Professional Documents

Culture Documents

27201451249V M1 1703 Hist PDF

Uploaded by

Priyanka AgrawalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

27201451249V M1 1703 Hist PDF

Uploaded by

Priyanka AgrawalCopyright:

Available Formats

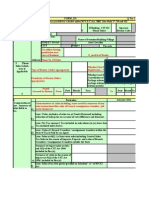

FORM 231 Ver 1.8.

3

Return-cum-chalan of tax payable by a dealer under M.V.A.T.Act, 2002 (See Rule 17, 18 and 45)

M.V.A.T. R.C.

1 27201451249V C.S.T.R.C. NO

No.

2.

Name of Dealer Smt VRUNDA RUPESH SALVI

Personal Information of

Dealer

BLOCK NO/FLAT Name of Premises/Building/Village

STREET/ROAD Area/Locality

City District Pin Code

Address

Location of Sales Tax officer having E_mail id of

jshetty15@gmail.com

jurisdiction over place of business Dealer

Mobile Number 9869237387

3. Type of Return (Select Whether First Return ? (In Case of New Registration /

Please Select whichever is Original N

Appropriate) New Package scheme dealer)

Applicable

Whether Last Return ? (In Case of Cancellation of

Periodicity of Return Registration Or For new Package scheme dealers for end

Monthly N

(Select Appropriate) of non package scheme period Or end of package scheme

period)

Date Month Year Date Month Year

4. Period Covered by return From To

01 JUN 2017 30 JUN 2017

5

Computation of net Particulars Amount (Rs)

turnover of sales liable to

tax Gross turnover of sales including, taxes as well as turnover of non

a) sales transactions like value of branch/ consignment transfers , job 1,089,095.00

work charges etc

Less:-Value ,inclusive of sales tax.,of Goods Returned including

b) 0.00

reduction of sales price on account of rate difference and discount .

Less:-Net Tax amount ( Tax included in sales shown in (a) above less

c) 129,540.00

Tax included in(b) above)

Less:-Value of Branch Transfers / consignment transfers within the

d) 0.00

State If Tax is Paid by an Agent

Less:-Sales u/s 8(1) i.e Inter state sales including Central Sales

Tax,Sales in the course of Imports, Exports and value of Branch 0.00

Transfers / Consignment Transfers outside the State

Turnover of export sales u/s 5(1) and 5(3)

e) 0.00 0.00

of the CST Act 1956 included in Box (e)

Turnover of sales in the course of import

u/s 5(2) of the CST Act 1956 included in 0.00 0.00

Box (e)

f) Less:-Sales of tax-free goods specified in Schedule" A" of MVAT Act 0.00

Less:-Sales of taxable goods fully exempted u/s 41 and u/s. 8 other

g) 0.00

than sales under section 8(1) & covered in Box 5(e)

h) Less:-Labour Charges/Job work charges 0.00

i) Less:-Other allowable deductions, if any 0.00

j) Balance: Net turnover of Sales liable to tax [a-(b+c+d+e+f+g+h+i)] 959,555.00

27201451249V/ 01 - JUN - 2017 To 30 - JUN - 2017 / Original / 2020-10-28 / 000008628792 / Page 1 of 6

6

Computation of Sales Rate of Tax Turnover of sales liable to tax (Rs.) Tax Amount (Rs)

Tax payable under the

MVAT Ac a) 13.50 959,555.00 129,540.00

b) 0.00 0.00 0.00

c) 0.00 0.00 0.00

d) 0.00 0.00 0.00

e) 0.00 0.00 0.00

f) 0.00 0.00 0.00

Total 959,555.00 129,540.00

6A Sales Tax collected in Excess of the Amount of Tax payable. 0.00

7.

