Professional Documents

Culture Documents

Computing The NET PAY

Uploaded by

Ross Christian Corpuz Manuel0 ratings0% found this document useful (0 votes)

133 views21 pagesBusiness Math

Original Title

Computing the NET PAY

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBusiness Math

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

133 views21 pagesComputing The NET PAY

Uploaded by

Ross Christian Corpuz ManuelBusiness Math

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 21

COMPUTING

THE NET PAY

NET PAY

• The amount of pay that the employee gets

after deductions are made

• It is also called the “take home pay”

• The most common deductions which are

mandated by law are;

• WITHHOLDING TAX

• SSS Contribution (private employees) / GSIS

Contribution (government employees

• Phil Health Contribution

• PAG – IBIG Contribution

WITHHOLDING TAX

• most basic and fundamental deduction

• Every employee is required to pay his/her

income tax annually

• Employers deduct certain amount from

employees’ salary every pay period

• “withholding tax is the installment payment

of the income tax for one year”

THE AMOUNT OF WITHHOLDING TAX TO BE

DEDUCTED DEPENDS ON THE FOLLOWING:

1. GROSS PAY – this refers to the total

amount of income per payment

period.

2. Payroll period. This refers to the

payment period – whether daily,

weekly, semi – monthly, or

monthly

EXAMPLE 1

1. Mark Umiten works as an

accounting clerk in a private

company. He receives a monthly

income of of Php 24,000. what is

his withholding tax for each pay

period?

SSS CONTRIBUTION

• All employees working in private

companies are automatically

enlisted members of the Social

Security System (SSS)

• SSS contribution provides benefits

to the employees, like salary loans,

sickness benefits, disability

benefits, and retirement benefits.

EXAMPLE 1

Luningning works as an office clerk

in a private company. She receives

a monthly income of Php 14,500.

What is her monthly SSS

contribution?

Answer: Thus, her SSS monthly

contribution is Php 526.80, while

her employer’s share is Php 1078.20

EXAMPLE 2

Linda Apolonio receives Php 21,900

monthly income as a private school

teacher. What is her monthly SSS

contribution?

Answer: Thus, her SSS monthly

contribution is Php 581.30, while her

employer’s share is Php 1208.70

EXAMPLE 3

Jenny Boncales works as a factory

worker. She receives a weekly

salary of Php 1,800. What is her SSS

contribution?

Answer: Thus, her SSS monthly

contribution is Php 254.30, while her

employer’s share is Php 525.70

GSIS CONTRIBUTION

• All government employees are

being deducted a certain amount

of Government Service

Insurance System (GSIS)

contributions, depending upon

the salary of the employees.

PHILHEALTH

CONTRIBUTION

• The Philhealth contribution

is a mandatory deduction

applied to all private and

government employees

• Members of Philhealth get

assistance during

hospitalization and sickness

EXAMPLE 1

Henry Dela Cruz receives a monthly

income of Php 18,700 as a guidance

consellor in a private school. What is

his monthly Philhealth contribution?

Answer: Employee’s Philhealth

contribution is Php 257.125. Likewise

his employer’s contribution is also Php

257.125.

EXAMPLE 2

Gina Diola works as a Division Chief

in a government office where she

receives a monthly income of Php

48,000. What is her Philhealth

monthly contribution?

Answer: Employee’s Philhealth

contribution is Php 550. Likewise his

employer’s contribution is also Php

550.

HDMF OR PAG – IBIG

CONTRIBUTION

• Another personal income deduction

that is mandated by law is the Home

Development Mutual Fund or Pag –

IBIG

• Pag – IBIG (Pagtutulungan sa

Kinabukasan: Ikaw, Bangko, Industria at

Gobyerno)

• providing an affordable financing option

enabling average-incomeFilipinos to buy

homes

EXAMPLE 1

Joel Reyes receives a monthly

income of Php 14,000 as a

government employee. How much is

his monthly HDMF contribution?

