Professional Documents

Culture Documents

Eleaflet Lifecover PDF

Uploaded by

muralinaiduOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Eleaflet Lifecover PDF

Uploaded by

muralinaiduCopyright:

Available Formats

WHILE PROTECTING YOUR FAMILY

LET THE

RIGHT REASONS

MAX LIFE GUIDE YOU

ONLINE The feeling of insecurity about the future of your family in your absence often fills

TERM PLAN your heart, we understand. Max Life Online Term Plan provides a protection solution

for your loved ones at an affordable price. The assurance of your family getting only

SUM ASSURED

the best in life, combined with hassle-free online application process. That’s our promise.

A Non-Participating, Get insured with us online and put your fears to rest.

Non-Linked,

Pure Term Insurance Plan;

(UIN - 104N078V01)

PLAN BENEFITS :

100% Sum assured as lumpsum on death of life insured A 30-day Free-Look period

Additional protection through Max Life Comprehensive High Sum Assured Discounts

Accident Benefit rider (UIN - 104B025V01) Rewards you for a healthy lifestyle -

A hassle-free online application process low premium rates for non-smokers

CHECK KARO SAHI CHUNO

This plan is a Pure Term plan that provides only death benefit and no maturity benefit. LIFE INSURANCE COVERAGE IS AVAILABLE IN THIS PRODUCT.

PLAN FEATURES HOW IT WORKS

Minimum Entry Age: 18years (age at last birthday) Payment of Rs. 1 Crore

(100% of sum assured)

POLICY COMMENCEMENT

to the nominee. Policy

Maximum Entry Age: 60 years (age at last birthday)

CHOSEN SUM ASSURED

UNFORTUNATE contract ends

DEATH

POLICY TERM ENDS

- 1 CRORE

Policy Term: Pick a Term from 10 to 35 years (interval of 1 year) subject to maximum expiry age

PREMIUMS PAID

}

Maximum Expiry Age: 70 years (age at last birthday)

Premium Payment Term: Equal to Policy Term

YEAR 1 YEAR 2 YEAR 30

Premium Payment Mode: Annual Mode Only

POLICY TERM (IN YEARS)

}

Disclaimer - Kindly note that the above is only an illustration and does not in any way create any rights and/or obligations. The actual experience on the contract may be different from illustrated.

For more details please request for your specific benefit illustration. The premium mentioned is exclusive of service tax charges.

Sum Assured (In Rs.) Suppose Mr. Sharma, aged 30, opts for sum assured of ` 1 Crore for 30

Minimum: `25 lacs years under Max Life Online Term plan with sum assured as death benefit

for a premium of ` 7,400 (excluding service tax)

Maximum: `100 Crs

After paying 9 premiums, unfortunately Mr. Sharma dies

The sum assured is available in the multiples of `1 lac only Under the chosen death benefit, his nominee will get ` 1 Crore on his

death within the policy term and the policy contract will be terminated

Following are the other Death benefit options available: Sum Assured + Level Monthly Income and Sum Assured + Increasing Monthly Income.

Rider option available: Max Life Comprehensive Accident Benefit Rider (UIN - 104B025V01). For more details on Max Life Comprehensive Accident Benefit Rider and the various

terms and conditions, please refer to the rider brochure.

1 CHOOSE THE

2 3 4 UPLOAD

MAKE ONLINE

FOUR EASY SUM ASSURED,

DEATH BENEFIT

FILL UP

ONLINE PROPOSAL PAYMENT USING NET

RELEVANT

DOCUMENTS AND

THAT’S IT

YOU ARE DONE !