Computation of Particulars Amount (Rs)

Purchases Eligible for

Set-off Total turnover of Purchases including taxes, value of Branch

a) Transfers/ Consignment Transfers received and Labour/ job work 846,925.00

charges

Less:-Value of goods return(inclusive of tax,including reduction of

b) 0.00

Purchase price on account of rate difference and discount .

c) Less:-Imports (Direct imports) 0.00

d) Less:-Imports (High seas purchases) 0.00

Less:-Inter-State purchases (Excluding purchases against certificate in

e) 0.00

form 'H')

Less: Purchases of taxble goods (either local or Interstate) against

e1) 0.00

certificate in Form'H'

f) Less:-Inter-State branch / consignment transfers received 0.00

Less:-Within the State Branch Transfers /Consignment Transfers

g) 0.00

received where tax is to be paid by an Agent

Less:-Within the State purchases of taxable goods from un-registered

h) 0.00

dealers

Less:-Within the State Purchases of taxable goods from registered

i) 0.00

dealers under MVAT Act, 2002 and which are not eligible for set-off

Less:-Within the State purchases of taxable goods which are fully

j) exempted from tax u/s 41 and u/s 8 but not covered under section 0.00

8(1)

Less:-Within the State purchases of tax-free goods specified in

k) 0.00

Schedule "A"

l) Less:-Other allowable deductions, if any 0.00

Balance: Within the State purchases of taxable goods from registered

m) 846,925.00

dealers eligible for set-off [a-(b+c+d+e+e1+f+g+h+i+j+k+l) ]

27201451249V/ 01 - JUN - 2017 To 30 - JUN - 2017 / Original / 2020-10-28 / 000008628792 / Page 2 of 6

7A.

Computation of Purchase Rate of Tax Turnover of Purchases liable to tax (Rs.) Tax Amount (Rs)

Tax payable on the

purchases effected during a) 0.00 0.00 0.00

this period or previous

periods b) 0.00 0.00 0.00

c) 0.00 0.00 0.00

d) 0.00 0.00 0.00

e) 0.00 0.00 0.00

Total 0.00 0.00

8

Tax Rate wise breakup of Rate of Tax Net Turnover of purchases (Rs.) Tax Amount (Rs)

within state purchases

from registered and a) 13.50 746,189.00 100,736.00

unregistered dealers

eligible for set-off as per b) 0.00 0.00 0.00

box 7(m) and 7A

c) 0.00 0.00 0.00

d) 0.00 0.00 0.00

e) 0.00 0.00 0.00

Total 746,189.00 100,736.00

9.

Computation of set-off Particulars Purchase Value (Rs.) Tax Amount (Rs)

claimed in this return

Within the State purchases of taxable goods from

a) 746,189.00 100,736.00

registered dealers eligible for set-off as per Box 8

Less: Reduction in the amount of set_off u/r 53(1) of

the corresponding purchase price of (Sch C, D & E) 0.00 0.00

b) goods

Less: Reduction in the amount of set_off u/r 53(2) of

0.00 0.00

the corresponding purchase price of (Sch B) goods

Less: Reduction in the amount of set-off under any

c) 0.00 0.00

other sub rule of Rule 53 and/or rule 52B

Add: Adjustment on account of set-off claimed Short

d) 0.00 0.00

in earlier return

Less: Adjustment on account of set-off claimed Excess

e) 0.00 0.00

in earlier return

Set-off available for the period of this return [a-(b+c-d

f) 0.00 100,736.00

+e)]

27201451249V/ 01 - JUN - 2017 To 30 - JUN - 2017 / Original / 2020-10-28 / 000008628792 / Page 3 of 6

10. Computation for Tax payable along with return

Particulars Amount (Rs)

A. Aggregate of credit

a) Set off available as per Box 9 (f) 100,736.00

available for the period

covered under this return b) Excess credit brought forward from previous return 0.00

c) Amount already paid ( Details to be entered in Box 10 E) 7,642.00

Excess Credit if any , as per Form 234 , to be adjusted against the

d) 0.00

liability as per Form 231

Adjustment of ET paid under Maharashtra Tax on Entry of Goods

e) into Local Areas Act 2002 /Maharashtra Tax on Entry of Motor 0.00

Vehicle Act into Local Areas Act 1987

e1) Amount of Tax collected at source u/s 31A 0.00

f) Refund adjustment order No. ( Details to be entered in Box 10 F) 0.00

g) Total available credit (a+b+c+d+e+e1+f) 108,378.00

B Total tax payable and a) Sales Tax payable as per box 6 + Purchase Tax payable as per box 7A 129,540.00

adjustment of CST/ET

payable against available Adjustment on account of MVAT payable, if any as per Return Form

credit b) 0.00

234 against the excess credit as per Form 231.

