignment Sales Construction ContractsShaene GalloraNo ratings yet

- Answers To Installment Accounting Previously Uploaded in This ProfileDocument6 pagesAnswers To Installment Accounting Previously Uploaded in This ProfileKate AlvarezNo ratings yet

- Consolidated Net Income For 20x5Document13 pagesConsolidated Net Income For 20x5Ryan PatitoNo ratings yet

- Chapter 2 AssignmentDocument8 pagesChapter 2 AssignmentRoss John JimenezNo ratings yet

- Chapter 15 Akun Keuangan TugasDocument3 pagesChapter 15 Akun Keuangan Tugassegeri kecNo ratings yet

- GainersDocument17 pagesGainersborn2grow100% (1)

- Pittman Company Is A Small But Growing Manufacturer of Telecommunications Equipment.Document12 pagesPittman Company Is A Small But Growing Manufacturer of Telecommunications Equipment.Kailash KumarNo ratings yet

- Investment in AssociateDocument20 pagesInvestment in AssociateMaricon BerjaNo ratings yet

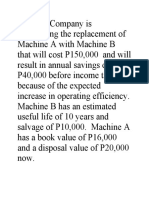

- Capital BudgetingDocument2 pagesCapital BudgetingAlexis KingNo ratings yet

- TAÑOTE Daisy AEC7 MEPIIDocument9 pagesTAÑOTE Daisy AEC7 MEPIIDaisy TañoteNo ratings yet

- Assignment1 BonutanHMDocument4 pagesAssignment1 BonutanHMmaegantrish543No ratings yet

- Capital Budgeting Sample ProblemsDocument10 pagesCapital Budgeting Sample ProblemsMark Gelo WinchesterNo ratings yet

- Quiz Finma 0920Document5 pagesQuiz Finma 0920Danica RamosNo ratings yet

- Chapter 17Document19 pagesChapter 17Christian Blanza LlevaNo ratings yet

- Consolidated Total Comprehensive Income Attributable To Parent P106,000Document2 pagesConsolidated Total Comprehensive Income Attributable To Parent P106,000Wawex DavisNo ratings yet

- INSTALLMENT SALES UpdatedDocument26 pagesINSTALLMENT SALES UpdatedMichael BongalontaNo ratings yet

- Business Finance SamplesDocument2 pagesBusiness Finance SamplesjoeromesantosNo ratings yet

- Chapter 5Document5 pagesChapter 5Kristine Jhoy Nolasco SecopitoNo ratings yet

- Tutanes, Ma. Angelita 3BAM5ADocument2 pagesTutanes, Ma. Angelita 3BAM5AMaxGel De VeraNo ratings yet

- Exercise 1Document4 pagesExercise 1Nyster Ann RebenitoNo ratings yet

- Investment in Associate' 2Document9 pagesInvestment in Associate' 2Joefrey Pujadas BalumaNo ratings yet

- ACP312 Intercompany-Sale-Of-Inventory-QuizDocument31 pagesACP312 Intercompany-Sale-Of-Inventory-QuizJocelyn GorospeNo ratings yet

- EXERCISE 12-2 (15 Minutes)Document9 pagesEXERCISE 12-2 (15 Minutes)Mari Louis Noriell MejiaNo ratings yet

- Strategic Cost Management Practical Applications DagpilanDocument6 pagesStrategic Cost Management Practical Applications Dagpilancarol indanganNo ratings yet

- Income Statement and OCI - Exercises - AnswerDocument3 pagesIncome Statement and OCI - Exercises - AnswerYstefani ValderamaNo ratings yet

- Ch08 Responsibility Accounting, Segment Evaluation and Transfer Pricing PDFDocument10 pagesCh08 Responsibility Accounting, Segment Evaluation and Transfer Pricing PDFjdiaz_646247No ratings yet

- Tutorial Solutions Week 5Document9 pagesTutorial Solutions Week 5Mangala PrasetiaNo ratings yet

- Assignment 1 - Taxation On Individuals-SolutionsDocument5 pagesAssignment 1 - Taxation On Individuals-SolutionsCleofe Mae Piñero AseñasNo ratings yet

- ACCCOB3Document10 pagesACCCOB3Jenine YamsonNo ratings yet

- Seminar in Management AccountingDocument6 pagesSeminar in Management AccountinglolaNo ratings yet

- Quiz Finma 0920Document6 pagesQuiz Finma 0920Danica Jane RamosNo ratings yet

- Solution Income Statment Part 1 Revision PDFDocument2 pagesSolution Income Statment Part 1 Revision PDFAA BB MMNo ratings yet

