Professional Documents

Culture Documents

FAR.2922 - Investments in Equity Instruments

Uploaded by

Bea San JoseOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FAR.2922 - Investments in Equity Instruments

Uploaded by

Bea San JoseCopyright:

Available Formats

Since 1977

FAR OCAMPO/OCAMPO

FAR.2922-Investments in Equity Instruments –

Financial Assets at Fair Value

DISCUSSION PROBLEMS

Use the following information for the next two questions. c. Contractual rights to receive cash or another

financial asset from another entity.

On 1 January 2020, Totga Co. purchased 20,000 ordinary

d. Contractual rights to exchange financial assets or

shares of FZ Co. at P100 per share. At the time of the

financial liabilities with another entity under

purchase, FZ Co. had 100,000 ordinary shares

conditions that are potentially favorable to the

outstanding. For the year ended December 31, 2020, FZ

entity.

Co. reported profit of P2,400,000 and paid cash dividends

of P600,000. The shares of FZ are selling at P110 per

4. An investment in equity instrument may not be

share on December 31, 2020.

classified as a financial asset subsequently measured

at

Totga is entitled to appoint two directors to the board,

a. Fair value through profit or loss

which consists of eight members. The remaining of the

b. Fair value through other comprehensive income

voting rights are held by two other companies, each of

c. Amortized cost

which is entitled to appoint three directors. The board

d. None of the above

makes decisions on the basis of simple majority. Because

board meetings are often held at very short notice, Totga

5. At initial recognition, an entity may make an

does not always have representation on the board. Often

irrevocable election to present in other comprehensive

the suggestions of the representative of Totga are ignored,

income subsequent changes in the fair value of an

and the decisions of the board seem to take little notice of

investment in an equity instrument that is

any representations made by the director from Totga.

a. Acquired principally for the purpose of selling it in

the near term.

1. Significant influence is

b. On initial recognition is part of a portfolio of

a. The power to participate in the financial and

identified financial instruments that are managed

operating policy decisions of the investee but is not

together and for which there is evidence of a

control or joint control over those policies.

recent actual pattern of short-term profit-taking.

b. Deemed to exist when the investor is exposed, or

c. A derivative.

has rights, to variable returns from its involvement

d. None of the above.

with the investee and has the ability to affect those

returns through its power over the investee. 6. All investments in equity instruments and contracts on

c. The contractually agreed sharing of control of an those instruments must be measured at fair value.

arrangement, which exists only when decisions Cost may be an appropriate estimate of fair value in

about the relevant activities require the unanimous which of the following?

consent of the parties sharing control. a. Insufficient more recent information is available to

d. The power to govern the financial and operating measure fair value.

policies of an entity so as to obtain benefits from b. There is a wide range of possible fair value

its activities. measurements and cost represents the best

estimate of fair value within that range.

2. The carrying amount of the investment in FZ Co. as of c. Investments in quoted equity instruments.

December 31, 2020 should be d. Either a or b.

a. P2,200,000 c. P2,360,000

b. P2,000,000 d. P2,480,000 LECTURE NOTES:

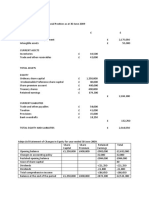

LECTURE NOTES: Financial Assets Measurement Summary

Accounting for Investments in Ordinary Shares Classification Initial Subsequent Change in FV

Summary FA@FVTPL FV FV P/L

FA@FVTOCI FV + TC FV OCI (Equity)

Level of FA@AC FV + TC AC Ignore

Influence Method Investment Standard

Little or Fair value Financial PFRS 9

none asset PAS 32 7. An entity acquired an investment in equity instrument

PFRS 7 for P800,000 on 31 March 2020. The direct acquisition

Significant Equity Investment in PAS 28 costs incurred were P140,000.

Associate

Control Consolidation Investment in PFRS 10 On 31 December 2020 the fair value of the instrument

Subsidiary was P1,100,000 and the transaction costs that would be

Joint Equity Investment in PAS 28 incurred on sale were estimated at P120,000.

control Joint Venture If the investment is designated as FA@FVTOCI, what

gain would be recognized in the financial statements for

3. Investments in equity instruments are financial assets the year ended 31 December 2020?

because they are a. Nil c. P420,000

a. Cash equivalents. b. P40,000 d. P160,000

b. Equity instruments of another entity.