c) Adjustment on account of CST payable as per return for this period 0.00

Adjustment on account of ET payable under Maharashtra tax on

d) Entry of Goods into Local Areas Act, 2002 / /Maharashtra Tax on 0.00

Entry of Motor Vehicle Act into Local Areas Act1987

Amount of Tax Collected in Excess of the amount of Sales Tax

e) 0.00

payable if any (as per Box 6A)

f) Interest Payable 0.00

f1) Late Fee Payable 5,000.00

Balance: Excess credit =[10A(g)-(10B(a)+10B(b)+10B(c)+ 10B(d)+

g) 0.00

10B(e)+ 10 B(f)+ 10 B(f1))]

Balance Amount payable= [ 10B(a)+10B(b)+10B(c)+ 10B(d)+10B(e)

h) 26,162.00

+10 B(f)+ 10 B(f1)-10A(g)]

C Utilisation of Excess

a) Excess credit carried forward to subsequent tax period 0.00

Credit as per box 10B(g)

Excess credit claimed as refund in this return(Box10 B(g)- Box 10

b) 0.00

C(a))

D Tax payable with a) Total Amount payable as per Box 10B(h) 26,162.00

return-Cum-Chalan

Amount paid as per revised return/fresh return ( Details to be included

b) 0.00

in Box 10 E)

Amount paid as per Revised /Fresh return ( Details to be entered in

c) 0.00

Box 10 E)

27201451249V/ 01 - JUN - 2017 To 30 - JUN - 2017 / Original / 2020-10-28 / 000008628792 / Page 4 of 6

E. Details of Amount Paid along with return and /or Amount already Paid

Challan CIN No Amount (Rs) Payment date Name of the Bank Branch Name

Total 0.00

F. Details of RAO

RAO No Amount Adjusted( Rs) Date of RAO

Total 0.00

G. The Statement contained in Box 1 to 10 are true and correct to the best of my knowledge and belief.

Date of Filing of Return Date 11 Month OCT Year 2017 Place

Name of Authorised Person VRUNDA SALVI Remarks

Designation PROPRIETOR Mobile No 9869237387

E_mail_id* jshetty15@gmail.com

27201451249V/ 01 - JUN - 2017 To 30 - JUN - 2017 / Original / 2020-10-28 / 000008628792 / Page 5 of 6

E - RETURN : FORM 231

M.V.A.T R.C. Number 27201451249V

C.S.T. R.C. Number

Name of Dealer Smt VRUNDA RUPESH SALVI

Type of Return Original

Periodicity of Return Monthly

Financial Year 2017-2018

Period From 01-JUN-2017

To 30-JUN-2017

Date & Time of submission of Return Oct 11, 2017 , 2:55:55 PM

Transaction id 000008628792

IP 888.88.888.888

Total Amount payable 33,804.00

Amount already paid 7,642.00

Balance amount Payable 26,162.00

Excess credit carried forward to subsequent

0.00

Return

Excess credit claimed as refund in this Return 0.00

Disclaimer: - This acknowledgment is generated from the information submitted in the return.

This is electronically generated acknowledgment, signature not required.

27201451249V/ 01 - JUN - 2017 To 30 - JUN - 2017 / Original / 2020-10-28 / 000008628792 / Page 6 of 6

You might also like

- Form 231Document9 pagesForm 231Pushkar JoshiNo ratings yet

- 27860151571V 27860151571C Venktesh Trading CompanyDocument7 pages27860151571V 27860151571C Venktesh Trading CompanyAdesh NaharNo ratings yet

- Form 231 Sharp EnterprisesDocument8 pagesForm 231 Sharp Enterprisesqaid_duraiyaNo ratings yet

- Form 231Document14 pagesForm 231Jignesh Dinesh MewadaNo ratings yet

- Form 231 Errors Sno Error Line No Error BOX No Error Box DescriptionDocument9 pagesForm 231 Errors Sno Error Line No Error BOX No Error Box DescriptionnitinnawarNo ratings yet

- Audit Report PART-3 Schedule-IDocument6 pagesAudit Report PART-3 Schedule-IsuniljaithwarNo ratings yet

- 114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023Document5 pages114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023Babar MalikNo ratings yet