Answer: Thus, Joel Reyes’ HDMF

contribution is Php 280. Likewise,

his employer’s share is also Php

280.

EXAMPLE 2

Federico Ferrer receives a

monthly compensation of Php

4500 as a house gardener. How

much is his HDMF contribution?

Answer: Employee’s share is 90.

Likewise, employer’s share is 90.

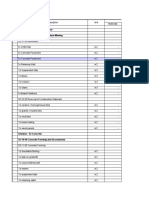

COMPUTING THE NET PAY

Example 1

Federico Castro is a sales clerk in a

private company. He has a monthly salary of

Php 17,800. What is his net pay?

Withholding Tax : ₱ 0.00

SSS Contribution: ₱

You might also like

- BUSINESS MATHEMATICS Lesson 5 IONDocument9 pagesBUSINESS MATHEMATICS Lesson 5 IONPurple. Queen95100% (2)

- Business Math Q4 M3Document28 pagesBusiness Math Q4 M3irishmaelacaba05No ratings yet

- Group 6 HandoutsDocument6 pagesGroup 6 HandoutsCrisel Rose EscanerNo ratings yet

- BUS. MATH Q2 - Week3Document4 pagesBUS. MATH Q2 - Week3DARLENE MARTINNo ratings yet

- Payroll Deductions ExplainedDocument11 pagesPayroll Deductions ExplainedheenimNo ratings yet

- Bus Math-Module 5.5 Standard DeductionsDocument67 pagesBus Math-Module 5.5 Standard Deductionsaibee patatagNo ratings yet

- Business Math Lesson1 Week 3Document6 pagesBusiness Math Lesson1 Week 3REBECCA BRIONES0% (1)

- Business MathDocument15 pagesBusiness MathIvy RabidaNo ratings yet

- Salaries and WagesDocument14 pagesSalaries and WagesNicole FuderananNo ratings yet

- Salary, Wage, Income, Gross Earnings & Net Earnings 1. Computing The Salaries and WagesDocument9 pagesSalary, Wage, Income, Gross Earnings & Net Earnings 1. Computing The Salaries and WagesAlmirah H. AliNo ratings yet

- Salaries and WagesDocument16 pagesSalaries and WagesKarlo SityarNo ratings yet

- BUSINESS MATH MODULE 4B For MANDAUE CITY DIVISIONDocument34 pagesBUSINESS MATH MODULE 4B For MANDAUE CITY DIVISIONJASON DAVID AMARILANo ratings yet

- SalariesDocument4 pagesSalariesChristian VerdaderoNo ratings yet

- Welcome To Business Math Class: Mr. Aron Paul San MiguelDocument18 pagesWelcome To Business Math Class: Mr. Aron Paul San MiguelPatrice Del MundoNo ratings yet

- Business Math Lesson1 Week 4Document6 pagesBusiness Math Lesson1 Week 4REBECCA BRIONESNo ratings yet

- Business Taxation (Compensation Income)Document67 pagesBusiness Taxation (Compensation Income)Robelyn FabriquelNo ratings yet

- BM Module 3 4 Q2W3 4 For PDFDocument5 pagesBM Module 3 4 Q2W3 4 For PDFDanica De veraNo ratings yet

- Q2 - Business Math LAS3 FOR PRINTING - 230517 - 092725Document5 pagesQ2 - Business Math LAS3 FOR PRINTING - 230517 - 092725yenny lynNo ratings yet

- Lesson 1: Employee CompensationDocument22 pagesLesson 1: Employee Compensationwilhelmina romanNo ratings yet

- Salaries and Wages: Salary Is The Compensation UsuallyDocument7 pagesSalaries and Wages: Salary Is The Compensation UsuallyJulius LitaNo ratings yet

- Standard DeductionDocument58 pagesStandard DeductionJoseph Gabriel EstrellaNo ratings yet