Page 1 of 5 www.teamprtc.com.ph FAR.2922

EXCEL PROFESSIONAL SERVICES, INC.

Use the following information for the next two questions. 13. For the year ended December 31, 2019, WQA

Company reported opening retained earnings of

On its December 31, 2019, balance sheet, an entity

P1,850,000 and cumulative unrealized gains recorded

appropriately reported a P4,000 credit balance in its

as reserves of P25,000. These gains are from an

Market Adjustment-Trading Securities account. There was

investment with an original cost of P100,000 and a fair

no change during 2020 in the composition of the entity’s

value of P125,000. The company policy is to value all

portfolio of trading securities. Pertinent data are as

investments at fair value with unrealized gains and

follows:

losses included in reserves. The company’s accounting

Fair Value policy is that when an investment is sold, the reserve

Security Cost 12/31/20 amount is transferred to retained earnings. During

A P120,000 P126,000 2020, one-half of the investment was sold. The

B 90,000 80,000 remaining investment increased in value to P70,000. A

C 160,000 157,000 second investment was bought for P150,000 and its

P370,000 P363,000 fair value had increased to P165,000 by the end of

2020. What is the reserve balance at December 31,

8. The credit balance in the account Market Adjustment--

2020?

Trading Securities at December 31, 2019 should be

a. P27,500 c. P45,000

interpreted as

b. P35,000 d. P60,000

a. The net unrealized holding gain for 2019.

b. The net realized holding loss for 2019.

14. On June 1, 2020, Ping Corp. purchased 10,000 of

c. The net unrealized holding gain to date.

Pong’s 50,000 outstanding shares at a price of P6.00

d. The net unrealized holding loss to date.

per share. Pong had earnings of P3,000 per month

during 2020 and paid dividends of P10,000 on March

9. What amount of loss on these securities should be

1, 2020 and P12,500 on December 1, 2020. The fair

included in the entity’s income statement for the year

value of Pong’s shares was P6.50 per share on

ended December 31, 2020?

December 31, 2020.

a. P11,000 c. P3,000

b. P 7,000 d. P0 Which statement is correct?

a. Assuming that the investment is FVTPL, the total

effect on Ping’s profit or loss for the year ended

Use the following information for the next two questions. December 31, 2020 is P2,500.

b. Assuming that the investment is FVTOCI, the total

Pompey Inc. carries the following marketable equity

effect on Ping’s profit or loss for the year ended

securities on its books at December 31, 2019 and 2020.

December 31, 2020 is P7,500.

All securities were purchased during 2019.

c. Assuming that the investment is an associate, the

FA@FVTPL: total effect on Ping’s profit or loss for the year

Cost Fair value ended December 31, 2020 is P3,600.

12/31/19 12/31/20 d. After all closing entries for 2020 are completed, the

P Company P 500,000 P 260,000 P 400,000 effect of the increase in fair value on total

R Company 260,000 400,000 400,000 shareholders' equity would be the same amount

T Company 700,000 600,000 500,000 under the FVTOCI and FVTPL approaches.

Total P1,460,000 P1,260,000 P1,300,000

FA@FVTOCI: 15. On January 1, 2019, Lallo Company purchased 15% of

Cost Fair value Vintar Company’s ordinary shares for P20,000,000.

12/31/19 12/31/20 The following data concerning Vintar Company are

C Company P4,100,000 P3,600,000 P3,600,000 available:

I Company 1,000,000 1,200,000 1,400,000 2019 2020

Total P5,100,000 P4,800,000 P5,000,000 Net income P6,000,000 P7,000,000

Cash dividend paid None 15,000,000

10. The net amount to be recognized in 2020

In its income statement for the year ended December

comprehensive income is

31, 2020, how much should Lallo report as income

a. P240,000 gain c. P260,000 loss

from this investment?

b. P200,000 gain d. P 60,000 loss

a. P2,250,000 c. P700,000

b. P1,950,000 d. P600,000

11. The net unrealized gain/loss at December 31, 2020 in

accumulated other comprehensive income in

16. Lasam Company received dividends from its

shareholders' equity is

investments in ordinary shares during the current

a. P260,000 loss c. P100,000 loss

period as follows:

b. P200,000 gain d. P 40,000 gain

a. A share dividend of 20,000 shares from A

Company when the market price of A’s shares was

12. PFRS 9 permits an entity to make an irrevocable P30 per share.

election to present in other comprehensive income b. A cash dividend of P2,000,000 from B Company in

changes in the fair value of an investment in an equity which Lasam owns a 20% interest.