STEPS TO APPLY OPTION AND FORM BANKING, CREDIT SCHEDULE MEDICAL

EXAMINATION

CALCULATE OR DEBIT CARD

PREMIUM

Max Life/e-broc/Maxus/OTPSA/30Jan14

1800 200 3383 buyonline.maxlifeinsurance.com online@maxlifeinsurance.com facebook.com/maxlife

Max Life Insurance Ltd. is a joint venture between Max India Ltd. and Mitsui Sumitomo Insurance Co. Ltd. Max Life Insurance Co. Ltd., 11th Floor, DLF Square Building, Jacaranda Marg, BEWARE OF SPURIOUS PHONE CALLS AND FICTITIOUS/FRAUDULENT OFFERS

DLF Phase II, Gurgaon (Haryana) – 122002. IRDA Regn. No - 104. For more details on the risk factors, terms and conditions, please read the sales brochure carefully before concluding a IRDA clarifies to public that

sale. You may be entitled to certain applicable tax benefits on your premiums and Policy benefits. Please note all the tax benefits are subject to tax laws prevailing at the time of payment of IRDA or its officials do not involve in activities like sale of any kind of insurance or financial products or invest premiums.

premium or receipt of benefits by you. Tax benefits are subject to changes in tax laws. Insurance is the subject matter of solicitation. IRDA does not announce any bonus.

Public receiving such phone calls are requested to lodge a police complaint along with details of phone call, number

You might also like

- PNB Metlife MMTPDocument20 pagesPNB Metlife MMTPKiran KumarNo ratings yet

- MMTP Plus BrochureDocument20 pagesMMTP Plus Brochureritesh142No ratings yet

- Share 9691785777195145Document5 pagesShare 9691785777195145raghavendramakam86No ratings yet

- 3 CR 10payDocument5 pages3 CR 10payashokvardhnNo ratings yet

- Troo Product Quick Guide: Product Name Description Payor Age Insured Age Policy Term Minimum Prem. RidersDocument5 pagesTroo Product Quick Guide: Product Name Description Payor Age Insured Age Policy Term Minimum Prem. RidersRia Charmye FlorendoNo ratings yet

- Insurance Is A Contract in Which An Individual or EntityDocument54 pagesInsurance Is A Contract in Which An Individual or EntitychitkarashellyNo ratings yet

- A New-Age Comprehensive Health Insurance Plan.: Non-InclusivesDocument2 pagesA New-Age Comprehensive Health Insurance Plan.: Non-InclusivesVikas MalikNo ratings yet

- IllustrationDocument4 pagesIllustrationavarman85No ratings yet

- IN Mahindra Blazo X (Tipper) HCV 202211124Document18 pagesIN Mahindra Blazo X (Tipper) HCV 202211124Psychedelic TranscendenceNo ratings yet

- D070651574 843783813366789 TpquoteDocument2 pagesD070651574 843783813366789 TpquoteSUBODH KUMARNo ratings yet

- Max Life Smart Secure Plus Plan: (Life Cover With Return of Premium, Pay Till 60)Document6 pagesMax Life Smart Secure Plus Plan: (Life Cover With Return of Premium, Pay Till 60)fake fNo ratings yet

- IllustrationDocument4 pagesIllustrationAnngad ShyamNo ratings yet

- MoneyBackPlus BrochureDocument7 pagesMoneyBackPlus BrochuremanjugnpNo ratings yet

- Wall SectionDocument1 pageWall SectionAjay KushwahaNo ratings yet

- Protecting Your Income Even Aer Retirement Is Assured: Aditya Birla Sun Life Insurance Vision Lifeincome PlanDocument6 pagesProtecting Your Income Even Aer Retirement Is Assured: Aditya Birla Sun Life Insurance Vision Lifeincome PlanParmeshwar SinghNo ratings yet

- WealthSecure Max Placemat EN - 1122Document2 pagesWealthSecure Max Placemat EN - 1122jcll26No ratings yet

- Diabetes Safe BrochureDocument13 pagesDiabetes Safe BrochureNaga RajanNo ratings yet

- Life Insurance Policies in IndiaDocument40 pagesLife Insurance Policies in IndiaBaby SivaNo ratings yet

- Investment On Crypto IdeaDocument4 pagesInvestment On Crypto IdeaPavithranNo ratings yet

- Star Critical Illness Multipay Insurance BrochureDocument7 pagesStar Critical Illness Multipay Insurance Brochuresanjay4u4allNo ratings yet

- Comparision of Whole Life PoliciesDocument8 pagesComparision of Whole Life PoliciesKunal BhansaliNo ratings yet

- Orient Pension Plan: Make The SMART ChoiceDocument2 pagesOrient Pension Plan: Make The SMART Choiceemaraty khNo ratings yet

