Professional Documents

Culture Documents

Agreeya Solutions (India) Private Limited: Earnings Deductions

Uploaded by

Girnar studioOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Agreeya Solutions (India) Private Limited: Earnings Deductions

Uploaded by

Girnar studioCopyright:

Available Formats

4/7/22, 4:25 PM Intelligent Pay Ver. 6.

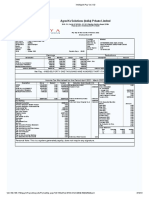

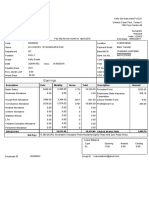

AgreeYa Solutions (India) Private Limited

B-38, C-2, Sector 57,NOIDA - 201 301

(Gautam Buddha Nagar) [Uttar

Pradesh]

CIN: U72300DL2003PTC118299

Pay Slip for the month of March 2022

All amounts in INR

Emp Code : IN-51062 Location : Mumbai

Emp Name : Pravin Dnyaneshwar Patil Bank/MICR :

Department : Staffing Bank A/c No. : 33756595855 (State Bank of India)

Designation : Java Developer Company : AgreeYa Solutions (India) Private Limited

Grade : E-1 PAN : FAZPS4344E

Segment : N/A Arrear Day(s) : 0.00

Gender : Male PF UAN : 101491631337

DOB : 19 Mar 1992 Payable Days :31.00

Earnings Deductions

Description Rate Monthly Arrear Total Description Amount

BASIC 18333.00 18333.00 0.00 18333.00 PF 1800.00

HRA 9167.00 9167.00 0.00 9167.00 PROF. TAX 200.00

SPECIAL ALLOWANCE 13683.00 13683.00 0.00 13683.00

Conveyance Allowance 1600.00 1600.00 0.00 1600.00

Medical Reimbursement 1250.00 1250.00 0.00 1250.00

GROSS EARNINGS 44033.00 44033.00 0.00 44033.00 GROSS DEDUCTIONS 2000.00

Net Pay : 42033.00 (FORTY TWO THOUSAND THIRTY THREE ONLY)

Income Tax Worksheet for the Period April 2021 - March 2022

Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA Calculation(Non-Metro)

BASIC 219405.00 0.00 219405.00 Investments u/s 80C Rent Paid 0.00

HRA 109708.00 0.00 109708.00 Provident Fund 21600.00 From: 01/04/2021

SPECIAL ALLOWANCE 163755.00 0.00 163755.00 To: 31/03/2022

Conveyance Allowance 19148.00 0.00 19148.00 1. Actual HRA 0.00

Medical Reimbursement 14960.00 0.00 14960.00 2. 40% or 50% of Basic 0.00

3. Rent > 10% Basic 0.00

Least of above is exempt 0.00

Taxable HRA 109708.00

Gross 526976.00 0.00 526976.00 Total Investments u/s 80C 21600.00

Tax Working U/S 80C 21600.00

Total Ded Under Chapter VI-A 21600.00 TDS Deducted Monthly

Standard Deduction 50000.00 Month Amount

Previous Employer Taxable Income 0.00

April-2021 0.00

Previous Employer Professional Tax 0.00 May-2021 0.00

Professional Tax 2500.00 June-2021 0.00

Under Chapter VI-A 21600.00 July-2021 0.00

Any Other Income 0.00 August-2021 0.00

Taxable Income 452876.00

September-2021 0.00

Total Tax 10143.80 October-2021 0.00

Tax Rebate u/s 87a 10143.80 November-2021 0.00

Surcharge 0.00 December-2021 0.00

Tax Due 0.00 January-2022 0.00

Educational Cess 0.00

February-2022 0.00

Net Tax 0.00 March-2022 0.00

Tax Deducted (Previous Employer) 0.00 Tax Deducted on Perq. 0.00

Tax Deducted on Perq. 0.00 Total 0.00

Tax Deducted on Any Other Income. 0.00

Tax Deducted Till Date 0.00 Leave Balances

Tax to be Deducted 0.00 Type Opening Availed closing

CL 2.00 0.00 2.00

Tax per month 0.00

Tax on Non-Recurring Earnings 0.00 SL 1.50 0.00 1.50

Tax Deduction for this month 0.00 Total Any Other Income 0.00

Personal Note: This is a system generated payslip, does not require any signature.

