Professional Documents

Culture Documents

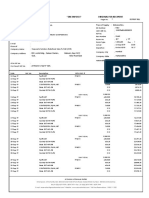

Tax Invoice: House No. 93B, Wagholi, Amravati Gstin/Uin: 27BRWPC9032L1Z6 State Name: Maharashtra, Code: 27

Uploaded by

Masy1210 ratings0% found this document useful (0 votes)

112 views1 pageOriginal Title

Sahil Bill

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

112 views1 pageTax Invoice: House No. 93B, Wagholi, Amravati Gstin/Uin: 27BRWPC9032L1Z6 State Name: Maharashtra, Code: 27

Uploaded by

Masy121Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

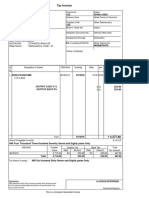

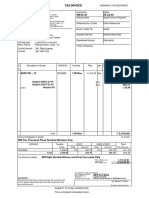

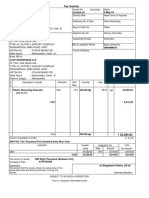

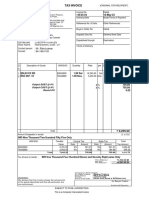

TAX INVOICE

SAHIL ENTERPRISES Invoice No. Dated

Shop No. H-16, Ground Floor 065 1-Apr-2019

Bharat Lokhand Bazar

Parshuram Pupala Marg Delivery Note Mode/Terms of Payment

Mumbai - 400008

GSTIN/UIN: 27AOBPK2462H1Z3

State Name : Maharashtra, Code : 27 Supplier's Ref. Other Reference(s)

Contact : 9821245669

E-Mail : sahilenterprise19@gmail.com 065

Buyer Buyer's Order No. Dated

Zyabulal Yashvant Chavhan

House No. 93B, Wagholi, Amravati Despatch Document No. Delivery Note Date

GSTIN/UIN : 27BRWPC9032L1Z6

State Name : Maharashtra, Code : 27 Despatched through Destination

Bill of Lading/LR-RR No. Motor Vehicle No.

MH-43-Y5332

Terms of Delivery

Sl Description of Goods HSN/SAC Quantity Rate per Amount

No.

1 Wooden Furniture 9403 51.00 Nos 823.53 Nos 42,000.00

Output CGST @ 9 % 9 % 3,780.00

Output SGST @ 9 % 9 % 3,780.00

Total 51.00 Nos ₹ 49,560.00

Amount Chargeable (in words) E. & O.E

INR Forty Nine Thousand Five Hundred Sixty Only

HSN/SAC Taxable Central Tax State Tax Total

Value Rate Amount Rate Amount Tax Amount

9403 42,000.00 9% 3,780.00 9% 3,780.00 7,560.00

Total 42,000.00 3,780.00 3,780.00 7,560.00

Tax Amount (in words) : INR Seven Thousand Five Hundred Sixty Only

Declaration

We declare that this invoice shows the actual price of the

goods described and that all particulars are true and

correct.

SUBJECT TO MUMBAI JURISDICTION

This is a Computer Generated Invoice

You might also like

- Api 107Document1 pageApi 107Abhishek IndraleNo ratings yet

- Invoice 114Document1 pageInvoice 114bshari93_918887308No ratings yet

- Babar - Dna JunDocument1 pageBabar - Dna JunAbhijeetNo ratings yet

- Invoice: APS University Road Rewa Gstin/Uin: 23AABAR8770L1Z4 State Name: Madhya Pradesh, Code: 23Document1 pageInvoice: APS University Road Rewa Gstin/Uin: 23AABAR8770L1Z4 State Name: Madhya Pradesh, Code: 23Kamta Prasad PatelNo ratings yet

- Accounting VoucherDocument1 pageAccounting Voucherramzanahmad14No ratings yet

- Tax Invoice: (Duplicate For Transporter)Document1 pageTax Invoice: (Duplicate For Transporter)BisheshNo ratings yet