- Diabetes Safe BrochureDocument8 pagesDiabetes Safe Brochureshobana dineshNo ratings yet

- Star Super Surplus Floater BrochureDocument14 pagesStar Super Surplus Floater BrochureBeenu BhallaNo ratings yet

- Emedlife Insurance Broking Services Limited: Sl. No. Coverages Expiring Terms & ConditionsDocument6 pagesEmedlife Insurance Broking Services Limited: Sl. No. Coverages Expiring Terms & ConditionsYanamandra Radha Phani ShankarNo ratings yet

- Assured Money Back BrochureDocument10 pagesAssured Money Back BrochureTaksh DhamiNo ratings yet

- PP12201710730 HDFC Life Sampoorn Samridhi Plus Retail BrochureDocument16 pagesPP12201710730 HDFC Life Sampoorn Samridhi Plus Retail BrochureFuse BulbNo ratings yet

- Iselect Smart360 Life Secure FlyerDocument1 pageIselect Smart360 Life Secure Flyerakshayg0792No ratings yet

- Tata Aia Life Insurance Investone BrochureDocument13 pagesTata Aia Life Insurance Investone BrochureVaibhav Shelar100% (1)

- ENGLISH One Pager Sanchay Plus Long Term Income Retail FinalDocument2 pagesENGLISH One Pager Sanchay Plus Long Term Income Retail FinalAbhisek BrahmaNo ratings yet

- Edelweiss Tokio Life - Cashflow Protection Plus - : OverviewDocument2 pagesEdelweiss Tokio Life - Cashflow Protection Plus - : OverviewarunNo ratings yet

- Iraksha Trop: Protection SolutionsDocument5 pagesIraksha Trop: Protection SolutionsPradeep ShastryNo ratings yet

- EXTRON'S CONSULTANT-Only Web Site: Terms and ConditionsDocument3 pagesEXTRON'S CONSULTANT-Only Web Site: Terms and ConditionsMHEP_DANIELNo ratings yet

- Super Income LeafletDocument2 pagesSuper Income Leafletsspublicationservices indiaNo ratings yet

- Save, Invest & Protect Your FutureDocument2 pagesSave, Invest & Protect Your Futureemaraty khNo ratings yet

- Orient Internation Term PlanDocument2 pagesOrient Internation Term Planemaraty khNo ratings yet

- Etouch One-Pager-SHIELD 13 02 2021Document2 pagesEtouch One-Pager-SHIELD 13 02 2021hiren1079No ratings yet

- PROTECTING Your Big Smiles Tomorrow, With Smaller Amounts TodayDocument6 pagesPROTECTING Your Big Smiles Tomorrow, With Smaller Amounts TodayRaghavendra SinghNo ratings yet

- Accounts of Insurance CompaniesDocument17 pagesAccounts of Insurance CompaniesCHANCHALNo ratings yet

- Golden Premier Saver: (Online)Document12 pagesGolden Premier Saver: (Online)Siddharth MohapatraNo ratings yet

- R07 HC3D02 MML 02 XX DWG Ci 55501Document1 pageR07 HC3D02 MML 02 XX DWG Ci 55501moh amohNo ratings yet

- AckoPolicy C t4 IuBC4TkhCqFY4P6HQDocument5 pagesAckoPolicy C t4 IuBC4TkhCqFY4P6HQAmeer KpNo ratings yet

- Lgip 1Document11 pagesLgip 1kushagra sonekarNo ratings yet

- Brochure Shriram Assured Income Plan Offline PDFDocument12 pagesBrochure Shriram Assured Income Plan Offline PDFVSNo ratings yet

- SL 1923 2015 RevisedDocument1 pageSL 1923 2015 Revisedsuedrewaz.sdNo ratings yet

- ETD00457018545-Hemanta KumarDocument5 pagesETD00457018545-Hemanta KumarhktantyNo ratings yet

- AckoPolicy n7osk9qXhRRDZQxCfjoMGADocument3 pagesAckoPolicy n7osk9qXhRRDZQxCfjoMGAtravelsstour70No ratings yet

- ABSLI Assured SavingDocument20 pagesABSLI Assured Savingm00162372No ratings yet

