Professional Documents

Culture Documents

MAT Calculation: Setoff MAT Credits - End Net Tax Payable

MAT Calculation: Setoff MAT Credits - End Net Tax Payable

Uploaded by

richa krishna0 ratings0% found this document useful (0 votes)

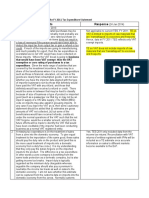

8 views1 pageThe document shows financial information for a company over 8 years including book profit, depreciation, taxable income, carry forward losses, corporate tax payments, MAT calculations, and deferred tax calculations. It tracks values year-over-year to calculate the company's annual tax obligations.

Original Description:

Tax Model Question

Original Title

Tax-Unsolved

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document shows financial information for a company over 8 years including book profit, depreciation, taxable income, carry forward losses, corporate tax payments, MAT calculations, and deferred tax calculations. It tracks values year-over-year to calculate the company's annual tax obligations.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageMAT Calculation: Setoff MAT Credits - End Net Tax Payable

MAT Calculation: Setoff MAT Credits - End Net Tax Payable

Uploaded by

richa krishnaThe document shows financial information for a company over 8 years including book profit, depreciation, taxable income, carry forward losses, corporate tax payments, MAT calculations, and deferred tax calculations. It tracks values year-over-year to calculate the company's annual tax obligations.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Year - 1 Year - 2 Year - 3 Year - 4 Year - 5 Year - 6 Year - 7 Year - 8

PBT - Book Profit ( 100) ( 100) ( 100) ( 100) ( 100) ( 100) ( 100) ( 100)

Add: Dep SLM ( 100) ( 100) ( 100) ( 100) ( 100) ( 100) ( 100) ( 50)

Less: Dep WDV ( 300) ( 300) ( 150) ( - ) ( - ) ( - ) ( - ) ( - ) accelrated dep

Taxable Income

Carry Forward Loss - Beg

Additions to CFL

Set Off

Carry Forward Loss - End

Profit available for taxation

Corporate Tax @ 33% ( - )

MAT Calculation

PBT (Book Profits)

Tax as per MAT ( @ 19%)

Tax Payable ( - )

MAT paid over tax

MAT Credit - Beg

Addition

Setoff

MAT Credits - End

Net Tax Payable ( - )

Deferred Tax Calculation

Tax as per Books (@ 33%) ( - )

Deferred Tax Liability

Opening

Additions (DTL) ITE - ITP

Closing

You might also like

- CFA Level III FormulaDocument39 pagesCFA Level III Formulammqasmi100% (1)

- Rmo15 03anxb PDFDocument1 pageRmo15 03anxb PDFAM CruzNo ratings yet

- MAT Calculation: Setoff MAT Credits - End Net Tax PayableDocument2 pagesMAT Calculation: Setoff MAT Credits - End Net Tax PayableHardik ThackerNo ratings yet

- Tax CaseDocument2 pagesTax CaseAnshika PandeyNo ratings yet

- MAT Calculation: Setoff MAT Credits - End Net Tax PayableDocument4 pagesMAT Calculation: Setoff MAT Credits - End Net Tax PayableGokuNo ratings yet

- Kso TugasDocument7 pagesKso TugasRahmat Ramadhan RahmatNo ratings yet

- Advanced Corporate Finance I Valuation: Class 3 Capital Budgeting & Project FCF Examples Professor Janis SkrastinsDocument23 pagesAdvanced Corporate Finance I Valuation: Class 3 Capital Budgeting & Project FCF Examples Professor Janis SkrastinsAdam StylesNo ratings yet

- Transocean Ltd. and Subsidiaries Supplemental Effective Tax Rate AnalysisDocument1 pageTransocean Ltd. and Subsidiaries Supplemental Effective Tax Rate Analysissuhasshinde88No ratings yet

- PGDM CV DCF 20th August LectureDocument11 pagesPGDM CV DCF 20th August Lecturepratik waliwandekarNo ratings yet

- SC2x W9L2 DCFAnalysis CLEANDocument68 pagesSC2x W9L2 DCFAnalysis CLEANvi tranNo ratings yet