- 087 PDFDocument1 page087 PDFKaran ParekhNo ratings yet

- 35 Unit1128.invDocument4 pages35 Unit1128.invLaxmikant JoshiNo ratings yet

- Tax Invoice: Vsat Refurb Solutions Pvt. LTD 2023-24/10048 30-Jan-24Document1 pageTax Invoice: Vsat Refurb Solutions Pvt. LTD 2023-24/10048 30-Jan-24Lavanye ManchandaNo ratings yet

- KentDocument1 pageKentSunil PatelNo ratings yet

- Accounting Voucher DisplayDocument1 pageAccounting Voucher DisplayASHISH VARNWALNo ratings yet

- NAKODADocument1 pageNAKODAtaxsachin16No ratings yet

- LUCKYDocument1 pageLUCKYkishan computerNo ratings yet

- Babar - Dna - Wifi - Jan-May 2022Document1 pageBabar - Dna - Wifi - Jan-May 2022AbhijeetNo ratings yet

- Api 122Document1 pageApi 122Abhishek IndraleNo ratings yet

- Api 120Document1 pageApi 120Abhishek IndraleNo ratings yet

- PDF&Rendition 1Document1 pagePDF&Rendition 1SATISH SONDHINo ratings yet

- Tax Invoice DetailsDocument1 pageTax Invoice DetailsSANJAY PRAKASHNo ratings yet

- Tax Invoice for Rolling ChairDocument2 pagesTax Invoice for Rolling Chair20MA32 - PRABAVATHI TNo ratings yet

- Babar - Dna JunDocument1 pageBabar - Dna JunAbhijeetNo ratings yet

- 10th PassDocument1 page10th PassDigital Seva KendraNo ratings yet

- Shree Chenaramjee Fancy Electric & Hardware Store: CGST SGSTDocument1 pageShree Chenaramjee Fancy Electric & Hardware Store: CGST SGSTDr. Shashank RkNo ratings yet

- Assemble 6-8Document1 pageAssemble 6-8ok okNo ratings yet

- Final InvoiceDocument1 pageFinal InvoiceVivek SugandhiNo ratings yet

- PDFDocument1 pagePDFdhunniNo ratings yet

- 76Document1 page76rakesh.kumar.76icicibankNo ratings yet

- Vaishali Dna Wifi 2021Document1 pageVaishali Dna Wifi 2021AbhijeetNo ratings yet

- Tri 18Document1 pageTri 18amitkv7No ratings yet

- Api 127Document1 pageApi 127Abhishek IndraleNo ratings yet

- Babar DnaDocument1 pageBabar DnaAbhijeetNo ratings yet

- Tax Invoice: State Name: Gujarat, Code: 24Document1 pageTax Invoice: State Name: Gujarat, Code: 24jayshah_26No ratings yet

- Sky Agro 449Document1 pageSky Agro 449Pranil RathodNo ratings yet

- Adobe Scan 29 Jul 2021Document1 pageAdobe Scan 29 Jul 2021VALATHOTTIC KUTTAPATA SAJINo ratings yet

- Tax invoice detailsDocument1 pageTax invoice detailsParth DamaNo ratings yet

- 1 MergedDocument11 pages1 Mergedhimalaya.2343No ratings yet

- Saddam ShaikhDocument1 pageSaddam ShaikhSaddam ShaikhNo ratings yet

- Swaroop Enterprises 11.02.2019Document2 pagesSwaroop Enterprises 11.02.2019Sunil AlandNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherPapia ChandaNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherSomesh chandraNo ratings yet

- 11 Nityam Creations LLPDocument1 page11 Nityam Creations LLPheebaairsystemlgNo ratings yet

- Tax Invoice: Easymix Concrete Solution 1 1-Feb-2023Document1 pageTax Invoice: Easymix Concrete Solution 1 1-Feb-2023amit chouguleNo ratings yet

- Tax Invoice: Naman Traders 389/23-24 25-Jul-23Document2 pagesTax Invoice: Naman Traders 389/23-24 25-Jul-23rahulpawar4725No ratings yet

- Tax Invoice: Bhagyalaxmi Plastics (23-24) 30/2023-24 3-May-23Document1 pageTax Invoice: Bhagyalaxmi Plastics (23-24) 30/2023-24 3-May-23Avinash TiwariNo ratings yet