- Intercompany TransactionsDocument5 pagesIntercompany TransactionsJessica IslaNo ratings yet

- Tax AssigmentDocument1 pageTax Assigmentasdfg qwertNo ratings yet

- Inclusion To Gross Income - Part 3 (TORREON, Kimberly Shane) - Sheet3Document1 pageInclusion To Gross Income - Part 3 (TORREON, Kimberly Shane) - Sheet3Shane TorrieNo ratings yet

- Corporate Liquidation and Joint ArrangementDocument7 pagesCorporate Liquidation and Joint ArrangementPaupauNo ratings yet

- Acc 223a - Answers To CH 15 AssignmentDocument7 pagesAcc 223a - Answers To CH 15 AssignmentAna Leah DelfinNo ratings yet

- Chapter 16 - Inter-Company Profit Transactions - Inventories Chapter 16 - Inter-Company Profit Transactions - InventoriesDocument17 pagesChapter 16 - Inter-Company Profit Transactions - Inventories Chapter 16 - Inter-Company Profit Transactions - InventoriesDrew BanlutaNo ratings yet

- Ebora Mike Lester C BSMA 3101 Lesson 04Document3 pagesEbora Mike Lester C BSMA 3101 Lesson 04Mike Lester EboraNo ratings yet

- Addtl Exercises 10 12Document5 pagesAddtl Exercises 10 12John Lester C AlagNo ratings yet

- Chapter 14 Assignment Exercise 1: Department 1 2 4 TotalDocument18 pagesChapter 14 Assignment Exercise 1: Department 1 2 4 TotalAna Leah DelfinNo ratings yet

- Income Taxation Answer ExamDocument5 pagesIncome Taxation Answer Examyezaquera100% (1)

- 2806-Individuals PPT PDFDocument35 pages2806-Individuals PPT PDFMay Grethel Joy PeranteNo ratings yet

- ContinueDocument2 pagesContinuebaek hyun canawayNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Leon XIII - Rerum Novarum (1891)Document4 pagesLeon XIII - Rerum Novarum (1891)Wawex DavisNo ratings yet

- 1991 Centesimus Annus - "The One Hundredth Year" - John Paul IIDocument4 pages1991 Centesimus Annus - "The One Hundredth Year" - John Paul IIWawex DavisNo ratings yet

- Ang Can We Afford To Give Our Employees A Pay RaiseDocument4 pagesAng Can We Afford To Give Our Employees A Pay RaiseWawex DavisNo ratings yet

- 1963 Pacem in Terris - "Peace On Earth" - John XXIIIDocument4 pages1963 Pacem in Terris - "Peace On Earth" - John XXIIIWawex DavisNo ratings yet

- NiFor Us Acme Supply Company Computer PaperDocument4 pagesNiFor Us Acme Supply Company Computer PaperWawex DavisNo ratings yet

- 1971 Justicia in Mundo - "Justice in The World" - SynodDocument4 pages1971 Justicia in Mundo - "Justice in The World" - SynodWawex DavisNo ratings yet

- Big Did The Company Earn A Satisfactory IncomeDocument4 pagesBig Did The Company Earn A Satisfactory IncomeWawex DavisNo ratings yet

- Indicate How To Report Cash and Related Items.Document4 pagesIndicate How To Report Cash and Related Items.Wawex DavisNo ratings yet

- Explain What Accounting IsDocument4 pagesExplain What Accounting IsWawex DavisNo ratings yet

- Principal Agent RelationshipsDocument4 pagesPrincipal Agent RelationshipsWawex DavisNo ratings yet

- Installment Sales MethodDocument4 pagesInstallment Sales MethodWawex DavisNo ratings yet

- Guidelines For Revenue Recognition: The Provides That Companies Should Recognize Revenue When It Is or and When It IsDocument4 pagesGuidelines For Revenue Recognition: The Provides That Companies Should Recognize Revenue When It Is or and When It IsWawex Davis100% (1)

- Loss in The Current Period On A Profitable ContractDocument4 pagesLoss in The Current Period On A Profitable ContractWawex DavisNo ratings yet

- Trade Loading and Channel StuffingDocument4 pagesTrade Loading and Channel StuffingWawex DavisNo ratings yet

- Revenue Recognition For FranchisesDocument4 pagesRevenue Recognition For FranchisesWawex DavisNo ratings yet