- Office Number 30, Lower Ground Al Latif Center, Gulberg 3, Lahore Gulberg Town Muhammad Ali ShahDocument4 pagesOffice Number 30, Lower Ground Al Latif Center, Gulberg 3, Lahore Gulberg Town Muhammad Ali ShahWaqas AmjadNo ratings yet

- Useful Life or 60 Mos. (Whichever Is Shorter) : (Attach Additional Sheet, If Necessary)Document6 pagesUseful Life or 60 Mos. (Whichever Is Shorter) : (Attach Additional Sheet, If Necessary)Katherine OlidanNo ratings yet

- GSTR9 09aaact9363l1zq 032023Document8 pagesGSTR9 09aaact9363l1zq 032023sachinkumar.rkcjNo ratings yet

- Declaration 3966758Document5 pagesDeclaration 3966758mehboob rehmanNo ratings yet

- 18-19 - CT - Annual - 19dec19 - 05.35PM - SEE & Financial InstitutionDocument2 pages18-19 - CT - Annual - 19dec19 - 05.35PM - SEE & Financial InstitutionWUTYI THINNNo ratings yet

- Audit Report PART-3 Schedule-Iv: Eligibility Certificate (EC) No. Certificate of Entitlement (COE) NoDocument12 pagesAudit Report PART-3 Schedule-Iv: Eligibility Certificate (EC) No. Certificate of Entitlement (COE) NosuniljaithwarNo ratings yet

- Form CST Errors Sno Error Box Description Error Line No Error Box NoDocument12 pagesForm CST Errors Sno Error Box Description Error Line No Error Box NoVivek PatilNo ratings yet

- Buslaw3 VATDocument58 pagesBuslaw3 VATVan TisbeNo ratings yet

- 19 CT Annual 18dec19 11.09AMDocument2 pages19 CT Annual 18dec19 11.09AMWUTYI THINNNo ratings yet

- BIR Form No. 2551MDocument1 pageBIR Form No. 2551MLorraine Steffany BanguisNo ratings yet

- Street Sheikh Gulab Din Wali, Muhalla Islamabad Mohsin Razi: Wed, 5 May 2021 13:55:14 +0500Document4 pagesStreet Sheikh Gulab Din Wali, Muhalla Islamabad Mohsin Razi: Wed, 5 May 2021 13:55:14 +0500Sadiq SonsNo ratings yet

- JanuaryDocument8 pagesJanuaryRohama TullaNo ratings yet

- MarchDocument7 pagesMarchRohama TullaNo ratings yet

- FeburaryDocument8 pagesFeburaryRohama TullaNo ratings yet

- Apartment-201, 2nd Floor Plaza # 43, E-Commercial, Jinnah Boulevard, DHA Phase-II, Islamabad Islamabad Urban Ammar KhatirDocument3 pagesApartment-201, 2nd Floor Plaza # 43, E-Commercial, Jinnah Boulevard, DHA Phase-II, Islamabad Islamabad Urban Ammar KhatirAnonymous gKfTqXObkDNo ratings yet

- SCH 3Document8 pagesSCH 3suniljaithwarNo ratings yet

- (Attach Additional Sheet, If Necessary) : Useful Life or 60 Mos. (Whichever Is Shorter)Document2 pages(Attach Additional Sheet, If Necessary) : Useful Life or 60 Mos. (Whichever Is Shorter)Bianca LizardoNo ratings yet

- Submitted IT-Return TY-23Document5 pagesSubmitted IT-Return TY-23Hazrat BilalNo ratings yet

- Asif 111Document4 pagesAsif 111mueed6074No ratings yet

- Haji BilalDocument4 pagesHaji BilalComplaint CellNo ratings yet

- (Name of Registered Business Entity) Annual Tax Incentives Report-Income-Based Tax Incentives For Calendar/Fiscal YearDocument5 pages(Name of Registered Business Entity) Annual Tax Incentives Report-Income-Based Tax Incentives For Calendar/Fiscal YearRoui Jean VillarNo ratings yet

- 22-23 Annual IT 02052023 0210pmDocument8 pages22-23 Annual IT 02052023 0210pmWint PaingNo ratings yet

- 21 22-Annual IT 22mar2022 1155pmDocument8 pages21 22-Annual IT 22mar2022 1155pmWint PaingNo ratings yet

- Statement of Business or Professional Activities: Part 1 - IdentificationDocument6 pagesStatement of Business or Professional Activities: Part 1 - IdentificationHimanshu MohtaNo ratings yet