- Accounting Voucher RajeshreeDocument1 pageAccounting Voucher Rajeshree01shreyaNo ratings yet

- SpymDocument1 pageSpymVishal KumarNo ratings yet

- Drill MachineDocument1 pageDrill Machineranjitghosh684No ratings yet

- Sale Bill 081Document2 pagesSale Bill 081Nilesh PatilNo ratings yet

- Tax Invoice: Description of Goods Amount Per Rate Quantity Hsn/SacDocument1 pageTax Invoice: Description of Goods Amount Per Rate Quantity Hsn/Sacanshagrawal0000No ratings yet

- 0068 NehaDocument1 page0068 Nehang.neha8990No ratings yet

- RzMrc3RPZUpmeGVUZUU5NnJyaUZTUT09 Seller Tax InvoiceDocument1 pageRzMrc3RPZUpmeGVUZUU5NnJyaUZTUT09 Seller Tax InvoicePratyush kumar NayakNo ratings yet

- Suntech Power2Document1 pageSuntech Power2Nomaan KhanNo ratings yet

- Barrel Motors PVT LTD Invoice SEPT 22Document1 pageBarrel Motors PVT LTD Invoice SEPT 22Priyadarshan BanjanNo ratings yet

- Proforma Invoice for Hard Disk PurchaseDocument2 pagesProforma Invoice for Hard Disk Purchasesanjib RNo ratings yet

- Sidd Hes War 2604Document1 pageSidd Hes War 2604vishalNo ratings yet

- GST Invoice FormatDocument17 pagesGST Invoice FormatSeetharam shanmugamNo ratings yet

- UntitDocument1 pageUntitVaijnathNo ratings yet

- Tax Invoice: Naman Traders 145/23-24 12-May-23Document2 pagesTax Invoice: Naman Traders 145/23-24 12-May-23rahulpawar4725No ratings yet

- TAX INVOICEDocument1 pageTAX INVOICEAnjani KumariNo ratings yet

- HightDocument1 pageHightjaikant.hccNo ratings yet

- West Wing Assets ListDocument20 pagesWest Wing Assets ListMasy121No ratings yet

- West Wing Assets ListDocument21 pagesWest Wing Assets ListMasy121No ratings yet

- Alfa ReadingDocument1 pageAlfa ReadingMasy121No ratings yet

- West Wing Assets ListDocument21 pagesWest Wing Assets ListMasy121No ratings yet

- DCB BANK - Monthly Consolidated StatementDocument2 pagesDCB BANK - Monthly Consolidated StatementMasy121No ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument14 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceMasy121No ratings yet

- Introduction of Banking SystemDocument10 pagesIntroduction of Banking SystemMasy1210% (1)

- Introduction of Banking SystemDocument10 pagesIntroduction of Banking SystemMasy1210% (1)

- 05 Chapter 2Document123 pages05 Chapter 2Masy121No ratings yet

- Finance Intern Seeks OpportunityDocument2 pagesFinance Intern Seeks OpportunityMasy121No ratings yet

- Resume FormatDocument2 pagesResume FormatMasy121No ratings yet

- Finance Intern Seeks OpportunityDocument2 pagesFinance Intern Seeks OpportunityMasy121No ratings yet

- BondsDocument18 pagesBondsMasy121No ratings yet

- Resume FormatDocument2 pagesResume FormatMasy121No ratings yet

- Resume FormatDocument2 pagesResume FormatMasy121No ratings yet

- Assessment Finance TutorialsDocument2 pagesAssessment Finance TutorialsMasy121No ratings yet

- Cost Leadership Strategy: Mehul Rasadiya Ms. Brinda RaychaDocument46 pagesCost Leadership Strategy: Mehul Rasadiya Ms. Brinda RaychaMasy121No ratings yet

- Rent ReceiptDocument1 pageRent Receiptbathyal28% (43)