- RupalDocument6 pagesRupalsivaganga MNo ratings yet

- Tax Calculator FY 23-24Document6 pagesTax Calculator FY 23-24Arish BallanaNo ratings yet

- MFRS 112 DtadtlDocument19 pagesMFRS 112 DtadtlAlisa FarhaNo ratings yet

- 8 Tax CaseDocument5 pages8 Tax CaseDharmil OzaNo ratings yet

- Transocean Ltd. and Subsidiaries Supplemental Effective Tax Rate AnalysisDocument1 pageTransocean Ltd. and Subsidiaries Supplemental Effective Tax Rate Analysissuhasshinde88No ratings yet

- Analysis of Historical PerformancesDocument6 pagesAnalysis of Historical Performancespratik waliwandekarNo ratings yet

- Goods and Services Tax (GST) Presentation To The Members of GJEPCDocument54 pagesGoods and Services Tax (GST) Presentation To The Members of GJEPCTheking OfsexNo ratings yet

- FCFF Calculation 16.05.2022Document5 pagesFCFF Calculation 16.05.2022রাফিউল রিয়াজ অমিNo ratings yet

- AC330 Exam Notes SampleDocument3 pagesAC330 Exam Notes SampleRicardo KlnNo ratings yet

- ShaftesburyCapitalPLCLSESHC PublicInvestmentFirmDocument1 pageShaftesburyCapitalPLCLSESHC PublicInvestmentFirmAaren Tan Whei LungNo ratings yet

- CFAP AAFR Winter 2021 AnswersDocument7 pagesCFAP AAFR Winter 2021 AnswersHassanNo ratings yet

- Basics On Income Tax PDFDocument10 pagesBasics On Income Tax PDFHannan Mahmood TonmoyNo ratings yet

- Tax Summary 2019 Ver.1Document163 pagesTax Summary 2019 Ver.1Aiko Cherrie NakamuraNo ratings yet

- Consolidation: Consolidated AssetsDocument2 pagesConsolidation: Consolidated AssetsShaira BugayongNo ratings yet

- Matrix of Comments To TES 11Document3 pagesMatrix of Comments To TES 11Renato E. Reside Jr.No ratings yet

- Study Session 05: Shemal MustaphaDocument11 pagesStudy Session 05: Shemal MustaphafirefxyNo ratings yet

- F6ZWEDocument8 pagesF6ZWEkevior2No ratings yet

- RRDocument1 pageRRNatesvar RajNo ratings yet

- Dalmia Bharat Sugar Bill No. 21 PDFDocument3 pagesDalmia Bharat Sugar Bill No. 21 PDFsanjayNo ratings yet

- TPB-Formulae StructureDocument28 pagesTPB-Formulae StructureNaresh NavuluriNo ratings yet

- Goods and Services Tax (GST) Presentation To The Members of GJEPCDocument53 pagesGoods and Services Tax (GST) Presentation To The Members of GJEPCAnkita TomarNo ratings yet

- PAK CFE Supplemental Formula Sheet (Spring 2023)Document49 pagesPAK CFE Supplemental Formula Sheet (Spring 2023)CalvinNo ratings yet

- 4 - Estimating The Hurdle Rate PDFDocument58 pages4 - Estimating The Hurdle Rate PDFPankaj VarshneyNo ratings yet

- Wingo Logo PlaceholderDocument6 pagesWingo Logo PlaceholderAlexa ContrerasNo ratings yet

- Vuelo No. Hora de Salida Hora de Llegada DuraciónDocument4 pagesVuelo No. Hora de Salida Hora de Llegada DuraciónMartín Elias Plaza VegaNo ratings yet

- Machinery Services: TemplateDocument2 pagesMachinery Services: TemplategazanNo ratings yet

- Add Equipment Edit Equipment Remove All EquipmentDocument14 pagesAdd Equipment Edit Equipment Remove All EquipmentJose VargasNo ratings yet