- 20-21 CT Annual 24nov2021Document3 pages20-21 CT Annual 24nov2021Wint PaingNo ratings yet

- Monthly Remittance Return of Income Taxes Withheld On CompensationDocument2 pagesMonthly Remittance Return of Income Taxes Withheld On CompensationDeebees Marie Erazo TumulakNo ratings yet

- Acknowledgement Slip: Name: Address: CHAK NO. 39/141 P.O SAME Registration No Tax YearDocument4 pagesAcknowledgement Slip: Name: Address: CHAK NO. 39/141 P.O SAME Registration No Tax YearFairTax SolutionsNo ratings yet

- Useful Life or 60 Mos. (Whichever Is Shorter) : (Attach Additional Sheet, If Necessary)Document3 pagesUseful Life or 60 Mos. (Whichever Is Shorter) : (Attach Additional Sheet, If Necessary)Mark Alvin Tallongon100% (2)

- T2125-17e - Statement of Business or Professional Activities Fill Up FormDocument6 pagesT2125-17e - Statement of Business or Professional Activities Fill Up FormjoanaNo ratings yet

- Eopt Act Comparative SummaryDocument6 pagesEopt Act Comparative Summarybbc.moniqueNo ratings yet

- 114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023Document7 pages114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023Bm ShopNo ratings yet

- GSTR9 08aaafu3205h1zh 032022Document8 pagesGSTR9 08aaafu3205h1zh 032022Deepanshu AgarwalNo ratings yet

- 21-22 Annual CT 19042022 0402pmDocument3 pages21-22 Annual CT 19042022 0402pmWint PaingNo ratings yet

- Lecture Slides - Lecture 01 - VAT (Part 1)Document6 pagesLecture Slides - Lecture 01 - VAT (Part 1)nkosinathiNo ratings yet

- TallyHelp - Official Online Help Channel of Tally SolutionsDocument7 pagesTallyHelp - Official Online Help Channel of Tally Solutionswww.TdsTaxIndia.comNo ratings yet

- Karvy Stock Broking LTDDocument2 pagesKarvy Stock Broking LTDMayank KumarNo ratings yet

- House No. 1947, Mohallah Sakira Ram, Behind Rahim Medical Center, G.T Road, Peshawar Peshawar Umair JamalDocument2 pagesHouse No. 1947, Mohallah Sakira Ram, Behind Rahim Medical Center, G.T Road, Peshawar Peshawar Umair JamalUmair Jamal IslamianNo ratings yet

- GSTR9 33AAACA7962L1ZH 032022-FinalDocument8 pagesGSTR9 33AAACA7962L1ZH 032022-FinalVASUMATHY SURESHNo ratings yet

- FIN AL: Form GSTR-9Document8 pagesFIN AL: Form GSTR-9mani samiNo ratings yet

- 2584/2 Chotki Ghitti Hyd Rizwana: Acknowledgement Slip 114 (1) (Return of Income Filed Voluntarily For Complete Year)Document4 pages2584/2 Chotki Ghitti Hyd Rizwana: Acknowledgement Slip 114 (1) (Return of Income Filed Voluntarily For Complete Year)Mohsin Ali Shaikh vlogsNo ratings yet

- SK-PST FormDocument1 pageSK-PST FormOsama JavaidNo ratings yet

- GSTR1 33anypm1879j3z5 012024Document5 pagesGSTR1 33anypm1879j3z5 012024mmohamedharis3221No ratings yet

- Declaration 3830366377261Document4 pagesDeclaration 3830366377261Sammar Aziz KhanNo ratings yet

- Declaration 1120189422981Document5 pagesDeclaration 1120189422981Hazrat BilalNo ratings yet

- Draf T: Form GST CMP - 08Document1 pageDraf T: Form GST CMP - 08akshaya beheraNo ratings yet

- RandomDocument4 pagesRandomComplaint CellNo ratings yet

- GSTR9 09abepk8302l1zh 032018Document8 pagesGSTR9 09abepk8302l1zh 032018Capraful PrabhakaranNo ratings yet

- Khurram Perwez ButtDocument7 pagesKhurram Perwez ButtFarhan AliNo ratings yet

- 1601 CDocument6 pages1601 CJose Venturina Villacorta100% (1)