122.160.186.178/ipay/CPayroll/reports/PreSalSlip.aspx?id=bde6d493-e766-4ad8-b085-f024467c1bdd 29/253

You might also like

- Cash App Guide SolutionsDocument40 pagesCash App Guide Solutionsmarinemercyasd50% (2)

- SMS0928 - 31 12 2022Document1 pageSMS0928 - 31 12 2022UTF RecordsNo ratings yet

- JIT Inventory ManagementDocument22 pagesJIT Inventory ManagementSharifMahmudNo ratings yet

- November 2019 Cox Bill SummaryDocument2 pagesNovember 2019 Cox Bill SummaryBob TullyNo ratings yet

- Payslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Document1 pagePayslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)SK TECH TRICKSNo ratings yet

- Infogain Solutions settlement statement summaryDocument1 pageInfogain Solutions settlement statement summaryArmaanNo ratings yet

- SalarySlipwithTaxDetails 2021 JuneDocument1 pageSalarySlipwithTaxDetails 2021 JuneSameer KulkarniNo ratings yet

- PI Industries April 2020 Pay SlipDocument1 pagePI Industries April 2020 Pay SlipRahul mishraNo ratings yet

- Director Purchasing Procurement Manager in Oklahoma City OK Resume Jeff AmendDocument3 pagesDirector Purchasing Procurement Manager in Oklahoma City OK Resume Jeff AmendJeffAmendNo ratings yet

- Amara Raja Batteries LimitedDocument1 pageAmara Raja Batteries LimitedNani AnugaNo ratings yet

- IncomeTax Banggawan Ch11Document9 pagesIncomeTax Banggawan Ch11Noreen Ledda33% (9)

- Payslip March 2023Document1 pagePayslip March 2023kaushalNo ratings yet

- Grofers India PVT LTD: Payslip For The Month of APRIL 2021Document1 pageGrofers India PVT LTD: Payslip For The Month of APRIL 2021Anirban GhoshNo ratings yet

- ING Vysya Life Insurance PayslipDocument1 pageING Vysya Life Insurance PayslipHarsh JasaniNo ratings yet

- Pay Slip - 607043 - Jun-22Document1 pagePay Slip - 607043 - Jun-22Supriya KandukuriNo ratings yet

- SalarySlipwithTaxDetails 2021 MayDocument1 pageSalarySlipwithTaxDetails 2021 MaySameer KulkarniNo ratings yet

- 澳洲383797123 Gas bill PDFDocument2 pages澳洲383797123 Gas bill PDFZheng YangNo ratings yet

- PoshmarkDocument13 pagesPoshmarkHitesh SharmaNo ratings yet

- Payslip For The Month of May 2022: VVDN Technologies Private LimitedDocument1 pagePayslip For The Month of May 2022: VVDN Technologies Private LimitedAbinashNo ratings yet

- Subramani PayslipDocument2 pagesSubramani PayslipMr. HarshaNo ratings yet

- Fast, Reliable Medical LogisticsDocument12 pagesFast, Reliable Medical LogisticsrakeshdadhichiNo ratings yet

- IDC Technologies Solutions India Pvt. LTD.: Earnings Deductions Amount AmountDocument1 pageIDC Technologies Solutions India Pvt. LTD.: Earnings Deductions Amount AmountDevipriyaNo ratings yet

- Pay Slip - 604316 - May-22Document1 pagePay Slip - 604316 - May-22ArchanaNo ratings yet

- India Local Monthly130122210312905Document1 pageIndia Local Monthly130122210312905NAGARJUNANo ratings yet

- Newgen 02695Document1 pageNewgen 02695havo lavoNo ratings yet

- Randheer Yadav PayslipDocument1 pageRandheer Yadav Payslippankaj yadavNo ratings yet

- SalarySlipwithTaxDetails Feb-22Document2 pagesSalarySlipwithTaxDetails Feb-22Divyanshu BaghelNo ratings yet

- Mahindra World City April 2022 payslipDocument1 pageMahindra World City April 2022 payslipSidvik InfotechNo ratings yet

- OYO Hotel and Homes Private Limited Pay Slip for August 2022Document2 pagesOYO Hotel and Homes Private Limited Pay Slip for August 2022Vivek ViviNo ratings yet

- Business Account Statement: Account Summary For This PeriodDocument2 pagesBusiness Account Statement: Account Summary For This PeriodBrian TalentoNo ratings yet

- Slip PDFDocument1 pageSlip PDFAnonymous LVfNCfKuNo ratings yet

- Muthoot Microfin LTD: Pay Slip For The Month of Apr2022Document2 pagesMuthoot Microfin LTD: Pay Slip For The Month of Apr2022MANIKANDAN ANANTHARAJANNo ratings yet