- Hotel BillDocument3 pagesHotel BillAbbas FakhruddinNo ratings yet

- Commissioner of Internal Revenue V. Sony Philippines. Inc. G.R. No. 178697, November 17, 2010 FactsDocument2 pagesCommissioner of Internal Revenue V. Sony Philippines. Inc. G.R. No. 178697, November 17, 2010 FactsBrent TorresNo ratings yet

- Inr014298 53291001Document2 pagesInr014298 53291001NARASIMHS MURTHYNo ratings yet

- Residence in IndiaDocument7 pagesResidence in IndiaSuryaNo ratings yet

- Form 12BB tax deductionsDocument2 pagesForm 12BB tax deductionsMayank JainNo ratings yet

- Form 16 SummaryDocument7 pagesForm 16 SummaryMithlesh SharmaNo ratings yet

- This Is To Certify That The Following Payments Have Been Made Under Life Insurance Policies Held byDocument1 pageThis Is To Certify That The Following Payments Have Been Made Under Life Insurance Policies Held byDeepak ShrigadiNo ratings yet

- US Internal Revenue Service: n-03-59Document2 pagesUS Internal Revenue Service: n-03-59IRSNo ratings yet

- Agreeya Solutions (India) Private Limited: Earnings DeductionsDocument1 pageAgreeya Solutions (India) Private Limited: Earnings DeductionsGirnar studioNo ratings yet

- Solved You Are The Tax Manager in A Cpa Office OneDocument1 pageSolved You Are The Tax Manager in A Cpa Office OneAnbu jaromiaNo ratings yet

- VDH - 01 - Overview Intern - Taxation - 20200509Document7 pagesVDH - 01 - Overview Intern - Taxation - 20200509Gökhan OğuzNo ratings yet

- Skripsi Khairunisa Armstrong (Inggris)Document47 pagesSkripsi Khairunisa Armstrong (Inggris)CharlotteNo ratings yet

- Determination of Annual ValueDocument4 pagesDetermination of Annual ValueStudy AllyNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Mahesh KhairnarNo ratings yet

- BCTA UJ Question PaperDocument10 pagesBCTA UJ Question PaperFresh LoverzzNo ratings yet

- Gging TagDocument14 pagesGging TagCaroline DonaldsonNo ratings yet

- Tax Treaties: Minimum StandardDocument2 pagesTax Treaties: Minimum StandardANDREANo ratings yet

- Order Receipt Tracking Number 9400111108400006892471Document1 pageOrder Receipt Tracking Number 9400111108400006892471Ramazan nurNo ratings yet

- ISACA 2023 Invoice PDFDocument6 pagesISACA 2023 Invoice PDFSatish Kumar Reddy ByreddyNo ratings yet

- 1601C GuidelinesDocument1 page1601C GuidelinesfatmaaleahNo ratings yet

- Mileage Allowance Rates 2011Document2 pagesMileage Allowance Rates 2011Fuzzy_Wood_PersonNo ratings yet

- Ca De-4Document4 pagesCa De-4Kevin Marcos FelicianoNo ratings yet

- CIR vs. Burroghs, G.R. No. 66653, June 19, 1986Document1 pageCIR vs. Burroghs, G.R. No. 66653, June 19, 1986Oro ChamberNo ratings yet

- BSLR Del 1600447723 1 1Document1 pageBSLR Del 1600447723 1 1AdityaNo ratings yet

- Government remedies for collecting income taxDocument2 pagesGovernment remedies for collecting income taxJoseph Eric NardoNo ratings yet

- Contact KRA for Tax Questions and PIN Certificate DetailsDocument1 pageContact KRA for Tax Questions and PIN Certificate Detailsmike kiroreNo ratings yet

- Income Statement Garuda IndonesiaDocument4 pagesIncome Statement Garuda IndonesiakanianabilaNo ratings yet

- Problem Solutions - Taxation (Buckwold 2016-2017)Document142 pagesProblem Solutions - Taxation (Buckwold 2016-2017)Raquel Vandermeulen73% (11)

- Bill Berry Is The Lead Audit Partner and The ManagingDocument1 pageBill Berry Is The Lead Audit Partner and The ManagingMuhammad ShahidNo ratings yet