Professional Documents

Culture Documents

Export and Import Procedure PDF

Uploaded by

Jubaida Alam Juthy0 ratings0% found this document useful (0 votes)

22 views18 pagesOriginal Title

Export and Import Procedure.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views18 pagesExport and Import Procedure PDF

Uploaded by

Jubaida Alam JuthyCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 18

Export and Import Procedure

-Md. Khairul Alam Chowdhury, FVP

Business Operations Division

Import Policy Order 2015-2018

Nine Chapters & four annexure

1st Chapter: Introduction

2nd Chapter: General rules for import

3rd Chapter: Import Fees

4th Chapter: Miscellaneous provisions

5th Chapter: General rules for industrial import

6th Chapter: Rules for commercial import

7th Chapter: Rules for public sector import

8th Chapter: Import Trade Control Committee

9th Chapter: Membership of CC&I

Annexure-1: List of controlled and restricted items

Annexure-2: Procedure for import on joint basis

Annexure-3: List of chemicals allowed for import

Annexure-4: List of CoC and Trade Associations

General rules for import

All items except in the restricted list are allowed for

import

Import from/product of Israel and import in Israel

flag vessel is NOT allowed

Use of 8 digit HS Code is mandatory

Import at competitive rate

Docs required along with LCAF for opening LC:

Customer’s Application (CF-7), PI/Indent, Insurance

Cover Note, Certificate of Membership from Trade

Association, Renewed IRC, Declaration on payment of

income tax of last FY, proof of e-TIN and other docs

as required by the regulatory authority

Export Policy – 2015-2018

Target export income by 2021 is USD 60 billion

12 Highest Priority sectors

14 Special Development Sectors

There are some banned and restricted items for export

mentioned in Annexure-1 & 2

Incentive for the exporters:

ERQ

EDF

Back to Back LC

Loan with reduced interest rates

90% advance against Export LC/Contract

Guidelines for Foreign

Exchange Transactions 2009

Import

Import control:

Ministry of Commerce

Import Policy Order (IPO)

Dealing with known customer

Import

LC Authorisation Form

Appropriate Incoterm

Use correct HS Code

Credit Report

Payment of discrepant documents

Bill of Entry

Export

Registration of exporters with CCI&E

Declaration by the exporter to the Customs

Authority to be made in EXP Form

Opening & Operation of

Documentary Credit

Payment Terms

There are four main payment/settlement terms:

1. Payment in advance

2. Documentary credits

3. Documentary collections

4. Open account

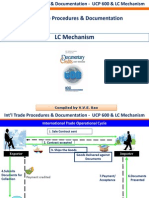

What is a Documentary Credit

A Documentary Credit is an irrevocable undertaking

issued by a bank whereby it undertakes to make

payment to a beneficiary, provided that the

documents stipulated in the documentary credit are

presented, and all of its terms and conditions are

complied with.

Structure of a basic DC transaction

Notes to the figure

1. Contract is agreed between Buyer (Applicant) & Seller

(Beneficiary) indicating DC as a method of settlement

2. Applicant applies to its bank for DC

3. Issuing Bank issues DC and advises it through a bank

known as ‘Advising Bank’

4. Advising Bank advises the DC to Beneficiary

5. Beneficiary makes shipment of the goods

6. Beneficiary presents documents to the Advising Bank

also known as ‘Nominated Bank’

7. Advising Bank sends documents to the Issuing Bank

8. Issuing Bank determines that the documents comply,

debits the Applicant’s account, handover the

documents to the Applicant for taking delivery of the

goods & reimburses the Advising/Nominated Bank

9. The Nominated/Advising Bank effects settlement to

the Beneficiary

Types of Documentary Credit

Commercial documentary credit

Standby letter of credit

Characteristics of Documentary

Credits

Revocable documentary credit

Irrevocable documentary credit

Irrevocable confirmed documentary credit

Transferable documentary credit

Back-to-Back documentary credit

Clean documentary credit

Advance payment (red clause) documentary credit

Revolving documentary credit

Evergreen and annually renewable documentary credit

Risk of Documentary Credits

Risks faced by an applicant:

Non-delivery of goods

Short-shipment or shipment of inferior goods

Goods received by applicant before documents received

by the issuing bank

Loss or damage to goods in transit

Foreign exchange risk

Risk faced by a beneficiary:

Failure to comply with documentary credit conditions

Failure of, or delays in payment from, the issuing bank

Fraud

Foreign exchange risk

Q&A

Thank You

You might also like

- Understanding key aspects of letters of creditDocument86 pagesUnderstanding key aspects of letters of creditMasud Khan ShakilNo ratings yet