- RSPL Limited: Payslip For The Month of JUNE 2021Document1 pageRSPL Limited: Payslip For The Month of JUNE 2021Manju ManjappaNo ratings yet

- Chola Business Services Pay SlipDocument3 pagesChola Business Services Pay SlipsathyaNo ratings yet

- M/S Venkata Praneeth Developers Pvt. LTD.: Pay Slip For The Month of April - 2022Document1 pageM/S Venkata Praneeth Developers Pvt. LTD.: Pay Slip For The Month of April - 2022Rahul GuptaNo ratings yet

- Earnings Deductions: Eicher Motors LimitedDocument1 pageEarnings Deductions: Eicher Motors LimitedBarath BiberNo ratings yet

- FUTURE RETAIL PAYSLIPDocument2 pagesFUTURE RETAIL PAYSLIPN Quinton SinghNo ratings yet

- Offer Letter-Ramesh-RathodDocument2 pagesOffer Letter-Ramesh-RathodGirnar studioNo ratings yet

- Altruist Technologies Pvt. LTD.: Personal DetailsDocument1 pageAltruist Technologies Pvt. LTD.: Personal DetailsDeepak kumar M R100% (1)

- Payslip For The Month of November 2020: Cms It Services Private LimitedDocument2 pagesPayslip For The Month of November 2020: Cms It Services Private LimitedKrishna AryanNo ratings yet

- Project Report of MBA On Taxation - 309668020Document69 pagesProject Report of MBA On Taxation - 309668020Shashank Kurakula0% (1)

- Agreeya Solutions (India) Private Limited: Earnings DeductionsDocument1 pageAgreeya Solutions (India) Private Limited: Earnings DeductionsGirnar studioNo ratings yet

- India Local Monthly130122210312905Document1 pageIndia Local Monthly130122210312905NAGARJUNANo ratings yet

- V-Mart Retail Limited: Sangam Kumar Singh Sales ManagerDocument1 pageV-Mart Retail Limited: Sangam Kumar Singh Sales Managerdipakk21051994No ratings yet

- V-Mart Retail Limited: Earnings DeductionsDocument1 pageV-Mart Retail Limited: Earnings Deductionsdipakk21051994No ratings yet

- SalarySlipwithTaxDetailsDocument2 pagesSalarySlipwithTaxDetailsIndian LegendNo ratings yet

- 00331686_SalarySlipwithTaxDetails (10)Document1 page00331686_SalarySlipwithTaxDetails (10)Nilesh GopnarayanNo ratings yet

- SalarySlipwithTaxDetailsDocument2 pagesSalarySlipwithTaxDetailsIndian LegendNo ratings yet

- Payslip For The Month of Jan 2024: 6th Floor, Garage Society, BPTP Centra One, Sector-61, GurugramDocument1 pagePayslip For The Month of Jan 2024: 6th Floor, Garage Society, BPTP Centra One, Sector-61, Gurugramps384077No ratings yet

- Matrimony.Com Limited Pay Slip for October 2021Document1 pageMatrimony.Com Limited Pay Slip for October 2021Kiran NoraNo ratings yet

- Salary SlipDocument1 pageSalary Slipsaini starNo ratings yet

- AllInOne-638196844886179135 00254365Document1 pageAllInOne-638196844886179135 00254365dir.office.sgearNo ratings yet

- Payslip For The Month of May 2021: 16 Iris House Business Centre Nangal Raya New Delhi 110046Document1 pagePayslip For The Month of May 2021: 16 Iris House Business Centre Nangal Raya New Delhi 110046Manisha ThakurNo ratings yet

- Salary Sep.20 SlipDocument1 pageSalary Sep.20 Slipkedarnath jaiswalNo ratings yet

- SettlementReportDocument1 pageSettlementReportSarath KumarNo ratings yet

- EmployeeData Oct (2)Document2 pagesEmployeeData Oct (2)Ankit SinghNo ratings yet

- DownloadDocument1 pageDownloadAnimesh JenaNo ratings yet

- IN-1203 Salary MARCH2023Document1 pageIN-1203 Salary MARCH2023Habibur KhanNo ratings yet

- AllInOne-636929264608099960 00208843 PDFDocument1 pageAllInOne-636929264608099960 00208843 PDFKosuru SankarNo ratings yet

- MarchDocument1 pageMarchx62bzy8pktNo ratings yet

- Payslip Sep2023Document2 pagesPayslip Sep2023ALINo ratings yet

- EmployeeData JulyDocument2 pagesEmployeeData Julyankit singhrajNo ratings yet

- IN-1203 Salary APRIL2023Document1 pageIN-1203 Salary APRIL2023Habibur KhanNo ratings yet

