Professional Documents

Culture Documents

SalarySlipwithTaxDetails 2021 June

Uploaded by

Sameer KulkarniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SalarySlipwithTaxDetails 2021 June

Uploaded by

Sameer KulkarniCopyright:

Available Formats

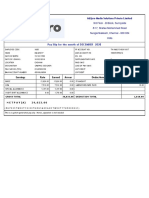

ADITYA BIRLA FASHION AND RETAIL LIMITED

,-

Pay Slip for the month of June 2021

All amounts in INR

Location : Nanded

Emp Code : 367034 IFSC Code : UTIB0001371

Emp Name : Sameer Surendra Kulkarni Bank A/c No. : 919010072218817 (AXIS BANK)

D e s i g n a t i o n: Coordinator PAN : HEIPK0868F

DOB : 18 Jun 1997 DOJ : 11 Nov 2019 Payable Days : 30.0 PF No. : KDMAL02155190000037929

Total Days : 30.0 A r r e a r D a y ( s ): 0.0 PF UAN. : 101537978790

ESI No. : 2503887684

G r o u p D a t e o f J o i n i n g: 11 Nov 2019

Earnings Deductions

Description Rate Monthly Arrear Total Description Amount

Basic 7429.00 7429.00 0.00 7429.00 PF 1534.00

HRA 2972.00 2972.00 0.00 2972.00 ESI 119.00

ADHOC Allowance 5356.00 5356.00 0.00 5356.00 PROF. TAX 200.00

Cash Risk Allowance 200.00 0.00 200.00 ELWF 12.00

GROSS EARNINGS 15757.00 15957.00 0.00 15957.00 GROSS DEDUCTIONS 1865.00

Net Pay : 14092.00 (FOURTEEN THOUSAND NINETY TWO ONLY)

Income Tax Worksheet for the Period April 2021 - March 2022

*You have opted tax option with investment

Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA Calculation( N o n - M e t r o )

Basic 89148.00 0.00 89148.00 Investments u/s 80C Rent Paid 0.00

HRA 35664.00 0.00 35664.00 Provident Fund 18410.00 From: 01/04/2021

ADHOC Allowance 64272.00 0.00 64272.00 To: 31/03/2022

Cash Risk Allowance 400.00 0.00 400.00 1. Actual HRA 35664.00

2. 40% or 50% of Basic 35659.00

3. Rent - 10% Basic 0.00

Least of above is exempt 0.00

Gross 189484.00 0.00 189484.00 Total Investments u/s 80C 18410.00 Taxable HRA 35664.00

Tax Working U/S 80C 18410.00

Standard Deduction 50000.00 T o t a l D e d U n d e r C h a p t e r V I - A 18410.00

Previous Employer Taxable Income 0.00 TDS Deducted Monthly

Previous Employer Professional Tax 0 Month Amount

Professional Tax 2500 April-2021 0.00

Under Chapter VI-A 18410.00 May-2021 0.00

Any Other Income 0.00 June-2021 0.00

Taxable Income 118580.00 Tax Deducted on Perq. 0.00

Total Tax 0.00 Total 0.00

Tax Rebate u/s 87a 0.00

Surcharge 0.00

Tax Due 0.00

Health and Education Cess 0.00

Net Tax 0.00

Tax Deducted (Previous Employer) 0.00

Tax Deducted on Perq. 0.00

Tax Deducted on Any Other Income. 0.00

Tax Deducted Till Date 0.00

Tax to be Deducted 0.00

Tax per month 0.00

Tax on Non-Recurring Earnings 0.00 Total Any Other Income

Tax Deduction for this month 0.00

Disclaimer: This is a system generated payslip, does not require any signature.

