Professional Documents

Culture Documents

Remarks

Uploaded by

alibuxjatoiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Remarks

Uploaded by

alibuxjatoiCopyright:

Available Formats

Initially we took ten companies as follows

And we allocated the equal percentage of portfolio investment in each company our portfolio

parameters were as follows:

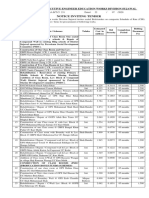

After Running Solver, Excel suggested following allocation percentage of portfolio investment on

stocks

composition of stocks and parameters of portfolio ware as follows

As it is clear from the result that Return per unit risk improved from 1.89 to 2.28 and Risk of Portfolio

increased from 10.25 to 11.25 and Portfolio Monthly greatly increased from 19% to 26%.

We took out some companies from portfolio as suggested by solver and replaced them with other

good stocks as follows:

And portfolio parameters are as follows:

As we can see that we have improved the Return per unit risk (from 2.28 to 2.47) and Risk has

markedly decreased from 11.58% to 9.48% that means our portfolio is now less risky than earlier but

in order to optimize profit of portfolio we run the solver to see the improvement by efficient

allocation of investment money on stocks and we got the following results

And the parameters of portfolio are as follows.

As it is clear from results that the return per unit risk has markedly improved from 2.47 to 3.13 and

Risk of Portfolio is decreased from 9.84% to 9.49% while return has jumped from 24% to 30% which

is very good return for our portfolio and if we continuously adjust our portfolio by replacing

companies we will get maximum return that no one can think about.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Annual Procurement Plan 2020-21.Document7 pagesAnnual Procurement Plan 2020-21.alibuxjatoiNo ratings yet

- A Review and Study On Stabilization of Expansive Soil Using Brick DustDocument8 pagesA Review and Study On Stabilization of Expansive Soil Using Brick DustalibuxjatoiNo ratings yet

- Use of Brick Dust and Fly Ash As A Soil Stabilizer: November 2019Document5 pagesUse of Brick Dust and Fly Ash As A Soil Stabilizer: November 2019alibuxjatoiNo ratings yet

- Determinants of Profitability of Islamic Banks, A Case Study of PakistanDocument15 pagesDeterminants of Profitability of Islamic Banks, A Case Study of PakistanalibuxjatoiNo ratings yet

- Effect of Marble Dust and Burnt Brick DuDocument3 pagesEffect of Marble Dust and Burnt Brick DualibuxjatoiNo ratings yet

- Ber PDFDocument1 pageBer PDFalibuxjatoiNo ratings yet

- 10 Companies Detail Before SolverDocument72 pages10 Companies Detail Before SolveralibuxjatoiNo ratings yet

- Types of RainfallDocument2 pagesTypes of RainfallalibuxjatoiNo ratings yet

- Attendance Sheets Technical & FinancialDocument4 pagesAttendance Sheets Technical & FinancialalibuxjatoiNo ratings yet

- What Do You Know About Pavement Design and Its Types? Also Differentiate Between Flexible and Rigid PavementDocument5 pagesWhat Do You Know About Pavement Design and Its Types? Also Differentiate Between Flexible and Rigid PavementalibuxjatoiNo ratings yet

- PAVEMENTS Design Course OutlineDocument2 pagesPAVEMENTS Design Course OutlinealibuxjatoiNo ratings yet

- Steel Properties: Engr: Muhammad Yasir Samoo BE Civil MUET JamshoroDocument10 pagesSteel Properties: Engr: Muhammad Yasir Samoo BE Civil MUET JamshoroalibuxjatoiNo ratings yet

- What Is A 'Mean-Variance Analysis'Document2 pagesWhat Is A 'Mean-Variance Analysis'alibuxjatoiNo ratings yet

- Sukkur Municipal Corporation: (Notice For Inviting Tender)Document1 pageSukkur Municipal Corporation: (Notice For Inviting Tender)alibuxjatoiNo ratings yet

- Notice Inviting Tender: Office of The Executive Engineer Education Works Division SujawalDocument4 pagesNotice Inviting Tender: Office of The Executive Engineer Education Works Division SujawalalibuxjatoiNo ratings yet

- General Abstract PDFDocument8 pagesGeneral Abstract PDFalibuxjatoiNo ratings yet

- Banks Investment in Govt Securities Rises To Rs6.33trDocument2 pagesBanks Investment in Govt Securities Rises To Rs6.33tralibuxjatoiNo ratings yet