- Business-Math Q2 W3-FinalDocument17 pagesBusiness-Math Q2 W3-FinalLorieanne NavarroNo ratings yet

- Business Mathematics Week 2Document37 pagesBusiness Mathematics Week 2Jewel Joy PudaNo ratings yet

- Summary of MANDATORY GOVERNMENT BENEFITS OF EMPLOYEESDocument1 pageSummary of MANDATORY GOVERNMENT BENEFITS OF EMPLOYEESSheilah Mae PadallaNo ratings yet

- Maximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryFrom EverandMaximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryNo ratings yet

- Business Math Report WEEK 1Document25 pagesBusiness Math Report WEEK 1HOney Mae Alecida OteroNo ratings yet

- Business Mathematics Worksheet Week 3Document4 pagesBusiness Mathematics Worksheet Week 3300980 Pitombayog NHS100% (1)

- (Q2) BS MATH Mod 3Document3 pages(Q2) BS MATH Mod 3Duhreen Kate CastroNo ratings yet

- Eloisa S. Gavilan BSBA-HR2nd YrDocument2 pagesEloisa S. Gavilan BSBA-HR2nd YrGoldengate CollegesNo ratings yet

- Why Is Finland Testing A Basic Income? Basic Income: Amount and PaymentDocument2 pagesWhy Is Finland Testing A Basic Income? Basic Income: Amount and PaymentJavier Elvira MathezNo ratings yet

- Business Math: Standard DeductionsDocument12 pagesBusiness Math: Standard DeductionsMontenegro Roi Vincent100% (1)

- Lesson 2 Wk10 4th Fundamental Operations of Mathematics As Applied in Salaries and Wages StudentDocument11 pagesLesson 2 Wk10 4th Fundamental Operations of Mathematics As Applied in Salaries and Wages StudentFrancine Arielle Bernales100% (1)

- MMMMDocument9 pagesMMMMABMachineryNo ratings yet

- ModuleDocument6 pagesModuleGe Ne VieveNo ratings yet

- Summary of Government ComplianceDocument11 pagesSummary of Government Compliancekhalil rebatoNo ratings yet

- Math 11 ABM Business Math Q2 Week 3Document18 pagesMath 11 ABM Business Math Q2 Week 3Flordilyn DichonNo ratings yet

- Gross EarningsDocument27 pagesGross EarningsAin lorraine BacaniNo ratings yet

- BUSINESS MATH MODULE 4A For MANDAUE CITY DIVISIONDocument14 pagesBUSINESS MATH MODULE 4A For MANDAUE CITY DIVISIONJASON DAVID AMARILANo ratings yet

- Making MoneyDocument8 pagesMaking MoneyYunike TrifenaNo ratings yet

- Benefits of A Wage EarnerDocument49 pagesBenefits of A Wage EarnerAmore BuenafeNo ratings yet

- Catherine May C FM 3 AssDocument2 pagesCatherine May C FM 3 AssGeriel FajardoNo ratings yet

- Introduction-to-Salaries-Wages-Income-and-Benefits (2)Document14 pagesIntroduction-to-Salaries-Wages-Income-and-Benefits (2)YAHIKOヤヒコYUICHIゆいちNo ratings yet

- Chapter 9 - Employee Benefits and ServicesDocument41 pagesChapter 9 - Employee Benefits and Serviceschari.cadizNo ratings yet

- BusmathDocument2 pagesBusmathalyssaNo ratings yet

- Bus Math-Module 5.4 Gross and Net EarningDocument51 pagesBus Math-Module 5.4 Gross and Net Earningaibee patatagNo ratings yet

- TABL2751 2016-2 Tutorial Program FinalDocument25 pagesTABL2751 2016-2 Tutorial Program FinalAnna ChenNo ratings yet

- PAG IBIG Home Development Mutual FundDocument13 pagesPAG IBIG Home Development Mutual FundAnn Serrato100% (1)