You might also like

- Payroll Insights - Farsight IT SolutionsDocument1 pagePayroll Insights - Farsight IT SolutionsyogeshNo ratings yet

- Payslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Document1 pagePayslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)SK TECH TRICKSNo ratings yet

- Sampangi Sowbhagya (POL11622)Document1 pageSampangi Sowbhagya (POL11622)Sowbhagya VaderaNo ratings yet

- Pay Slip - 604316 - Feb-23Document1 pagePay Slip - 604316 - Feb-23ArchanaNo ratings yet

- Manpreet Kaur: EligibilityDocument1 pageManpreet Kaur: EligibilityRajesh KumarNo ratings yet

- Payslip - May - 2020 PDFDocument1 pagePayslip - May - 2020 PDFchanduNo ratings yet

- Pay Slip - 604316 - Jul-23Document1 pagePay Slip - 604316 - Jul-23ArchanaNo ratings yet

- Payslip For The Month of March 2015 Earnings DeductionsDocument1 pagePayslip For The Month of March 2015 Earnings Deductionsmadhusudhan N RNo ratings yet

- Dec07 PDFDocument1 pageDec07 PDFomkassNo ratings yet

- Sify Technologies payslip title for Vinod Kumar BoseDocument1 pageSify Technologies payslip title for Vinod Kumar BoseJOOOOONo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountAmrit RajNo ratings yet

- STEAG Energy Services Pay Slip for August 2020Document1 pageSTEAG Energy Services Pay Slip for August 2020Tuhin ChakrabortyNo ratings yet

- Indian ITR Acknowledgement for AY 2020-21Document1 pageIndian ITR Acknowledgement for AY 2020-21AJAY KUMAR JAISWALNo ratings yet

- 498186: Vamsi Krishna Nadella: BSCPL Infrastructure LTDDocument1 page498186: Vamsi Krishna Nadella: BSCPL Infrastructure LTDvamsiNo ratings yet

- Pay Slip: Directorate General Border Security Force Block 10, CGO Complex New Delhi (Information Technology Wing)Document1 pagePay Slip: Directorate General Border Security Force Block 10, CGO Complex New Delhi (Information Technology Wing)jassiNo ratings yet

- Fortis Hospital February 2019 PayslipDocument1 pageFortis Hospital February 2019 PayslipmkumarsejNo ratings yet

- Unknown PDFDocument2 pagesUnknown PDFbijoytvknrNo ratings yet

- Aug PDFDocument1 pageAug PDFRNo ratings yet

- PaySlip 221253181486P PDFDocument1 pagePaySlip 221253181486P PDFpraveenNo ratings yet

- AUGUST PayslipDocument1 pageAUGUST PayslipRakesh MandalNo ratings yet

- Mylan Laboratories Limited: Payslip For The Month of APRIL 2017Document1 pageMylan Laboratories Limited: Payslip For The Month of APRIL 2017vediyappanNo ratings yet

- Salary Slip May 2019Document1 pageSalary Slip May 2019Lalsiemlien HmarNo ratings yet

- Payslip 172820180712150142Document1 pagePayslip 172820180712150142LakshmananNo ratings yet

- MIOT Hospitals pay slip Oct 2022Document1 pageMIOT Hospitals pay slip Oct 2022jesten jadeNo ratings yet

- You Have Opted For Old Tax RegimeDocument2 pagesYou Have Opted For Old Tax RegimeRamsheed Ashraf100% (1)

- Jyothy Laboratories LTD: Payslip For The Month of June 2019Document2 pagesJyothy Laboratories LTD: Payslip For The Month of June 2019BALUNo ratings yet

- Apr 21Document1 pageApr 21pavan kumarNo ratings yet

- Techfoco Global Services PVT LTD No 5, 5Th Cross Street, Balaji Nagar Ekkatuthangal, Chennai - 600 032Document1 pageTechfoco Global Services PVT LTD No 5, 5Th Cross Street, Balaji Nagar Ekkatuthangal, Chennai - 600 032manoj mohanNo ratings yet

- Shriram Transport Finance Company Limited: Do Not Circulate Without Authorization Printed On 03/12/2009Document1 pageShriram Transport Finance Company Limited: Do Not Circulate Without Authorization Printed On 03/12/2009Ronald AllenNo ratings yet

- Amount in Words Is Rupees Eleven Thousand Six OnlyDocument1 pageAmount in Words Is Rupees Eleven Thousand Six OnlyGunaganti MaheshNo ratings yet

- Employee Details Payment & Working Days Details Location Details Nilu KumariDocument1 pageEmployee Details Payment & Working Days Details Location Details Nilu KumariRohit raagNo ratings yet

- This Is My Money. I Earned It by Doing My Best For Our CustomersDocument3 pagesThis Is My Money. I Earned It by Doing My Best For Our CustomersAbzi SyedNo ratings yet