instrument. Amounts presented in other c. A cash dividend of P1,500,000 from C Company in

comprehensive income which Lasam owns a 10% interest.

a. May be subsequently transferred to profit or loss. d. 10,000 ordinary shares of D Company in lieu of

b. Shall be subsequently transferred to retained cash dividend of P20 per share. The market price

earnings. of D Company’s shares was P180. Lasam holds

c. Either a or b. originally 100,000 ordinary shares of D Company.

d. Neither a nor b. Lasam owns 5% interest in D Company.

Page 2 of 5 www.teamprtc.com.ph FAR.2922

EXCEL PROFESSIONAL SERVICES, INC.

e. A liquidating dividend of P2,000,000 from E For the year ended December 31, 2020, Gamu should

Company. Lasam owns a 5% interest in E report on its income statement a gain on disposal of

Company. a. P300,000 c. P175,000

f. A dividend in kind of one ordinary share of X b. P210,000 d. P250,000

Company for every 5 ordinary shares of F

Company held. Lasam holds 200,000 F Company

shares which have a market price of P50 per share. 22. What is the principle for recognition of a financial asset

The market price of X Company’s ordinary share is in PFRS 9?

P30 per share. a. A financial asset is recognized when, and only

when, it is probable that future economic benefits

What amount of dividend income should Lasam report

will flow to the entity and the cost or value of the

in its current period income statement?

instrument can be measured reliably.

a. P4,500,000 c. P6,300,000

b. A financial asset is recognized when, and only

b. P5,700,000 d. P5,900,000

when, the entity obtains control of the instrument

and has the ability to dispose of the financial asset

independent of the actions of others.

Use the following information for the next three questions.

c. A financial asset is recognized when, and only

Pamplona Company owns 1,000,000 shares of Penablanca when, the entity obtains the risks and rewards of

Company’s 5,000,000 shares of P50 par, 10% cumulative, ownership of the financial asset and has the ability

nonparticipating preference shares. During 2020 to dispose of the financial asset.

Penablanca declared and paid dividends of P40,000,000 on d. A financial asset is recognized when, and only

preference shares. No dividends had been declared or when, the entity becomes a party to the

paid during 2019. contractual provisions of the instrument.

17. Dividends are recognized in profit or loss only when:

a. The entity’s right to receive payment of the 23. A regular way purchase or sale is a purchase or sale of

dividend is established. a financial asset under a contract whose terms require

b. It is probable that the economic benefits delivery of the asset within the time frame established

associated with the dividend will flow to the entity. generally by regulation or convention in the

c. The amount of the dividend can be measured marketplace concerned. Which statement is incorrect

reliably. regarding regular way purchase or sale of a financial

d. All of the above. asset?

a. A regular way purchase or sale of financial assets

18. What amount should Pamplona report as dividend is recognized and derecognized using either trade

income in its 2020 income statement? date or settlement date accounting. The choice of

a. P5,000,000 c. P10,000,000 method is an accounting policy.

b. P8,000,000 d. Nil b. Under trade date accounting, the financial asset is

recognized and derecognized on the date the entity

19. How should Pamplona report the 2019 dividend in commits to the purchase or sale.

arrears that was received in 2020? c. Under settlement date accounting, the financial

a. As a reduction in cumulative preferred dividends asset is recognized and derecognized on the date it

receivable. is delivered.

b. As a retroactive change of the prior period financial d. For purposes of regular way accounting, assets

statements. held for trading and designated at fair value

c. Include, net of income taxes, after 2020 income through profit or loss form one category.

from continuing operations.

d. Include in 2020 income from continuing

operations. 24. On June 29, 2020, an entity commits itself to purchase

a financial asset to be classified as FVTPL for

20. On January 2, 2020, Theodora Company purchased P100,000, its fair value on commitment (trade) date.

40,000 shares of Byzantine, Inc. stock at P100 per This financial asset has a fair value of P101,000 and

share. Brokerage fees amounted to P120,000. A P5 P101,500 on June 30, 2020 (the entity’s financial year-

dividend per share of Byzantine, Inc. shares had been end), and July 2, 2020 (settlement date), respectively.

declared on December 15, 2019, to be paid on March In the marketplace concerned, the time frame for

31, 2020 to shareholders of record on January 31, delivery of the asset or payment of liability is

2020. The shares are designated as FVTOCI. On transaction date plus 3 days (“T+3”).

December 31, 2020 the investment has a fair value of

Which statement is correct?