- ABM11 BussMath Q2 Wk4 Taxable-And-Nontaxable-BenefitsDocument11 pagesABM11 BussMath Q2 Wk4 Taxable-And-Nontaxable-BenefitsArchimedes Arvie Garcia0% (1)

- Tax ReportingDocument16 pagesTax Reportingseanandreit5No ratings yet

- Module 11 - Business MathematicsDocument31 pagesModule 11 - Business MathematicsMaam AprilNo ratings yet

- Benefits of Wage EarnersDocument16 pagesBenefits of Wage EarnersJulianaNo ratings yet

- Bus Math Week 3 Q2Document5 pagesBus Math Week 3 Q2Trixine BrozasNo ratings yet

- Salary Wage IncomeDocument5 pagesSalary Wage IncomeEnrique RiñosNo ratings yet

- Salaries and WagesDocument3 pagesSalaries and WagesAndrea OrbisoNo ratings yet

- Calculating Costs of New Employee Recruitment: Student Date PeriodDocument8 pagesCalculating Costs of New Employee Recruitment: Student Date PeriodIbrah1mov1chNo ratings yet

- Business Math Q2 Week 3Document9 pagesBusiness Math Q2 Week 3john100% (1)

- Midterm Lecture 2 Employee Benefits and ServicesDocument7 pagesMidterm Lecture 2 Employee Benefits and ServicesJohn LesterNo ratings yet

- History and Components of CompensationDocument42 pagesHistory and Components of CompensationNekoh Dela Cerna75% (4)

- Taxation Law HeadingsDocument41 pagesTaxation Law HeadingsAR RahoojoNo ratings yet

- Fire Your Over-Priced Financial Advisor and Retire SoonerFrom EverandFire Your Over-Priced Financial Advisor and Retire SoonerRating: 5 out of 5 stars5/5 (1)

- Lesson 3 Basic Term in StatisticsDocument15 pagesLesson 3 Basic Term in StatisticsRoss Christian Corpuz ManuelNo ratings yet

- The Impact of Use of Manipulatives On The Math Scores of Grade 2 StudentsDocument15 pagesThe Impact of Use of Manipulatives On The Math Scores of Grade 2 StudentsRoss Christian Corpuz ManuelNo ratings yet

- Lesson 3 Basic Term in StatisticsDocument15 pagesLesson 3 Basic Term in StatisticsRoss Christian Corpuz ManuelNo ratings yet

- Integral Zero Theorem Formative AssessmentDocument2 pagesIntegral Zero Theorem Formative AssessmentRoss Christian Corpuz ManuelNo ratings yet

- Integral Zero Theorem Formative AssessmentDocument2 pagesIntegral Zero Theorem Formative AssessmentRoss Christian Corpuz ManuelNo ratings yet

- Business Math Problem SolvingDocument1 pageBusiness Math Problem SolvingRoss Christian Corpuz ManuelNo ratings yet

- Intro to Probability Lesson 4Document15 pagesIntro to Probability Lesson 4Ross Christian Corpuz ManuelNo ratings yet

- Precalculus QuizDocument1 pagePrecalculus QuizRoss Christian Corpuz ManuelNo ratings yet

- BC Sample Paper-3Document4 pagesBC Sample Paper-3Roshini ANo ratings yet

- JKSTREGIESDocument59 pagesJKSTREGIESmss_singh_sikarwarNo ratings yet

- Taylor Introms11GE PPT 03Document40 pagesTaylor Introms11GE PPT 03hddankerNo ratings yet

- Nettoplcsim S7online Documentation en v0.9.1Document5 pagesNettoplcsim S7online Documentation en v0.9.1SyariefNo ratings yet

- Management Theory and Practice: Methods of Performance AppraisalDocument3 pagesManagement Theory and Practice: Methods of Performance AppraisalRadha maiNo ratings yet

- Adms OneAdms One ClassDocument9 pagesAdms OneAdms One ClasssafwatNo ratings yet