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Re-Engineering Agricultural Education For Sustainable Development in NigeriaDocument5 pagesRe-Engineering Agricultural Education For Sustainable Development in NigeriaPremier PublishersNo ratings yet

- Product Development Life Cycle - In-Depth DiscussionDocument2 pagesProduct Development Life Cycle - In-Depth DiscussionFahim IftikharNo ratings yet

- Capital and Return On CapitalDocument38 pagesCapital and Return On CapitalThái NguyễnNo ratings yet

- Icici Brochure - PENSION PLAN ULIPDocument10 pagesIcici Brochure - PENSION PLAN ULIPAbhishek PrabhakarNo ratings yet

- 1538139921616Document6 pages1538139921616Hena SharmaNo ratings yet

- Raghunath Internet: Name - Address SL - No DateDocument1 pageRaghunath Internet: Name - Address SL - No DateAlok NayakNo ratings yet

- Final Exam May 2015 CounterfeitingDocument3 pagesFinal Exam May 2015 Counterfeitingkaderr100% (1)

- CRM DimensionsDocument12 pagesCRM DimensionsetdboubidiNo ratings yet

- Secret of Successful Traders - Sagar NandiDocument34 pagesSecret of Successful Traders - Sagar NandiSagar Nandi100% (1)

- City of Highland Park 2020 Affordable Housing PlanDocument6 pagesCity of Highland Park 2020 Affordable Housing PlanJonah MeadowsNo ratings yet

- Ipo Note Oimex Electrode LimitedDocument7 pagesIpo Note Oimex Electrode LimitedSajjadul MawlaNo ratings yet

- Activities KeyDocument7 pagesActivities KeyCassandra Dianne Ferolino MacadoNo ratings yet

- Event Marketing Manager Specialist in Cincinnati KY Resume Kim ThompsonDocument2 pagesEvent Marketing Manager Specialist in Cincinnati KY Resume Kim ThompsonKimThompsonNo ratings yet

- Banking in Indo Pak SubcontinentDocument3 pagesBanking in Indo Pak Subcontinentimran khan100% (2)

- Cineplex CRMDocument7 pagesCineplex CRMSanjeev RamisettyNo ratings yet

- Case 1: Robin Hood: Archana Warrier BPS 4305 - 007 BochlerDocument2 pagesCase 1: Robin Hood: Archana Warrier BPS 4305 - 007 BochlerchenlyNo ratings yet

- Portfolio Management - India BullsDocument103 pagesPortfolio Management - India BullsNarsing Rao BodduNo ratings yet

- Qatar Airways PresentationDocument13 pagesQatar Airways PresentationDerrick NjorogeNo ratings yet

- Patton and Littleton EnglishDocument3 pagesPatton and Littleton EnglishAyu Ratih KusumadewiNo ratings yet

- Practice 4a EPS & Dilutive EPSDocument2 pagesPractice 4a EPS & Dilutive EPSParal Fabio MikhaNo ratings yet

- Global CFO VP Director Finance in Los Angeles CA Resume Lance GatewoodDocument2 pagesGlobal CFO VP Director Finance in Los Angeles CA Resume Lance GatewoodLanceGatewoodNo ratings yet

- Job Costing: True / False QuestionsDocument232 pagesJob Costing: True / False QuestionsElaine GimarinoNo ratings yet

- Emirates ReportDocument23 pagesEmirates Reportrussell92No ratings yet

- Retail Cloud Service 2613359Document128 pagesRetail Cloud Service 2613359AryanNo ratings yet

- 165-Article Text-980-1-10-20220214Document16 pages165-Article Text-980-1-10-20220214Jebat FatahillahNo ratings yet

- Chapter Eleven SolutionsDocument60 pagesChapter Eleven SolutionsaishaNo ratings yet

- Taxation LawDocument7 pagesTaxation LawJoliza CalingacionNo ratings yet

- PPFAS Monthly Portfolio Report February 28 2023Document44 pagesPPFAS Monthly Portfolio Report February 28 2023DevendraNo ratings yet

- Mid Term ExamDocument11 pagesMid Term ExamMohammed IbrahimNo ratings yet

- Tata Chemical ProjectDocument71 pagesTata Chemical ProjectDavinderSinghNo ratings yet