P4,200,000. How much should be recognized in the

a. The transaction is not a regular way purchase.

2020 other comprehensive income related to these

b. If the entity applies the trade date accounting

securities?

method, the entity will recognize a gain of P1,500

a. P400,000 c. P200,000

on July 2, 2020.

b. P280,000 d. P 80,000

c. If the entity applies the settlement date accounting

method, the entity will recognize the financial

21. On January 2, 2020, Gamu Company purchased as a

asset at P100,000 on July 2, 2020.

long term investment 10,000 ordinary shares of Ilagan

d. If the entity applies the settlement date accounting

Corporation for P70 per share, which represents a 1%

method, the entity will recognize a gain of P500 on

interest. On July 1, Ilagan Corporation declared its

July 2, 2020.

annual dividend on its ordinary shares of P5 per share

payable on August 1 to shareholder’s of record at July

25, 2020. On July 20, 2020 Gamu needed additional

cash for operations and sold all 10,000 shares Ilagan

for P100 per share.

Page 3 of 5 www.teamprtc.com.ph FAR.2922

EXCEL PROFESSIONAL SERVICES, INC.

SOLUTION GUIDE: 25. When settlement date accounting is applied, how

should an entity account for any change in the fair

TRADE DATE ACCOUNTING value of the asset to be received during the period

between the trade date and the settlement date?

June 29, 2020

a. The change in value is recognized for all financial

Equity investment – FVTPL P100,000

assets.

Due to broker P100,000

b. The change in value is not recognized for all

June 30, 2020 financial assets.

Equity investment - FVTPL P1,000 c. The change in value is not recognized for

FV adj. gain-P/L P1,000 investments in equity instruments measured at fair

value through other comprehensive income.

July 2, 2020 d. In the same way as it accounts for the acquired

Equity investment - FVTPL P 500 asset.

Due to broker 100,000

Cash P100,000

FV adj. gain-P/L 500 Use the following information for the next two questions.

SETTLEMENT DATE ACCOUNTING On December 28, 2020 (trade date), Francis Corp. enters

into a contract to sell an equity security classified as

June 29, 2020 FVTOCI for its current fair value of P303,000. The asset

Memo entry was acquired a year ago and its cost was P300,000. On

June 30, 2020 December 31, 2020 (financial year-end), the fair value of

Due from broker P1,000 the asset is P303,600. On January 5, 2021 (settlement

FV adj. gain-P/L P1,000 date), the asset's fair value is P303,900.

July 2, 2020 26. If Francis uses the trade date method to account for

Equity investment - FVTPL P101,500 regular way sales of its securities, the net amount to

Cash P100,000 be recognized in 2020 comprehensive income is

Due from broker 1,000 a. P3,900 c. P3,000

FV adj. gain-P/L 500 b. P3,600 d. P 0

SOLUTION GUIDE:

LECTURE NOTES:

December 28, 2020

Summary of recognition and derecognition in a regular way Equity investment – FVTOCI P3,000

purchase and sale of financial assets: FV adj. gain – OCI P3,000

Trade Date Settlement Date Due from broker P303,000

Recognize Commitment Delivery date Equity investment - FVTOCI P303,000

date

Derecognize Commitment Delivery date December 31, 2020

date No entry

Change in FV from

trade date to January 5, 2021

settlement date Cash P303,000

(for FA measured Due from broker P303,000

at FV):

Purchase Recognize Recognize

Sale Ignore Ignore 27. If Francis uses the settlement date method to account

for regular way sales of its securities, the net amount

Regular way purchase - Initial measurement to be recognized in 2021 comprehensive income is

a. P3,900 c. P3,000

b. P3,600 d. P 0

SOLUTION GUIDE:

December 28, 2020

Equity investment – FVTOCI P3,000

FV adj. gain – OCI P3,000

Memo entry - sale

December 31, 2020

No entry

January 5, 2021

Cash P303,000

Equity investment - FVTOCI P303,000

- now do the DIY drill -

Page 4 of 5 www.teamprtc.com.ph FAR.2922

EXCEL PROFESSIONAL SERVICES, INC.