- X-Ray Generator Communication User's Manual - V1.80 L-IE-4211Document66 pagesX-Ray Generator Communication User's Manual - V1.80 L-IE-4211Marcos Peñaranda TintayaNo ratings yet

- DOJ OIG Issues 'Fast and Furious' ReportDocument512 pagesDOJ OIG Issues 'Fast and Furious' ReportFoxNewsInsiderNo ratings yet

- Frequently Asked Questions About Ailunce HD1: Where Can Find HD1 Software & Firmware?Document5 pagesFrequently Asked Questions About Ailunce HD1: Where Can Find HD1 Software & Firmware?Eric Contra Color0% (1)

- Villanueva Poetry Analysis Template BSEE 35Document7 pagesVillanueva Poetry Analysis Template BSEE 35CHRISTIAN MAHINAYNo ratings yet

- D41P-6 Kepb002901Document387 pagesD41P-6 Kepb002901LuzioNeto100% (1)

- Unit Rates and Cost Per ItemDocument213 pagesUnit Rates and Cost Per ItemDesiree Vera GrauelNo ratings yet

- M.Com Second Semester – Advanced Cost Accounting MCQDocument11 pagesM.Com Second Semester – Advanced Cost Accounting MCQSagar BangreNo ratings yet

- Atlas Ci30002Tier-PropanDocument3 pagesAtlas Ci30002Tier-PropanMarkus JeremiaNo ratings yet

- Ed Brown CatalogDocument44 pagesEd Brown CatalogssnvetNo ratings yet

- Top-Down DesignDocument18 pagesTop-Down DesignNguyễn Duy ThôngNo ratings yet

- BSNL TrainingDocument25 pagesBSNL TrainingAditya Dandotia68% (19)

- Winter's Bracing Approach RevisitedDocument5 pagesWinter's Bracing Approach RevisitedJitendraNo ratings yet

- Engr2227 Apr03Document10 pagesEngr2227 Apr03Mohamed AlqaisiNo ratings yet

- A Generation of Contradictions-Unlocking Gen Z 2022 China FocusDocument25 pagesA Generation of Contradictions-Unlocking Gen Z 2022 China FocusCindy Xidan XiaoNo ratings yet

- Safety Data Sheet: 1. Identification of The Substance/preparation and of The Company/undertakingDocument4 pagesSafety Data Sheet: 1. Identification of The Substance/preparation and of The Company/undertakingBalasubramanian AnanthNo ratings yet

- Trial BalanceDocument2 pagesTrial BalanceJoseph Bayo BasanNo ratings yet

- Api RP 2a WSD 1pdf - CompressDocument1 pageApi RP 2a WSD 1pdf - CompressRamesh SelvarajNo ratings yet

- CB4 BBC Interviews EXTRA UnitDocument1 pageCB4 BBC Interviews EXTRA UnitCristianNo ratings yet

- Etherpad Text-Based TutorialDocument5 pagesEtherpad Text-Based Tutorialapi-437836861No ratings yet

- St. Anthony College Calapan City Syllabus: Course DescriptionDocument6 pagesSt. Anthony College Calapan City Syllabus: Course DescriptionAce HorladorNo ratings yet

- Senior High School Tracks: Free Powerpoint Templates Free Powerpoint TemplatesDocument11 pagesSenior High School Tracks: Free Powerpoint Templates Free Powerpoint TemplatesGeraldineNo ratings yet

- Cyrustek ES51966 (Appa 505)Document25 pagesCyrustek ES51966 (Appa 505)budi0251No ratings yet

- Major Project Report - Template 2021Document18 pagesMajor Project Report - Template 2021vamkrishnaNo ratings yet

- Idler Sprockets: Poly Chain GT and Powergrip GTDocument2 pagesIdler Sprockets: Poly Chain GT and Powergrip GTVolodymуr VorobetsNo ratings yet