- PROTECTING Your Dreams With An Assured Income: Life InsuranceDocument8 pagesPROTECTING Your Dreams With An Assured Income: Life InsuranceAnkit TibriwalNo ratings yet

- CERTIFICATE No. CXW-3250556-1Document2 pagesCERTIFICATE No. CXW-3250556-1dannyNo ratings yet

- Super Top Up - Benefit Illustration - PremiumDocument1 pageSuper Top Up - Benefit Illustration - PremiumDean WinchesterNo ratings yet

- Key Features: Tata AIA Life Guaranteed Return Insurance PlanDocument9 pagesKey Features: Tata AIA Life Guaranteed Return Insurance PlanIRCON RAPDRP Electrical ProjectsNo ratings yet

- Rakshakaran: A Non Linked, Participating, Whole Life Individual Savings PlanDocument6 pagesRakshakaran: A Non Linked, Participating, Whole Life Individual Savings PlanHemant ShakyaNo ratings yet

- PROTECTING Your Regular Income Even Aer Retirement Is AssuredDocument6 pagesPROTECTING Your Regular Income Even Aer Retirement Is AssuredSwati BsvNo ratings yet

- GMP Brochure V9 - ADV 0588Document8 pagesGMP Brochure V9 - ADV 0588anusprasadNo ratings yet

- General / Non Life InsuranceDocument30 pagesGeneral / Non Life InsuranceRahul Kumar JainNo ratings yet

- Mahalife Gold: Tata Aia Life InsuranceDocument5 pagesMahalife Gold: Tata Aia Life InsuranceFrancis ReddyNo ratings yet

- Medicare Protect BrochureDocument2 pagesMedicare Protect BrochureHimanshu SharmaNo ratings yet

- Pol PacDocument35 pagesPol PacKaren de LeonNo ratings yet

- Cart Information - Reference Number: CHY0WR99LDWDocument1 pageCart Information - Reference Number: CHY0WR99LDWmuralinaiduNo ratings yet

- Max Life - Comprehensive Accident Benefit Rider: UIN: 104B025V01Document7 pagesMax Life - Comprehensive Accident Benefit Rider: UIN: 104B025V01muralinaiduNo ratings yet

- Documents RequiredDocument1 pageDocuments RequiredmuralinaiduNo ratings yet

- Chamatkaram 2Document51 pagesChamatkaram 2muralinaiduNo ratings yet

- What A Song PDFDocument40 pagesWhat A Song PDFmuralinaiduNo ratings yet

- JeerapornKummabutr PaperDocument12 pagesJeerapornKummabutr PapermuralinaiduNo ratings yet

- CostsOfSetting Up anSKADocument4 pagesCostsOfSetting Up anSKAmuralinaiduNo ratings yet

- Old Adangal Application Form PDFDocument1 pageOld Adangal Application Form PDFmuralinaiduNo ratings yet

- Evaluation of Memory in Abacus LearnersDocument9 pagesEvaluation of Memory in Abacus LearnersmuralinaiduNo ratings yet

- Aha! Activities ExcerptsDocument10 pagesAha! Activities ExcerptsmuralinaiduNo ratings yet

- Section 100-Index-Finally CorrectedDocument2 pagesSection 100-Index-Finally CorrectedmuralinaiduNo ratings yet

- Annexure-100-A.1 (IS - IRC-List) - FINALLY CORRECTEDDocument14 pagesAnnexure-100-A.1 (IS - IRC-List) - FINALLY CORRECTEDmuralinaiduNo ratings yet

- NTPC Limited: Engineering Office Complex A-8A, SEC-24, NOIDA, U.P.201301 PH.:0120-2410333, FAX:0120-2410136Document2 pagesNTPC Limited: Engineering Office Complex A-8A, SEC-24, NOIDA, U.P.201301 PH.:0120-2410333, FAX:0120-2410136muralinaiduNo ratings yet

- Rayner Trading Course PDFDocument39 pagesRayner Trading Course PDFmuralinaidu100% (2)

- Section-1000 (Materials For Structures)Document12 pagesSection-1000 (Materials For Structures)muralinaiduNo ratings yet

- Bitumen Impregnated BoardDocument2 pagesBitumen Impregnated Boardmuralinaidu100% (1)