- 11 Letter of CreditDocument266 pages11 Letter of Creditحسيب مرتضي100% (24)

- Key Differences Between Natural Sciences and Social SciencesDocument6 pagesKey Differences Between Natural Sciences and Social SciencesAshenPerera60% (5)

- GC 1999 03 Minas BrethilDocument5 pagesGC 1999 03 Minas BrethilErszebethNo ratings yet

- Foreign Exchange NoteDocument37 pagesForeign Exchange NoteAtia IbnatNo ratings yet

- Ucp 600Document30 pagesUcp 600Kamal Hassan100% (3)

- International Trade FinanceDocument15 pagesInternational Trade Financefree bishoNo ratings yet

- Import Bill, Scrutiny, LodgementDocument41 pagesImport Bill, Scrutiny, Lodgementomi0855No ratings yet

- Import and Export Under LC: A GuideDocument1 pageImport and Export Under LC: A GuidehossainmzNo ratings yet

- Chapter 4-1Document18 pagesChapter 4-1syahiir syauqiiNo ratings yet

- A Guide ToDocument27 pagesA Guide Toneelamd456No ratings yet

- Roll No-D018, SAP ID - 80101190221Document9 pagesRoll No-D018, SAP ID - 80101190221Harsh GandhiNo ratings yet

- Itd 04 Ucp 600 LC MechanismDocument28 pagesItd 04 Ucp 600 LC MechanismVvs RaoNo ratings yet

- 55 Kaushan NimeshDocument12 pages55 Kaushan NimeshKaushan NimeshNo ratings yet

- Docs Papers For LCDocument23 pagesDocs Papers For LCRedwan RahmanNo ratings yet

- Chapter 11Document50 pagesChapter 11Ngọc YếnNo ratings yet

- Types of Export Finance ExplainedDocument14 pagesTypes of Export Finance Explainedsamy7541No ratings yet

- FEX 1an Overview On International TradeDocument63 pagesFEX 1an Overview On International TradeIstiaqueNo ratings yet

- International Trade and Trade Service OperationDocument19 pagesInternational Trade and Trade Service OperationEmebet Tesema100% (2)

- C Packing CreditDocument6 pagesC Packing CreditKapil KumarNo ratings yet

- Chaptre 4Document19 pagesChaptre 4Tariku AsmamawNo ratings yet

- International TradeDocument31 pagesInternational TradeHardik Shah100% (3)

- FEX and Foreign TradeDocument5 pagesFEX and Foreign TradeOvee Maidul IslamNo ratings yet

- DocumentationDocument13 pagesDocumentationAnonymous GcxSvKrtwaNo ratings yet

- Methods of Payment For DFTDocument31 pagesMethods of Payment For DFTPalak MehraNo ratings yet

- Import PPRDocument3 pagesImport PPRaeeeNo ratings yet

- Methods - PDF: Foreign Trade / International TradeDocument5 pagesMethods - PDF: Foreign Trade / International TradePuru TpNo ratings yet

- Guide to Letters of Credit for Importers and ExportersDocument48 pagesGuide to Letters of Credit for Importers and ExportersAmit RaiNo ratings yet

- Letter of Credit HardDocument35 pagesLetter of Credit HardReHopNo ratings yet

- Methods of International Payment TermsDocument28 pagesMethods of International Payment TermsHARSHIT SAXENA 22IB428No ratings yet

- Unlocking Benefits of Export Letters of CreditDocument49 pagesUnlocking Benefits of Export Letters of Creditmahmudratul85No ratings yet

- International Trade FinanceDocument12 pagesInternational Trade FinanceHarshit GoyalNo ratings yet

- Export Documents, Payments, Financing, and ShipmentDocument30 pagesExport Documents, Payments, Financing, and ShipmentPriyadarshini TripathiNo ratings yet

- HW 21416Document2 pagesHW 21416Shreya PariharNo ratings yet

- Letters of Credit & Bank Guarantees: Non-Fund Based LimitsDocument104 pagesLetters of Credit & Bank Guarantees: Non-Fund Based Limitssiddharthzala100% (1)

- Export Procedures and Letters of CreditDocument9 pagesExport Procedures and Letters of CreditIndeevar SarkarNo ratings yet

- Rest of ThingDocument58 pagesRest of ThingAvinash RbNo ratings yet

- WWW - Pakassignment.Blo: Send Your Assignments and Projects To Be Displayed Here As Sample For Others atDocument52 pagesWWW - Pakassignment.Blo: Send Your Assignments and Projects To Be Displayed Here As Sample For Others atPakassignmentNo ratings yet