- Pay Slip Title Under 40 CharactersDocument1 pagePay Slip Title Under 40 CharactersMickey CreationNo ratings yet

- OE0036Document1 pageOE0036kumud kalaNo ratings yet

- 2nd FLOOR, Gold Field, Sion Dharavi Link Road, Sion (W), Mumbai-400017Document1 page2nd FLOOR, Gold Field, Sion Dharavi Link Road, Sion (W), Mumbai-400017Faisal NumanNo ratings yet

- Chola Business Services Pay SlipDocument3 pagesChola Business Services Pay SlipsathyaNo ratings yet

- Insight Customer Call Solutions Salary SlipDocument1 pageInsight Customer Call Solutions Salary SlipAkash GuptaNo ratings yet

- HCCBK0799 SalarySlip February 2019 PDFDocument1 pageHCCBK0799 SalarySlip February 2019 PDFShalini100% (1)

- Mar18 PDFDocument1 pageMar18 PDFomkassNo ratings yet

- SalarySlip 5876095Document1 pageSalarySlip 5876095Larry WackoffNo ratings yet

- Payslip October 2022Document1 pagePayslip October 2022Raja guptaNo ratings yet

- Payslip For The Month of November 2016Document1 pagePayslip For The Month of November 2016chittaNo ratings yet

- Payslip Aug2022Document1 pagePayslip Aug2022Raut AbhimanNo ratings yet

- Global Edge Software Limited: Payslip For The Month of December - 2018Document1 pageGlobal Edge Software Limited: Payslip For The Month of December - 2018Manoj SahooNo ratings yet

- Earnings Deductions: Eicher Motors LimitedDocument1 pageEarnings Deductions: Eicher Motors LimitedR SEETHARAMANNo ratings yet

- Sahrudaya Health Care Private LimitedDocument1 pageSahrudaya Health Care Private LimitedBabu MallelaNo ratings yet

- OYO Hotel and Homes Private Limited Pay Slip for August 2022Document2 pagesOYO Hotel and Homes Private Limited Pay Slip for August 2022Vivek ViviNo ratings yet

- SalarySlipwithTaxDetails 2021 MayDocument1 pageSalarySlipwithTaxDetails 2021 MaySameer KulkarniNo ratings yet

- SalarySlipwithTaxDetails 2021 MayDocument1 pageSalarySlipwithTaxDetails 2021 MaySameer KulkarniNo ratings yet

- SalarySlipwithTaxDetails 2021 MayDocument1 pageSalarySlipwithTaxDetails 2021 MaySameer KulkarniNo ratings yet

- SalarySlipwithTaxDetails 2021 MayDocument1 pageSalarySlipwithTaxDetails 2021 MaySameer KulkarniNo ratings yet

- Payslip 90002364 10 2020Document1 pagePayslip 90002364 10 2020souvik deyNo ratings yet

- Salary Slip - February 2023 - Gurjeet Singh SainiDocument1 pageSalary Slip - February 2023 - Gurjeet Singh SainiGurjeet SainiNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment Yearpawan kumar raiNo ratings yet

- Business Tax Ans4Document24 pagesBusiness Tax Ans4Lars Frias100% (1)

- 5338 - August 2021 - 50GKBP45RLOWBH55BIZOX4Y54993178471246260287021635Document1 page5338 - August 2021 - 50GKBP45RLOWBH55BIZOX4Y54993178471246260287021635Shreyash SahayNo ratings yet

- CG JUL 2022 46134875 PayslipDocument1 pageCG JUL 2022 46134875 PayslipSoniNo ratings yet

- Jagan Mohan Absli Payslip AprilDocument1 pageJagan Mohan Absli Payslip AprilSurya GodasuNo ratings yet

- Upspl Pay Slip Dec 2022 EngineerDocument1 pageUpspl Pay Slip Dec 2022 EngineerpraveenNo ratings yet

- Salary SlipsDocument6 pagesSalary SlipsIMSaMiNo ratings yet

- March Salary PDFDocument1 pageMarch Salary PDFomkassNo ratings yet

- 375 - Salary Slip July 2018 PDFDocument1 page375 - Salary Slip July 2018 PDFAnkit SolankiNo ratings yet

- Local Government AdministrationDocument56 pagesLocal Government AdministrationAnirtsNo ratings yet