- Pulling Option ChainDocument317 pagesPulling Option ChainmuralinaiduNo ratings yet

- BOQ For EarthworkDocument1 pageBOQ For EarthworkmuralinaiduNo ratings yet

- w4 - Group InsuranceDocument23 pagesw4 - Group InsuranceNur AliaNo ratings yet

- Contingent ContractsDocument3 pagesContingent ContractsRaza ZeeNo ratings yet

- Dr. Reddy CaseDocument1 pageDr. Reddy Caseyogesh jangaliNo ratings yet

- Week 6 & 7Document29 pagesWeek 6 & 7Vandana MohanNo ratings yet

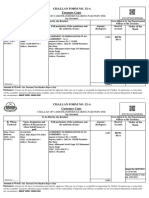

- Challan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheDocument1 pageChallan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheNoman MalikNo ratings yet

- Labor CasesDocument205 pagesLabor CasesJoseph DimalantaNo ratings yet

- Lease FA1Document39 pagesLease FA1Chitta LeeNo ratings yet

- 88 Citizen Surety & Insurance Company, Inc V CA & PerezDocument1 page88 Citizen Surety & Insurance Company, Inc V CA & PerezJoshua Alexander CalaguasNo ratings yet

- Virgin MobileDocument5 pagesVirgin MobileArnnava SharmaNo ratings yet

- Multiple Choice: Theory/Problems: Use The Following Information For The Next Two QuestionsDocument3 pagesMultiple Choice: Theory/Problems: Use The Following Information For The Next Two QuestionsSunshine Khuletz67% (12)

- Building Technology 4Document24 pagesBuilding Technology 4Melaine A. FranciscoNo ratings yet

- Law Study GuideDocument2 pagesLaw Study GuidetowilliamswanNo ratings yet

- MK10BE6571ID105721257 BorrowerDocument21 pagesMK10BE6571ID105721257 Borrowerayush.rana0991No ratings yet

- Fidelity and Body PartsDocument61 pagesFidelity and Body PartsTripathi OjNo ratings yet

- Universal Corn Products v. NLRCDocument4 pagesUniversal Corn Products v. NLRCfangs88No ratings yet

- Amabe Vs Asian Construction Et Al GR 183233Document9 pagesAmabe Vs Asian Construction Et Al GR 183233Breth1979No ratings yet

- SEC Form 17-A (August 31, 2018 PDFDocument261 pagesSEC Form 17-A (August 31, 2018 PDFqrqrqrqrqrqrqrqrqrNo ratings yet

- Morena Tender PreperationDocument56 pagesMorena Tender PreperationSheeren Sitara ChelladuraiNo ratings yet

- Discharge by Performance 2Document36 pagesDischarge by Performance 2nazatul juhari86% (7)

- Business Permit Application FormDocument2 pagesBusiness Permit Application FormmichelleberganosNo ratings yet

- China's New Worry: Outsourcing: Harold L. (Hal) SirkinDocument9 pagesChina's New Worry: Outsourcing: Harold L. (Hal) SirkinAndreea IlieNo ratings yet

- Employer-Employee Relationship PDFDocument15 pagesEmployer-Employee Relationship PDFMarcelino CasilNo ratings yet

- Mining Laws (RA 7942)Document4 pagesMining Laws (RA 7942)Jerry CaneNo ratings yet

- Fuerte DigestDocument5 pagesFuerte DigestOlenFuerteNo ratings yet

- Victorias Milling Co., Inc. vs. Court of AppealsDocument16 pagesVictorias Milling Co., Inc. vs. Court of AppealsKenneth LimosneroNo ratings yet

- Uy vs. Puson, 79 SCRA 598Document9 pagesUy vs. Puson, 79 SCRA 598Francis Leo TianeroNo ratings yet

- Nike The Sweadshops DebateDocument13 pagesNike The Sweadshops Debatekakatkar100% (3)

- Assignment of Credits - PPTX ABANDOJUDY ANNDocument27 pagesAssignment of Credits - PPTX ABANDOJUDY ANNDianaNo ratings yet

- Dino vs. CADocument7 pagesDino vs. CASherily CuaNo ratings yet