DO-IT-YOURSELF (DIY) DRILL

1. Marcus Company made the following transactions in Use the following information for the next two questions.

the ordinary shares of Cato Company designated as a

On December 28, 2020, Anne Company commits itself to

financial asset at fair value through profit or loss:

purchase a financial asset to be classified as FVTPL for

July 16, 2018 - Purchased 10,000 shares at P45 per P800,000, its fair value on commitment (trade) date. This

share. security has a fair value of P801,000 and P802,500 on

June 28, 2019 - Sold 2,000 shares for P51 per share. December 31, 2020 (Anne's financial year-end), and

May 18, 2020 - Sold 2,500 shares for P33 per share. January 5, 2021 (settlement date), respectively.

The end-of-year market prices for the shares were as 4. If Anne applies the trade date accounting method to

follows: account for regular way purchases of its securities,

December 31, 2018 - P47 per share how much gain should be recognized on January 5,

December 31, 2019 - P39 per share 2021?

December 31, 2020 - P31 per share a. P2,500 c. P1,000

b. P1,500 d. Nil

How much should be recognized in 2020 profit or loss

as a result of the fair value changes? 5. If Anne applies the settlement date accounting method

a. P77,000 c. P44,000 to account for regular way purchases of its securities,

b. P11,000 d. P 0 how much gain should be recognized on January 5,

2021?

a. P2,500 c. P1,000

2. On Feb. 2, 2019, I AM DETERMINED CO. purchased b. P1,500 d. Nil

10,000 shares of CPA CO. at P56 plus broker’s

commission of P4 per share. The investment is

FVTOCI. During 2018 and 2020, the following events 6. On December 28, 2020, Bakeks Company commits

occurred regarding the investment: itself to purchase equity securities to be classified as

12/15/19 CPA CO. declares and pays a P2.20 per held for trading for P1,000,000, its fair value on

share dividend commitment (trade) date. These securities have a fair

12/31/19 The market price of CPA CO. stock is value of P1,002,000 and P1,005,000 on December 31,

P52 per share at year-end 2020 (Bakeks' financial year-end), and January 5,

12/01/20 CPA CO. declares and pays a dividend 2021 (settlement date), respectively. If Bakeks

of P2 per share applies the settlement date accounting method to

12/31/20 The market price of CPA CO. stock is account for regular-way purchases, how much should

P55 per share at year-end be recognized in its 2020 profit or loss related to these

securities?

The net unrealized loss at December 31, 2020 in

a. P2,000 c. P3,000

accumulated OCI in shareholders' equity is

b. P4,000 d. P 0

a. P50,000 c. P80,000

b. P40,000 d. P60,000

7. On December 28, 2020 (trade date), Charming Corp.

enters into a contract to sell an equity security

3. On December 31, 2018, Zenobia Co. purchased equity

classified as FA@FVTOCI for its current fair value of

securities as classified as FVTOCI. Pertinent data are

P505,000. The asset was acquired a year ago and its

as follows:

cost was P500,000. On December 31, 2020 (financial

Fair value year-end), the fair value of the asset is P506,000. On

Cost 12/31/19 12/31/20 January 5, 2021 (settlement date), the asset's fair

C Company P 900,000 P 880,000 P780,000 value is P507,500. If Charming uses the trade date

P Company 1,100,000 1,120,000 1,240,000 method to account for regular-way sales of its

A Company 2,000,000 1,920,000 1,720,000 securities, how much should be reported as

reclassification adjustment in its 2020 financial

On December 31, 2020, Zenobia transferred its

statements?

investment in security P from FVTOCI to FVTPL. How

a. P7,500 c. P5,000

much should be recognized as component of equity as

b. P6,000 d. Nil

of December 31, 2020 related to these securities?

a. P300,000 c. P180,000

b. P260,000 d. P400,000

J - end of FAR.2922 - J

Page 5 of 5 www.teamprtc.com.ph FAR.2922

You might also like

- TOA - InvestmentsDocument8 pagesTOA - InvestmentsPrincessDiana Doloricon EscrupoloNo ratings yet

- Comprehensive Topics HandoutsDocument16 pagesComprehensive Topics HandoutsGrace CorpoNo ratings yet