- Pay Slip - 604316 - May-22Document1 pagePay Slip - 604316 - May-22ArchanaNo ratings yet

- Chapter 10 - Accounting For Governmental and Nonprofit Entities - 16th - SMDocument16 pagesChapter 10 - Accounting For Governmental and Nonprofit Entities - 16th - SMmaylee01050% (2)

- SettlementReportDocument1 pageSettlementReportSarath KumarNo ratings yet

- Curriculum Vitae: Personal DetailsDocument3 pagesCurriculum Vitae: Personal DetailsSameer KulkarniNo ratings yet

- Tax Assessment ManualDocument294 pagesTax Assessment ManualPrudvi RajNo ratings yet

- Tax Glimpses 2012Document92 pagesTax Glimpses 2012CharuJagwaniNo ratings yet

- Introduction To Business Taxes: A Transaction Is Subject To Business Tax If: A Transaction Is Subject To Business Tax IfDocument2 pagesIntroduction To Business Taxes: A Transaction Is Subject To Business Tax If: A Transaction Is Subject To Business Tax IfCherrie Mae FloresNo ratings yet

- Icome Regime of AgriDocument13 pagesIcome Regime of AgriZ_JahangeerNo ratings yet

- Applicable Study Material For November 19 ExamDocument3 pagesApplicable Study Material For November 19 ExamPrabhat Kumar MishraNo ratings yet

- Computing The NET PAYDocument21 pagesComputing The NET PAYRoss Christian Corpuz ManuelNo ratings yet

- Member ApplicationDocument2 pagesMember ApplicationIqbal singhNo ratings yet

- Regulating M&As: The Intent of The LawDocument3 pagesRegulating M&As: The Intent of The LawMats LuceroNo ratings yet

- BK Dass ProfileDocument9 pagesBK Dass ProfileShreyas ShrivastavaNo ratings yet

- Wind Farm Project Analysis and Site AssessmentDocument29 pagesWind Farm Project Analysis and Site AssessmentayobamiNo ratings yet

- Taxes: Viko Óvida Burbiene Faculty of Economics, 2004Document9 pagesTaxes: Viko Óvida Burbiene Faculty of Economics, 2004Daiva ValienėNo ratings yet

- Deco404 Public Finance Hindi PDFDocument404 pagesDeco404 Public Finance Hindi PDFRaju Chouhan RajNo ratings yet

- Train TicketsDocument1 pageTrain TicketsBhavesh PoojariNo ratings yet

- Comparing Mutual Funds and ULIPsDocument44 pagesComparing Mutual Funds and ULIPsKrishna Prasad GaddeNo ratings yet

- Zone Commissionerate/ Directorate Name of Officer Designation Contact DetailsDocument45 pagesZone Commissionerate/ Directorate Name of Officer Designation Contact DetailsRaj KarkiNo ratings yet

- Agricultural IncomeDocument15 pagesAgricultural Incomerups05No ratings yet

- Income Taxation in General (Supplement)Document4 pagesIncome Taxation in General (Supplement)Random VidsNo ratings yet

- CTA Rules in Favor of Jewelry Firm in Tax CaseDocument8 pagesCTA Rules in Favor of Jewelry Firm in Tax CaseJavieNo ratings yet

- Market CapDocument13 pagesMarket CapVikas JaiswalNo ratings yet

- Voter Guide Spring 2017Document16 pagesVoter Guide Spring 2017The Dispatch100% (1)

- Situations and Issues in The Philippine Forest and Wildlife TFBDocument14 pagesSituations and Issues in The Philippine Forest and Wildlife TFBTarcy F Bismonte100% (1)

- EconomyDocument86 pagesEconomySridhar HaritasaNo ratings yet

- Speech 4 OutlineDocument4 pagesSpeech 4 Outlineapi-252666392No ratings yet

- Recivable Management Bba 3rdDocument54 pagesRecivable Management Bba 3rdMuzameelAshrafNo ratings yet

- Sales CaseDocument20 pagesSales CaseIsabel HigginsNo ratings yet

- GST ChallanDocument1 pageGST ChallannavneetNo ratings yet

- Ithums73 - 1st FloorDocument1 pageIthums73 - 1st FloorBharat SadanaNo ratings yet