- Chapter 8 Foreign Trade Procedure and FinancingDocument22 pagesChapter 8 Foreign Trade Procedure and FinancingsajjadNo ratings yet

- The Exim Guide To Export FinanceDocument44 pagesThe Exim Guide To Export FinanceVipin GairolaNo ratings yet

- Chapter 5Document41 pagesChapter 5ngonh.nguyenhuyNo ratings yet

- Islamic International Trade FinancingDocument29 pagesIslamic International Trade FinancingIbrahim Mohamad RazipNo ratings yet

- Letter of Credit FaqsDocument8 pagesLetter of Credit FaqsMohamed AbdelbasetNo ratings yet

- Letter of Credit ReportDocument22 pagesLetter of Credit ReportMuhammad Waseem100% (4)

- Payment of Import Bills Through L/C: AssignmentDocument13 pagesPayment of Import Bills Through L/C: AssignmentarvinfoNo ratings yet

- Chapter 11Document29 pagesChapter 11Yên LêNo ratings yet

- Letter of CreditDocument11 pagesLetter of CreditPalani RajanNo ratings yet

- Import Procedures PresentationDocument24 pagesImport Procedures PresentationVaishali KakadeNo ratings yet

- International Trade Payment MethodsDocument19 pagesInternational Trade Payment Methodsfarhadcse30No ratings yet

- International Trade & Trade FinanceDocument19 pagesInternational Trade & Trade Financemesba_17No ratings yet

- Cridit Managment: MBA Banking & Finance 3 TermDocument28 pagesCridit Managment: MBA Banking & Finance 3 Term✬ SHANZA MALIK ✬100% (2)

- Clean Payments: Jitendra SingodiyaDocument3 pagesClean Payments: Jitendra SingodiyaJitendra SingodiyaNo ratings yet

- Interntinal BankingDocument6 pagesInterntinal BankingKazi Saif HiraNo ratings yet

- Methods of Settlement - Documentary Credit BasicsDocument80 pagesMethods of Settlement - Documentary Credit BasicsAtikah Abd NajibNo ratings yet

- AniketDocument5 pagesAniketAjay PrajapatiNo ratings yet

- International Financial Statement AnalysisFrom EverandInternational Financial Statement AnalysisRating: 1 out of 5 stars1/5 (1)

- The New CFO Financial Leadership ManualFrom EverandThe New CFO Financial Leadership ManualRating: 3.5 out of 5 stars3.5/5 (3)

- Equity Crowdfunding for Investors: A Guide to Risks, Returns, Regulations, Funding Portals, Due Diligence, and Deal TermsFrom EverandEquity Crowdfunding for Investors: A Guide to Risks, Returns, Regulations, Funding Portals, Due Diligence, and Deal TermsNo ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Practice Problem Solving Questions 1Document11 pagesPractice Problem Solving Questions 1Tarun MishraNo ratings yet

- Ok-Negotiable InstrumentDocument7 pagesOk-Negotiable InstrumentJubaida Alam JuthyNo ratings yet

- January 03, 2017: Subject: Request For Return The Security Money Amount of TK. 5,000.00/-Because of Cadre ChangeDocument3 pagesJanuary 03, 2017: Subject: Request For Return The Security Money Amount of TK. 5,000.00/-Because of Cadre ChangeJubaida Alam JuthyNo ratings yet

- Ok. Questions of GB & Negotiable InstrumentDocument10 pagesOk. Questions of GB & Negotiable InstrumentJubaida Alam JuthyNo ratings yet

- Participant's Name: Designation: Id: Branch: Learning TemplateDocument2 pagesParticipant's Name: Designation: Id: Branch: Learning TemplateJubaida Alam JuthyNo ratings yet

- Export and Import Procedure PDFDocument18 pagesExport and Import Procedure PDFJubaida Alam JuthyNo ratings yet

- Cash & GB MCQ NEW ESKATON FDocument18 pagesCash & GB MCQ NEW ESKATON FJubaida Alam Juthy57% (7)

- Cash Cadre Circular PDFDocument6 pagesCash Cadre Circular PDFJubaida Alam JuthyNo ratings yet

- Foreign Exchange Questions & AnswerDocument4 pagesForeign Exchange Questions & AnswerJubaida Alam JuthyNo ratings yet

- Question 1: Multiple Choice: Leave BlankDocument12 pagesQuestion 1: Multiple Choice: Leave BlankJubaida Alam JuthyNo ratings yet

- Final Money Laundering AssignmentDocument13 pagesFinal Money Laundering AssignmentJubaida Alam JuthyNo ratings yet