- Equity Retained Earnings 2Document2 pagesEquity Retained Earnings 2Marked ReverseNo ratings yet

- 9.3 Debt InvestmentsDocument7 pages9.3 Debt InvestmentsJorufel PapasinNo ratings yet

- Lecture Notes: Nature of Intangible Assets RecognitionDocument5 pagesLecture Notes: Nature of Intangible Assets RecognitionRyan Carta50% (2)

- 9.1 Equity Investments at Fair Value PDFDocument4 pages9.1 Equity Investments at Fair Value PDFJorufel PapasinNo ratings yet

- Orang Co. perpetual inventory system calculationsDocument3 pagesOrang Co. perpetual inventory system calculationsJobelle Candace Flores AbreraNo ratings yet

- Financial Asset at Amortized CostDocument14 pagesFinancial Asset at Amortized CostLorenzo Diaz DipadNo ratings yet

- Expenditures On The Project Were As Follows:: Problem 3Document3 pagesExpenditures On The Project Were As Follows:: Problem 3Par Cor100% (2)

- Audit investments equity securities fishing corpDocument9 pagesAudit investments equity securities fishing corpGirlie SisonNo ratings yet

- FAR - RQ - Investment in AssociatesDocument2 pagesFAR - RQ - Investment in AssociatesKriane Kei50% (2)

- Accounts payable and accrued liabilities for multiple companiesDocument2 pagesAccounts payable and accrued liabilities for multiple companiesNah HamzaNo ratings yet

- Since 1977Document6 pagesSince 1977Ashley LegaspiNo ratings yet

- FAR.104 PPE Acquisition and Subsequent ExpendituresDocument7 pagesFAR.104 PPE Acquisition and Subsequent ExpendituresMarlon Jeff Concepcion Cariaga100% (2)

- Wasting AssetsDocument4 pagesWasting AssetsjomelNo ratings yet

- P1-PB. Sample Preboard Exam PDFDocument12 pagesP1-PB. Sample Preboard Exam PDFAj VesquiraNo ratings yet

- Conceptual FrameworkDocument65 pagesConceptual FrameworkKatKat OlarteNo ratings yet

- Midterm SheDocument5 pagesMidterm SheKaye Delos SantosNo ratings yet

- Audit Quizzer ProblemDocument5 pagesAudit Quizzer ProblemJazzy100% (1)

- 8th PICPA National Accounting Quiz ShowdownDocument28 pages8th PICPA National Accounting Quiz Showdownrcaa04No ratings yet

- P1.004 - PPE Depreciation and Derecognition (Illustrative Problems)Document2 pagesP1.004 - PPE Depreciation and Derecognition (Illustrative Problems)Patrick Kyle AgraviadorNo ratings yet

- AuditingDocument8 pagesAuditingmagoimoiNo ratings yet

- Acctg13 PPE ProblemsDocument4 pagesAcctg13 PPE ProblemsKristel Keith NievaNo ratings yet

- (Odd) Acc 101 LT#2B PDFDocument5 pages(Odd) Acc 101 LT#2B PDF有福No ratings yet

- ADVACC Corporate LiquidationDocument4 pagesADVACC Corporate LiquidationKim Nicole ReyesNo ratings yet

- Simulated Final Exam. IntAccDocument6 pagesSimulated Final Exam. IntAccNicah AcojonNo ratings yet

- AP - TestbankDocument22 pagesAP - TestbankRamon Jonathan SapalaranNo ratings yet

- ch11 PDFDocument39 pagesch11 PDFerylpaez89% (9)

- The Enhancement Program Handouts - Far PDFDocument36 pagesThe Enhancement Program Handouts - Far PDFRica Jane Lloren0% (1)

- FAR NotesDocument11 pagesFAR NotesJhem Montoya OlendanNo ratings yet

- #16 Investment PropertyDocument4 pages#16 Investment PropertyClaudine DuhapaNo ratings yet

- HW On Quasi-Reorganization BDocument2 pagesHW On Quasi-Reorganization BCharles Tuazon100% (1)

- AFAR Final Preboard 2018 PDFDocument22 pagesAFAR Final Preboard 2018 PDFcardos cherryNo ratings yet

- Audit of Investments 1Document2 pagesAudit of Investments 1Raz MahariNo ratings yet