- Draf T: Form Gstr-1 (See Rule 59 (1) ) Details of Outward Supplies of Goods or ServicesDocument4 pagesDraf T: Form Gstr-1 (See Rule 59 (1) ) Details of Outward Supplies of Goods or ServicesShivchandraNo ratings yet

- GST Annual Return 2021 2022Document99 pagesGST Annual Return 2021 2022AUTHENTIC SURSEZNo ratings yet

- List of Services 2Document18 pagesList of Services 2L.P. SinghNo ratings yet

- TX-CYP Dec 21 AnswersDocument8 pagesTX-CYP Dec 21 AnswersKAM JIA LINGNo ratings yet

- Ias12 SN PDFDocument15 pagesIas12 SN PDFShiza ArifNo ratings yet

- SemGrp9 - Team6 (Edited)Document69 pagesSemGrp9 - Team6 (Edited)LingNo ratings yet

- An Insight Into GST in IndiaDocument26 pagesAn Insight Into GST in IndiaSrikantNo ratings yet

- Chap-7, 8 & 9 (Income Statemnet & Statement of Financial Position)Document17 pagesChap-7, 8 & 9 (Income Statemnet & Statement of Financial Position)7a4374 hisNo ratings yet

- Chap-7, 8 & 9 (Income Statemnet & Statement of Financial Position)Document18 pagesChap-7, 8 & 9 (Income Statemnet & Statement of Financial Position)7a4374 hisNo ratings yet

- Ac5a Week 4 Session 2Document13 pagesAc5a Week 4 Session 2RayaNo ratings yet

- Office of Bids and Awards Committee (BAC) : Project Procurement Management Plan (PPMP) Fy 2022Document18 pagesOffice of Bids and Awards Committee (BAC) : Project Procurement Management Plan (PPMP) Fy 2022Jayson PalmaNo ratings yet

- PWC Virtual Case Experience Corporate Tax - Model Work Task 1 - Tax Provision Calculation 2021Document6 pagesPWC Virtual Case Experience Corporate Tax - Model Work Task 1 - Tax Provision Calculation 2021arifansari2299No ratings yet

- Chapter 4 - CompleteDocument15 pagesChapter 4 - Completemohsin razaNo ratings yet

- Suggested Answers Certified Finance and Accounting Professional Examination - Summer 2018Document7 pagesSuggested Answers Certified Finance and Accounting Professional Examination - Summer 2018Muhammad Usama SheikhNo ratings yet

- Add Equipment Edit Equipment Remove All EquipmentDocument14 pagesAdd Equipment Edit Equipment Remove All EquipmentFarideh MashoufiNo ratings yet

- Merak Fiscal Model Library: Italy R/T (2000)Document2 pagesMerak Fiscal Model Library: Italy R/T (2000)Tripoli ManoNo ratings yet

- TPB-Formulae StructureDocument14 pagesTPB-Formulae StructureNaresh NavuluriNo ratings yet

- M/S ABC Limited NTN: Cnic: Income Tax Computation Tax Year 20X6Document1 pageM/S ABC Limited NTN: Cnic: Income Tax Computation Tax Year 20X6fergusonaf555No ratings yet

- M3 T5 Financial StatementsDocument15 pagesM3 T5 Financial StatementsPrshnt MishraNo ratings yet

- Fin460 ExercisesDocument6 pagesFin460 ExercisesNgọc CừuNo ratings yet

- P N 0 TH H T - T o H T: Module 36 Taxes: Co O ATEDocument3 pagesP N 0 TH H T - T o H T: Module 36 Taxes: Co O ATEZeyad El-sayedNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Kansai Nerolac QuestionDocument6 pagesKansai Nerolac Questionricha krishnaNo ratings yet

- Nerolac - On Ratio - SolvedDocument6 pagesNerolac - On Ratio - Solvedricha krishnaNo ratings yet

- Nerolac - Solution PDFDocument5 pagesNerolac - Solution PDFricha krishnaNo ratings yet

- Financial Modeling Case - Premium Bus ServiceDocument1 pageFinancial Modeling Case - Premium Bus Servicericha krishnaNo ratings yet