- Foreign Exchange Questions & AnswerDocument4 pagesForeign Exchange Questions & AnswerJubaida Alam JuthyNo ratings yet

- Internship Report On Incepta PharmaceutiDocument31 pagesInternship Report On Incepta PharmaceutihhaiderNo ratings yet

- Dimension ReductionDocument15 pagesDimension ReductionShreyas VaradkarNo ratings yet

- Workbook. Unit 3. Exercises 5 To 9. RESPUESTASDocument3 pagesWorkbook. Unit 3. Exercises 5 To 9. RESPUESTASRosani GeraldoNo ratings yet

- Gorsey Bank Primary School: Mission Statement Mission StatementDocument17 pagesGorsey Bank Primary School: Mission Statement Mission StatementCreative BlogsNo ratings yet

- Giáo Trình LPTD 2Document40 pagesGiáo Trình LPTD 2Hưng Trịnh TrọngNo ratings yet

- Yatendra Kumar Sharma ResumeDocument3 pagesYatendra Kumar Sharma ResumeDheeraj SharmaNo ratings yet

- The History of Coins and Banknotes in Mexico: September 2012Document35 pagesThe History of Coins and Banknotes in Mexico: September 2012Mladen VidovicNo ratings yet

- Teams Training GuideDocument12 pagesTeams Training GuideImran HasanNo ratings yet

- MS Excel Word Powerpoint MCQsDocument64 pagesMS Excel Word Powerpoint MCQsNASAR IQBALNo ratings yet

- P150EDocument4 pagesP150EMauro L. KieferNo ratings yet

- Air Brake System For Railway CoachesDocument40 pagesAir Brake System For Railway CoachesShashwat SamdekarNo ratings yet

- HE HOUSEKEEPING GR11 Q1 MODULE-6-for-teacherDocument25 pagesHE HOUSEKEEPING GR11 Q1 MODULE-6-for-teacherMikaela YtacNo ratings yet

- 12 Orpic Safety Rules Managers May 17 RevDocument36 pages12 Orpic Safety Rules Managers May 17 RevGordon Longforgan100% (3)

- Diesel fuel system for Caterpillar 3208 engineDocument36 pagesDiesel fuel system for Caterpillar 3208 engineLynda CarrollNo ratings yet

- Body Mechanics and Movement Learning Objectives:: by The End of This Lecture, The Student Will Be Able ToDocument19 pagesBody Mechanics and Movement Learning Objectives:: by The End of This Lecture, The Student Will Be Able TomahdiNo ratings yet

- Ð.Ð.Á Valvoline Áóìá Áíáâáóç Ñéôóùíáó 9.6.2019: Omaäa ADocument6 pagesÐ.Ð.Á Valvoline Áóìá Áíáâáóç Ñéôóùíáó 9.6.2019: Omaäa AVagelis MoutoupasNo ratings yet

- Wave Optics - I: Created by C. Mani, Principal, K V No.1, AFS, Jalahalli West, BangaloreDocument16 pagesWave Optics - I: Created by C. Mani, Principal, K V No.1, AFS, Jalahalli West, BangaloreNitesh Gupta100% (1)

- Đáp Án K Năng NóiDocument6 pagesĐáp Án K Năng NóiSói ConNo ratings yet

- Bajaj Internship ReportDocument69 pagesBajaj Internship ReportCoordinator ABS100% (2)

- Explicit Instruction: A Teaching Strategy in Reading, Writing, and Mathematics For Students With Learning DisabilitiesDocument3 pagesExplicit Instruction: A Teaching Strategy in Reading, Writing, and Mathematics For Students With Learning DisabilitiesKatherineNo ratings yet

- OSK Ekonomi 2016 - SoalDocument19 pagesOSK Ekonomi 2016 - SoalputeNo ratings yet

- Raoult's law and colligative propertiesDocument27 pagesRaoult's law and colligative propertiesGøbindNo ratings yet

- Since 1977 Bonds Payable SolutionsDocument3 pagesSince 1977 Bonds Payable SolutionsNah HamzaNo ratings yet

- Kaseya Performance and Best Practices Guide: Authors: Jacques Eagle Date: Thursday, April 29, 2010Document34 pagesKaseya Performance and Best Practices Guide: Authors: Jacques Eagle Date: Thursday, April 29, 2010markdavidboydNo ratings yet

- LQRDocument34 pagesLQRkemoNo ratings yet

- Assignement 4Document6 pagesAssignement 4sam khanNo ratings yet

- NIJ Sawmark Analysis Manual for Criminal MutilationDocument49 pagesNIJ Sawmark Analysis Manual for Criminal MutilationAntonio jose Garrido carvajalinoNo ratings yet