- Accounting for Spoiled Units and Increased Production CostsDocument3 pagesAccounting for Spoiled Units and Increased Production CostsMA ValdezNo ratings yet

- Liabilities BSA 5-2sDocument7 pagesLiabilities BSA 5-2sJustine GuilingNo ratings yet

- P1.110 Investment Property.Document1 pageP1.110 Investment Property.aleish0301100% (1)

- NCR CUP 1: FINANCIAL ACCOUNTING REPORTING Q&ADocument13 pagesNCR CUP 1: FINANCIAL ACCOUNTING REPORTING Q&AKenneth RobledoNo ratings yet

- Regional accounting convention JAM finals reviewDocument7 pagesRegional accounting convention JAM finals reviewVinluan JeromeNo ratings yet

- 5 Intangible AssetsDocument5 pages5 Intangible AssetsNeighvestNo ratings yet

- Auditing Problems Summer 2011: Problem 1Document37 pagesAuditing Problems Summer 2011: Problem 1Iscandar Pacasum DisamburunNo ratings yet

- Aud Application 2 - Handout 6 Revaluation (UST)Document5 pagesAud Application 2 - Handout 6 Revaluation (UST)RNo ratings yet

- IA1 Financial Assets at Fair ValueDocument11 pagesIA1 Financial Assets at Fair ValueSteffanie OlivarNo ratings yet

- Conceptual FrameworkDocument9 pagesConceptual FrameworkAveryl Lei Sta.Ana0% (1)

- Debt Securities ReviewerDocument30 pagesDebt Securities Reviewerjhie boterNo ratings yet

- VIRAY, NHICOLE S. Asset - PPE - 1 - For PostingDocument4 pagesVIRAY, NHICOLE S. Asset - PPE - 1 - For PostingZeeNo ratings yet

- StatementDocument4 pagesStatementAngel Alejo AcobaNo ratings yet

- 1911 Investments Investment in Associate and Bond InvestmentDocument13 pages1911 Investments Investment in Associate and Bond InvestmentCykee Hanna Quizo LumongsodNo ratings yet

- Wasting AssetsDocument2 pagesWasting AssetsAdan NadaNo ratings yet

- Audit of EquityDocument5 pagesAudit of EquityKarlo Jude Acidera0% (1)

- Mindanao State University College of Business Administration and Accountancy Marawi CityDocument7 pagesMindanao State University College of Business Administration and Accountancy Marawi CityHasmin Saripada AmpatuaNo ratings yet

- Chapter 14Document8 pagesChapter 14einnajeniale75% (4)

- Saklob Corp Returns & Premium Liability"TITLE"Tisyu Co Warranty Estimates & Expenses" TITLE"Messa Corp Bond Issuance & AmortizationDocument4 pagesSaklob Corp Returns & Premium Liability"TITLE"Tisyu Co Warranty Estimates & Expenses" TITLE"Messa Corp Bond Issuance & AmortizationArn HicoNo ratings yet

- Investment in AssociateDocument2 pagesInvestment in AssociateChiChi0% (1)

- Far 09 Government GrantsDocument9 pagesFar 09 Government GrantsJoshua UmaliNo ratings yet

- Investment in Equity SecuritiesDocument11 pagesInvestment in Equity SecuritiesnikNo ratings yet

- 7.30.22 Am Investments-In-Equity-InstrumentsDocument4 pages7.30.22 Am Investments-In-Equity-InstrumentsAether SkywardNo ratings yet

- FAR 2922 Investments in Equity Instruments PDFDocument5 pagesFAR 2922 Investments in Equity Instruments PDFEki OmallaoNo ratings yet

- FAR.3521 Investments in Equity InstrumentsDocument4 pagesFAR.3521 Investments in Equity InstrumentsCharisse Ahnne TosloladoNo ratings yet

- Equity Investments As of October 19, 2021Document25 pagesEquity Investments As of October 19, 2021Almirah's iCPA ReviewNo ratings yet

- Chapter 1 - Question 1Document4 pagesChapter 1 - Question 1Sophie ChopraNo ratings yet

- Kelompok3 Tugas3 AKLDocument4 pagesKelompok3 Tugas3 AKLsyifa fr100% (1)

- Wiley - Chapter 4: Income Statement and Related InformationDocument42 pagesWiley - Chapter 4: Income Statement and Related InformationIvan Bliminse86% (7)