- Jan PayslipDocument1 pageJan PayslipSidvik InfotechNo ratings yet

- RPT Pay Slip NIIT1Document1 pageRPT Pay Slip NIIT1kingnilay9831No ratings yet

- Oct 22Document1 pageOct 22manishcool981No ratings yet

- OctoberDocument1 pageOctoberrobertssuccess123No ratings yet

- KM PL 77965202309Document1 pageKM PL 77965202309DEVADATTA B KOTENo ratings yet

- G29206Document1 pageG29206Iyanar ANo ratings yet

- Miss Mitali Rathore: in Words: INR Sixty Six Thousand Four Hundred Seventy Five OnlyDocument1 pageMiss Mitali Rathore: in Words: INR Sixty Six Thousand Four Hundred Seventy Five OnlyMitali RathoreNo ratings yet

- Right to Work?: Assessing India's Employment Guarantee Scheme in BiharFrom EverandRight to Work?: Assessing India's Employment Guarantee Scheme in BiharNo ratings yet

- Builtability Private Limited: Payslip For The Month of May 2022Document1 pageBuiltability Private Limited: Payslip For The Month of May 2022Girnar studioNo ratings yet

- Division:AURANGABAD: 30 Health & Physical Education (Grade)Document1 pageDivision:AURANGABAD: 30 Health & Physical Education (Grade)Girnar studioNo ratings yet

- Ramesh Rathod ResumeDocument2 pagesRamesh Rathod ResumeGirnar studioNo ratings yet

- Agreeya Solutions (India) Private Limited: Earnings DeductionsDocument1 pageAgreeya Solutions (India) Private Limited: Earnings DeductionsGirnar studioNo ratings yet

- TSTRANSCO Department Tests NotificationDocument9 pagesTSTRANSCO Department Tests NotificationsalauddinNo ratings yet

- RRC UK Enrolment Form: ABA Business Center, Office No.: 1204, "Papa Gjon Pali II" Street, Tirana, AlbaniaDocument4 pagesRRC UK Enrolment Form: ABA Business Center, Office No.: 1204, "Papa Gjon Pali II" Street, Tirana, AlbaniaEdmond KeraNo ratings yet

- Taxation: Md. Kamrul Hasan ShovonDocument15 pagesTaxation: Md. Kamrul Hasan ShovonMaruf KhanNo ratings yet

- Tally Spss PDFDocument42 pagesTally Spss PDFAkshay PoplyNo ratings yet

- SS and SSS Chap 01 To 10 (2019)Document263 pagesSS and SSS Chap 01 To 10 (2019)lavpreetpannuNo ratings yet

- Important: Please See Notes Overleaf Before Filling UpDocument3 pagesImportant: Please See Notes Overleaf Before Filling UpgalorebayNo ratings yet

- Fatima's Receipt PDFDocument2 pagesFatima's Receipt PDFFaraz NaqviNo ratings yet

- D-8 - Property Tax-Payment Receipt - 2021-22Document1 pageD-8 - Property Tax-Payment Receipt - 2021-22Raviraj BankarNo ratings yet

- Reliance Retail LimitedDocument2 pagesReliance Retail LimitedKarna Satish KumarNo ratings yet

- Digital Payment Methods in IndiaDocument71 pagesDigital Payment Methods in Indiavinayak tiwariNo ratings yet

- WCTR2010 - Sessions - at - A - GlanceDocument63 pagesWCTR2010 - Sessions - at - A - GlanceqwertycrewNo ratings yet

- Statement of Account Half YearlyDocument4 pagesStatement of Account Half Yearlyhamza najam100% (1)

- Guidelines For Filling Customer Master Template: Field NameDocument1,048 pagesGuidelines For Filling Customer Master Template: Field Namealokrai1638No ratings yet

- XDocument2 pagesXSophiaFrancescaEspinosaNo ratings yet

- Coa Untuk MyobDocument24 pagesCoa Untuk MyobM AlfiansyahNo ratings yet

- VATDocument3 pagesVATkisakye simonNo ratings yet

- Bill Detail SABERDocument1 pageBill Detail SABERHARINo ratings yet

- Night Audit ReportDocument13 pagesNight Audit Reportsudi balakrishnaNo ratings yet

- Accounts Receivable and Payable Journal EntriesDocument9 pagesAccounts Receivable and Payable Journal Entriesemman neriNo ratings yet

- Challan FormDocument1 pageChallan FormMasroor KhanNo ratings yet