- Complicated Financial Words Made Easy .Document30 pagesComplicated Financial Words Made Easy .anon_591006593No ratings yet

- Finance Interview QuestionsDocument40 pagesFinance Interview QuestionsOmkar JangamNo ratings yet

- Inghams Group LimitedDocument22 pagesInghams Group Limitedengineer watchnutNo ratings yet

- Blank 3e ISM Ch01Document24 pagesBlank 3e ISM Ch01Sarmad KayaniNo ratings yet

- Pre-Test 9Document3 pagesPre-Test 9BLACKPINKLisaRoseJisooJennieNo ratings yet

- FARI Daisy 2021 Mock ExamDocument17 pagesFARI Daisy 2021 Mock ExamLauren McMahonNo ratings yet

- CoopDocument28 pagesCoopJuhuanna AleNo ratings yet

- CS Executive Old Paper 4 Tax Laws and Practice SA V0.3Document33 pagesCS Executive Old Paper 4 Tax Laws and Practice SA V0.3Raunak AgarwalNo ratings yet

- Corning Convertible Preferred Stock PDFDocument6 pagesCorning Convertible Preferred Stock PDFperwezNo ratings yet

- O/W: Mayne To Reward The Willing: Mayne Pharma Group (MYX)Document8 pagesO/W: Mayne To Reward The Willing: Mayne Pharma Group (MYX)Muhammad ImranNo ratings yet

- Kohat Cement Annual Report 2019 PDFDocument114 pagesKohat Cement Annual Report 2019 PDFRizwana Khan Rizwana Khan0% (1)

- Master Budgeting: June July August September October Third QuarterDocument10 pagesMaster Budgeting: June July August September October Third QuarterЭниЭ.No ratings yet

- Financial Performance of Titas GasDocument60 pagesFinancial Performance of Titas GasRiad-us Salehin100% (1)

- P.O.a Jan 2001 Paper 2Document10 pagesP.O.a Jan 2001 Paper 2Jerilee SoCute WattsNo ratings yet

- Market Cap, Large-Cap, Mid-Cap, Small-Cap DefinedDocument1 pageMarket Cap, Large-Cap, Mid-Cap, Small-Cap DefinedShitanshu YadavNo ratings yet

- FAR04-13.2 - SBPT BVPS EPS - RevisedDocument12 pagesFAR04-13.2 - SBPT BVPS EPS - RevisedAi NatangcopNo ratings yet

- Tim HortonsDocument194 pagesTim HortonsShashank Vatsavai100% (2)

- Corporate records inspection rights (S74, S75Document9 pagesCorporate records inspection rights (S74, S75Duke SucgangNo ratings yet

- Audit stockholders' equity problemsDocument7 pagesAudit stockholders' equity problemsLizette Oliva80% (5)

- 7918final Adv Acc Nov06Document20 pages7918final Adv Acc Nov06ஆக்ஞா கிருஷ்ணா ஷர்மாNo ratings yet

- SBI Priject Working Capital ManagementDocument58 pagesSBI Priject Working Capital Managementarijit242282% (76)

- Valix Vol. 3 2014 edition problem analysisDocument10 pagesValix Vol. 3 2014 edition problem analysisJenyl Mae NobleNo ratings yet

- Report Assignment Fundemantal - Versus - Technical AnalysisDocument18 pagesReport Assignment Fundemantal - Versus - Technical AnalysisaykamalNo ratings yet

- Question Bank Tax Planning Unit - I: I Test Your Skills: (A) State Whether The Following Statements Are True or FalseDocument69 pagesQuestion Bank Tax Planning Unit - I: I Test Your Skills: (A) State Whether The Following Statements Are True or Falselakshit_gupta100% (1)

- Hotel and Restaurant at Blue Nile FallsDocument26 pagesHotel and Restaurant at Blue Nile Fallsbig johnNo ratings yet

- Instruction: Shade The Letter of Your Choice in The Answer Sheet Provided. No Erasures AllowedDocument6 pagesInstruction: Shade The Letter of Your Choice in The Answer Sheet Provided. No Erasures AllowedmarygraceomacNo ratings yet

- Chapter 7 - Homework & Solution: Answers To QuestionsDocument15 pagesChapter 7 - Homework & Solution: Answers To QuestionsSumera SarwarNo ratings yet